Today’s report recaps last week’s webcast and elaborates on its themes, delving into the empirical evidence underpinning our conviction that asset allocators should underweight equities sparingly and fleetingly. We remain tactically…

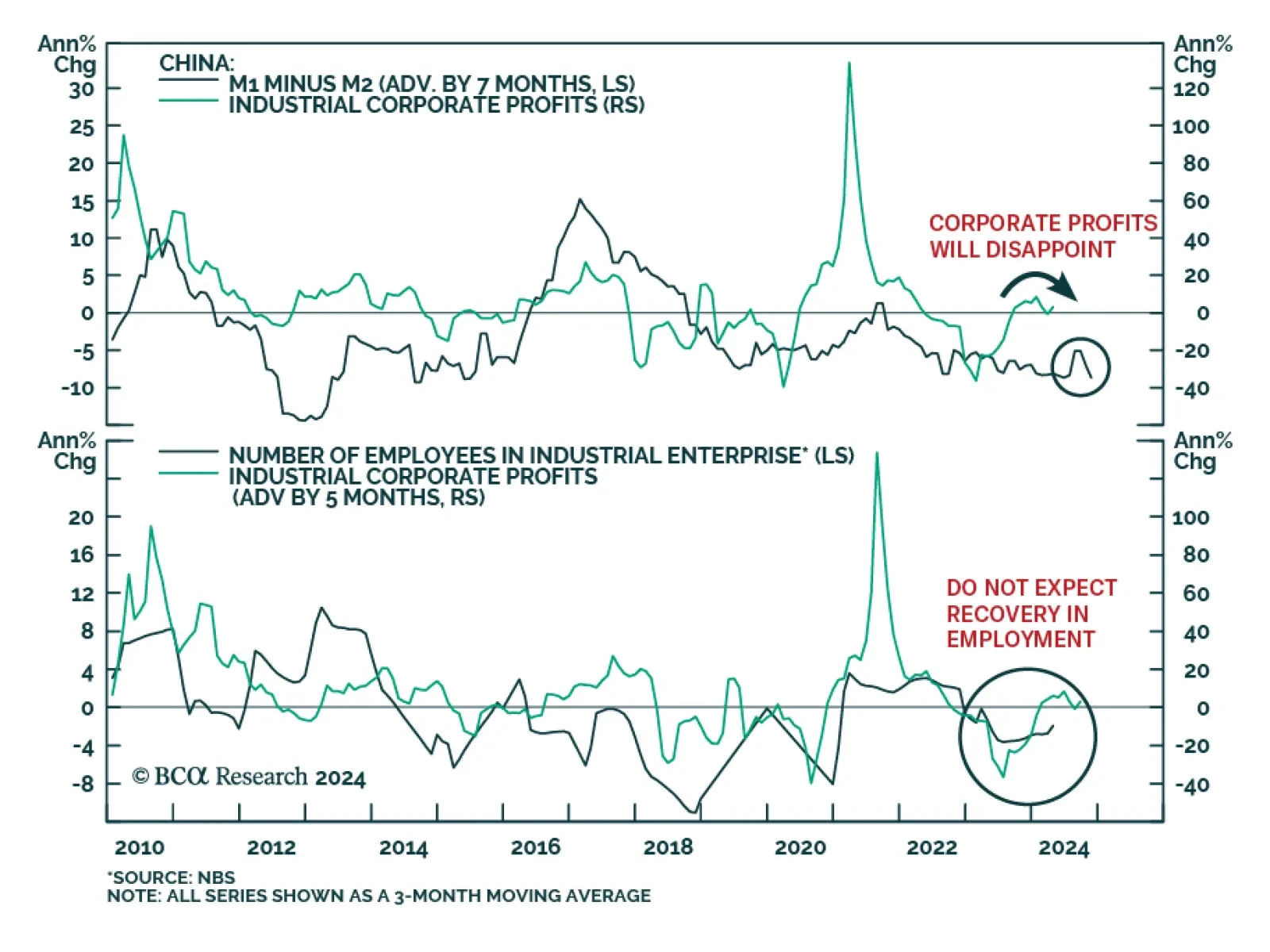

As in many other countries, China’s cyclical consumption growth is primarily driven by labor market conditions, income, and borrowing. BCA Research’s China Investment Strategy service maintains the view that these…

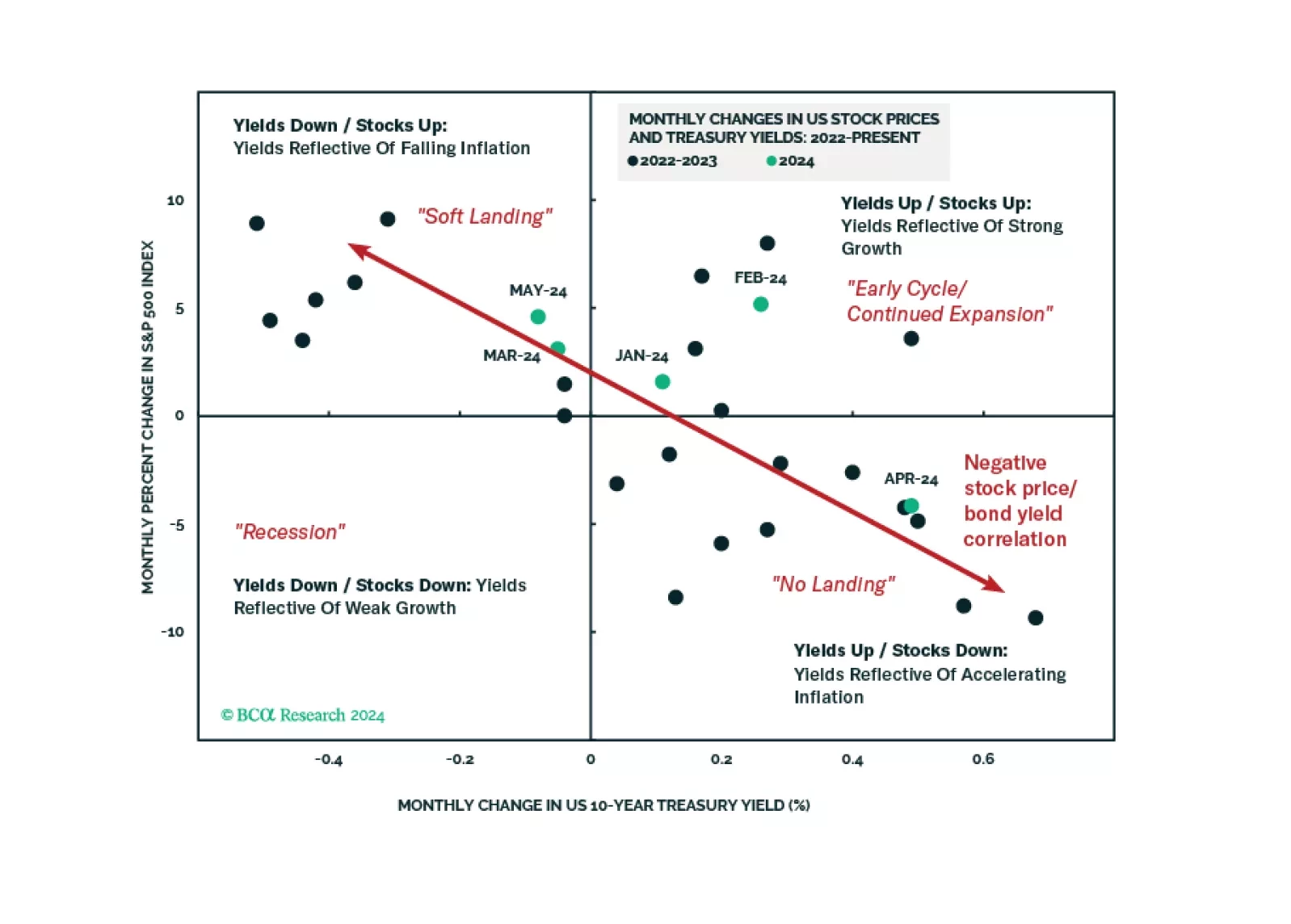

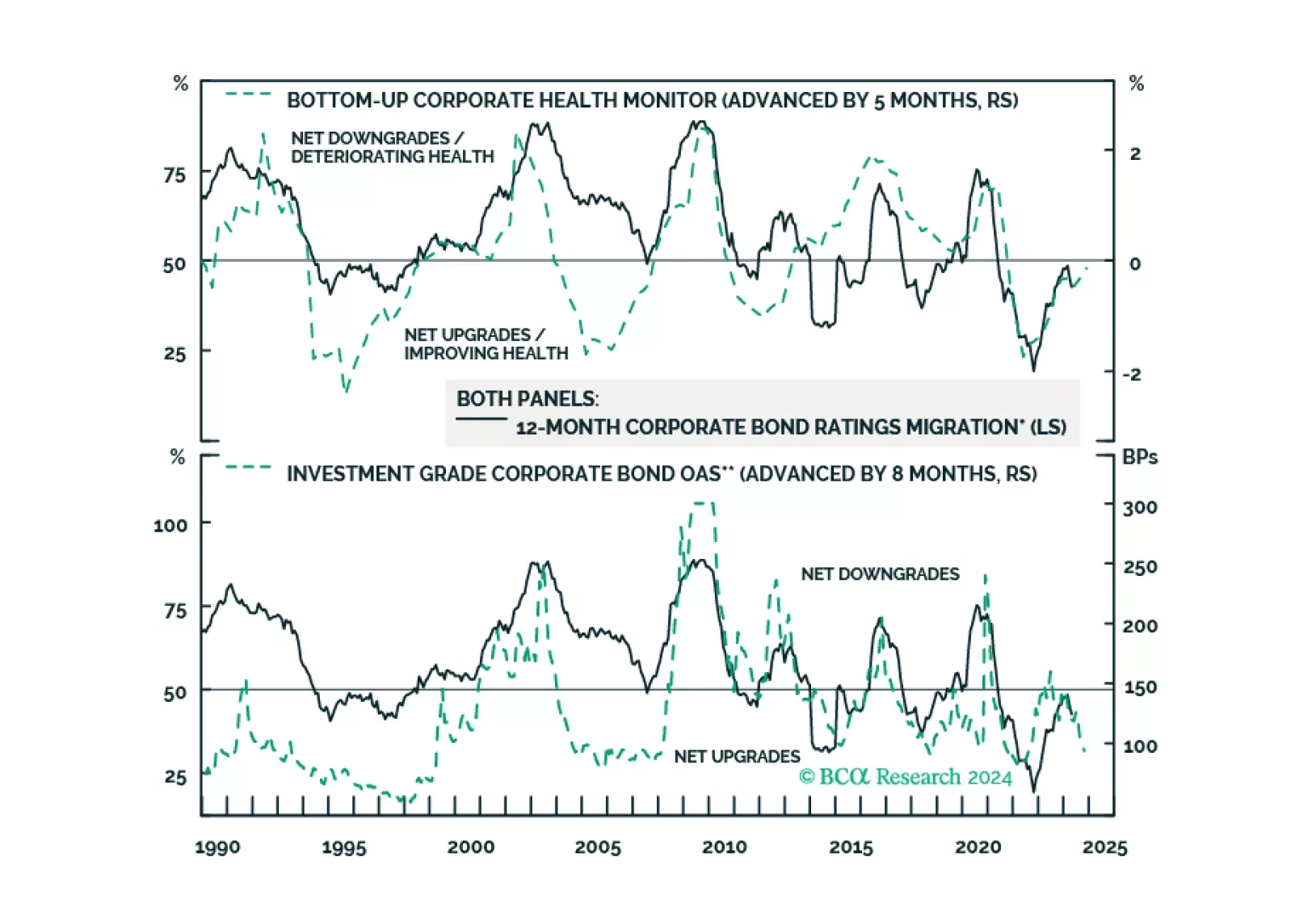

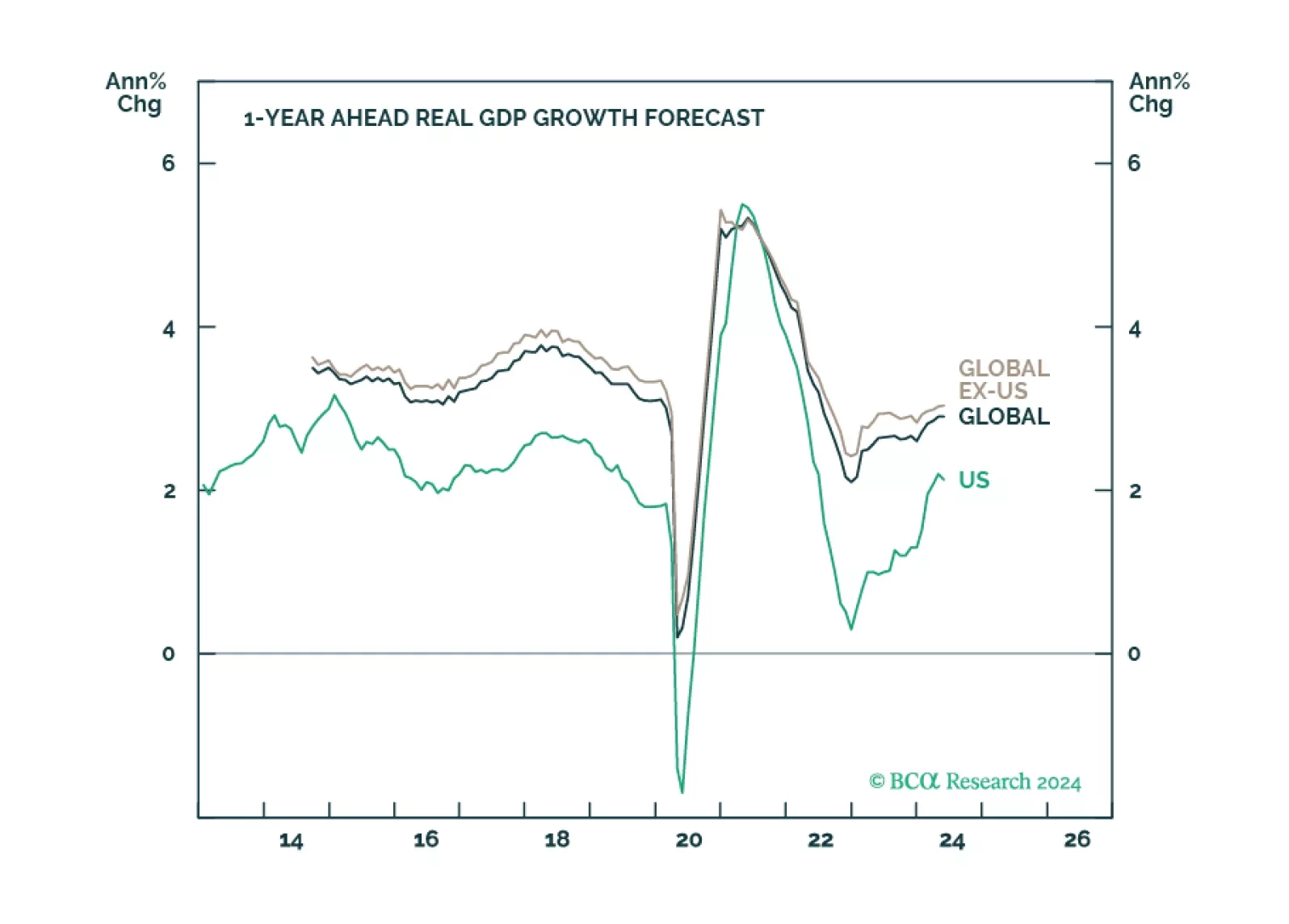

In Section I, we argue that global investors have been lulled into a false sense of security concerning the resiliency of the US economy. Tight monetary policy means that something must change for a recession to be avoided, and…

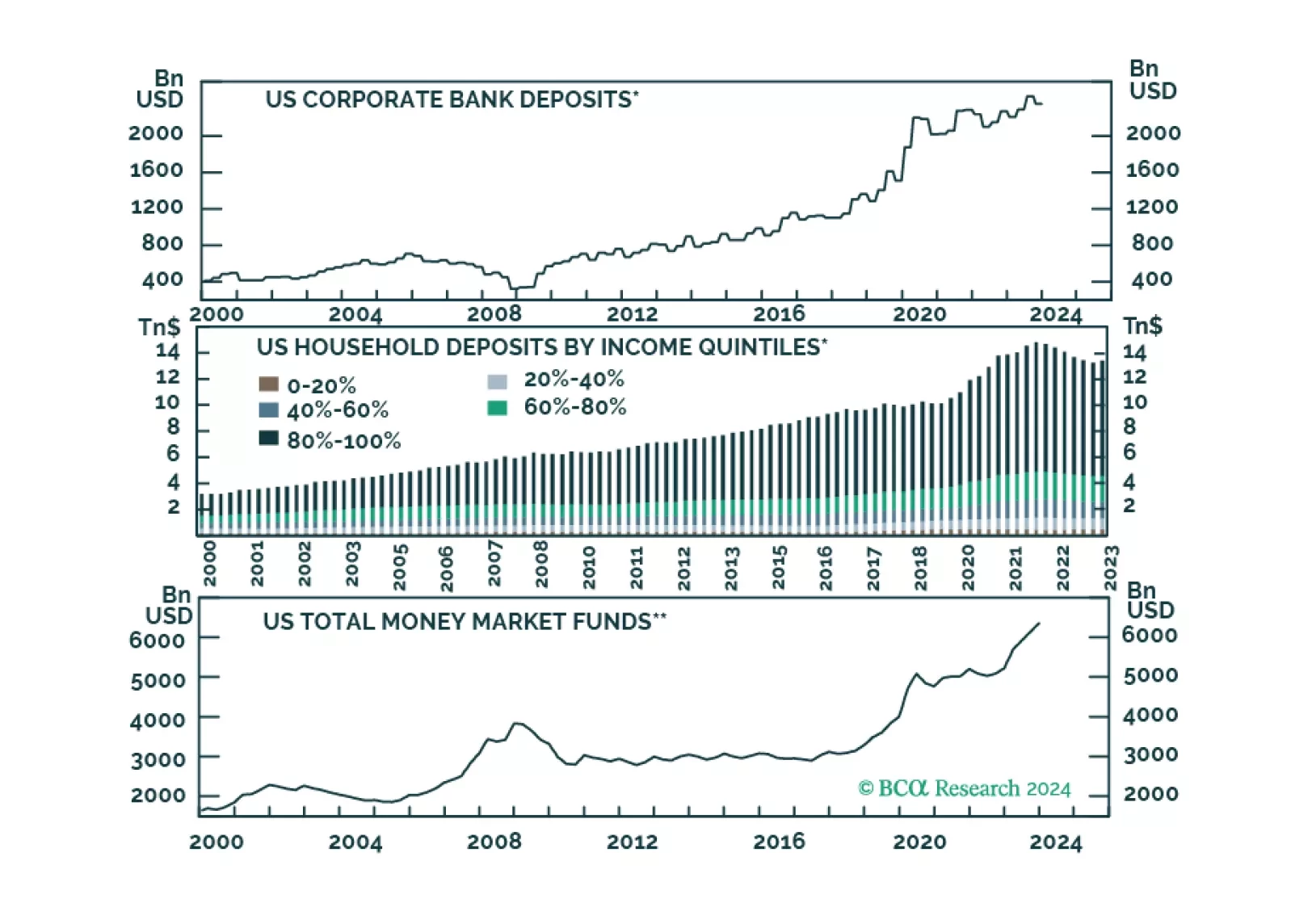

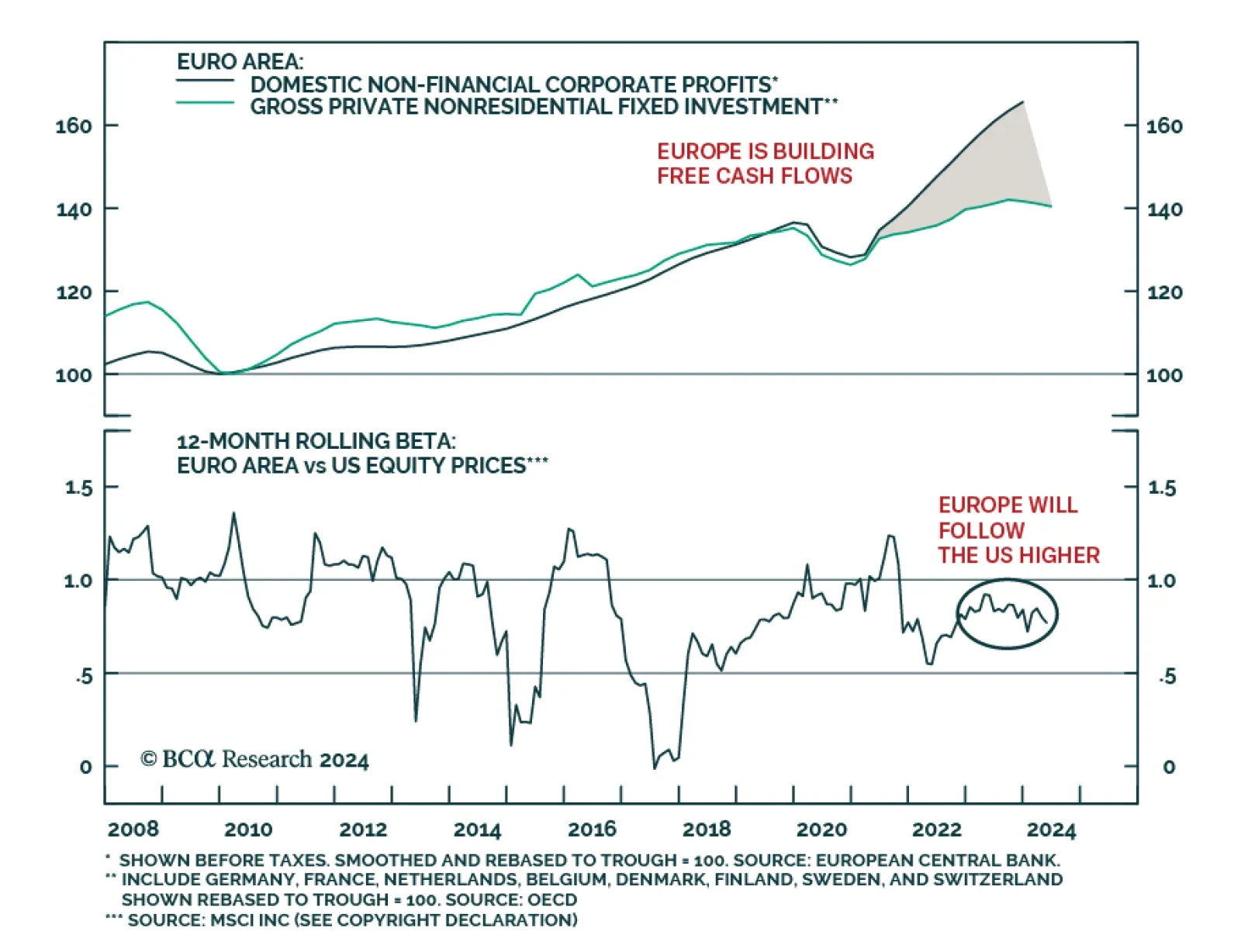

According to BCA Research’s European Investment Strategy service, the money sloshing around the financial system from pandemic-era stimulus measures disconnects near-term prospects for growth from risk asset prices. As a…

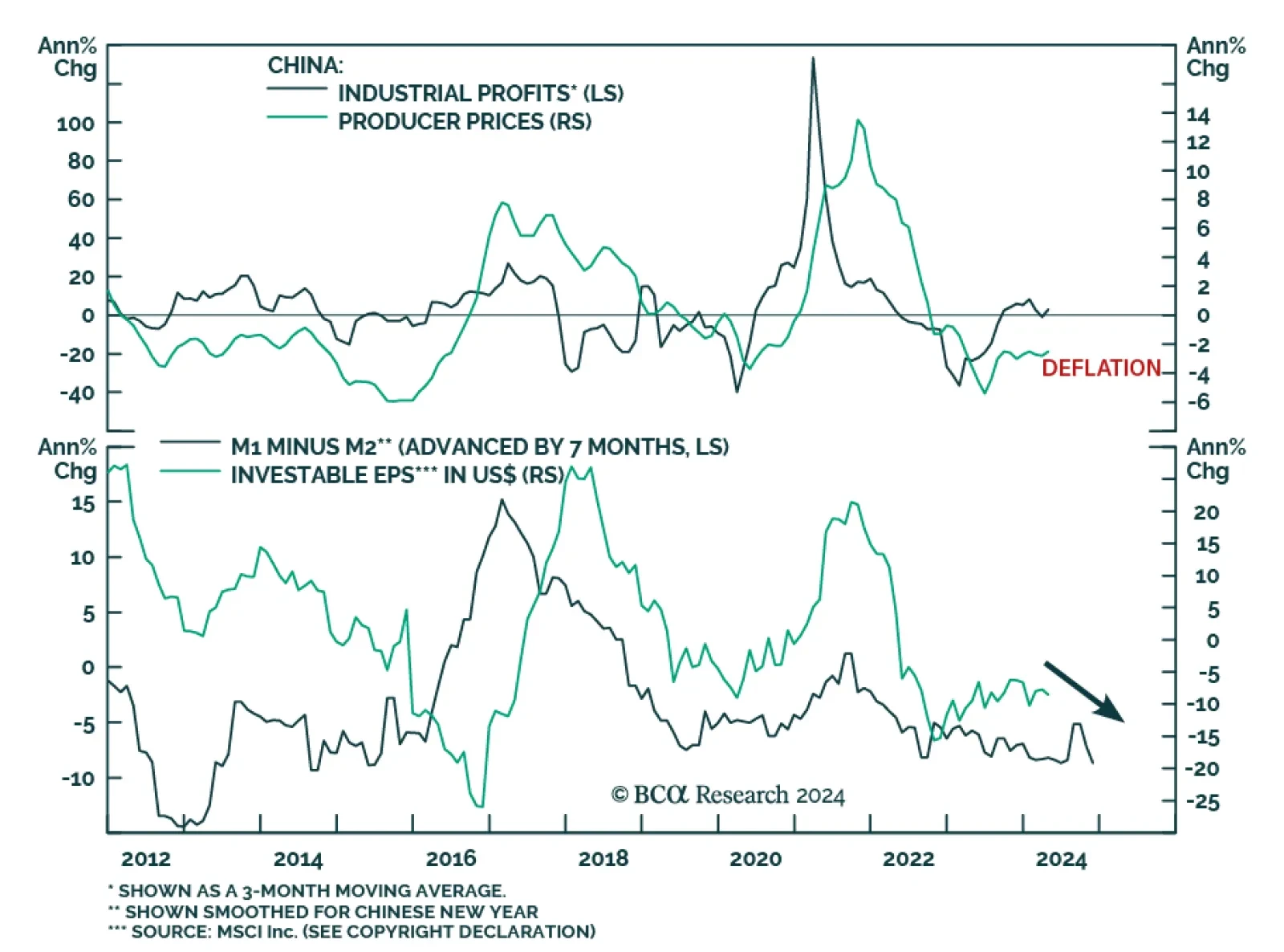

Chinese industrial profits rose by 4.0% y/y in April, from a 3.5% y/y contraction in March. They grew by 4.3% in the first four months of the year, compared to the same period in 2023. In March, the central government pledged…

Looking at economic activity, global monetary policy seems restrictive, however, the behavior of financial markets tells a different story. What gives?

There is a path to a soft landing, but it is a narrow one. We estimate that there is only a 20% chance that the US will avoid a recession before the end of 2025. We are currently neutral on global equities, but expect to downgrade…

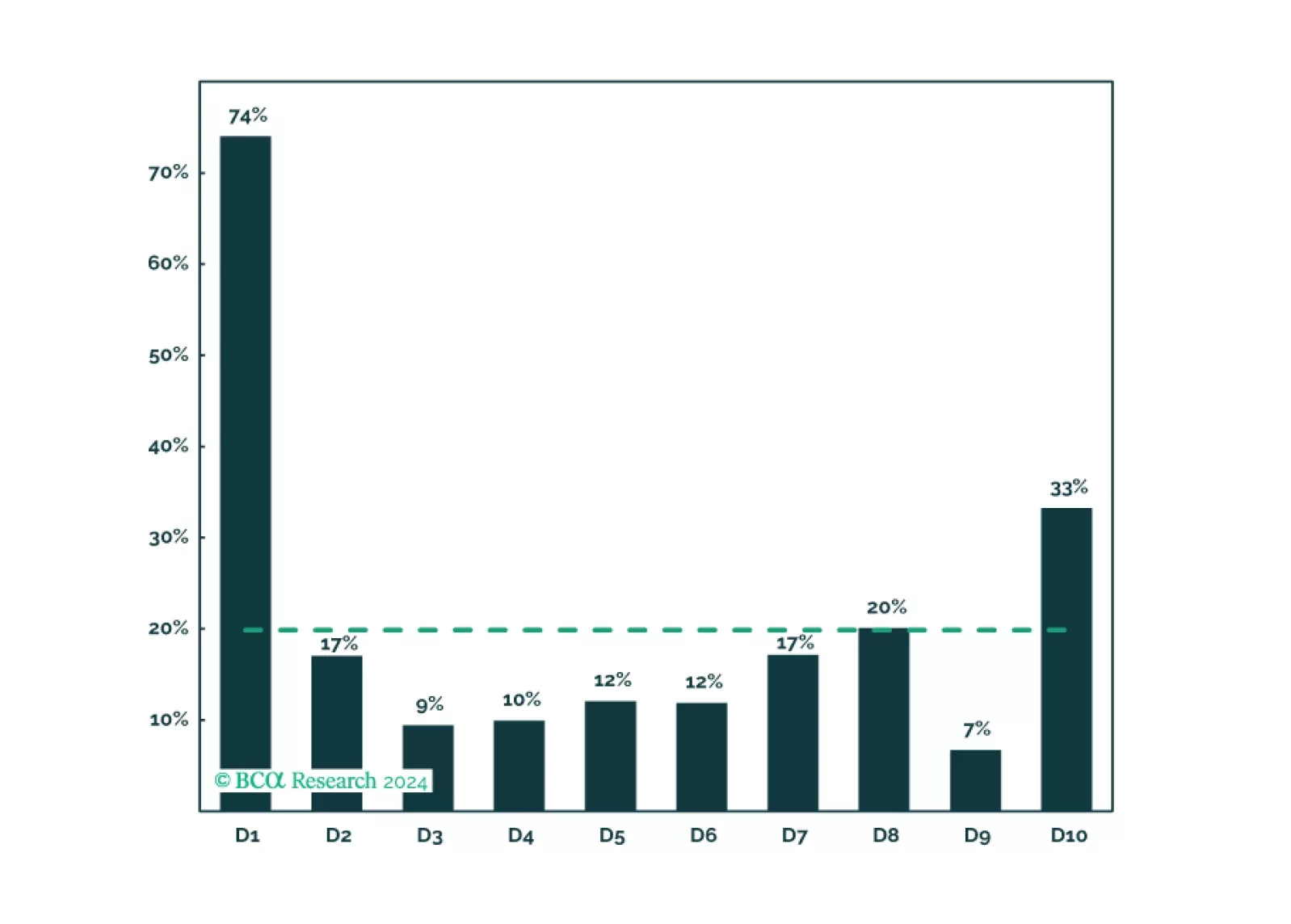

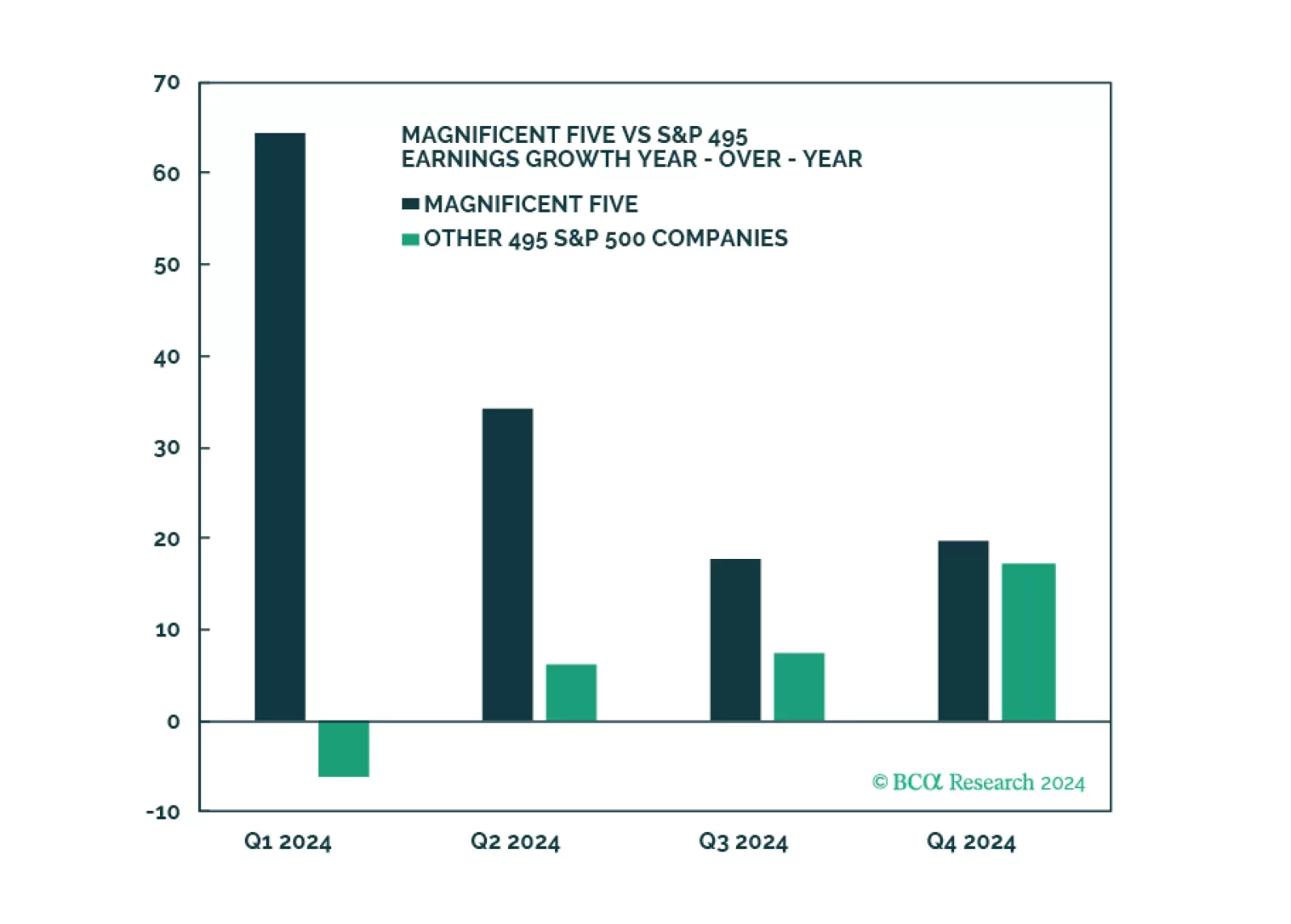

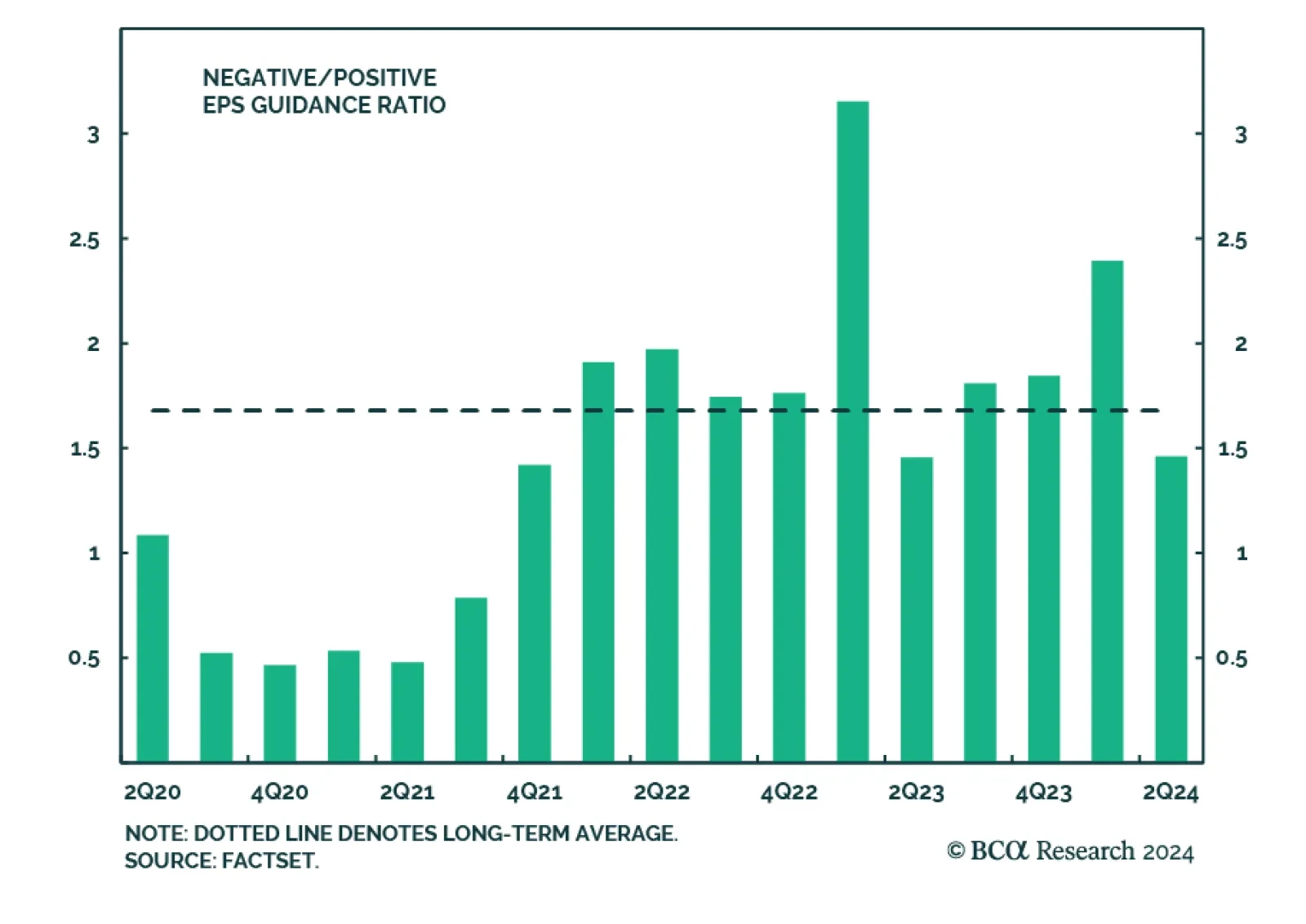

The Q1 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Three-quarters (two-thirds) of companies have topped earnings (sales) expectations in Q1, according to…

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…