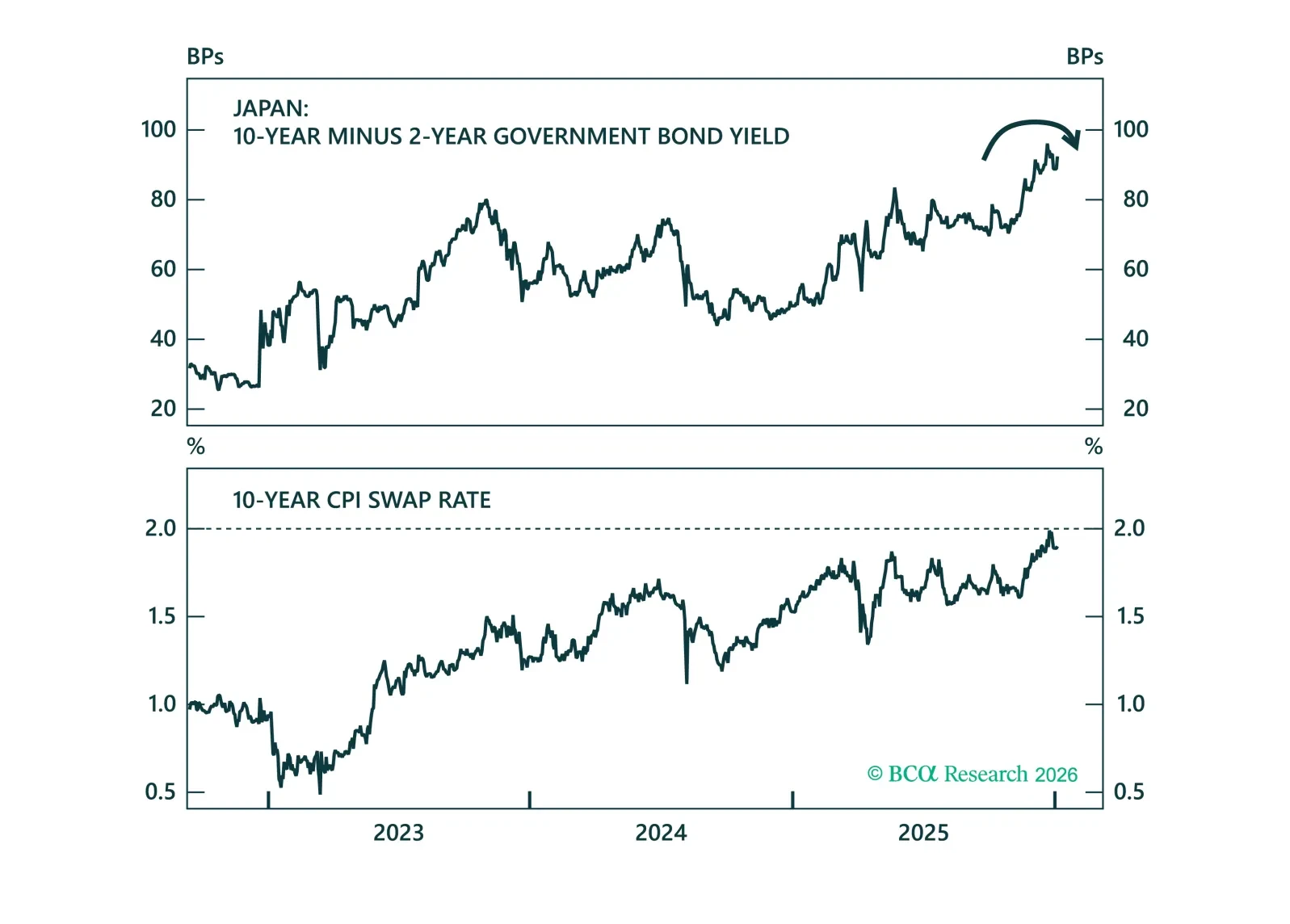

From steepening to flattening. As the BoJ continues to tighten in 2026, we show why curve flatteners are finally the right trade.

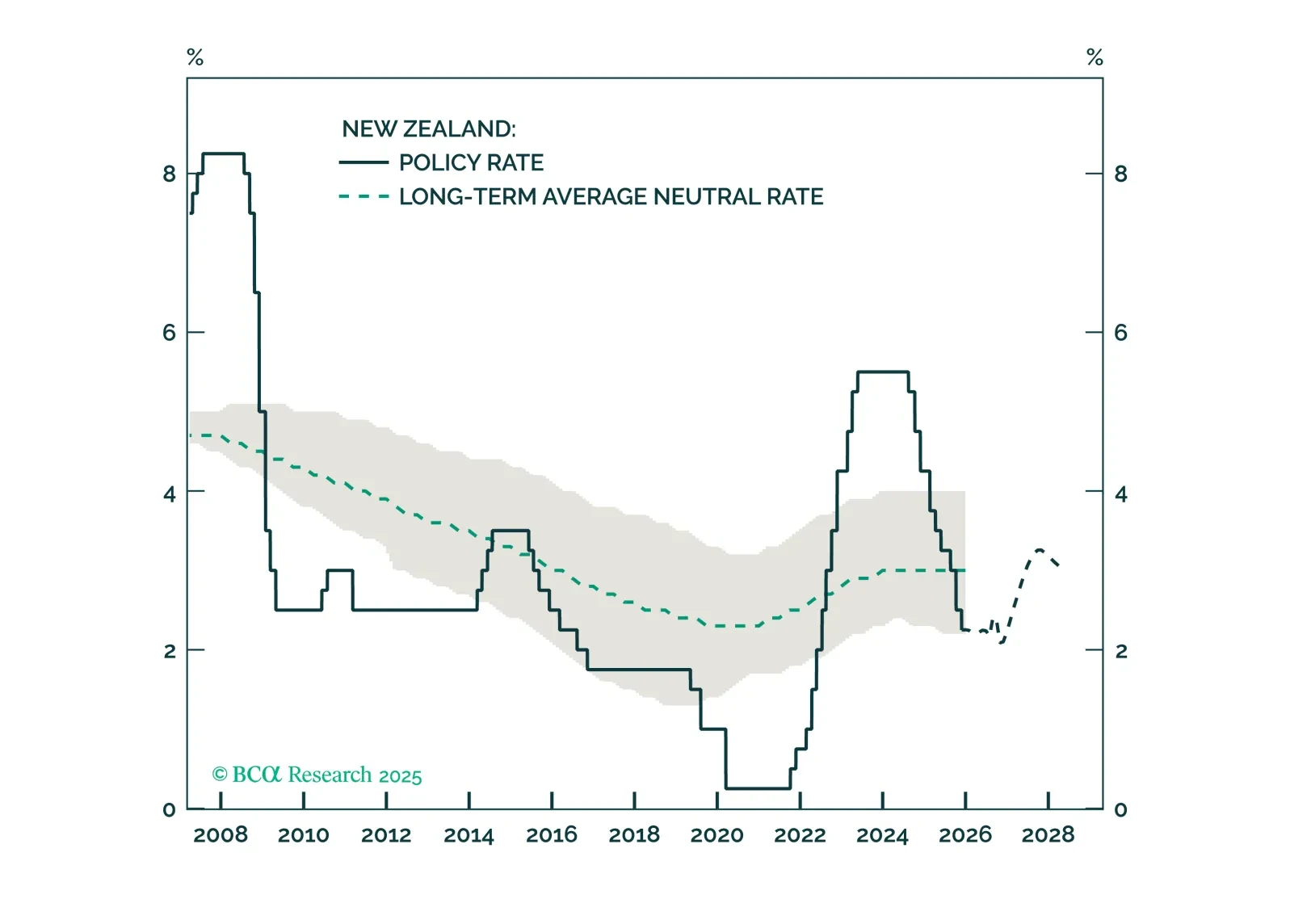

The RBNZ has concluded its aggressive easing blitz. With New Zealand economy finally showing signs of life, both the kiwi and local rates now look ripe for a reversal.

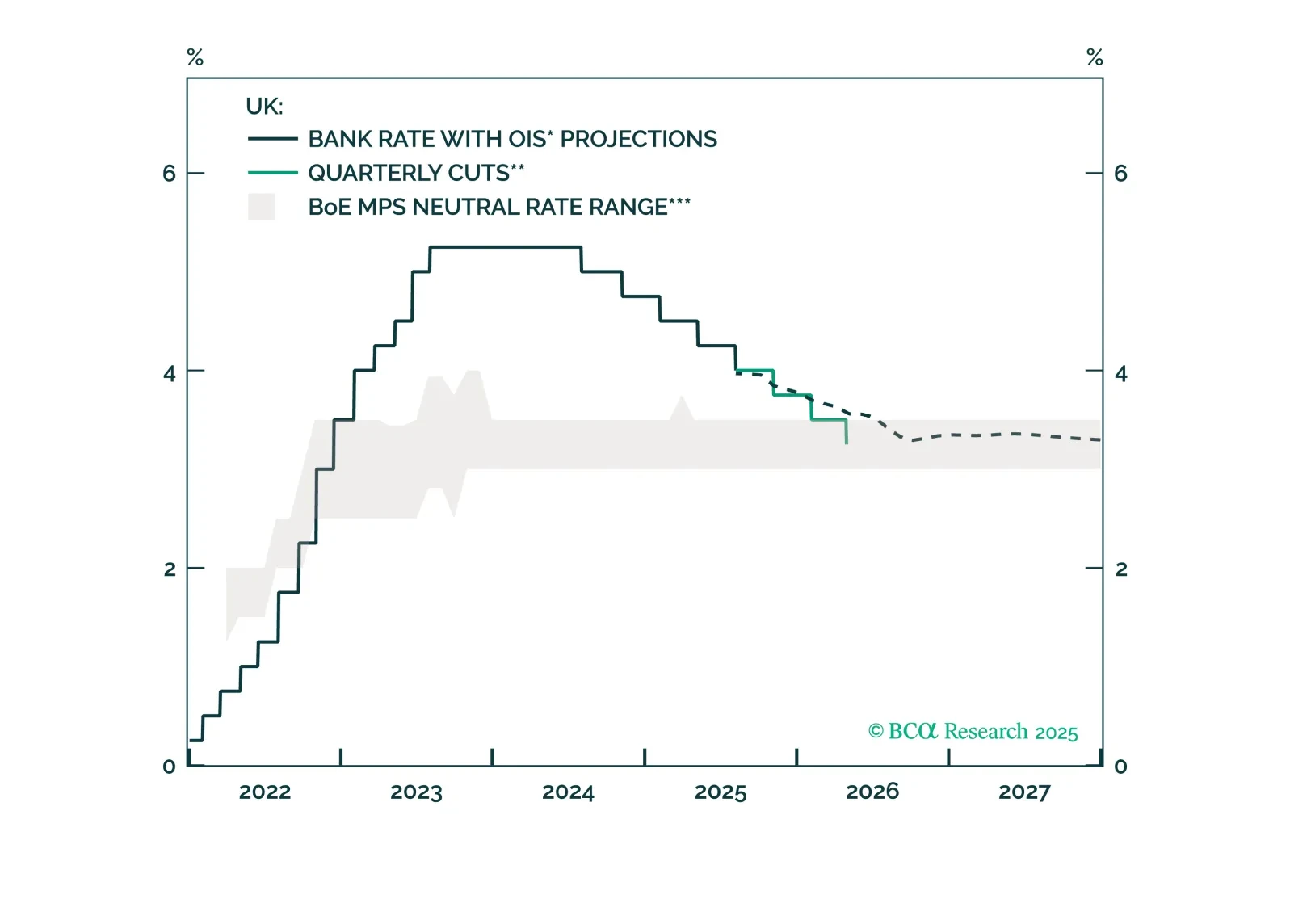

The Bank of England will resume rate cuts in December after the autumn budget is passed. Today’s Strategy Insight discusses what this means for UK gilts and the pound.

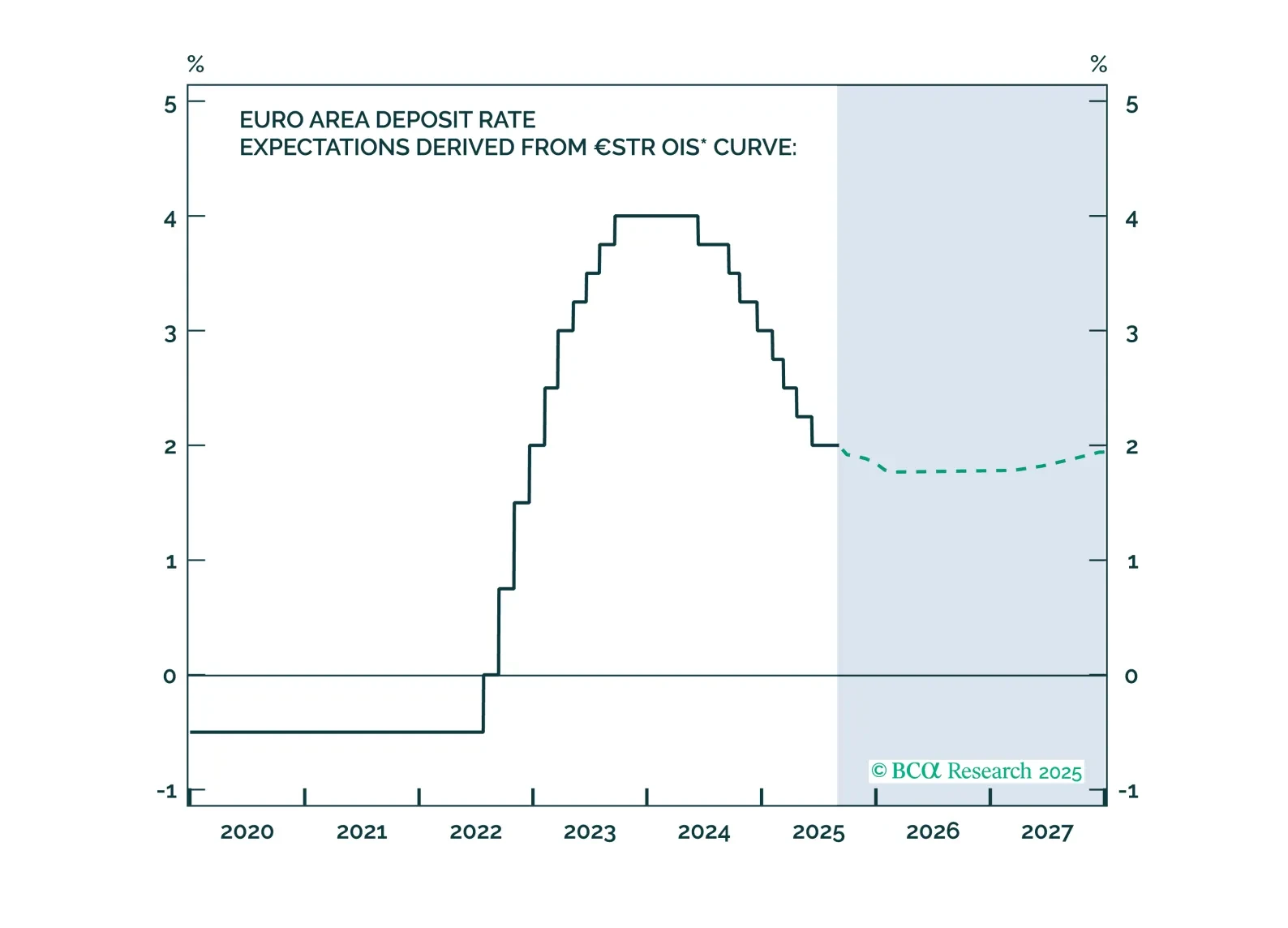

The ECB stood pat today, yet the policy path remains fraught with uncertainty as domestic resilience collides with global headwinds. This dichotomy continues to hold important implications for European assets over the coming months.…

The European Central Bank has achieved a soft landing. Inflation is back to target, with well-anchored inflation expectations. The unemployment rate is historically low, and real economic growth is stable, albeit weak. Given that…

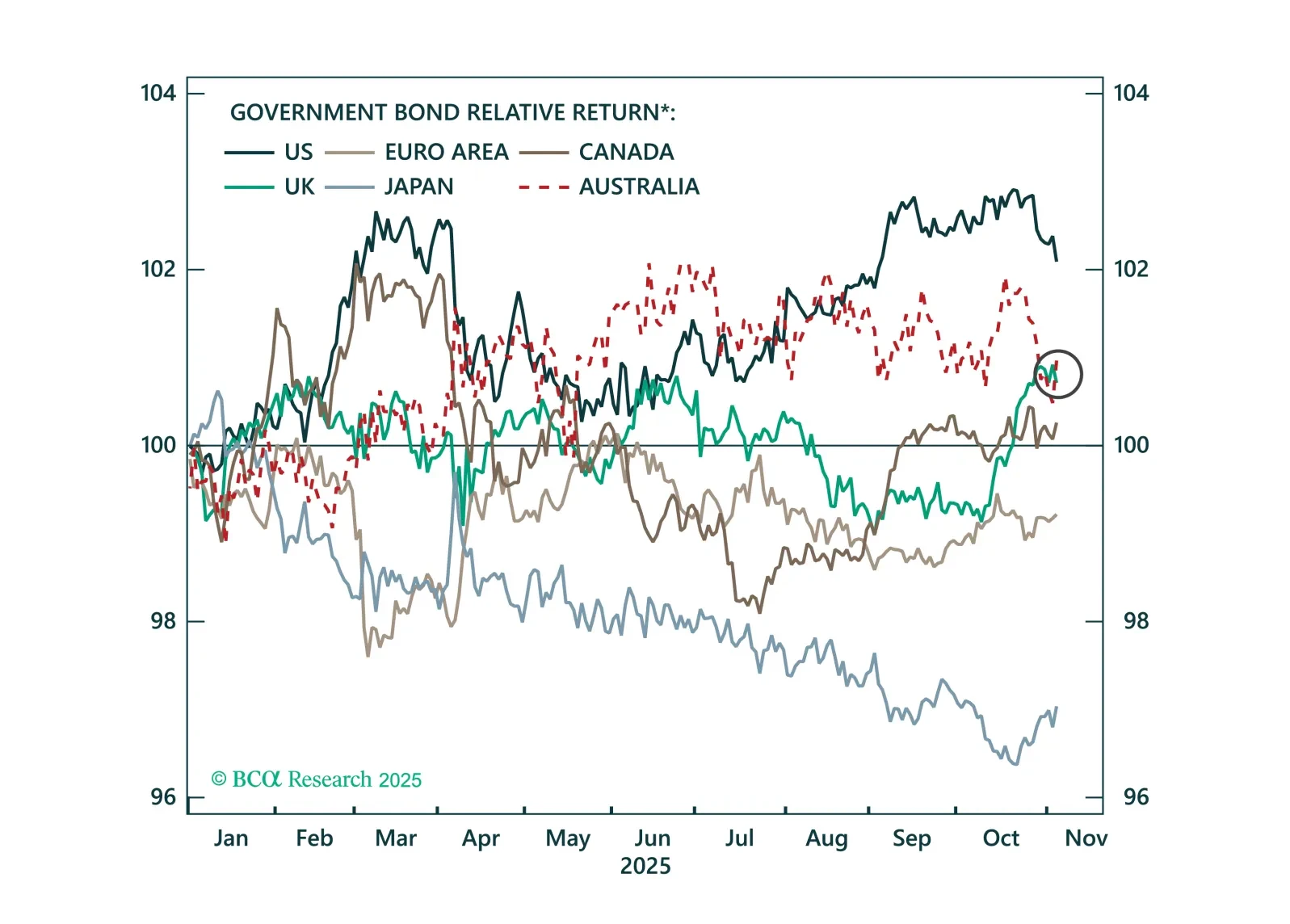

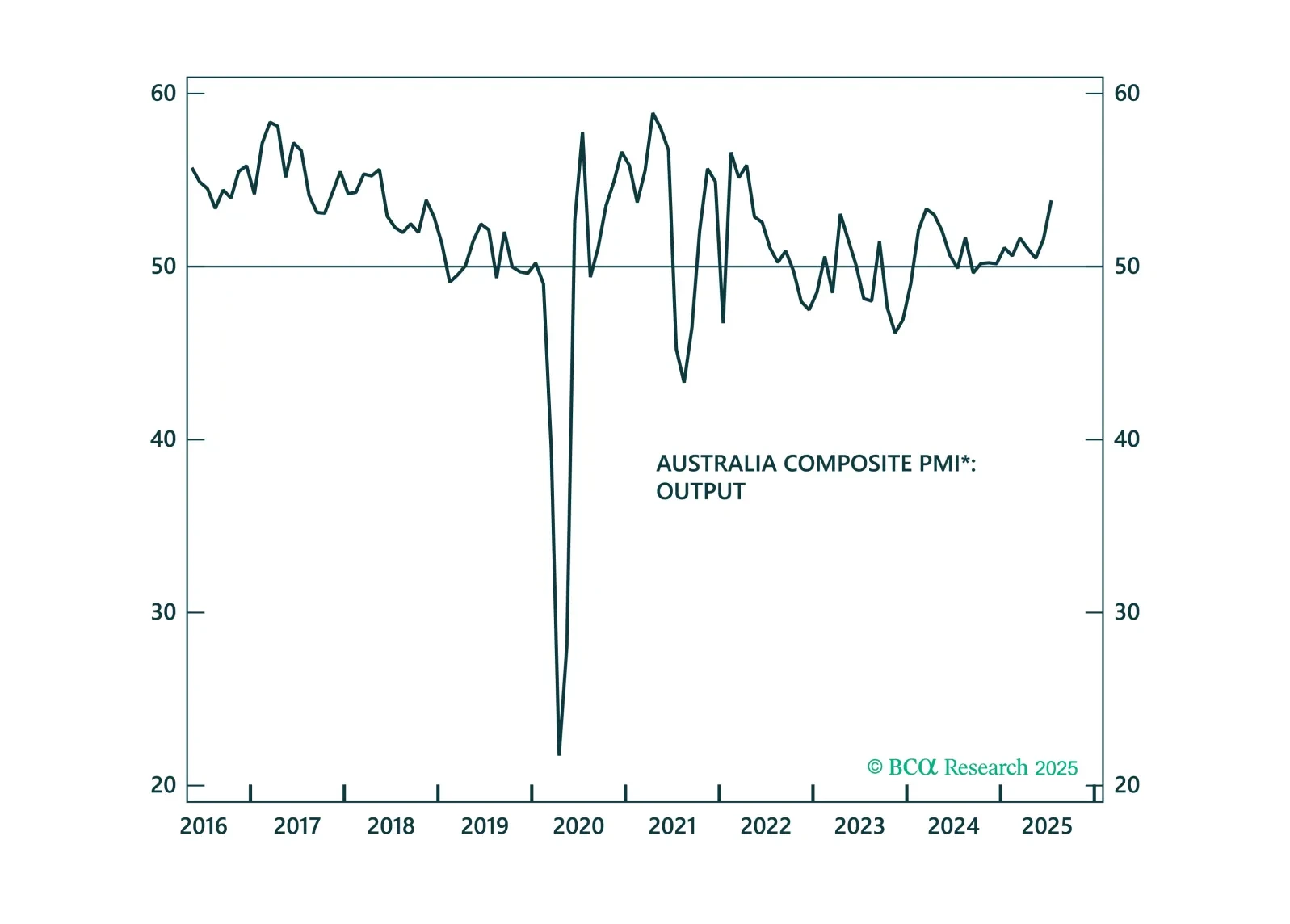

In a widely anticipated move, the RBA resumed cutting rates. However, with housing, consumption, and PMIs improving, we see little scope for the RBA to ease beyond market expectations.

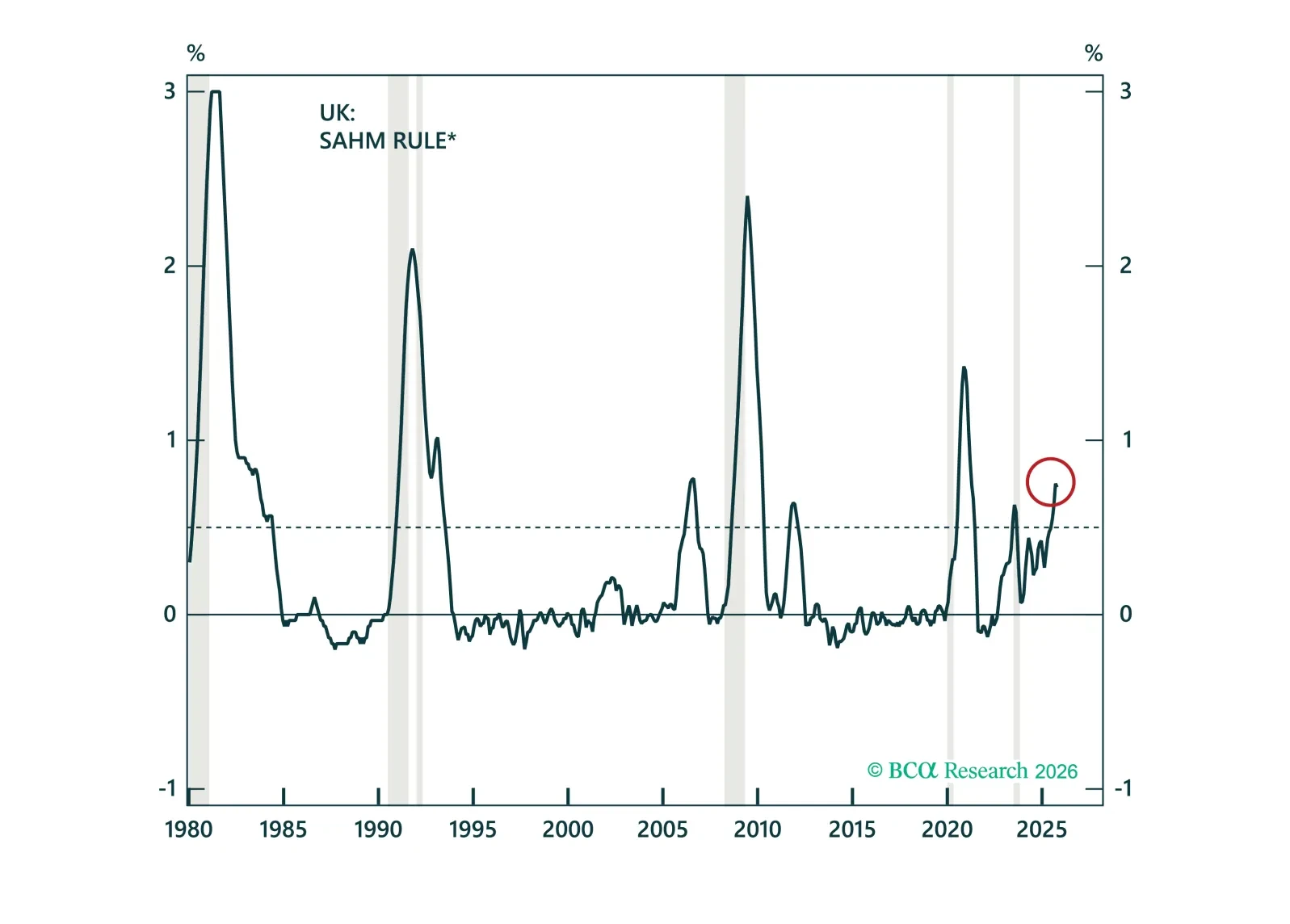

The BoE is easing, but risks falling behind. Labor and growth cracks are starting to emerge, and the Bank may soon be forced to move more decisively. This report outlines why gilts remain a buy and sterling’s path is diverging vs.…

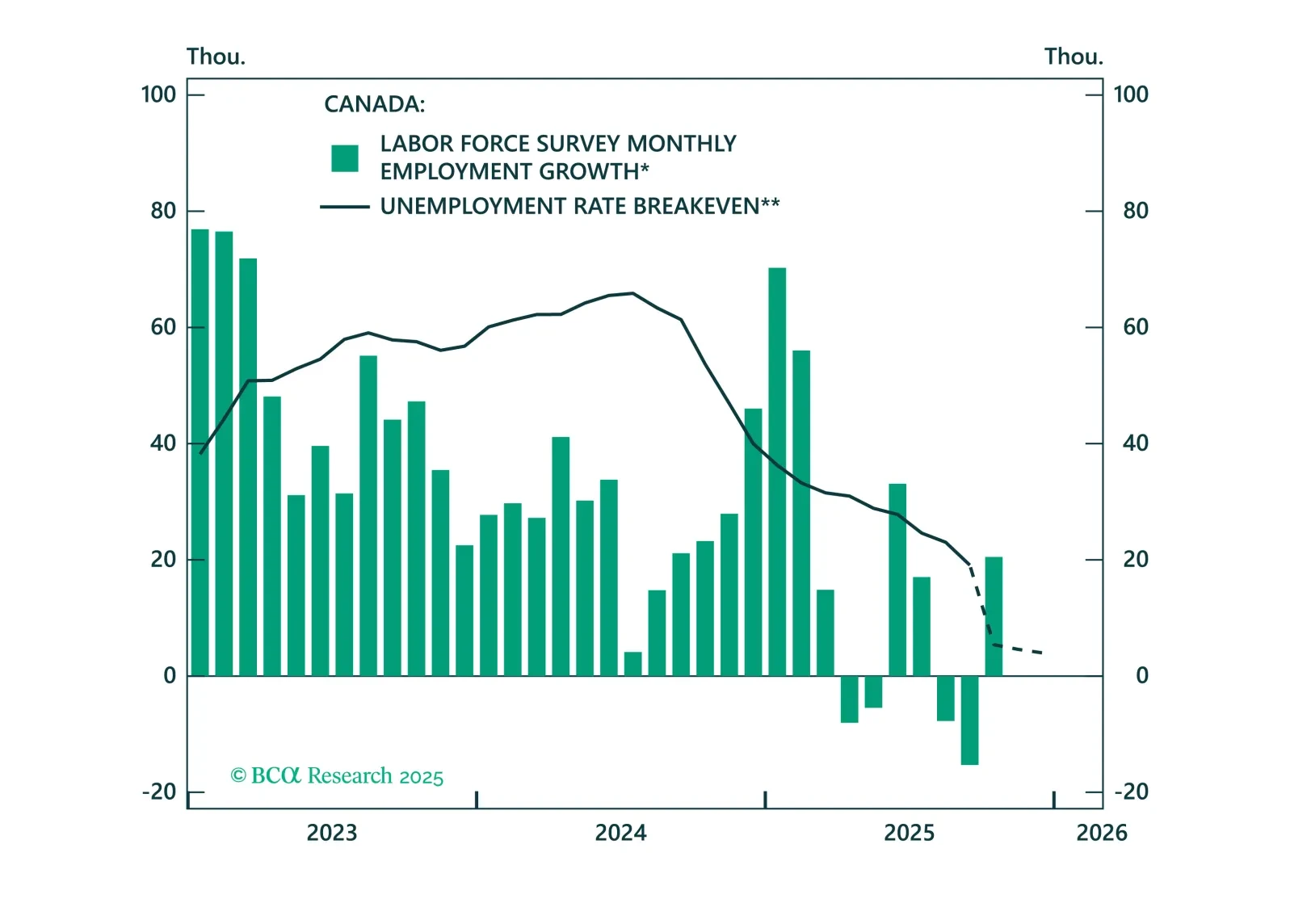

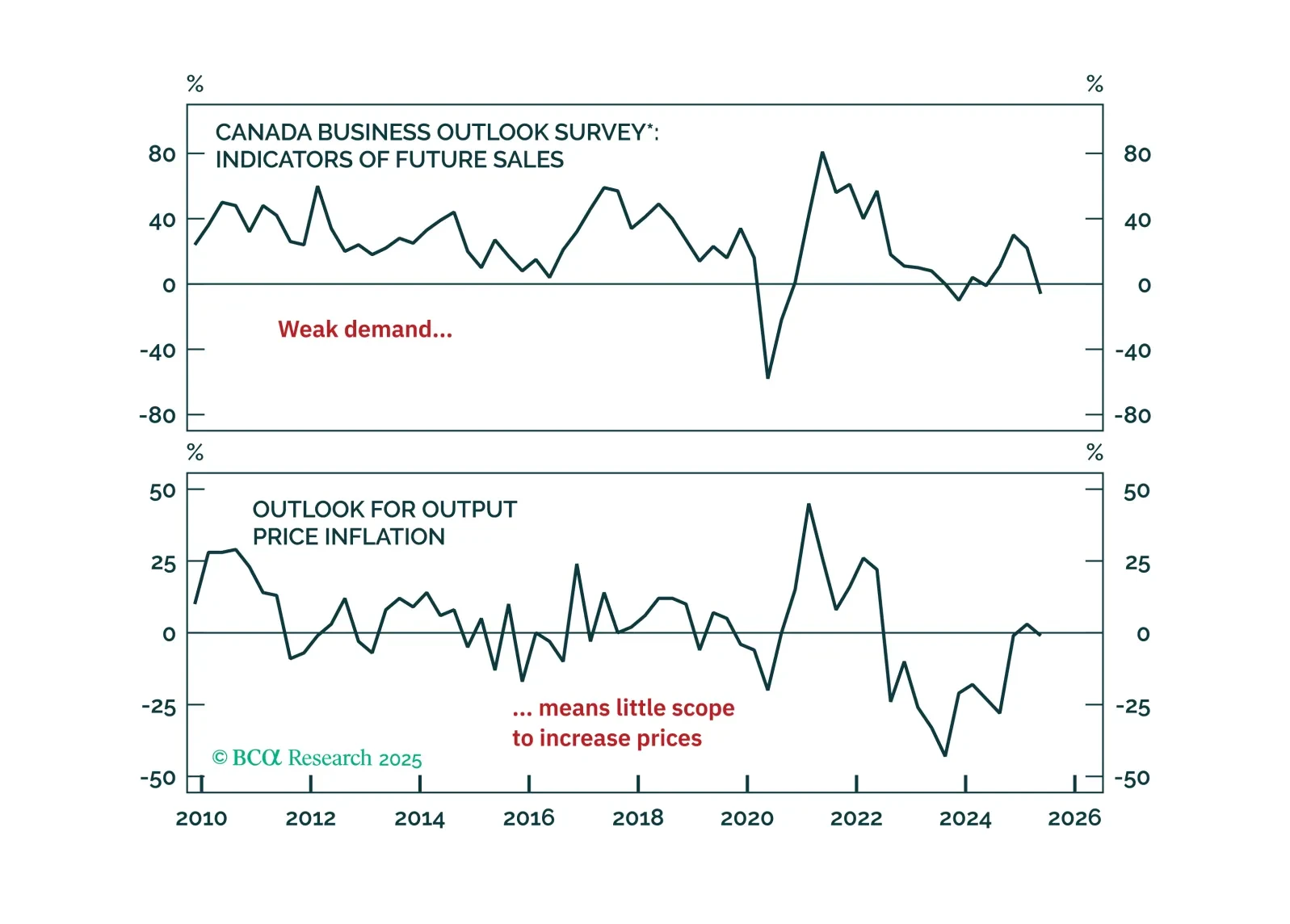

The Bank of Canada continues to hold its policy rate amid trade uncertainty and shows little concern about the potential economic damage from tariffs. We judge the risks differently and view a bet on more rate cuts this year as…