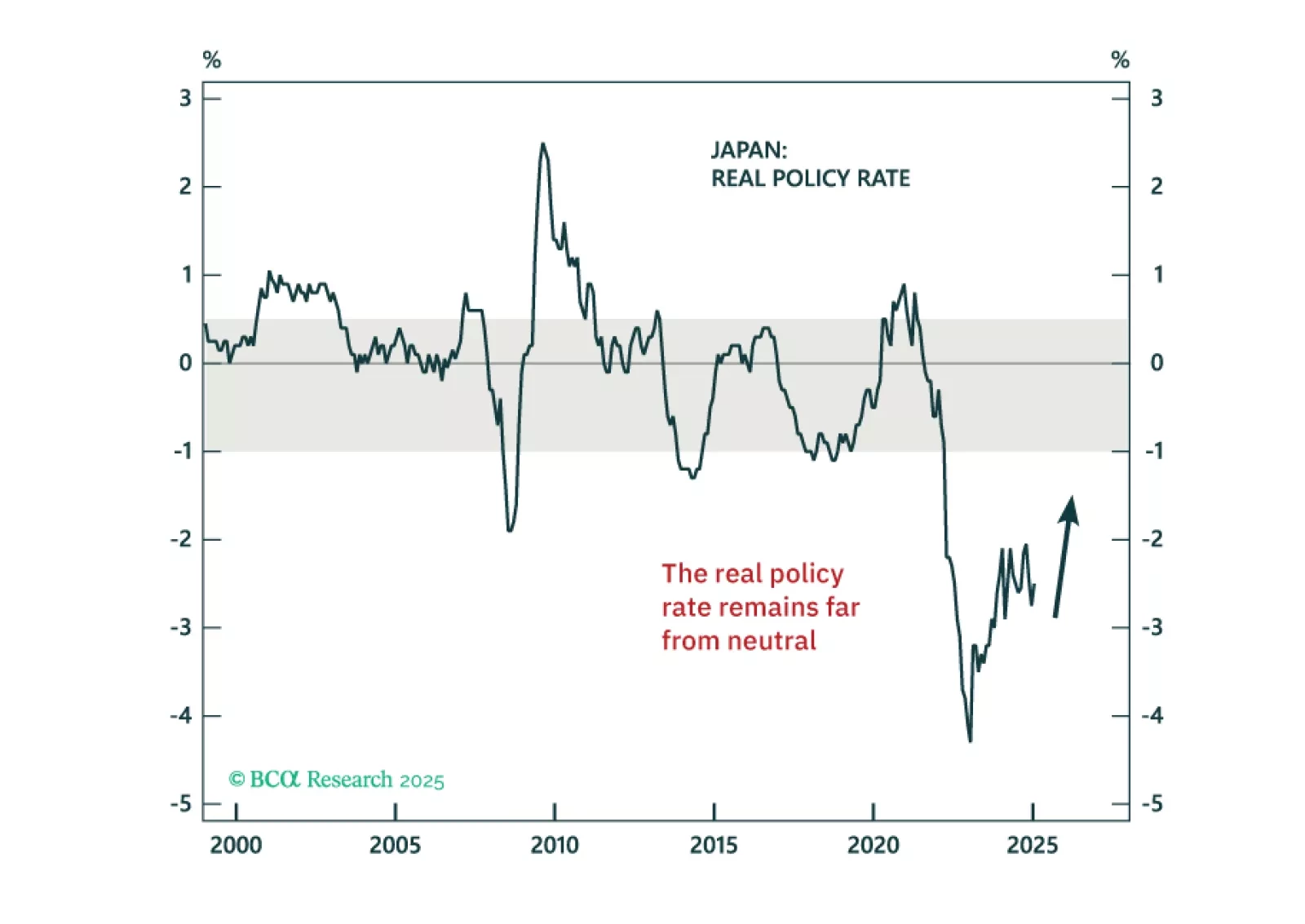

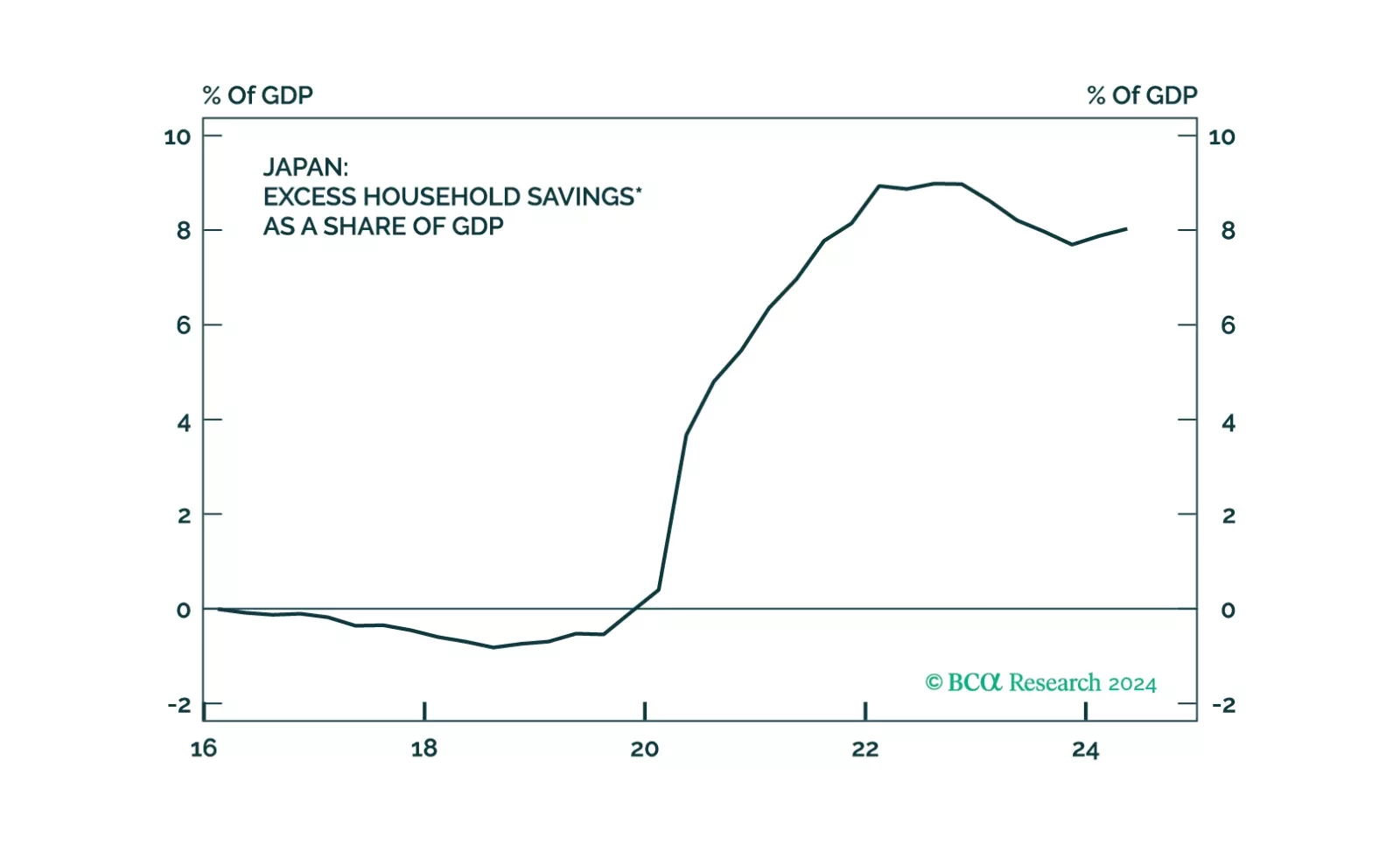

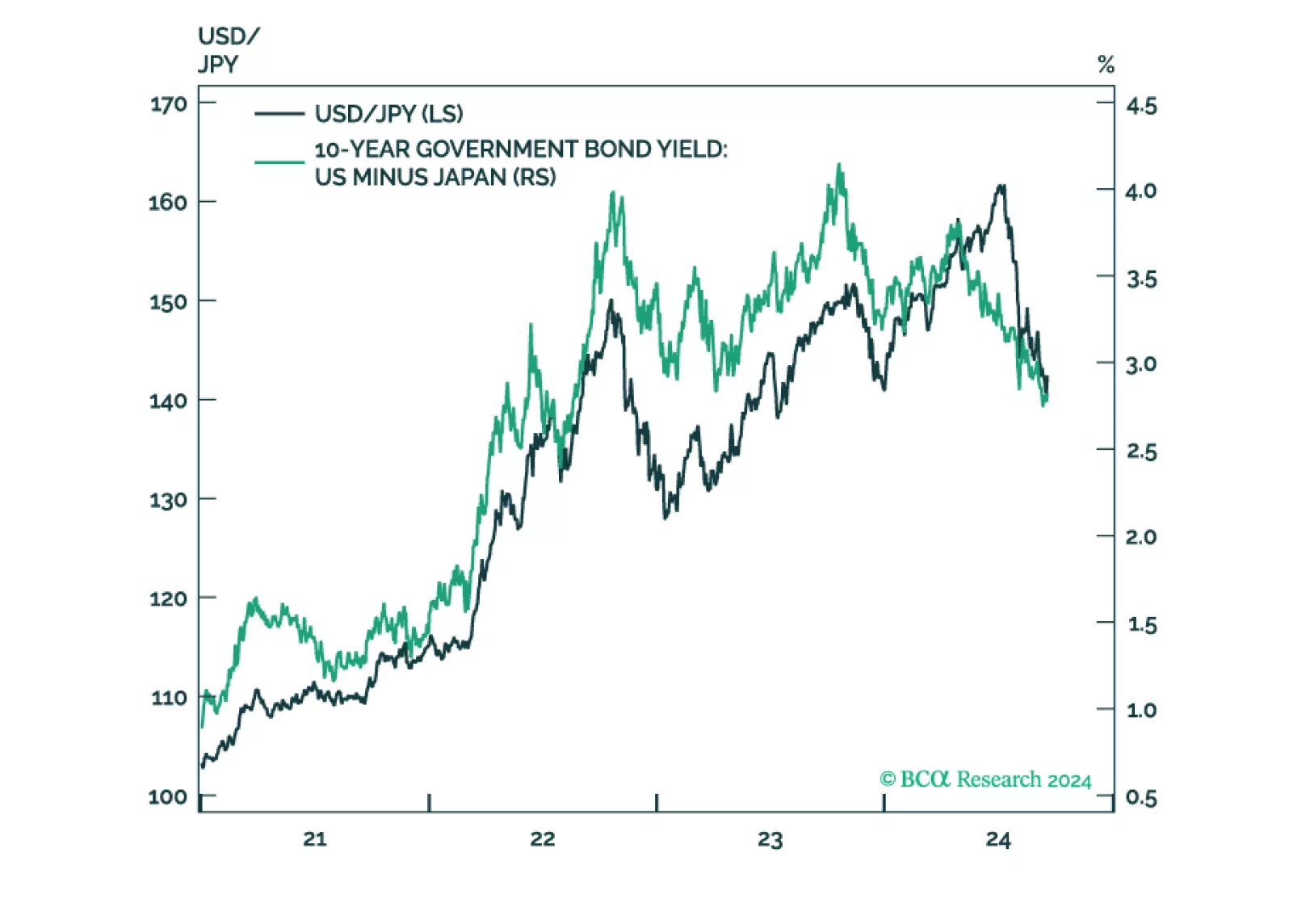

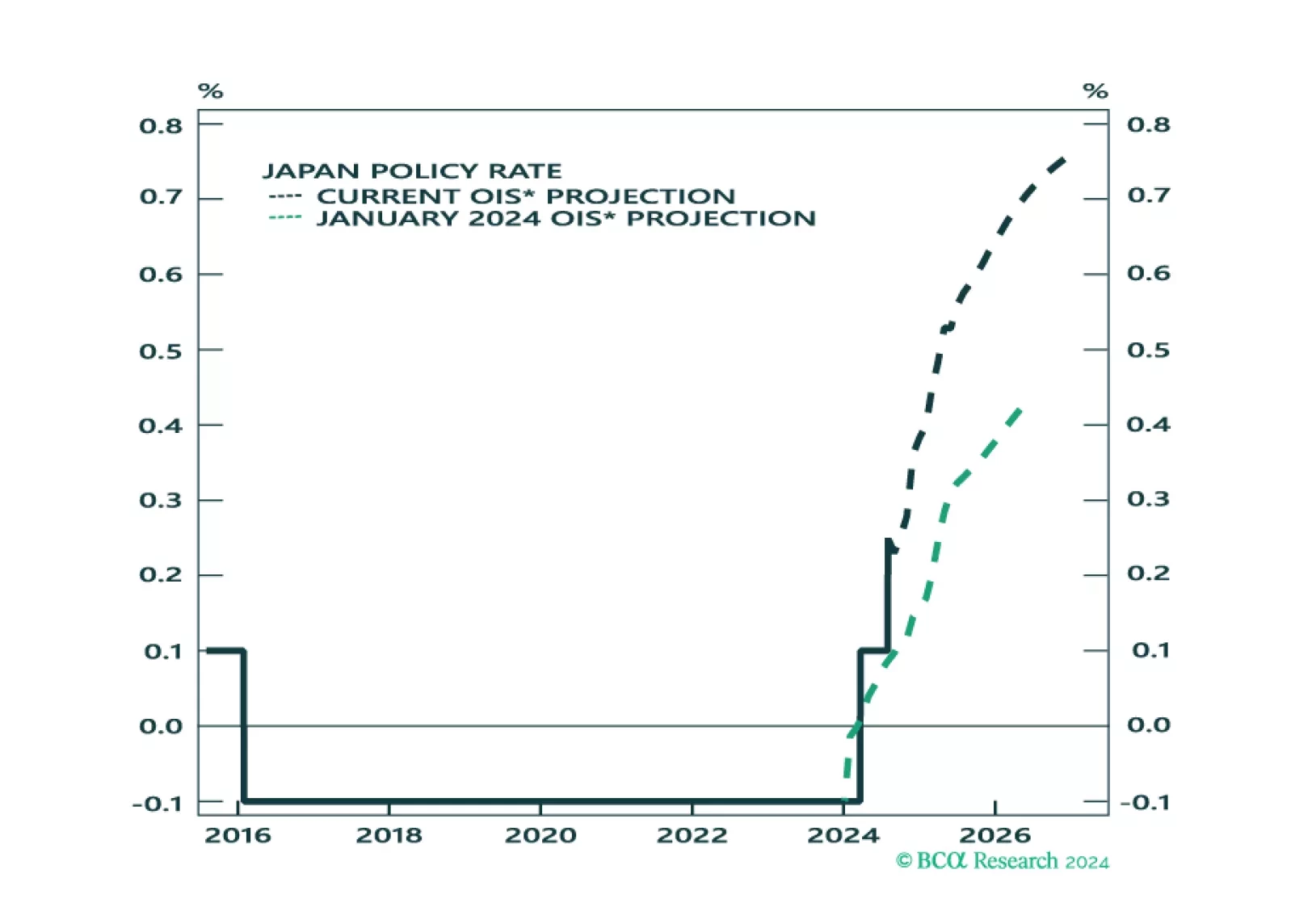

In today’s Strategy Insight, we discuss the monetary policy outlook for the Bank of Japan, following the 25-bps rate hike overnight, and what it means for JGBs and the yen.

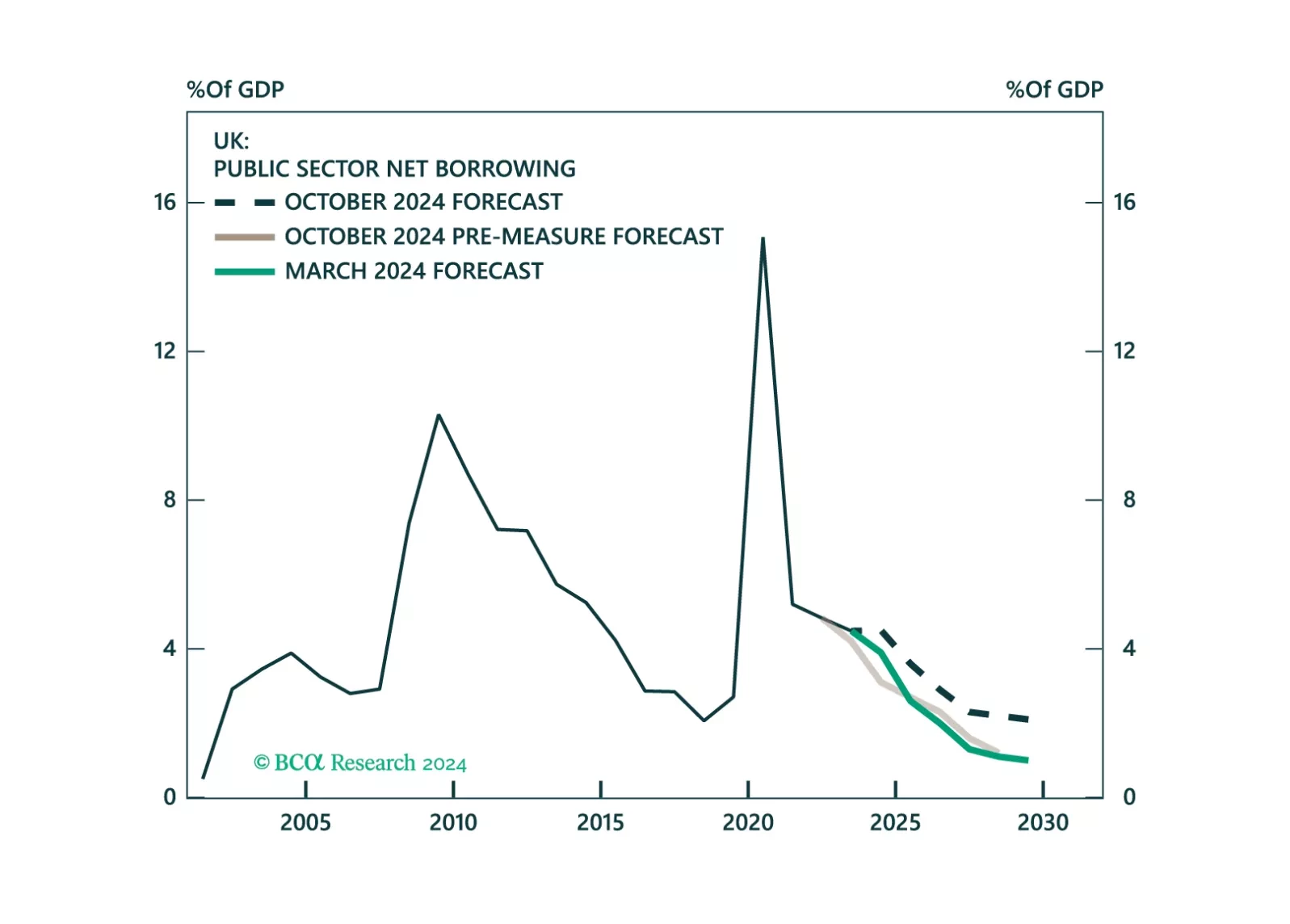

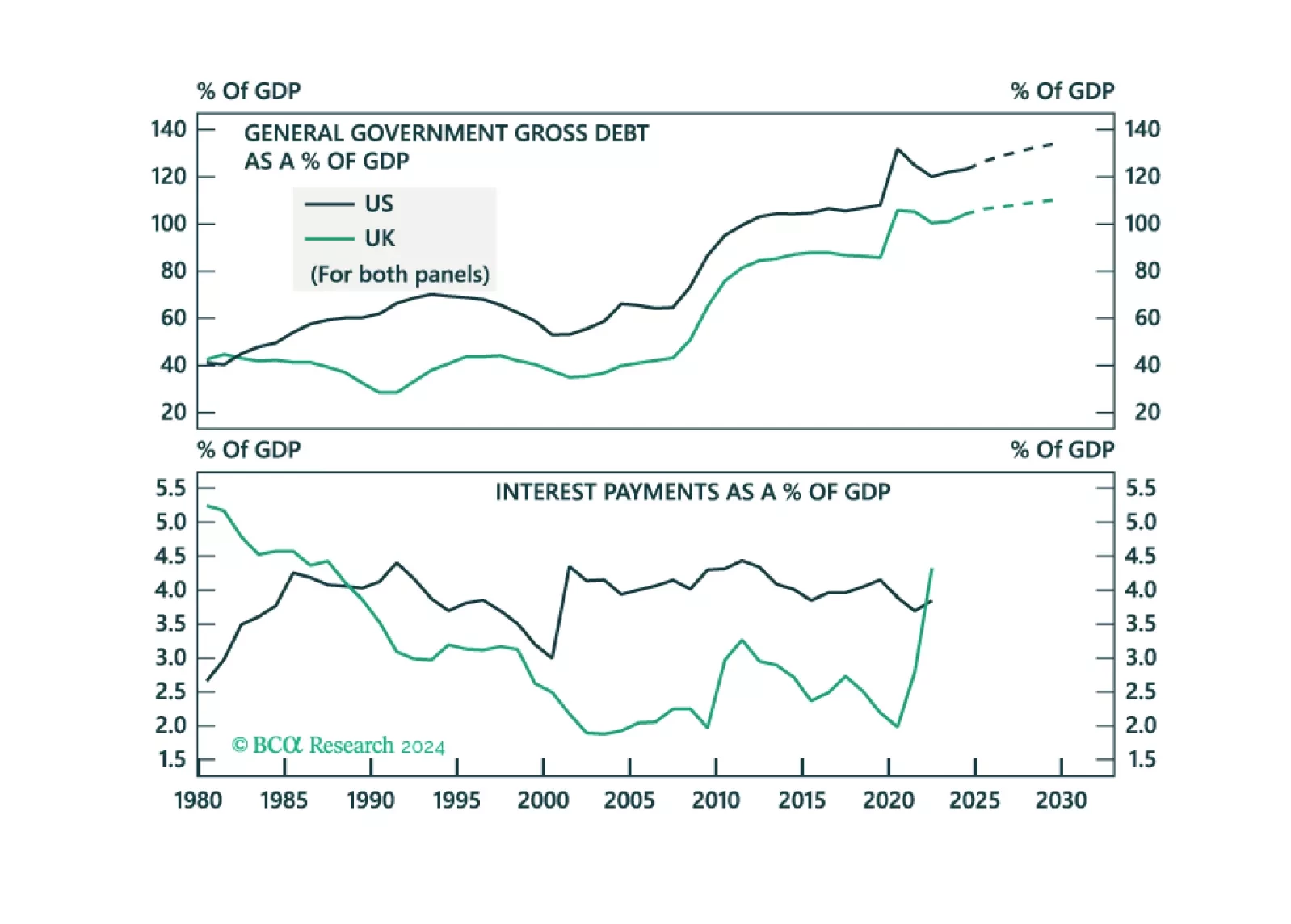

This Strategy Insight presents our view on today’s rate cut by the Bank of England as well as the budget announced by the UK government last week.

The latest Bank of Japan meeting did not alter our high-conviction views of being long the yen and underweight JGBs.

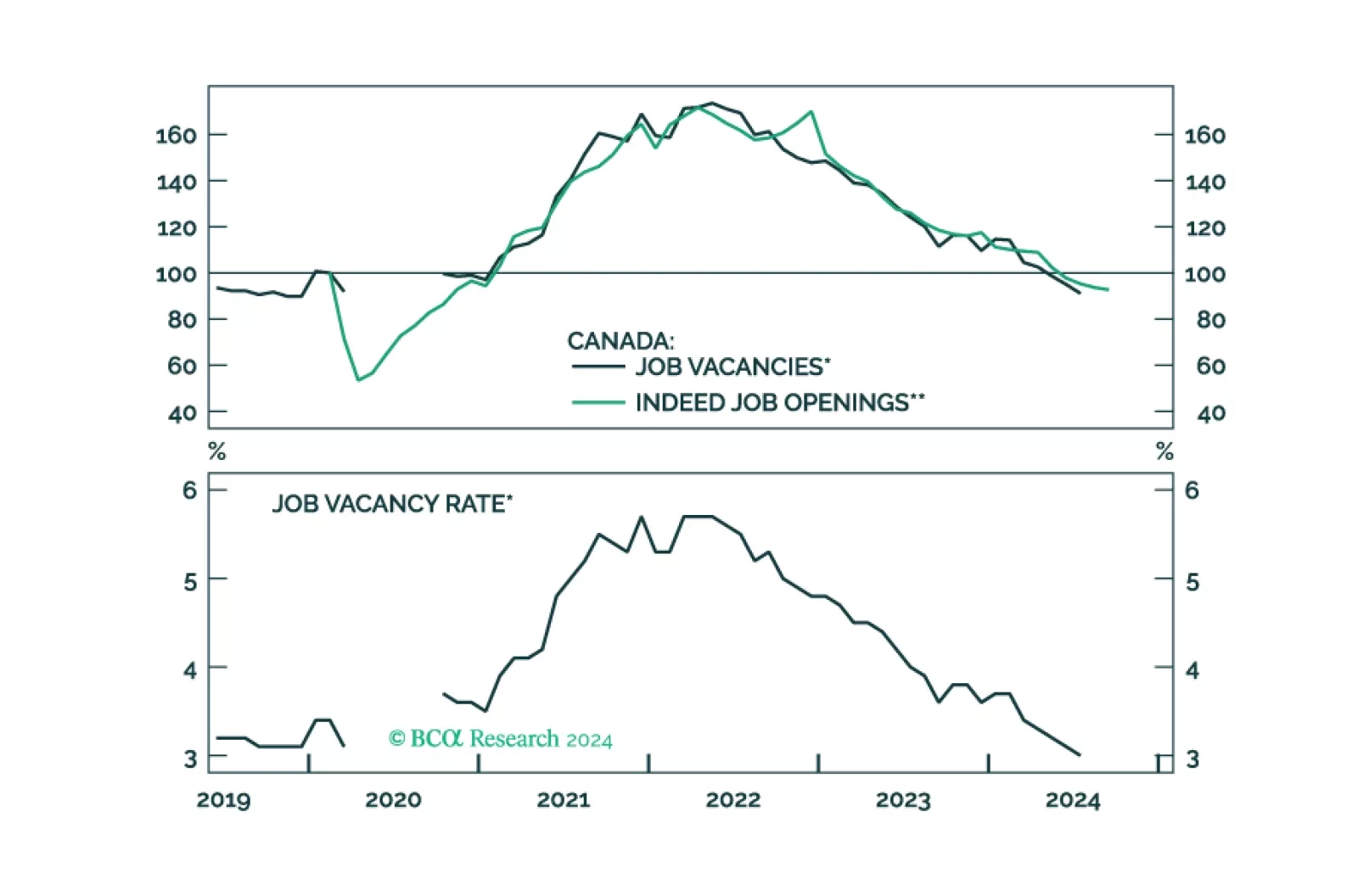

In this Insight, we evaluate if there is more juice in our macro bet of being long June 2025 CORRA versus SOFR futures, and correspondingly, being short the CAD, for investors with a 1-3 month horizon.

In this Insight, we assess whether investors should expect fiscal turbulence in the UK, that will drive UK yields higher and the pound lower.

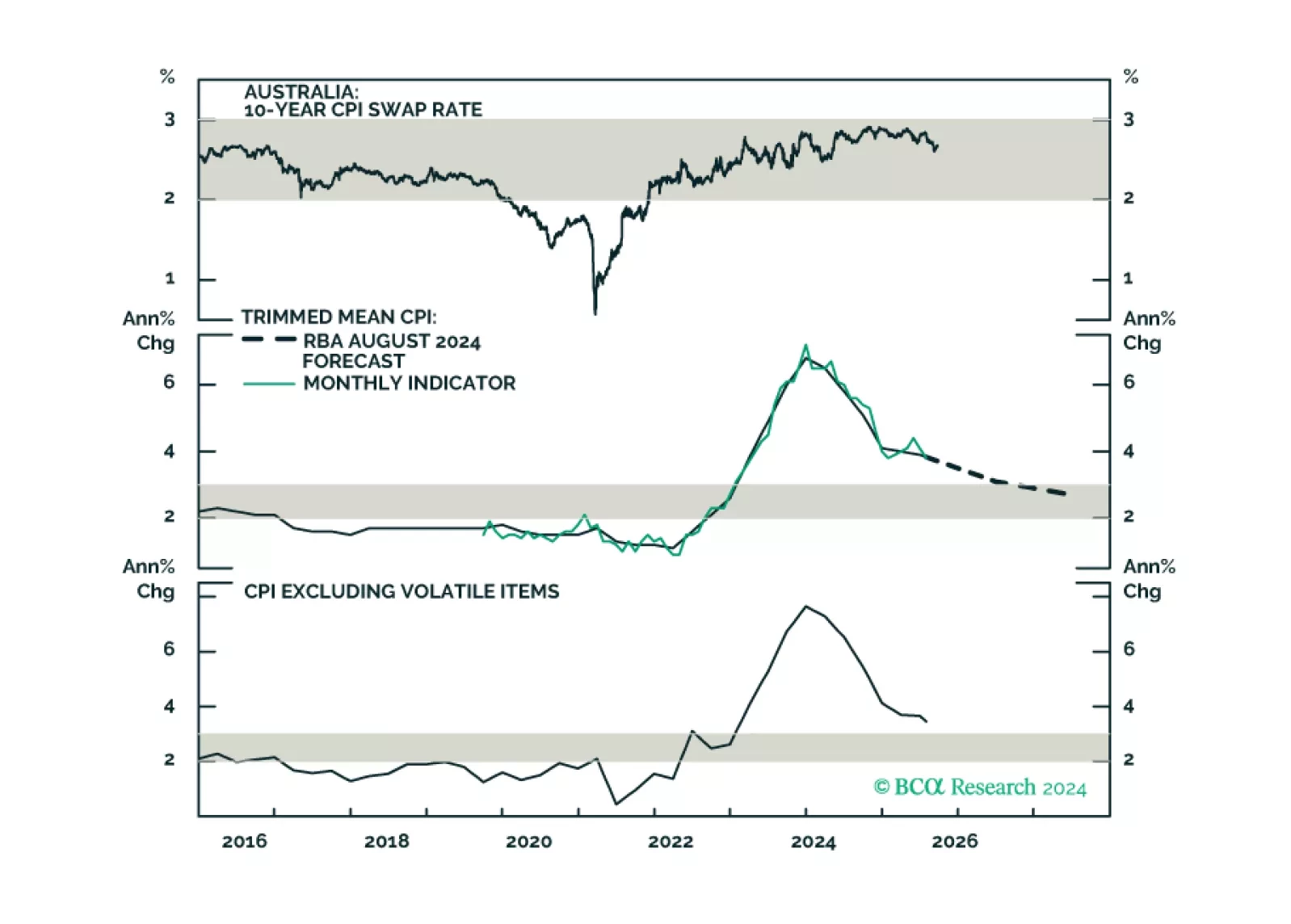

This insight parses through the RBA’s latest policy decision, and makes recommendations on whether to expect any rate cuts in 2024, and beyond.

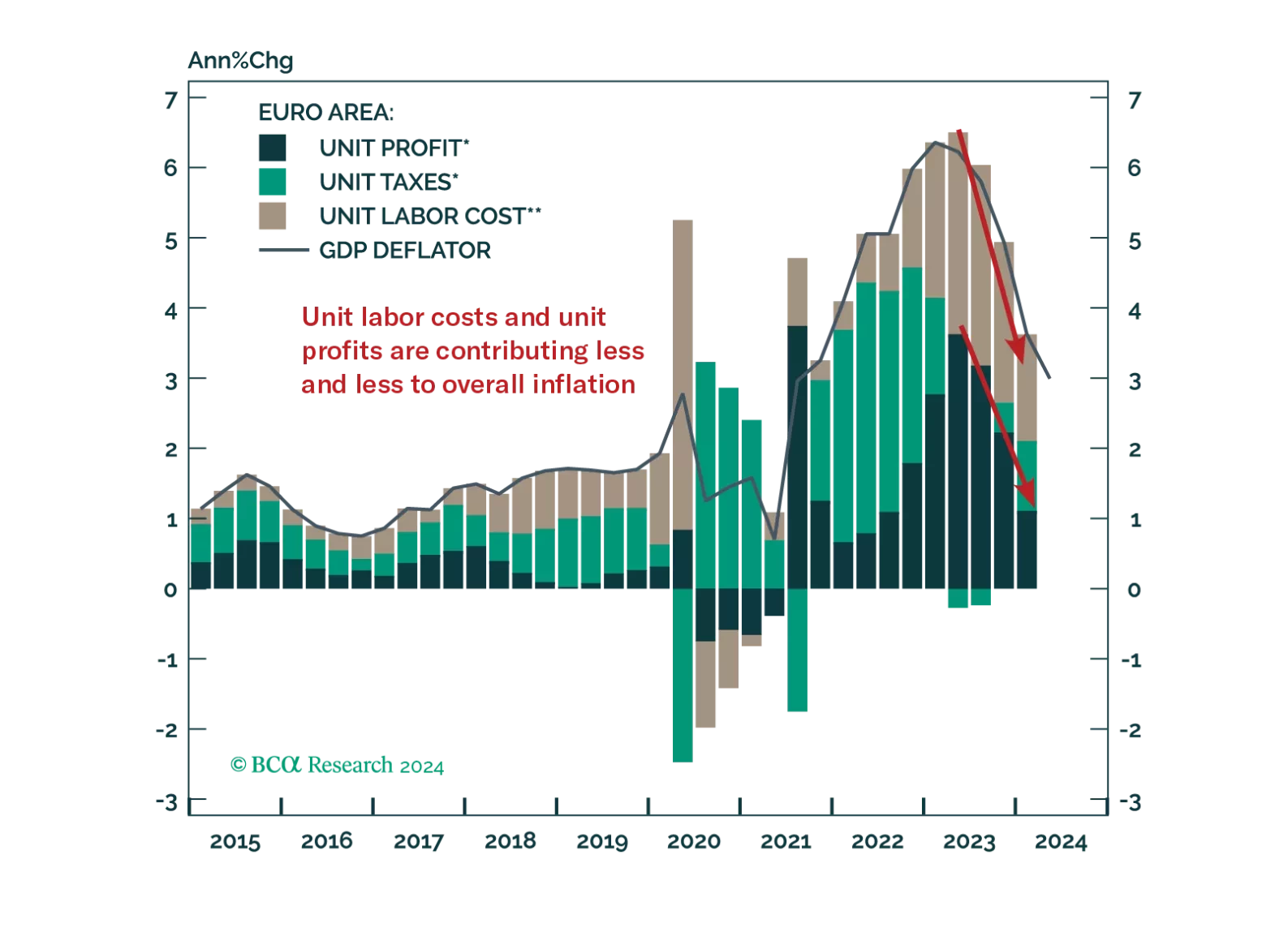

The ECB will cut rates once more this year; however, markets underprice how far it will ease next year.

What do the mixed signals sent by the UK economy mean for the Bank of England, and what are the implications for Gilts and the British pound?

We assess the investment implications of the BoJ and Fed meetings, and give our take on the next policy moves. We also assess the impact on asset markets.