Tariff front-running behavior makes the April hard economic data difficult to interpret, but we take the strong reading from Food Services spending as a signal that the US consumer has not yet buckled.

Cross-asset signals remain distorted by policy developments, but we expect the US dollar to rebound tactically. More than observable fundamentals, policy headlines have been driving cross-asset movements. Traditional leading…

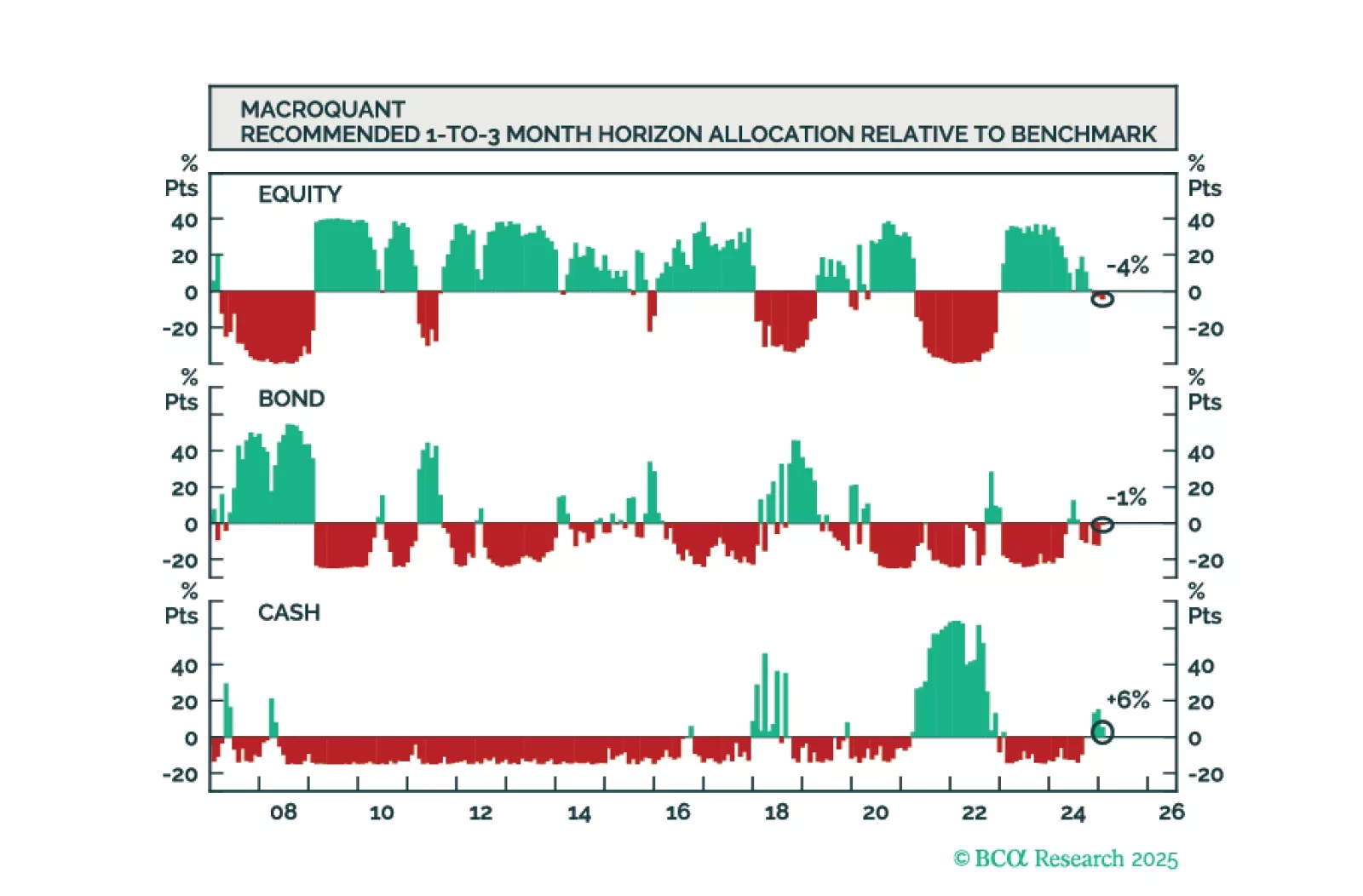

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

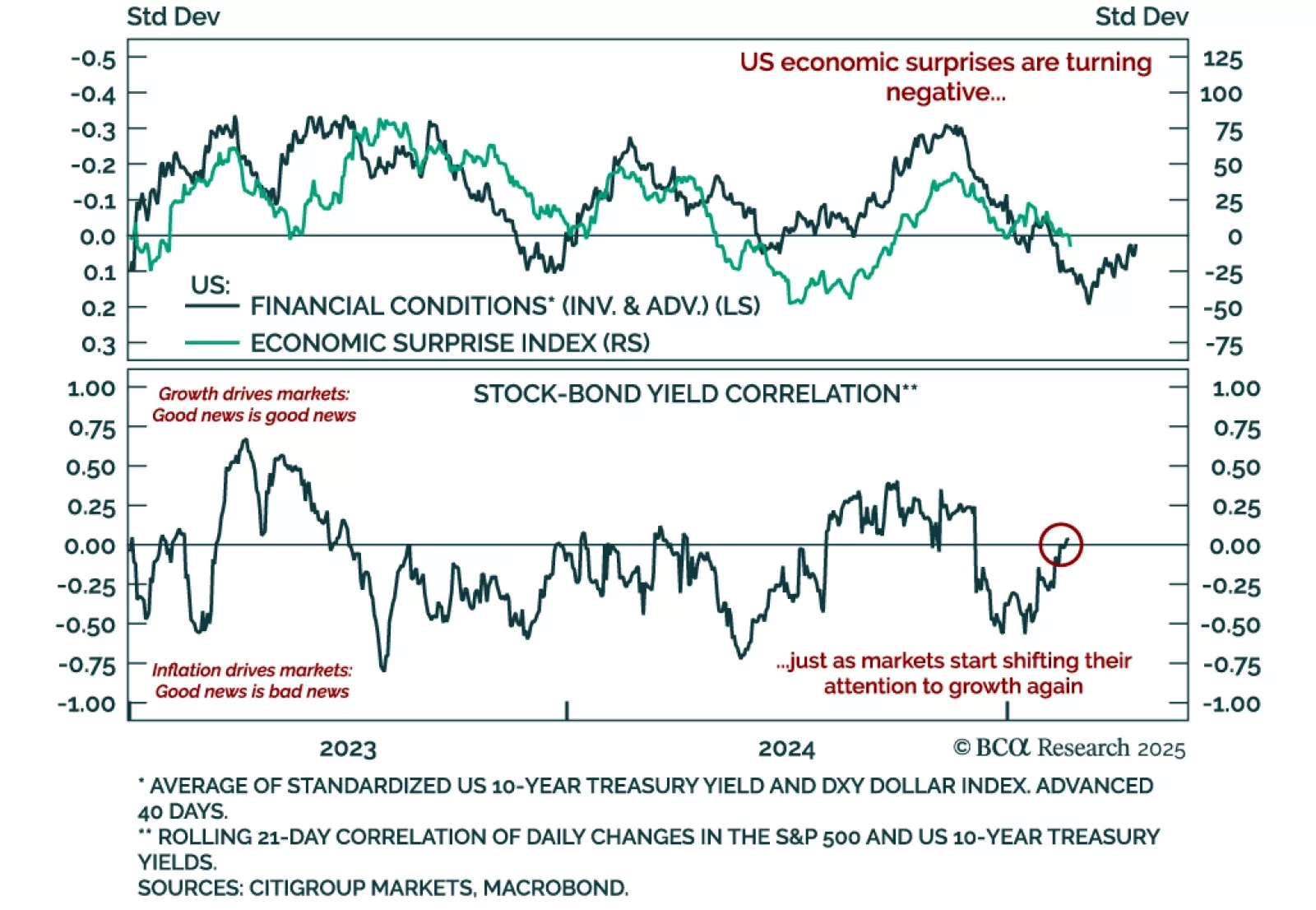

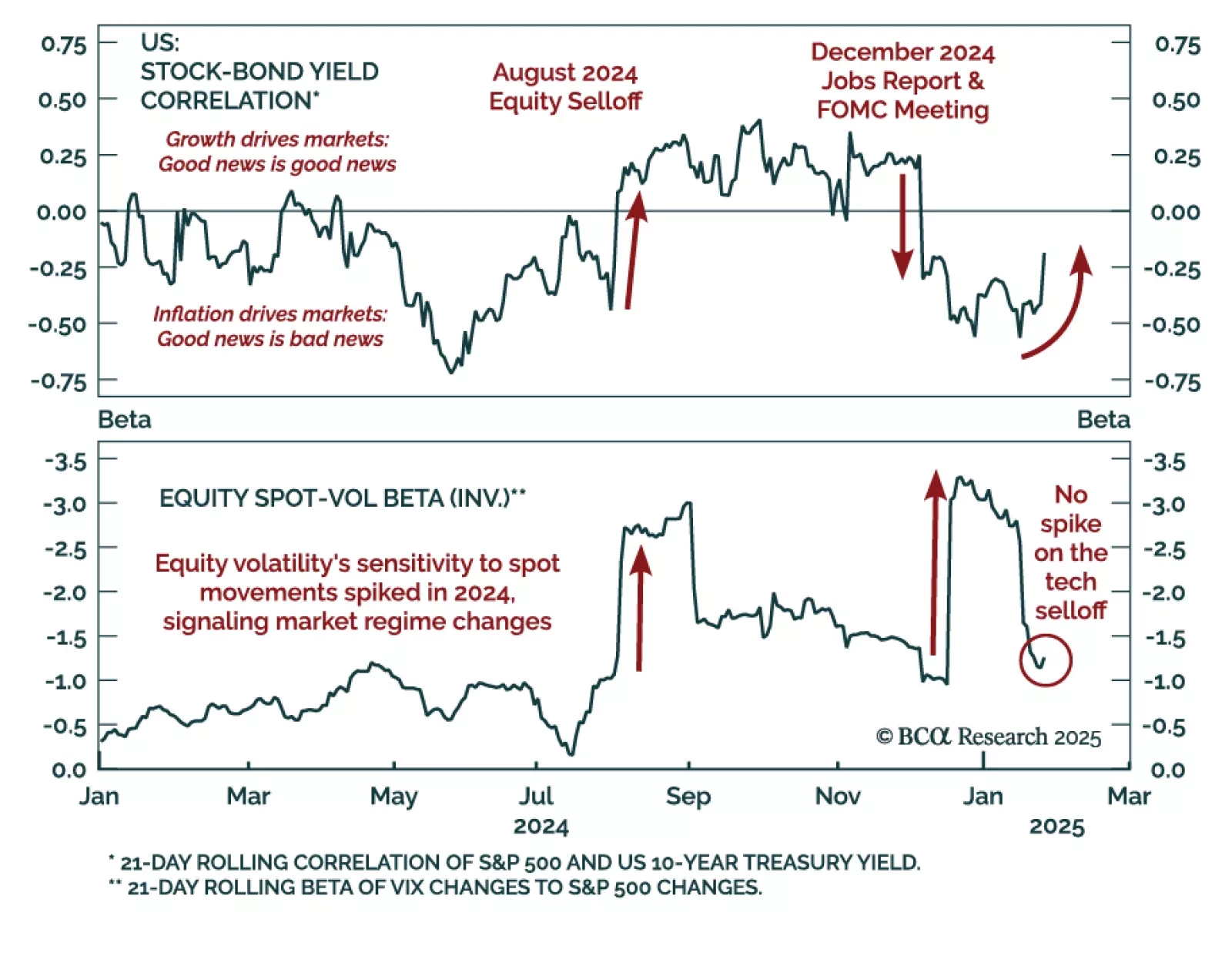

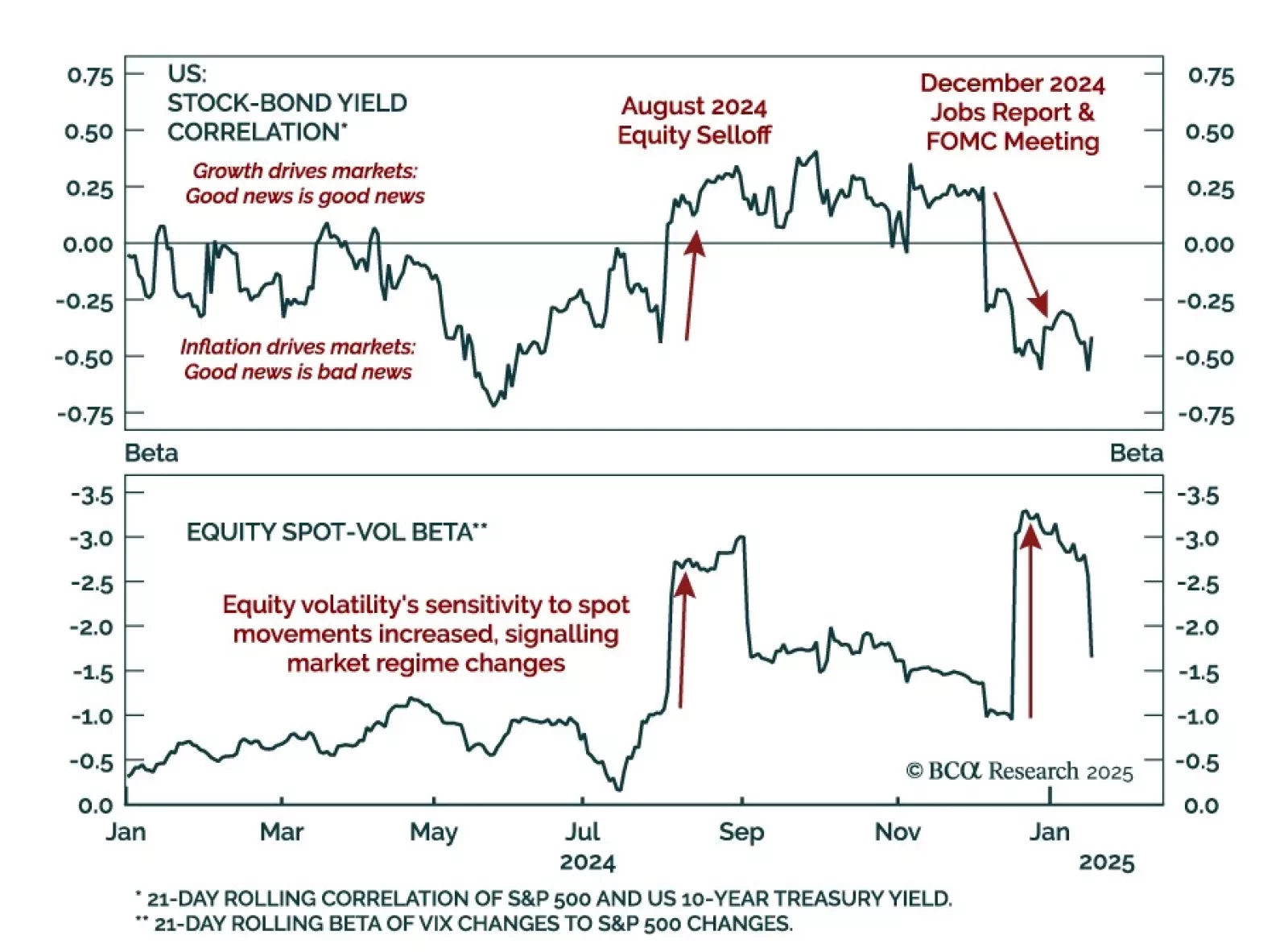

Two of our favorite indicators recently sent important signals. The first one, the short-term stock-bond yield correlation, recently drifted back to neutral territory after being negative. The correlation had been negative since…

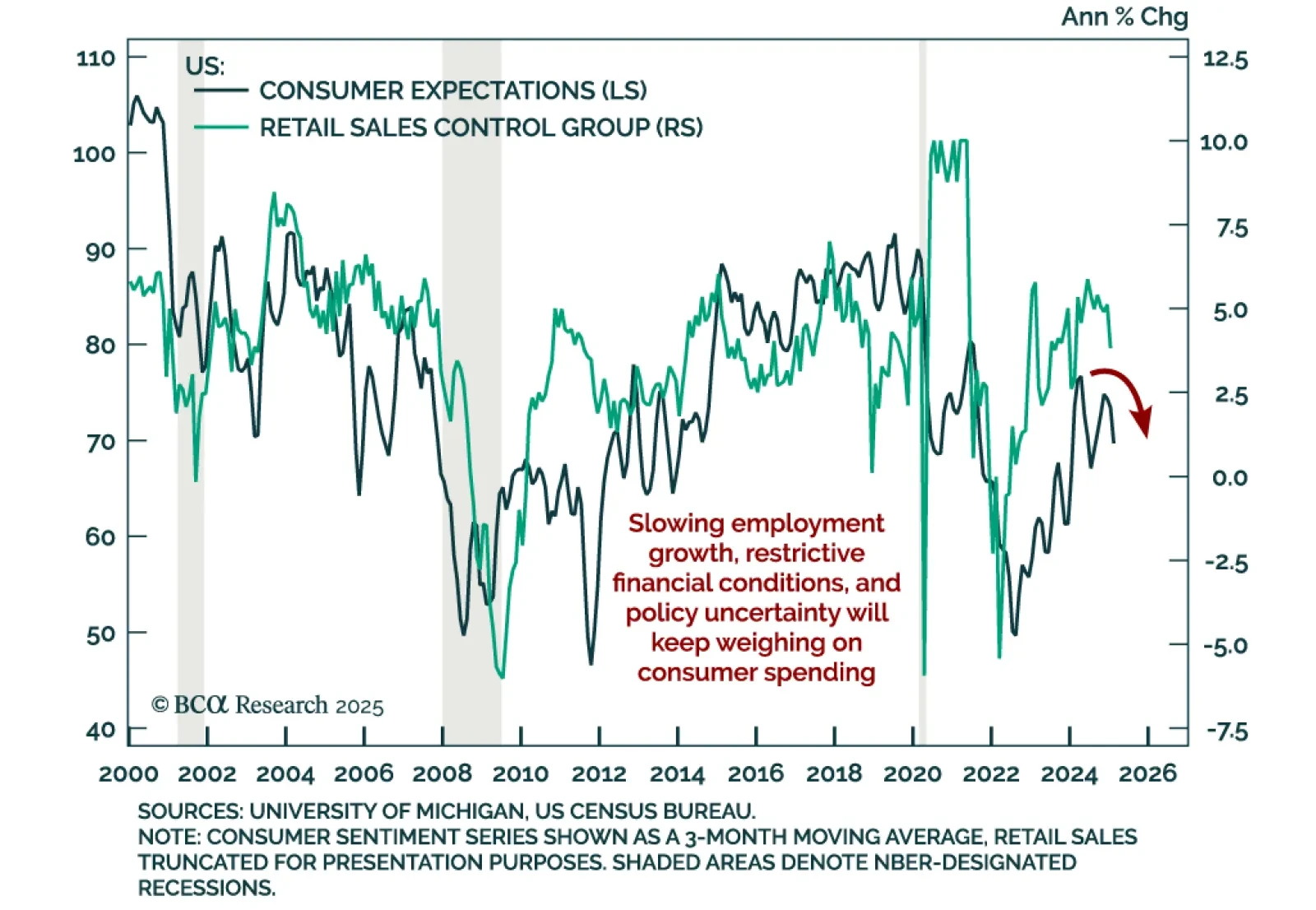

January US retail sales missed estimates, with the headline number contracting by 0.9% m/m. The decline was broad-based, with spending excluding autos and gas down 0.5%, and the control group also down 0.8%. The retail sales…

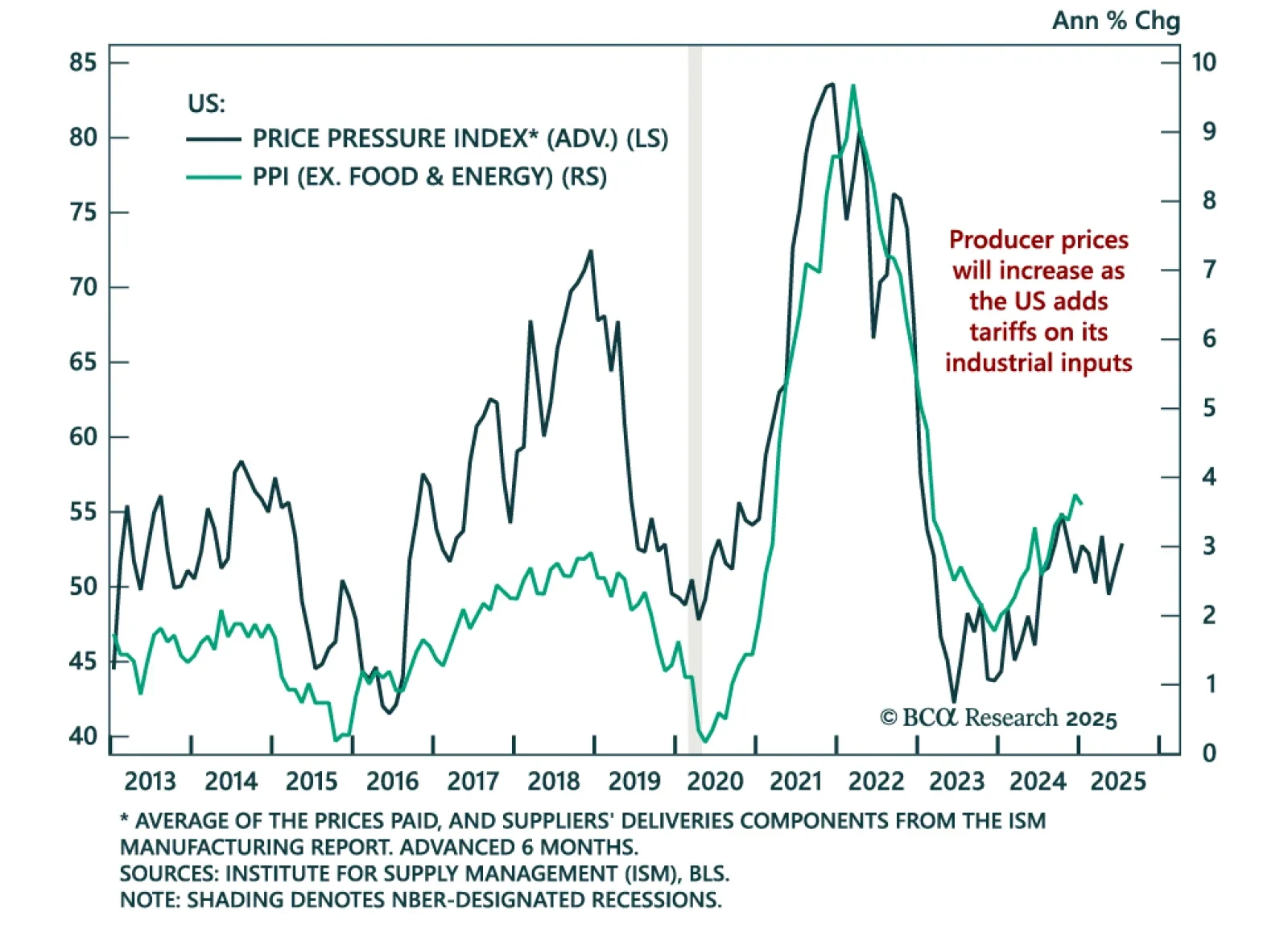

The January US Producer Price Index came in slightly hotter than estimates, but decelerated to 0.4% m/m (3.5% y/y) from an upwardly-revised 0.5% in December. Core PPI, excluding food, energy, and trade services, was also stronger…

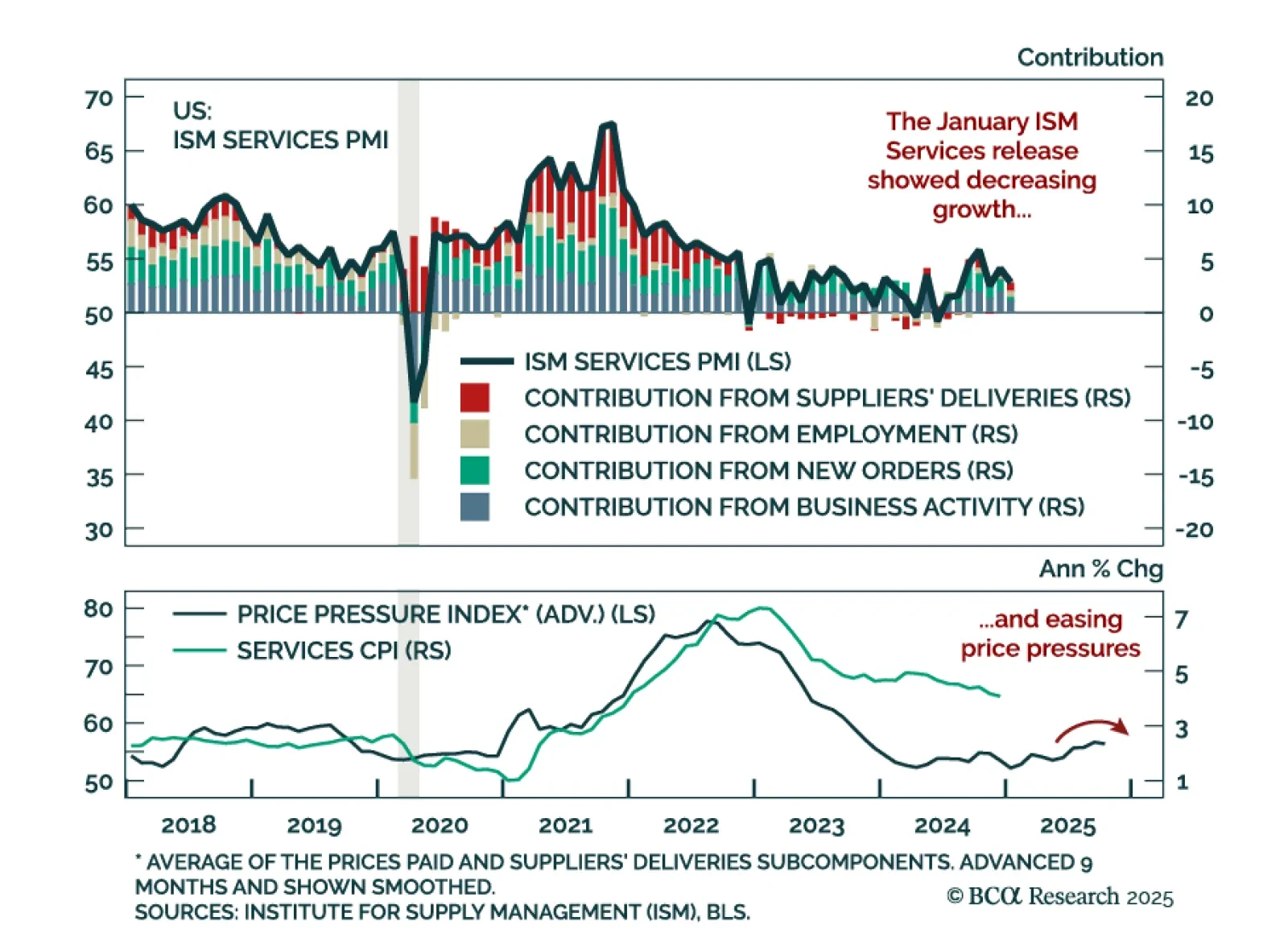

The January ISM Services missed estimates, decreasing to 52.8 from 54.0 in December. The move was driven by activity components, while employment and suppliers’ delivery times increased. Additionally, the prices paid measure…

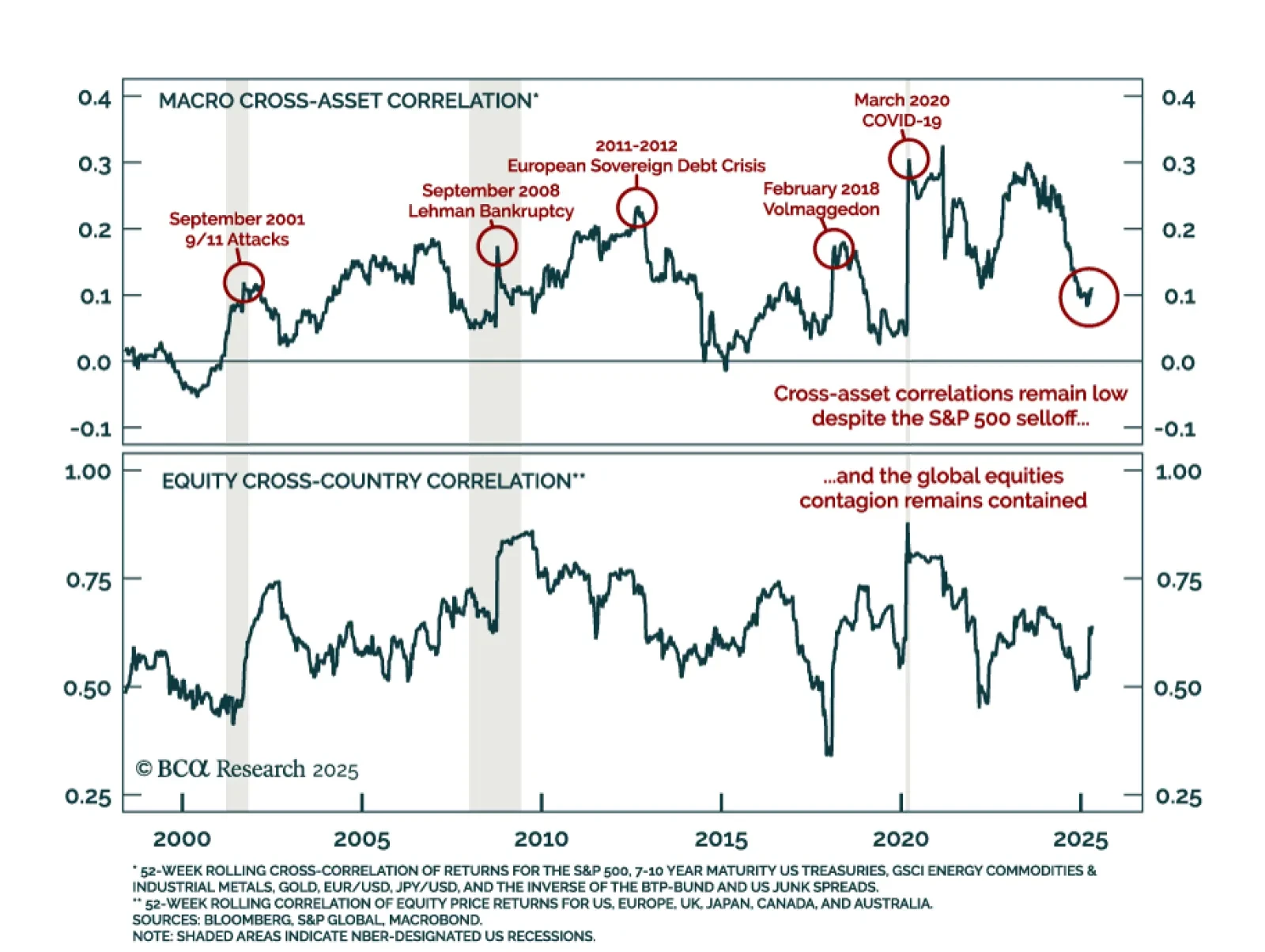

Monday’s selloff was orderly and concentrated in the tech sector. The price action was a classic risk-off response, where both stock prices and bond yields decreased. While the VIX increased, the equity spot-vol beta, volatility’s…

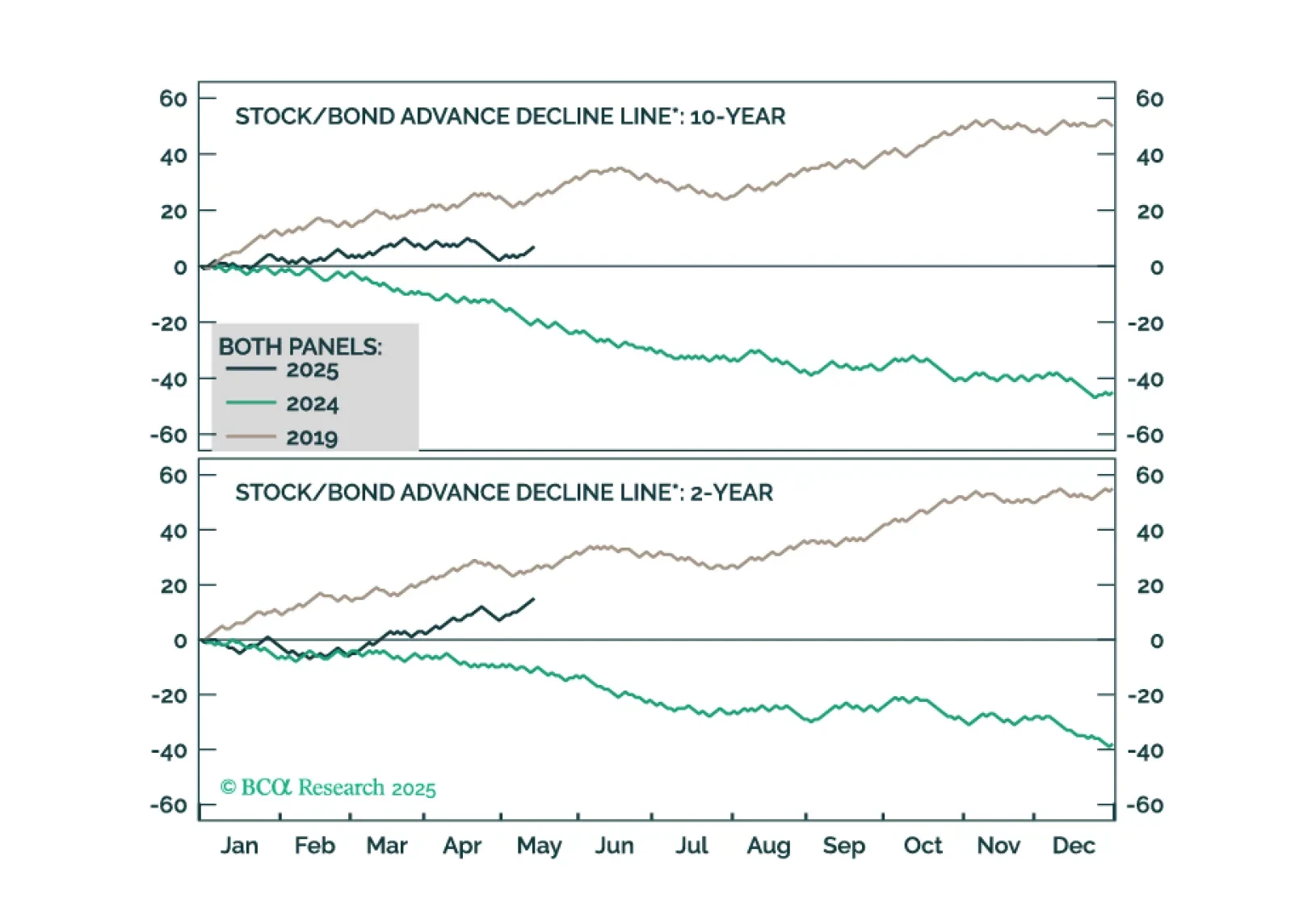

Two main market events defined 2024, highlighting how assets will react to economic data on the tactical horizon. The August 2024 selloff marked a positive shift in the stock-bond yield correlation, as higher odds of a “hard landing…