China’s Fourth Plenum outlined priorities for its 2026–2030 plan, emphasizing household consumption and technological upgrading but signaling continuity over change. The document highlights a rebalancing toward consumption as a share…

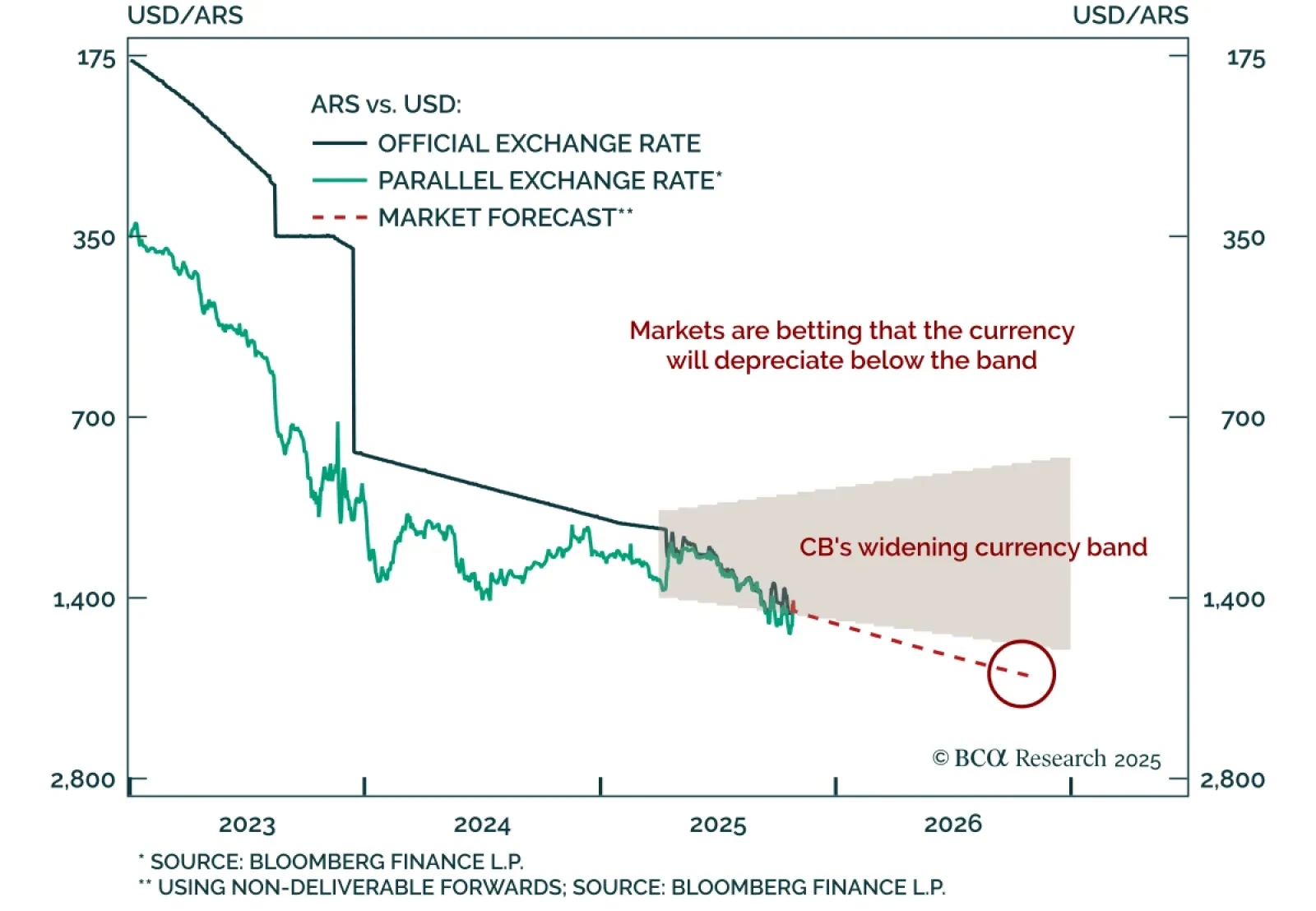

President Javier Milei’s decisive electoral victory has revitalized Argentina’s liberal reform agenda and restored investor confidence. After last month’s setback in Buenos Aires, markets feared the liberal experiment was over.…

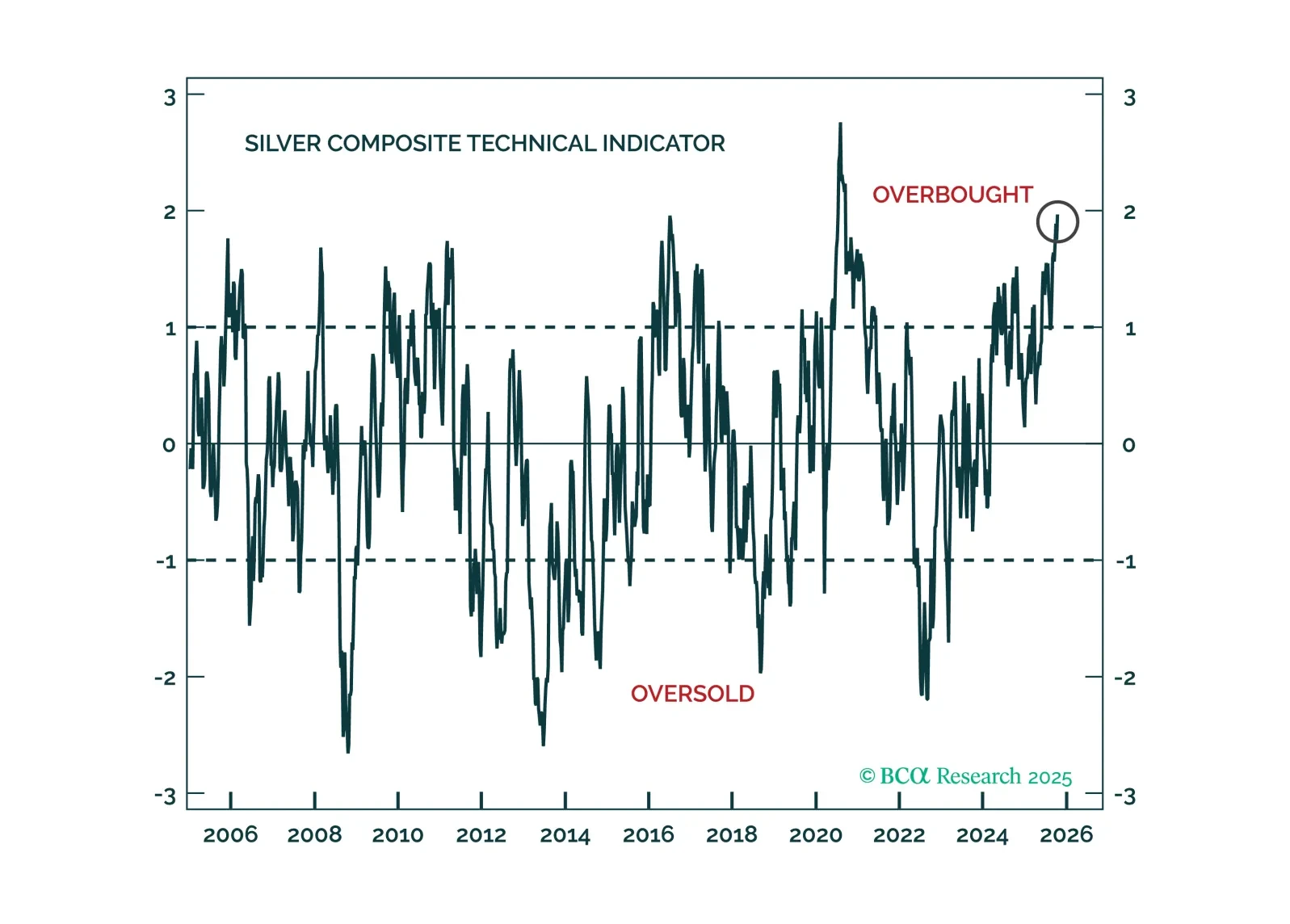

Speculative froth has built up across all precious metals, yet gold’s structural tailwinds will allow it to weather corrections better than its peers.

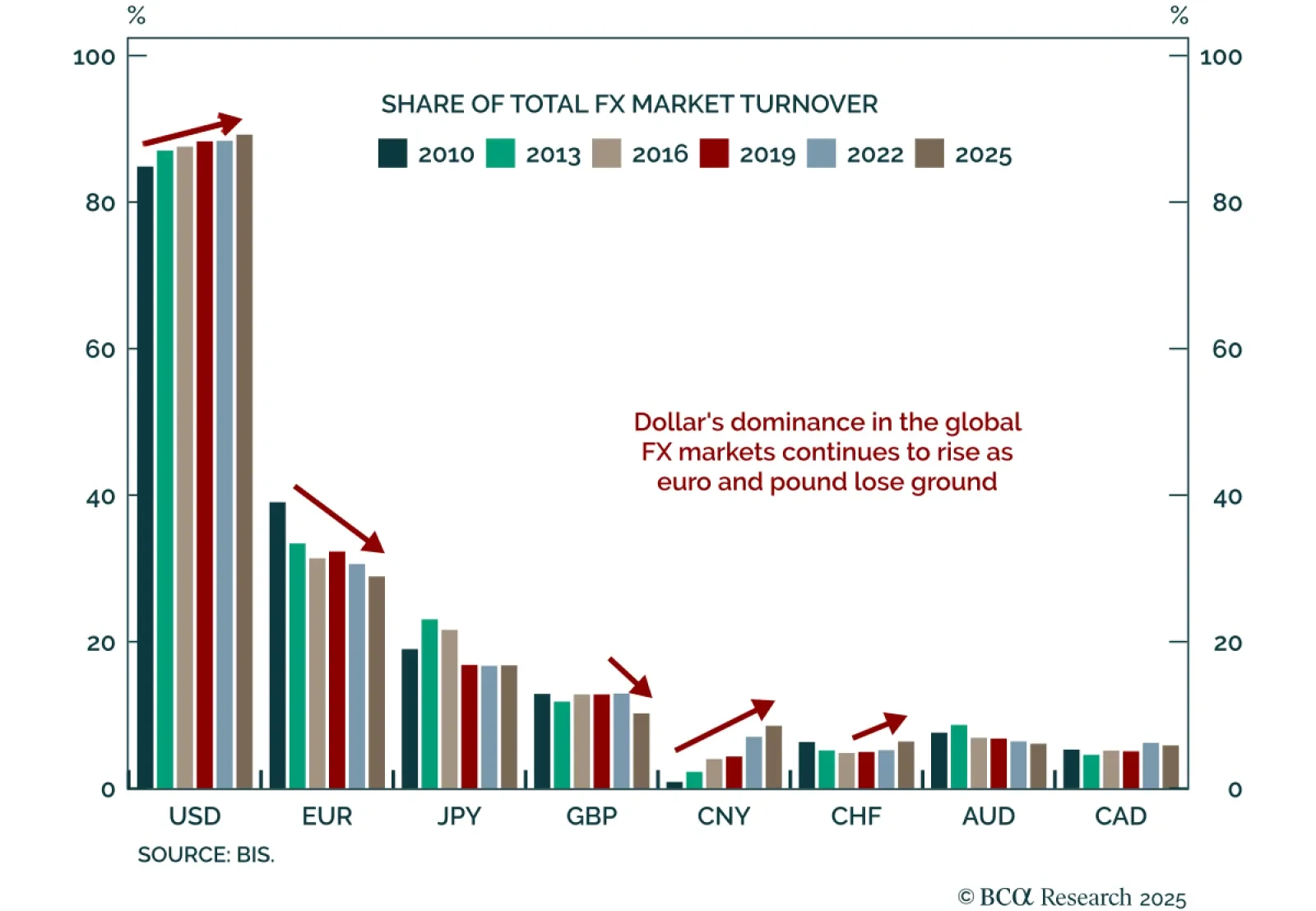

The latest BIS Triennial Central Bank Survey reaffirms the US dollar’s dominance in global FX markets, highlighting the structural challenges of truly moving away from the USD-centric financial system. The survey conducted in…

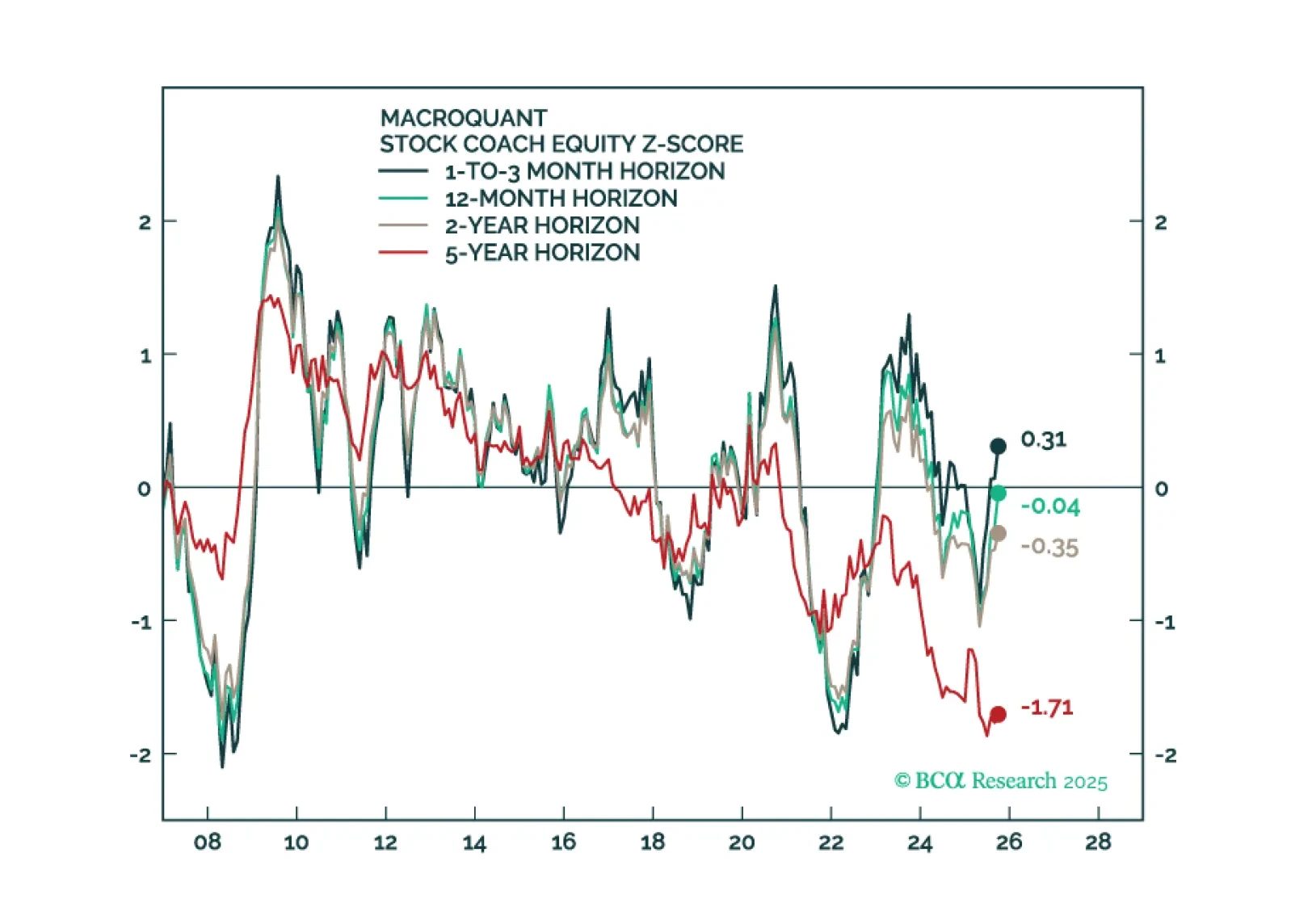

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

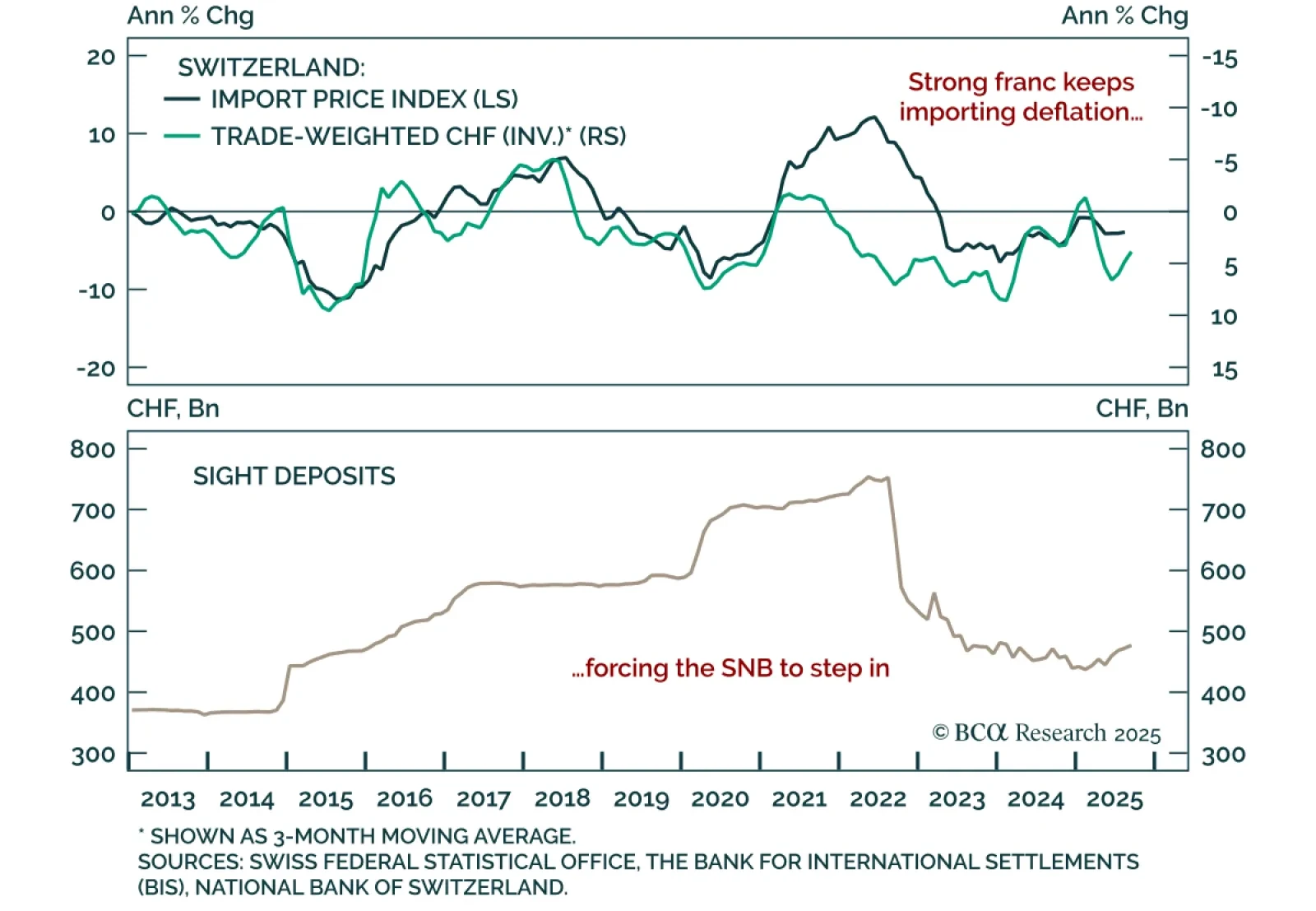

Expect greater currency interventions and negative policy rates from the Swiss National Bank (SNB), reinforcing a neutral stance on CHF and Swiss sovereign debt over the next 12 months. In recent joint statement on foreign…

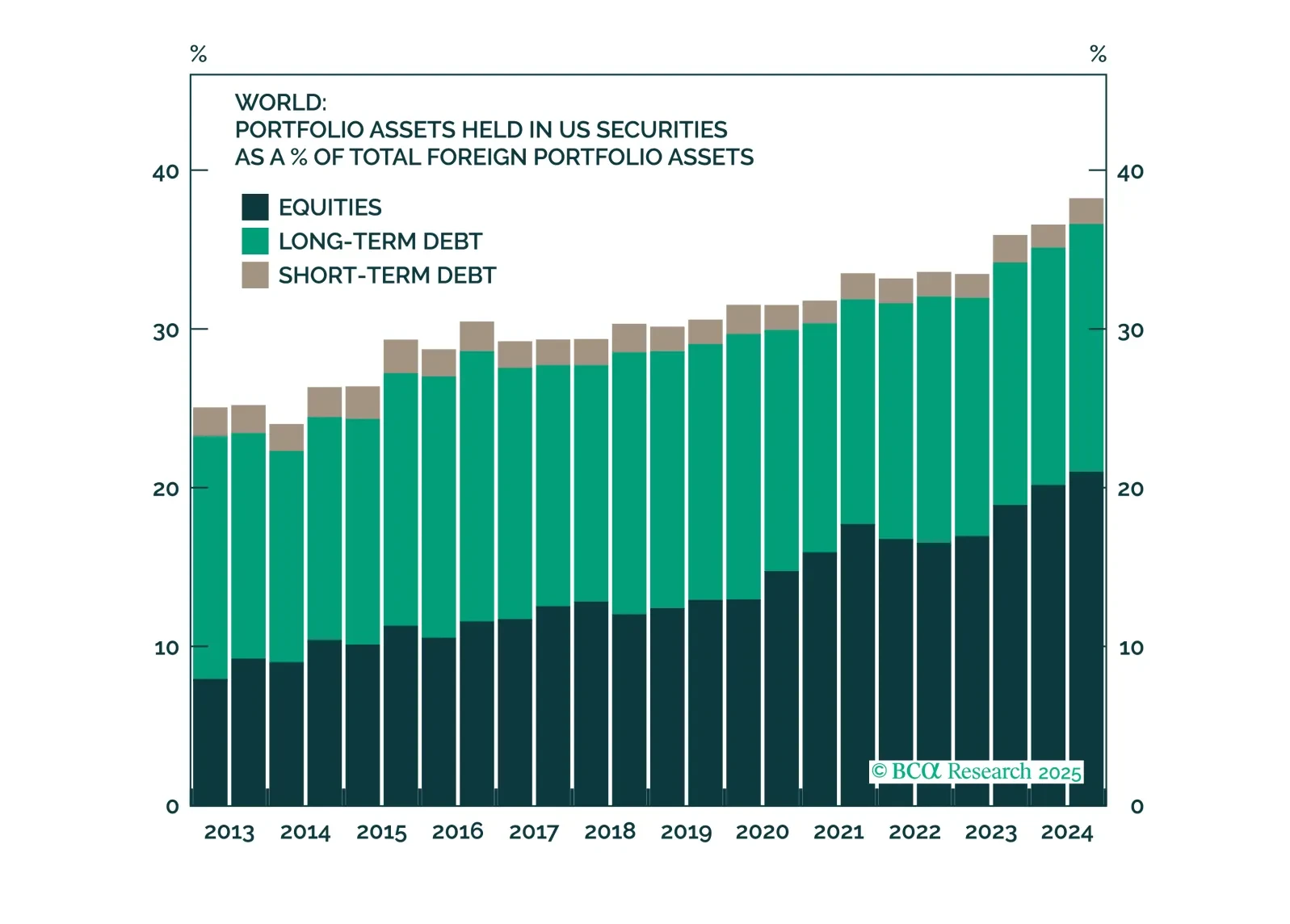

The dollar’s early 2025 decline was a reflection of a global rush to hedge accumulated USD exposure, not a mass exodus from US assets. With most hedging now complete, currency moves should again follow fundamentals, setting the stage…

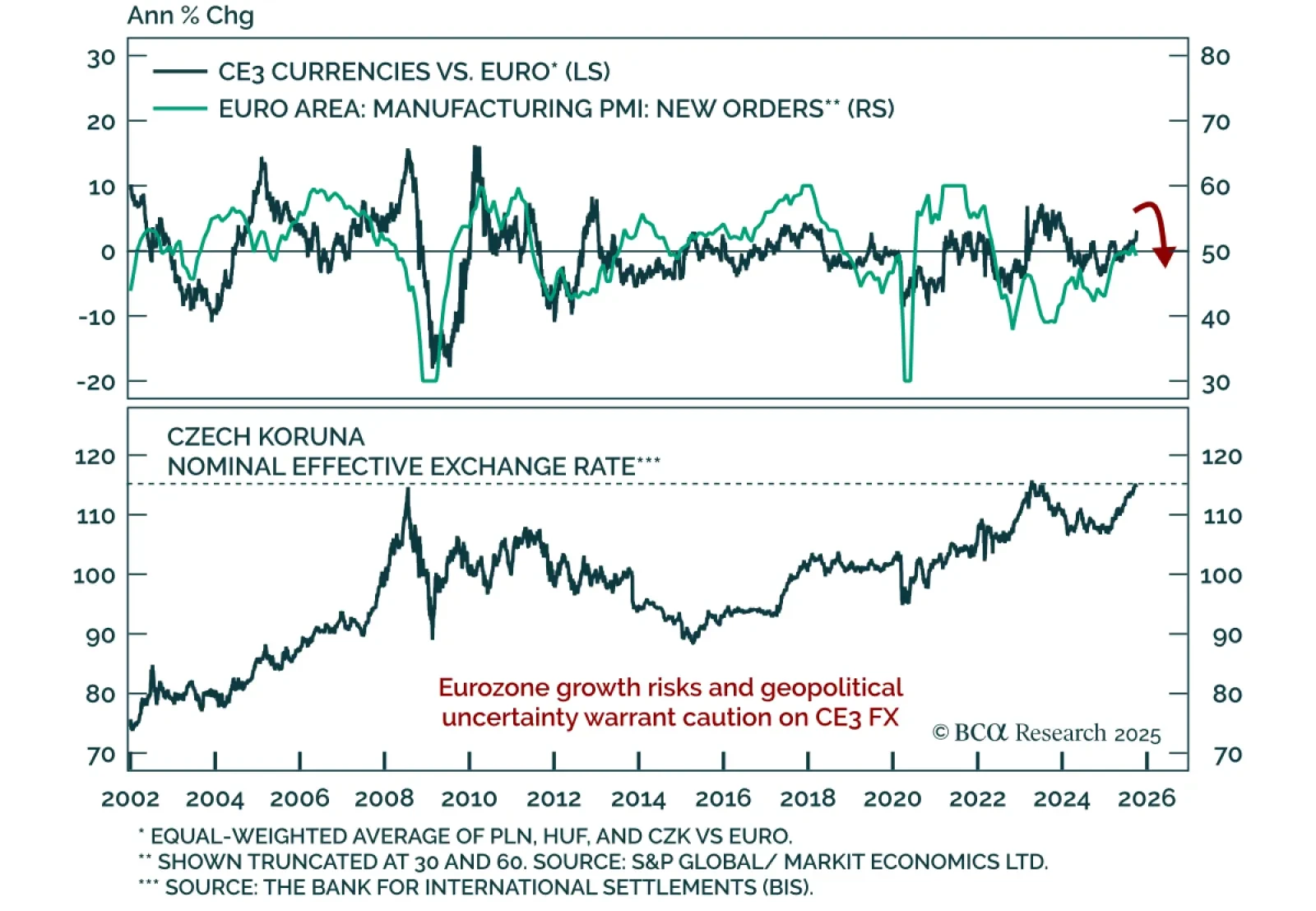

Eurosceptic billionaire Andrej Babis and his populist ANO party won the Czech parliamentary elections, securing 40% of the seats, short of an outright majority. The outcome was broadly in line with expectations but was viewed…

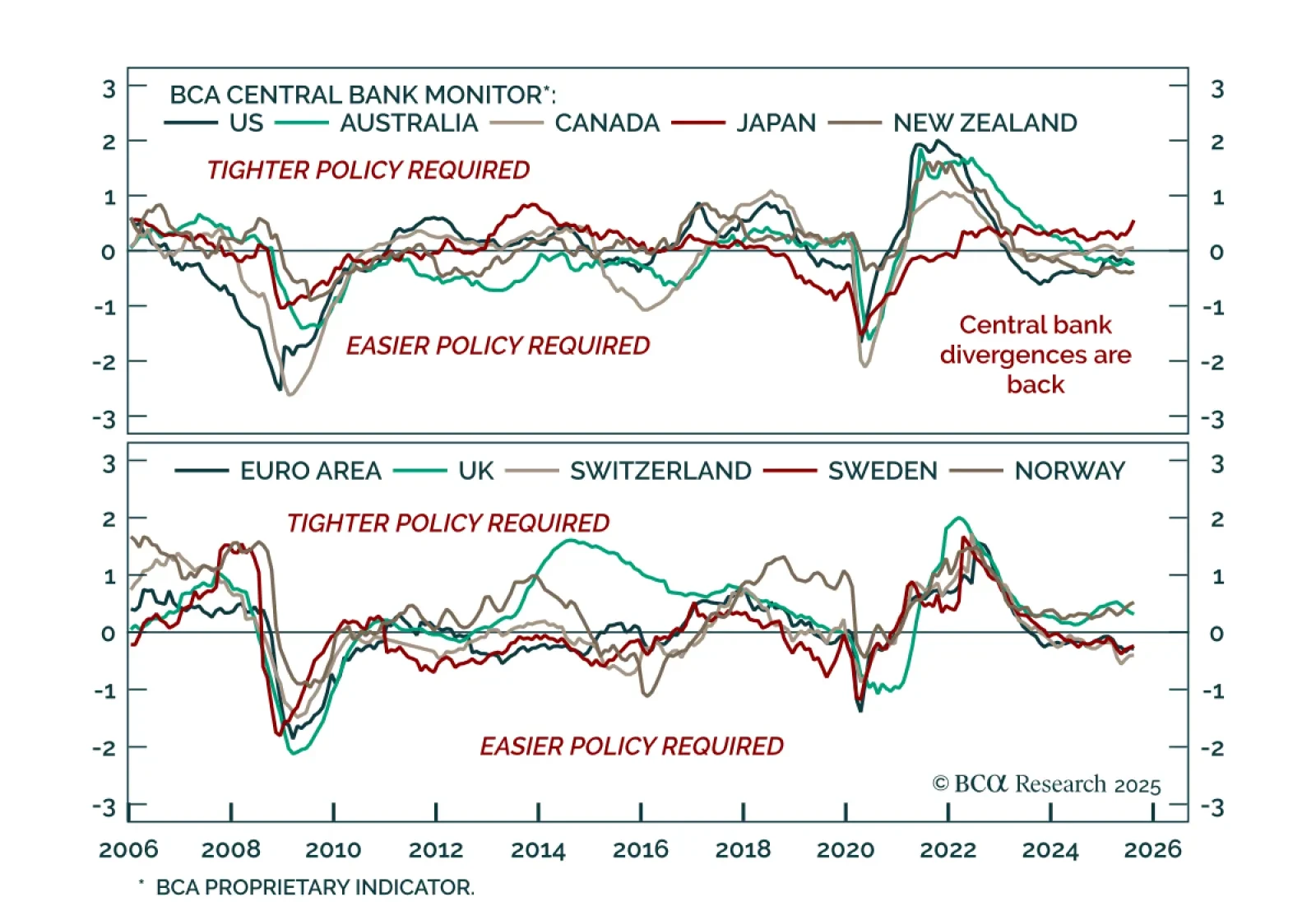

Our DM strategists recommend regional bond overweights in the UK, Canada, and Sweden, and express policy divergence through tactical FX trades: long USD, underweight GBP and SEK, and long JPY vs. EUR. Most G10 central banks are…

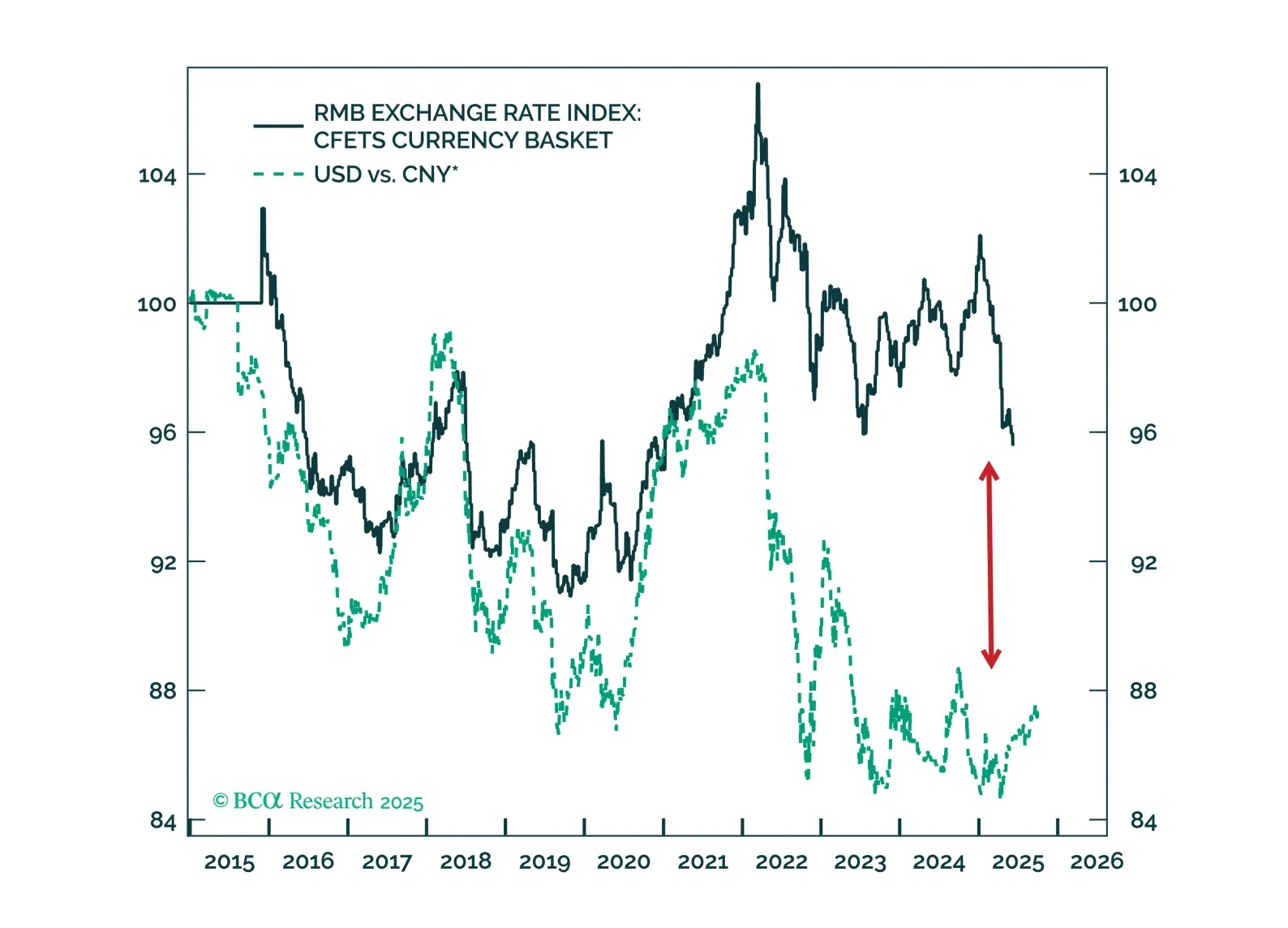

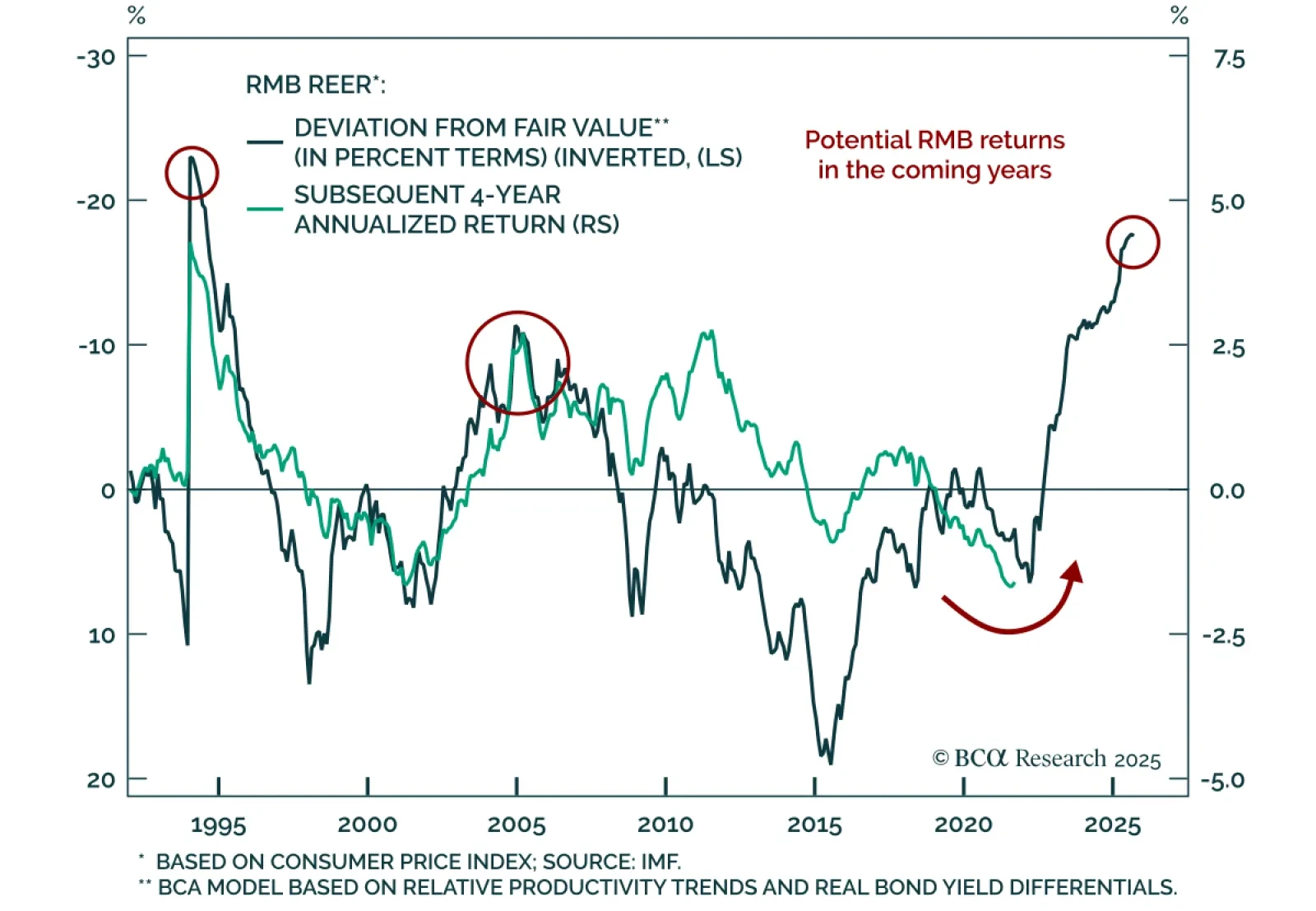

The CNY/USD has room to appreciate both cyclically and structurally, while nominal yields on China’s long-duration government bonds are set to fall. This combination supports Chinese equities.