Corporate Bonds

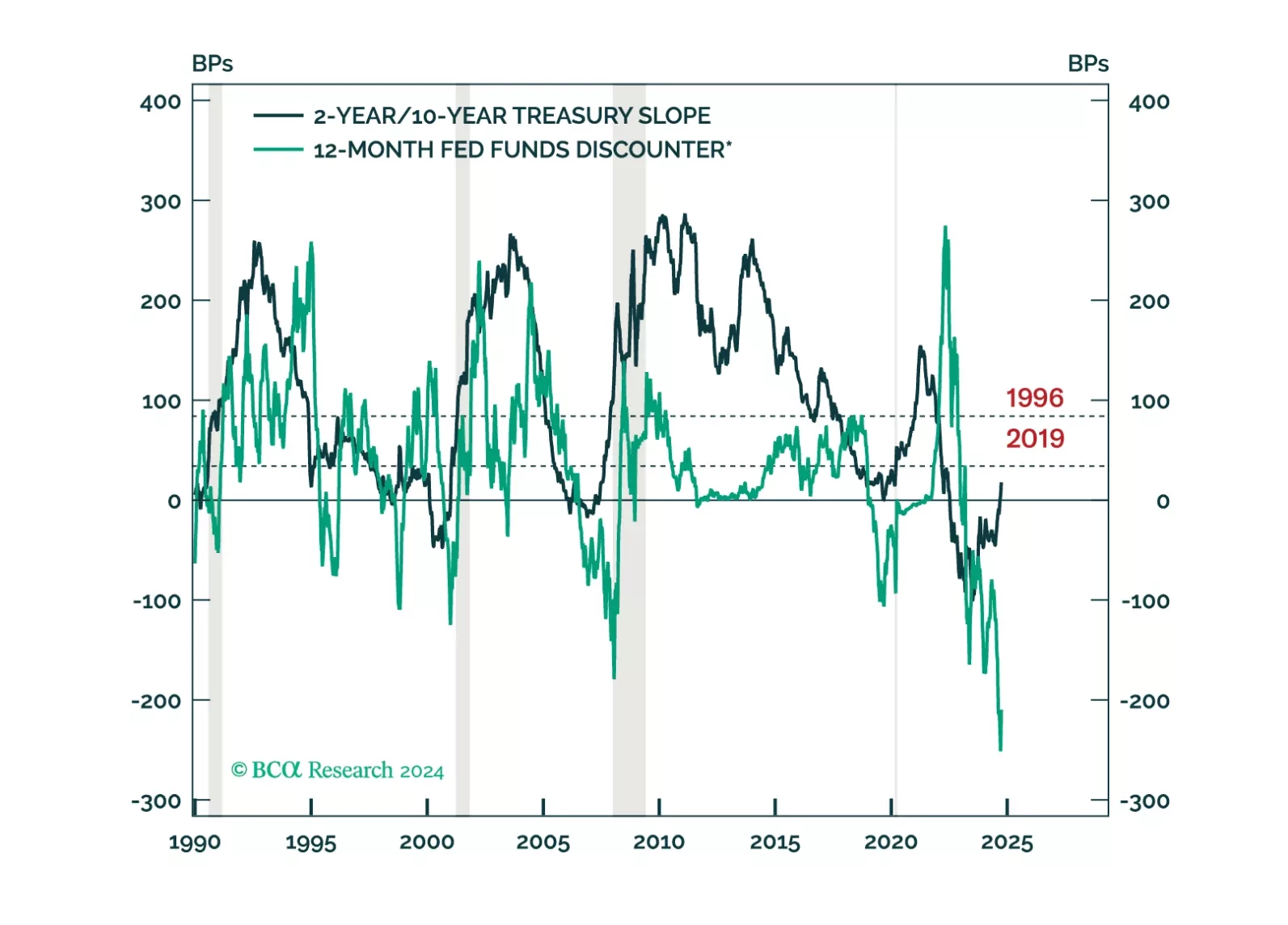

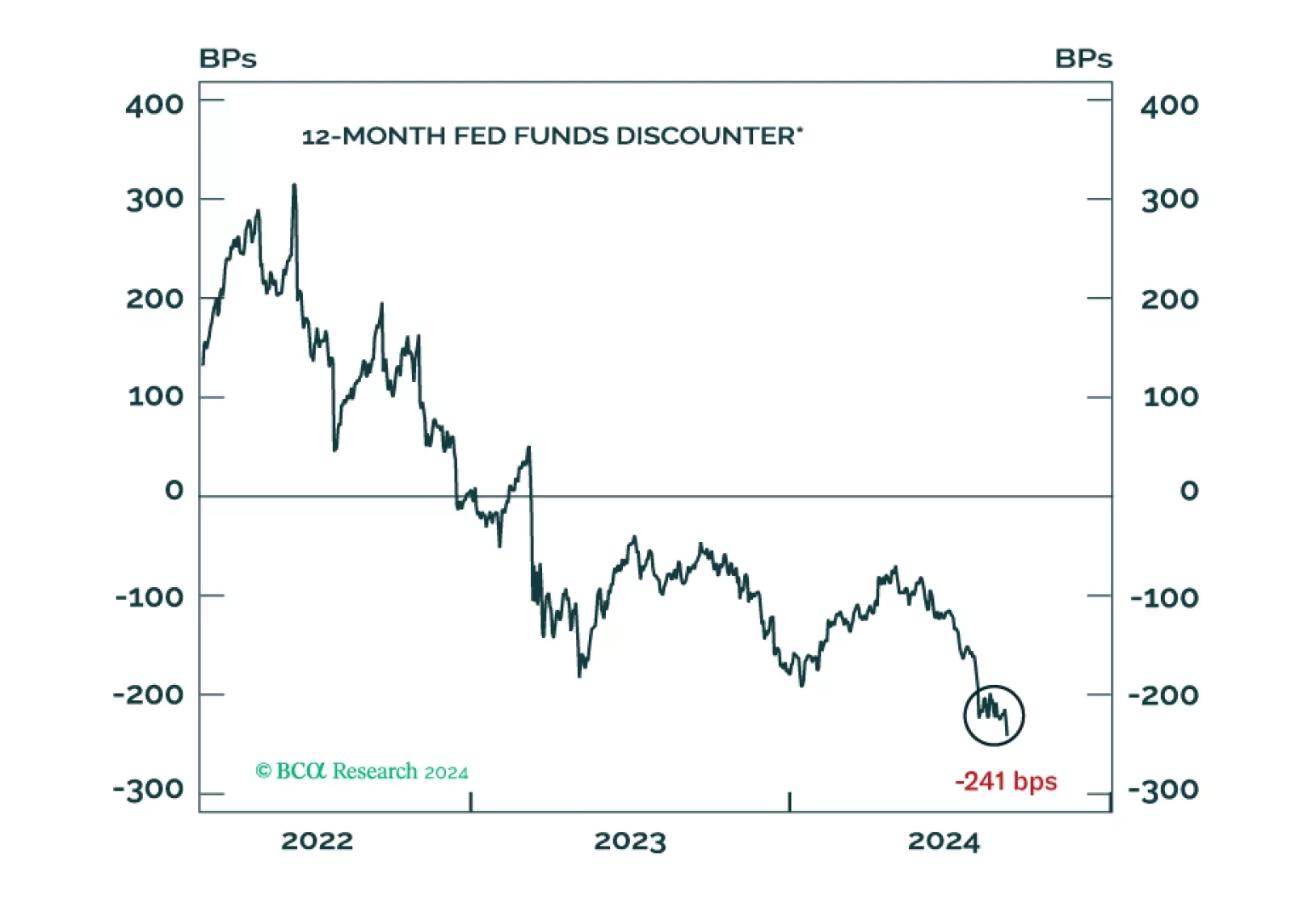

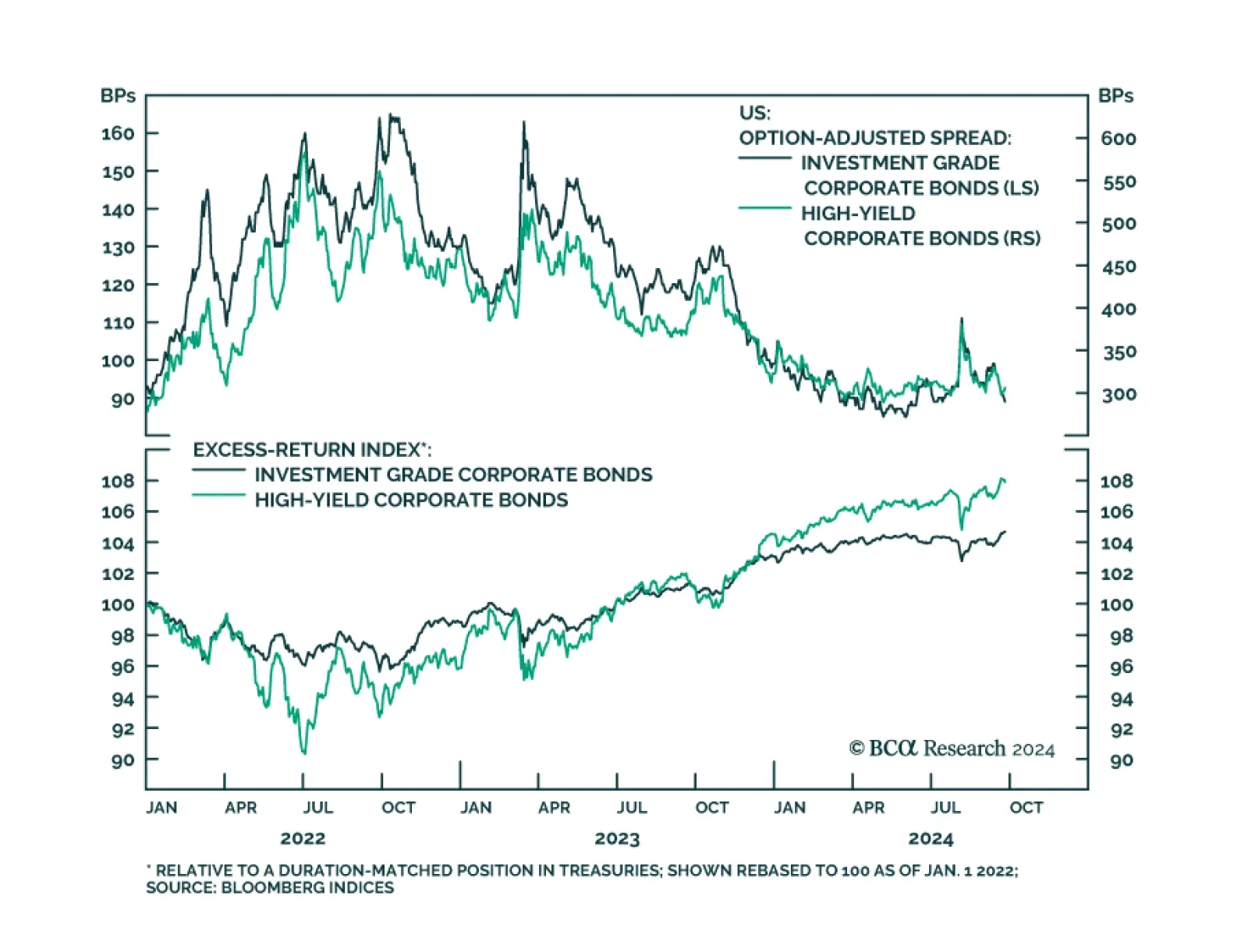

Our Q3 portfolio was defensive, which we believe will be the appropriate stance in the next six-to-twelve months. Data coming out of the US has remained robust which could cause US bond yields to temporarily overshoot. An overshoot in US bond yields will be an opportunity to dial up the portfolio’s defensive tilt. The average decline in 10-year Treasury yields 12 months after the first Fed rate cut is 100 bps. This time should be no different. There are not many changes to this quarter’s portfolio allocation. We have upgraded UK gilts to overweight and downgraded European credit to underweight. Portfolio duration remains the same. In terms of future changes, we are generally watching the trend in inflation given many central banks are delivering jumbo rate cuts. Any pause in the disinflationary trend we have seen will send bond yields soaring. This is a risk to our view. Otherwise, a recession in the first half of 2025 will cement our long duration stance.

Our Portfolio Allocation Summary for October 2024.

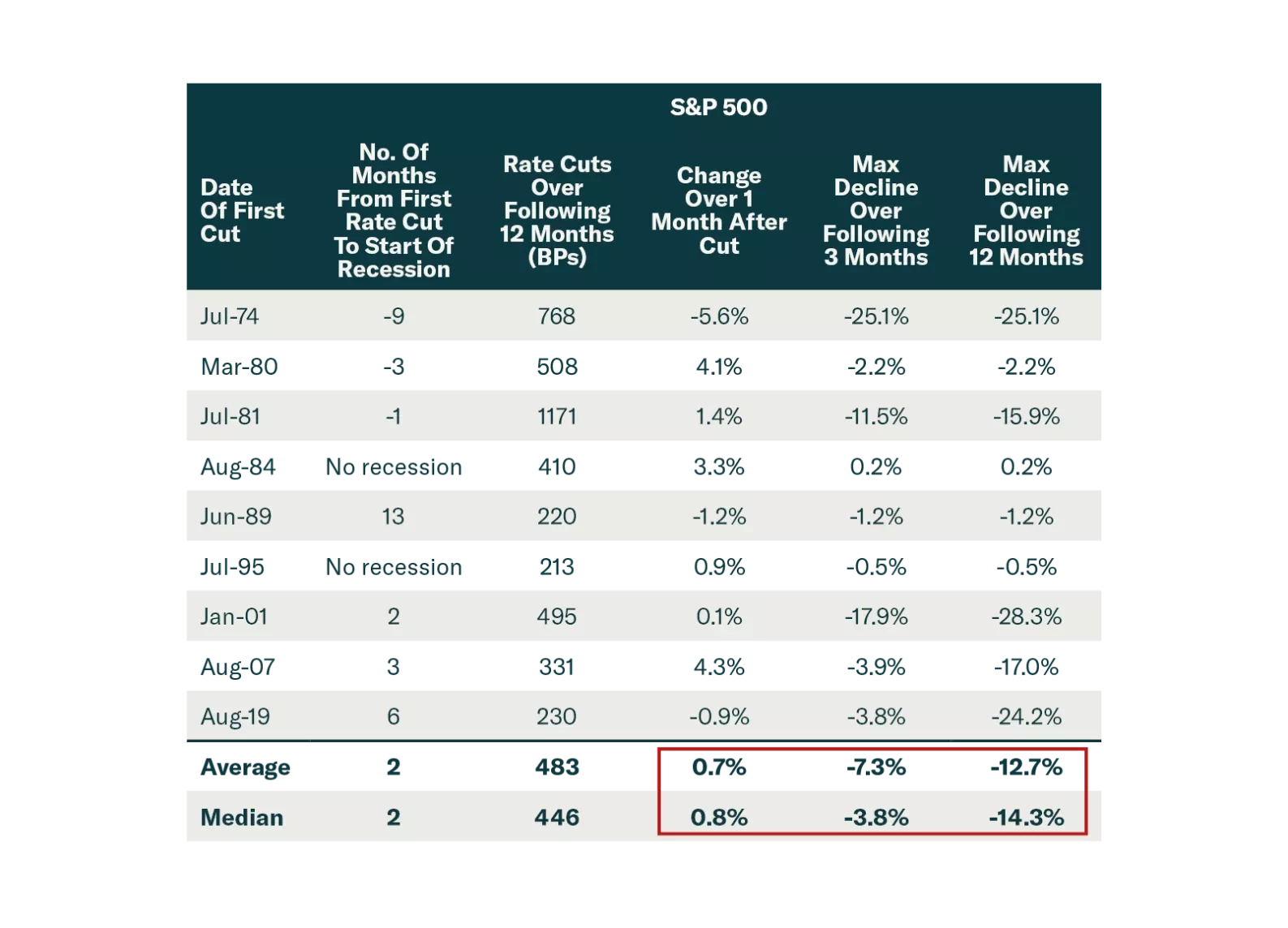

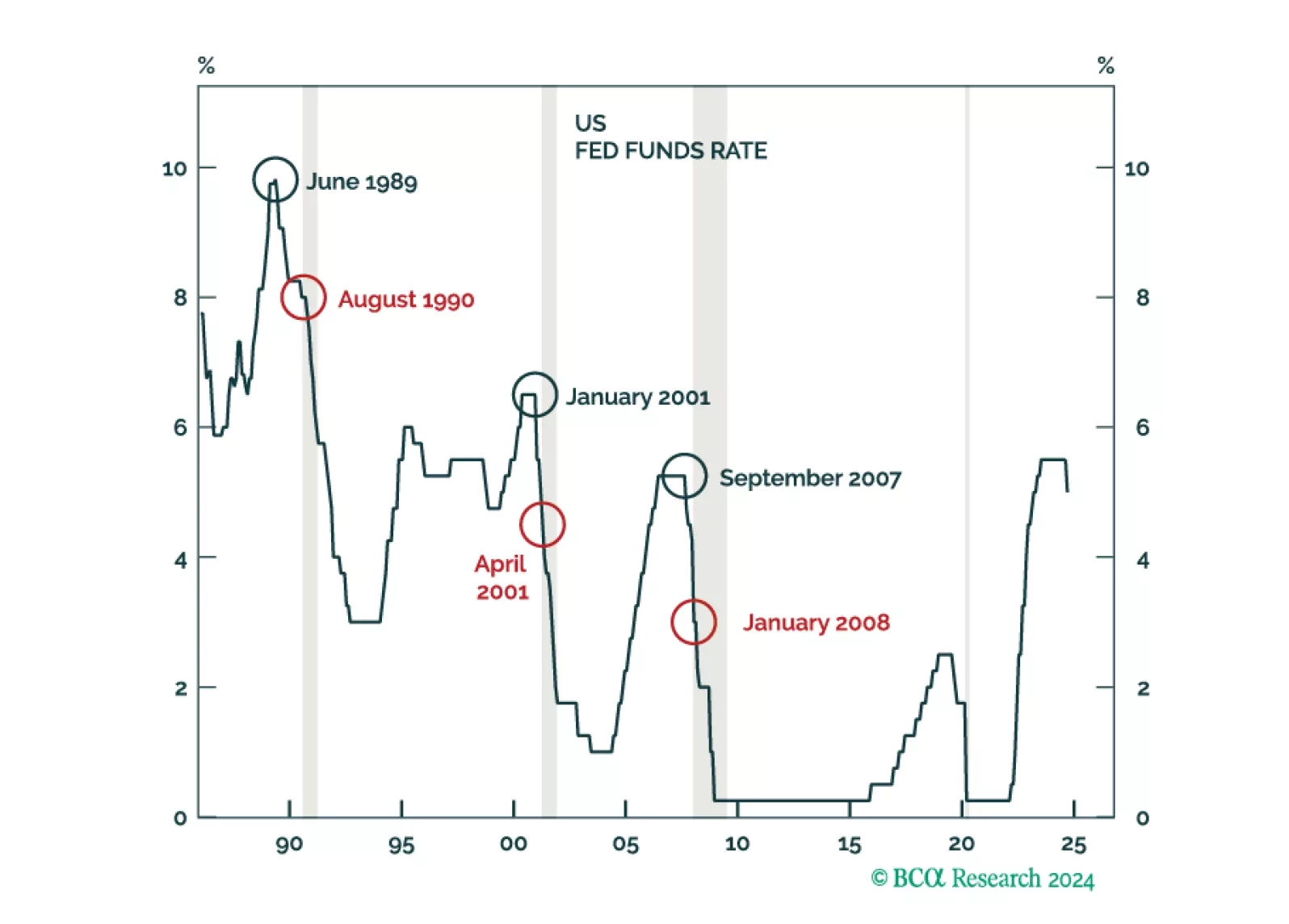

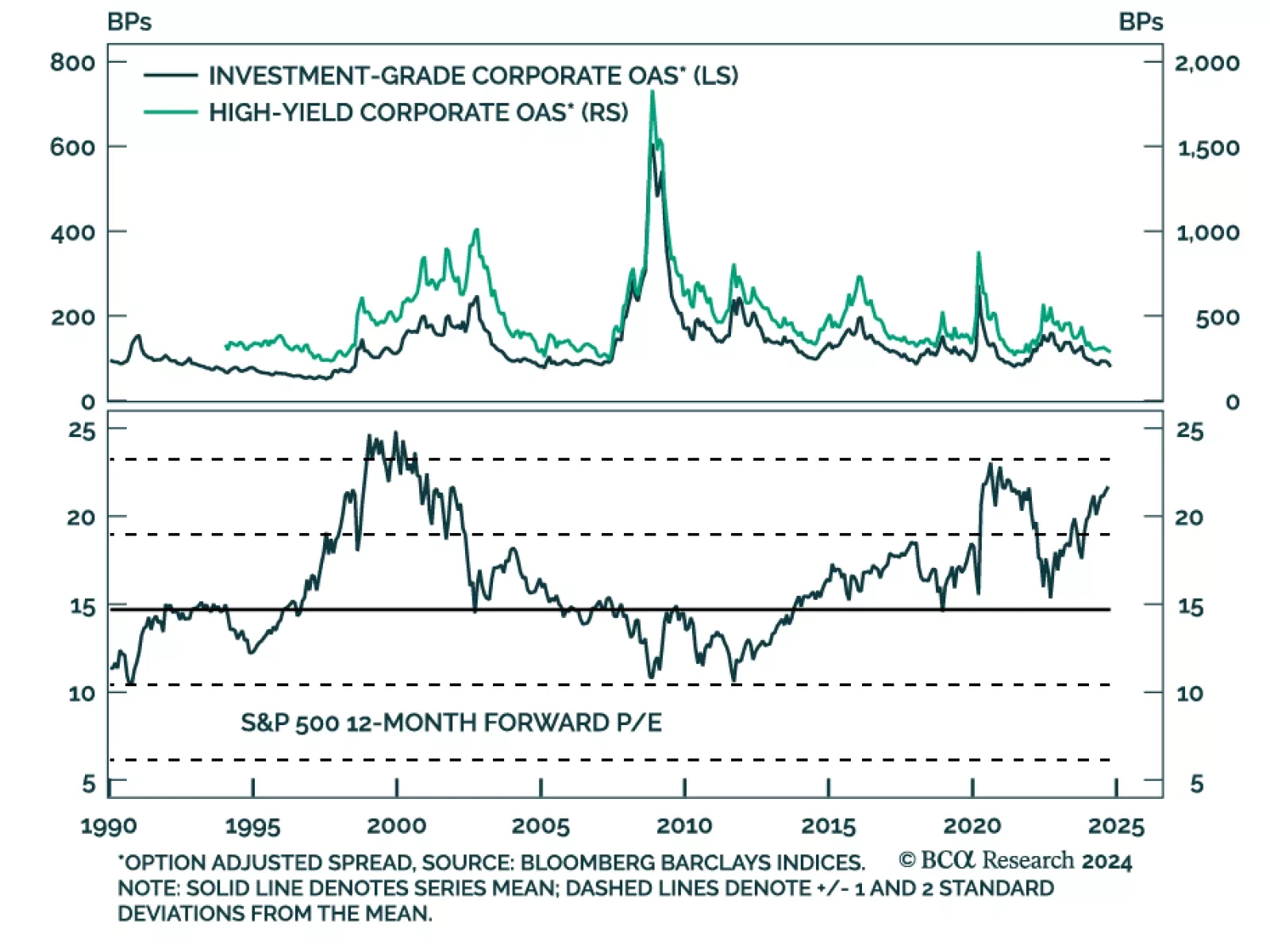

The market got excited by the 50 bps Fed cut and China stimulus. But these are a recognition that economies are slowing significantly. Stocks often rally after the first Fed cut, before falling sharply. Investors should stay defensive.

After resisting the consensus narrative in 2022 that a US recession was imminent, and then predicting an immaculate disinflation for 2023, the Global Investment Strategy team has joined the dark side and is now expecting a recession to start in the US within the next six months. Accordingly, we recommend that investors underweight stocks and overweight government bonds.

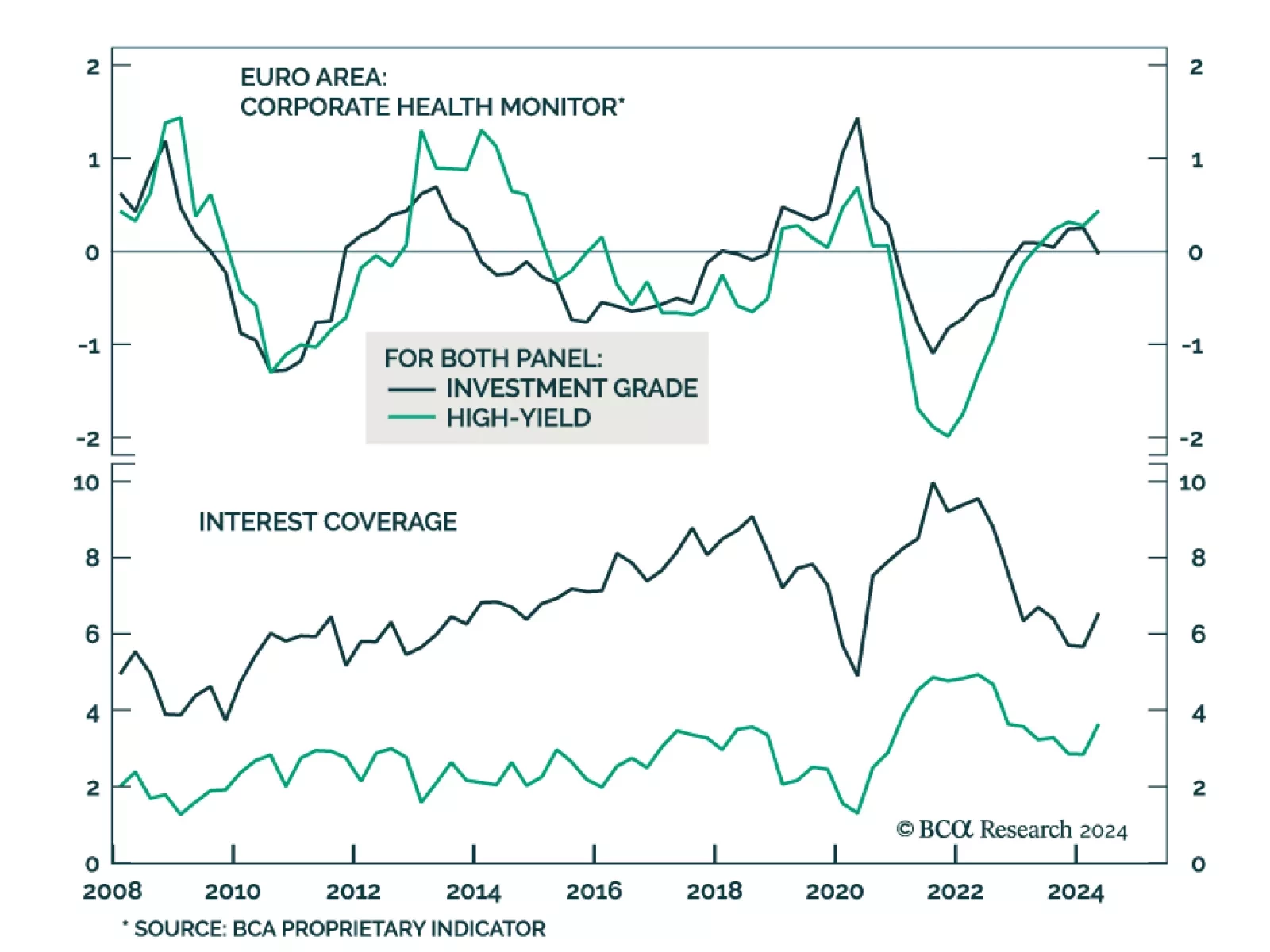

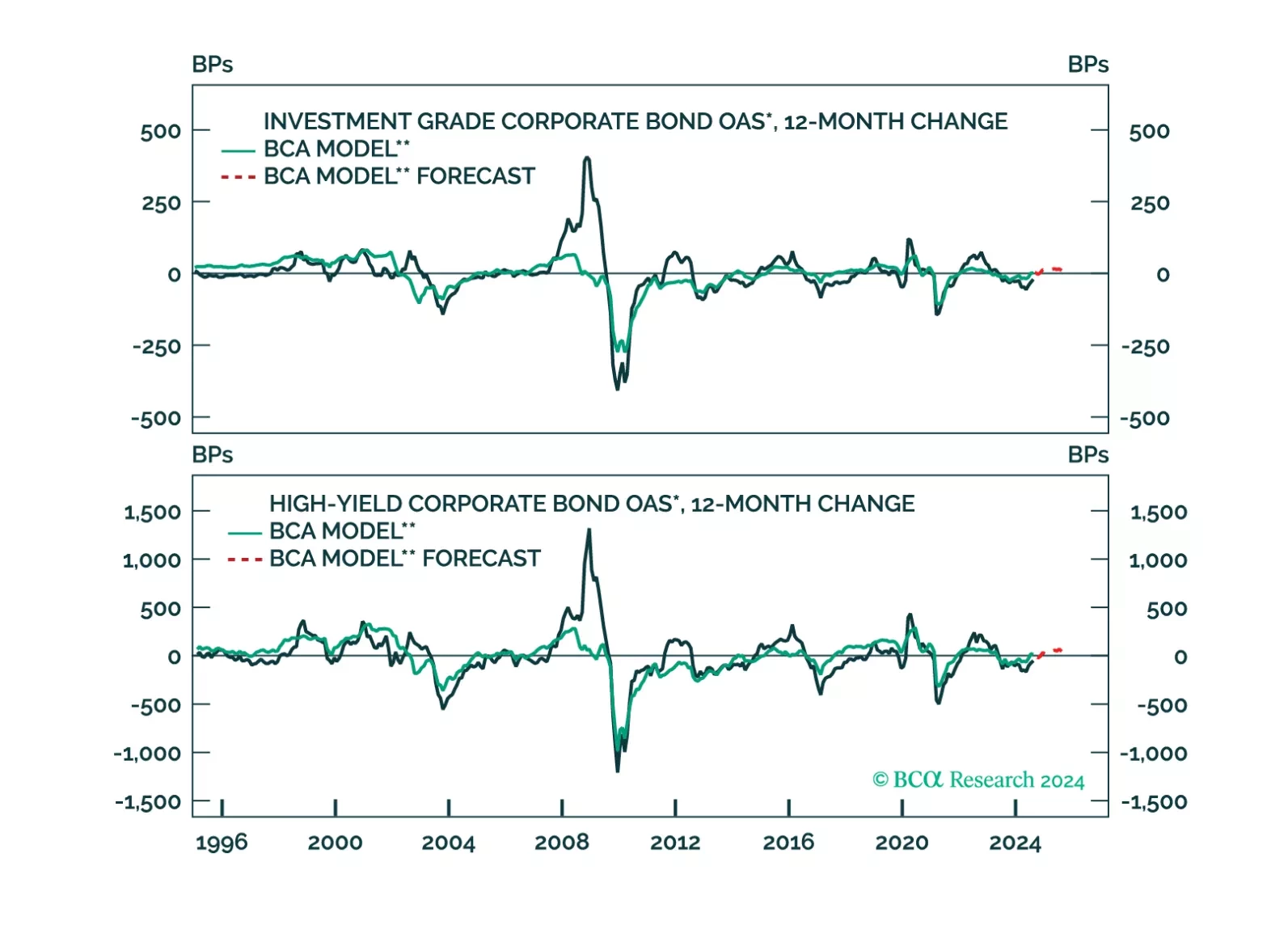

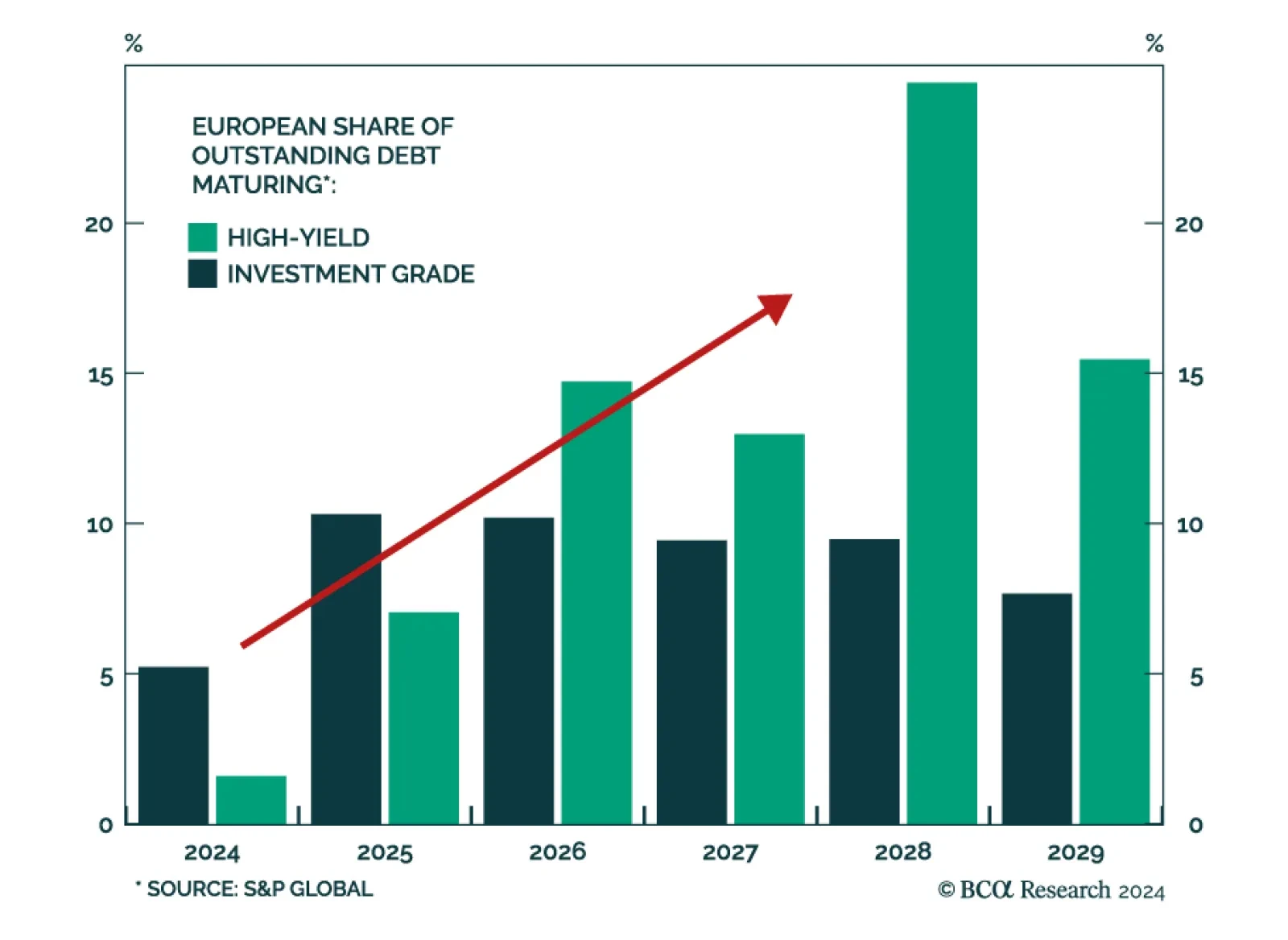

We update our corporate default rate model and consider the implications for corporate bond spreads.

Our Portfolio Allocation Summary for September 2024.