Our Counterpoint strategists overweigh Europe versus the US across both equities and bonds, and are structurally long bitcoin. Trump’s tariffs are deflationary for the world and inflationary for the US, prompting a sharp shift in…

This week, our three screeners cover equity plays on the run-up in gold prices, a hotter-than-expected US inflation print, and calling the top in Bitcoin.

Our Global Asset Allocation strategists assessed the current cryptocurrency environment, and pared back their bullish view on this asset class. In early 2023, our colleagues took a bullish stance on crypto, ahead of the broader…

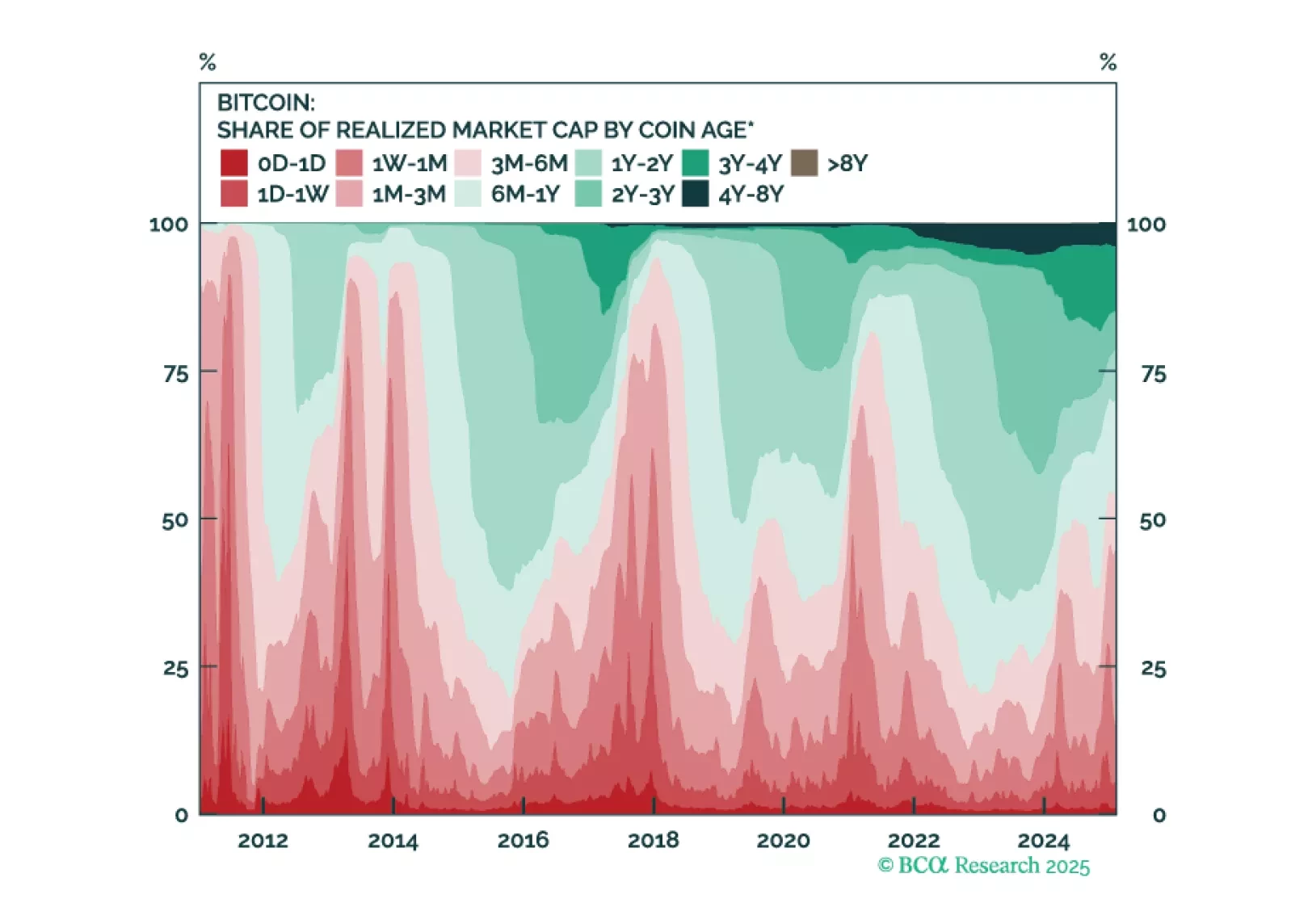

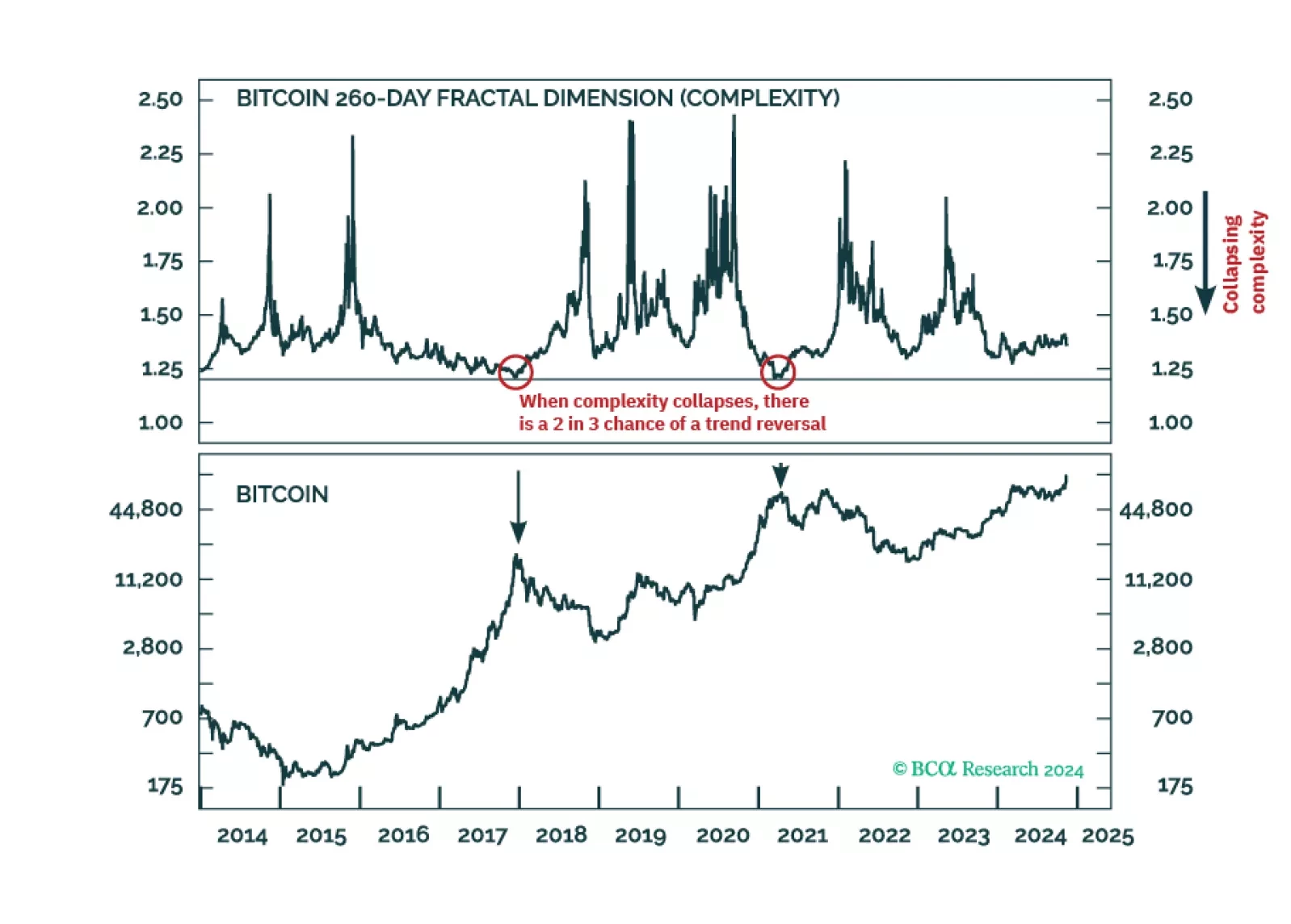

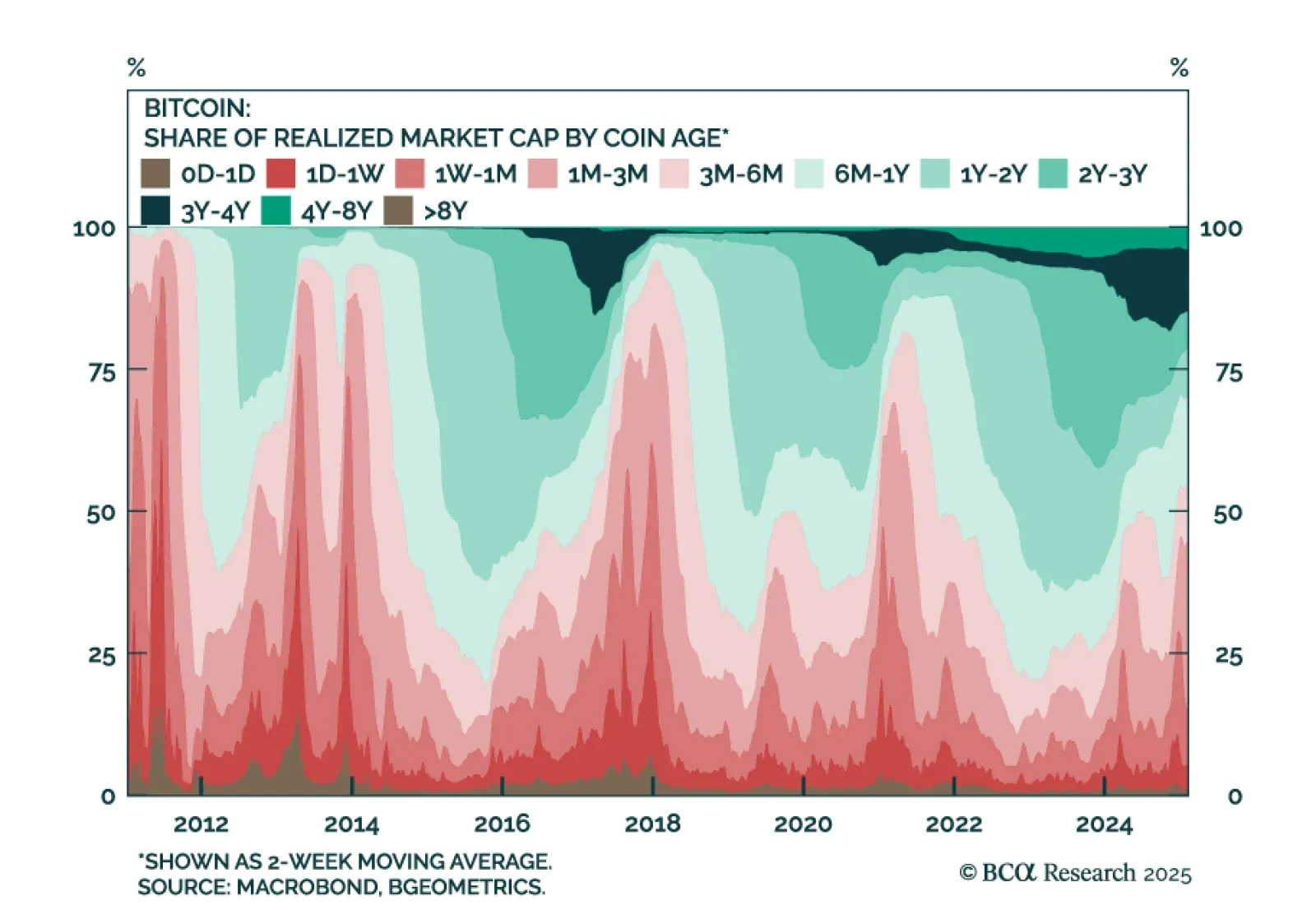

In this report, we reassess our bullish stance on crypto from early 2023, following Bitcoin’s recent all-time highs. While institutional adoption is broadening, there are also signs of excessive exuberance, speculation, and optimism…

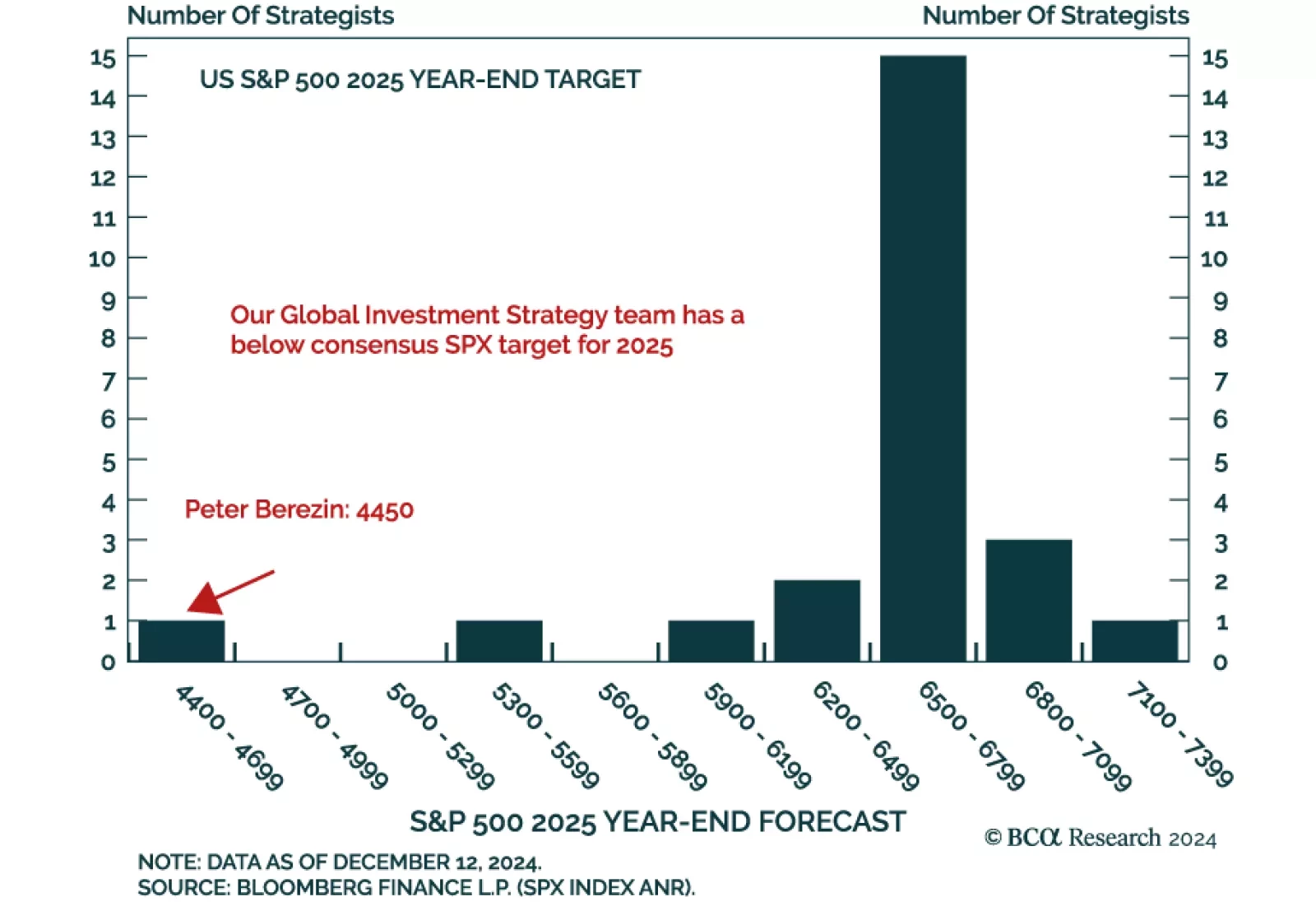

Our Global Investment Strategy team released their 2025 outlook, adopting the unique perspective of time-travelers reporting from January 2, 2026. They foresee a challenging 2025, with the global economy slowing sharply and…

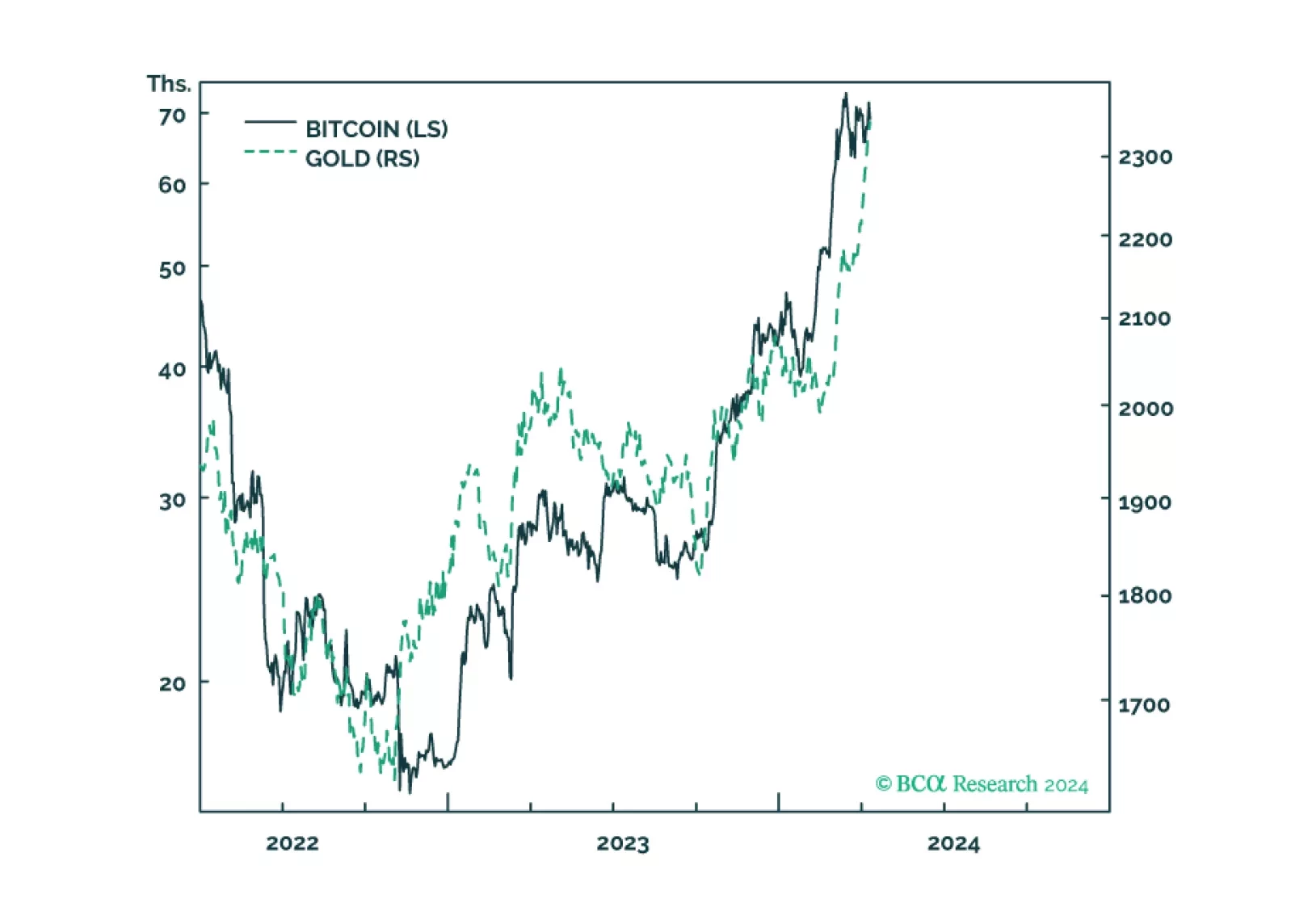

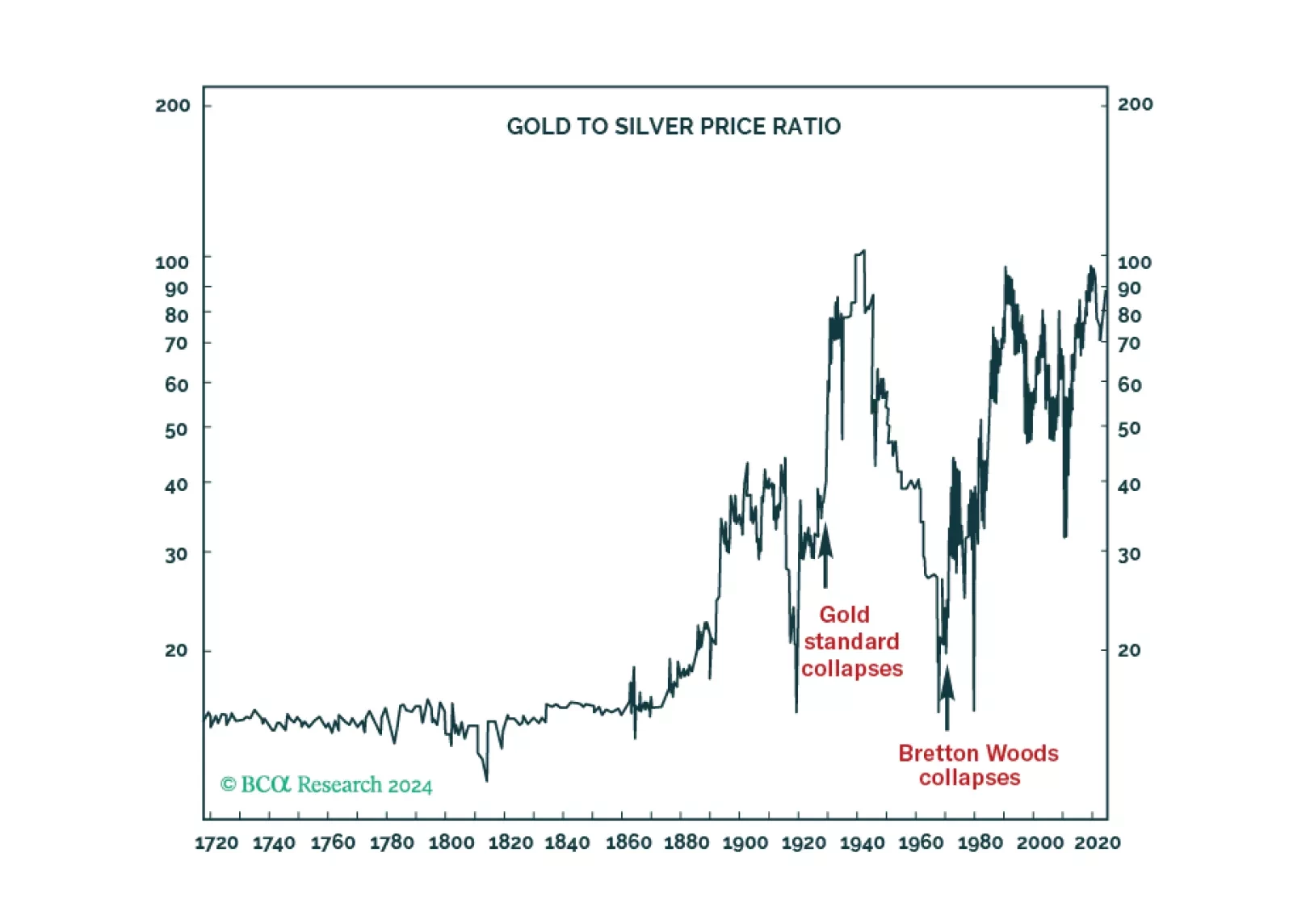

The value of both gold and bitcoin comes from the collective belief that they are the non-confiscatable assets to own in a fiat monetary system, as an insurance against hyperinflation, banking system failure, or state expropriation.…

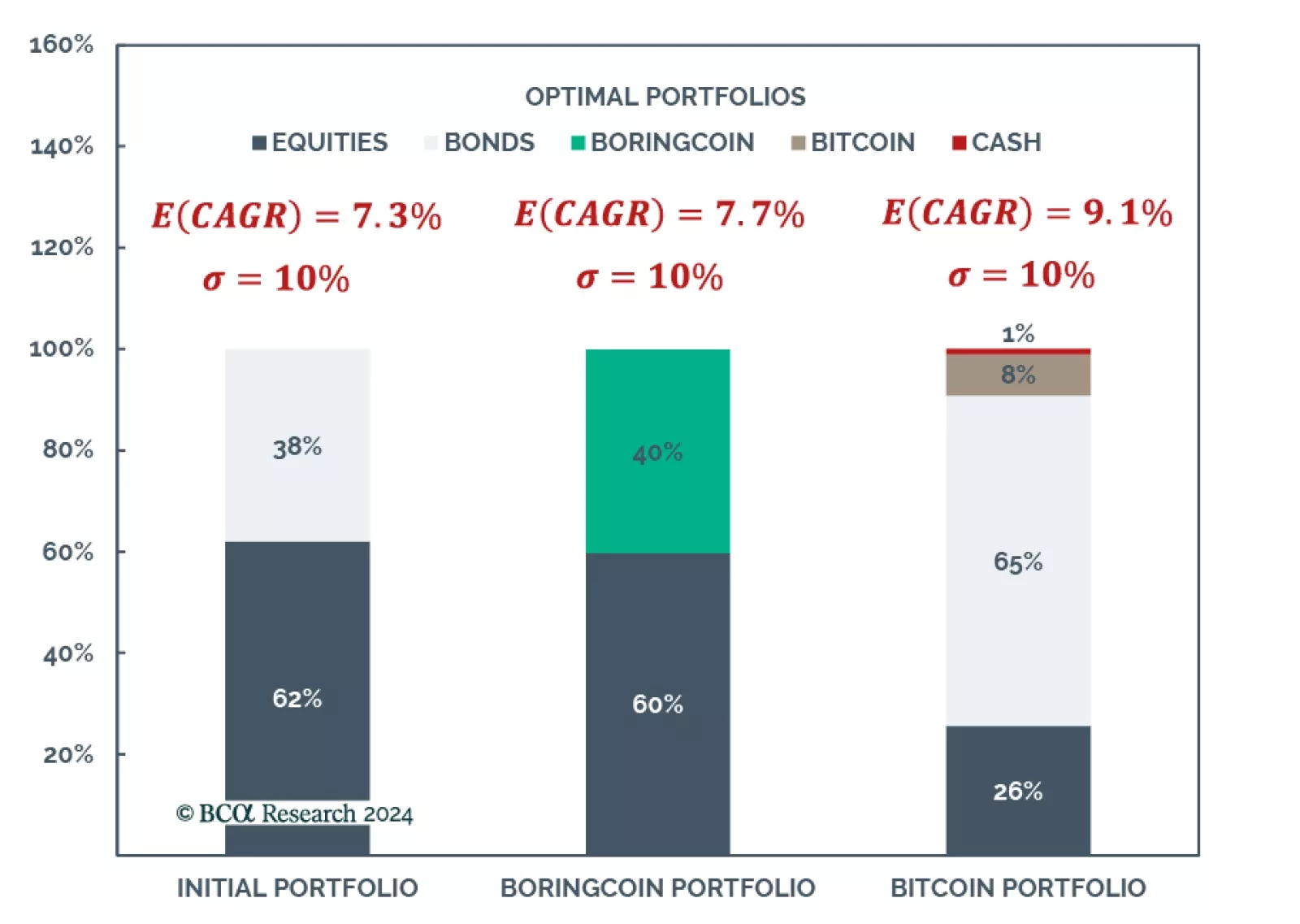

According to BCA Research’s Global Asset Allocation Strategy service, a common objection to buying Bitcoin raised by traditional investors is that it is too volatile. In the past it has been argued that this is irrelevant,…

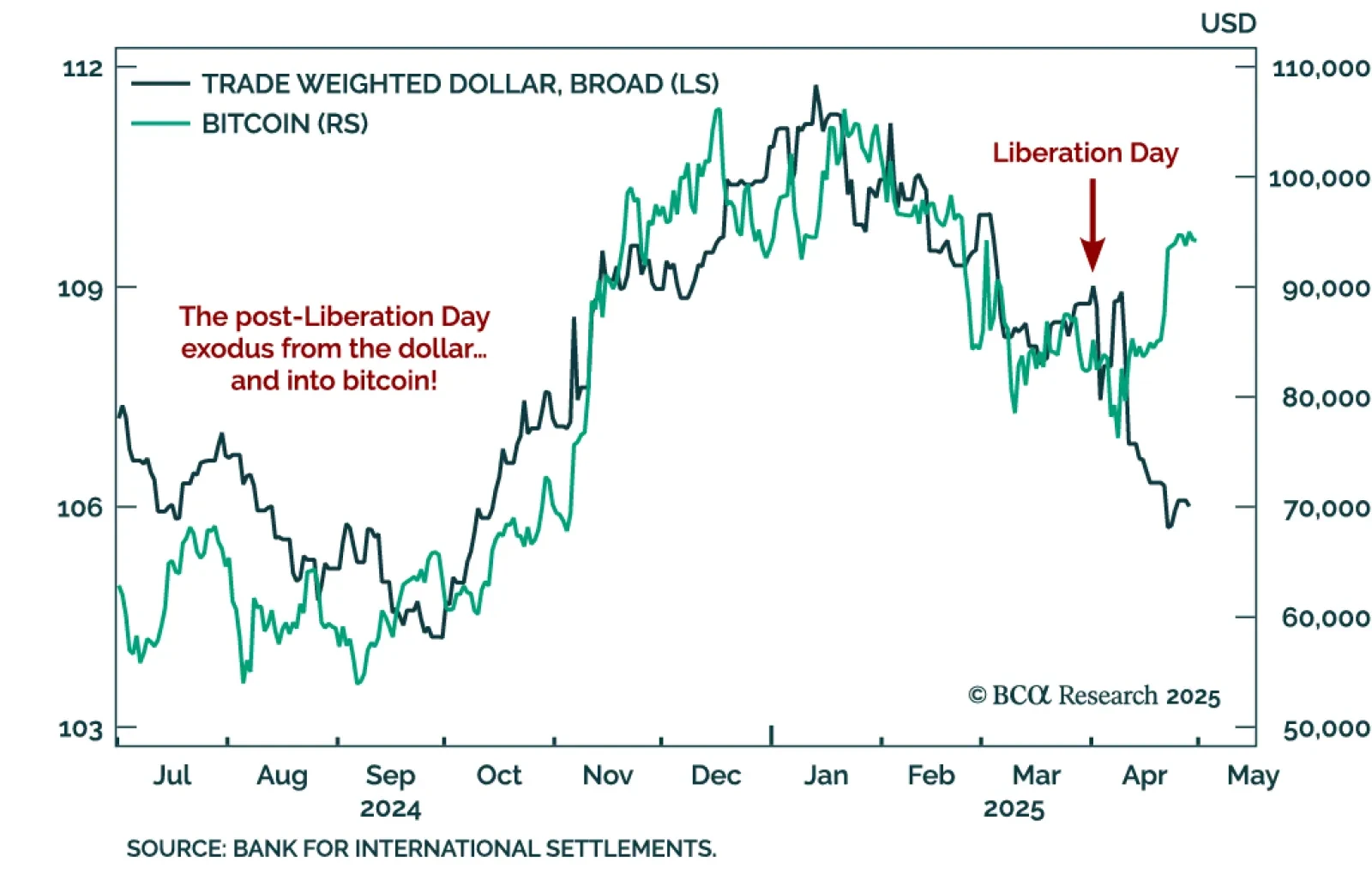

Gold and bitcoin are conceptually joined at the hip because the value of both comes from their ‘non-confiscatability’ by inflation, by bank failure, and in the case of bitcoin, by state expropriation. The sharp recent rallies in both…