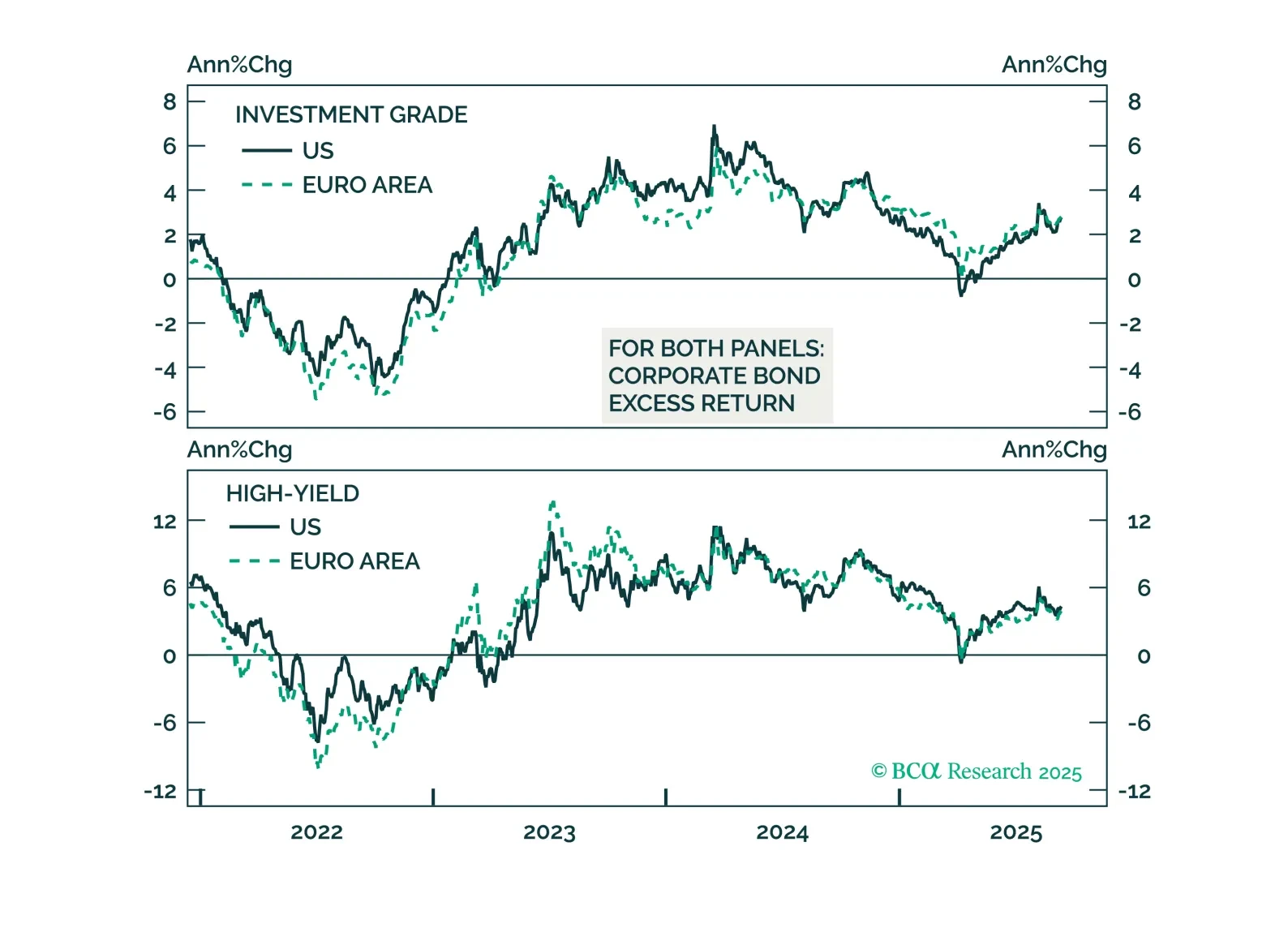

Despite concerns about fiscal sustainability, a rise in term premia, and attacks on central bank independence, monetary policy remains the primary driver of bond markets. In our Q3 Review & Outlook, we update our views and…

Our Portfolio Allocation Summary for October 2025.

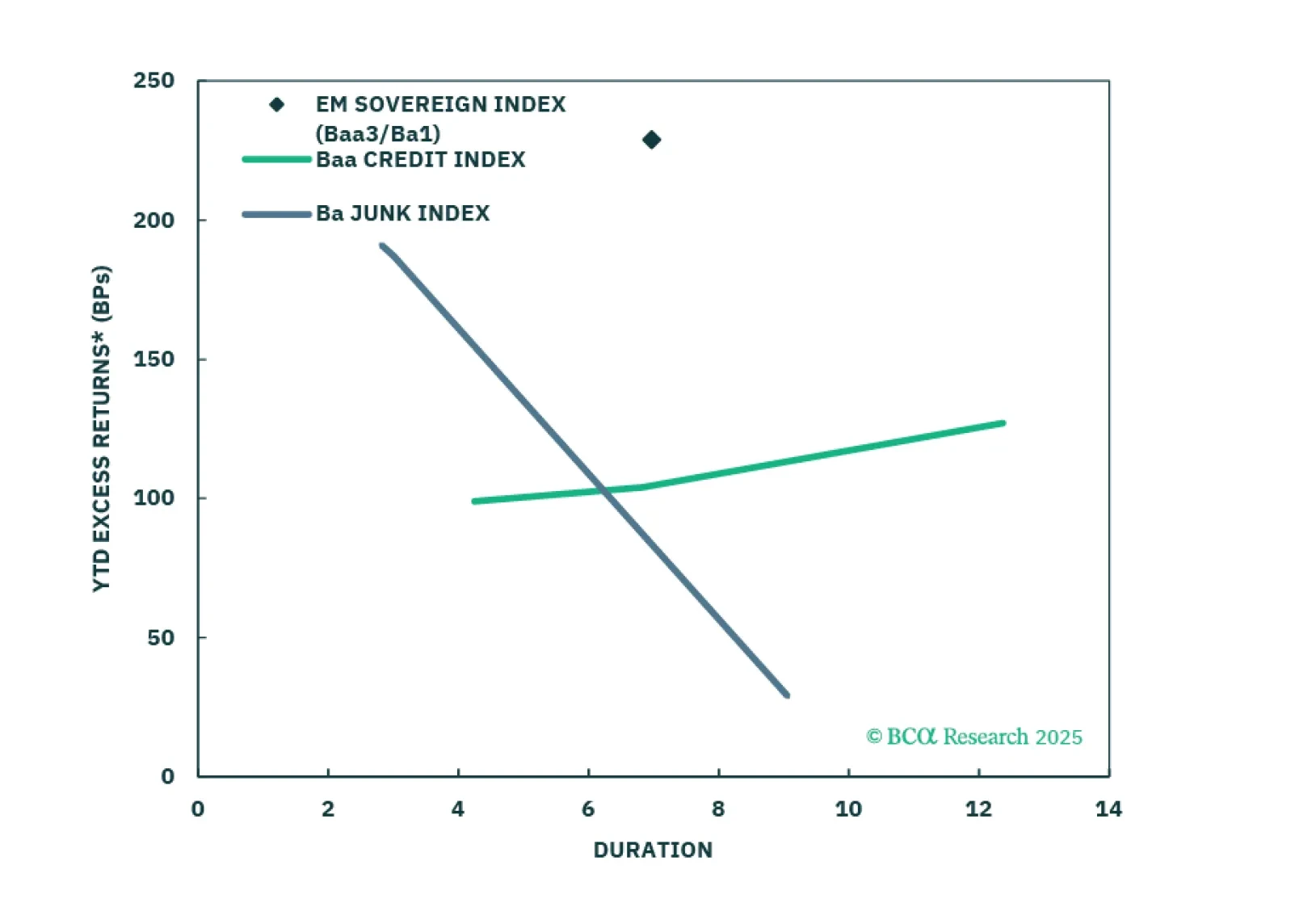

USD-denominated Emerging Market bonds have been outperforming US corporates for the past year. We don’t think the rally is exhausted yet.

Our Portfolio Allocation Summary for September 2025.

Our Portfolio Allocation Summary for August 2025.

Our Portfolio Allocation Summary for July 2025.

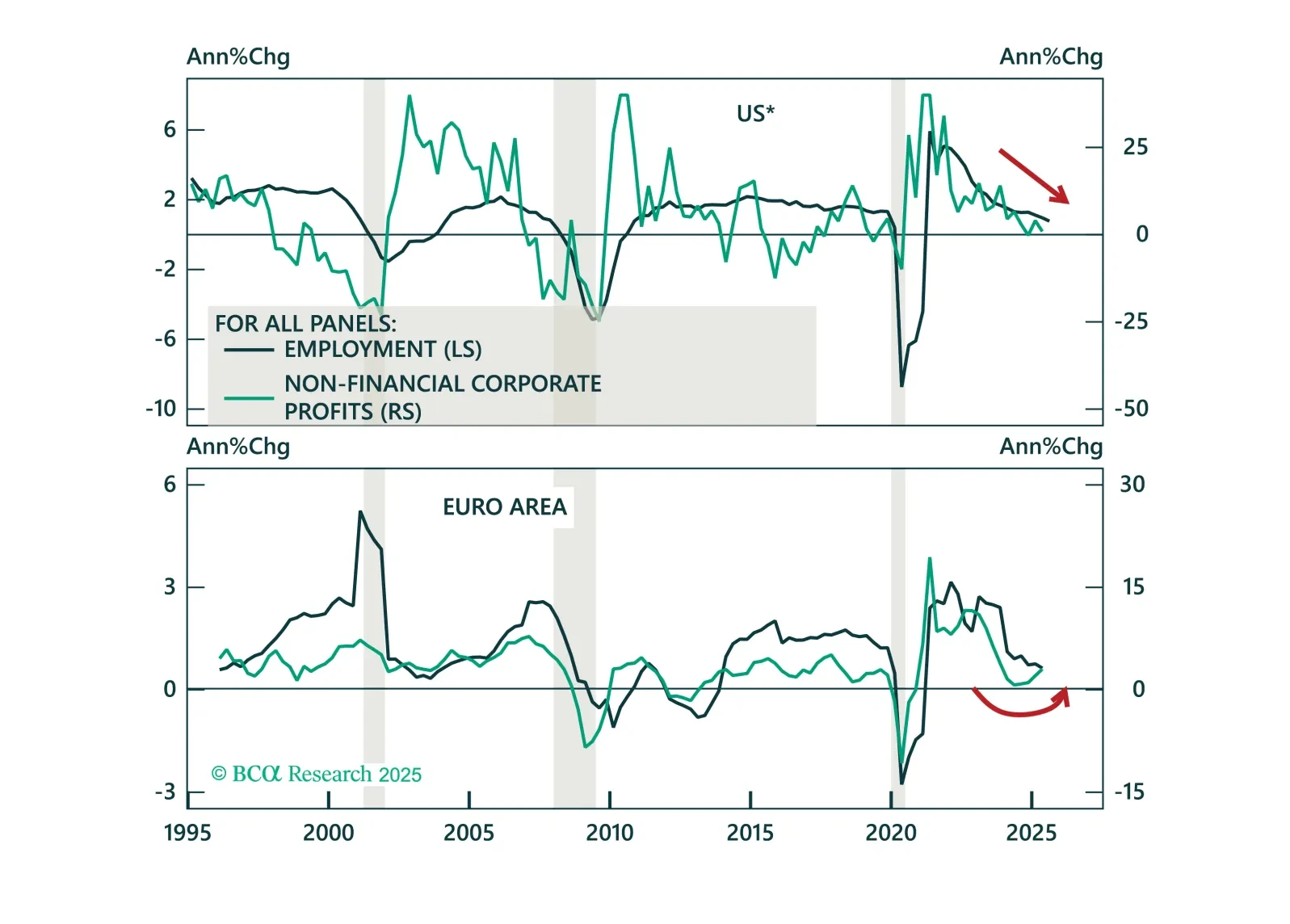

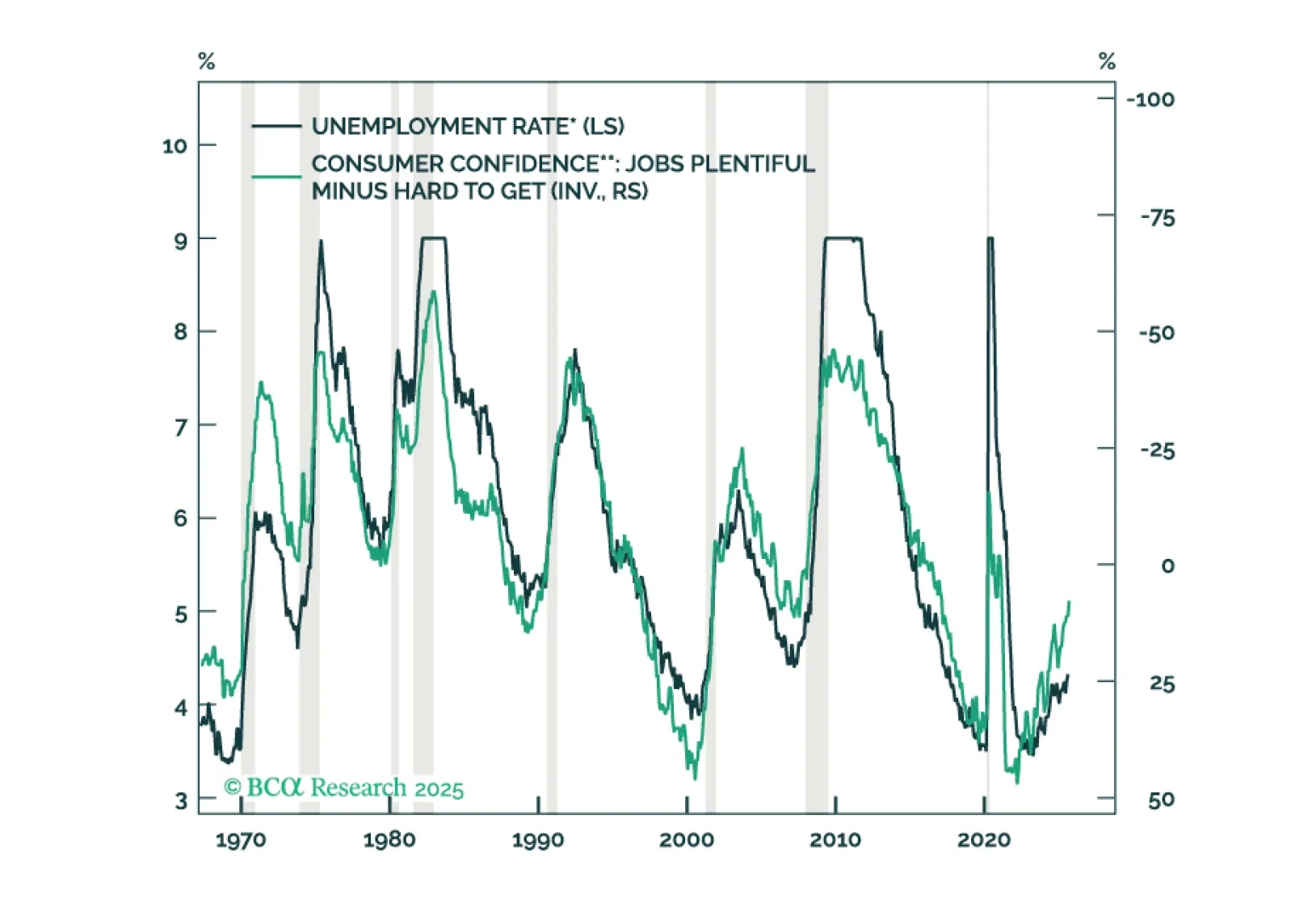

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

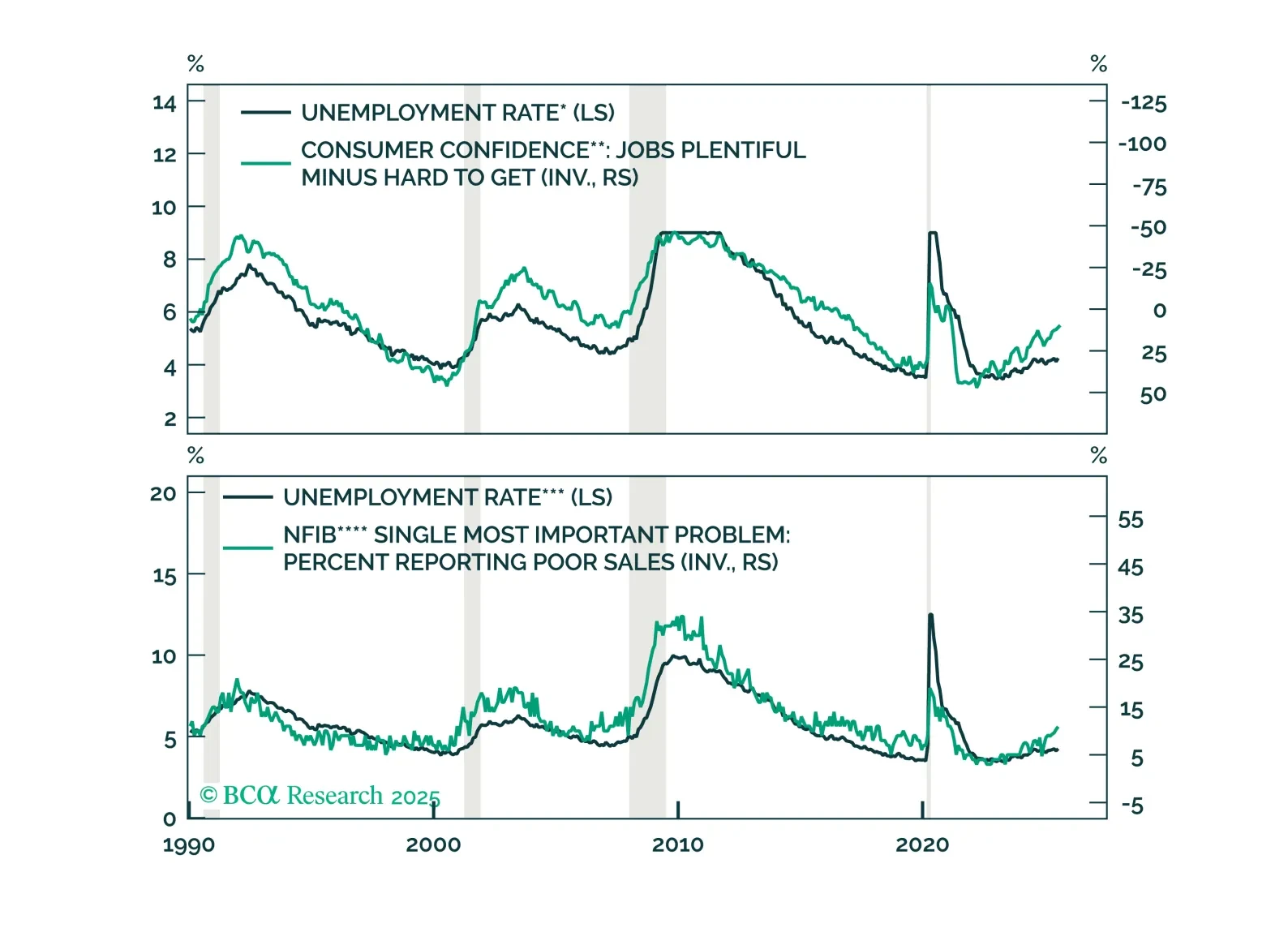

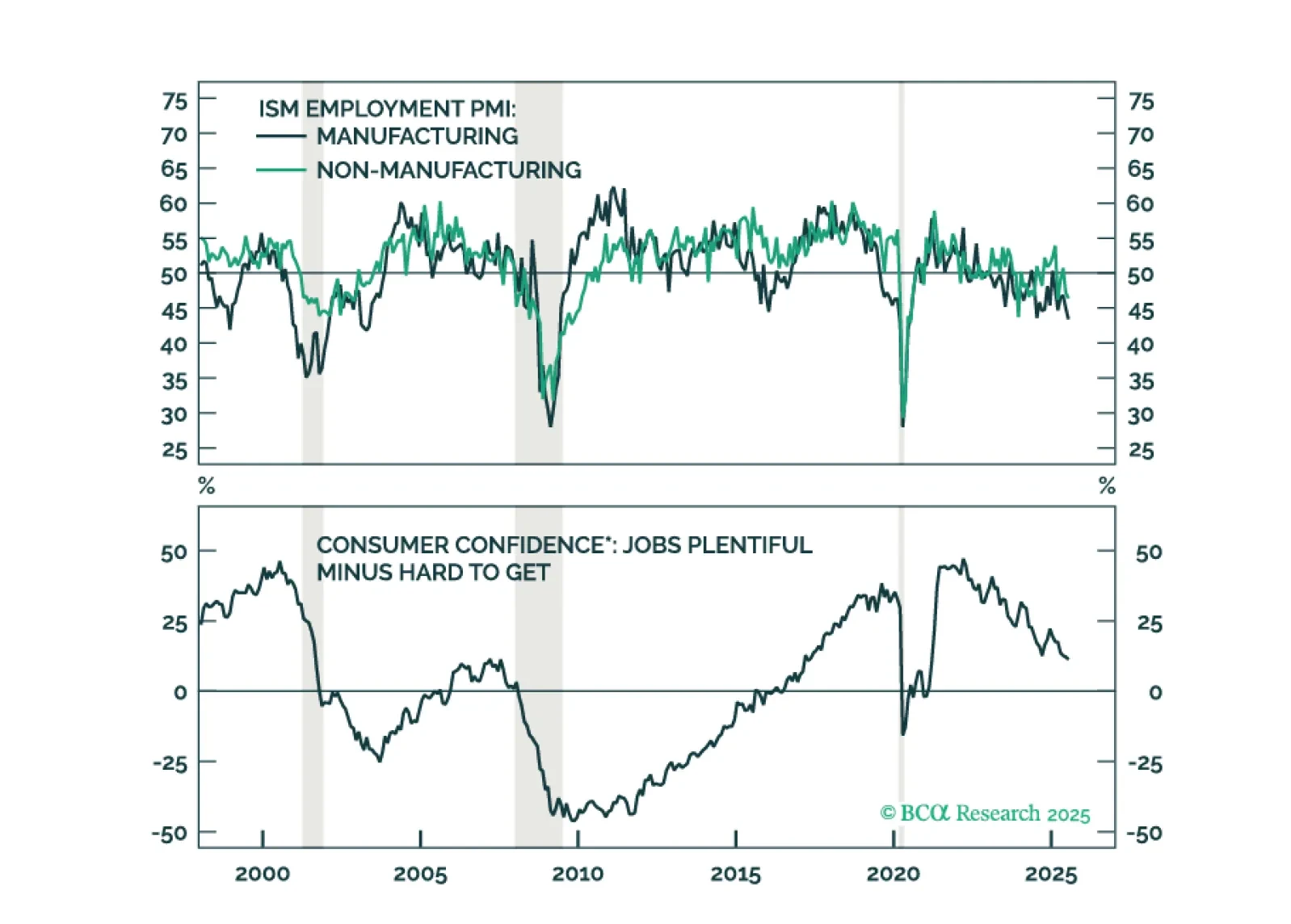

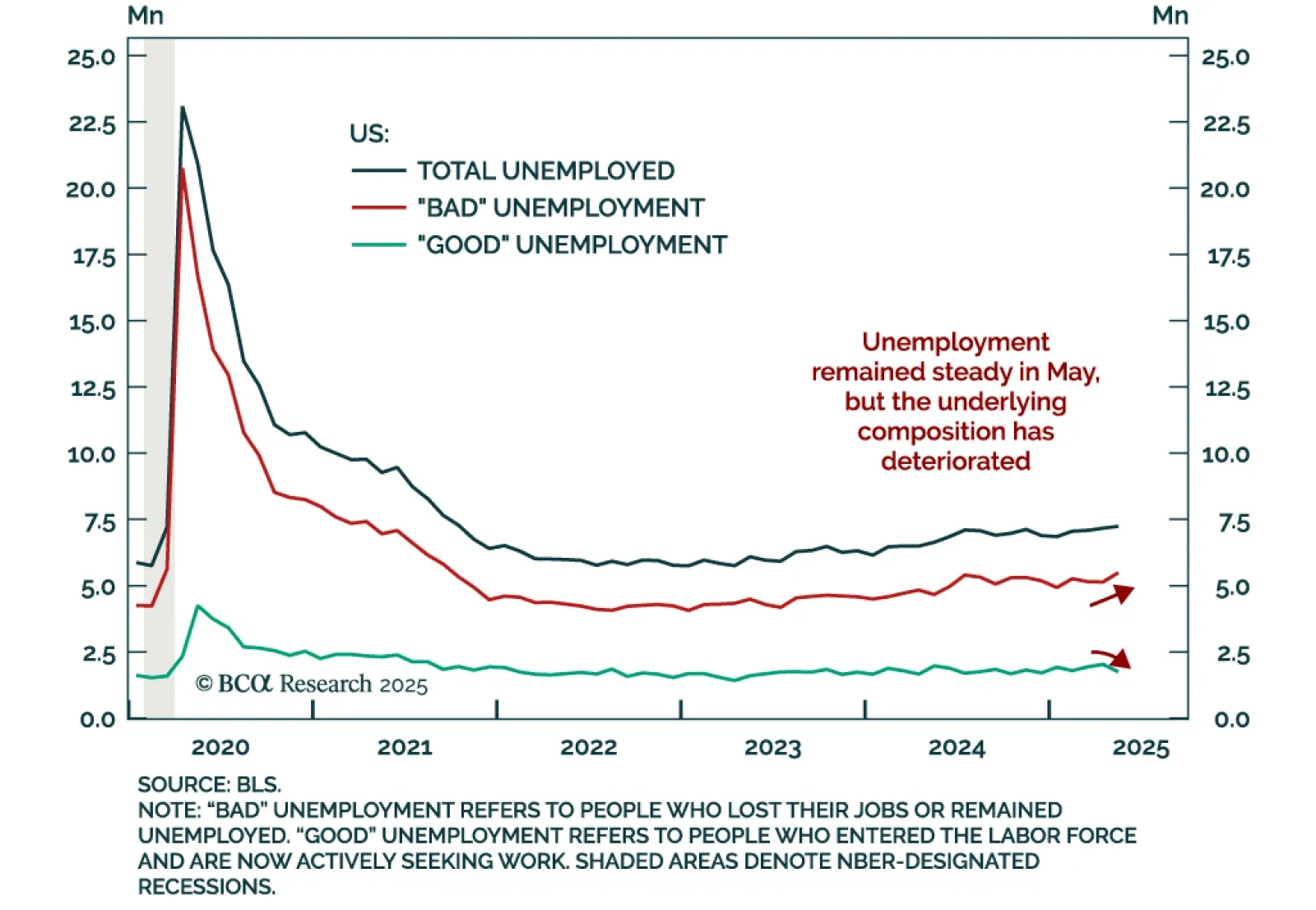

The May US jobs report reinforces our defensive stance as labor momentum is slowing even if not collapsing. Payrolls rose 139k, beating estimates, but decelerating from a downwardly revised 147k. Two-month revisions cut 95k jobs,…

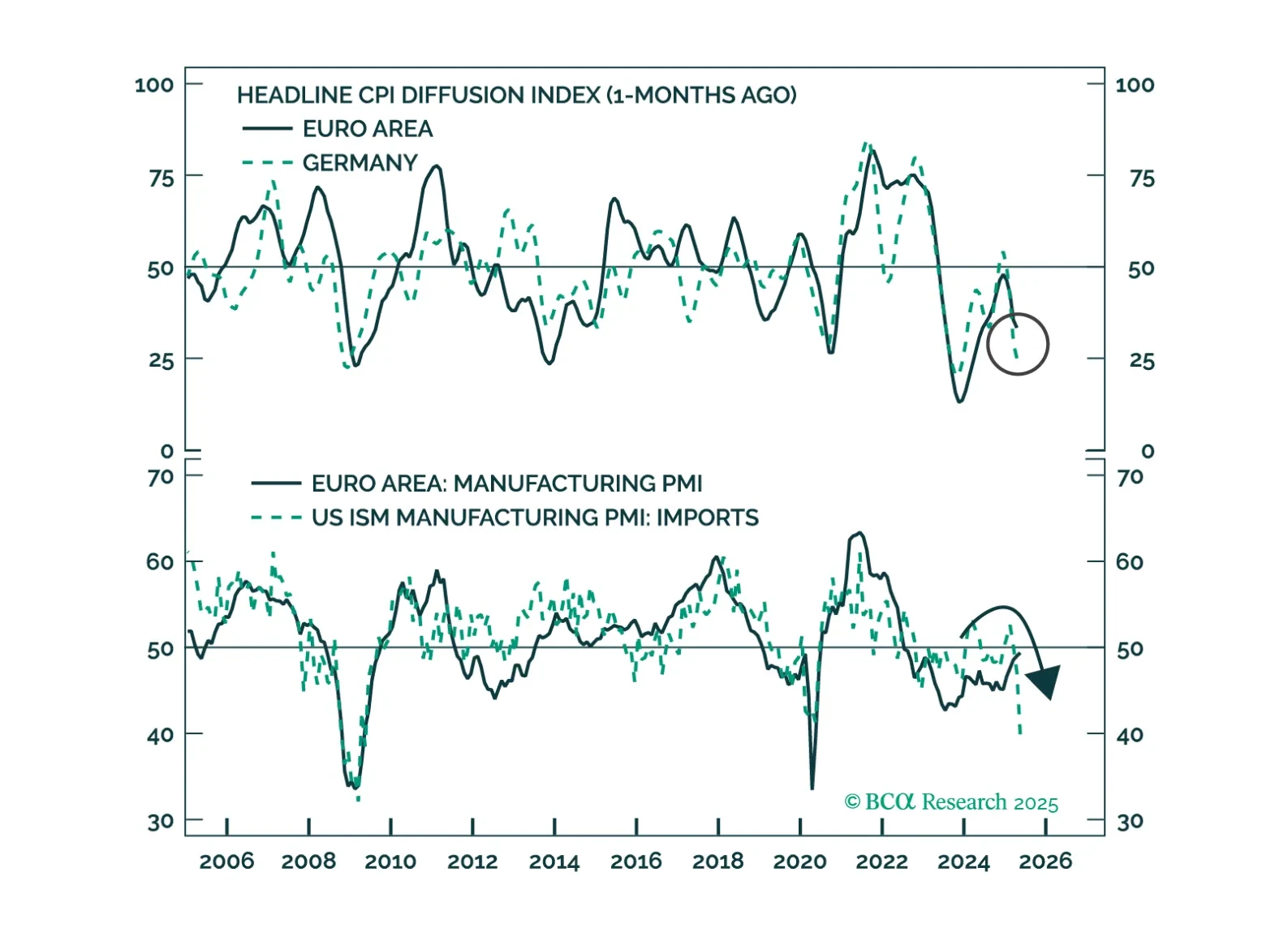

The ECB is changing its tone, but don’t call it a pivot. Slower cuts, sticky disinflation, and a soft growth patch shift the opportunity set. We break down the tactical bond trades and why EUR/USD dips are still for buying.