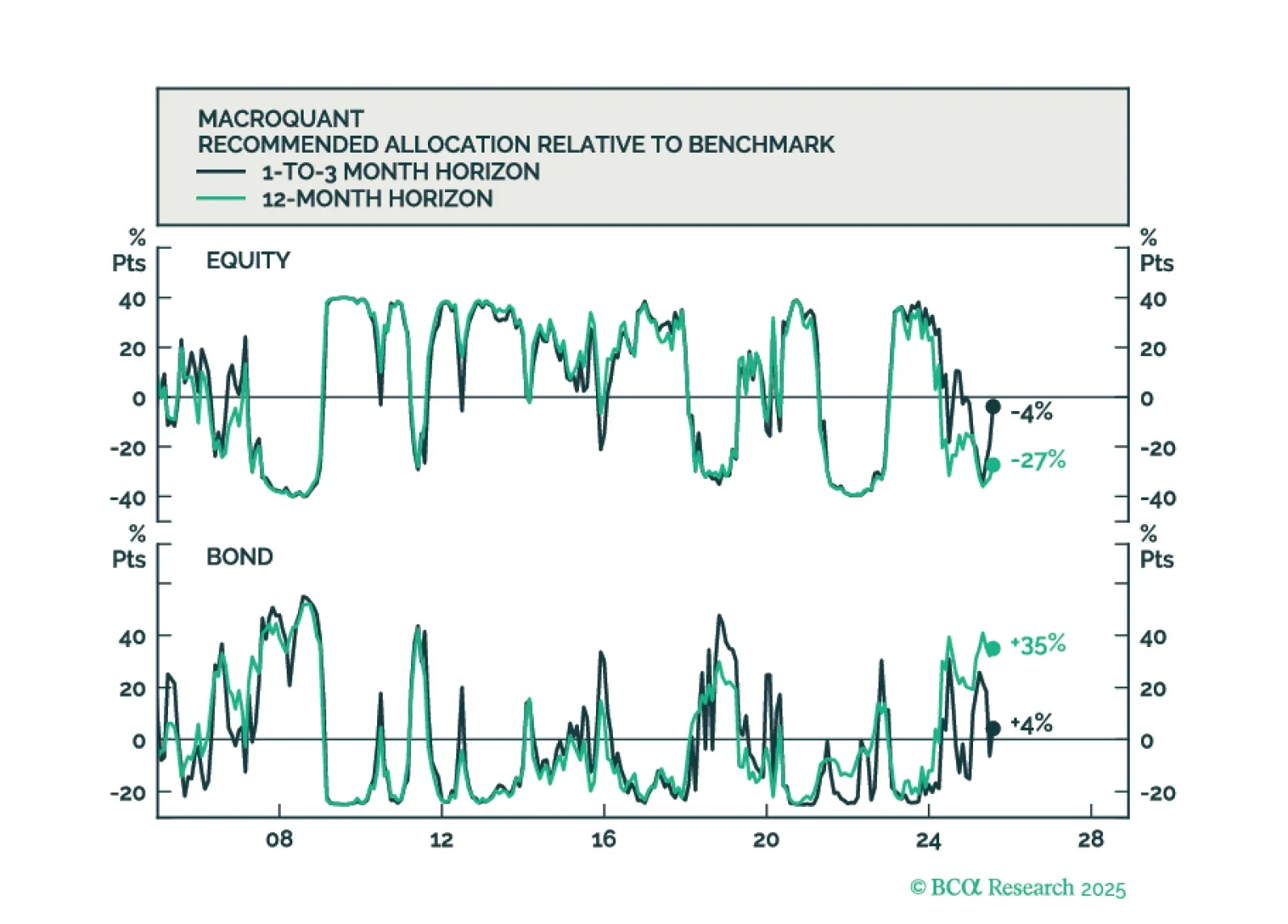

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.

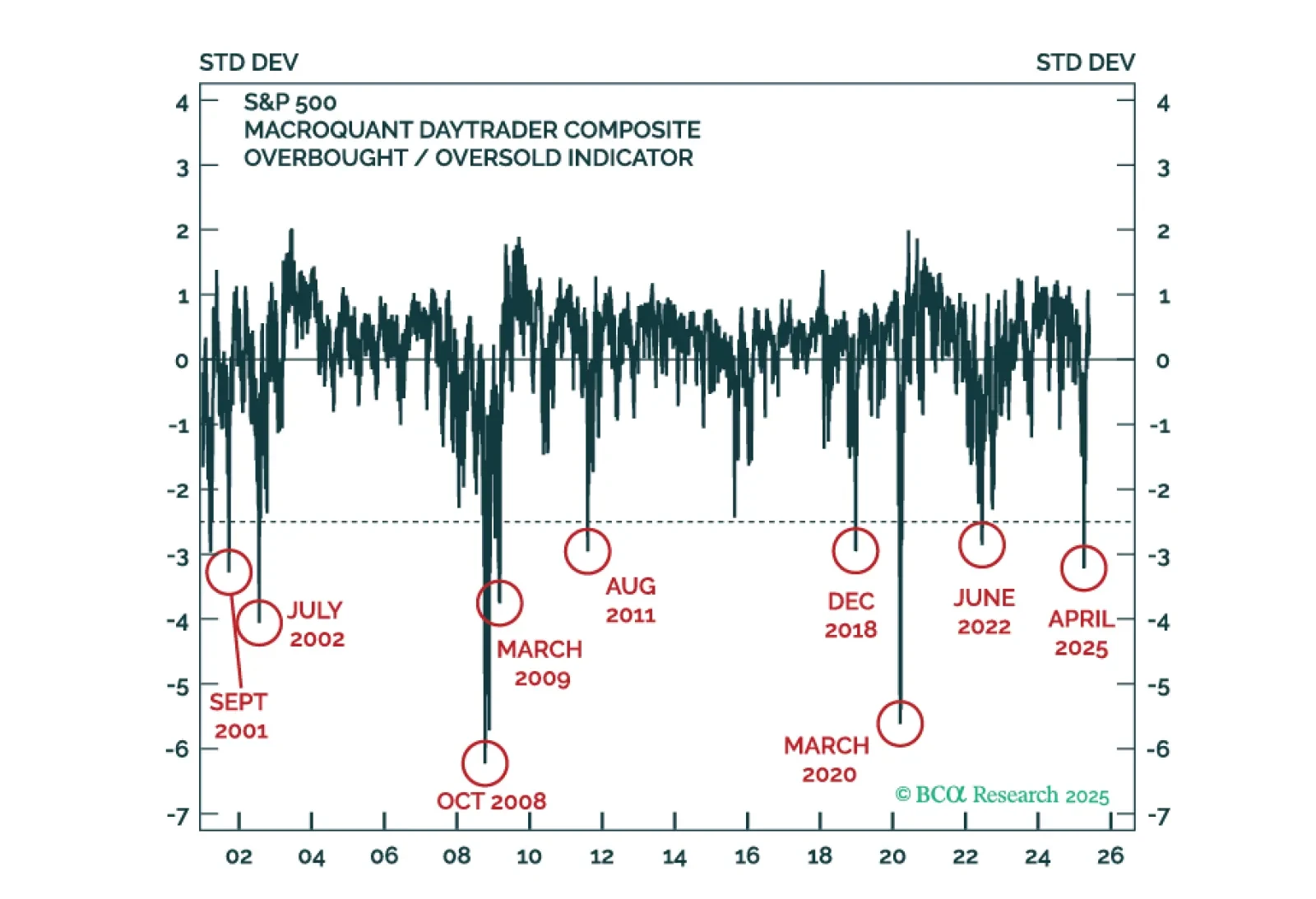

Our tactical framework, which tracks the reflexive loop between financial conditions and economic surprises, points to stronger near-term growth, leaving equities vulnerable if inflation re-accelerates. Data surprises move markets,…

Low rates volatility has been a key tailwind for equities, but the fragile equilibrium leaves markets exposed to AI sentiment and inflation risks. Rates volatility, measured by the MOVE index, has drifted to multi-year lows and sits…

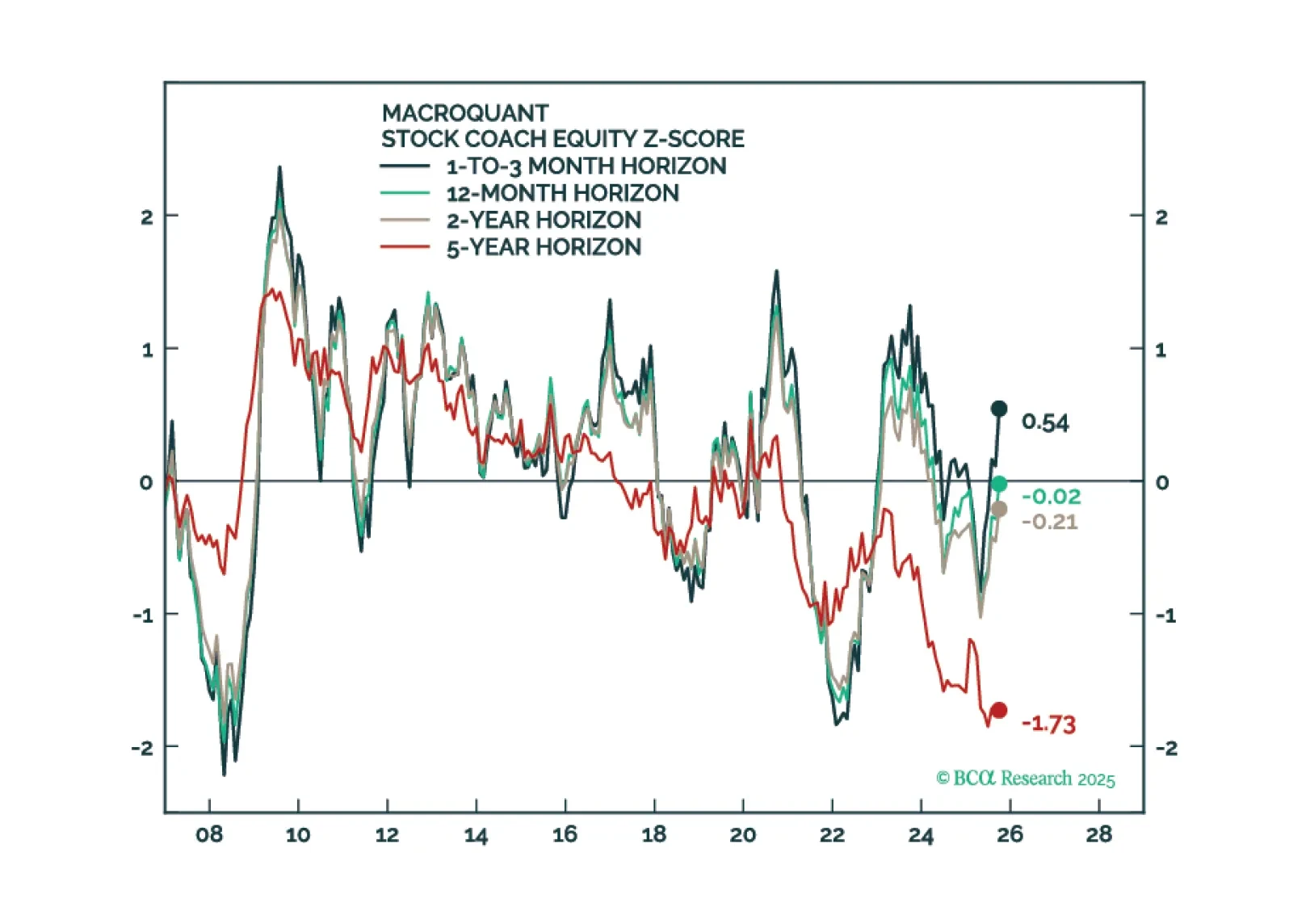

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

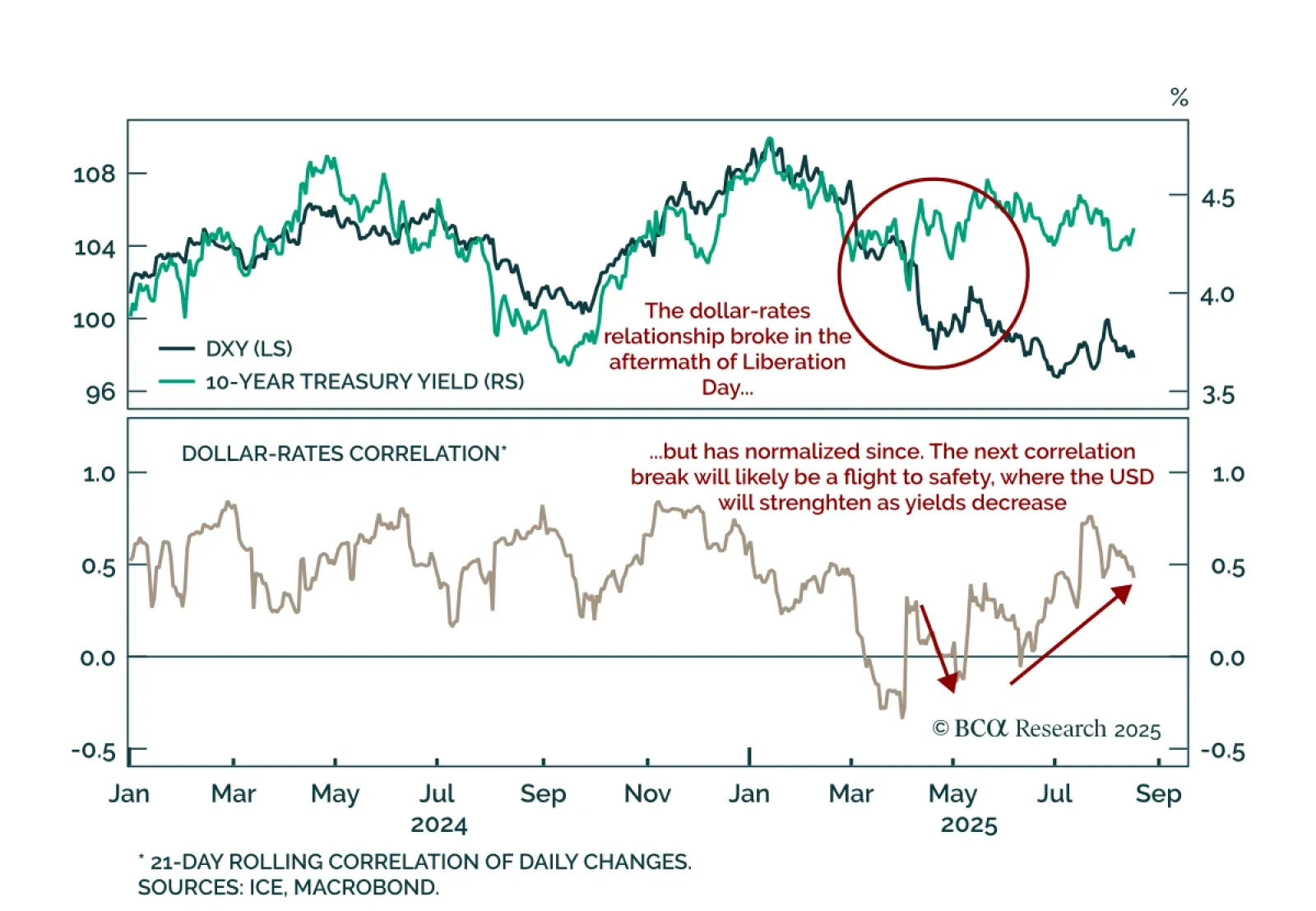

Trade tensions briefly broke the USD-rates link, but the dollar will remain a countercyclical currency for the near future. A key 2025 trend has been USD depreciation, driven by foreign investors reducing exposure to US assets…

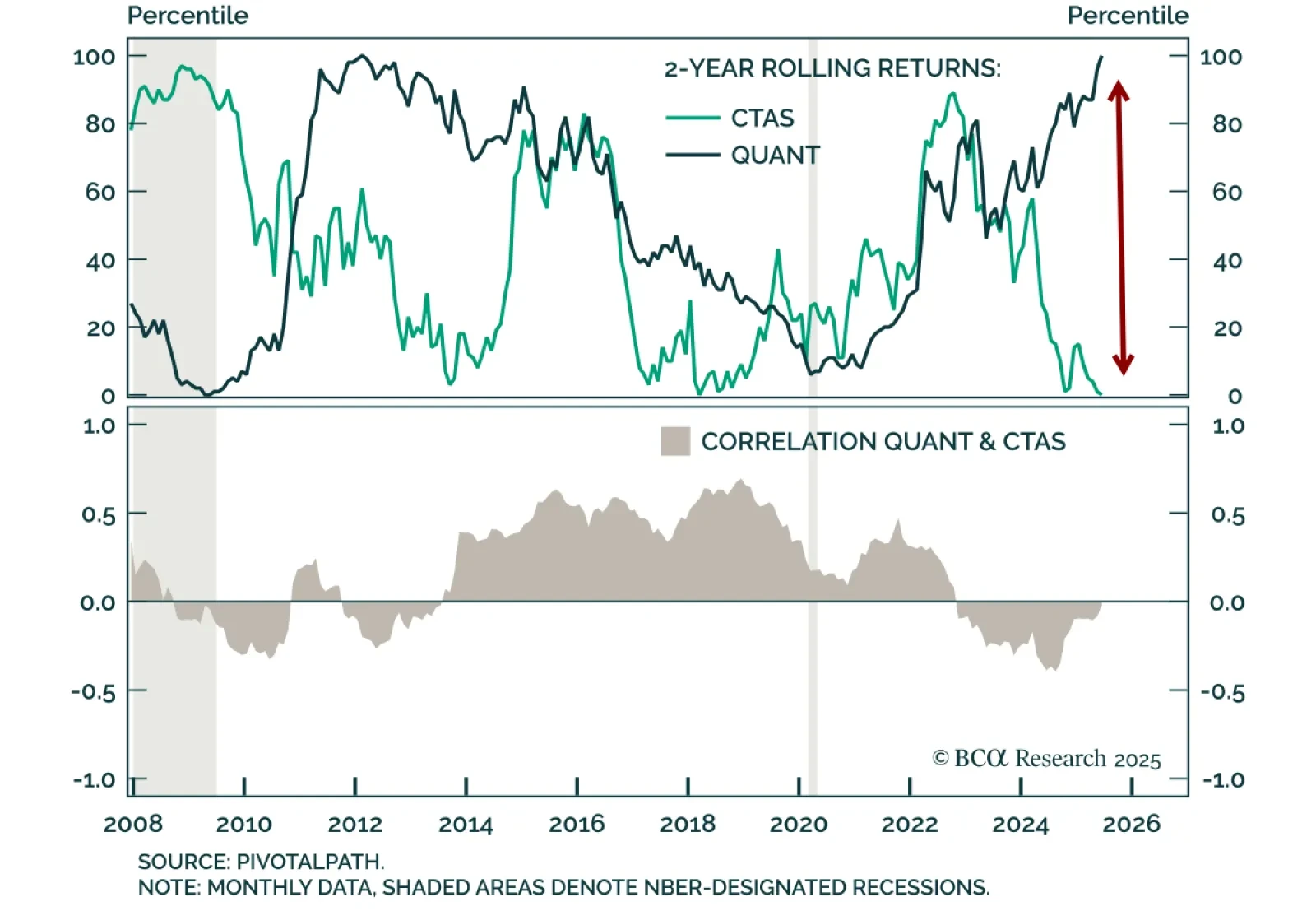

A historic divergence between systematic strategies is creating a compelling entry point into Managed Futures. Our Chart Of The Week comes from Brian Payne, Chief Strategist for our Private Markets & Alternatives team.…

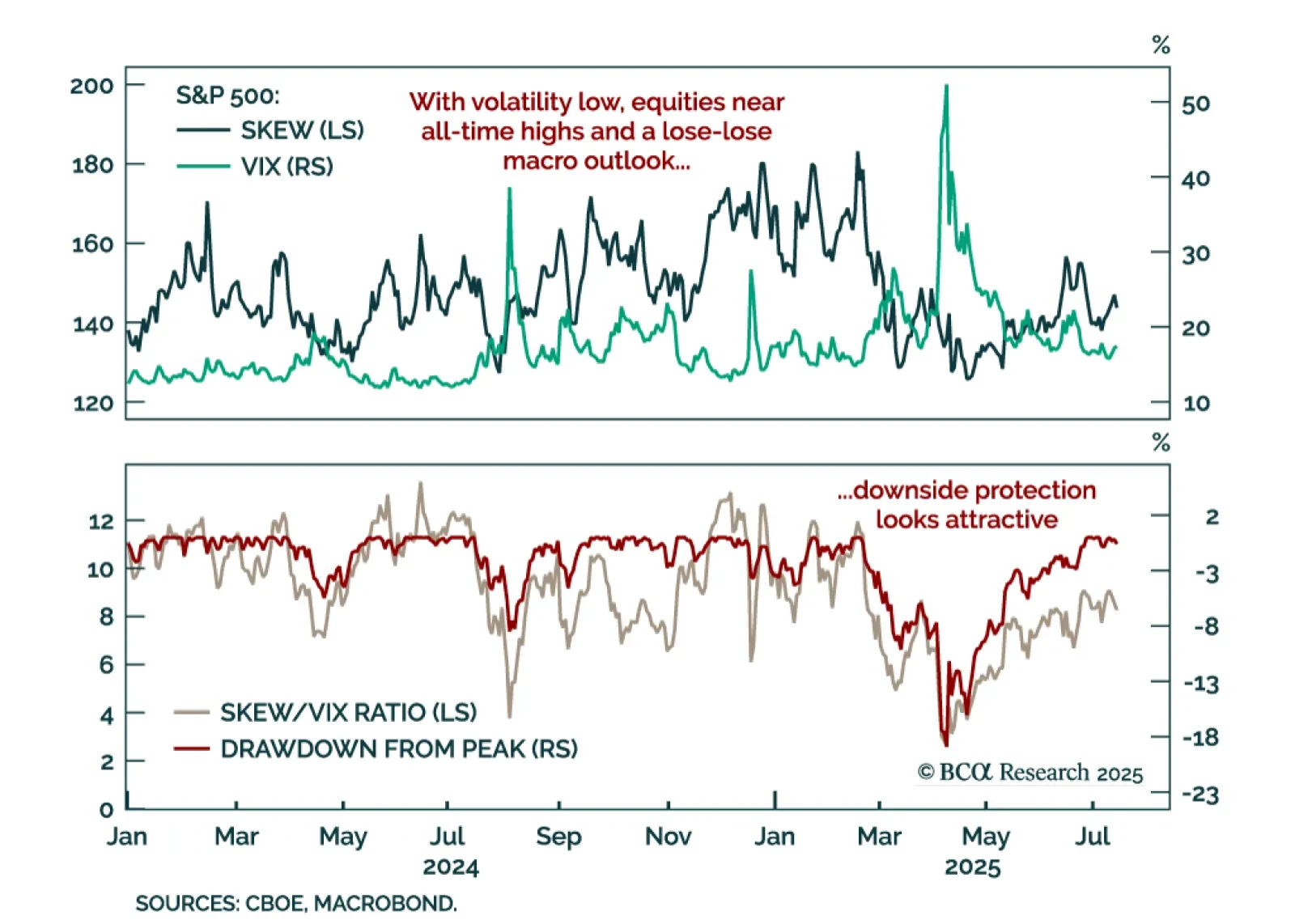

The S&P 500 sits near all-time highs, but sentiment and positioning suggest euphoria has not driven this rally. Prices are elevated, yet the SKEW/VIX ratio sits at 8.3, or its 67th percentile. While not at extreme levels…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.