According to BCA Research’s Emerging Markets Strategy service, the gap that has formed between the S&P 500 price and its operating profit margins, as well as the divergence between the S&P 500 Forward P/E ratio and…

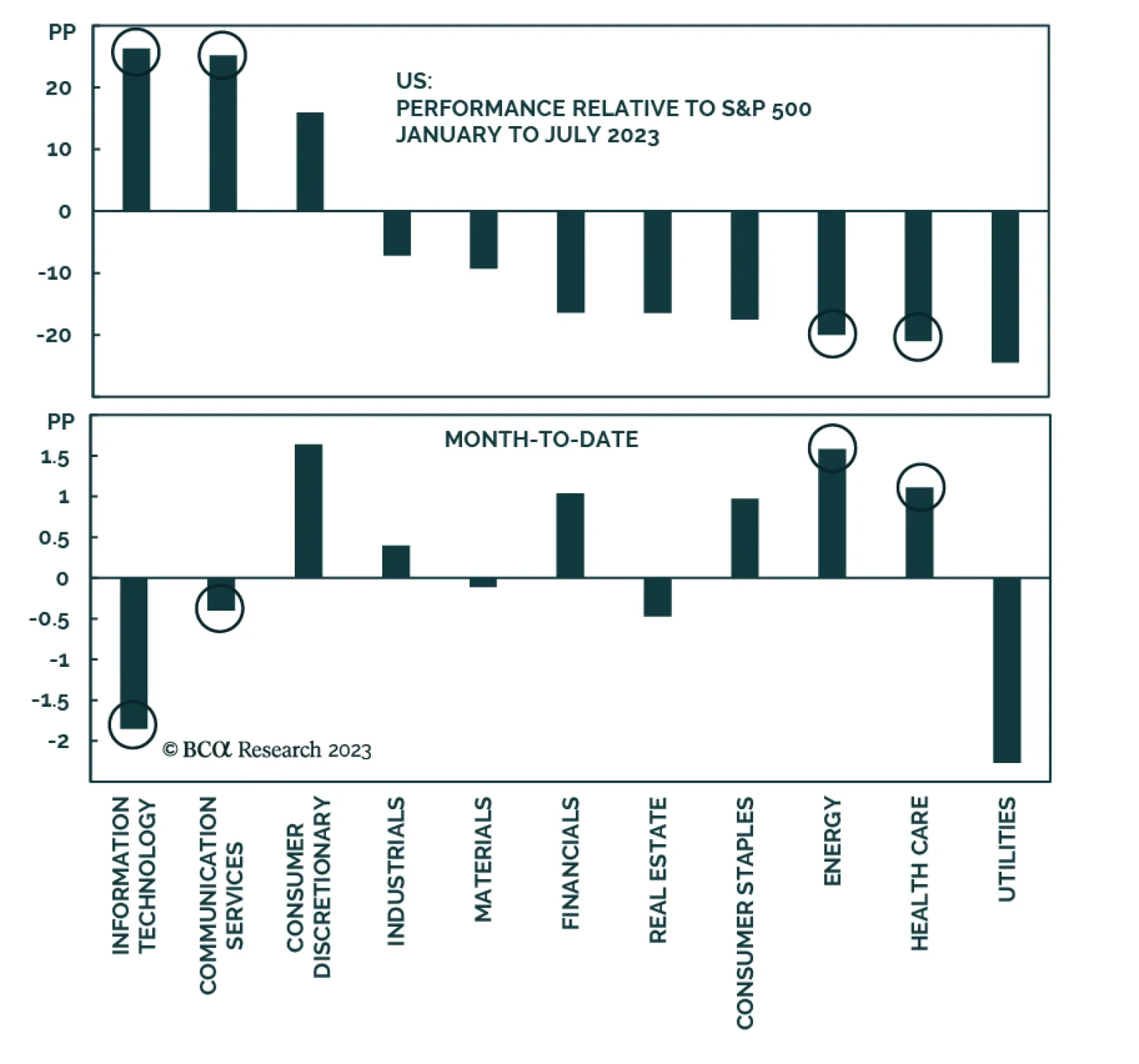

The S&P 500 has had a rough start to August. The index’s selloff since the end of July has pushed it down by 2.4%. Notably, the weakness is broad-based with all S&P 500 sectors in the red over this period. This…

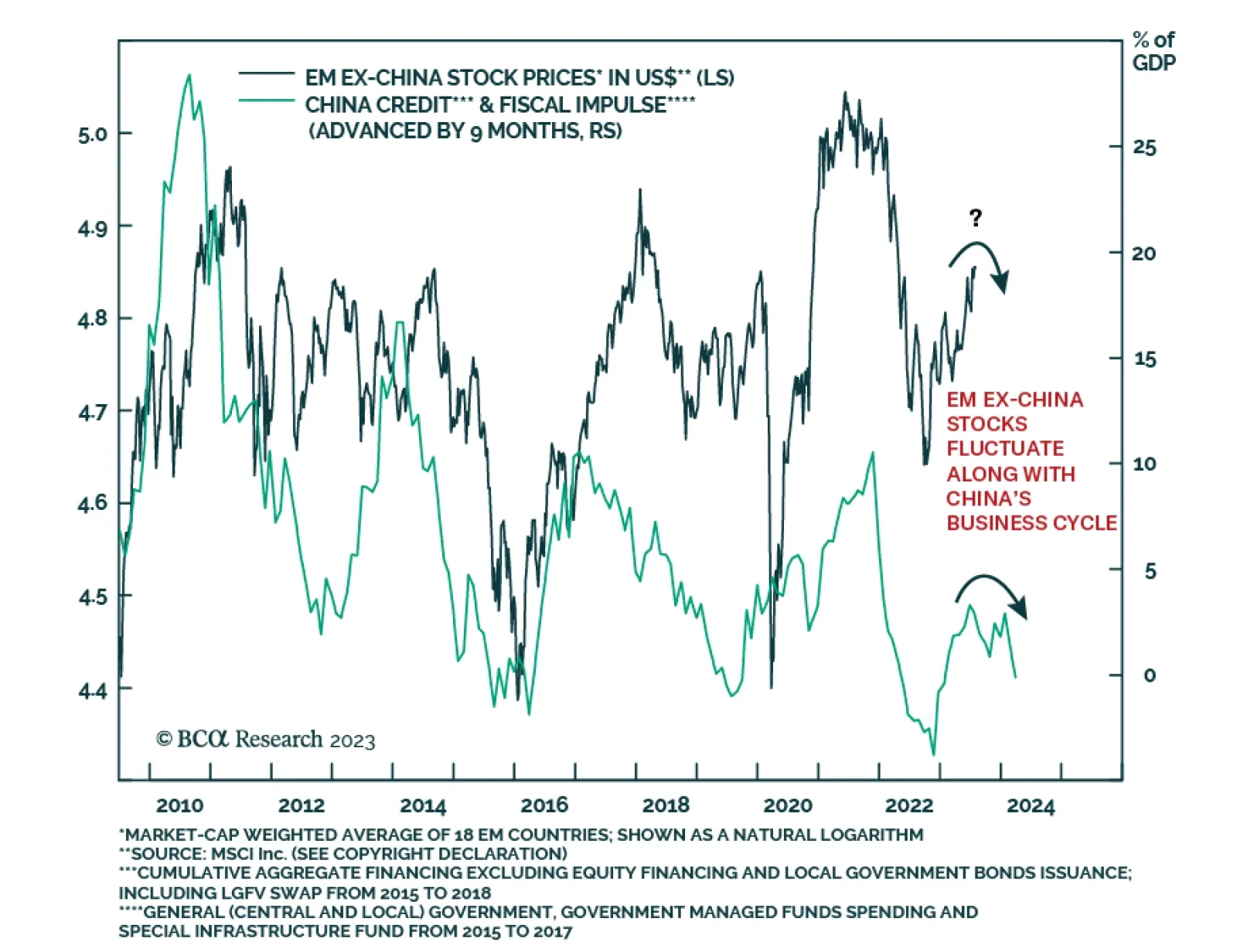

According to BCA Research’s Emerging Markets Strategy service, while EM ex-China markets are set to continue outperforming Chinese investable/offshore equities, they are unlikely to deliver superior absolute returns.…

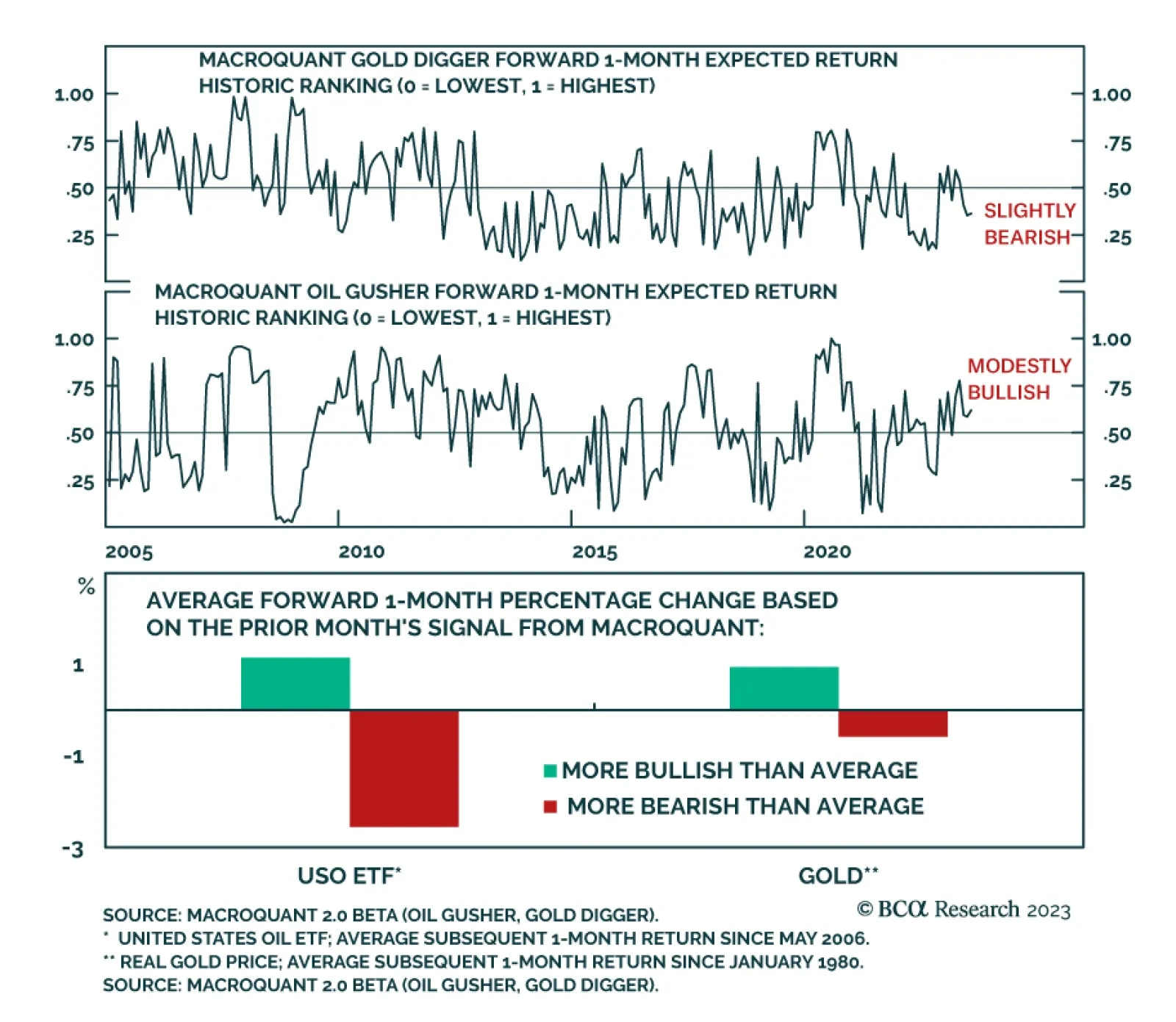

The Global Investment Strategy (GIS) service has been bearish on gold since the end of March, when it recommended a shift from neutral to underweight. Real gold prices are still quite elevated relative to their long-term history…

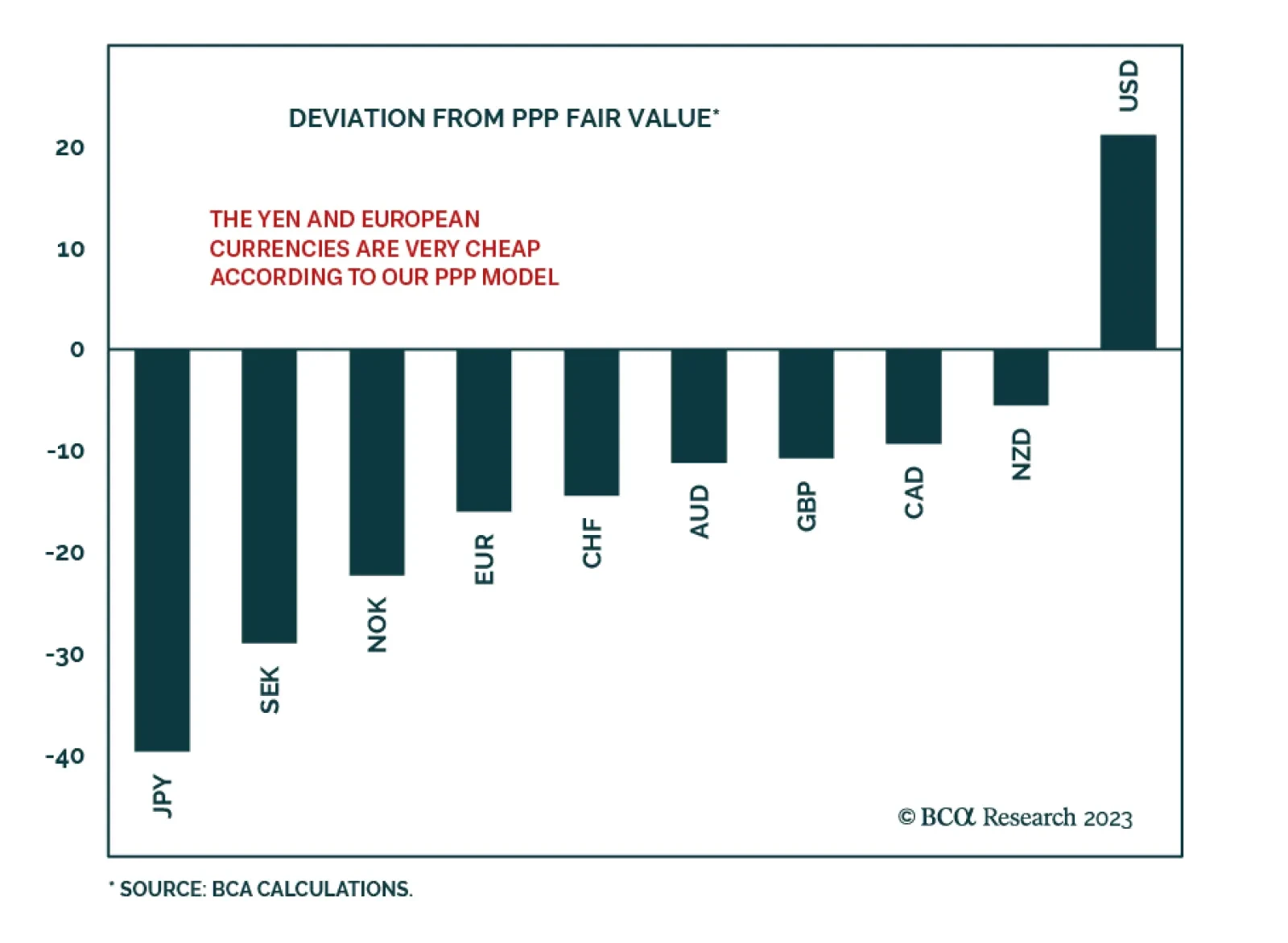

BCA Research’s Bank Credit Analyst service recently featured currency valuation models developed by our Foreign Exchange Strategy service. According to these models, the US dollar is extremely overvalued and thus vulnerable…

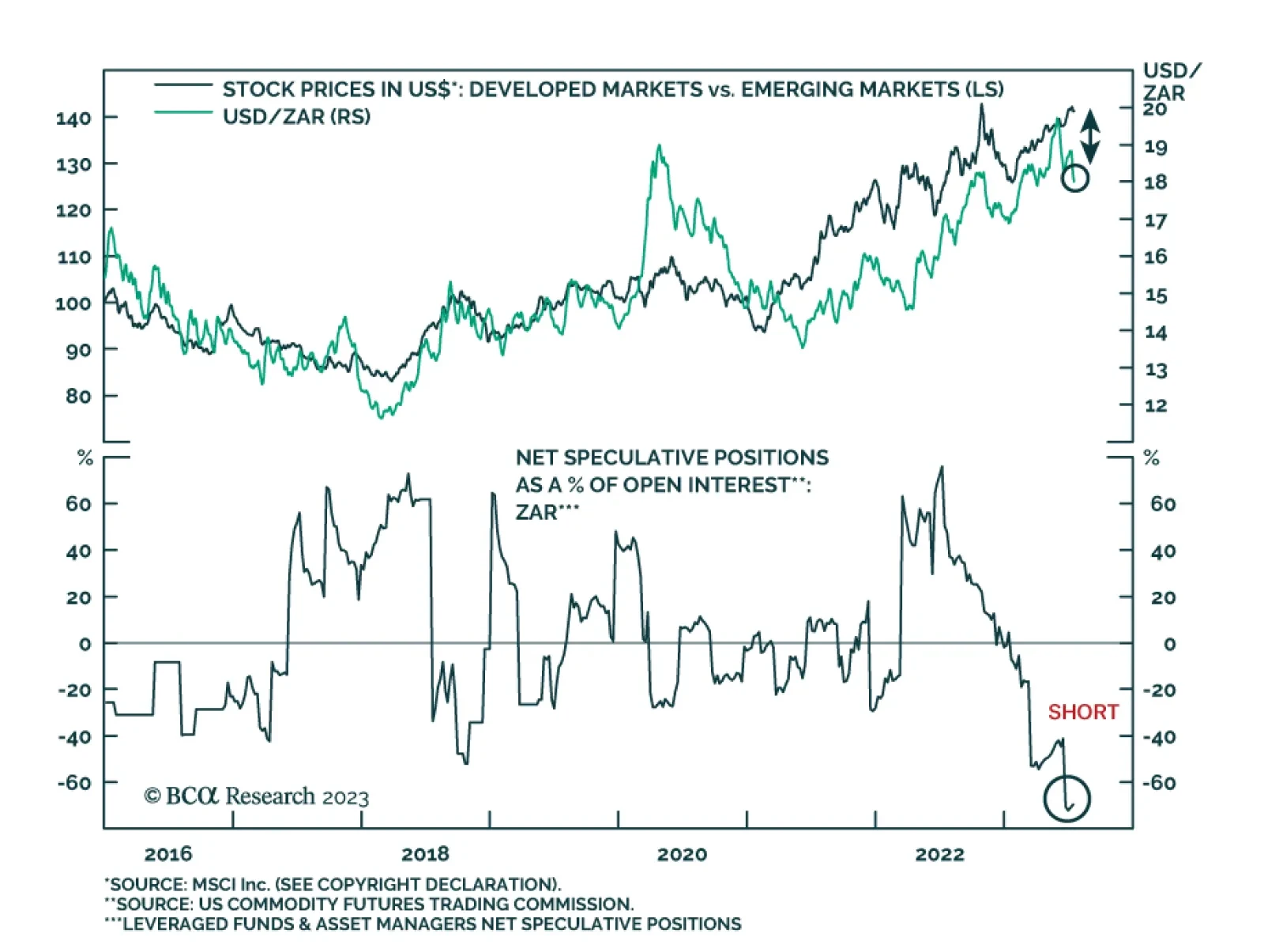

The South African rand has been a key winner amid the recent improvement in risk sentiment. Notably, the ZAR's 10.9% appreciation versus the US dollar since May 25 has made it the best performing major currency over this…

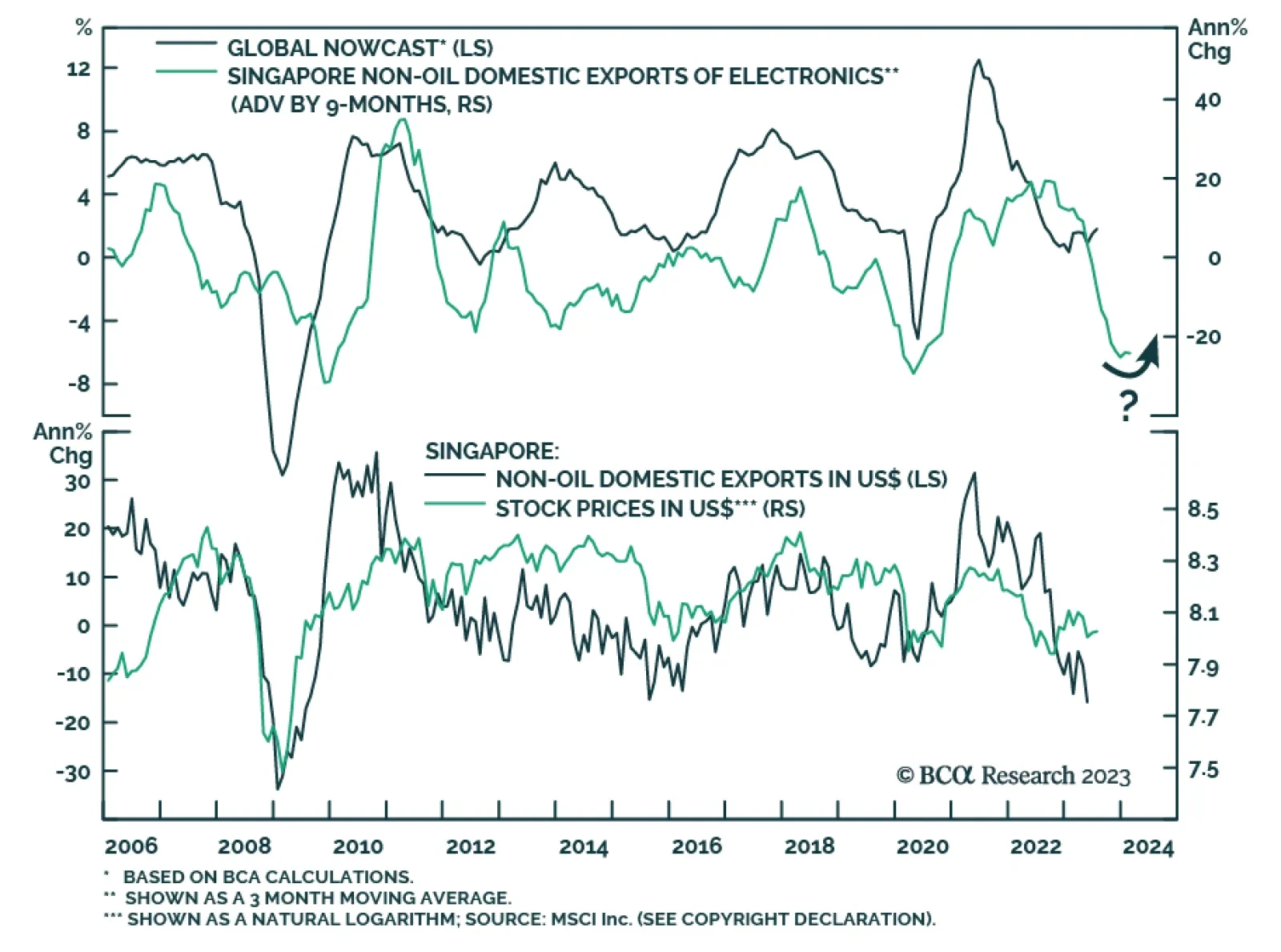

Singapore’s trade data continue to send a pessimistic signal about global manufacturing conditions. The year-over-year contraction in non-oil domestic exports (NODX) deepened to -15.5% y/y in June from -14.8% y/y –…

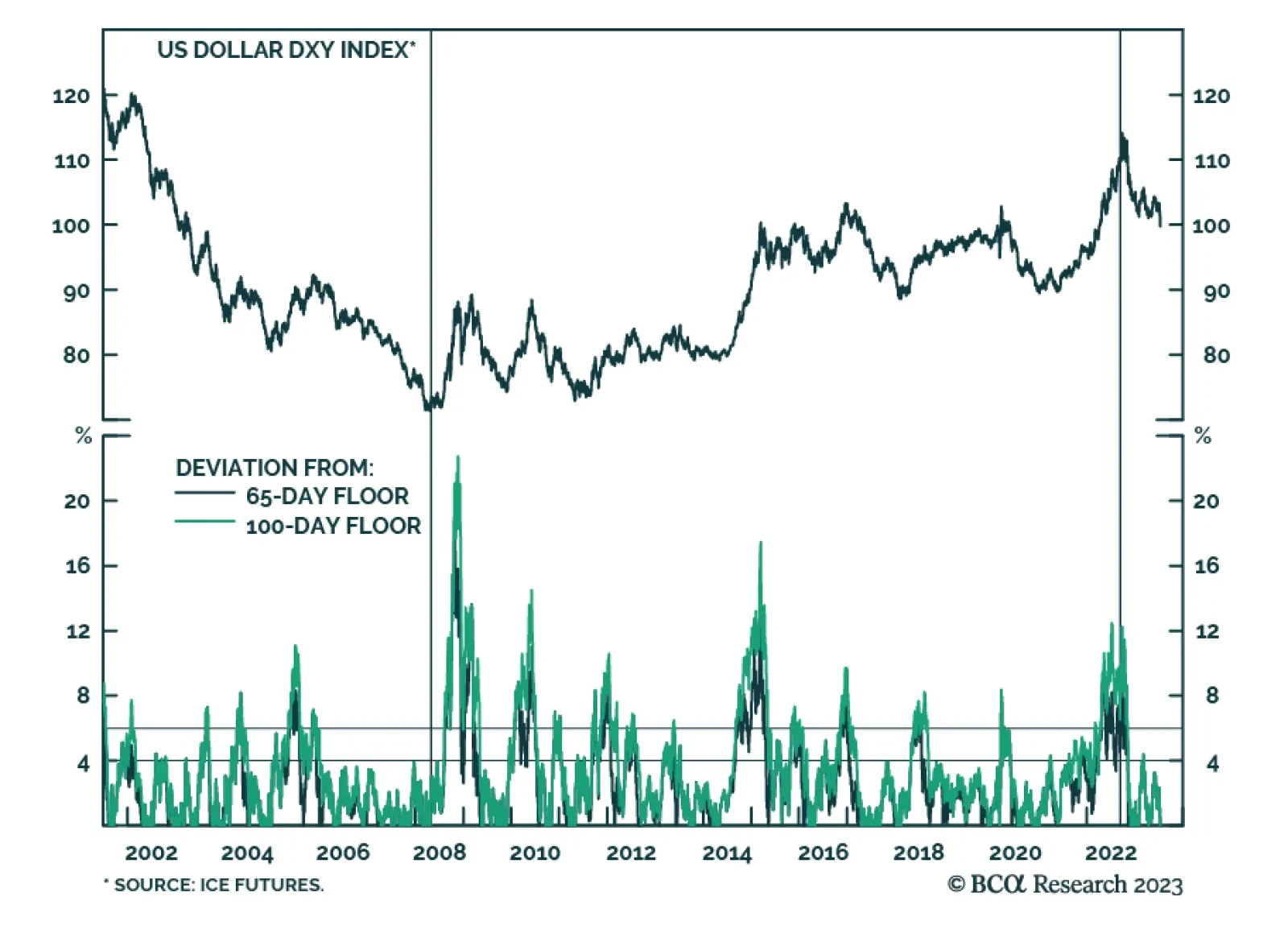

Since the release of softer (than expected) CPI numbers in the US, markets have embraced a soft-landing scenario for the global economy. In the FX space, the DXY has broken down below the psychological level of 100. Will this…

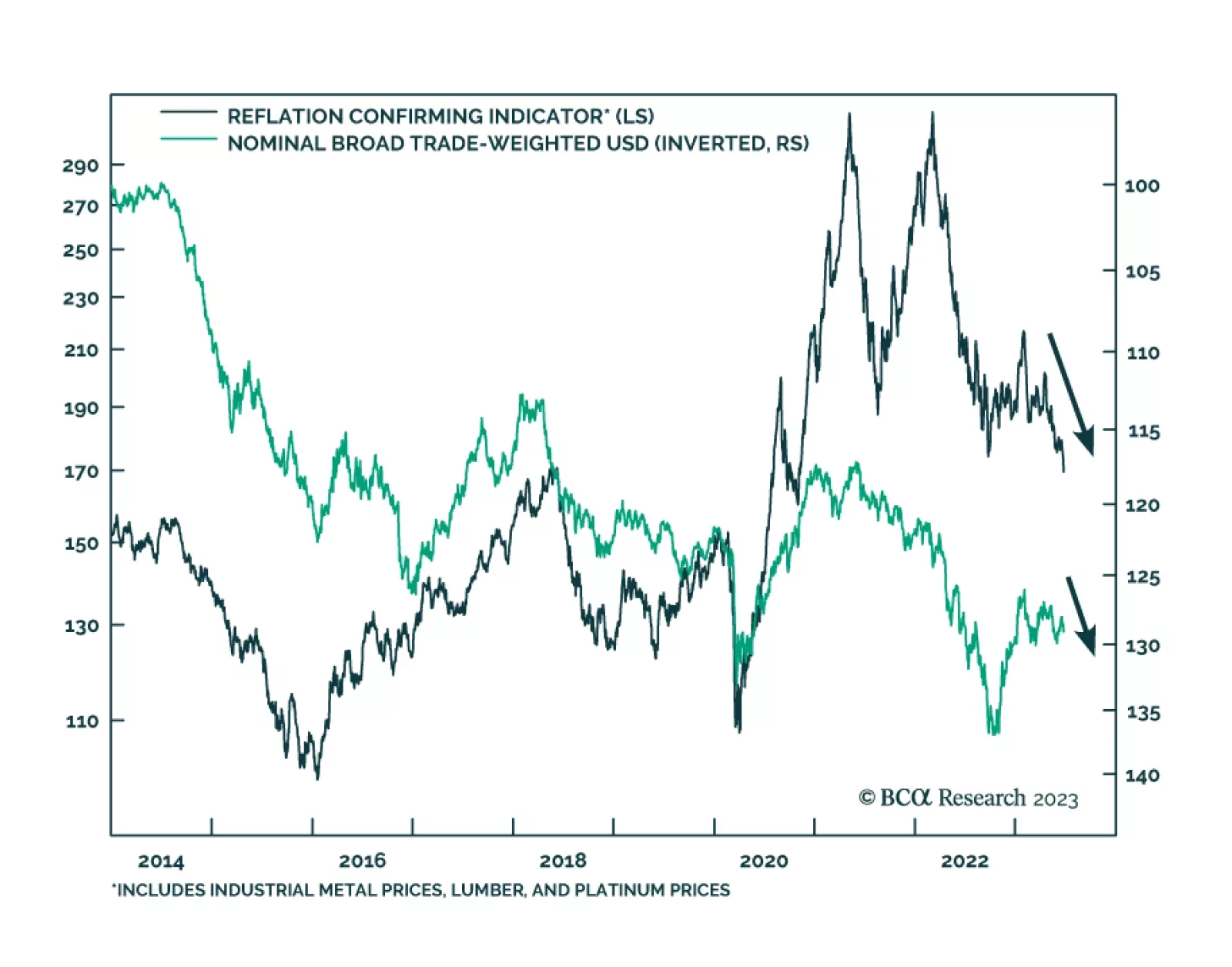

Our Emerging Markets Strategy’s Reflation Confirming Indicator has been gapping down, signaling a material rebound in the broad trade-weighted US dollar. The broad trade-weighted US dollar is a counter-cyclical currency…

This report looks at the relationship between rate risk and credit risk and how it has changed over time. It also makes the case for favoring agency MBS within an underweight allocation to US spread product.