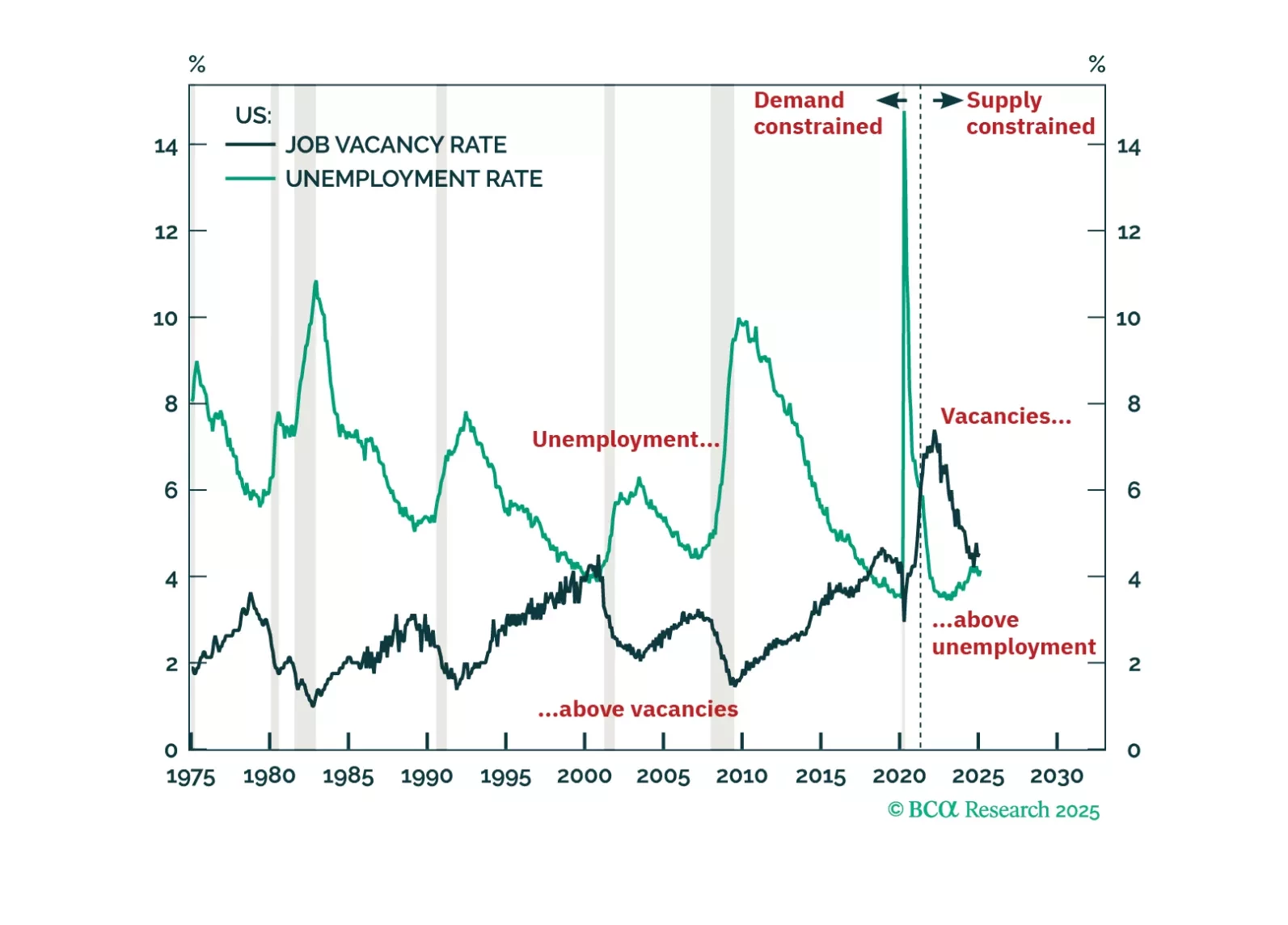

The US economy has never entered a demand-driven recession without labour demand running below labour supply and without the job vacancy rate running below the unemployment rate. Right now though, US labour demand is still running 1.…

Executive Summary To understand the economy and the market we must think of them as non-linear systems which experience sudden phase-shifts. The pandemic introduced phase-shifts in our lives, which led to phase-shifts in our goods…

Highlights Equity valuations are extremely stretched versus bonds, so there is little wiggle room for bonds to sell off before pulling down large tracts of the stock market. We estimate that bond yields can rise by no more than 30 bps…

Highlights Escalating trade tensions - most notably between the U.S. and China, and the U.S. and its NAFTA partners - threaten the outperformance ags posted in 1Q18, which was driven by unfavorable weather and transportation disruptions…

Highlights The tactical environment is dynamic, chaotic and unpredictable. ...Chaos also brings opportunity. We must recognize and exploit opportunities when chance presents them. Look for recurring patterns to exploit.1 Feature…

Dear Client, We are pleased to present our 2017 Outlook for Grains & Softs, covering corn, wheat, soybeans and rice in the grain markets, and cotton and sugar. This is our last regular Weekly Report for the year. You should have…

Refiners will reduce run rates over the next month or so to clear unintended inventory accumulation, but it's not like they've never had to deal with this situation.

The remarkable admission by OPEC's secretary-general, Salem el-Badri, earlier this week that with "any increase in (oil's) price, shale will come immediately and cover any reduction" in output only hints at the larger impact of light…