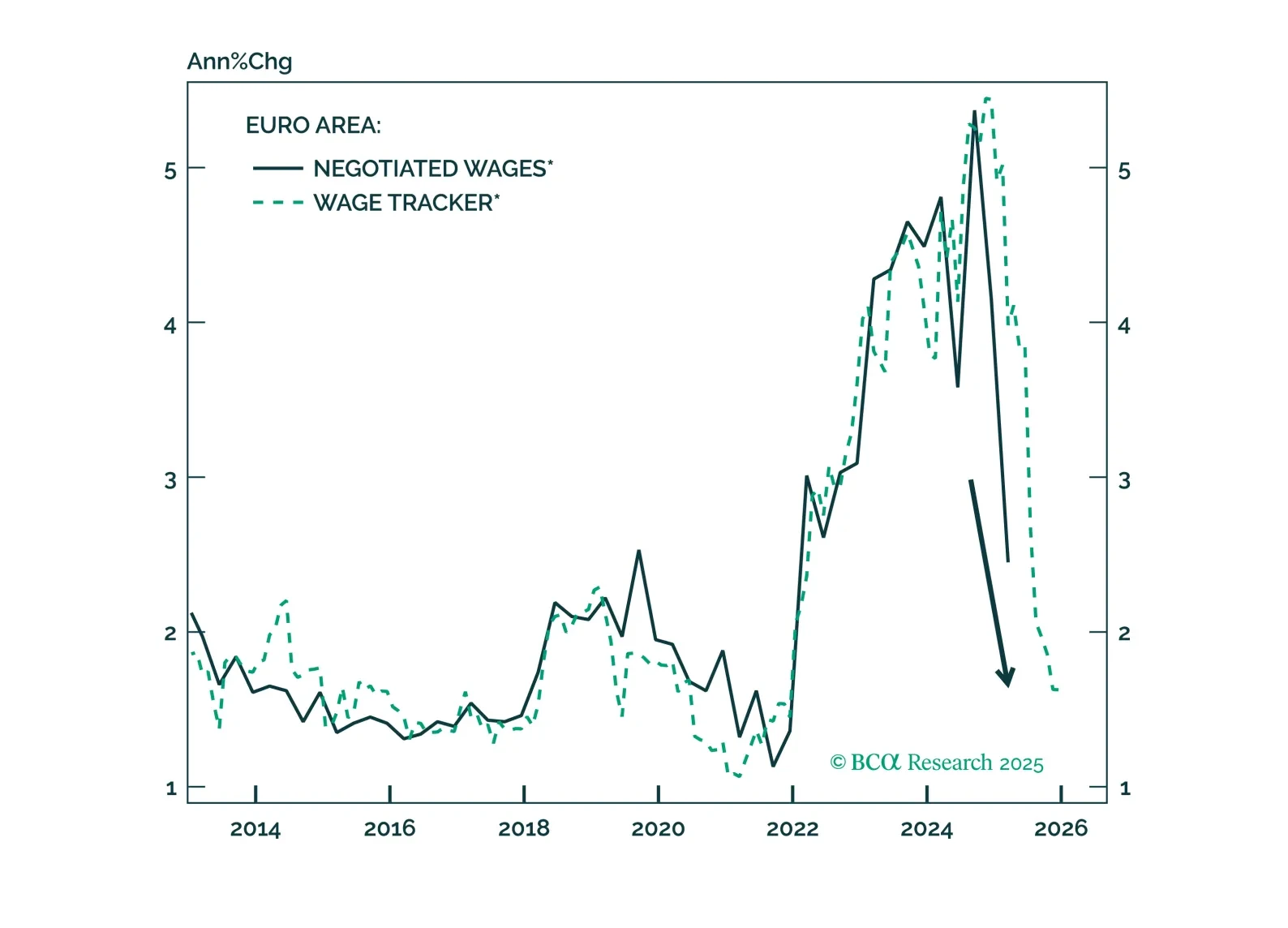

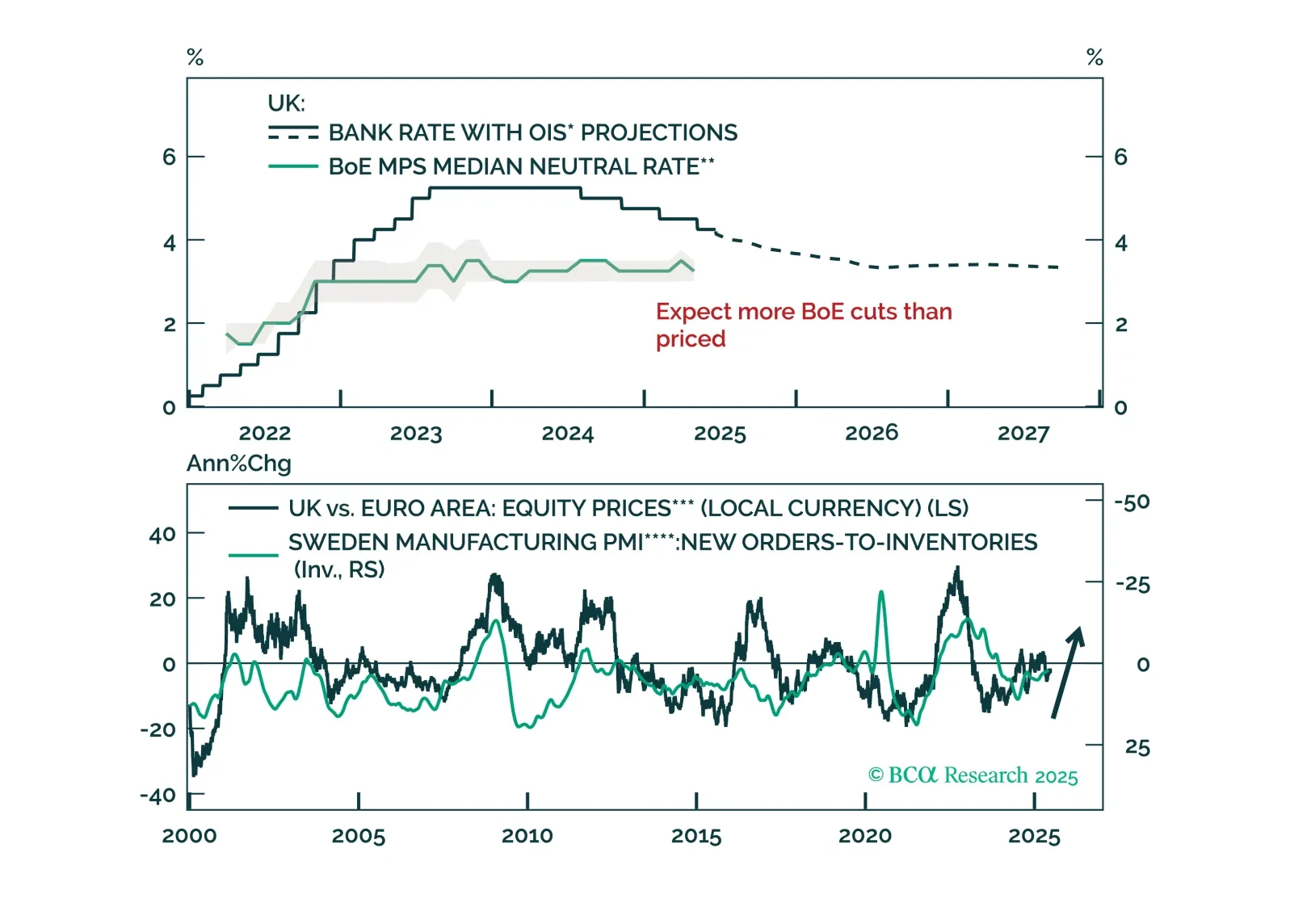

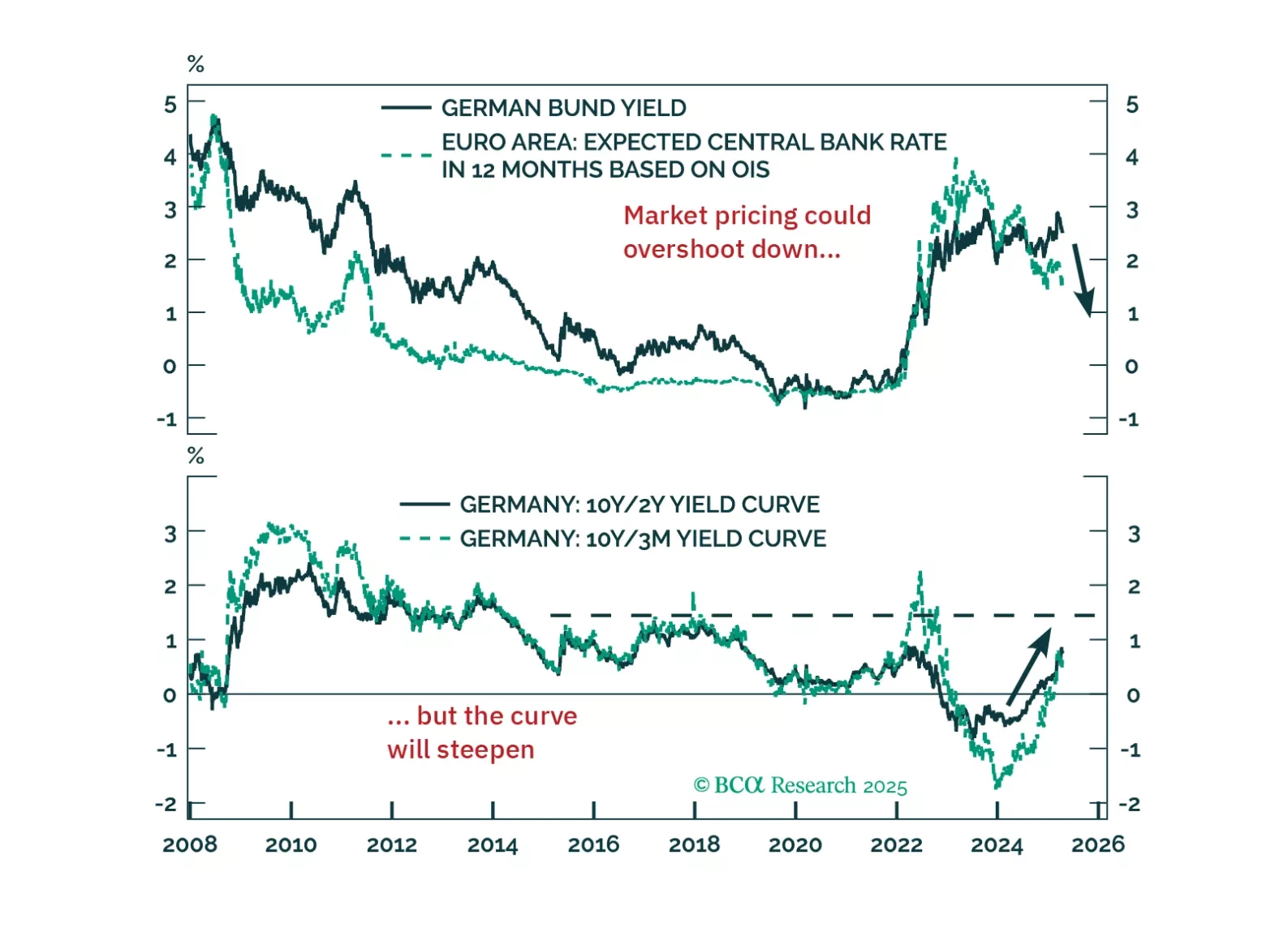

Consensus sees one final ECB cut; we argue two are coming as deflationary forces are building in Europe. Dive in for the trade map: falling Bund yields, tighter peripheral spreads, and a euro primed for a 2026 rebound.

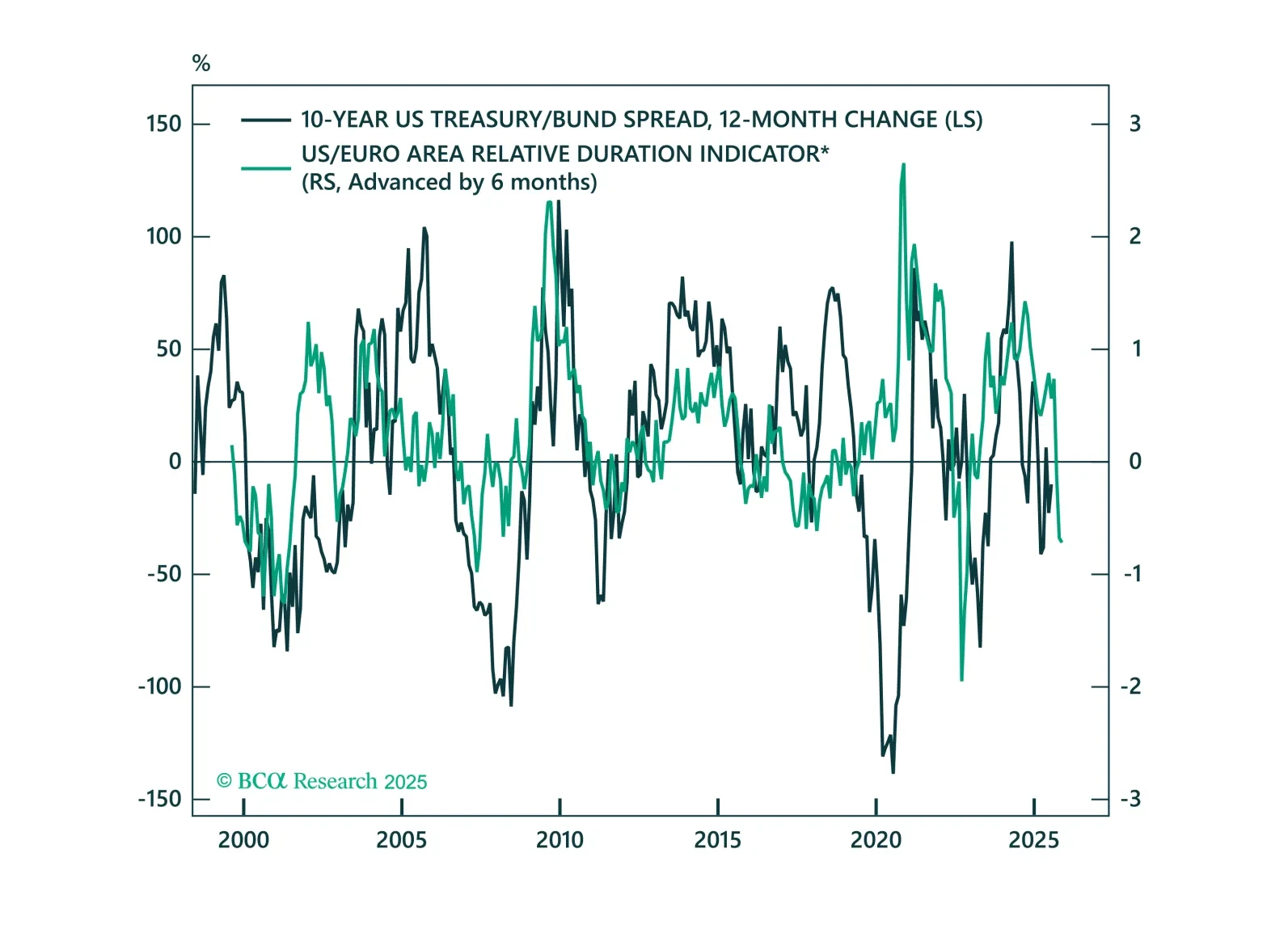

Volatility is back in UST/Bund spreads. We unpack what’s driving the moves and explain what we are watching for tactical opportunities in the UST/Bund spread.

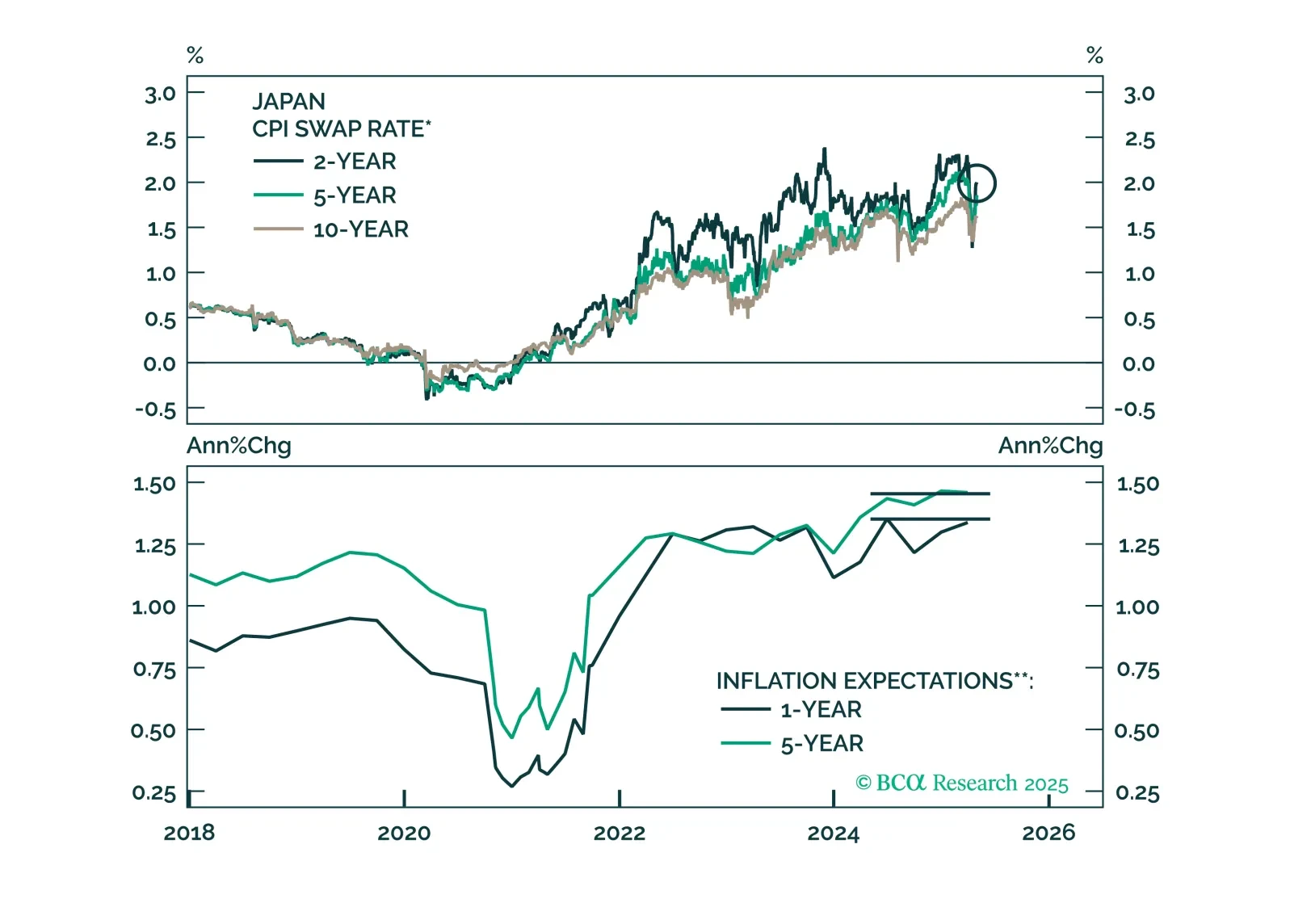

In this note, we reaffirm our underweight position in JGBs and long yen positions given the BoJ’s meeting overnight.

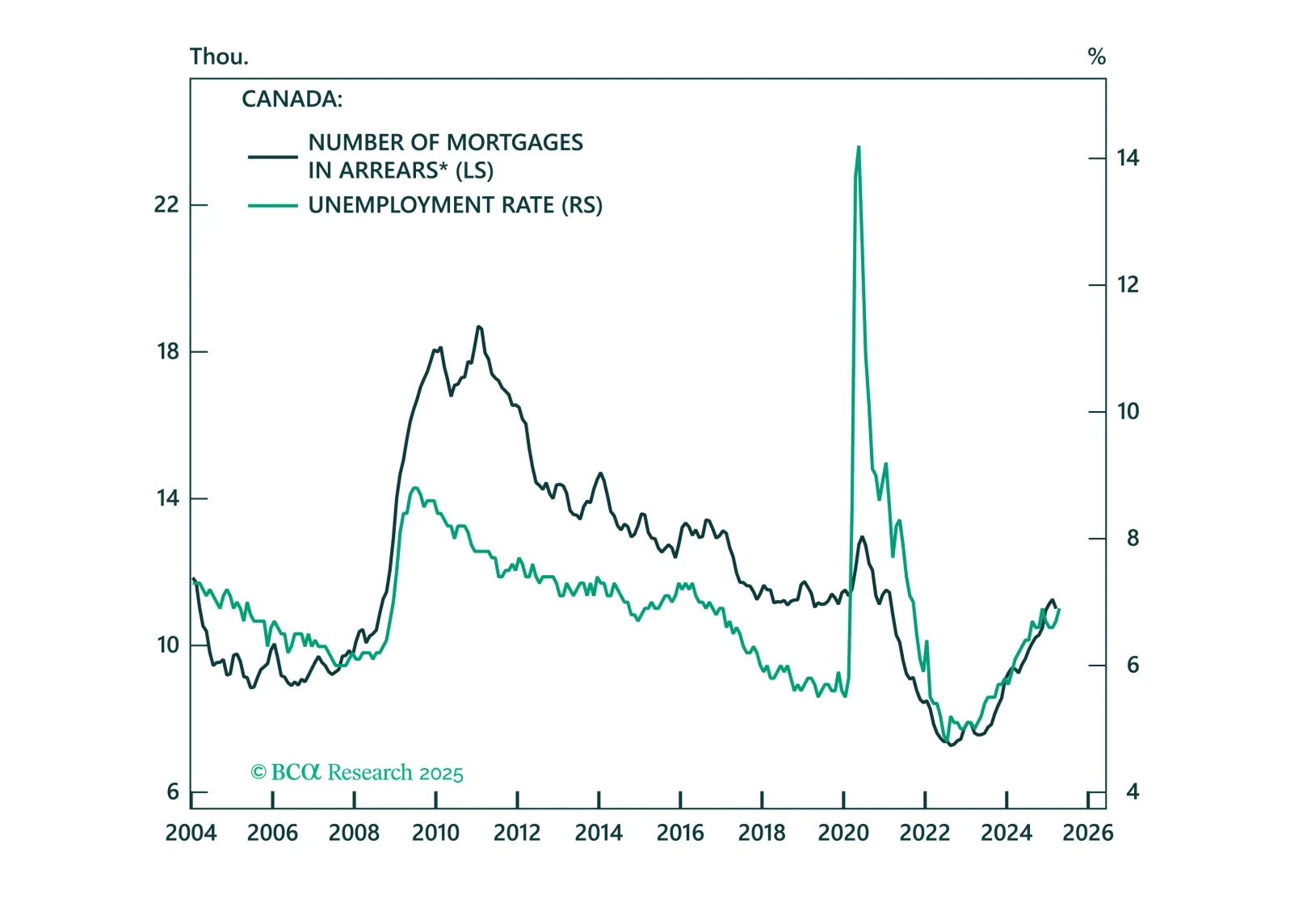

The Bank of Canada may be on hold for now, but deflationary risks are rising fast. Find out why rate cuts may come sooner than markets expect.

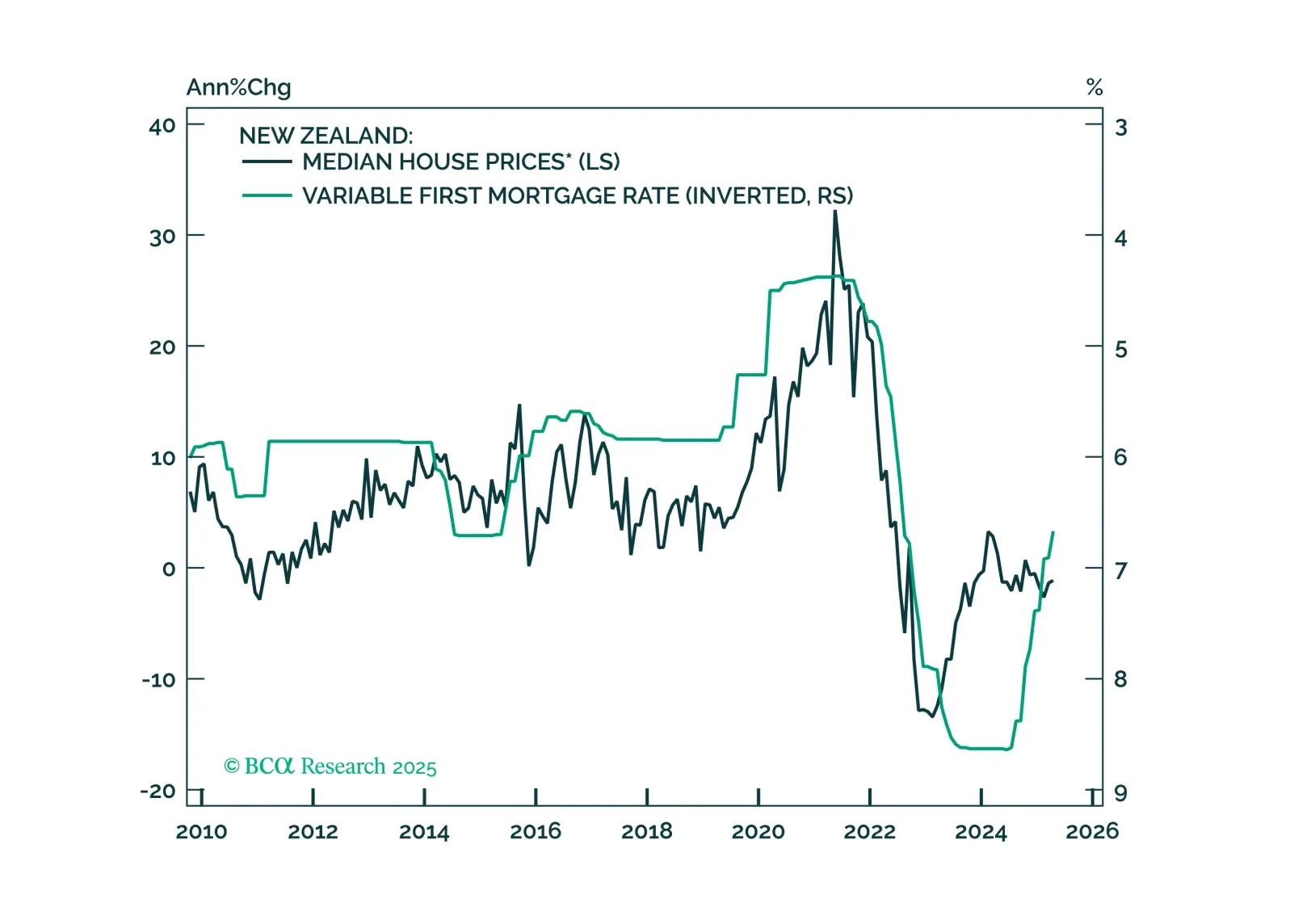

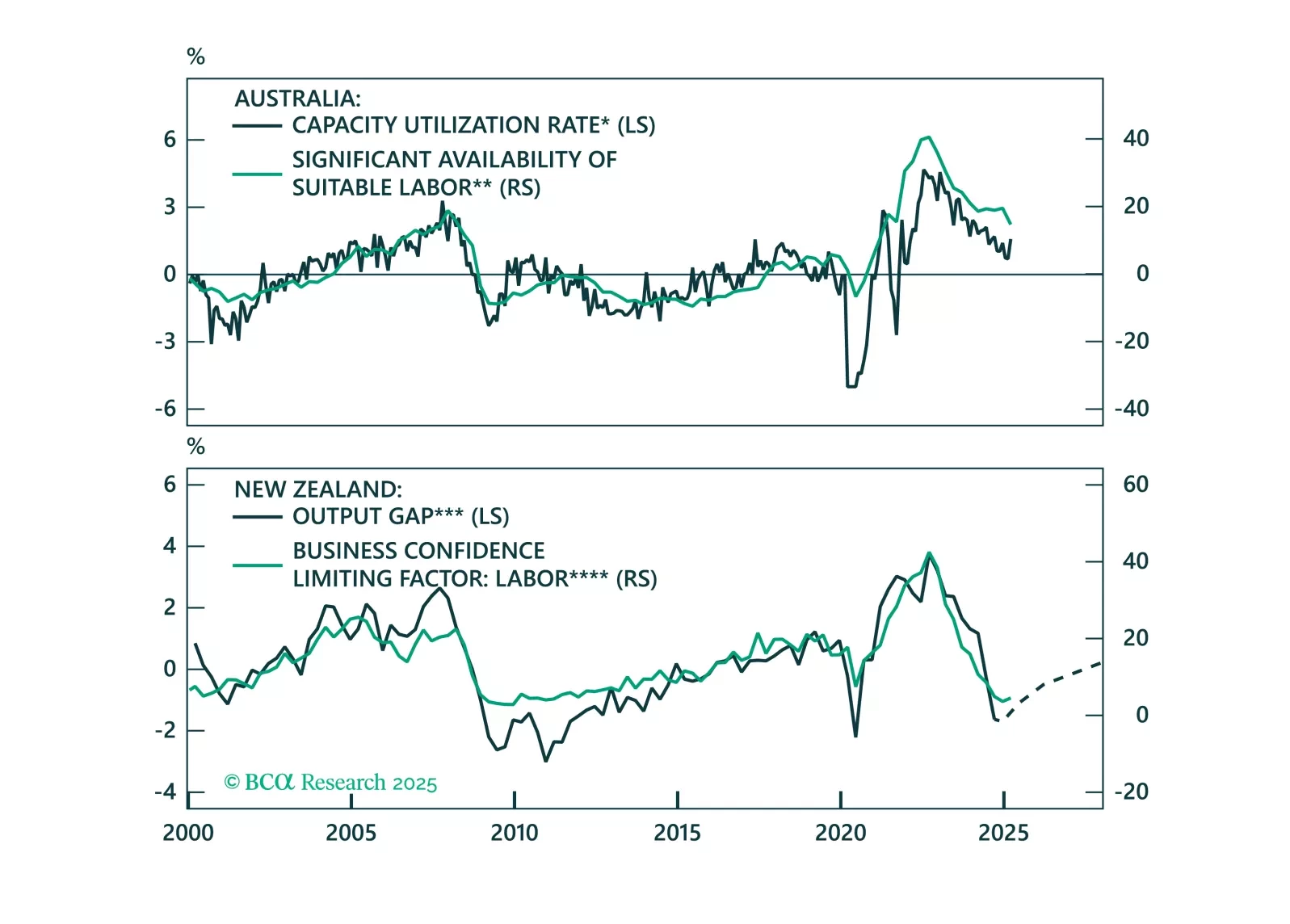

This Insight looks at the implications of the RBNZ’s rate cut on New Zealand assets.

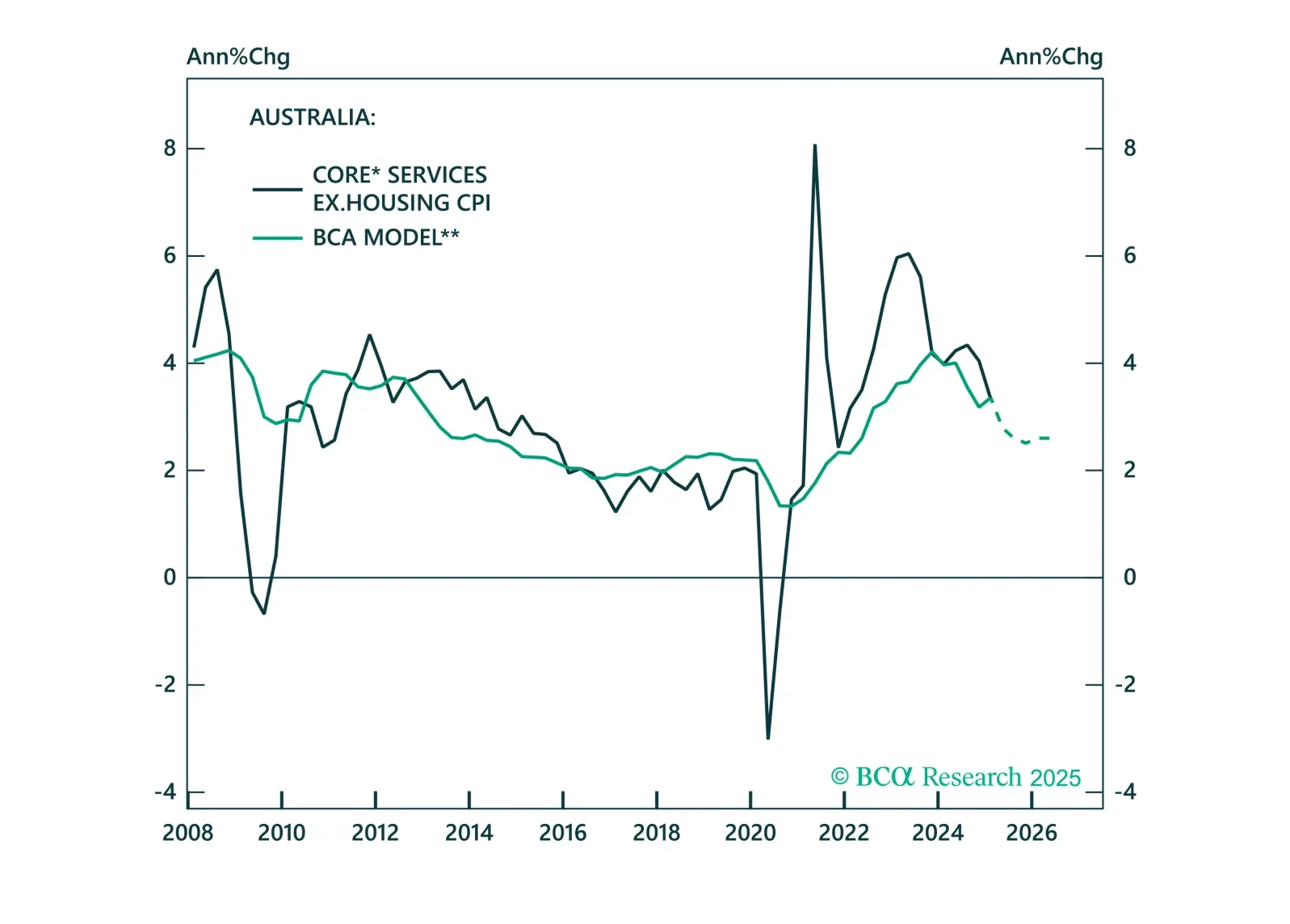

The RBA just turned dovish, but the macro data do not justify many more cuts. We unpack why Australia’s strong labor market and sticky inflation limit the scope for further easing.

This week’s report looks at Japan, with the recent BoJ meeting. While a trade war has injected uncertainty into the Japanese economy, our conviction remains high that JGBs will underperform other government bond markets, and the yen…

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…