This report is a quick take on our views on UK bonds and FX, given the recent budget.

Given the meetings between the Bank of Japan, the Bank of England, and the Swiss National Bank, our highest convictions views are:Overweight UK Gilts. It is also time to sell sterling. We are short sterling, as of 1.30. …

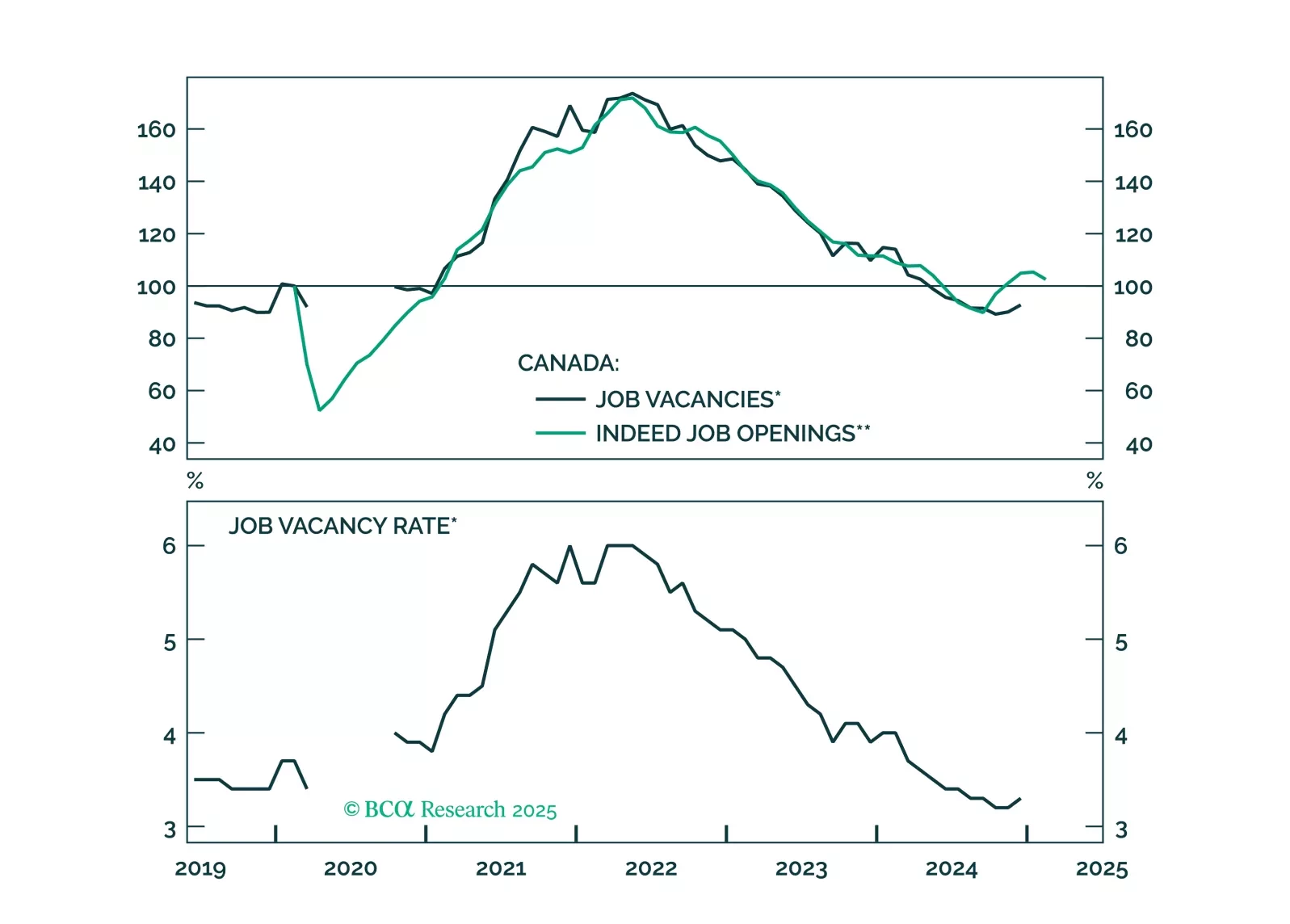

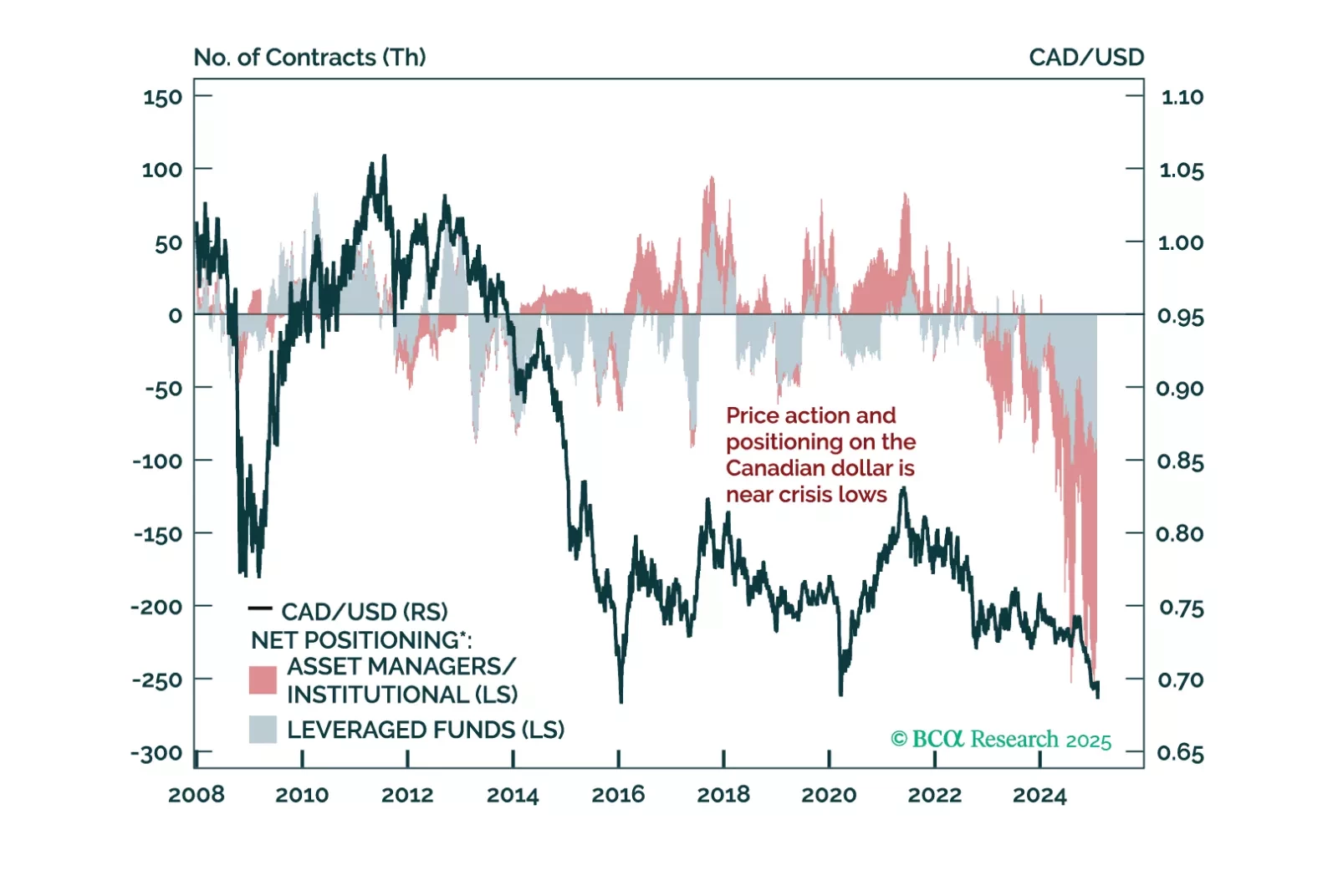

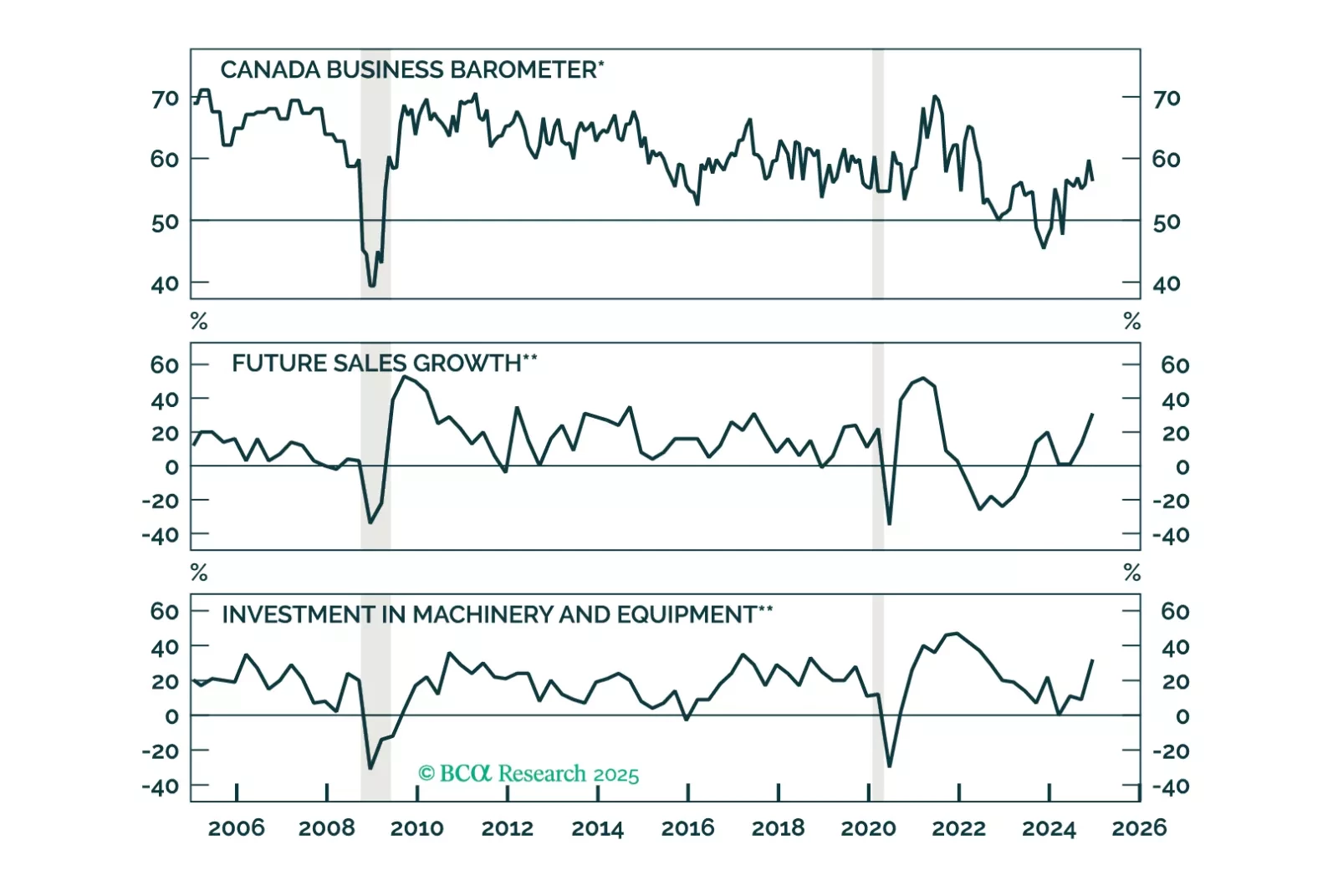

The trade war complicates the Bank of Canada’s task to achieve stable inflation. But the bottom line is that rising uncertainty, which will dampen business sentiment, will cause the BoC to cut rates by at least what is priced in the…

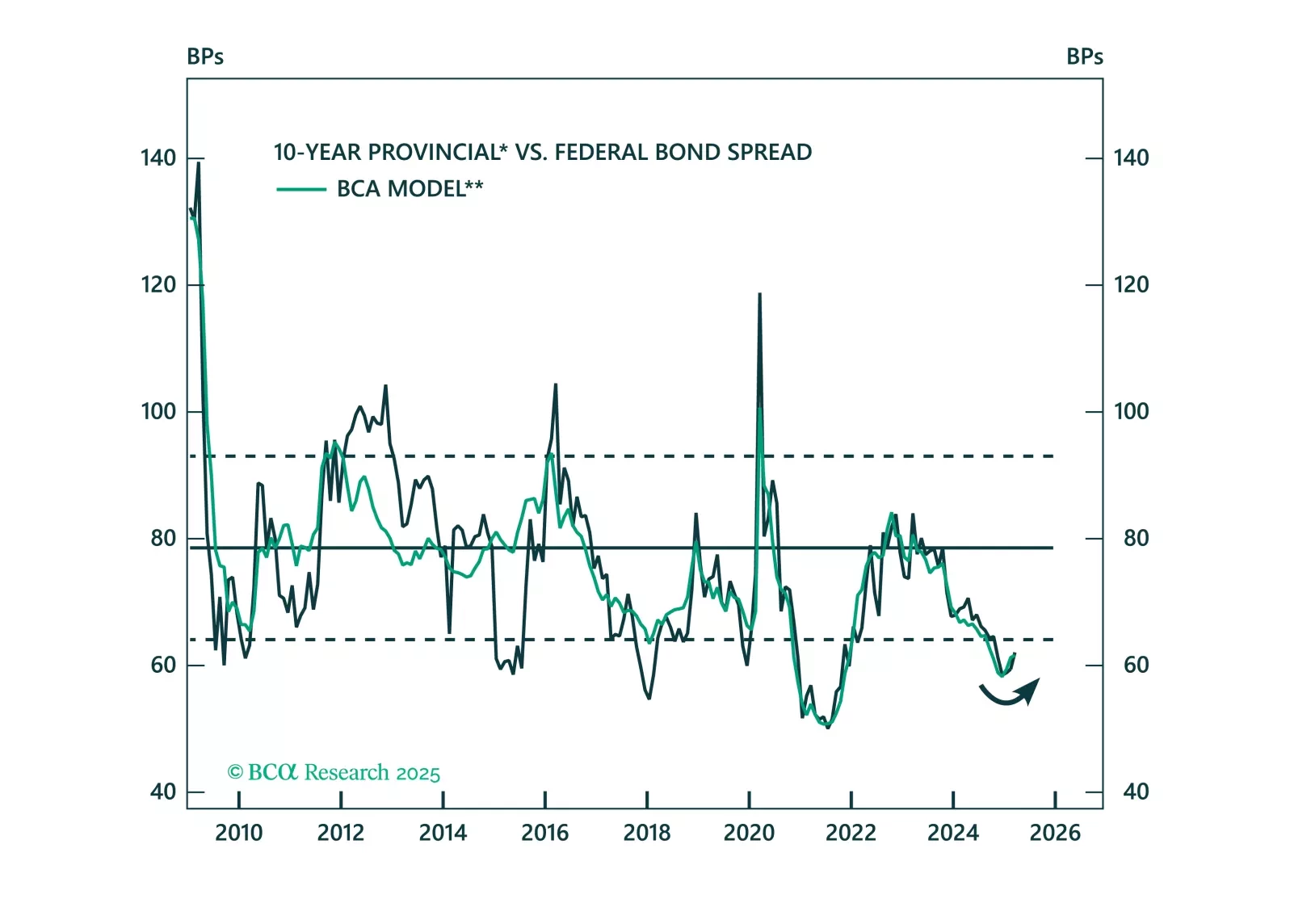

In this report, we explore the Canadian provincial bond market by developing a model to analyze its main drivers and understand the impact of a potential trade war between Canada and the US.

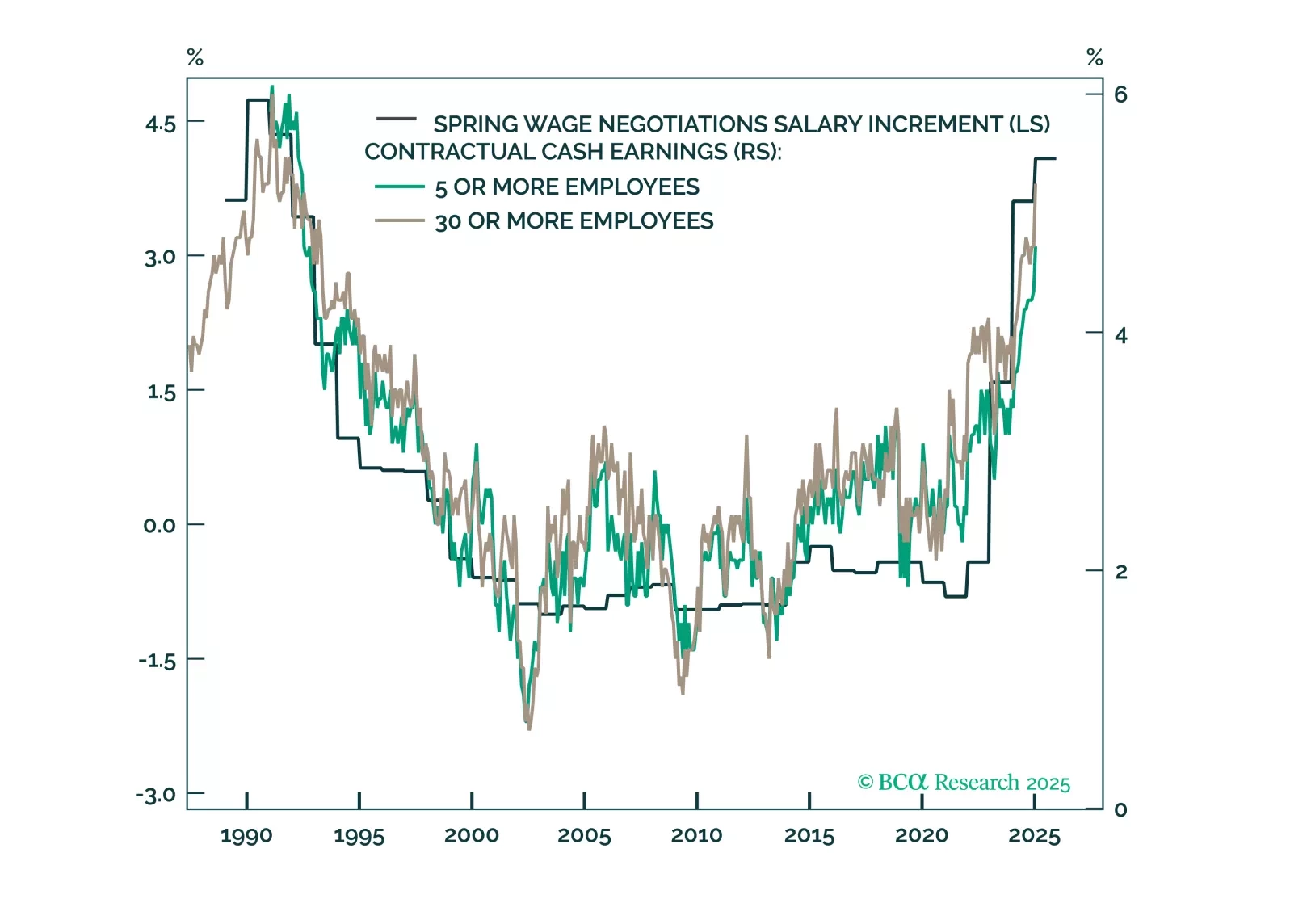

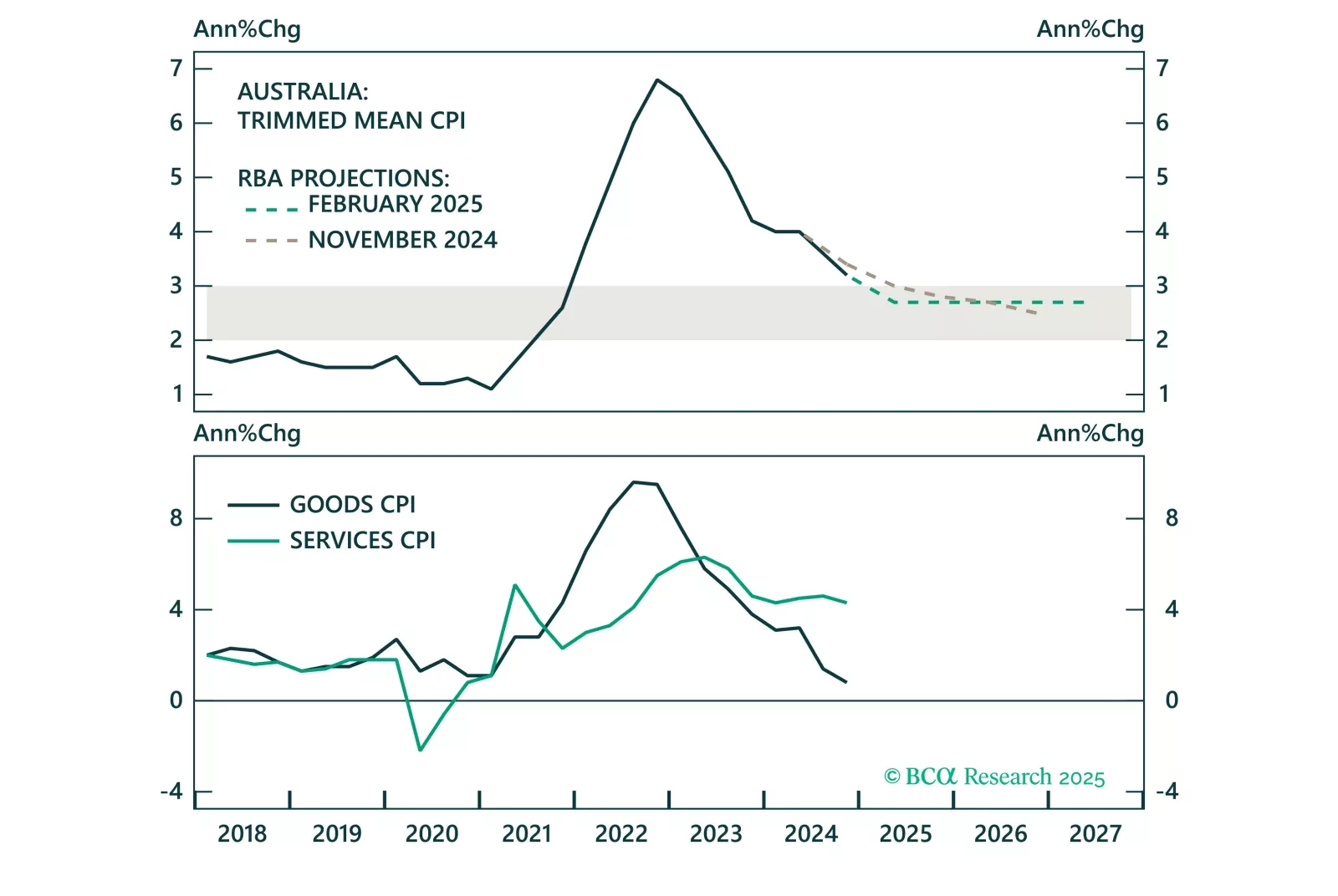

Overnight, the RBA cut the cash target rate for the first time since 2022, marking the beginning of the policy easing cycle in Australia. However, the RBA will proceed cautiously with further rate cuts, given a tight labor market and…

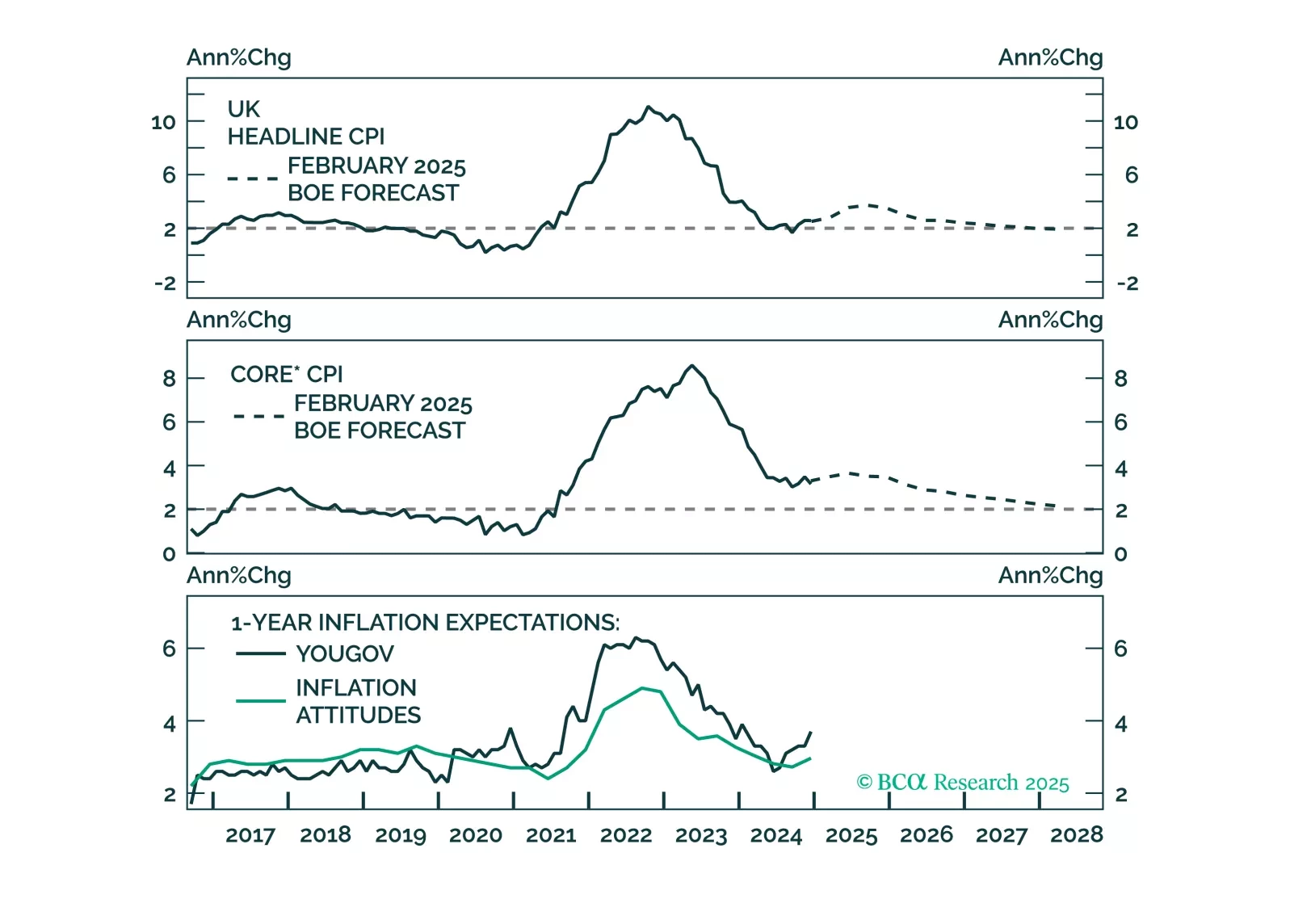

Following today’s Bank of England’s policy meeting, at which the policy rate was cut by 25 bps, we discuss our outlook for monetary policy in the UK. We expect the gradual easing to continue and discuss the investment implications…

This Insight is a post mortem on Canadian assets, after the threat of tariff wars.

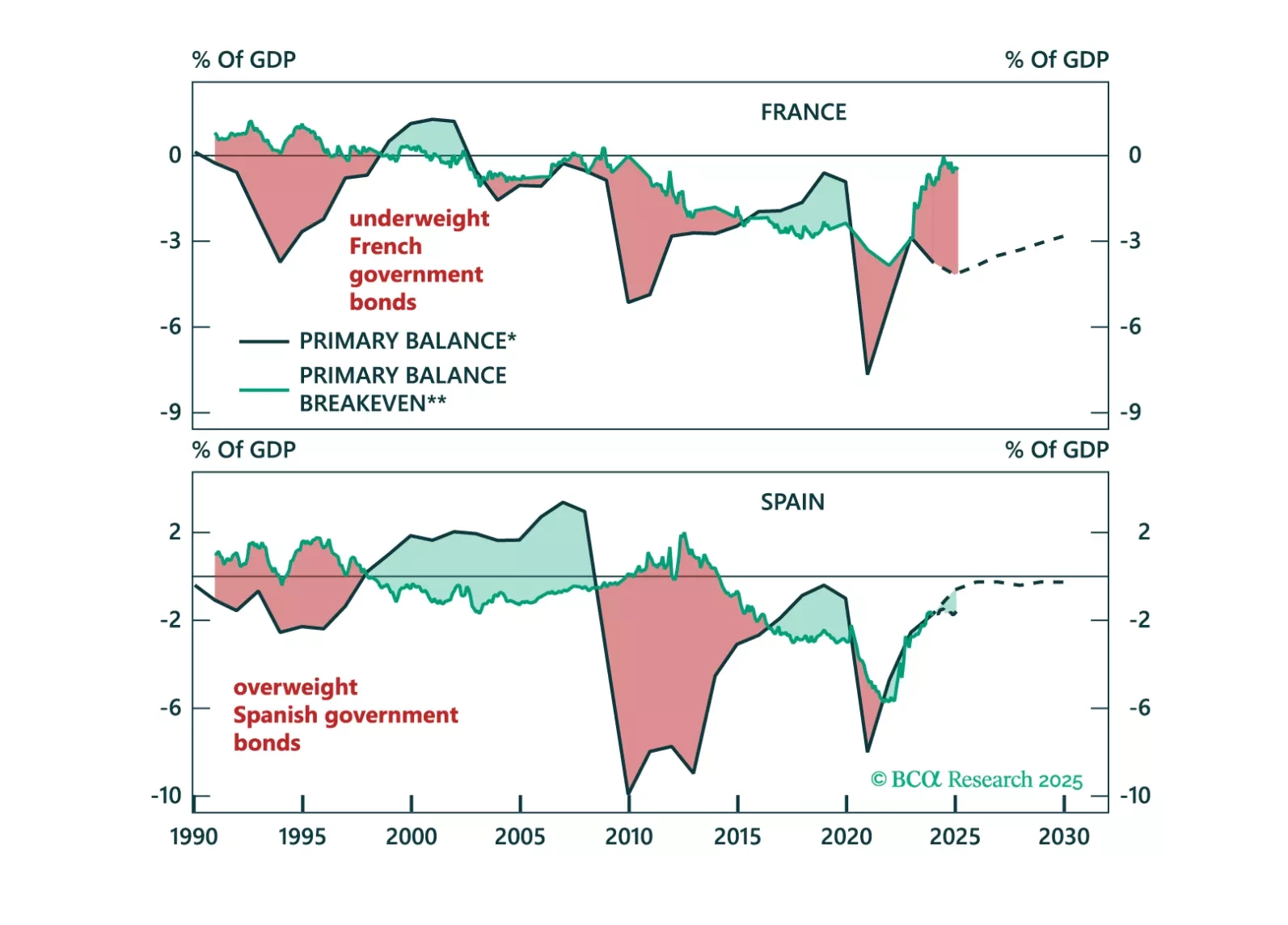

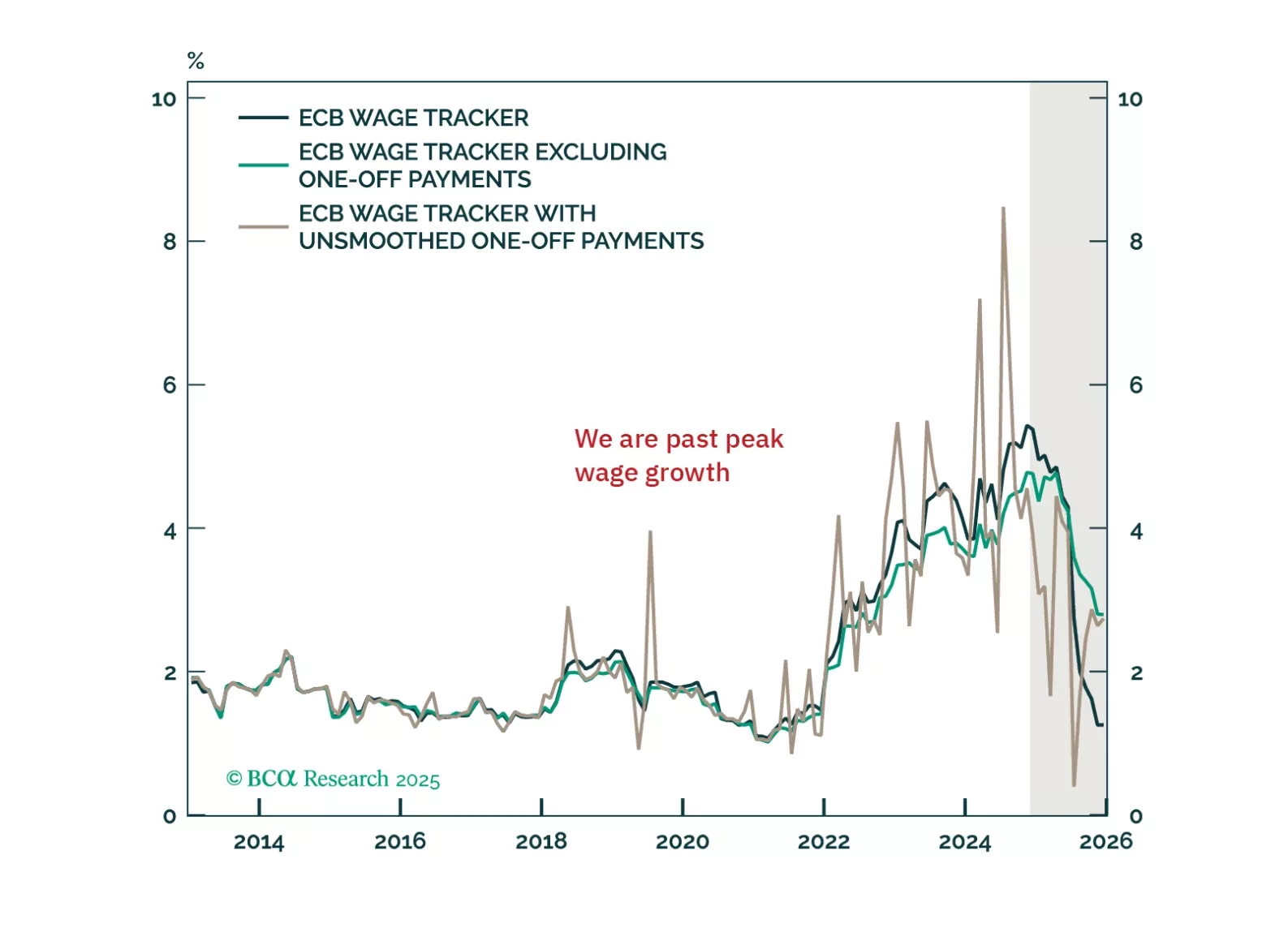

The ECB cut its deposit rate to 2.75%, as was widely anticipated. President Christine Lagarde did not provide any fireworks, but the Governing Council’s message was clear: Policy is restrictive, and inflation will fall further. As a…

This Insight looks at what investors should do with CAD and fixed-income assets, given the rate cut by the Bank of Canada today.