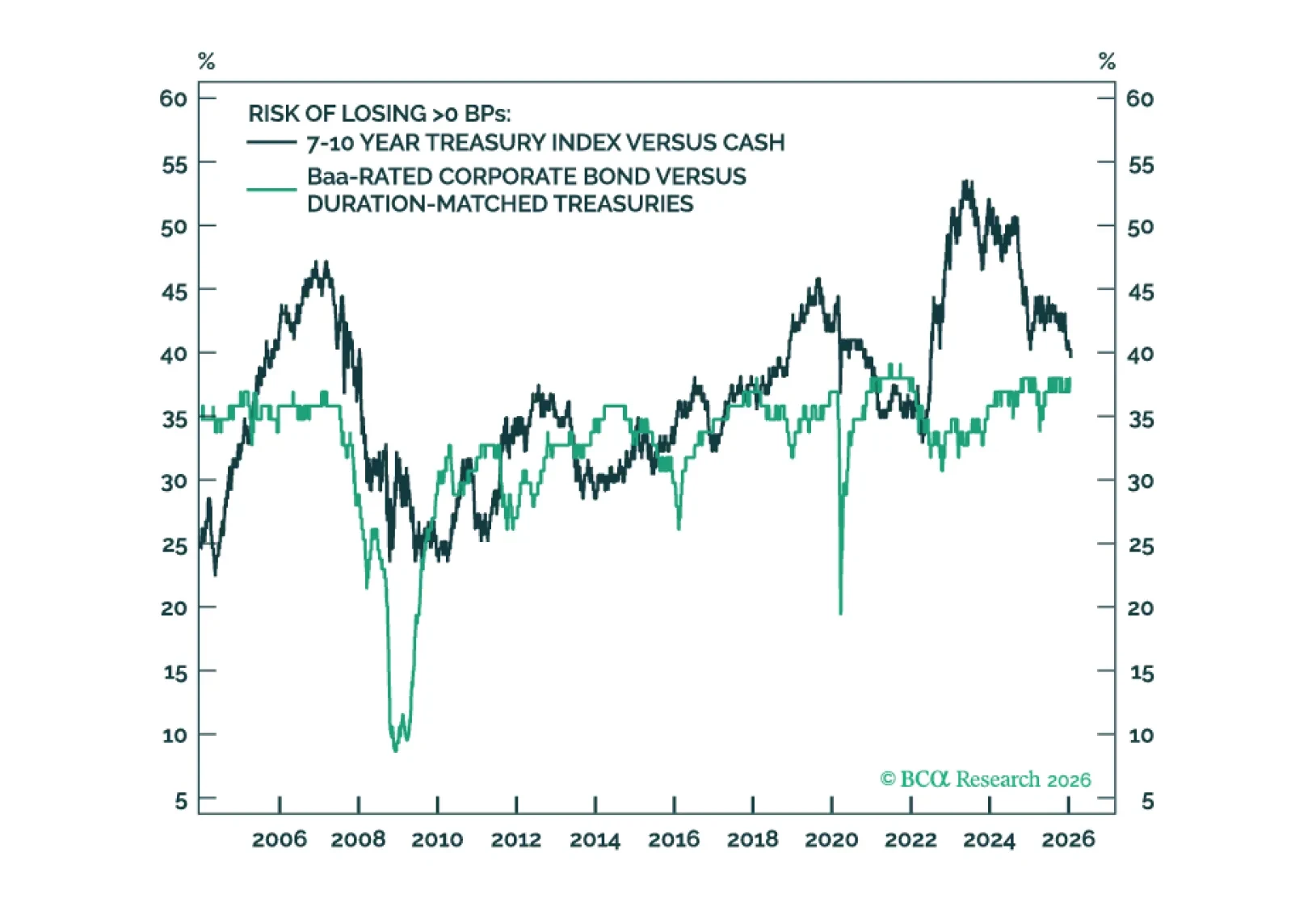

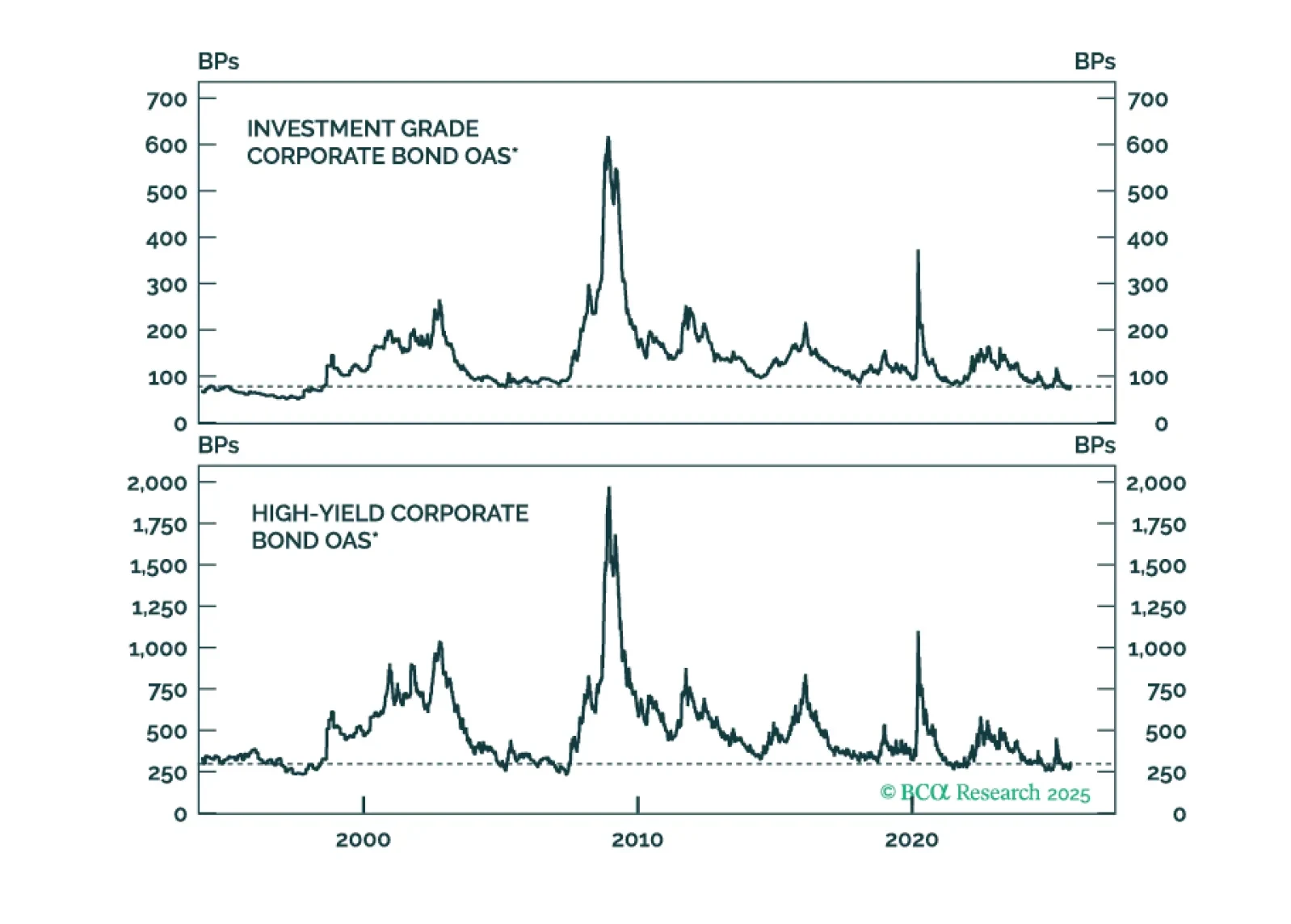

The 10-year Treasury term premium is now competitive with Baa- and Ba-rated credit spreads. Even without term premium compression, duration carry trades could outperform credit carry trades in a low rate vol environment.

Our Portfolio Allocation Summary for January 2026.

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

Our Portfolio Allocation Summary for December 2025.

Our Portfolio Allocation Summary for November 2025.

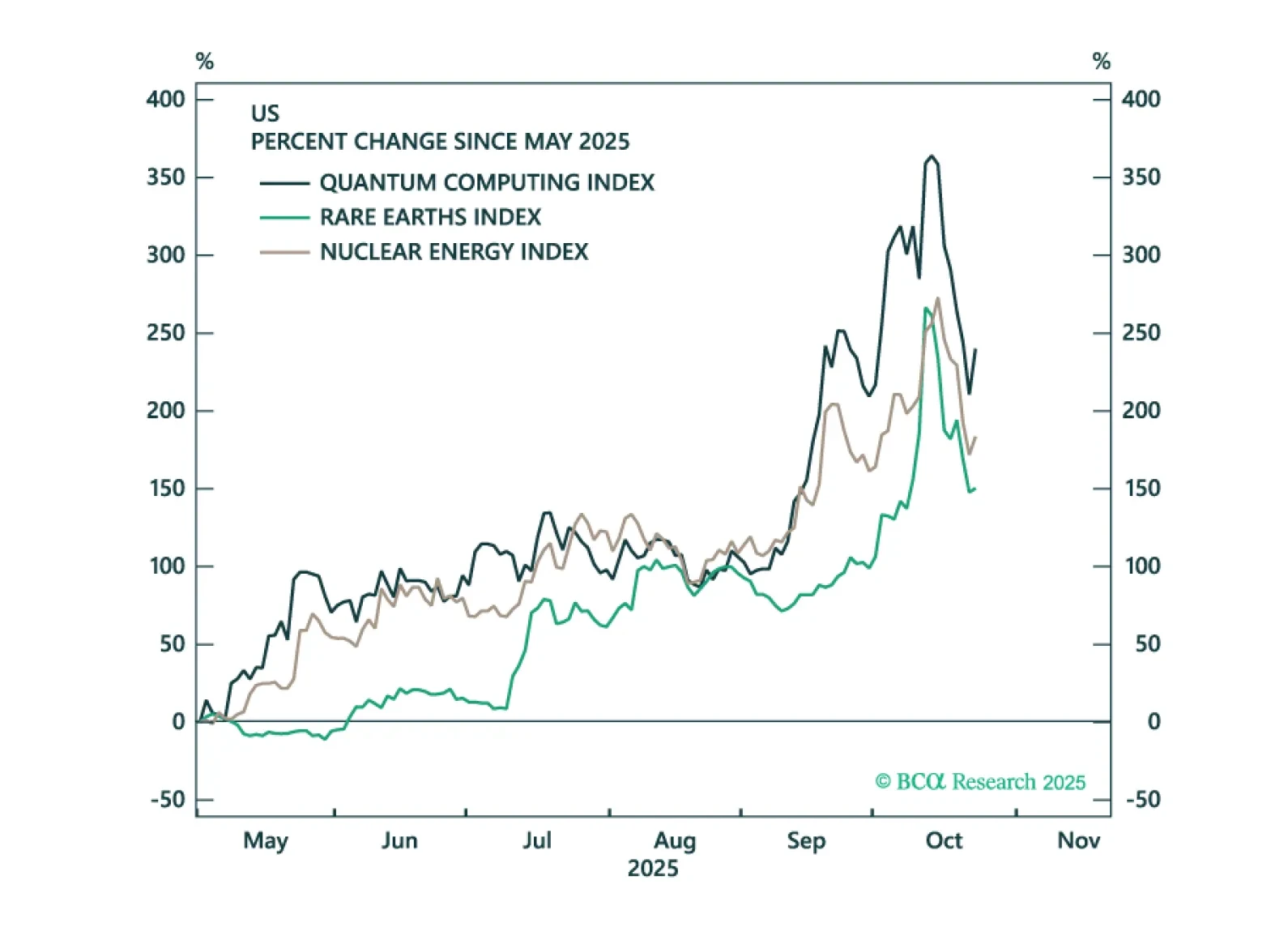

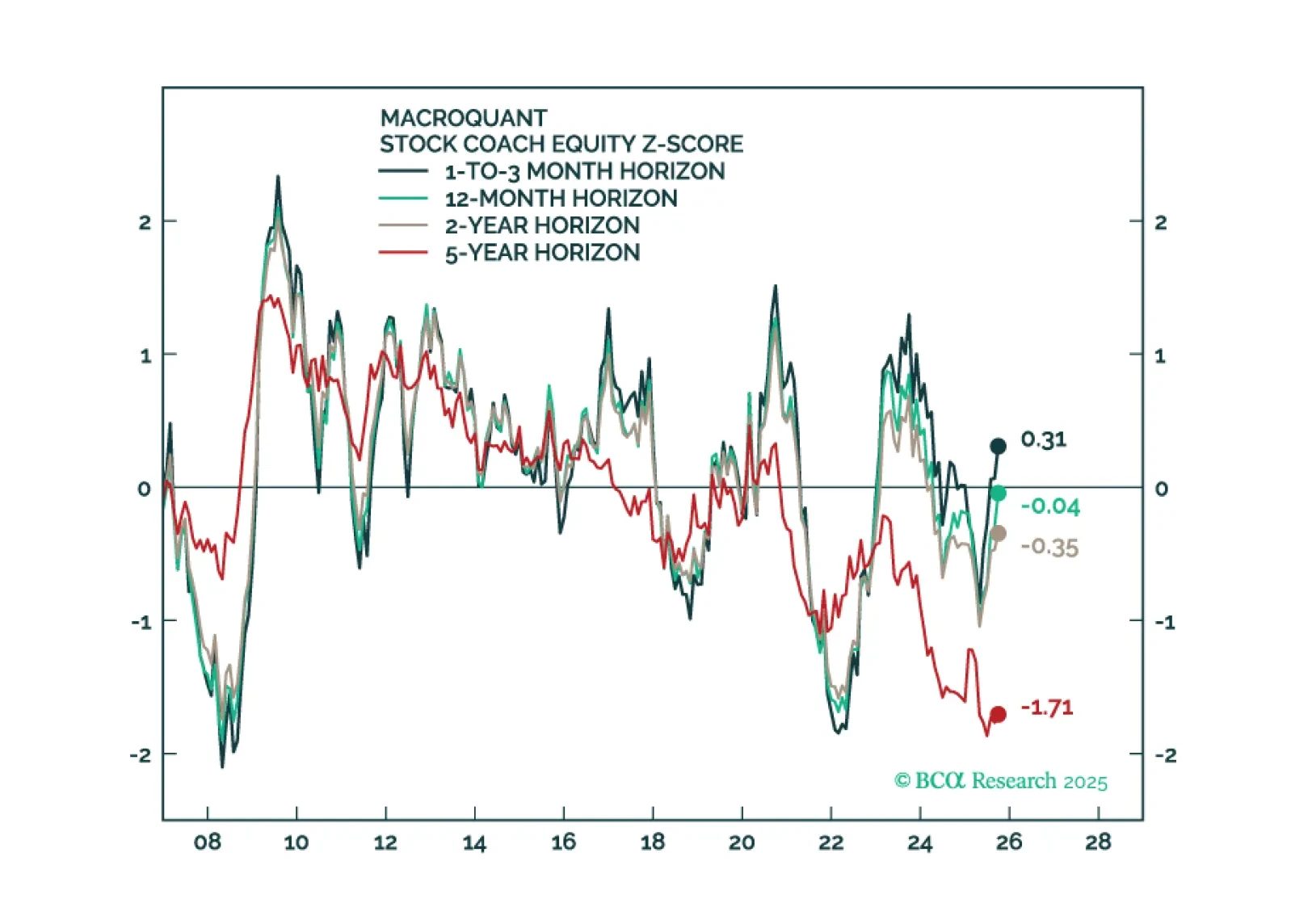

Precious metals, corporate credit, and tech stocks are all showing signs of late-cycle euphoria. We identify various trigger points that investors should monitor to turn more bearish.

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…