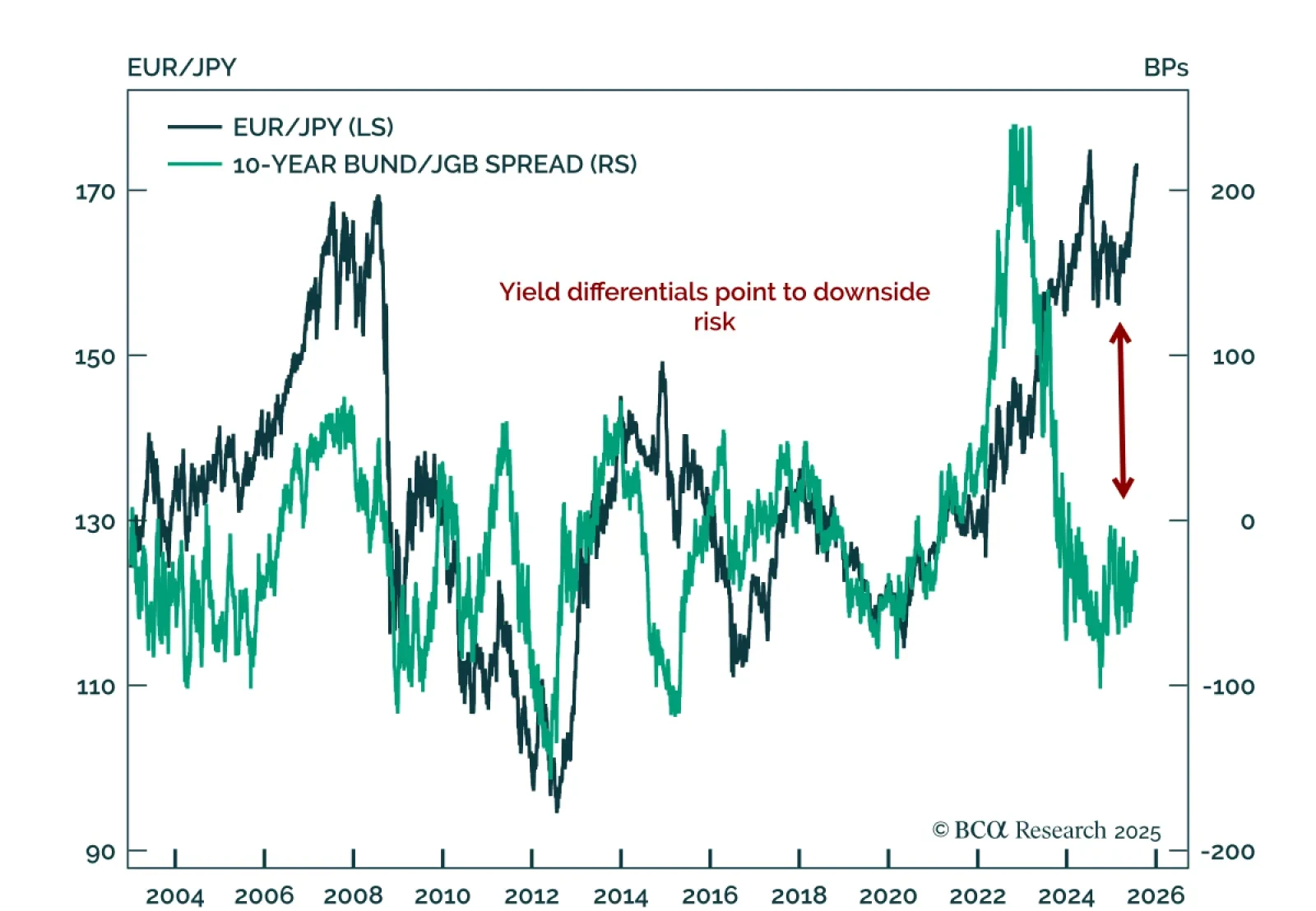

Our strategists recommend shorting EUR/JPY, citing stretched valuations and rising reversal risks. The cross has surged more than 6% since late May, triggering new short positions from the Counterpoint, European Investment Strategy,…

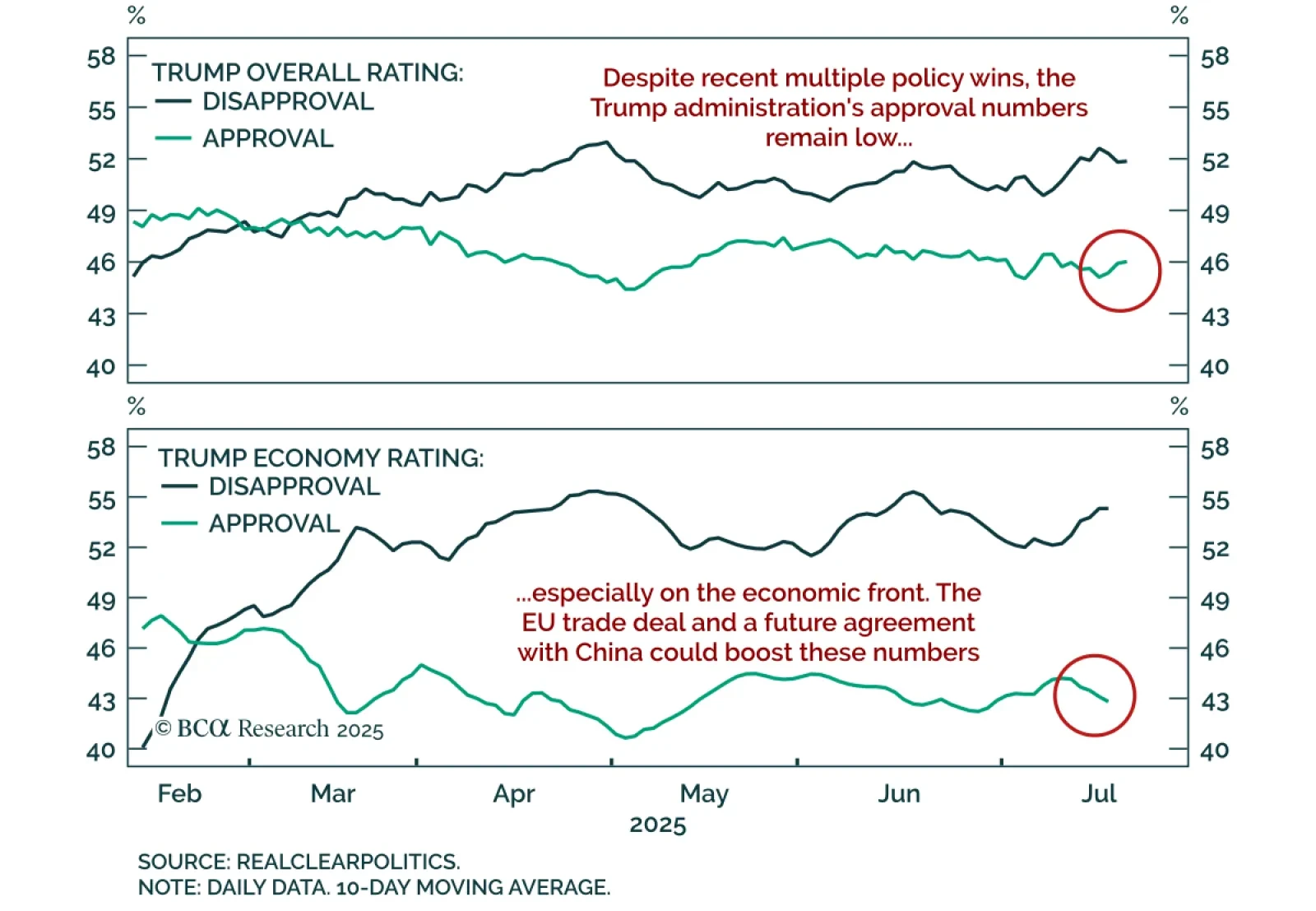

The US-EU trade deal lifts uncertainty but imposes high tariffs, weighing on the EUR and supporting our long USD positioning. The agreement includes a 15% tariff on all EU exports to the US, including cars and potentially,…

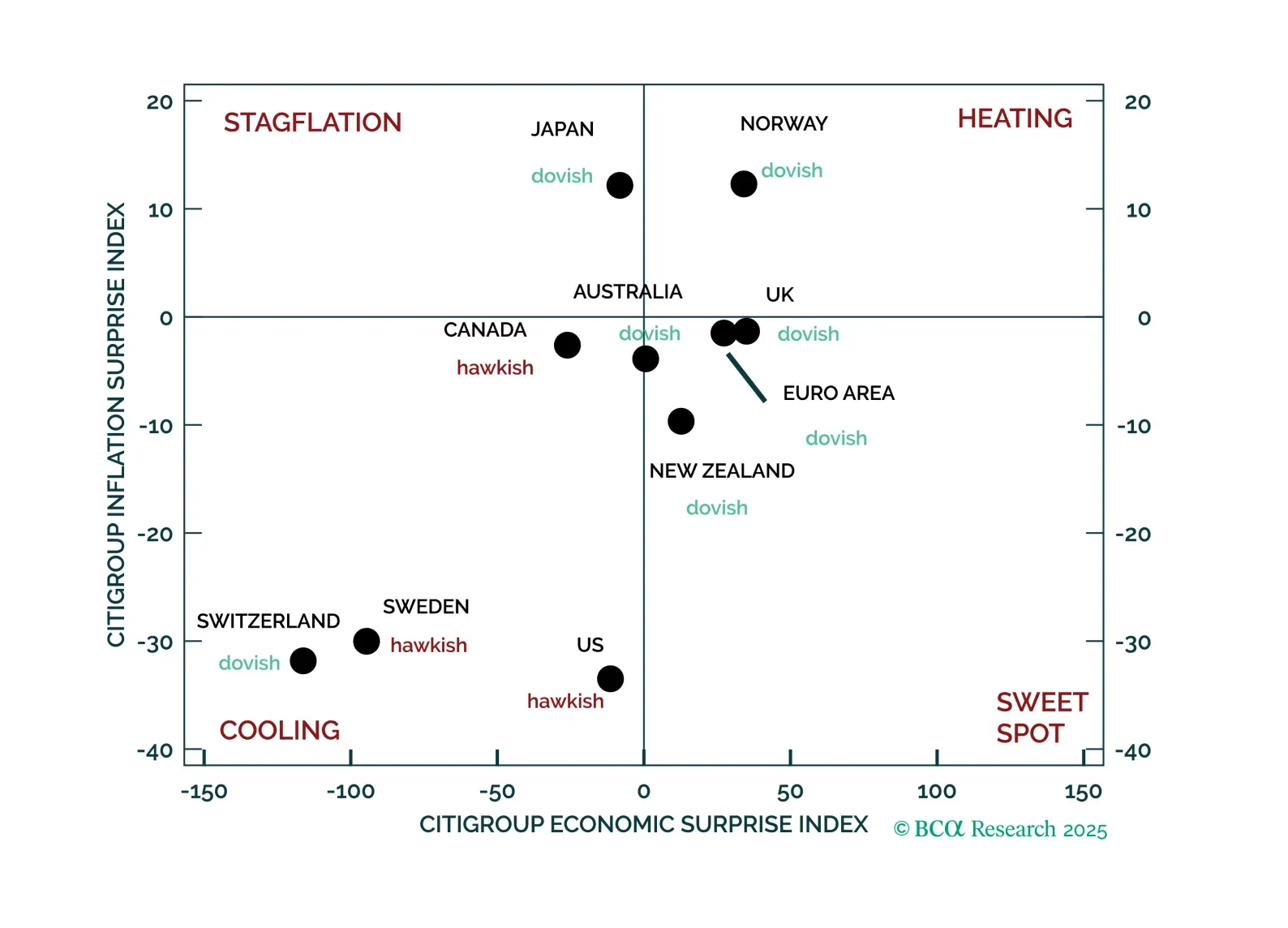

We apply a systematic approach to investing based on economic, inflation, and monetary policy surprises to the foreign exchange market. The signals from this framework are broadly consistent with the tactical views of our FX…

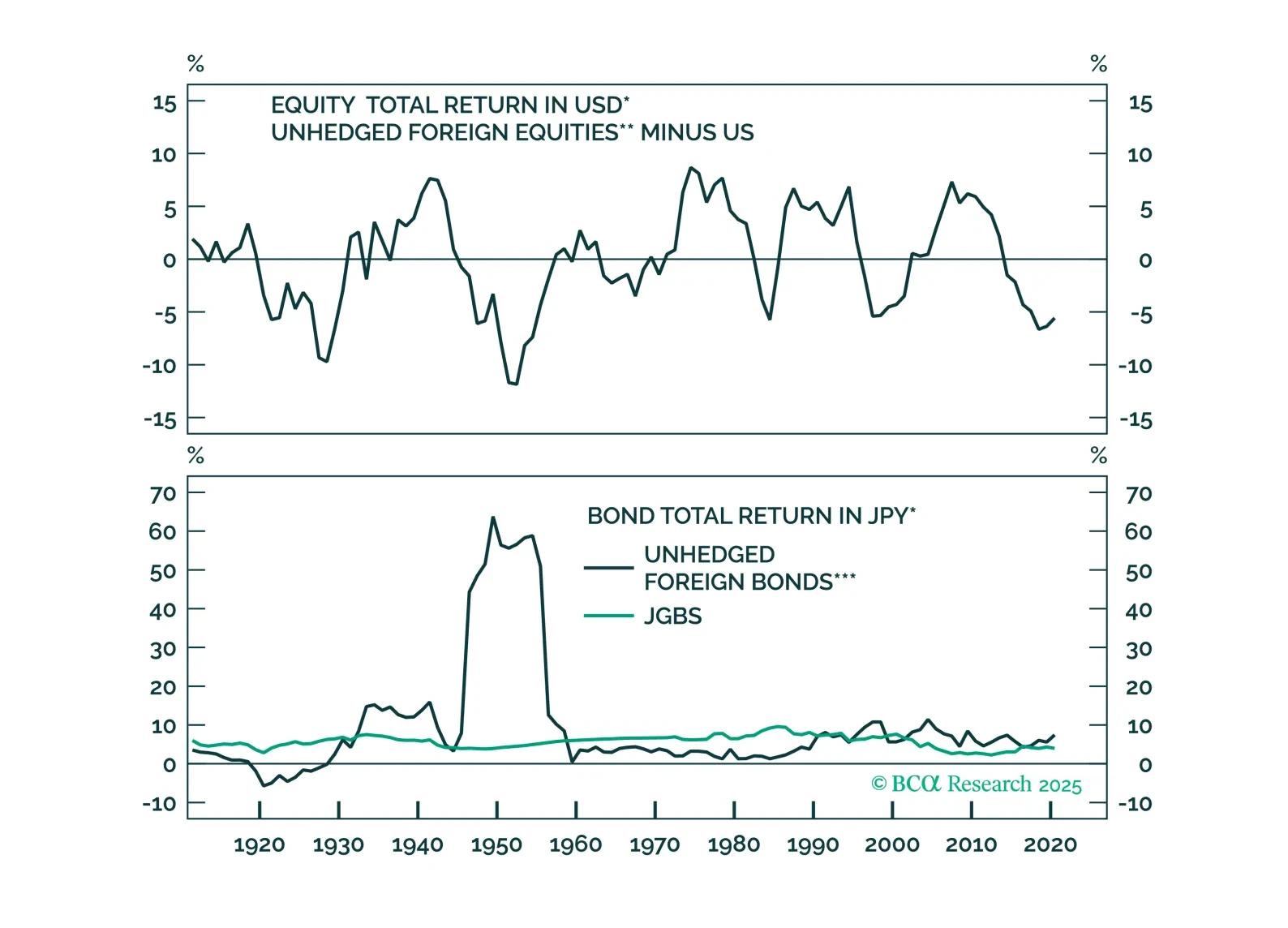

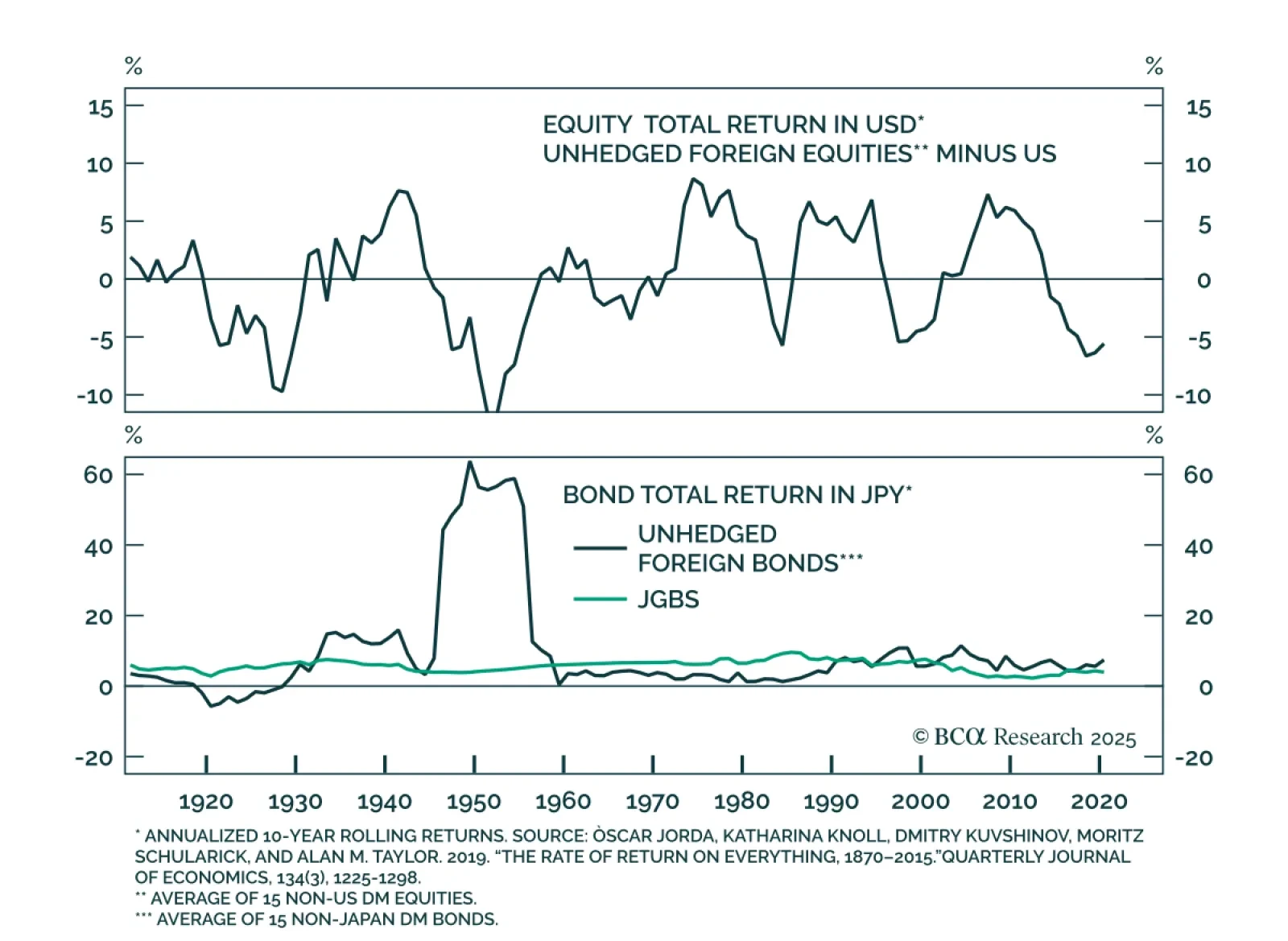

BCA’s Global Asset Allocation strategists find that international diversification outperforms home bias in both bonds and equities, especially when FX risk is hedged. Unhedged foreign bonds have consistently underperformed domestic…

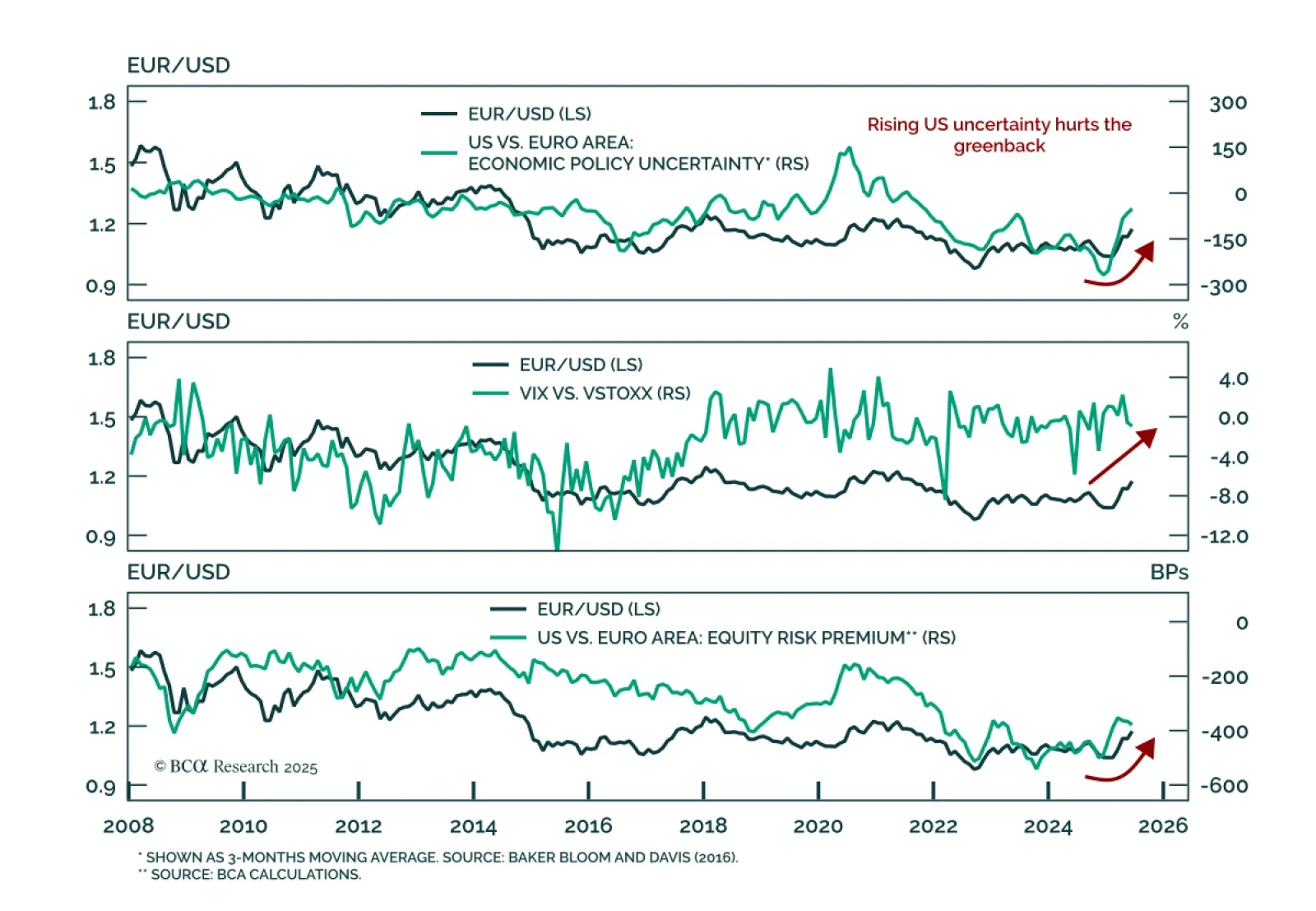

Rising US macro uncertainty and external imbalances are reinforcing euro strength and are supportive of a long-term bullish view on EUR/USD. Our Chart Of The Week comes from Mathieu Savary, Chief Strategist for Developed Markets ex…

Our DM ex-US strategists see EUR/USD in a multi-year bull market and recommend selling EUR/JPY at 172.5. The euro’s 2025 rally has been driven first by improving Eurozone growth expectations, then by mounting concerns over the US…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

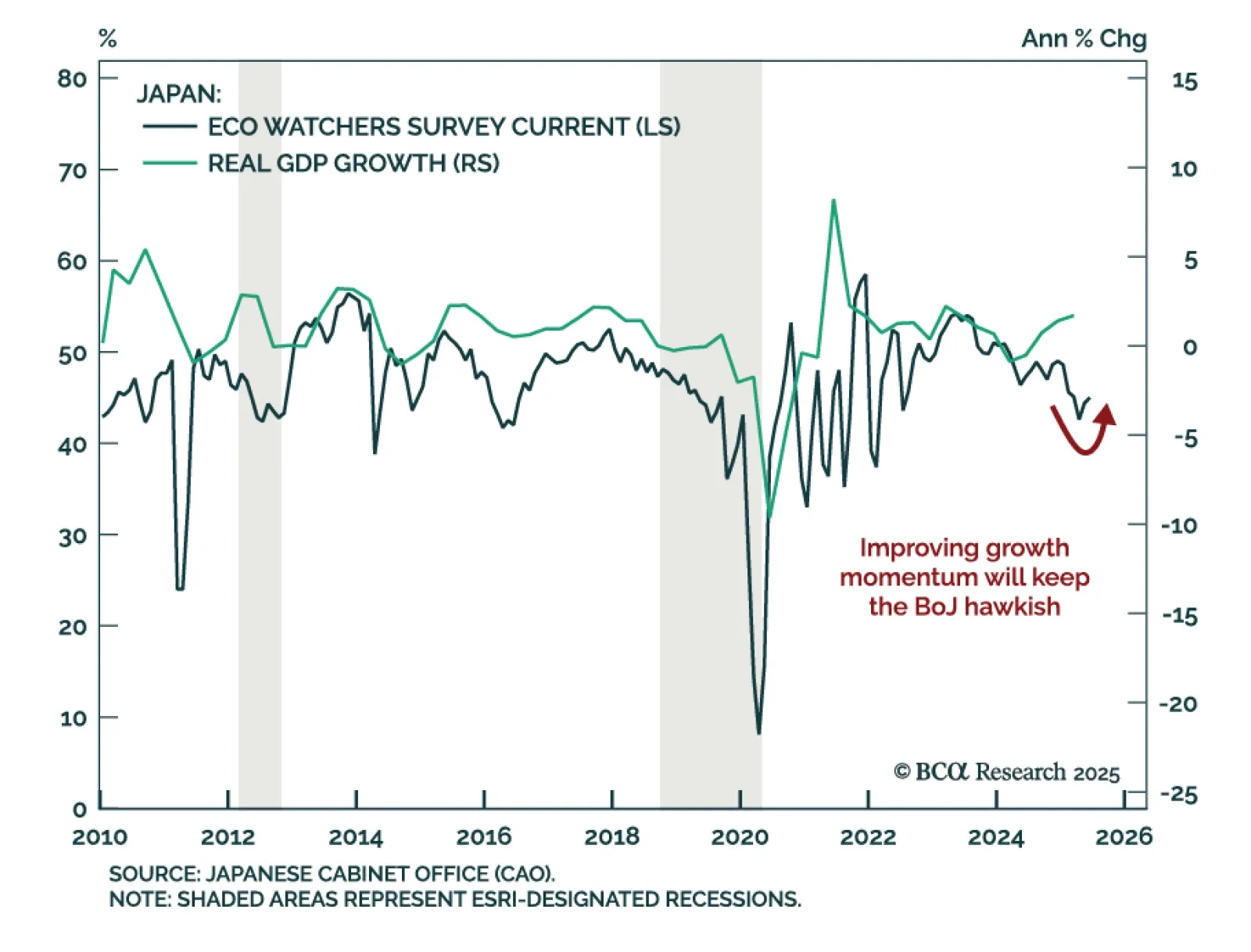

Japan’s improving growth momentum and structural inflation shift support an underweight in JGBs and long JPY positioning. The June Eco Watchers Survey was broadly in line with expectations, with current conditions ticking up to 45.0…

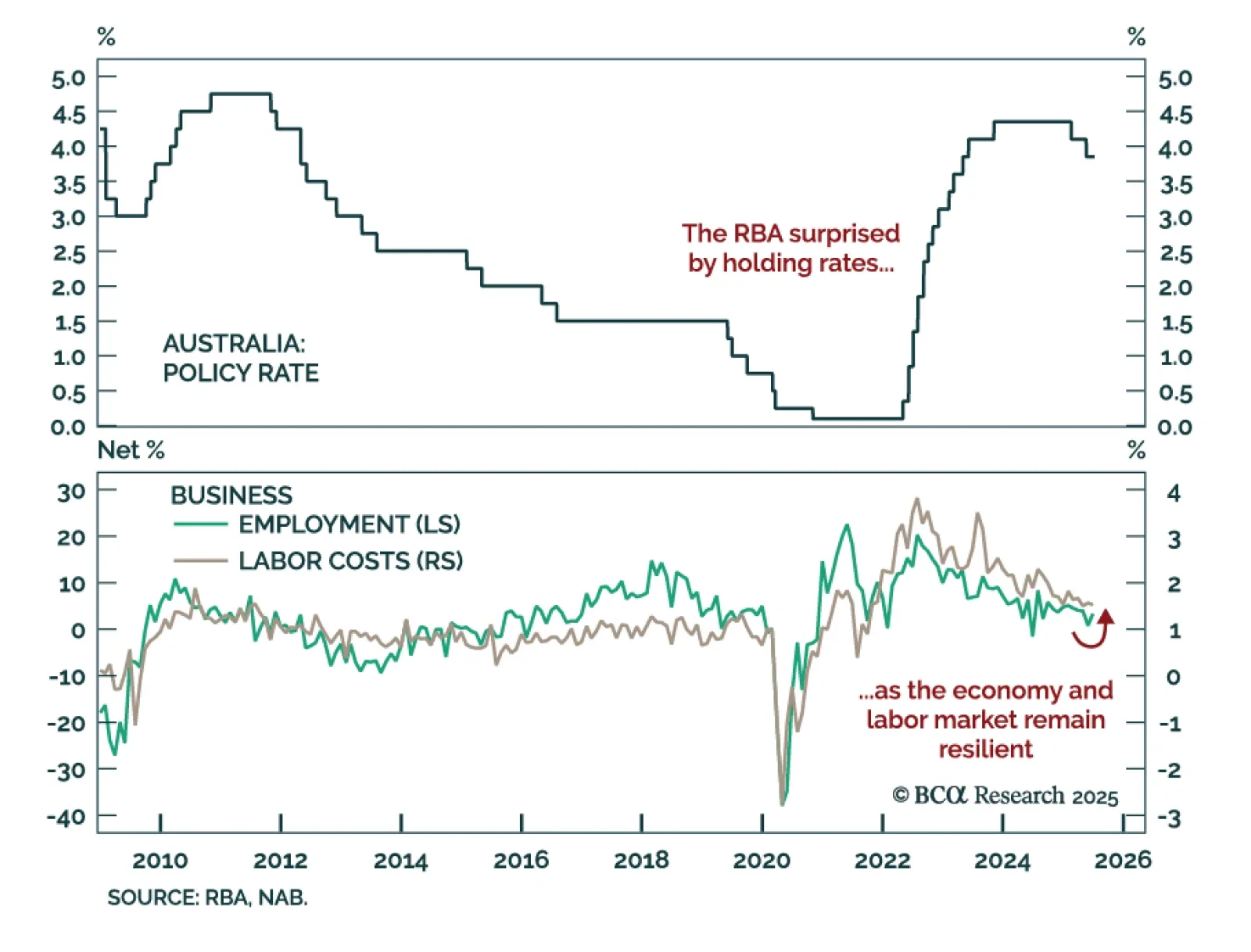

The RBA’s surprise hold reinforces a slower easing path, warranting an underweight on Australian bonds. Markets had priced in a 25 bps cut, but the central bank opted to keep rates at 3.85%. Governor Bullock characterized the…