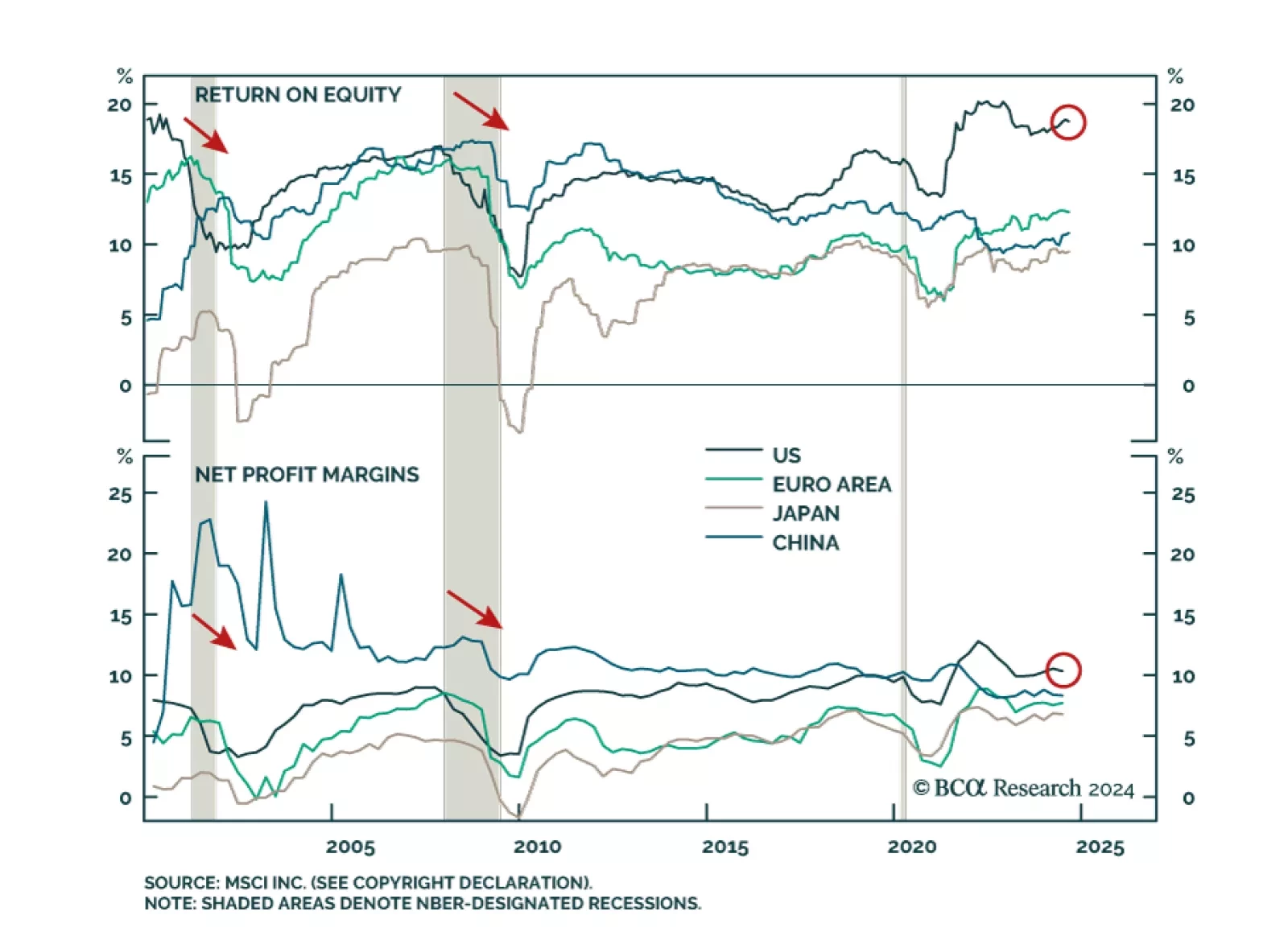

Despite the recent correction, US equity leadership remains intact. The MSCI US index has outperformed global markets by 3.8% in 2024YTD. A 7.8% expansion in forward earnings drove the MSCI US index’ 2024YTD gains which was…

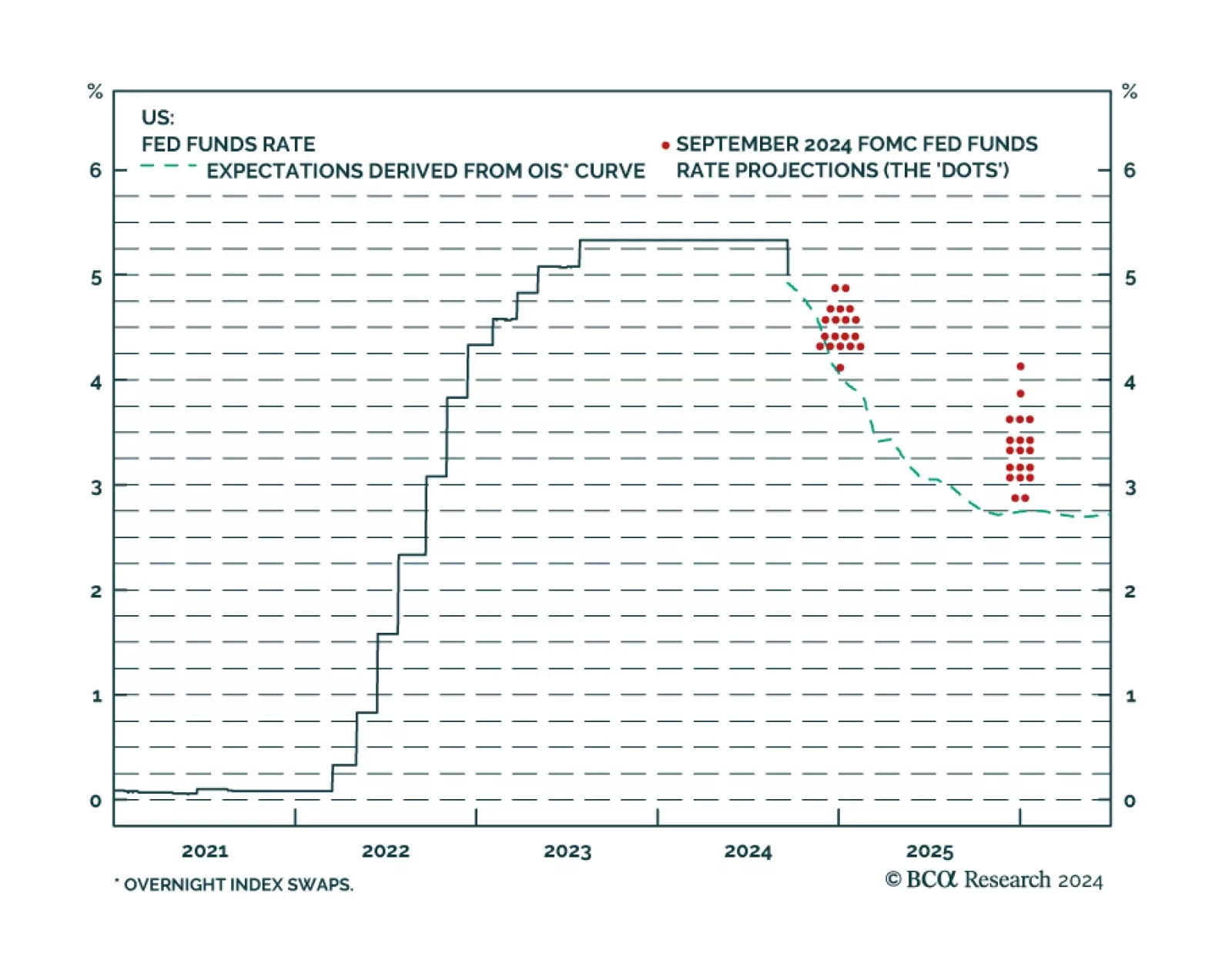

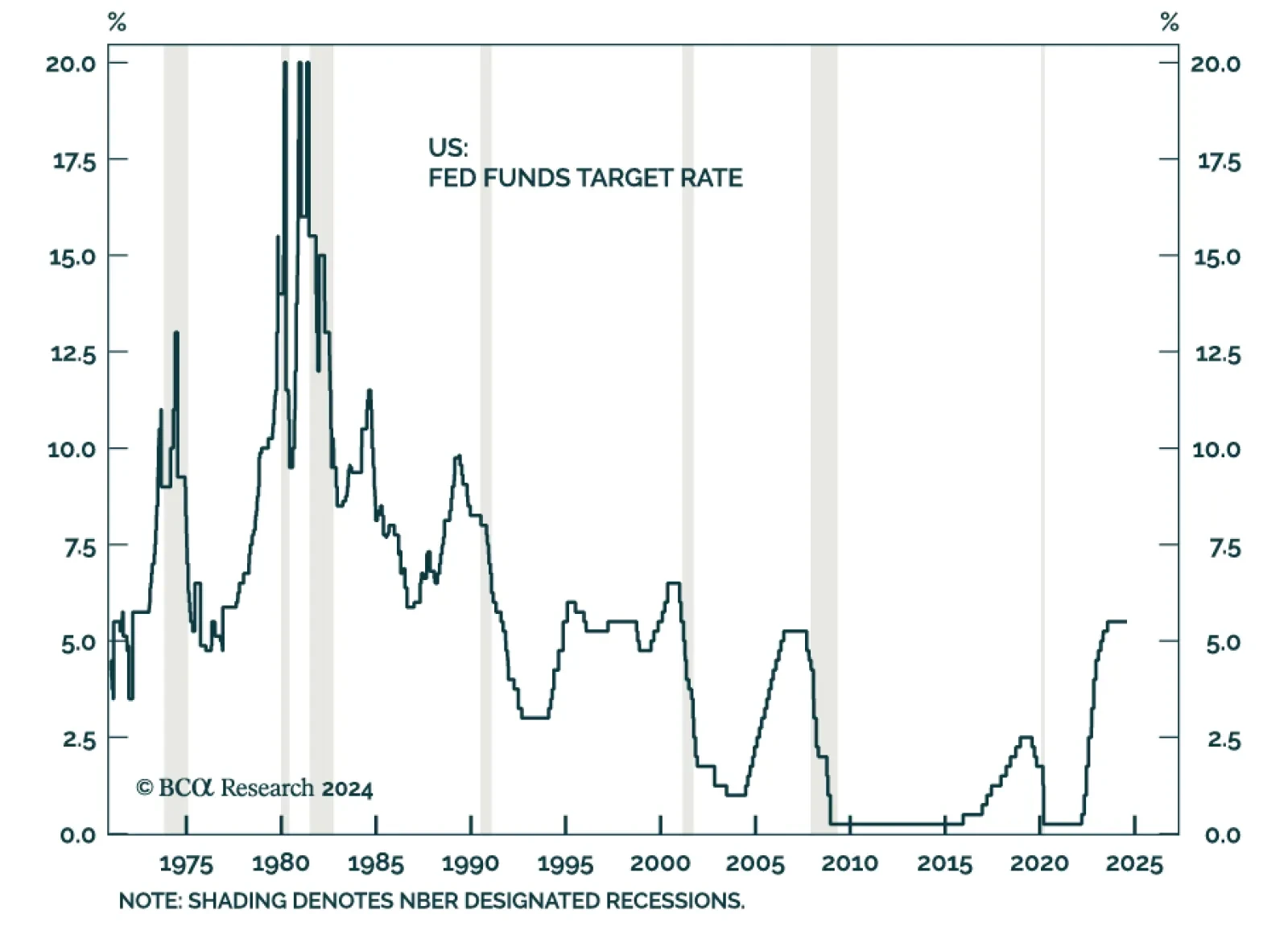

The Fed started its easing cycle with a bang, cutting the policy rate by 50 basis points in September, above consensus expectations but in line with odds embedded in the futures and OIS curves. Our US Bond strategists had…

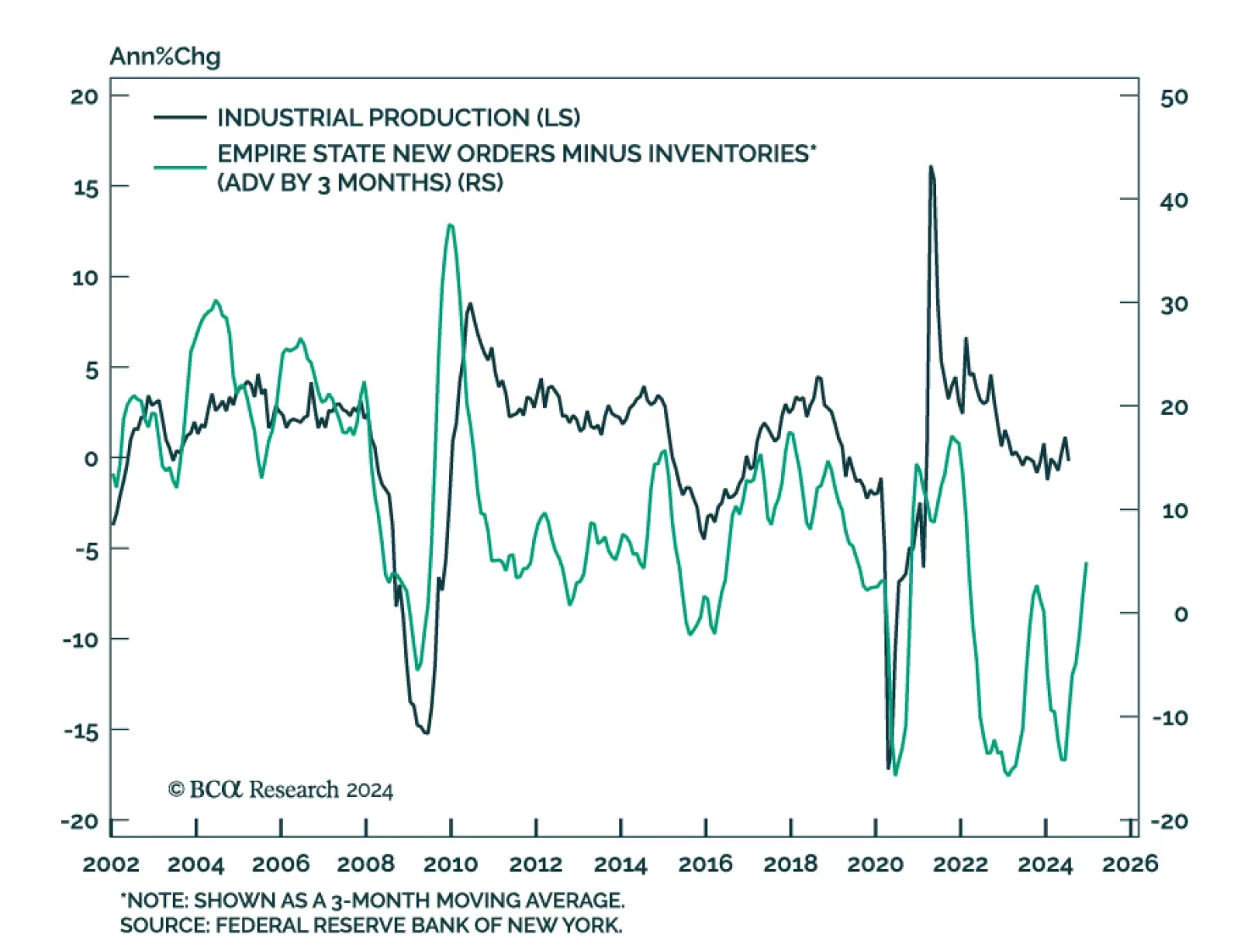

The timeliest of the regional Fed manufacturing surveys sent a positive signal about the state of US manufacturing activity in September. The Empire State manufacturing general business conditions index surprised positively.…

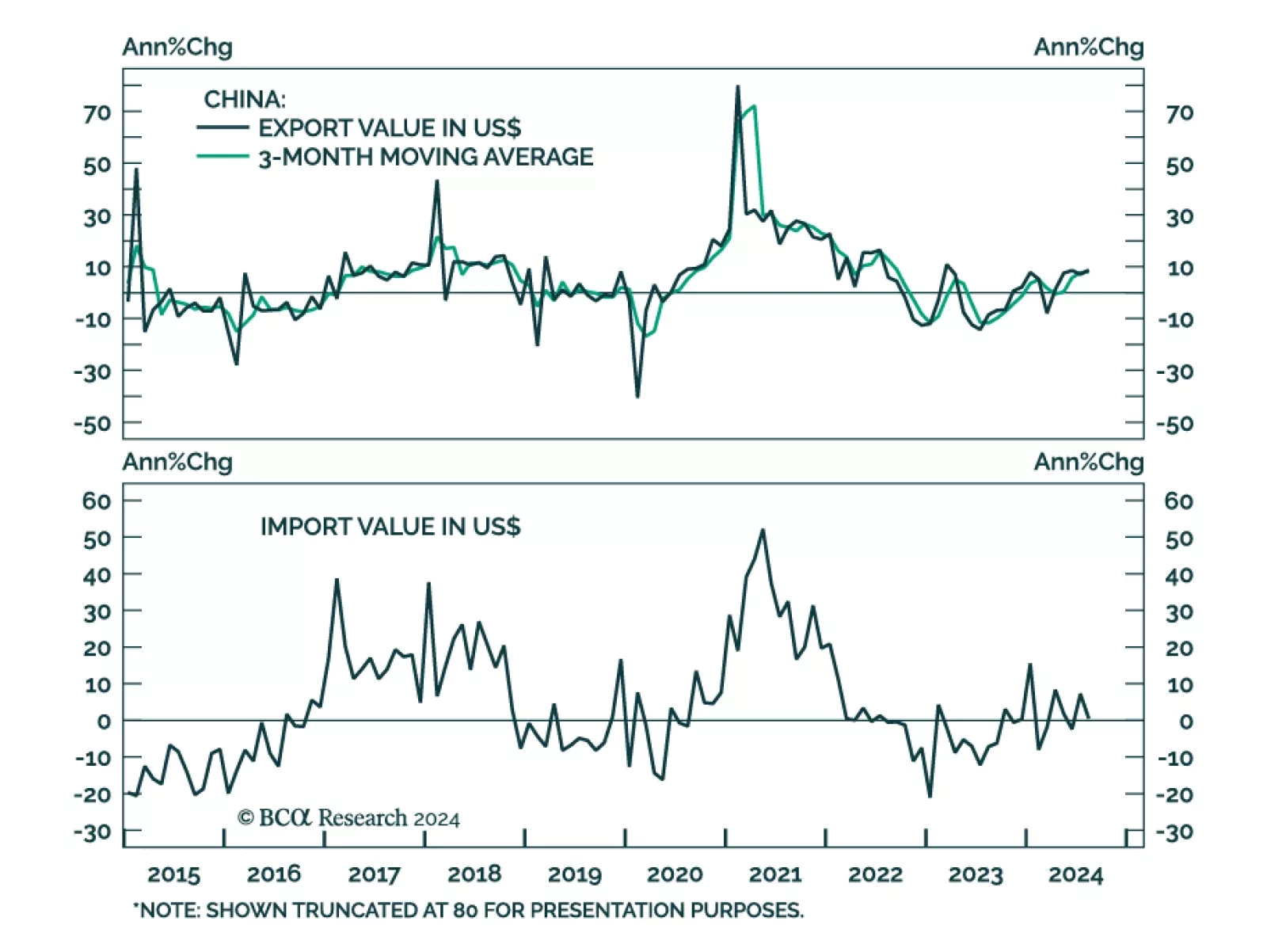

Chinese export growth in USD terms accelerated from 7.0% y/y to a larger-than-expected 8.7% in August. China’s exports to its major trading partners (US, EU and ASEAN) were all growing in August on a year-on-year basis,…

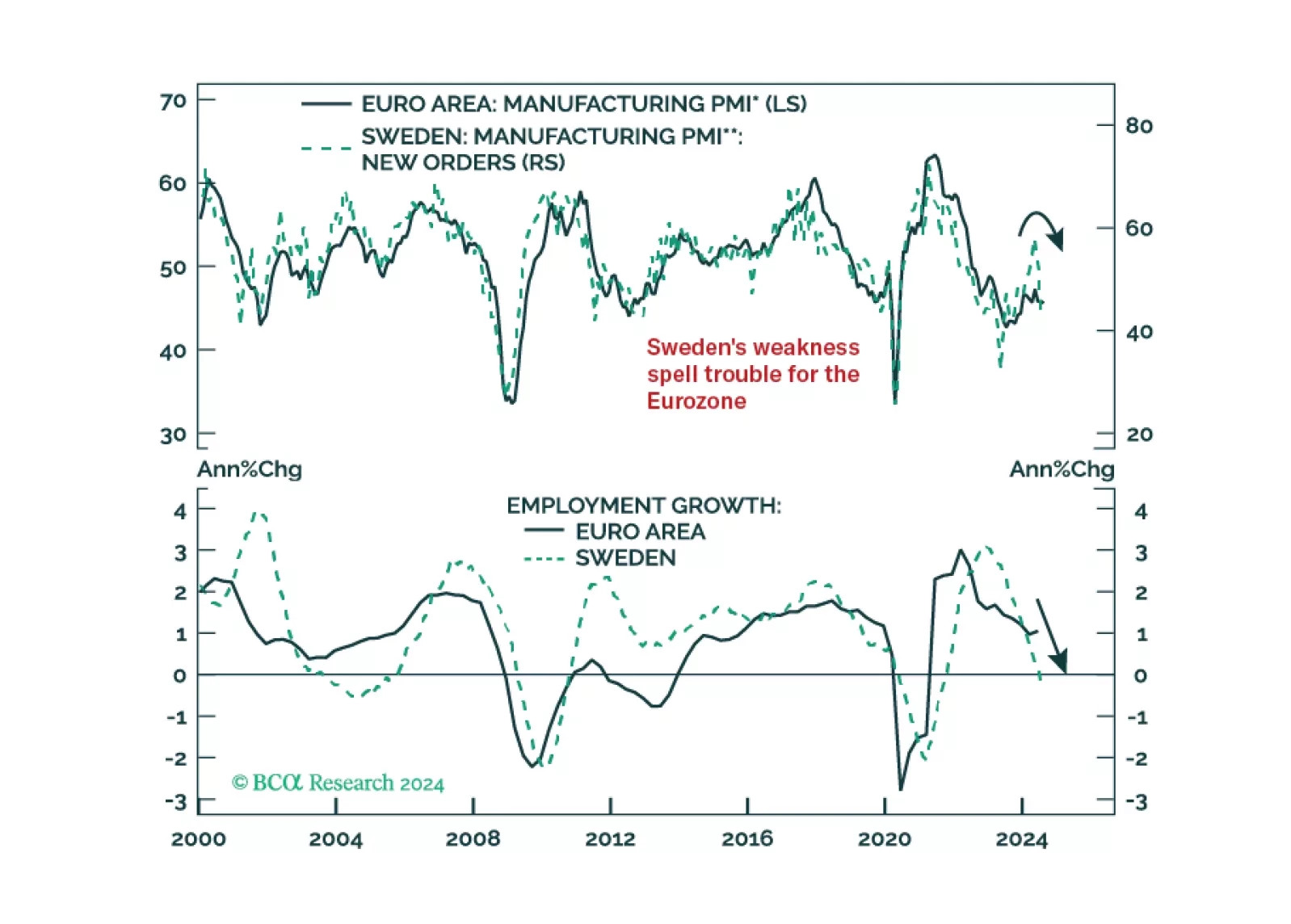

Our negative stance on European growth and assets is not devoid of risks. To gauge whether these risks warrant upgrading our growth outlook, we monitor Sweden closely. So, what is the current message from this Nordic economy?

What do the mixed signals sent by the UK economy mean for the Bank of England, and what are the implications for Gilts and the British pound?

According to BCA Research’s Global Asset Allocation service, there are clear signs that growth is weakening. BCA’s Global Nowcast has been slowing for three months. Behind this slowdown is the fact that the US…

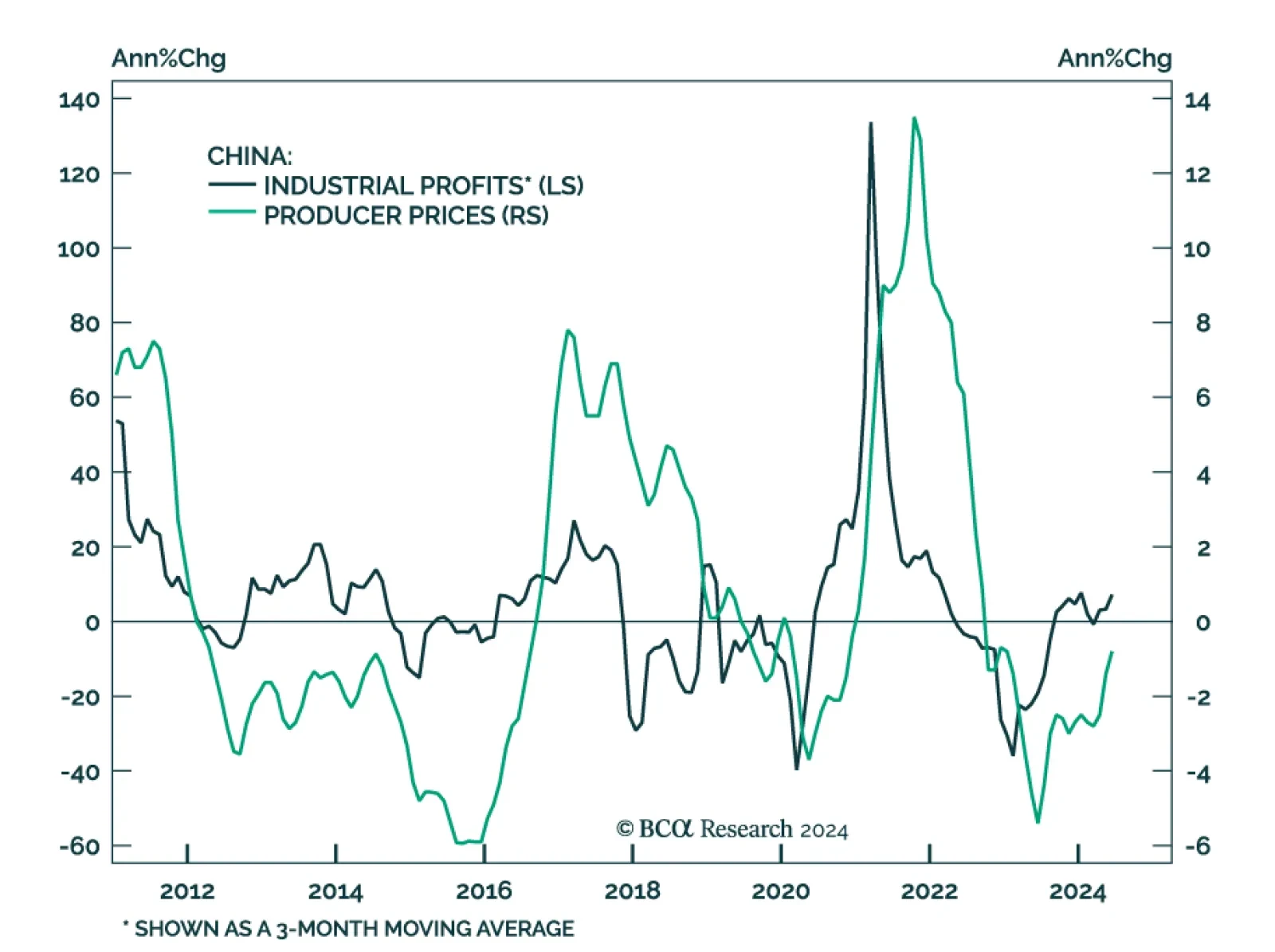

Chinese industrial profits growth accelerated in June, rising from 0.7% y/y to 3.6%. Profits expanded at 3.5% in the first half of 2024, compared to 3.4% in the first half of 2023, and suggest that China’s manufacturing…

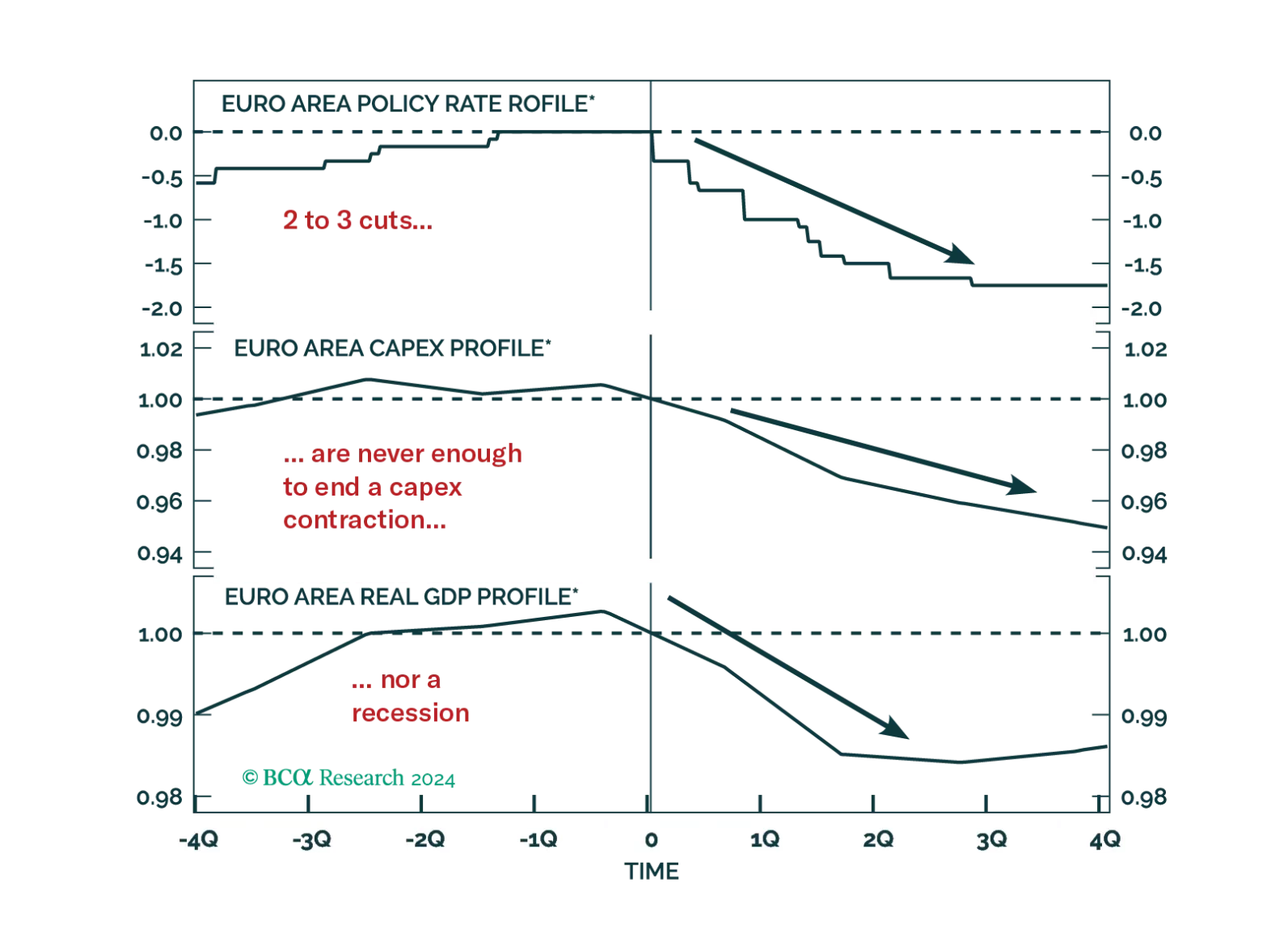

Investors hope that the ECB rate cuts priced into the curve will be sufficient to achieve a soft landing in Europe. History argues against this view, but will this time be different?