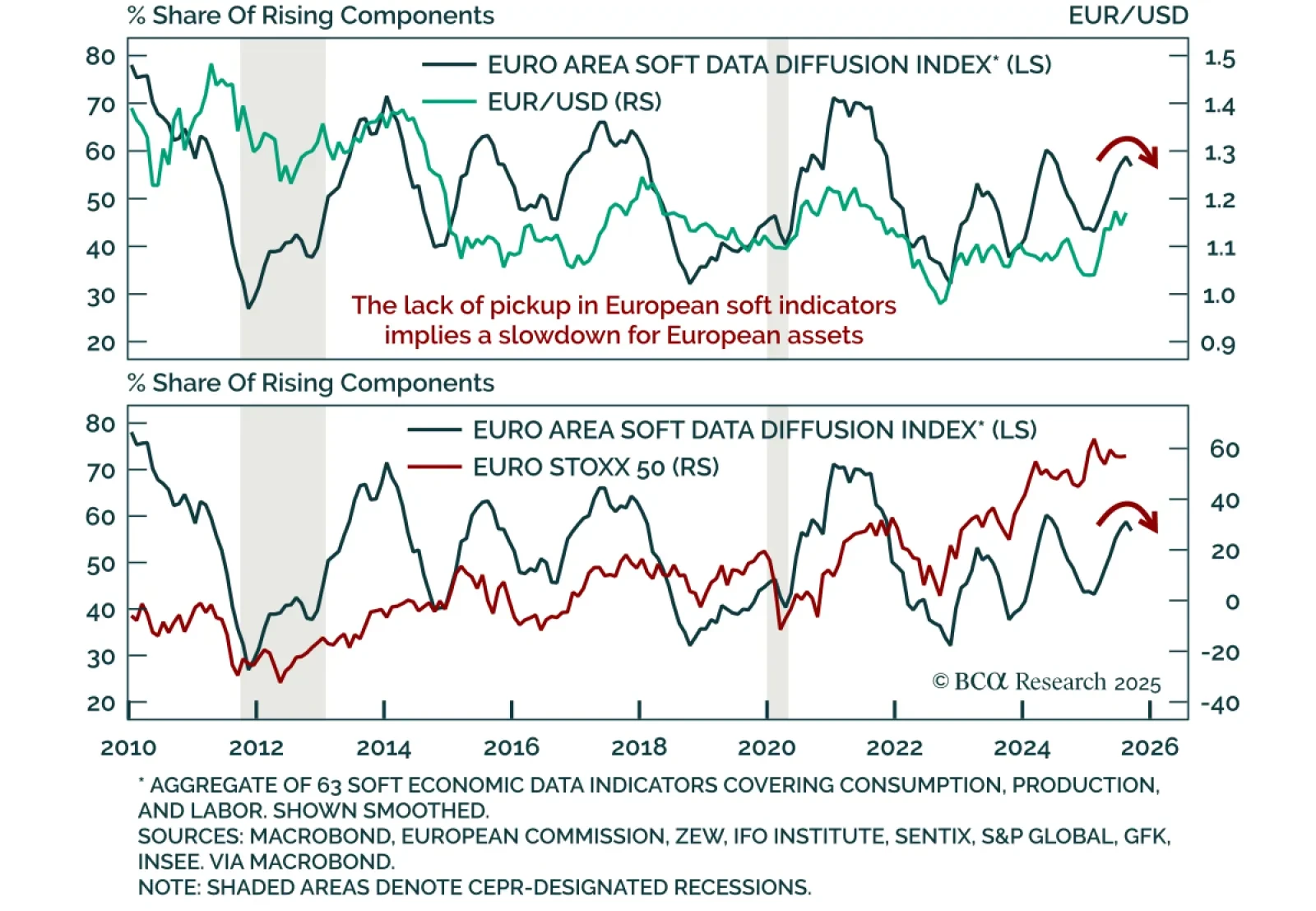

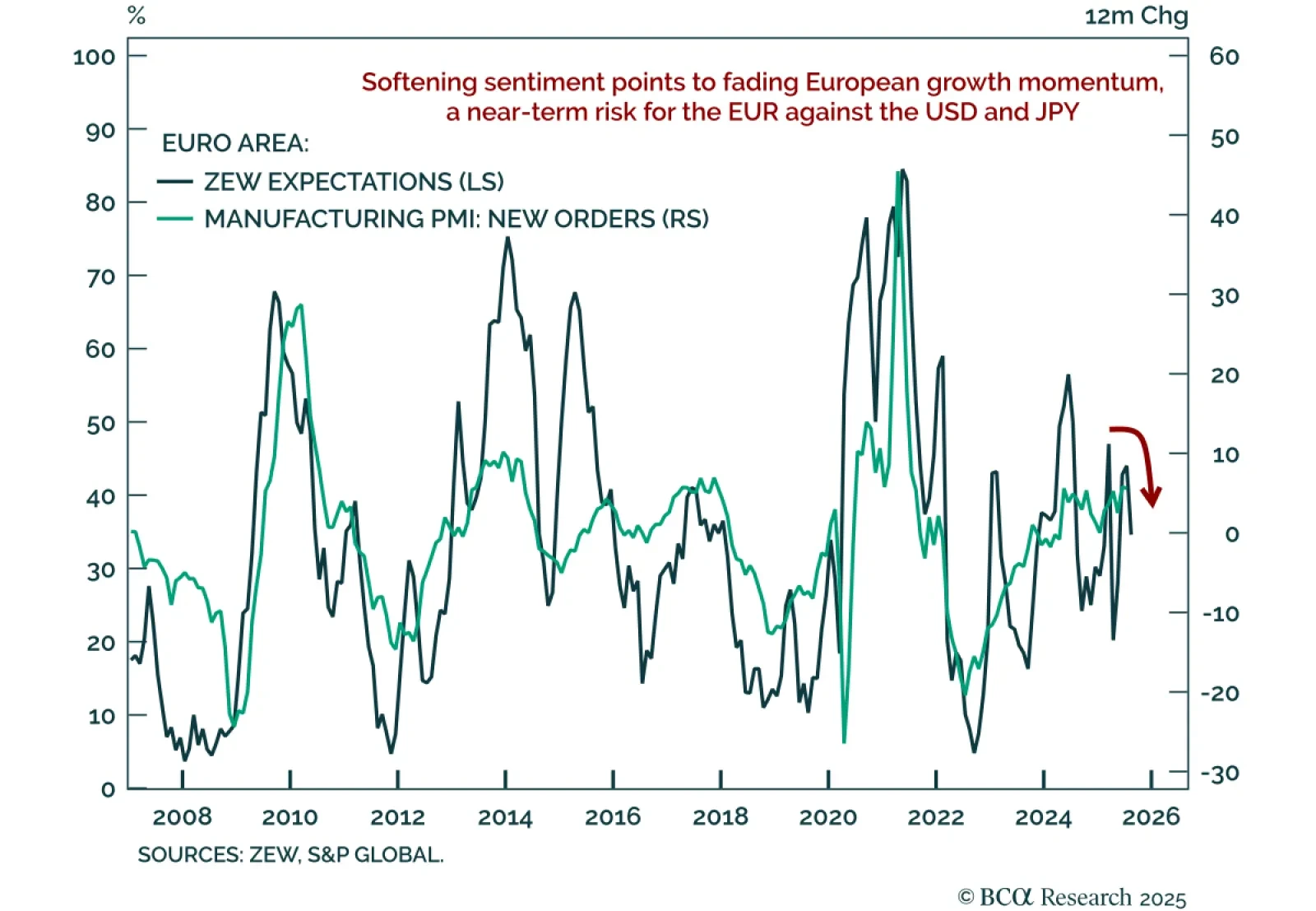

European sentiment indicators weakened again in August and September, reinforcing tactical US outperformance. While the September flash consumer confidence print beat expectations, it is still sluggish. Surveys such as Sentix and ZEW…

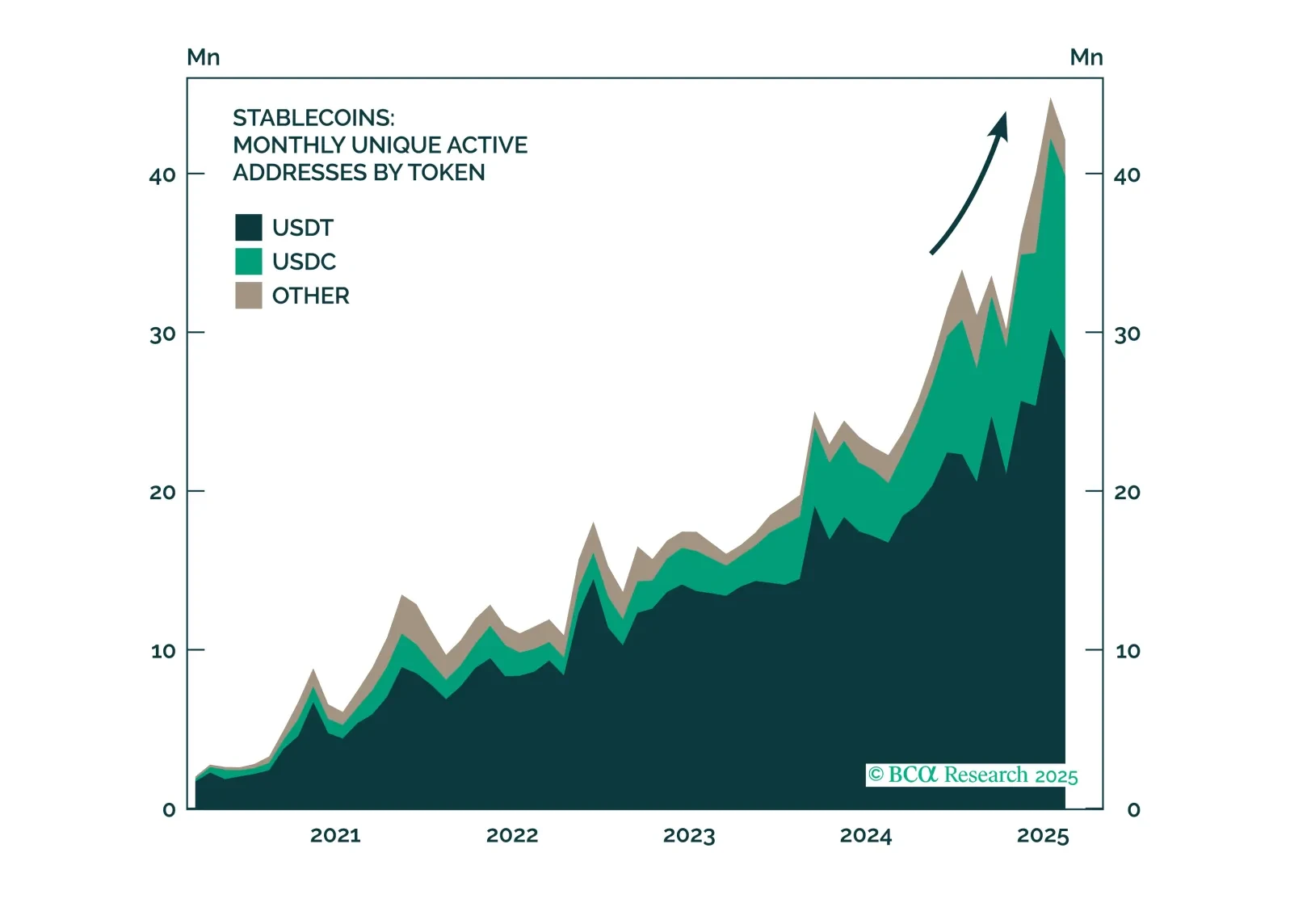

From Treasurys to tokenization, stablecoins are quietly becoming one of the most disruptive forces in global finance, with the power to compress yields, deepen dollar penetration, and shift the balance within crypto markets. Explore…

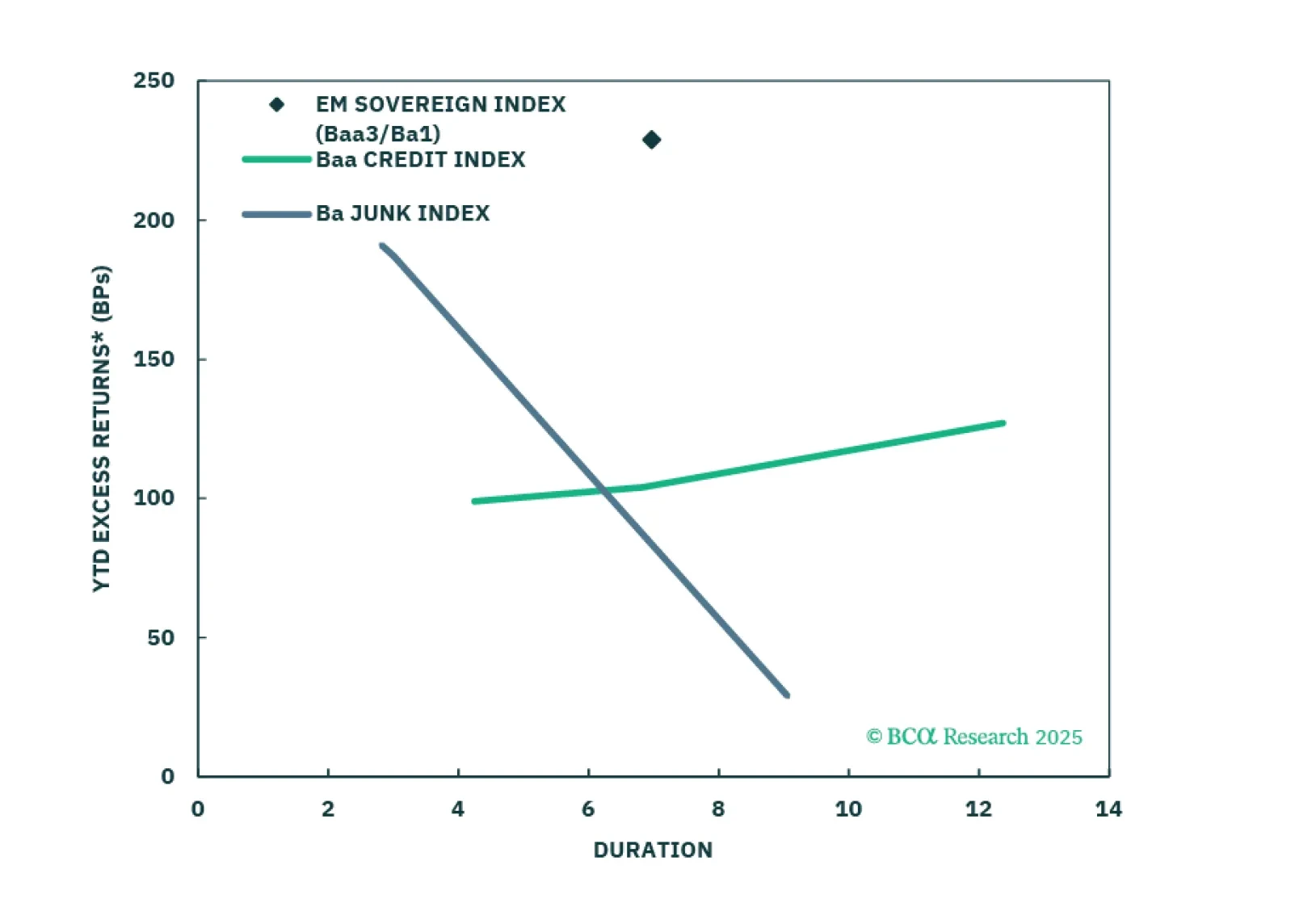

USD-denominated Emerging Market bonds have been outperforming US corporates for the past year. We don’t think the rally is exhausted yet.

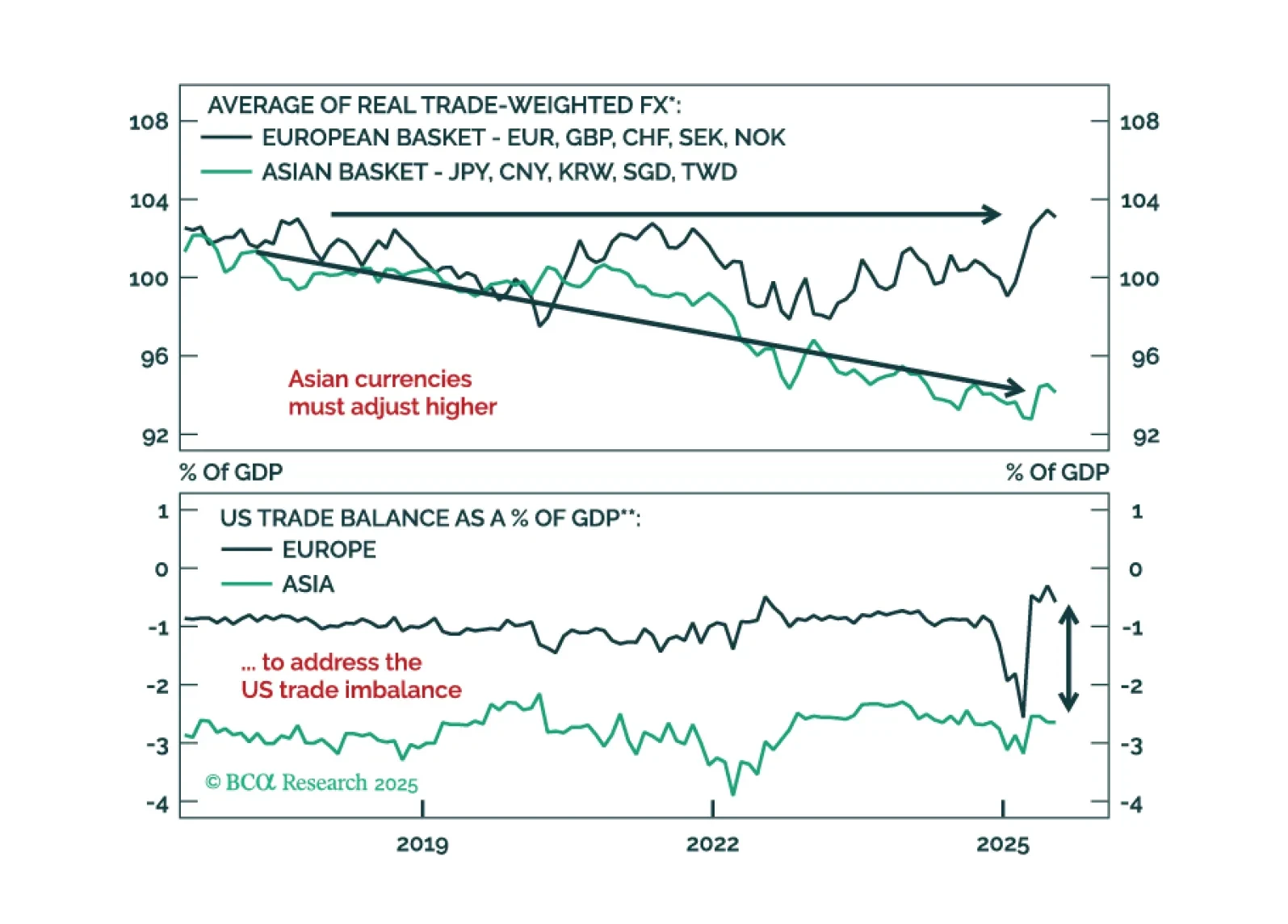

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

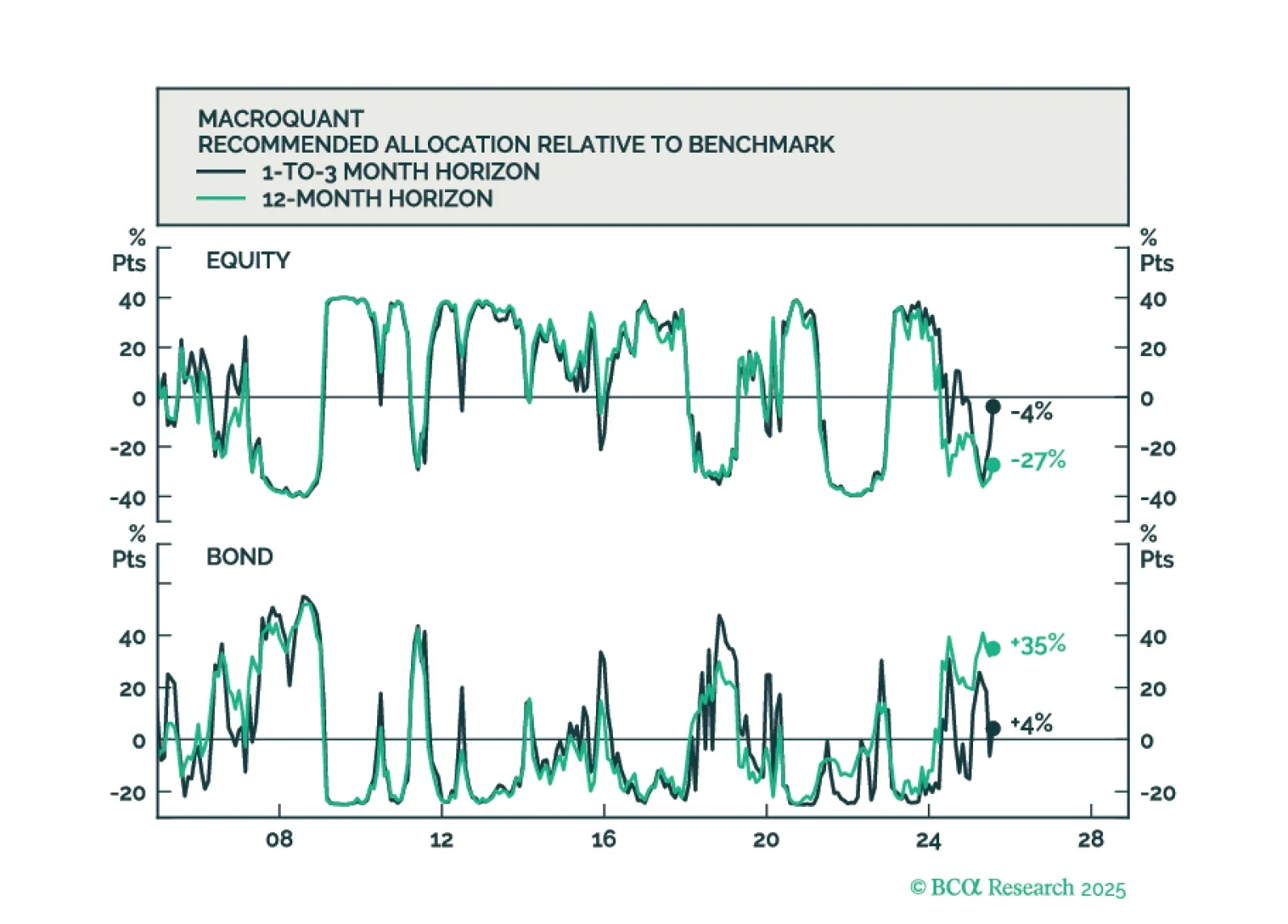

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

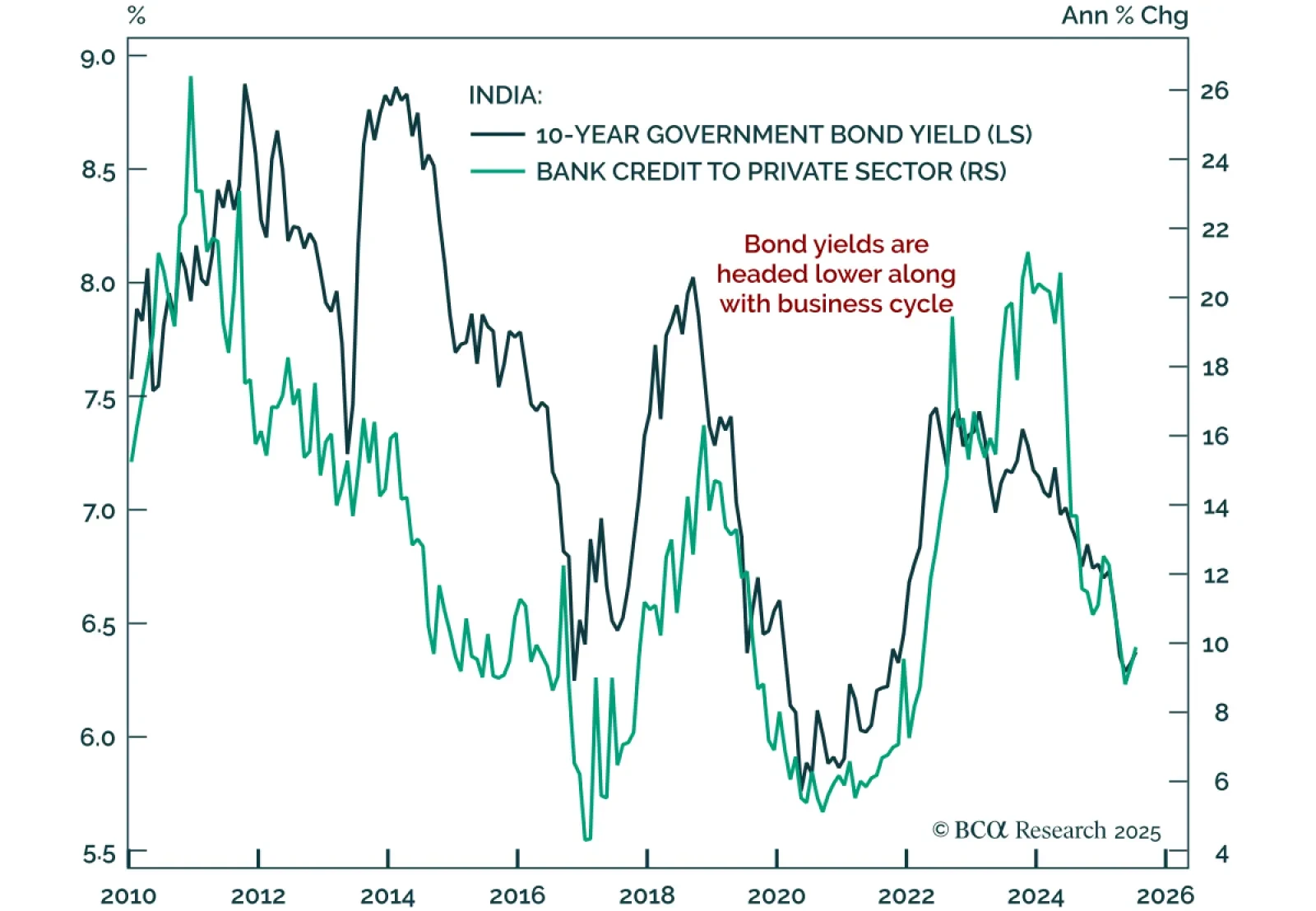

Our Emerging Markets and Foreign Exchange strategists recommend staying neutral-to-underweight on the Indian rupee versus EM Asia peers, as macro and policy pressures mount. US tariffs and possible sanctions on Russian oil imports…

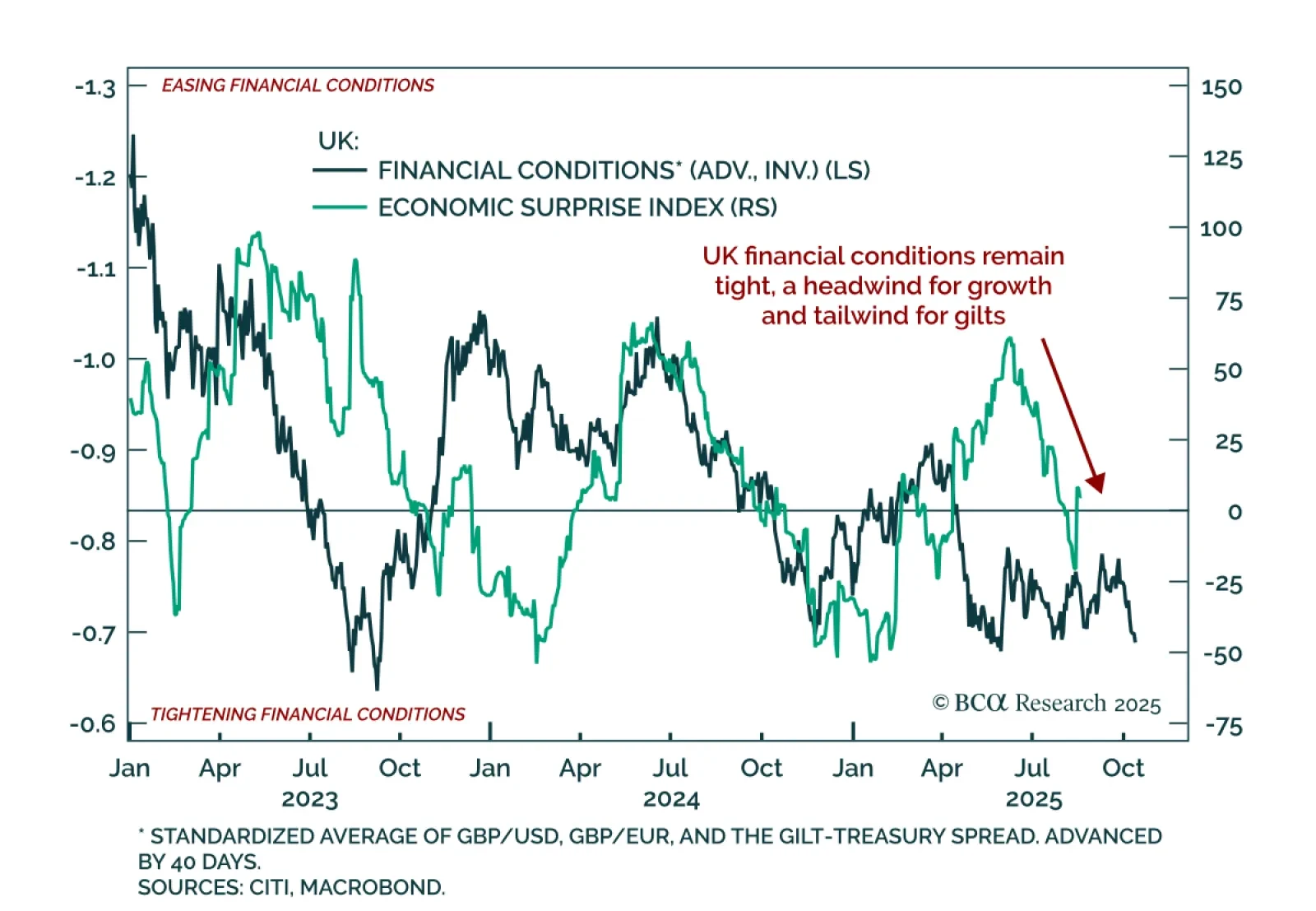

UK data momentum is fading, keeping Gilts attractive and GBP vulnerable. At 5.60%, 30-year Gilts trade at their highest yields since the late 1990s, reflecting persistent pressure on the long end across DMs. The Bank of England…

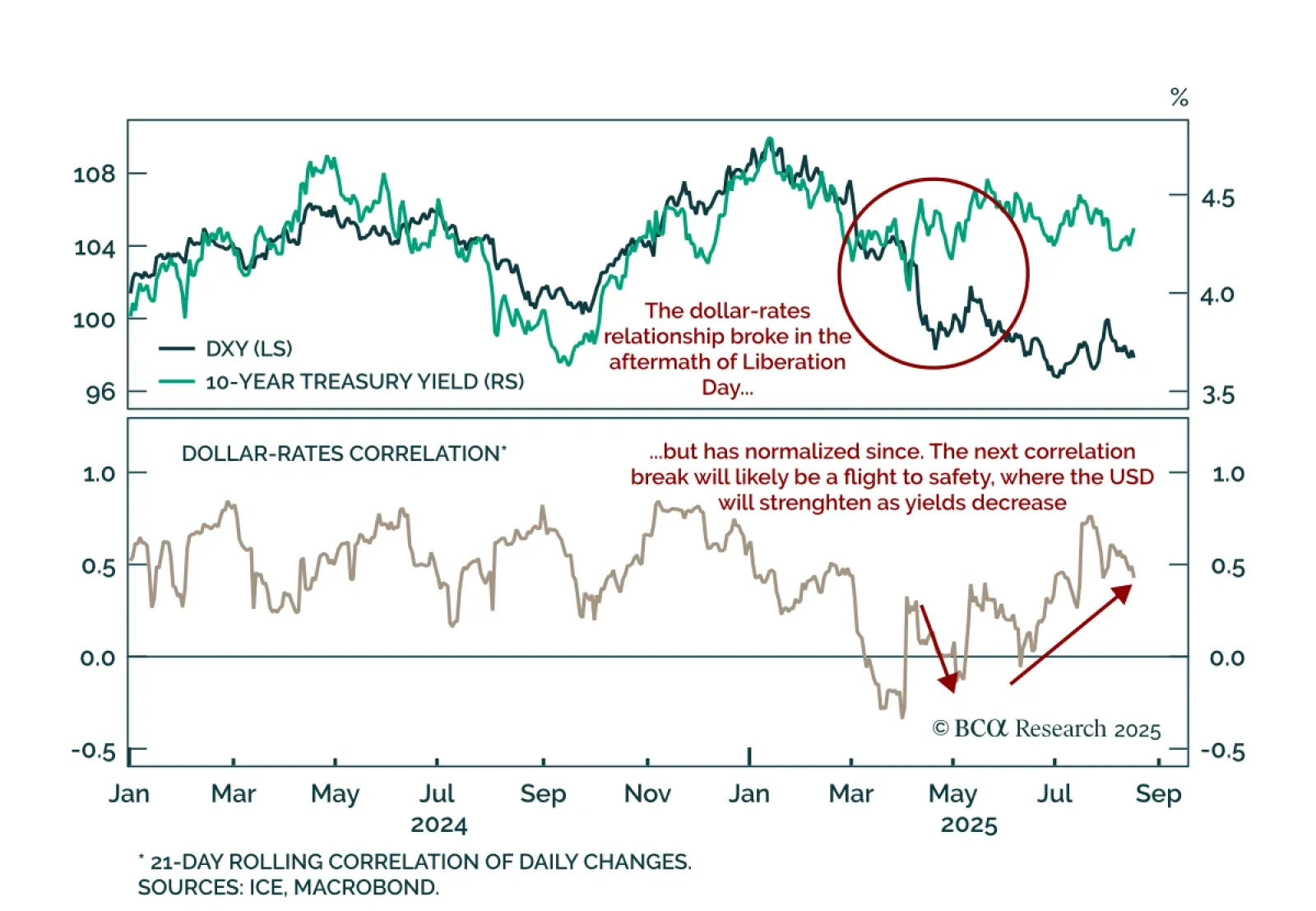

Trade tensions briefly broke the USD-rates link, but the dollar will remain a countercyclical currency for the near future. A key 2025 trend has been USD depreciation, driven by foreign investors reducing exposure to US assets…

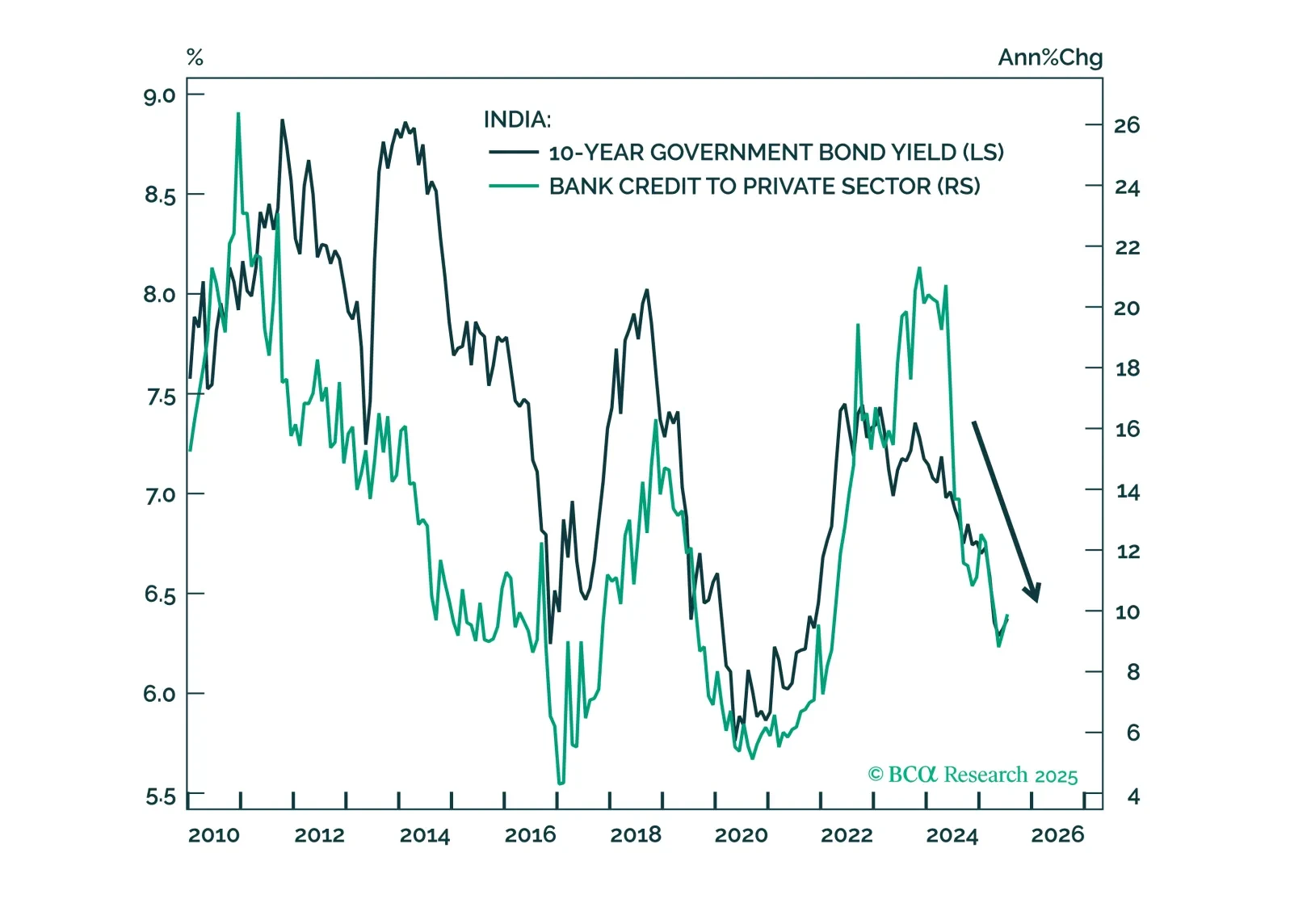

The Indian rupee remains vulnerable to further depreciation amid slowing growth, tight domestic policy, and fragile capital flows. Trade risks and a weakening external balance will likely keep INR underperforming EM Asia peers.…

European sentiment has moderated, pointing to near-term downside risk for a technically-stretched Euro. The August Eurozone ZEW Expectations index fell to 25.1 from 36.1, with Germany’s reading missing estimates, dropping sharply to…