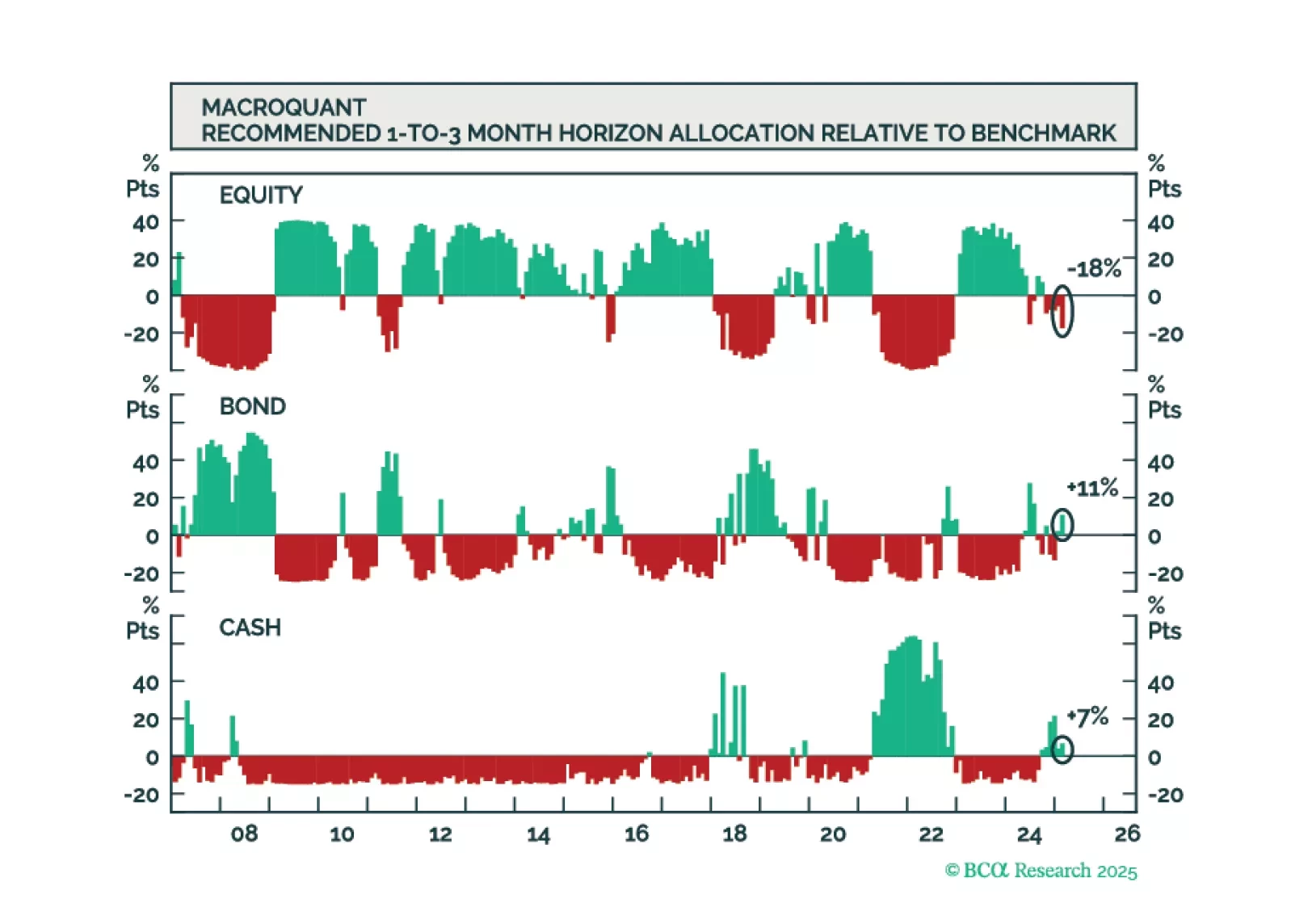

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

Going into April, MacroQuant recommends a modest underweight on stocks, offset by an overweight on bonds and cash. While MacroQuant is modestly bearish on stocks, we suspect that the downside risks to equities may be greater than…

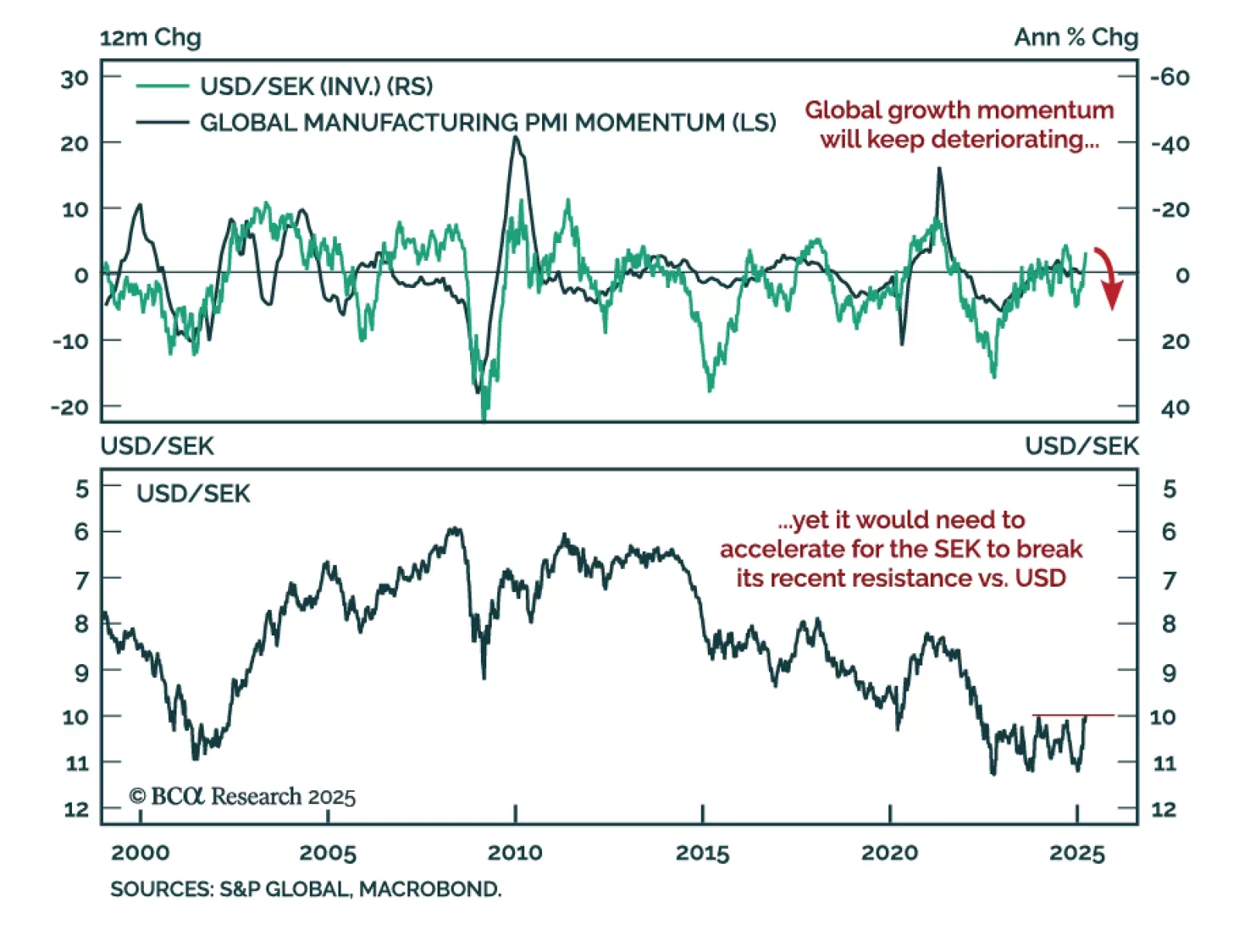

The SEK’s sharp rally is losing steam as local data weakens and EUR strength looks stretched. After appreciating more than 10% against the USD year-to-date, the krona is now showing signs of fatigue. Recent Swedish data has…

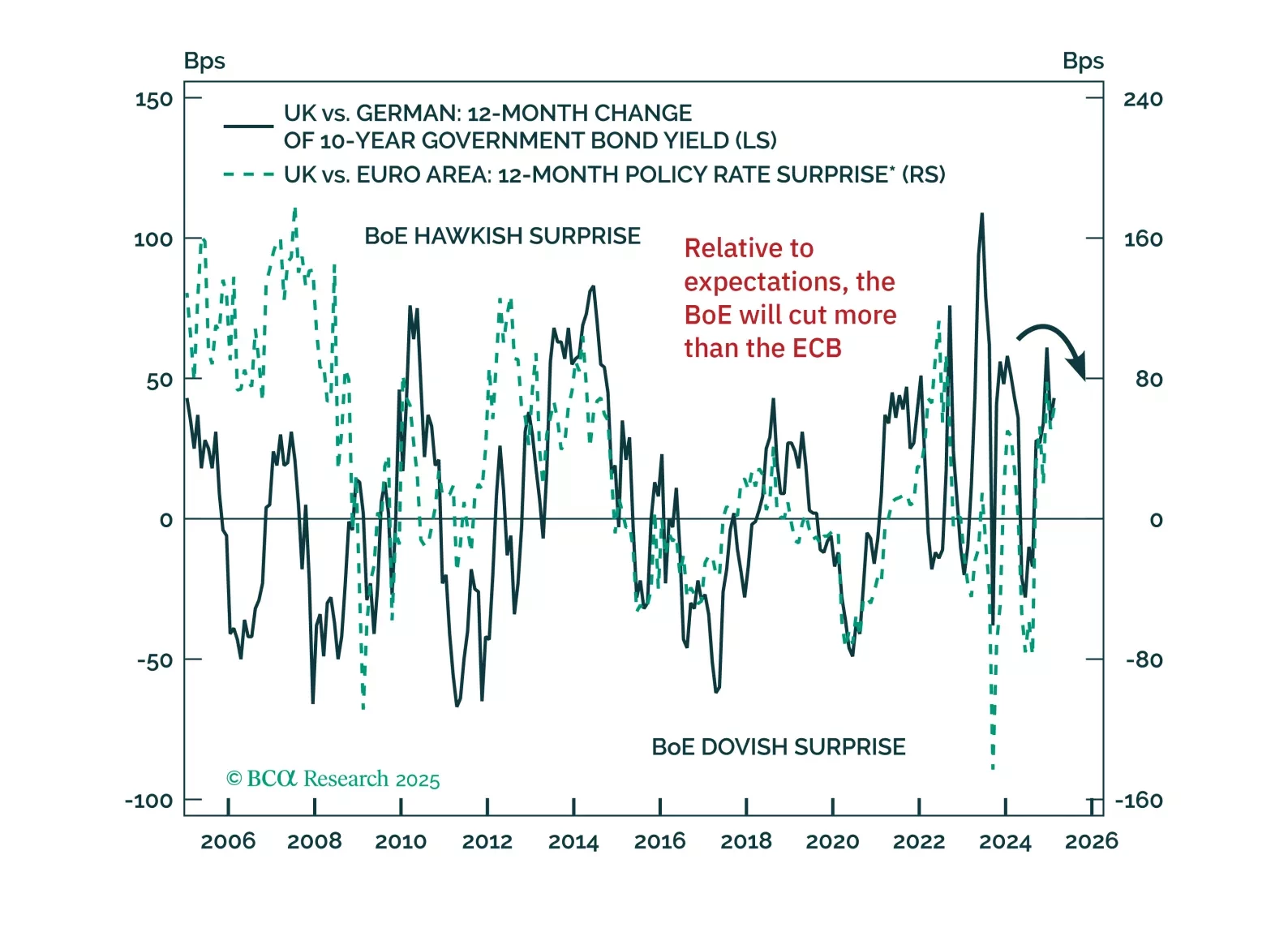

With economic headwinds building and fiscal dynamics shifting, bond markets are at a turning point. Our latest note outlines why German bund yields are set to decline and why UK gilts are poised to outperform — and how to position…

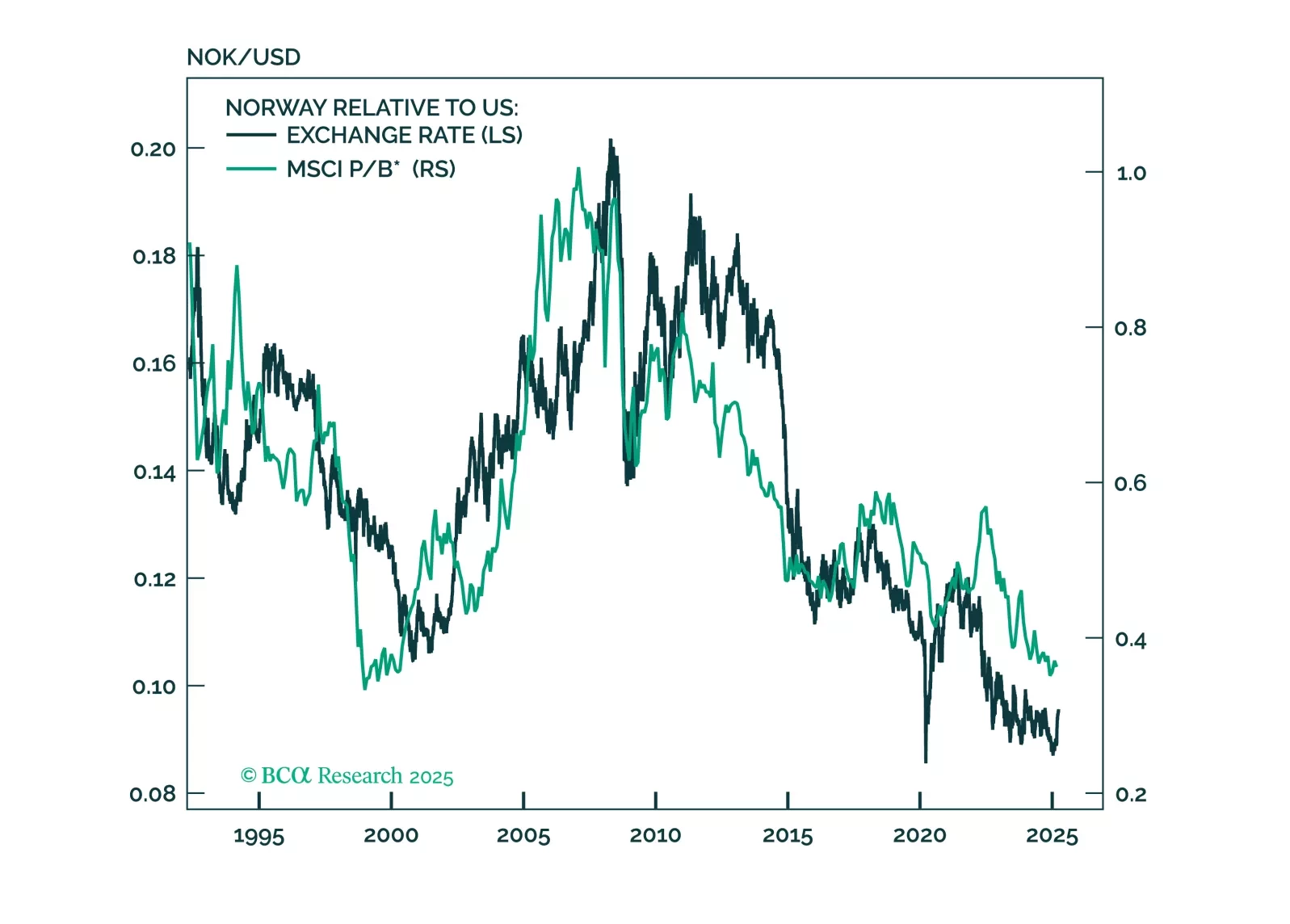

This report looks at investment implications, for Norwegian assets, given the recent meeting, from the Norges Bank.

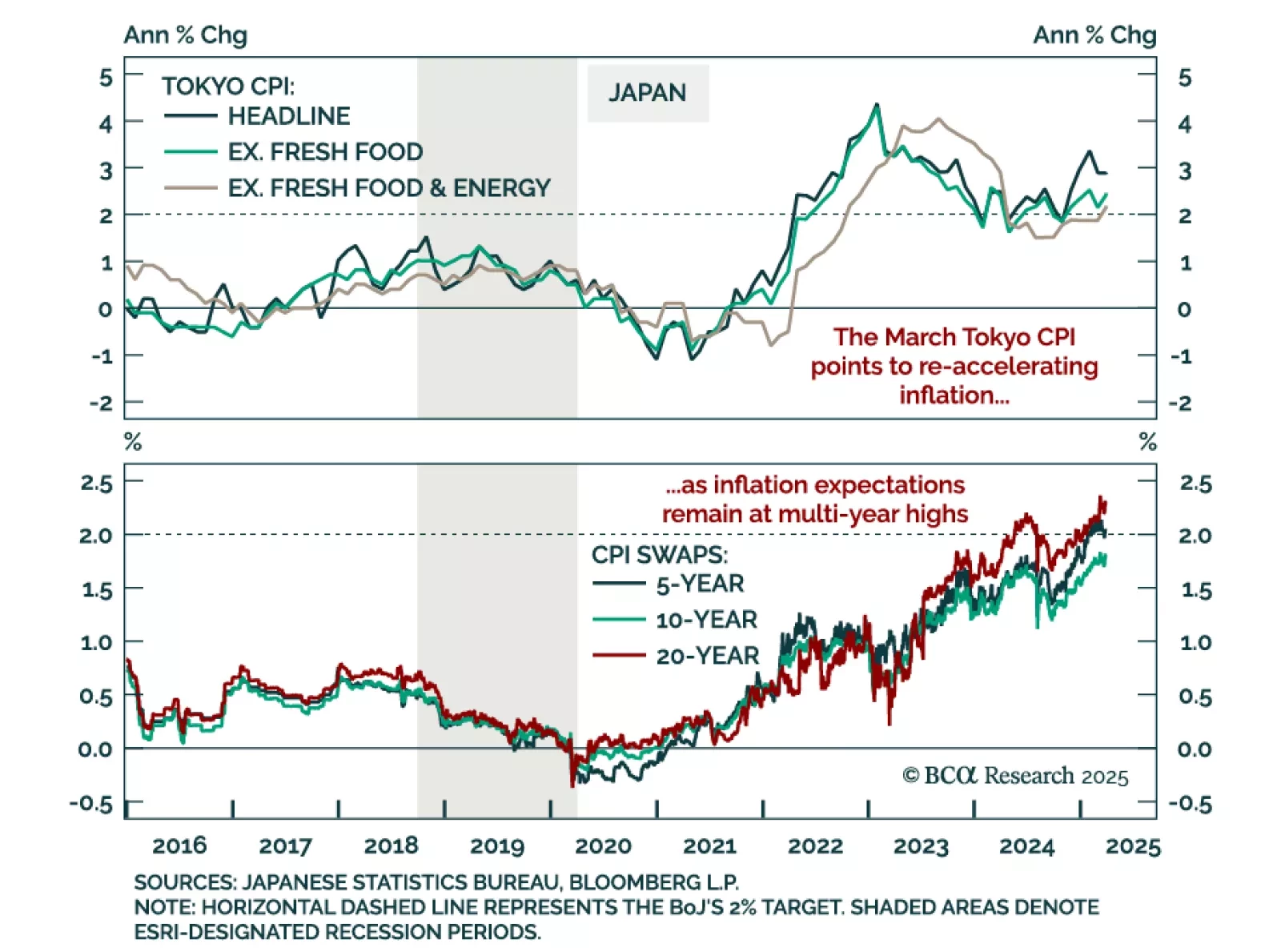

Japan’s inflation pulse remains firm, reinforcing our long JPY stance and cautious view on JGBs. Tokyo CPI for March surprised to the upside, with headline inflation slightly up at 2.9% y/y and “core core” accelerating above the BoJ’…

Stocks will continue to struggle in the second quarter as President Trump tries to implement tariffs. Tax cuts will only temporarily dispel growth fears, if at all. Middle Eastern instability will add oil price surprises to an…

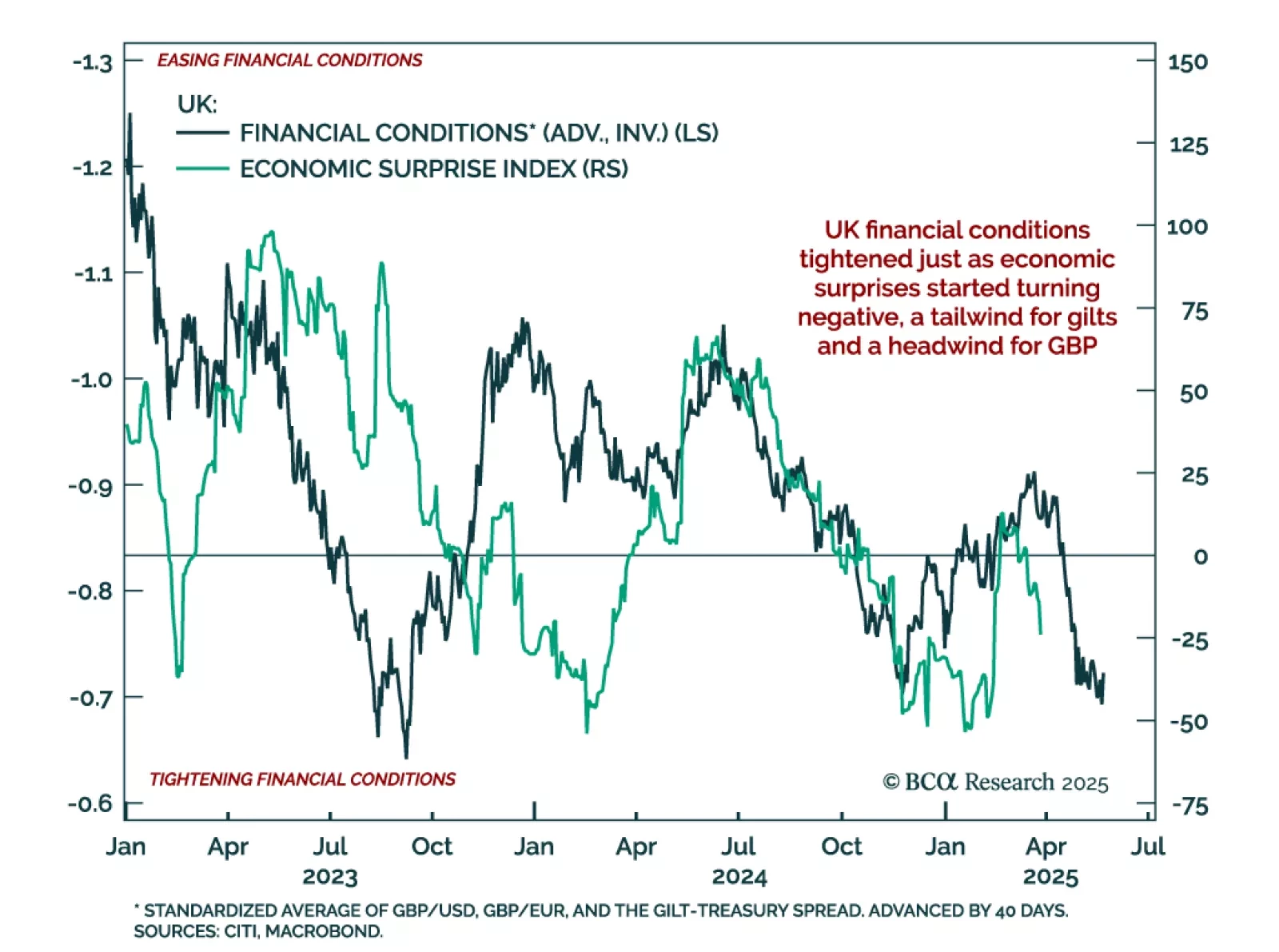

UK financial conditions have tightened just as economic surprises have turned negative, an uncomfortable combination that reinforces our tactical positioning. We remain overweight UK gilts within a global bond portfolio and are…

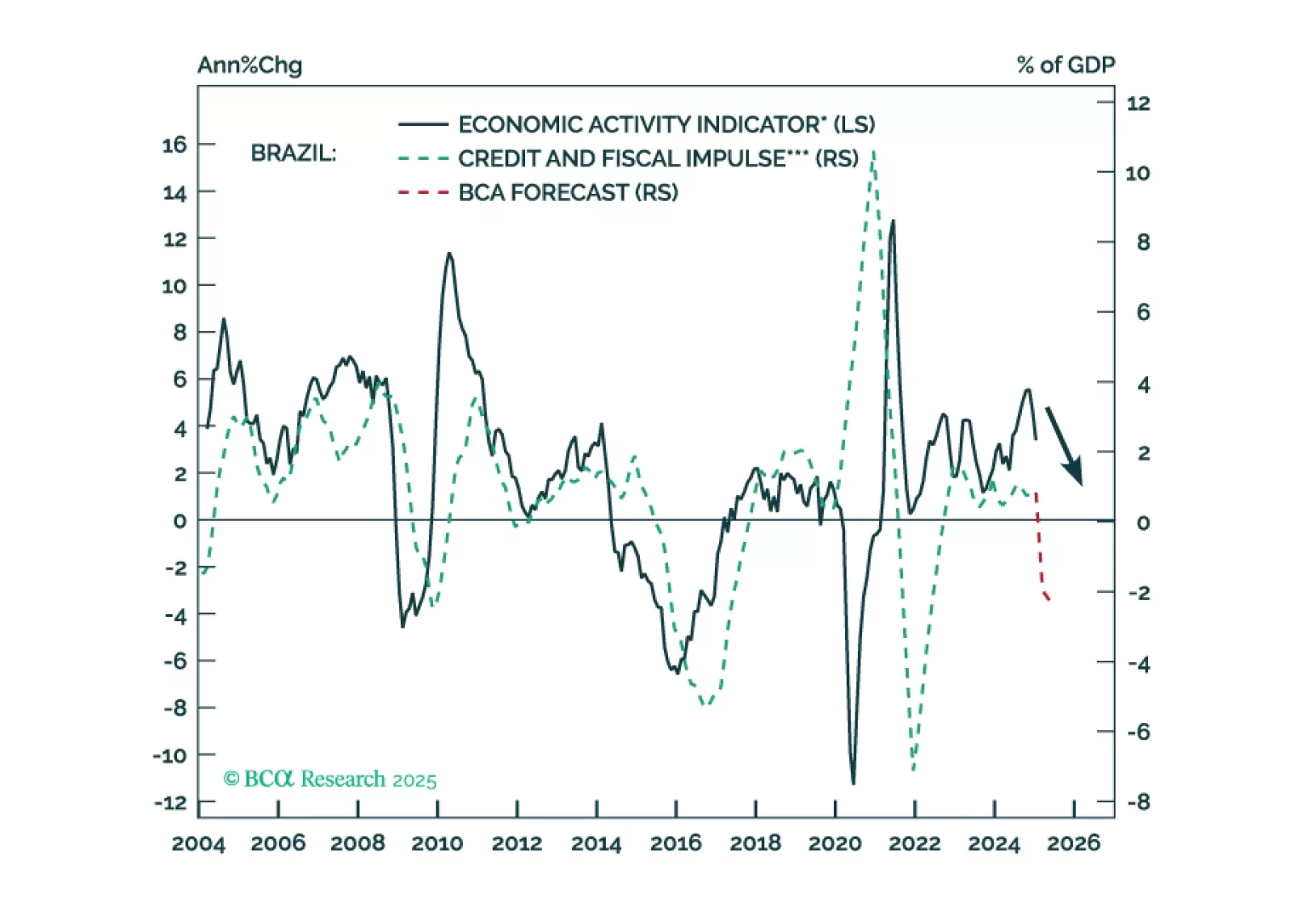

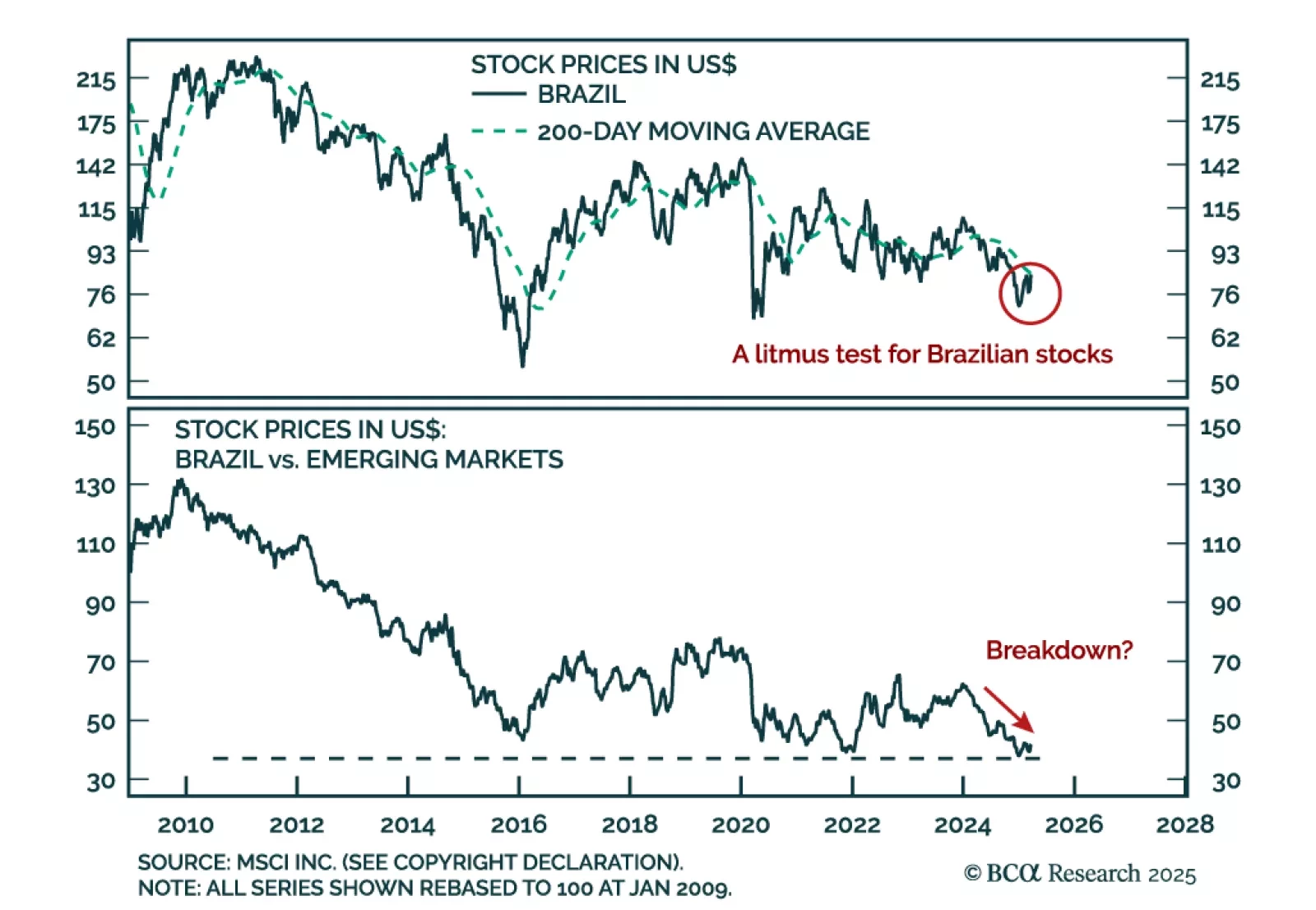

Our Emerging Market strategists downgraded Brazilian equities as public debt dynamics deteriorate and macro fundamentals weaken. While they previously maintained a neutral stance despite being bearish on the Bovespa, the risks have…

Brazilian policymakers are stuck between a rock and a hard place. There is no combination of fiscal and monetary policies that can assure decent growth, on-target inflation, a stable exchange rate, and public debt sustainability. We…