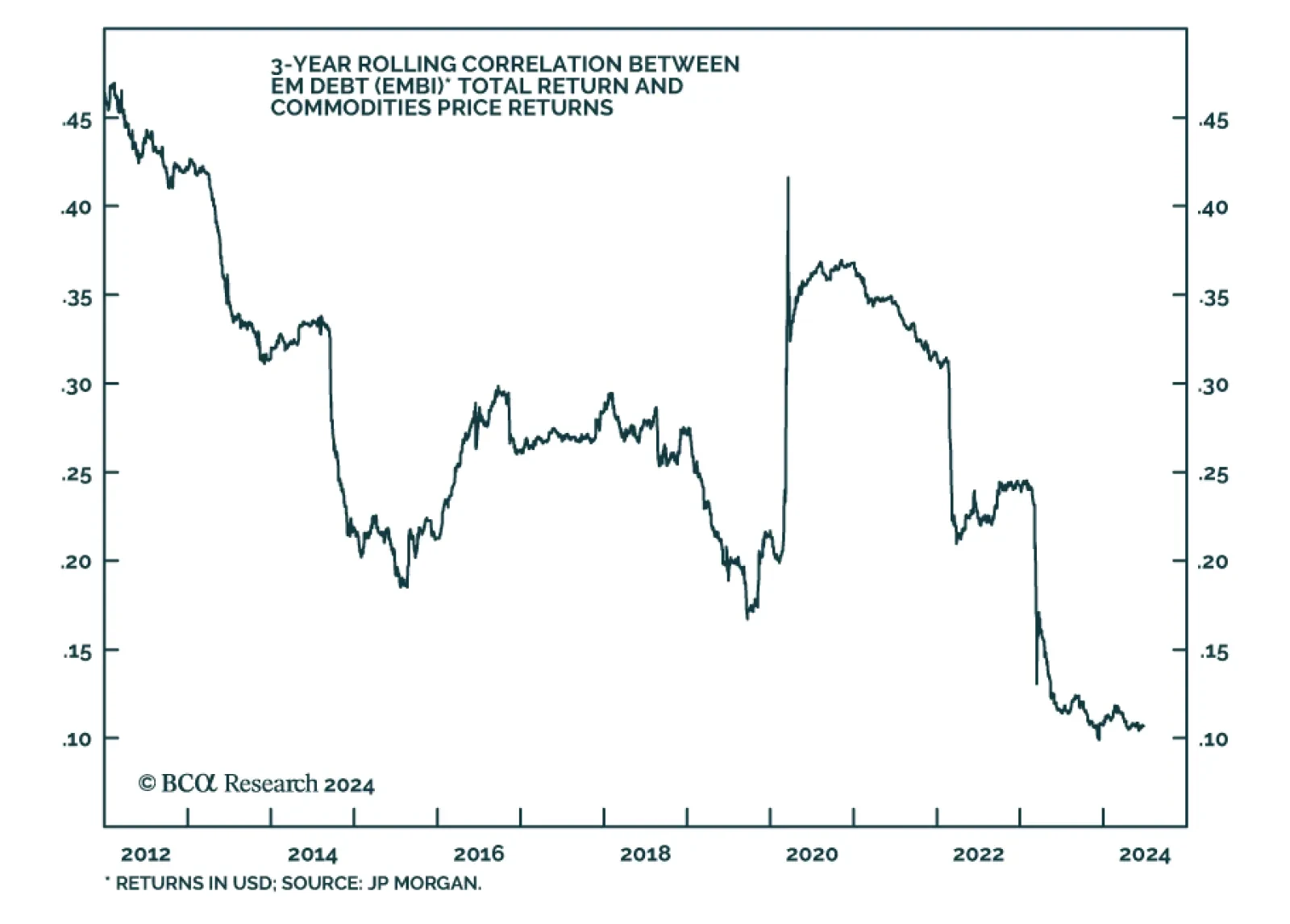

Emerging market debt is typically thought of as a cyclical asset. When risk assets sell off and the dollar rises, this asset class has historically suffered. However, there are some signs that the risk-on nature of EM debt has…

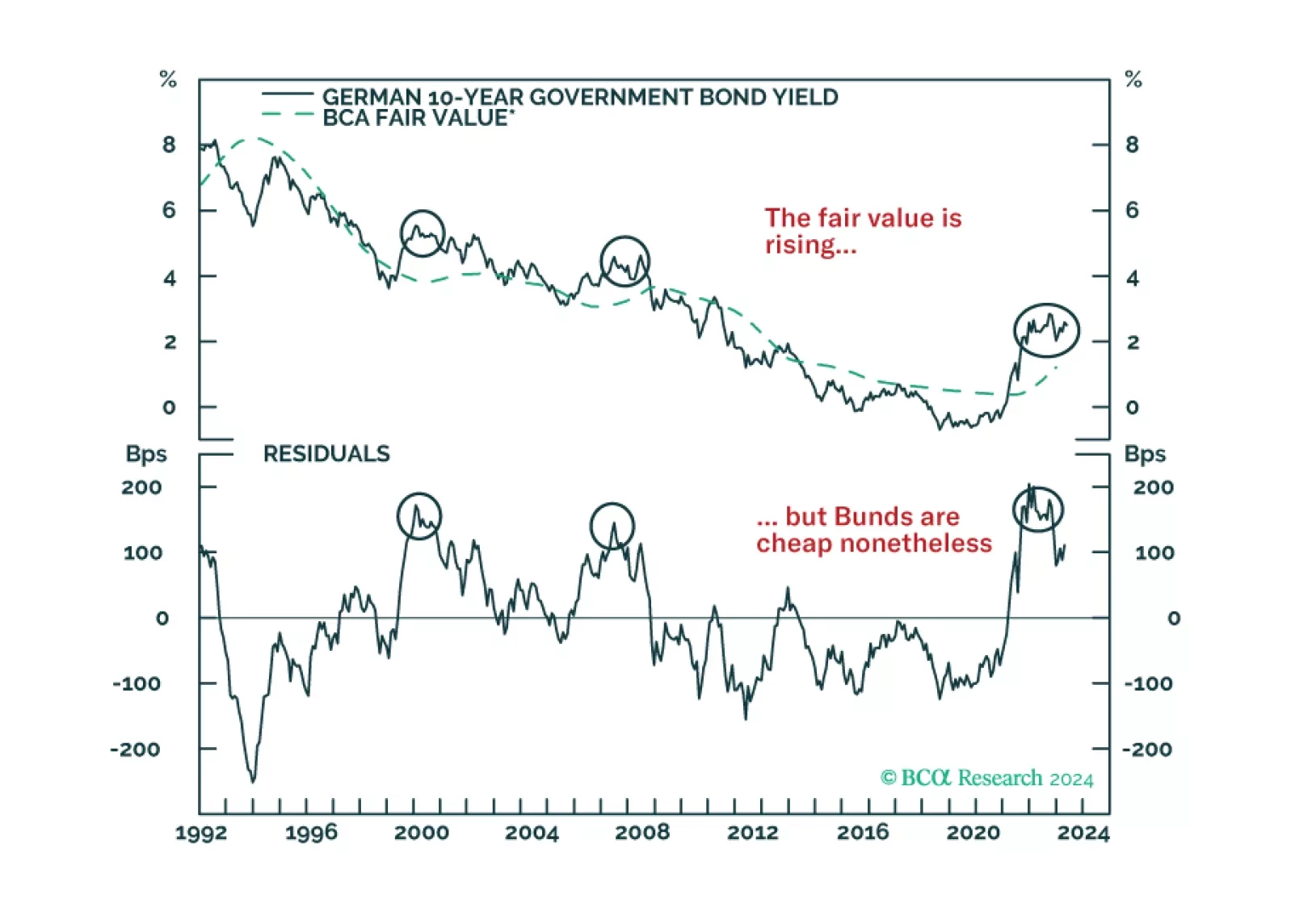

German Bunds have cheapened considerably, and the ECB is about to start cutting rates. Does this combination guarantee immediate profits from buying these bonds?

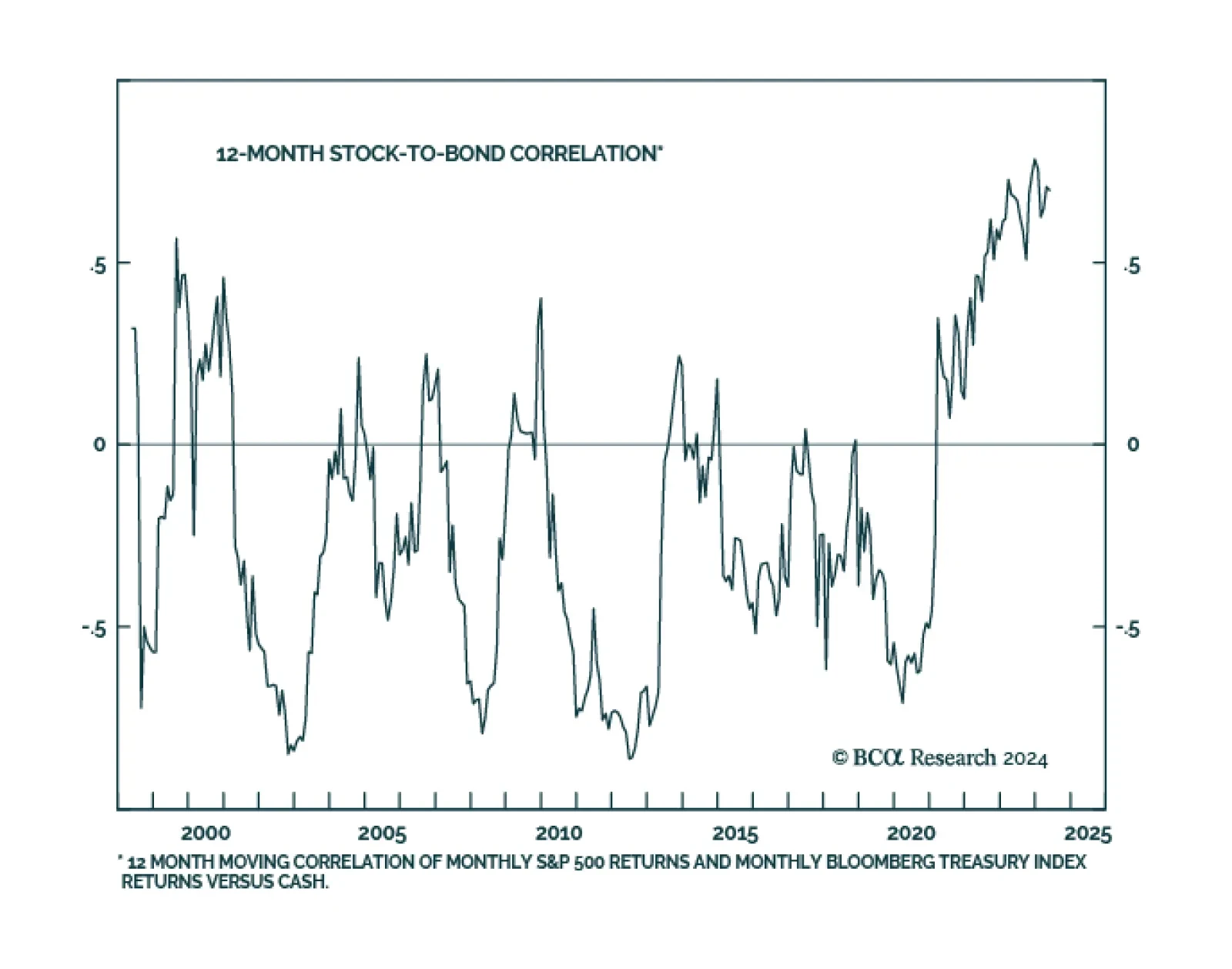

According to BCA Research’s US Bond Strategy service, investors should look to the stock-to-bond ratio to time the breakout in yields. The strong positive correlation between stock and bond returns has been a consistent…

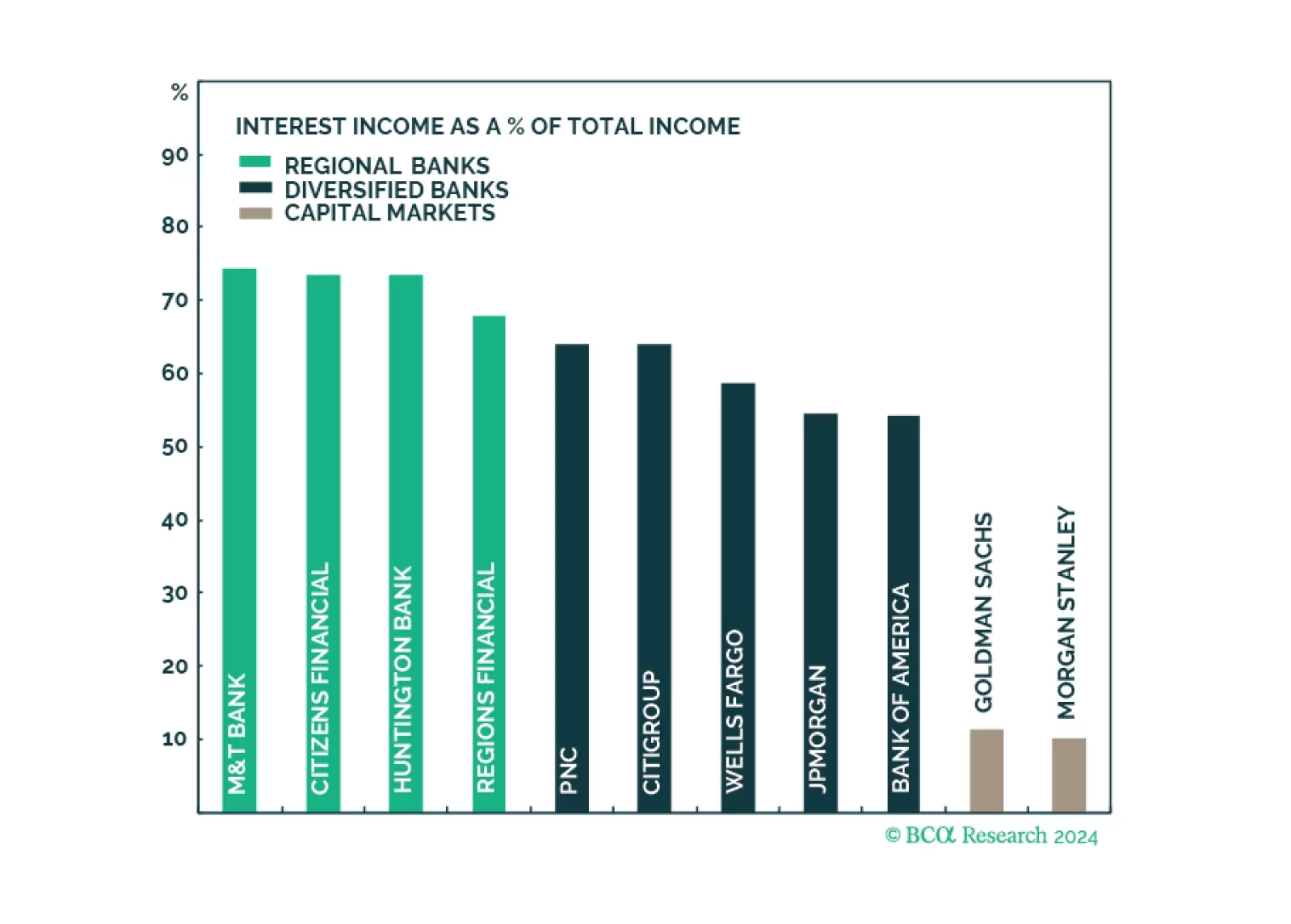

Q1 earnings results of the largest US banks have demonstrated that the engine of recent growth in profitability, NII, has faltered as funding costs are rising fast. However, the resurgence in non-NII thanks to a revival in corporate…

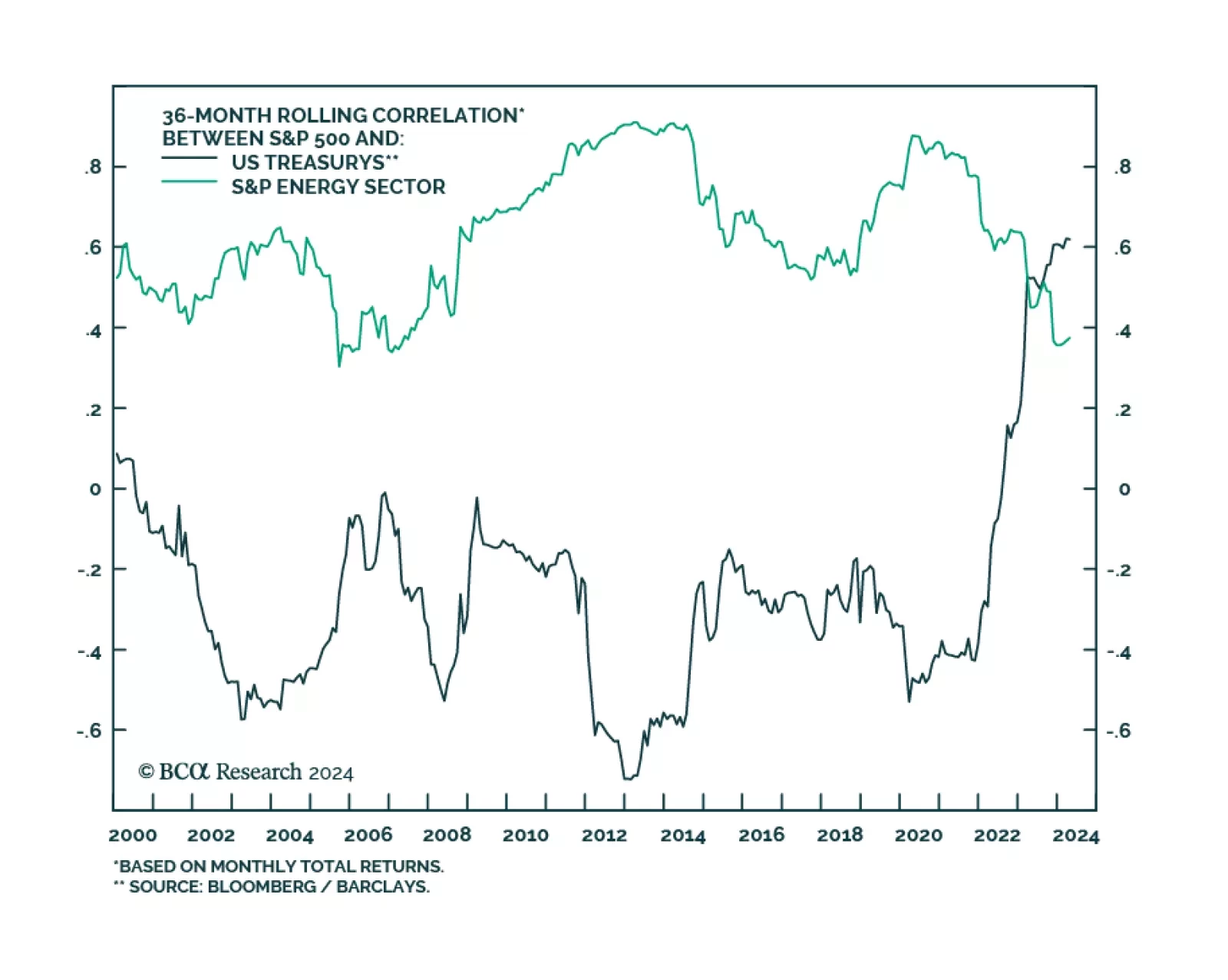

Traditionally, equity managers have thought of oil equities as cyclical. This is because, in the past, oil equities had a strong positive correlation to the overall market. But US oil equities have increasingly become more…

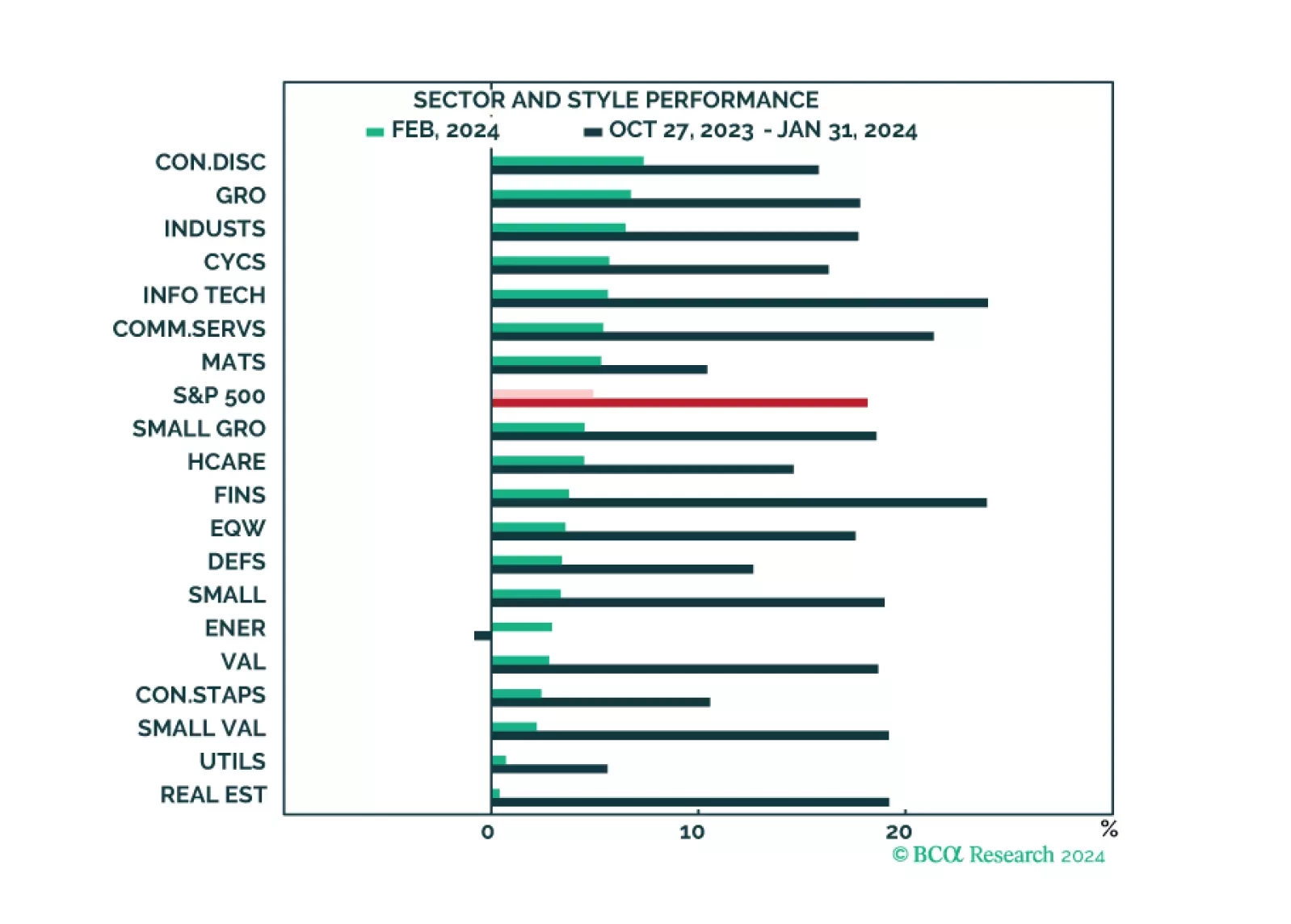

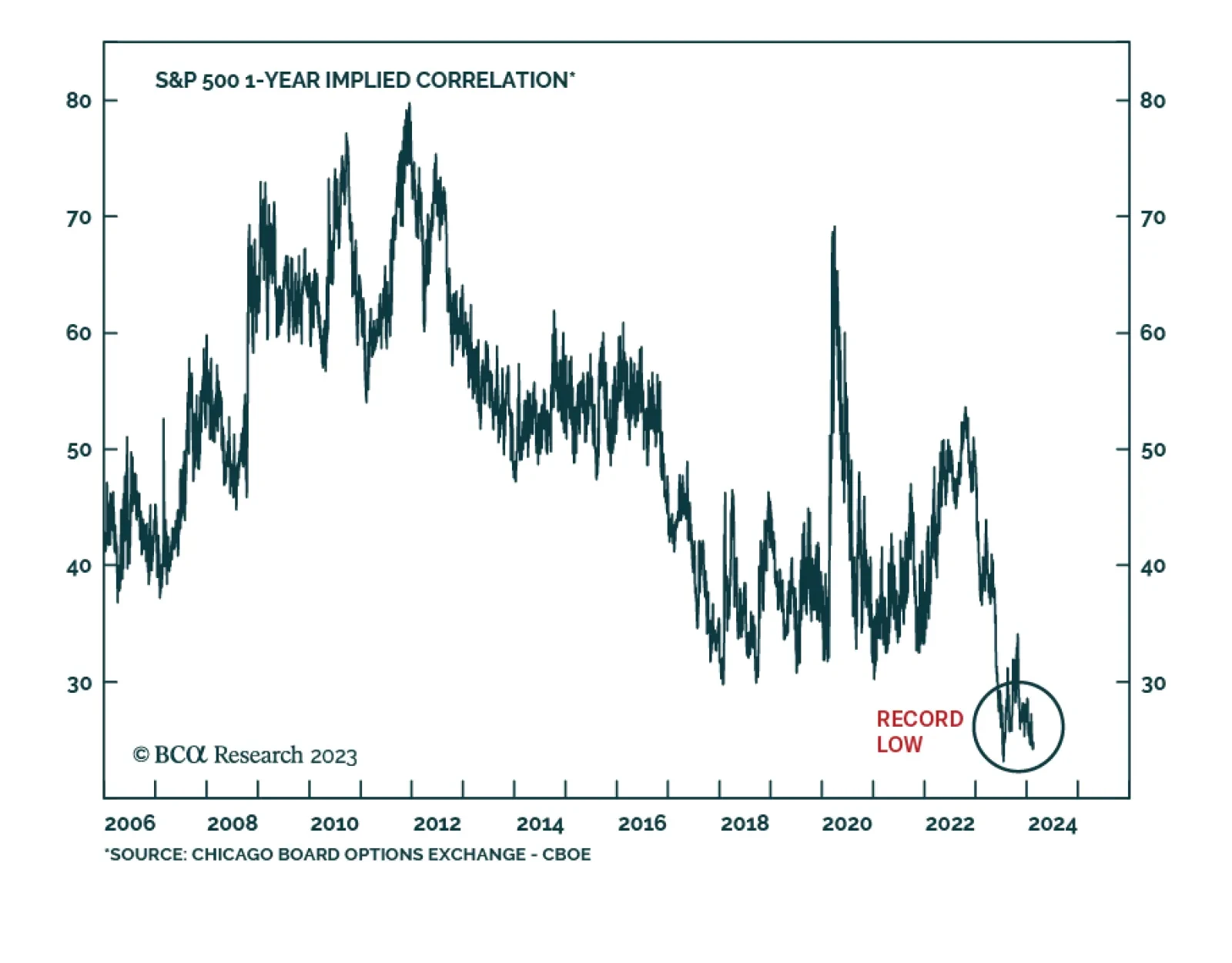

The market narrative continues to be dominated by the Magnificent Six, which drove both market performance and strong Q4 earnings results. While all sectors and styles have recently turned green, the rally is still mostly narrow.…

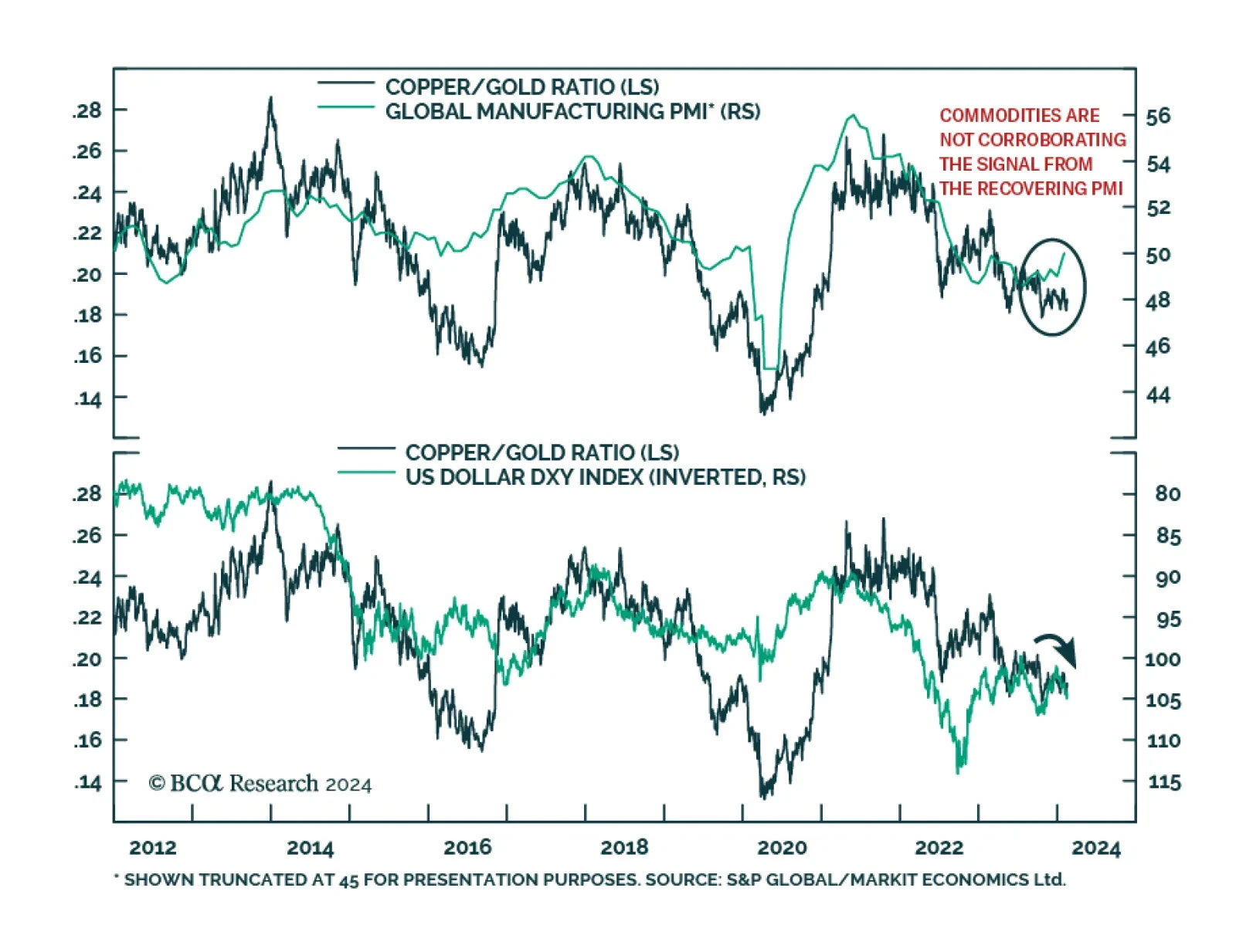

The Global Manufacturing PMI clocked in at 50 in January – exactly on the boom-bust line. The index has been on a general uptrend since mid-2023 with the January figure marking the first non-contractionary reading since…

According to BCA Research’s Emerging Markets Strategy service, the diminishing pace of disinflation in the US could pose a threat to US share prices in the near term. In the medium term, the key risk to US share prices is…

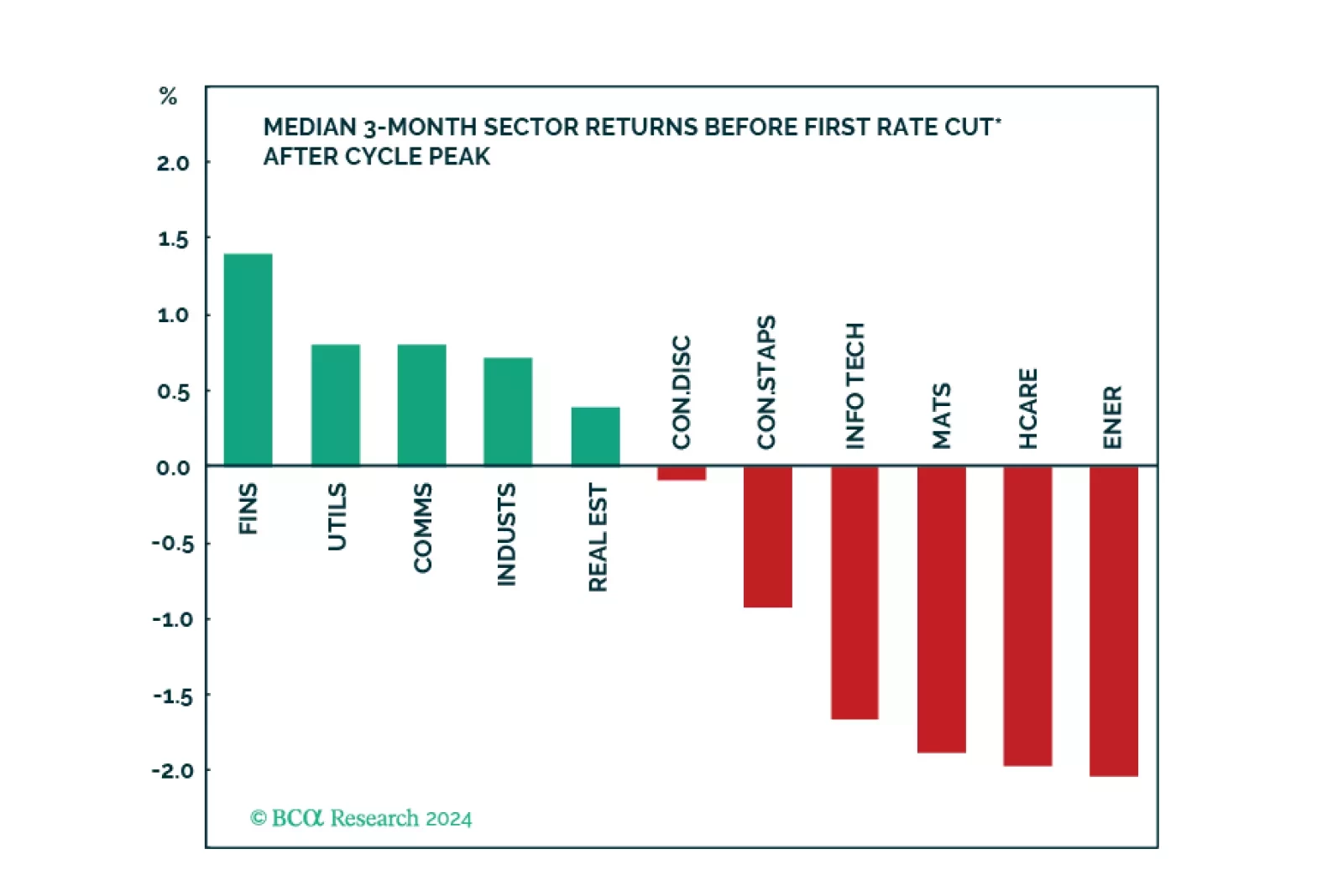

We created a sector selection scorecard based on performance of sectors under various macroeconomic regimes while taking into consideration revisions to expected earnings growth and valuations in a historical context. Our total…

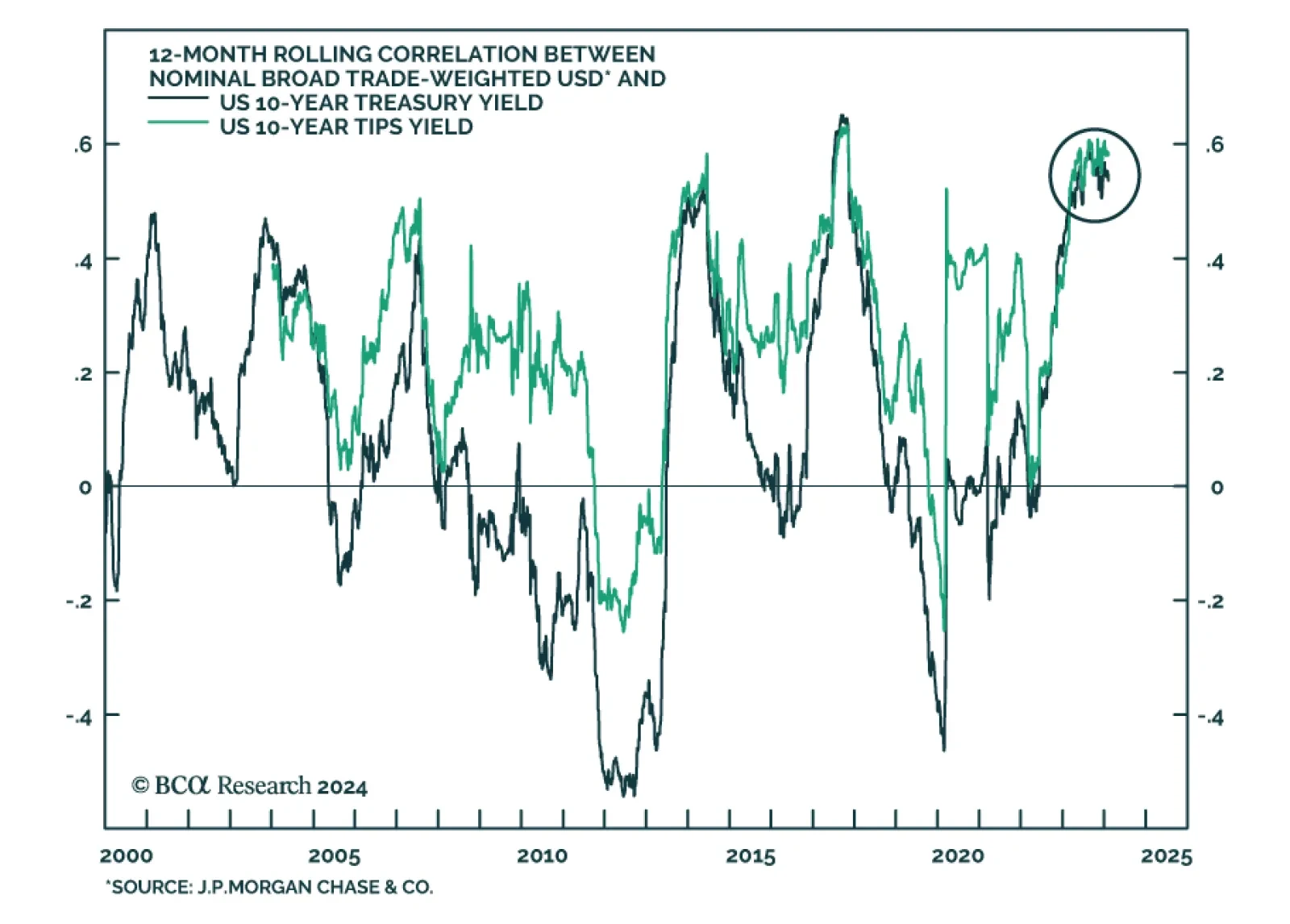

Our Emerging Markets team believes that the risk-reward profile of the US dollar remains very attractive. First, if US growth stays robust, US interest rate expectations will rise because rate cuts priced in will not be…