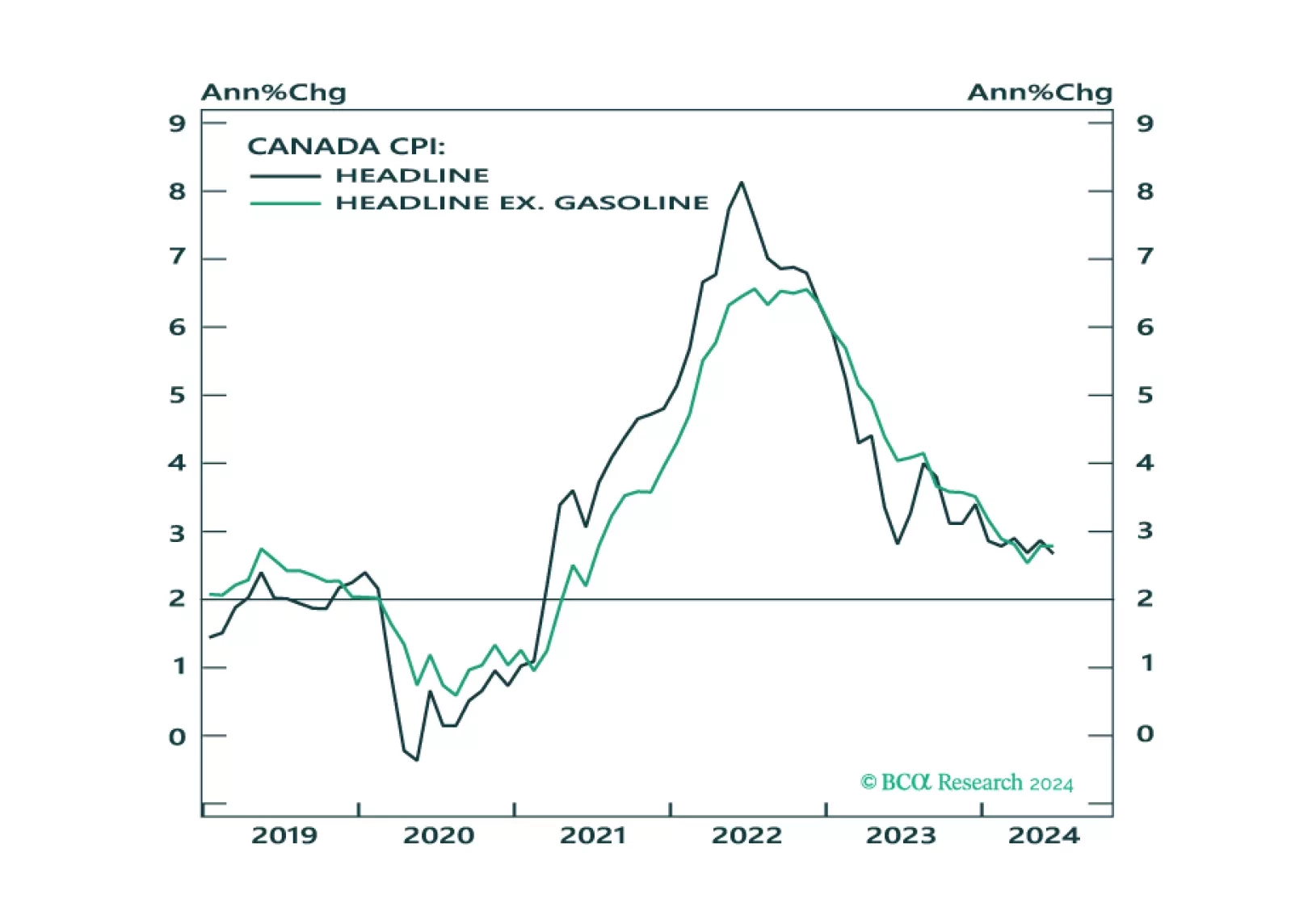

In this Insight, we look into the recent CPI release in Canada, and the possible implications for fixed-income market trades.

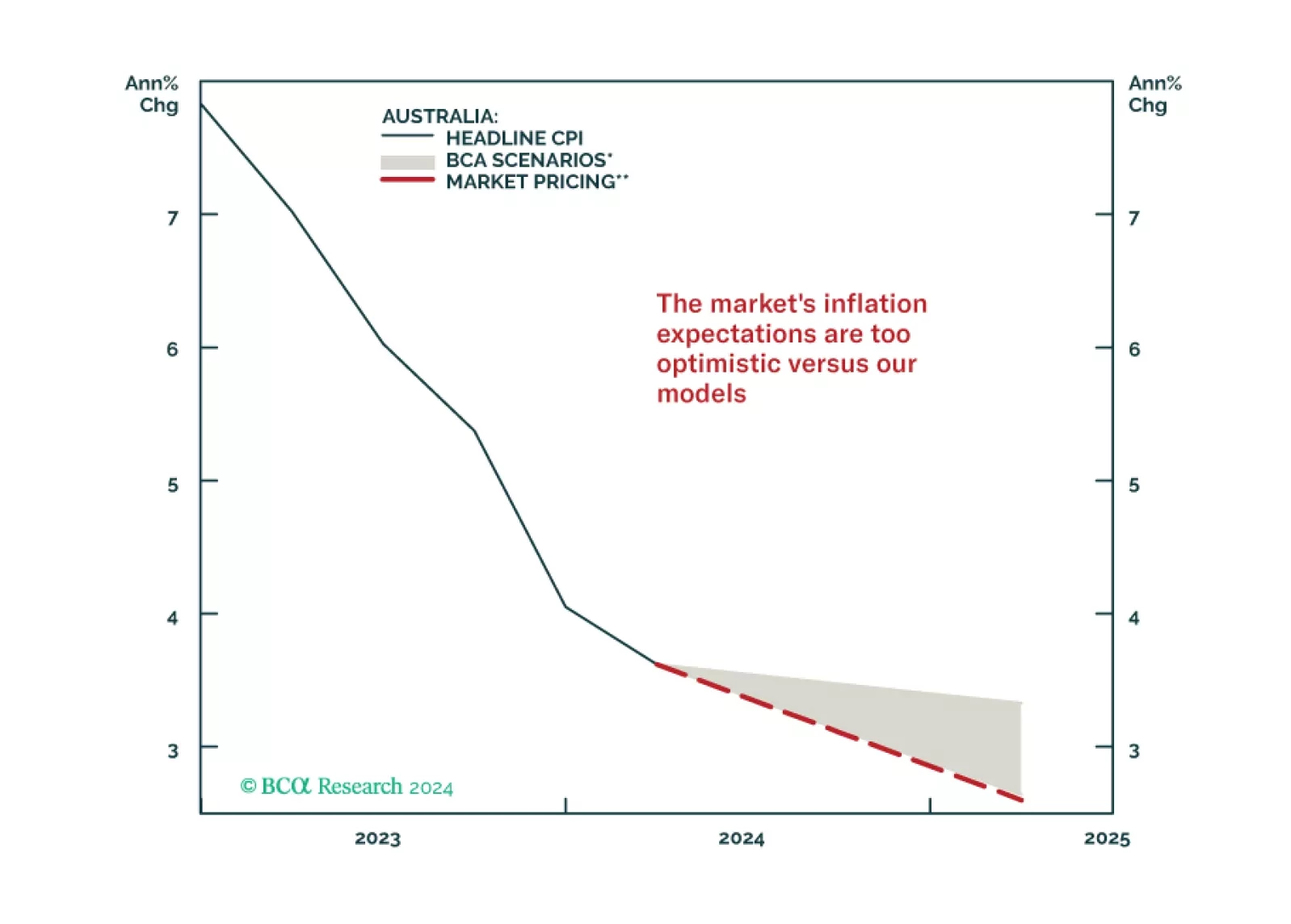

In light of this week’s RBA decision to keep policy on hold, we look at the best possible trades in fixed income markets. In our view, inflation-linked bonds, relative to nominals remain a good bet.

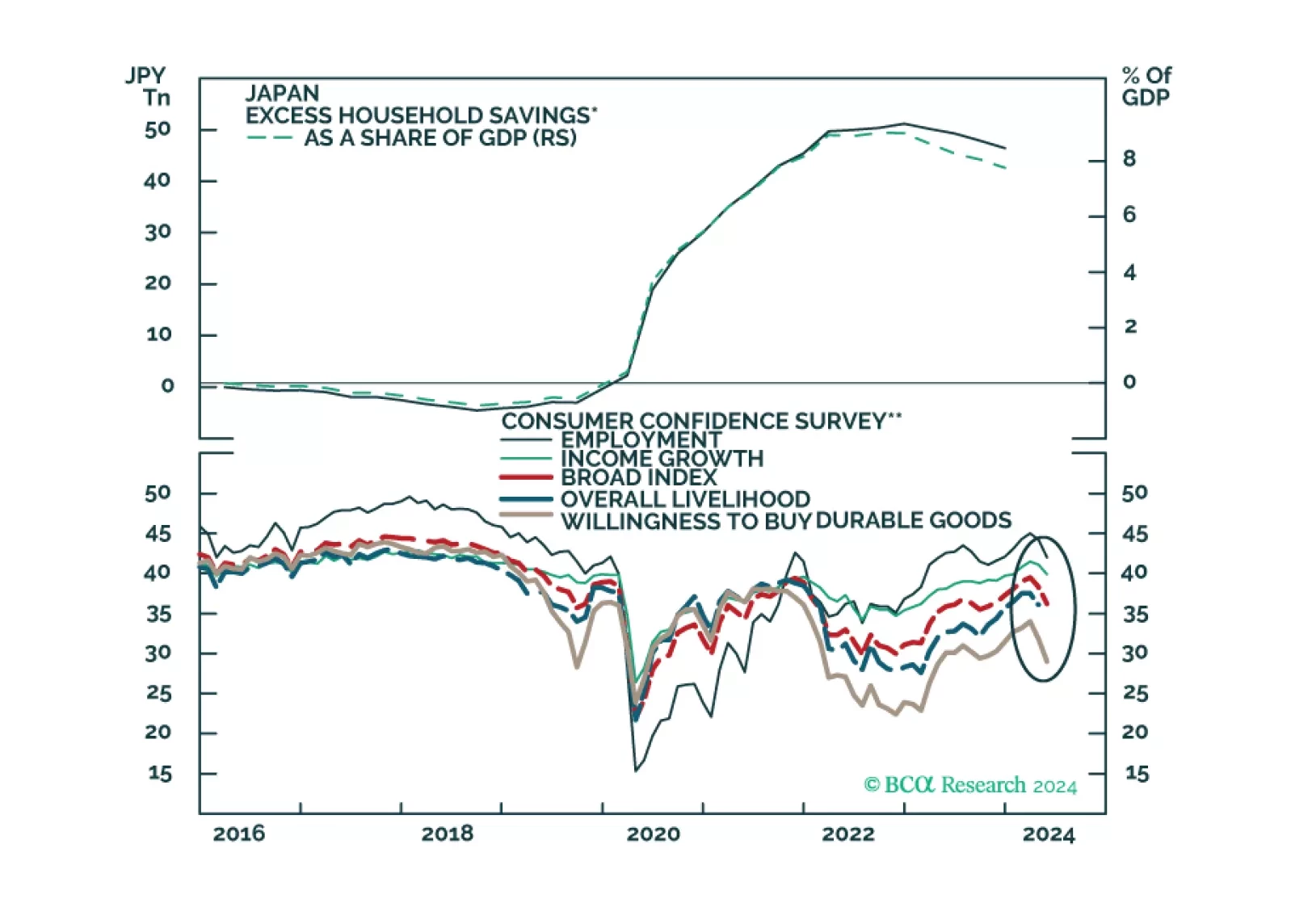

In this insight, we update our thinking on the recent BoJ move in terms of positioning for the yen and JGB yields.

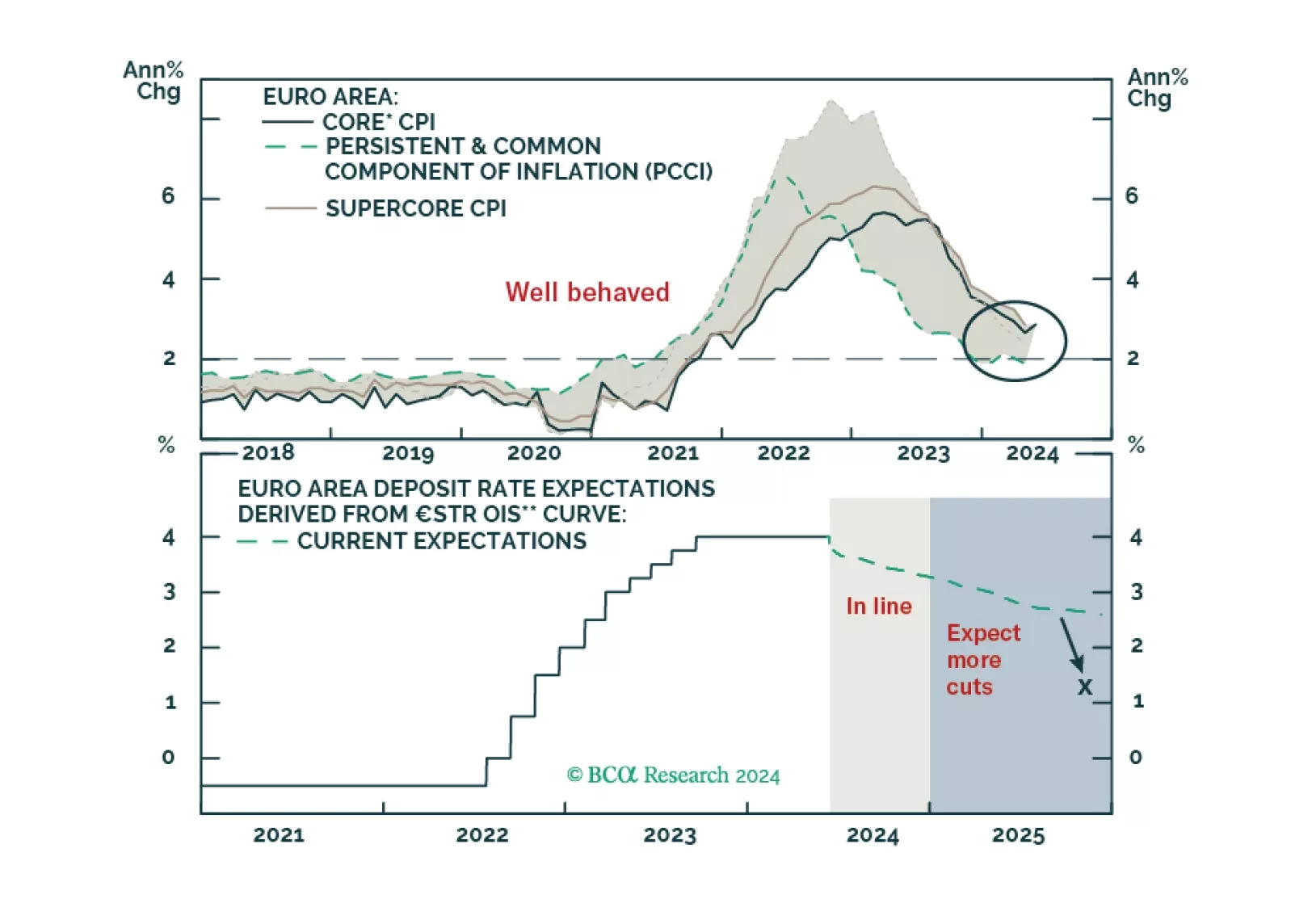

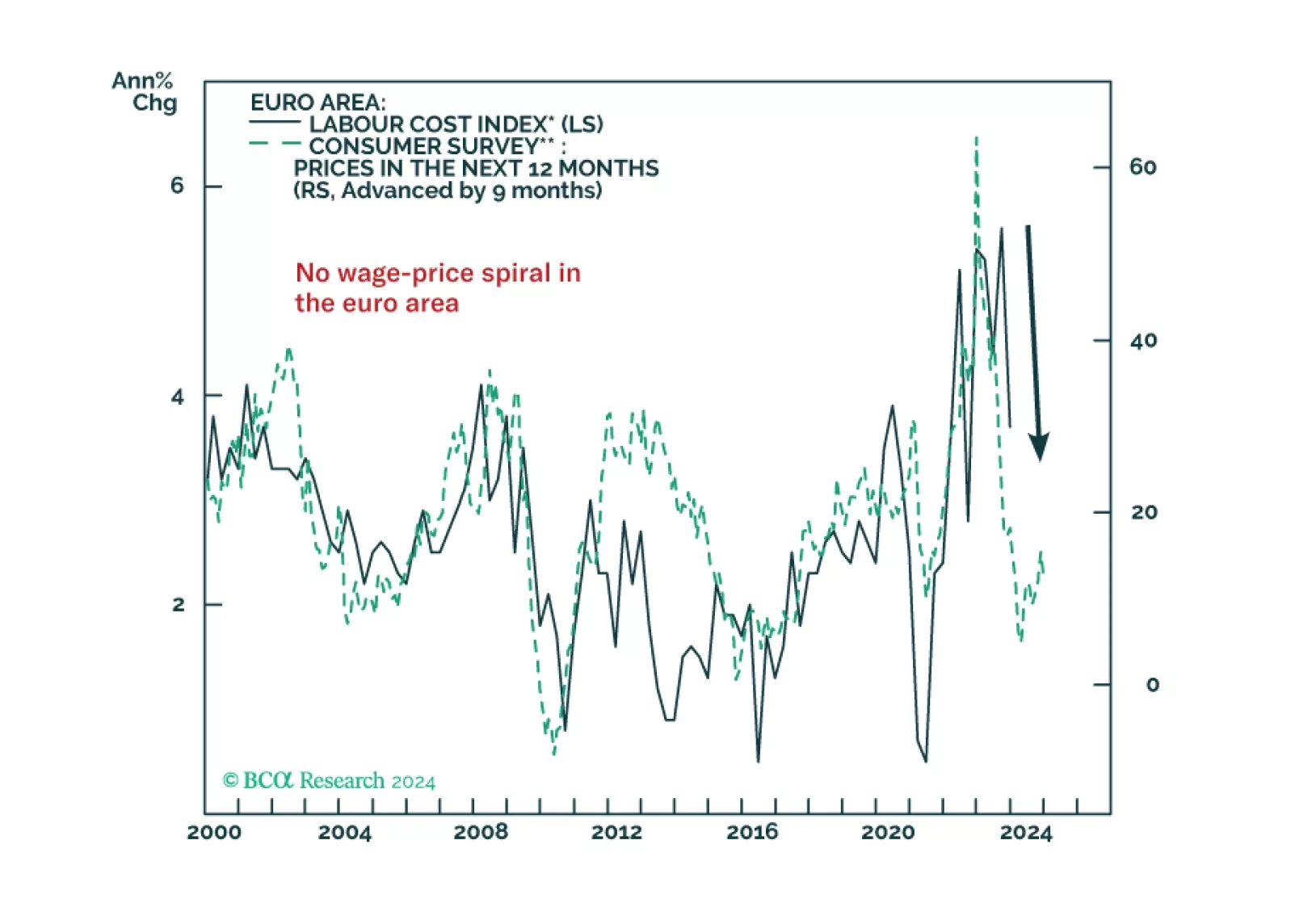

The ECB is now firmly in easing mode, even if it refuses to pre-commit to a specific rate path. What does this data dependency mean for the euro and European yields?

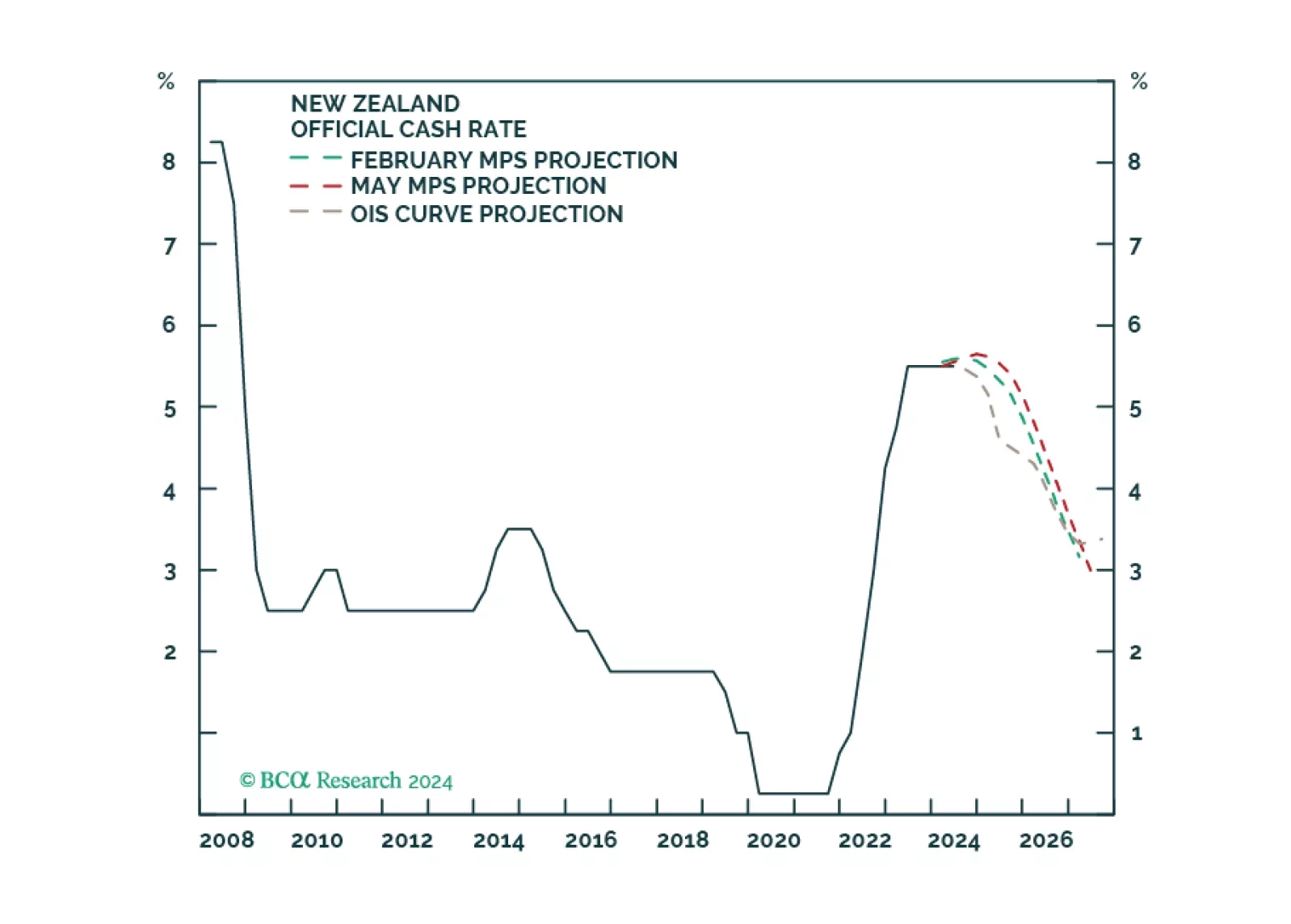

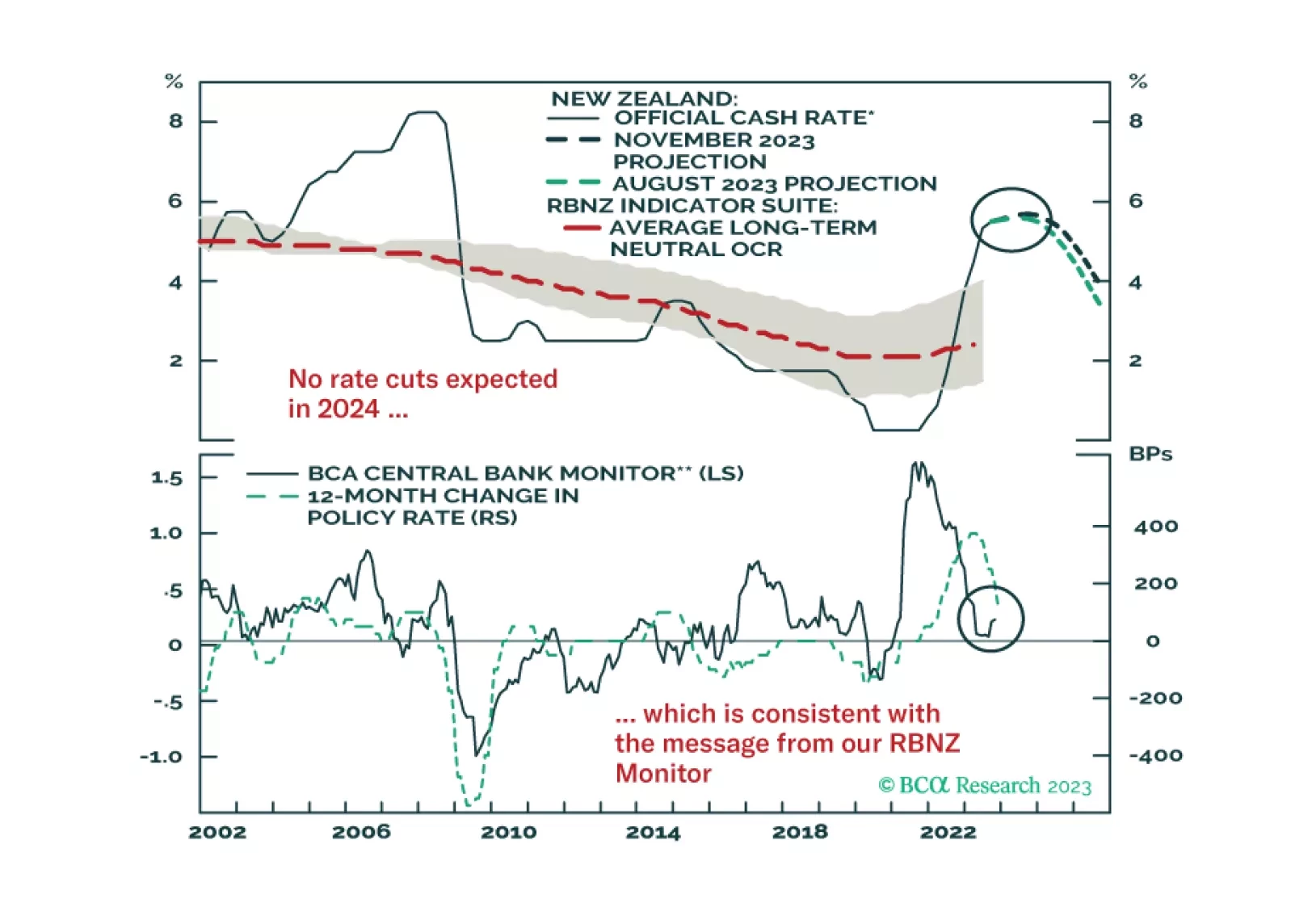

In this Insight, we revisit our "higher for longer" theme for the Reserve Bank of New Zealand, in light of the latest central bank meeting. In conclusion, we are inching towards a more dovish RBNZ ahead. Ergo, we recommend some fixed…

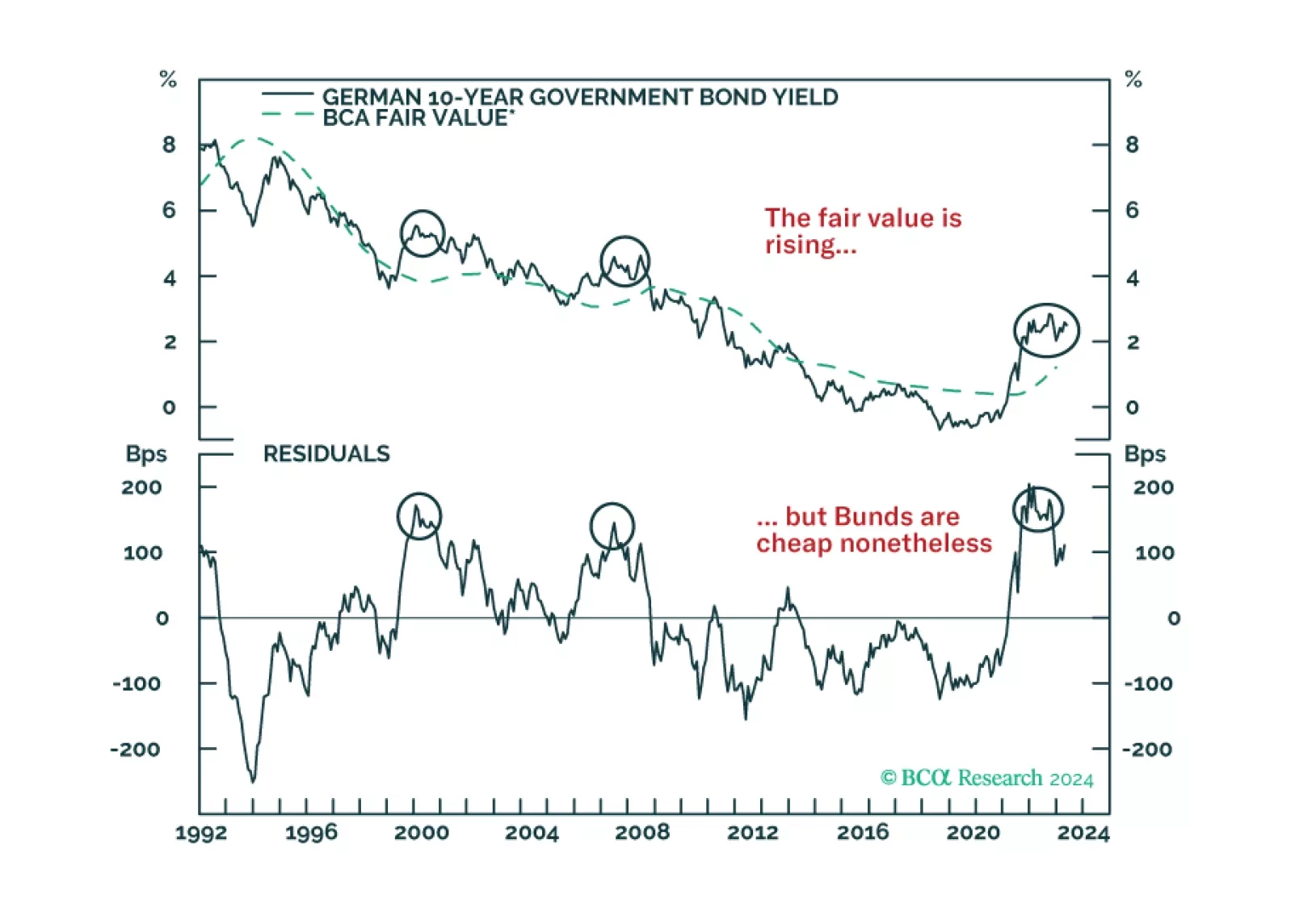

German Bunds have cheapened considerably, and the ECB is about to start cutting rates. Does this combination guarantee immediate profits from buying these bonds?

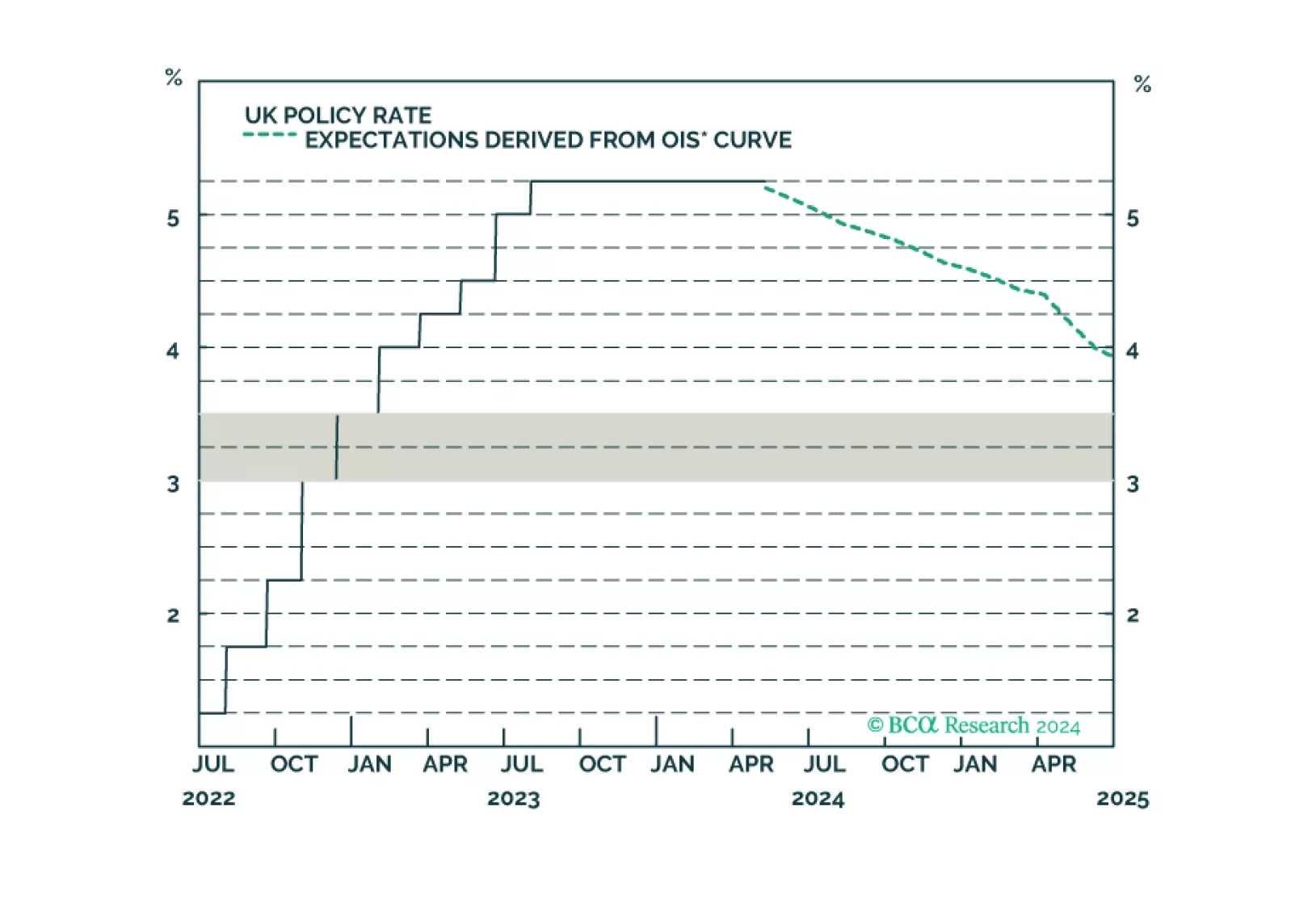

An update to our views on UK rates and currency following today’s Bank of England meeting.

At today’s monetary policy meeting, the ECB gave strong hints that rate cuts will begin as soon as the next meeting in June. In this Insight, we share our thoughts on today’s meeting and discuss the implications for European bond…

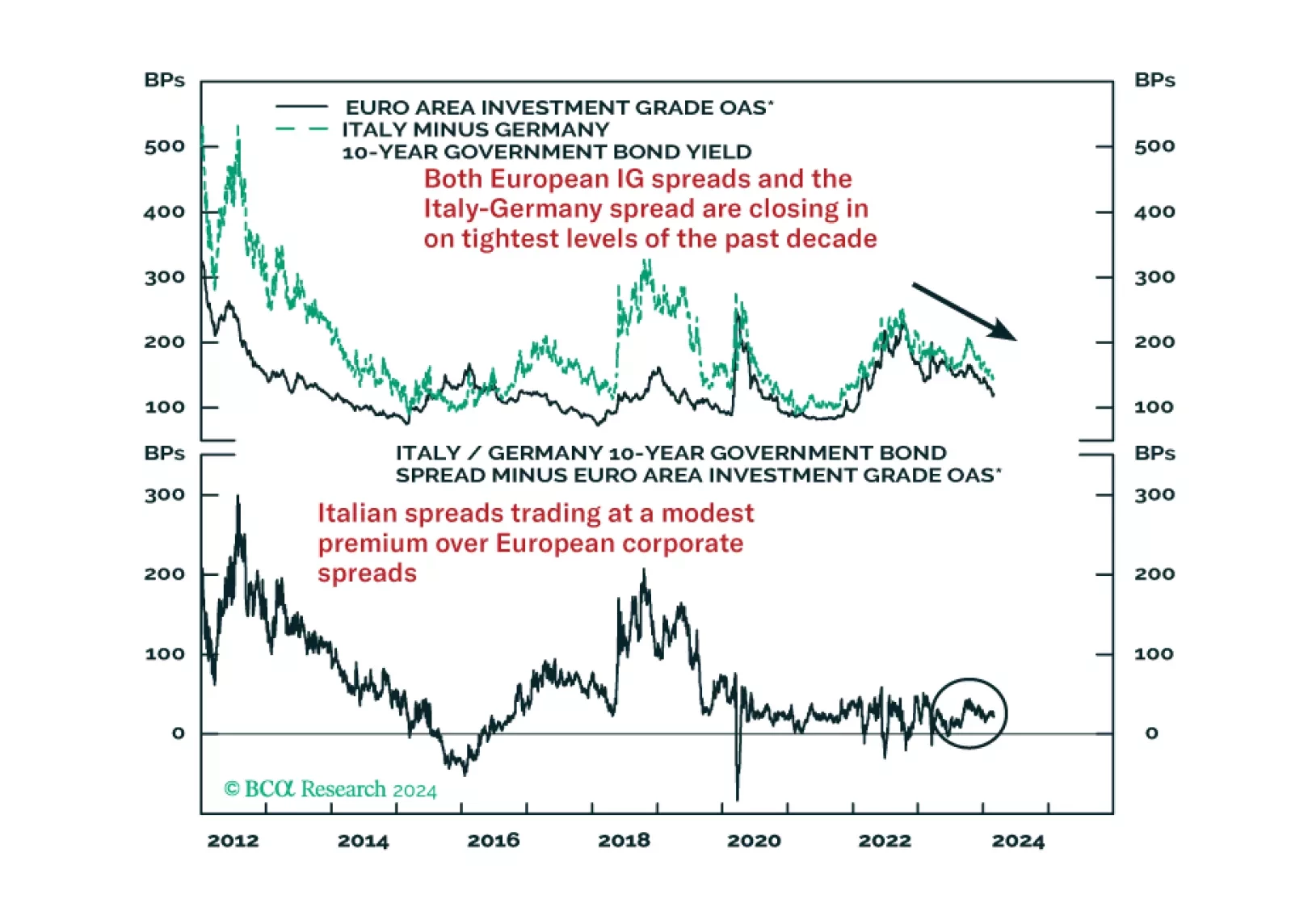

In this Strategy Insight, we take a comparative look at two of the largest spread product sectors in Europe – Italian government bonds and investment grade corporates. We make the case for favoring Italy over investment grade in the…

In this Insight, we discuss the outlook for monetary policy in New Zealand after this week’s RBNZ policy meeting, and introduce related fixed income and currency trade ideas.