In this first presentation of 2025, we start with an overview of the 2025 outlook webcast polls, and a brief post-mortem of the 2024 market performance. Then, we shift gears and examine what is behind the recent surge in bond yields…

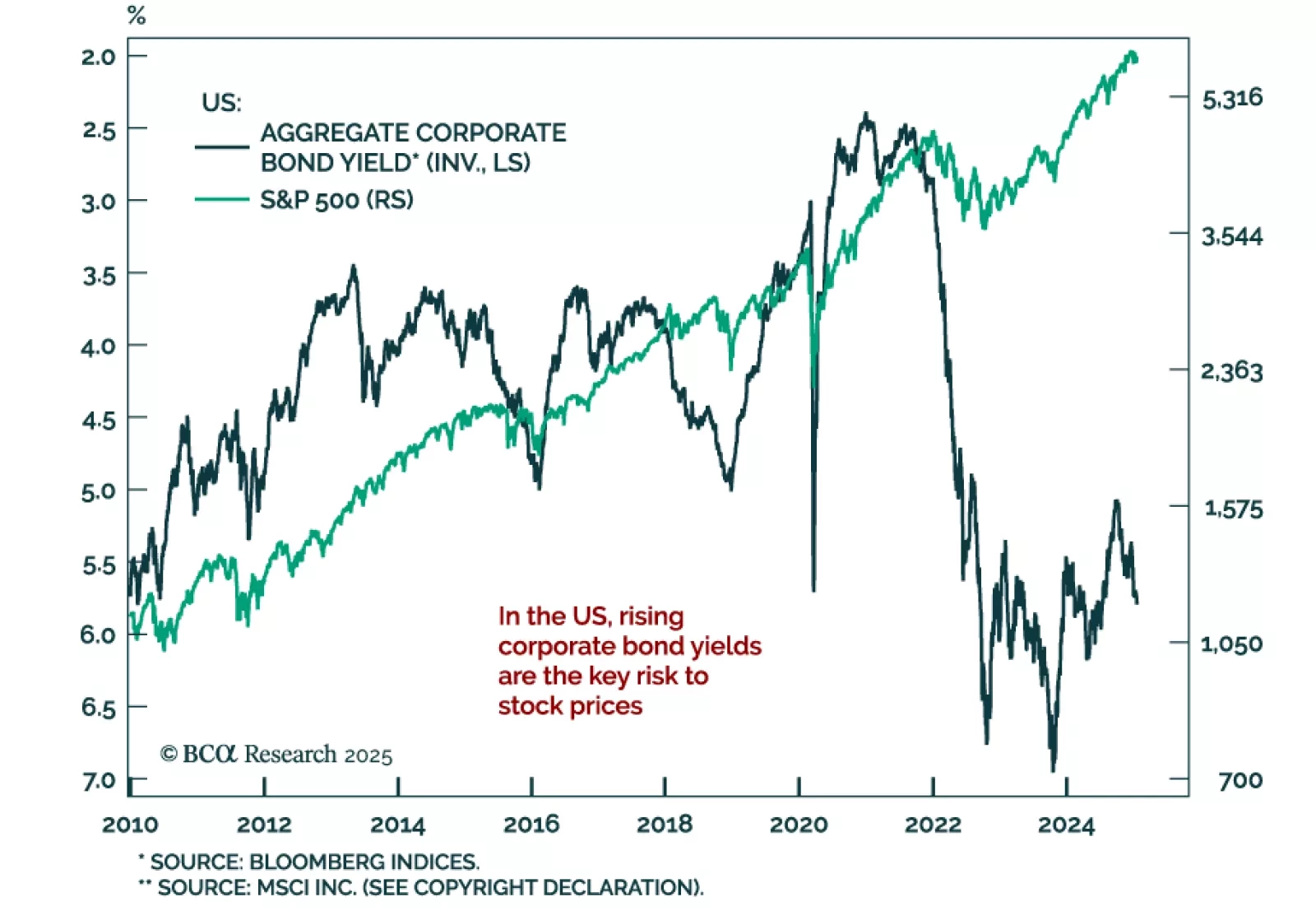

Our Chart Of The Week comes from Arthur Budaghyan, Chief Strategist for our Emerging Markets Strategy service. Arthur discusses the relationship between corporate bond yields and stock prices. Historically, US stocks suffer when…

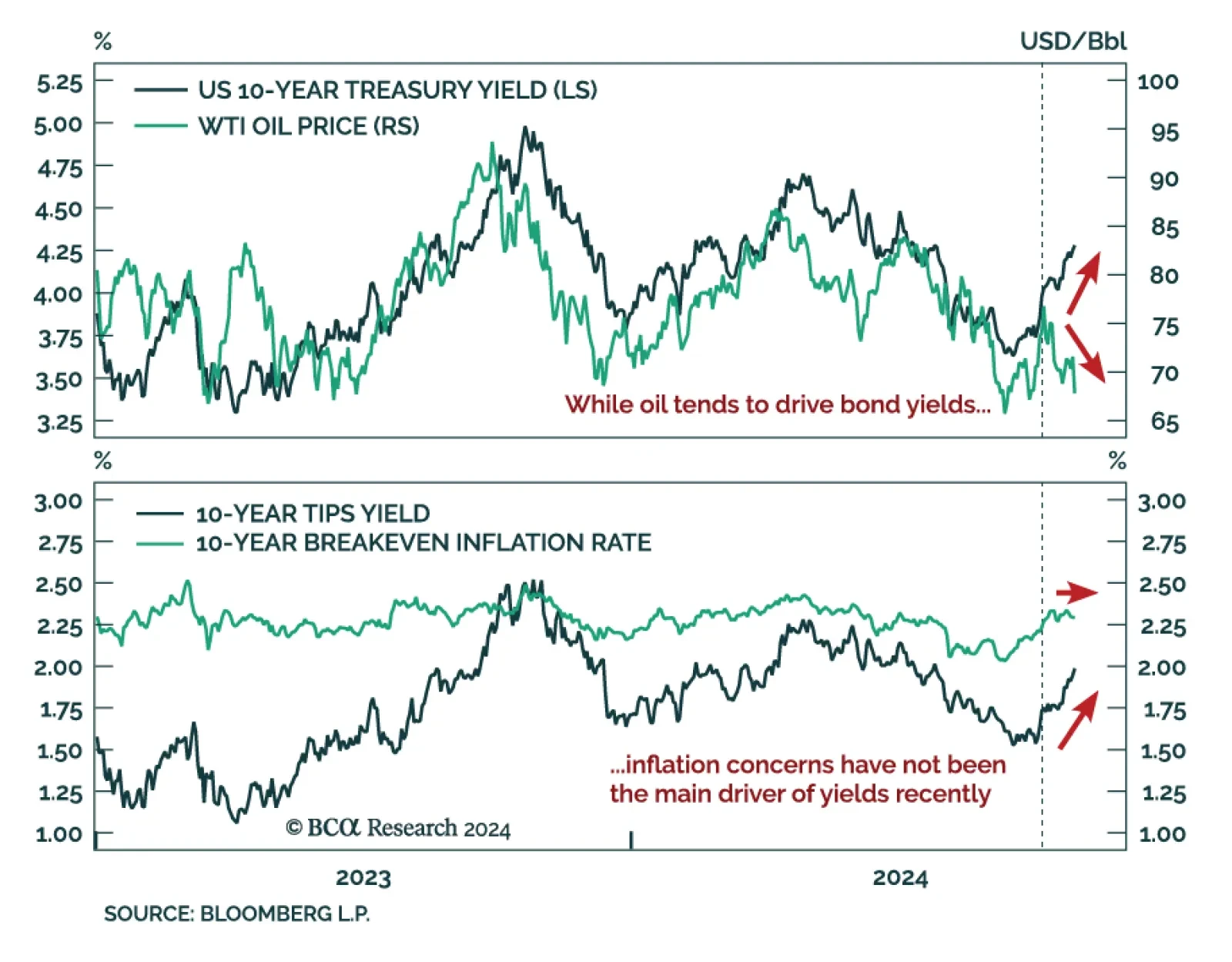

For the past two weeks, oil has sold off amid a global spike in yields. Oil prices and Treasury yields tend to be positively correlated, as oil prices are a fast-moving component of inflation, driving the inflation expectations…

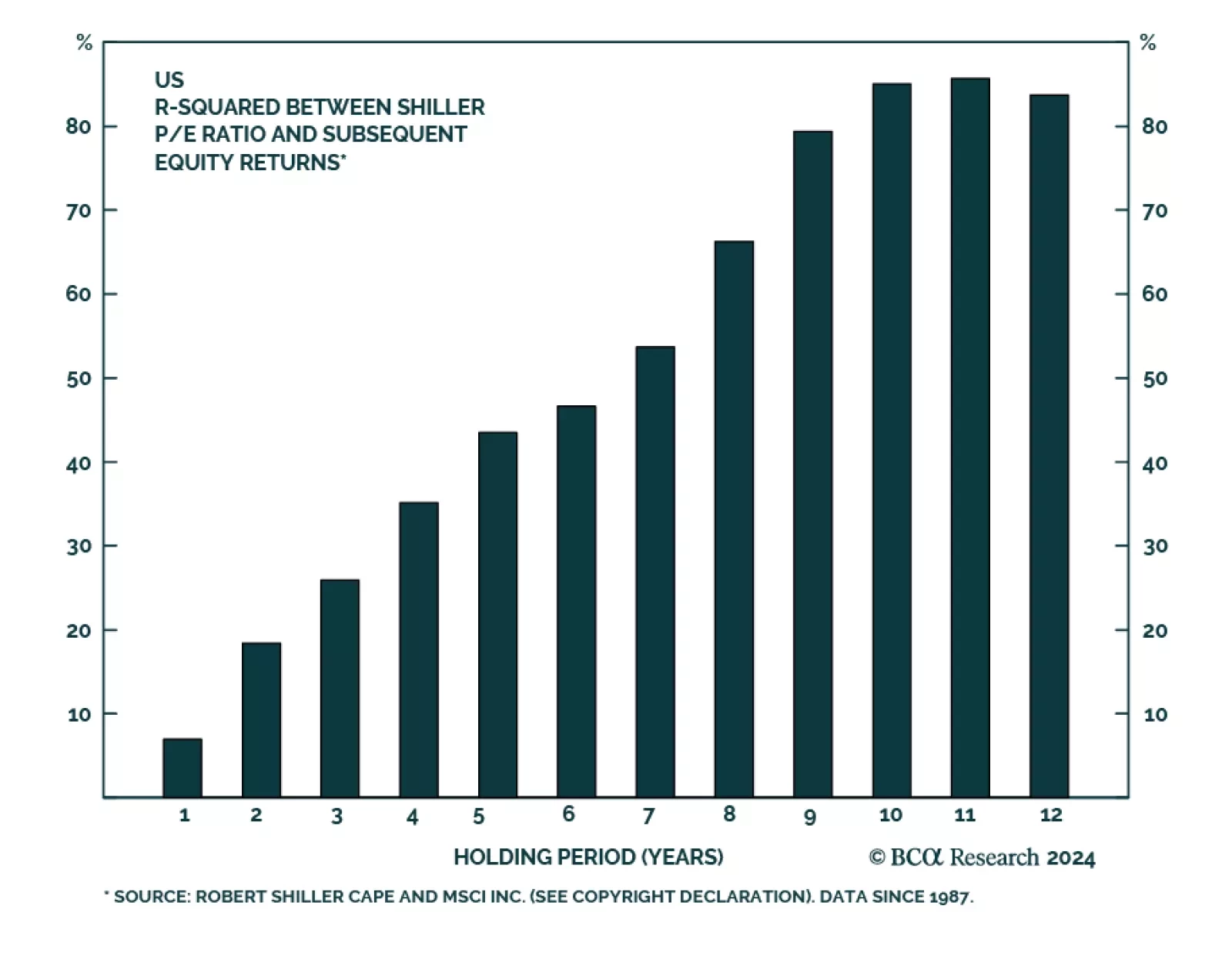

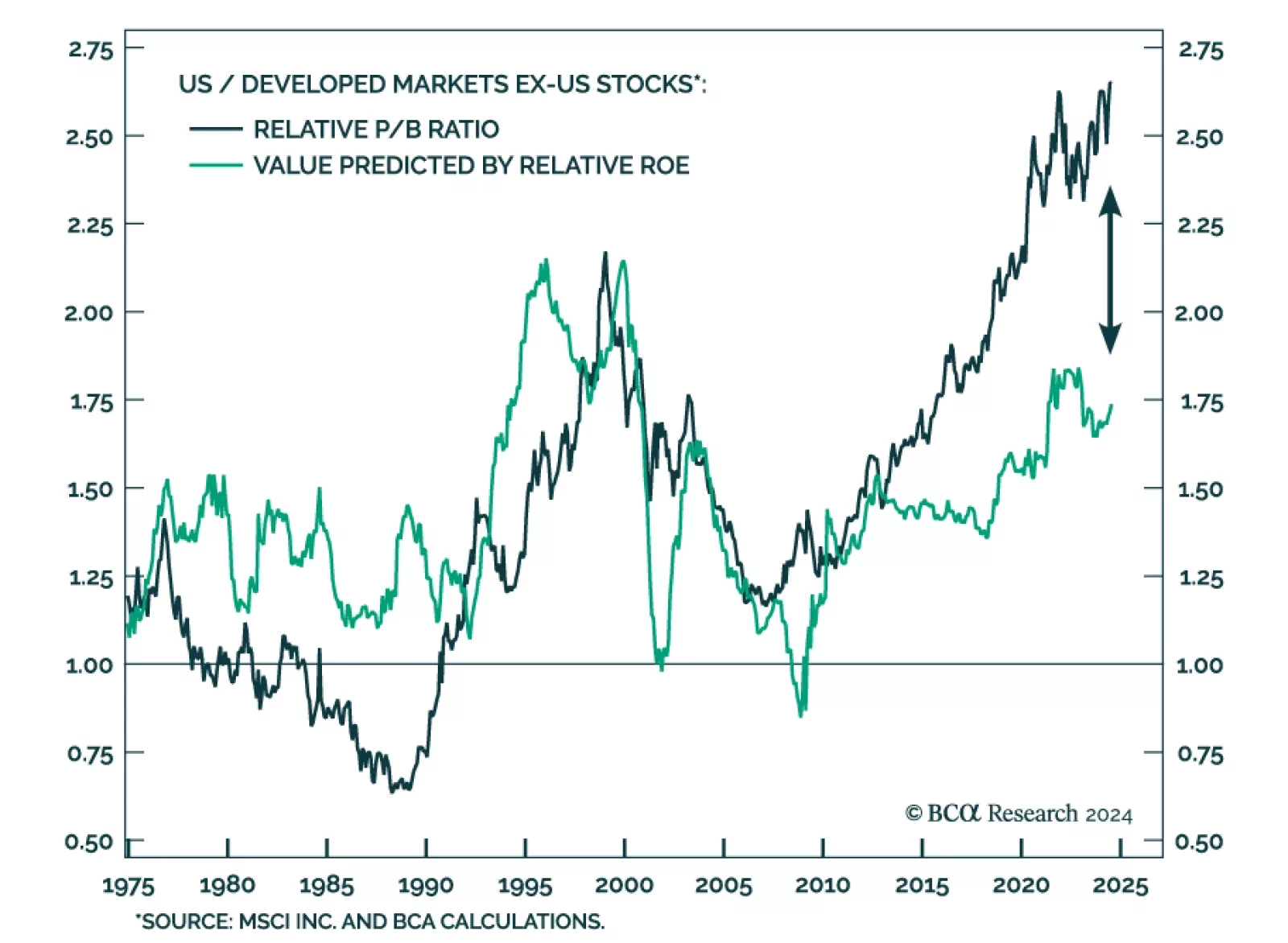

Elevated US equities valuations and their impact on returns are a hot topic right now. Valuations are not a tactical or cyclical timing tool, but they help predict long-term returns. Our Global Asset Allocation Strategy team…

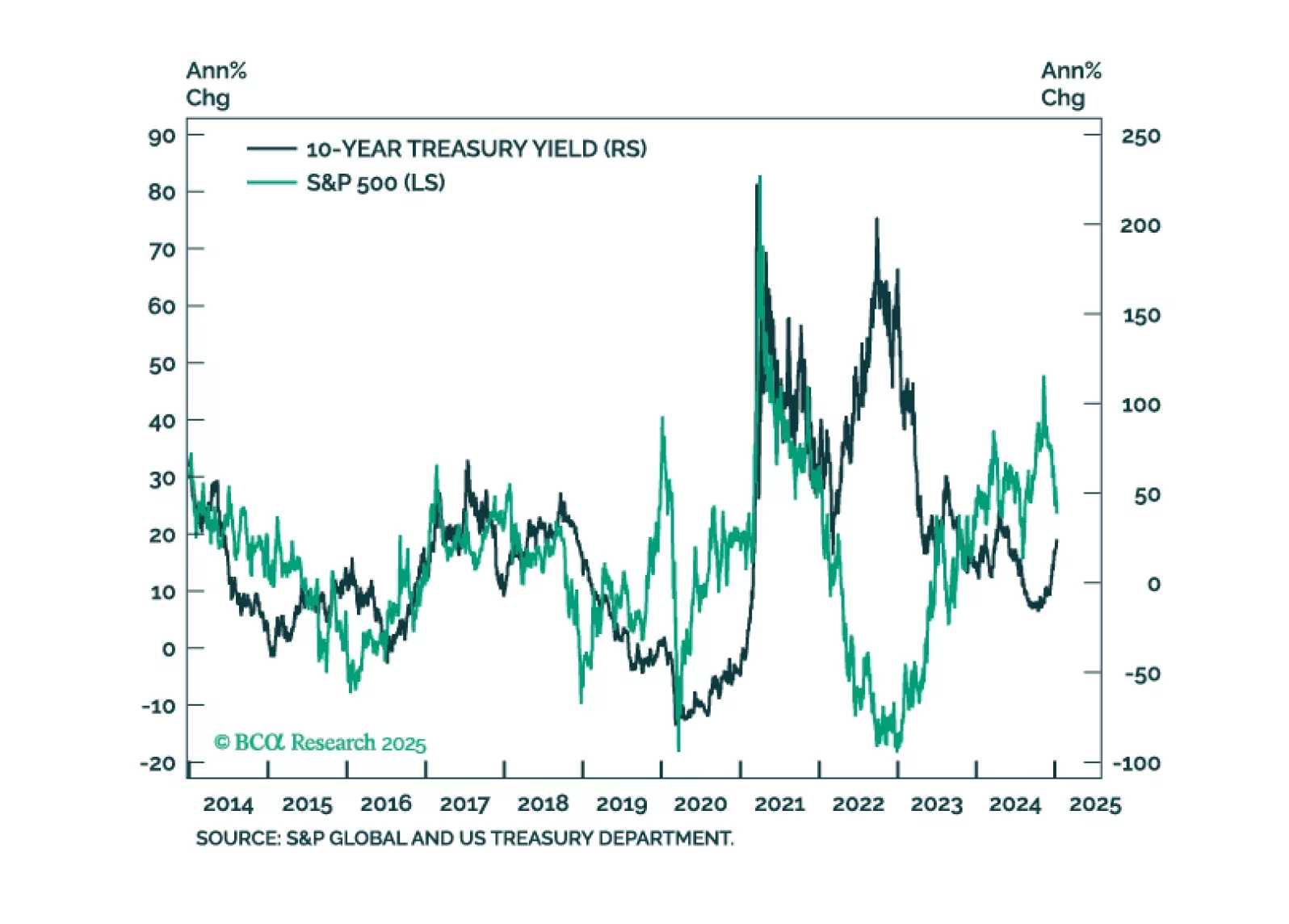

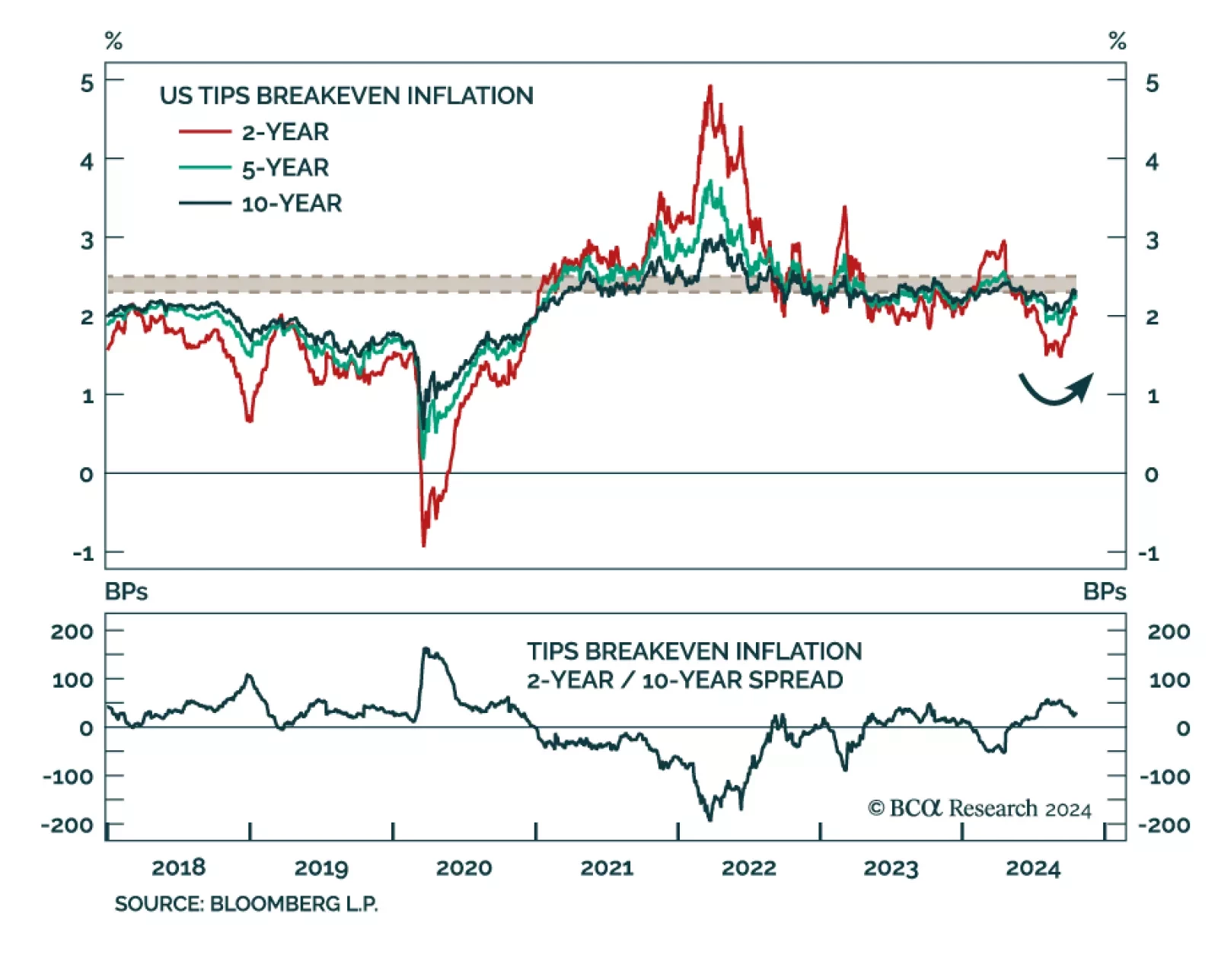

Since the August selloff in risk assets, the main cross-asset driver was the shift from inflation worries to growth worries. Some of that price action has reversed, as TIPS breakeven inflation rates swiftly rebounded since early…

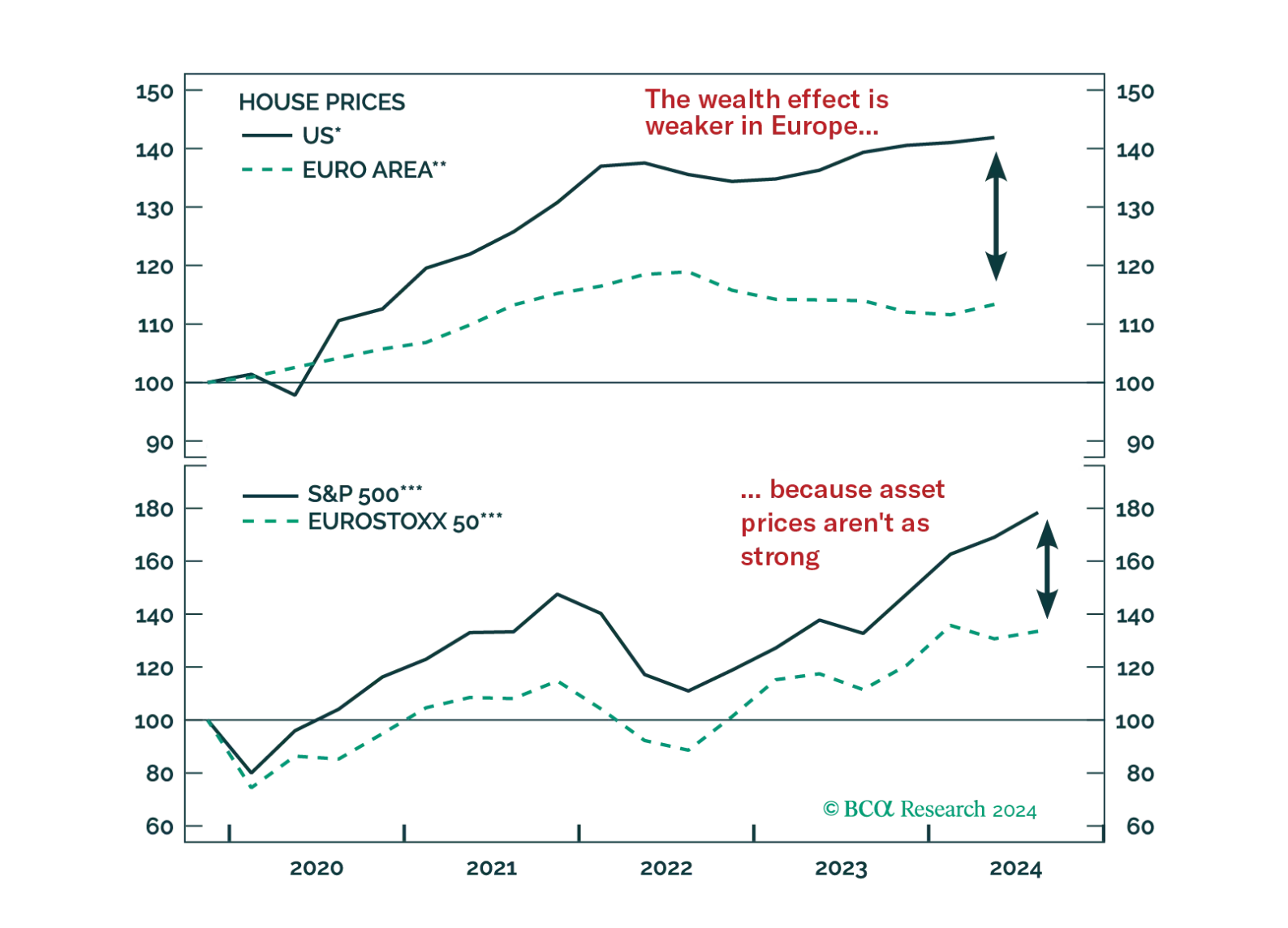

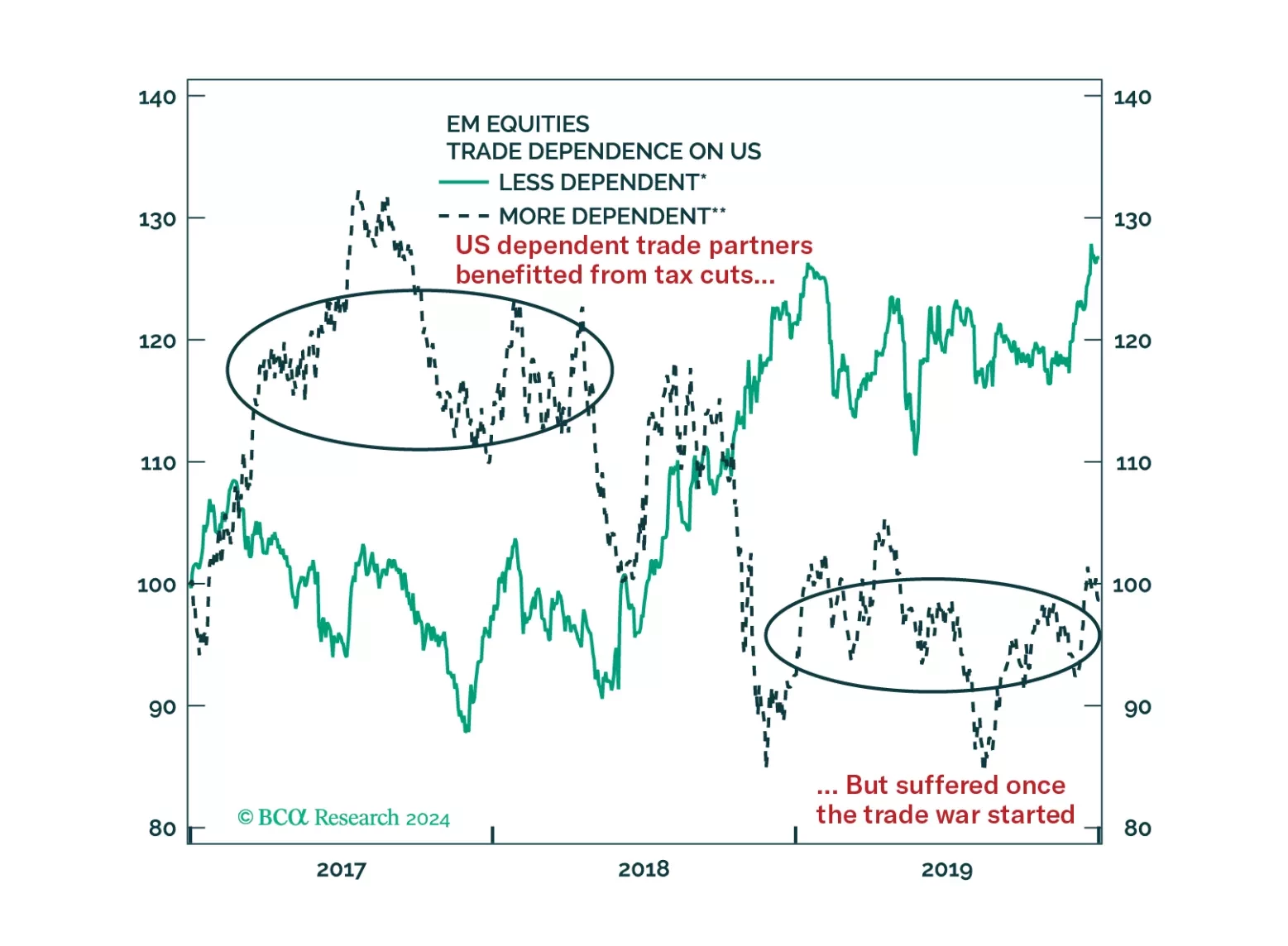

This week, we cover the main questions we fielded during our latest client trip in Europe. Among the many topics broached are Europe’s recession odds, the impact of China’s stimulus, and the outlook for European markets.

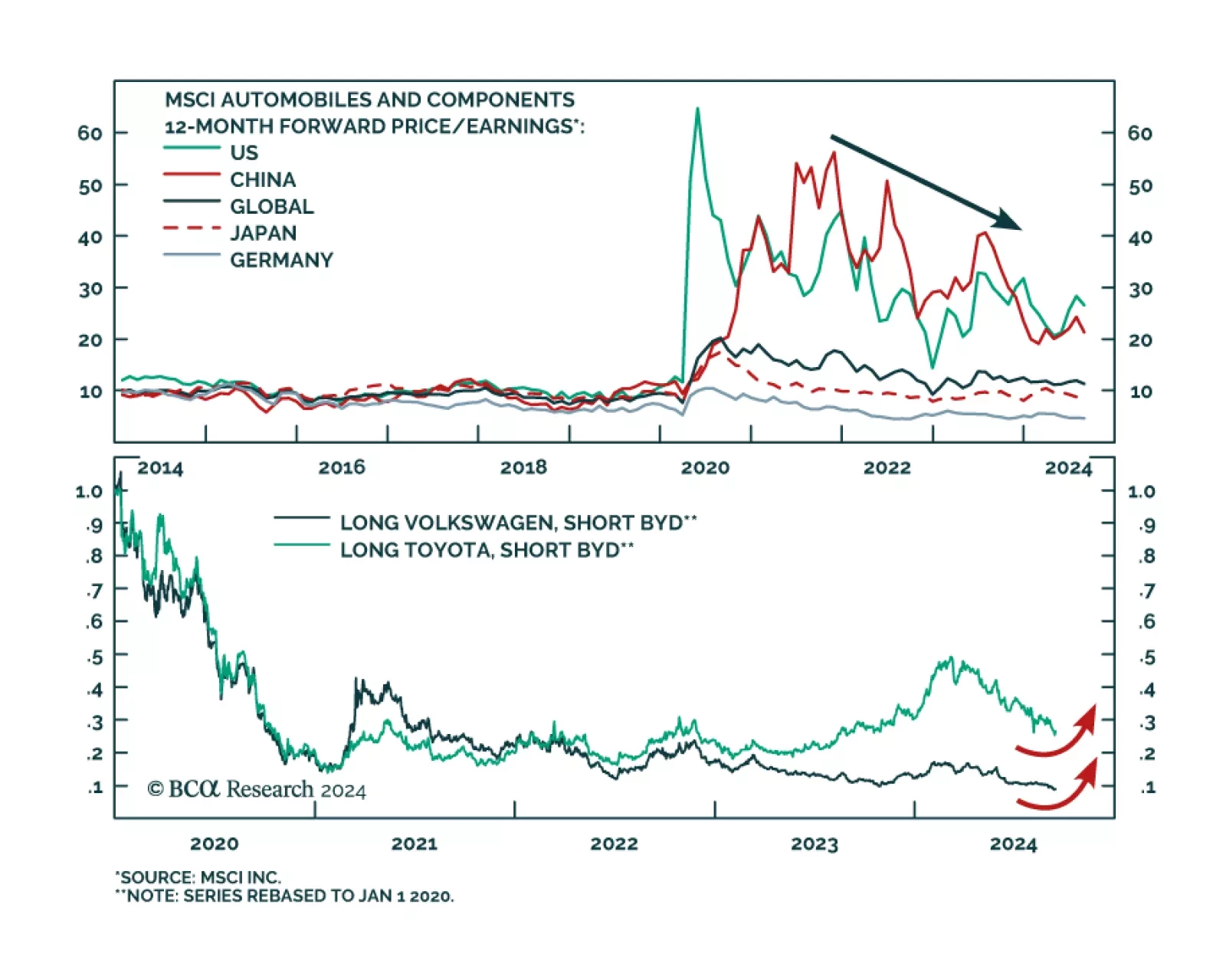

Volkswagen’s CEO has been making the point that the market for European carmakers has been deteriorating. Earlier last week, he went on to make a rather pointed reference at Chinese EV manufacturers. He was quoted…

According to our Bank Credit Analyst service, an inflection point in the relative performance of US stocks is not likely to occur over the coming 6-12 months. A recession favors US equities in common currency terms barring…

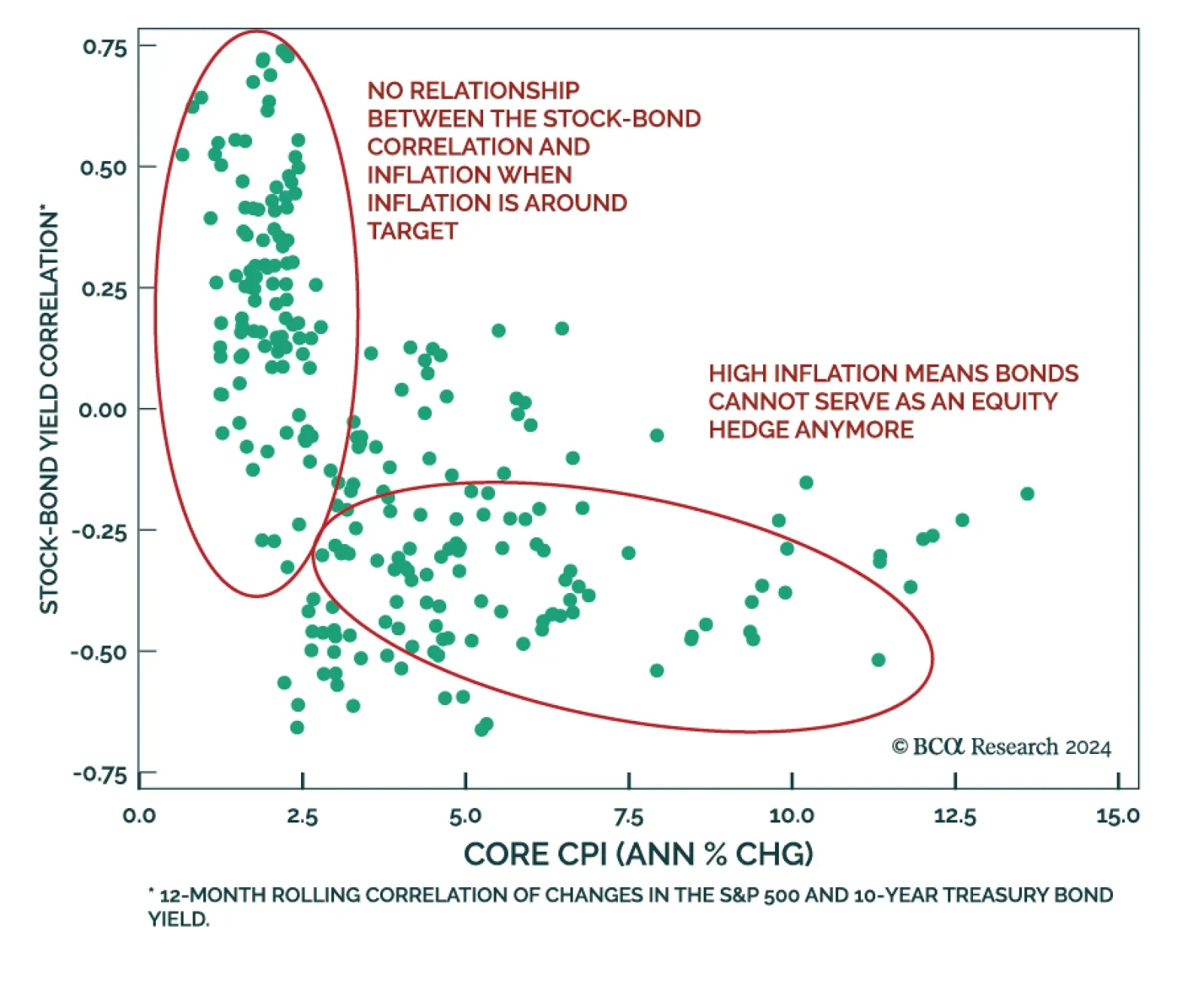

According to BCA Research’s Global Asset Allocation service, while the market action of the past few weeks is pointing to a return to a negative stock-bond correlation, more prints will be needed to confirm things are…