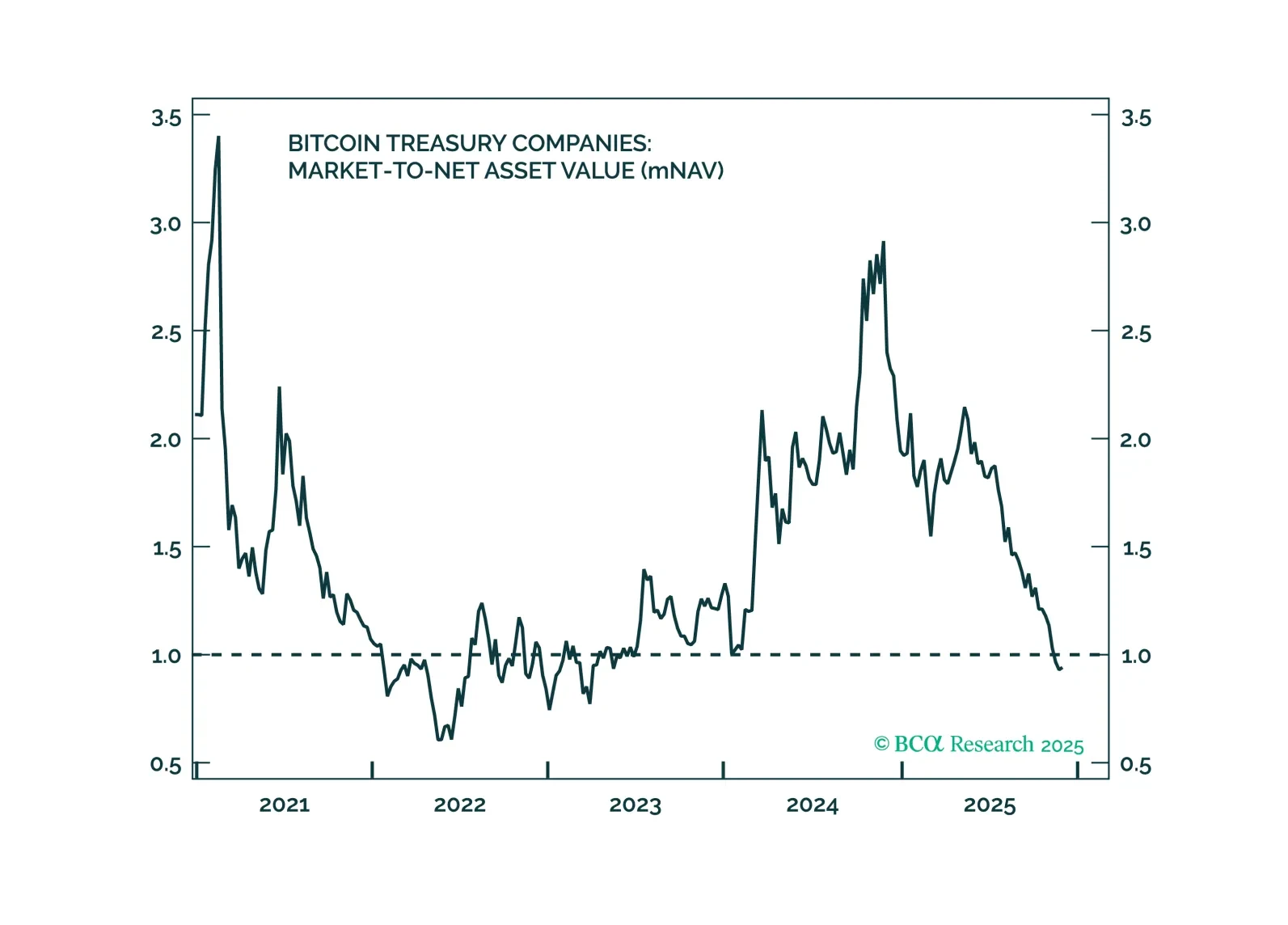

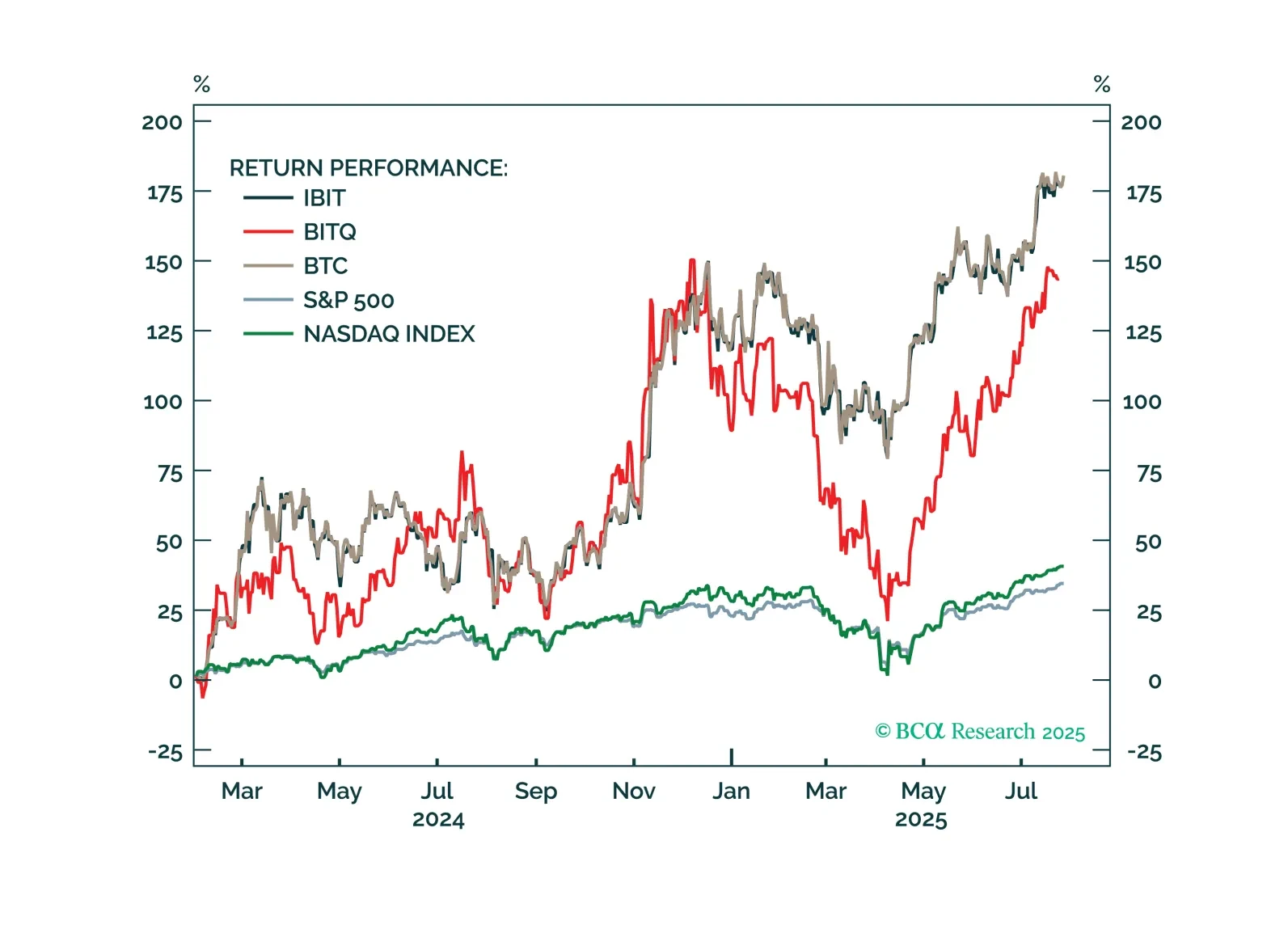

Bitcoin’s recent volatility masks a deeper story – the widest disconnect from traditional macro drivers since 2022. With sentiment now deeply negative and institutional demand still building, the conditions for a realignment with…

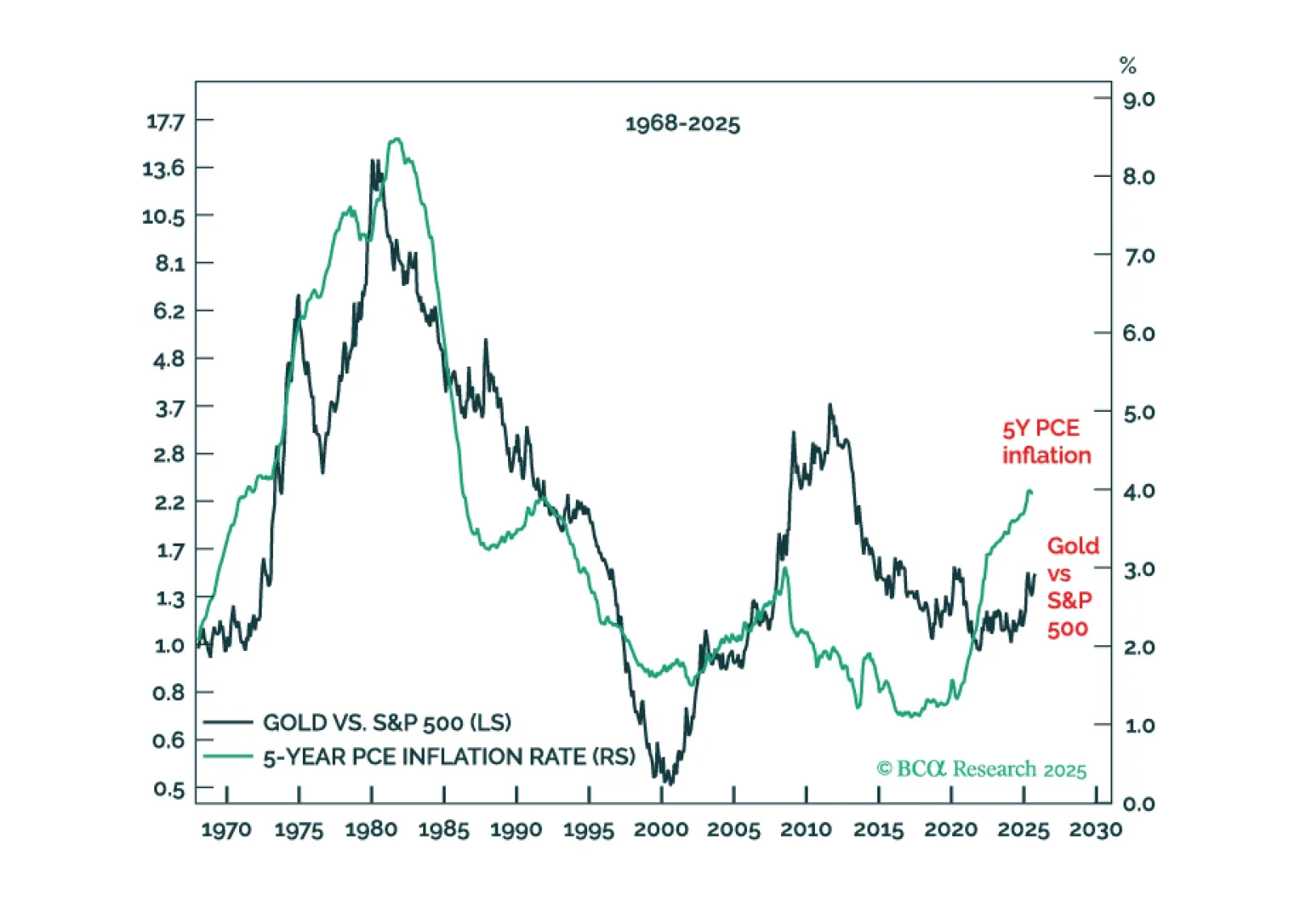

Long-term investors should own gold. The network effect that makes gold the physical ‘insurance asset’ of choice will generate long-term outperformance. But long-term investors should also own bitcoin. The network effect that makes…

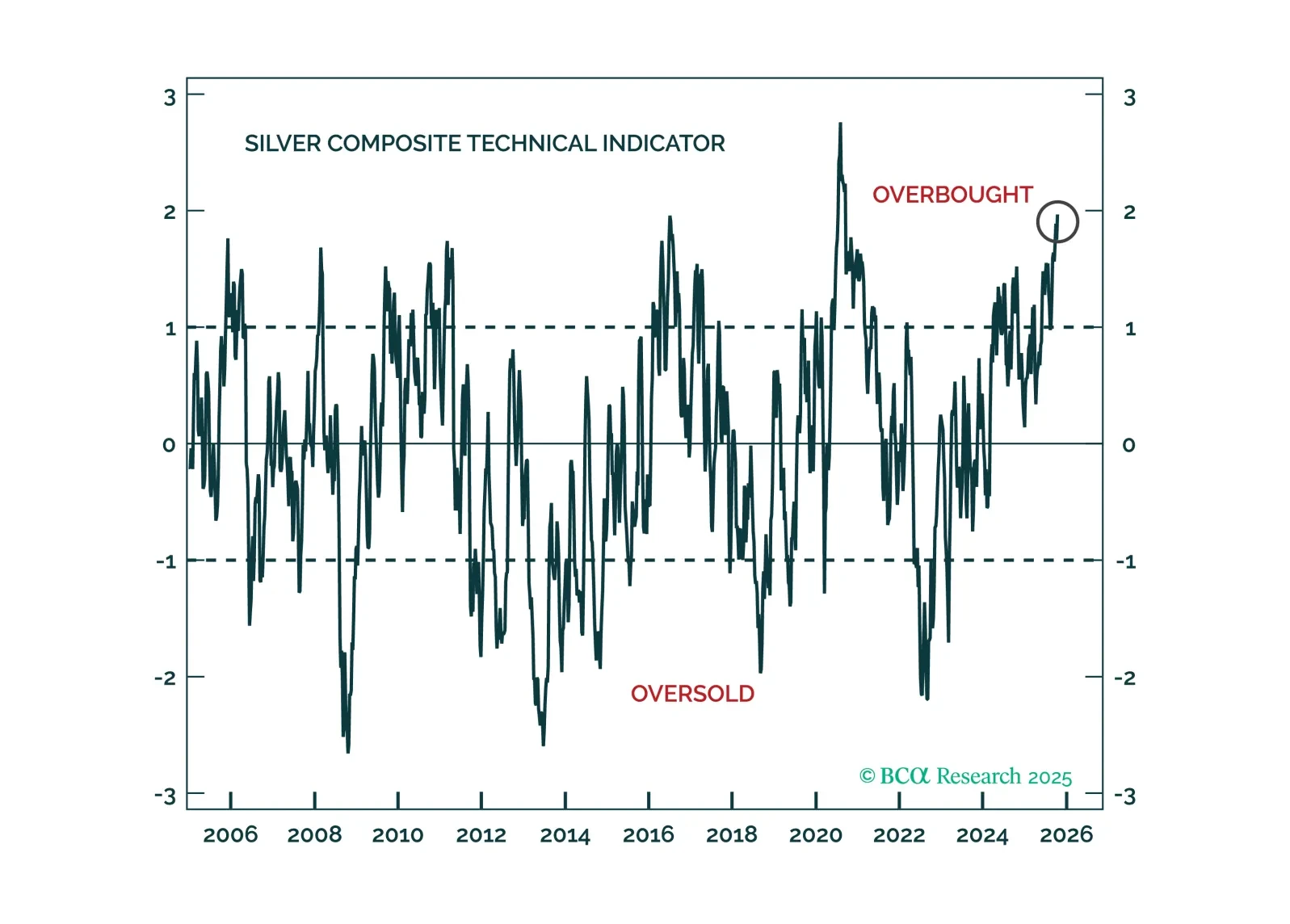

Speculative froth has built up across all precious metals, yet gold’s structural tailwinds will allow it to weather corrections better than its peers.

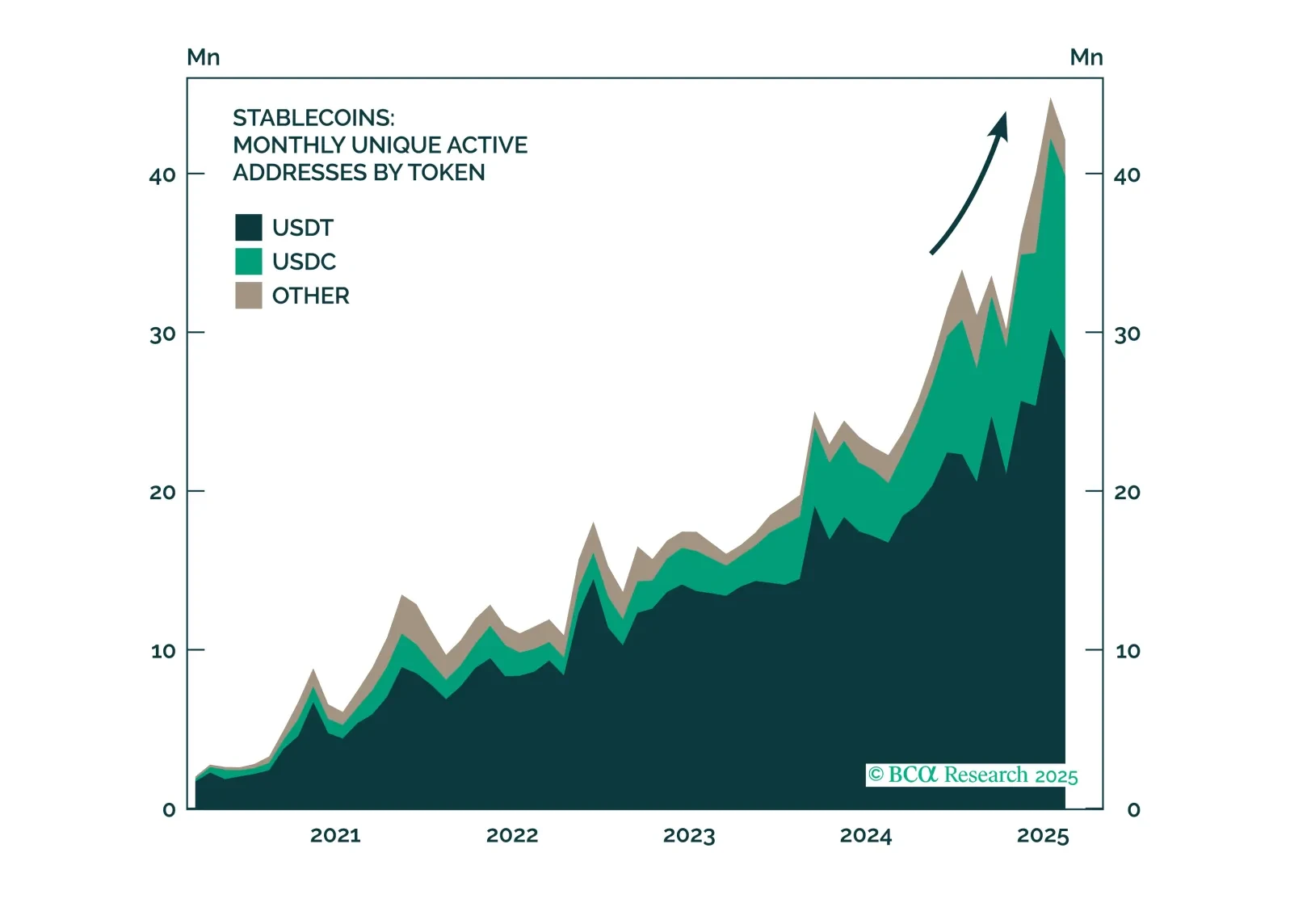

From Treasurys to tokenization, stablecoins are quietly becoming one of the most disruptive forces in global finance, with the power to compress yields, deepen dollar penetration, and shift the balance within crypto markets. Explore…

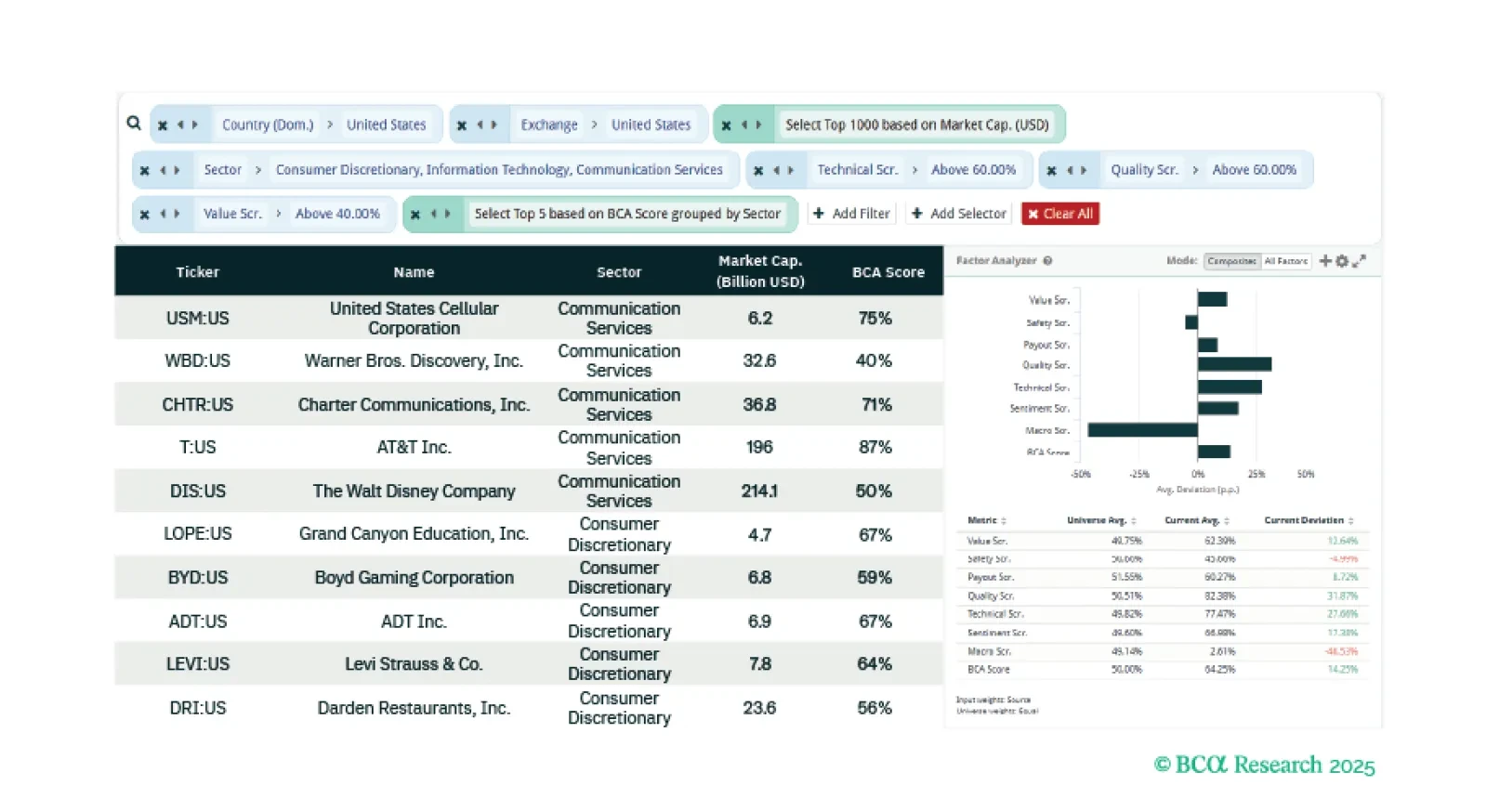

This week our three screeners identify: Broader and more accessible tech-driven equities, US equities exposed to cryptocurrencies, and doubling-down on top-decile stocks.

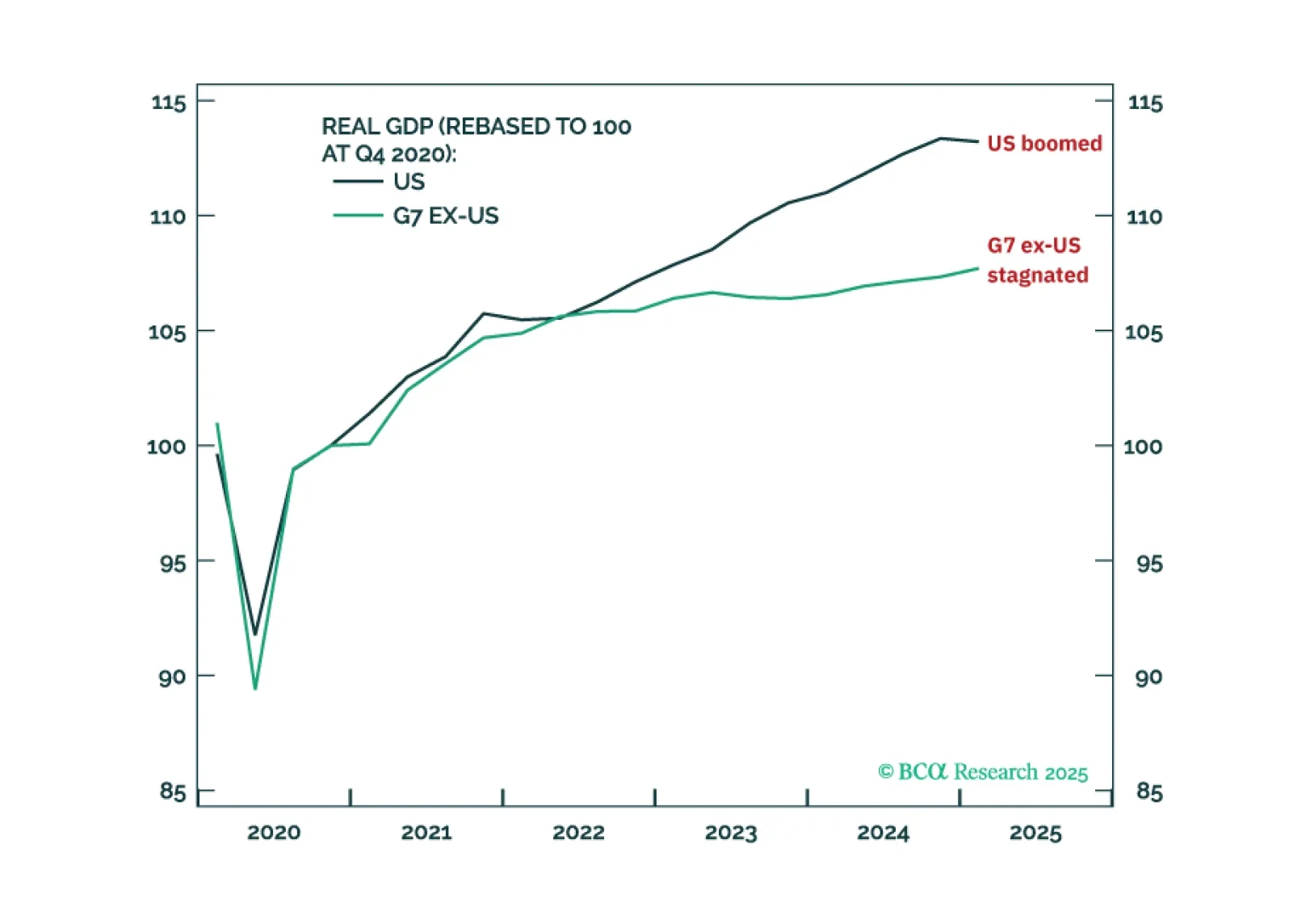

Euro area and Chinese interest rates must fall much further to prevent monetary policy from becoming ultra-restrictive. But Trump’s attempts to force unwarranted rate cuts from the Fed risks a vicious backlash from the bond…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

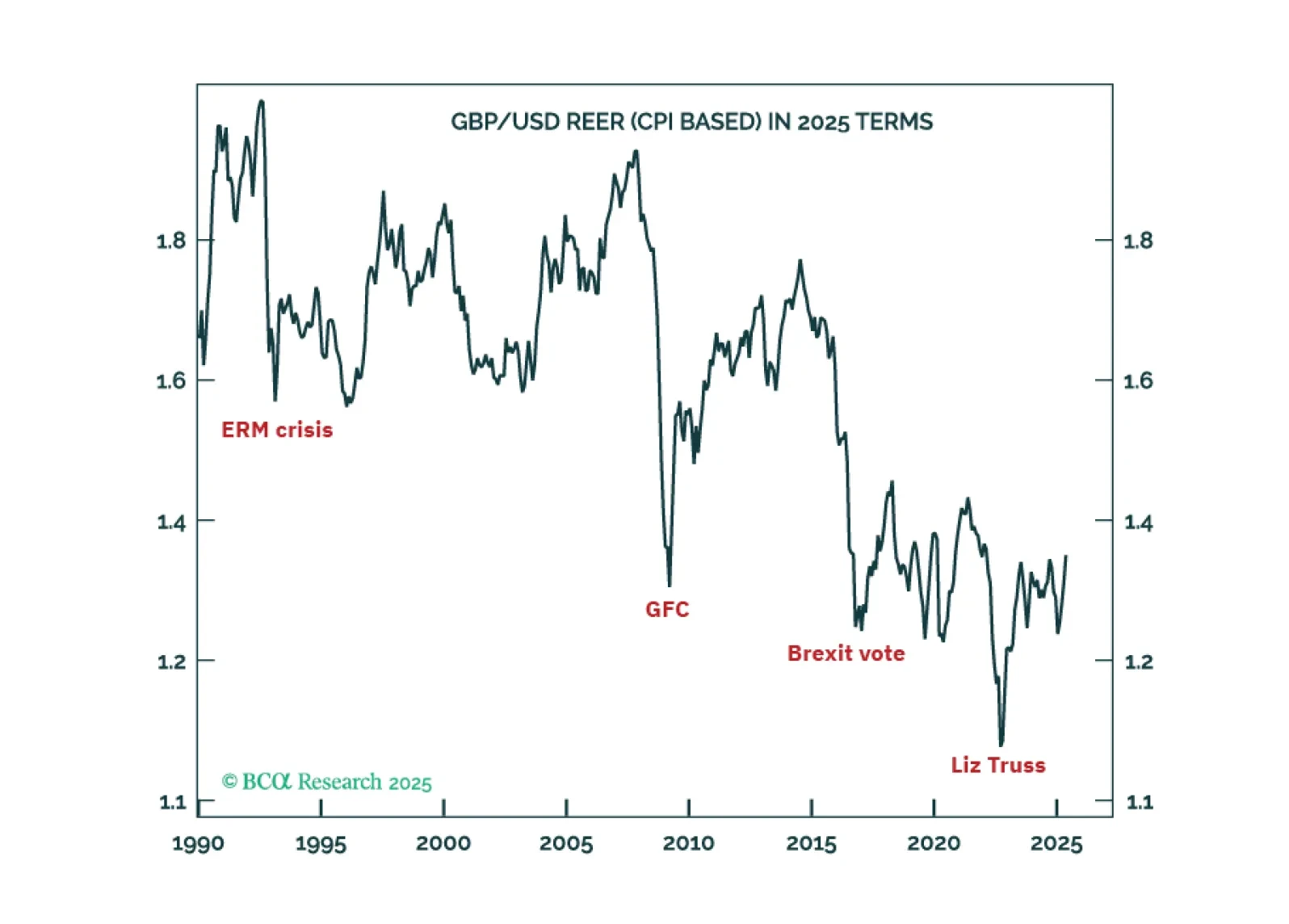

The pound will reach $1.60 if ‘America’s Brexit’ cancels out ‘Britain’s Brexit’. Meanwhile, the flight from the fiat dollar to non-fiat bitcoin will enable the preeminent cryptocurrency to reach $200,000+.

Bitcoin has become one of investors’ favorite assets to safeguard against fading US exceptionalism, but physical bullion has some macro advantages over its digital counterpart. First, bitcoin has benefited greatly from the…