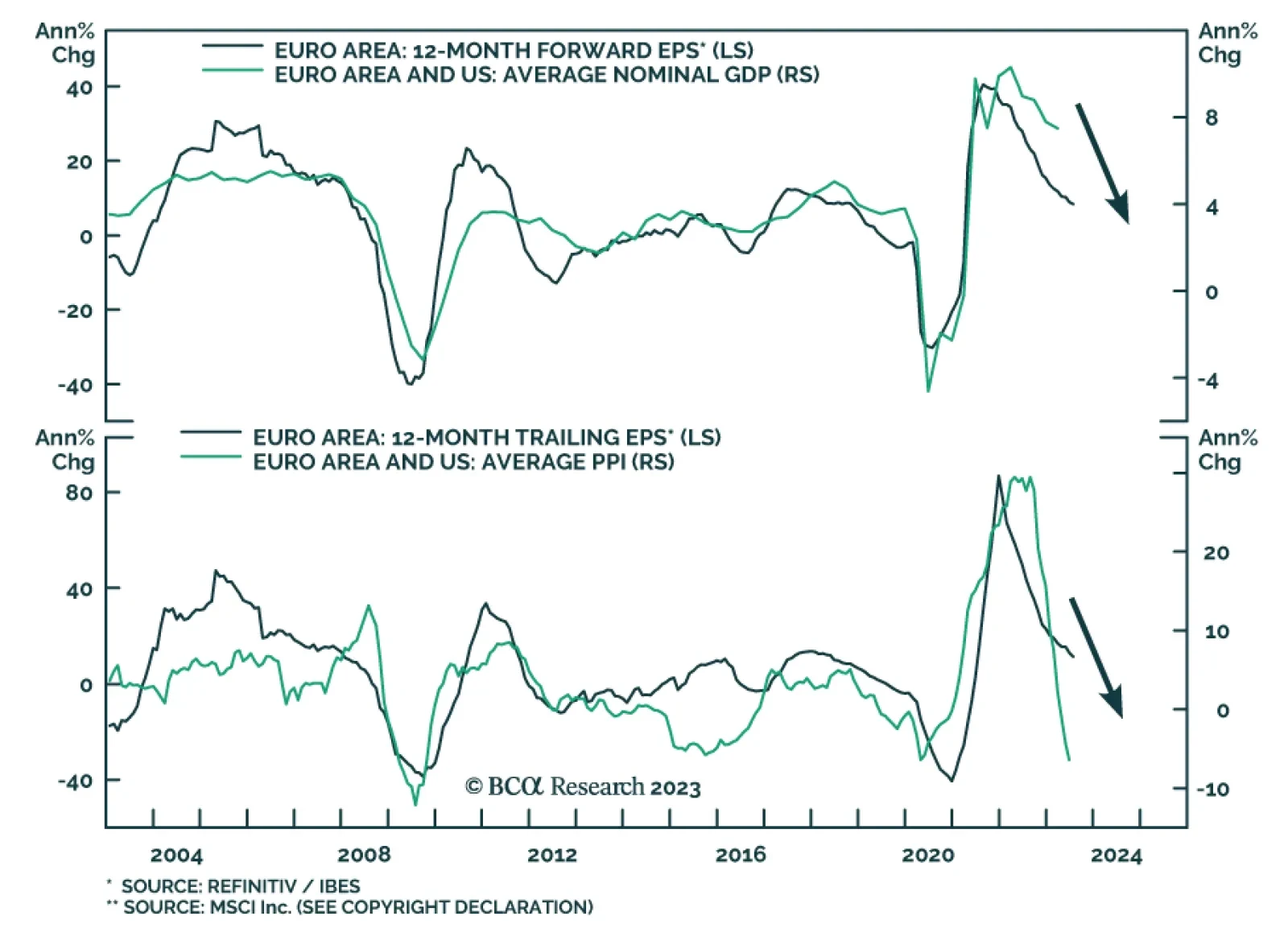

According to BCA Research’s European Investment Strategy service, the earnings outlook of Eurozone equities will continue to deteriorate over the coming two quarters despite the improvement in real economic activity.…

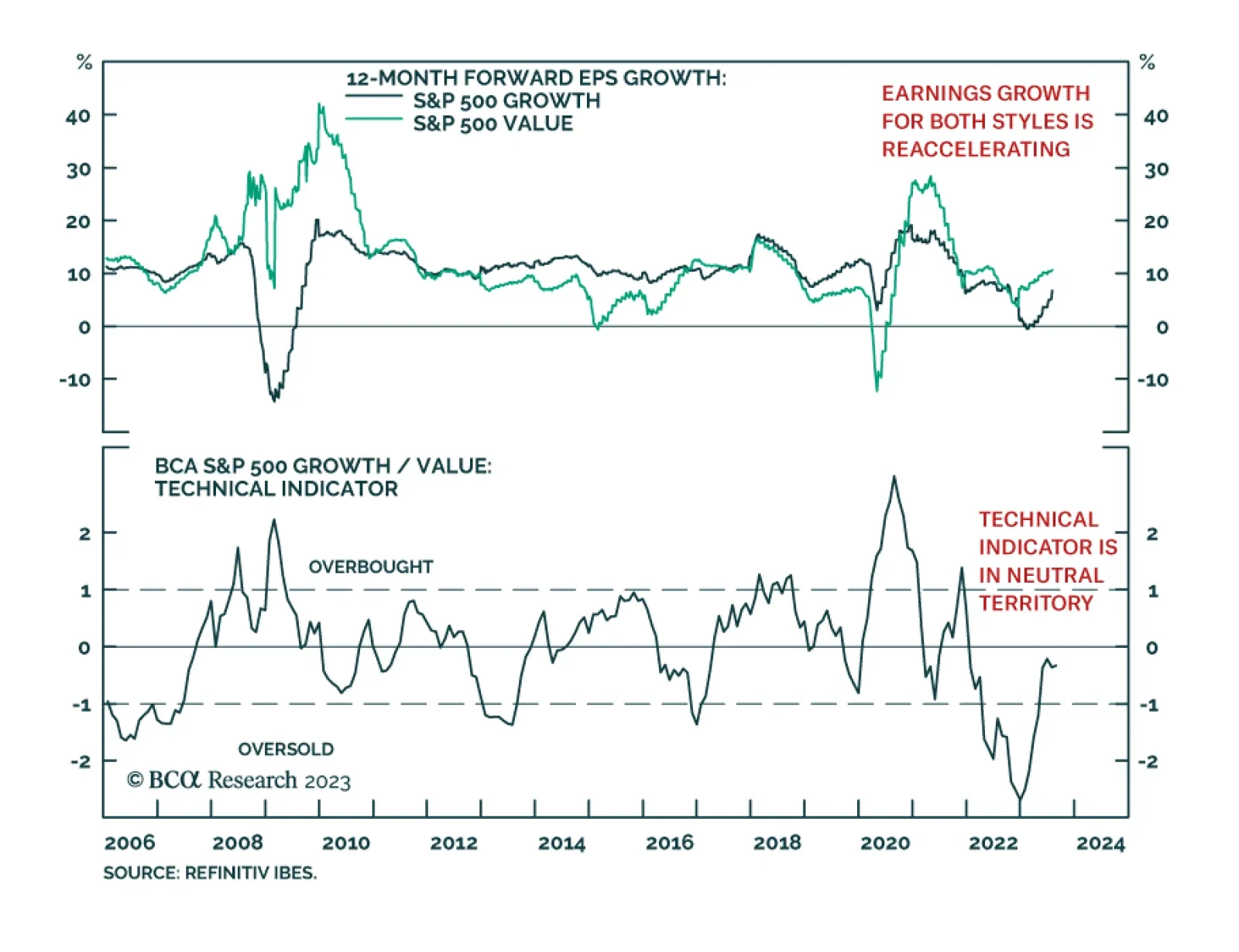

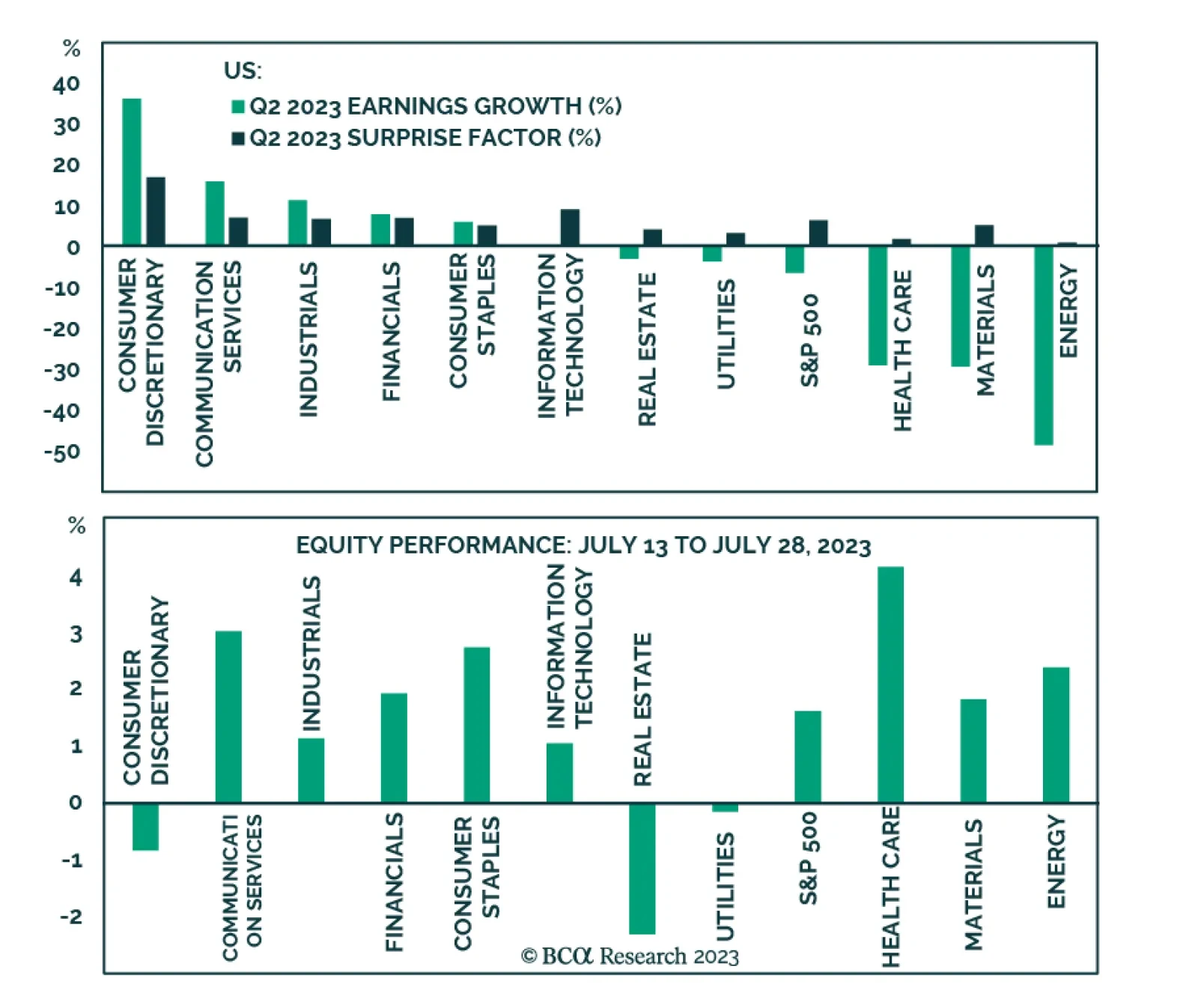

According to BCA Research’s US Equity Strategy service, the outperformance of Growth sectors most likely has run its course. The team has opened an overweight in Growth vs. Value in April. Since then, the trade is…

Inspired by a client’s questions, we examine the rationale behind the implementation of the trailing stop governing our near-term asset allocation recommendations.

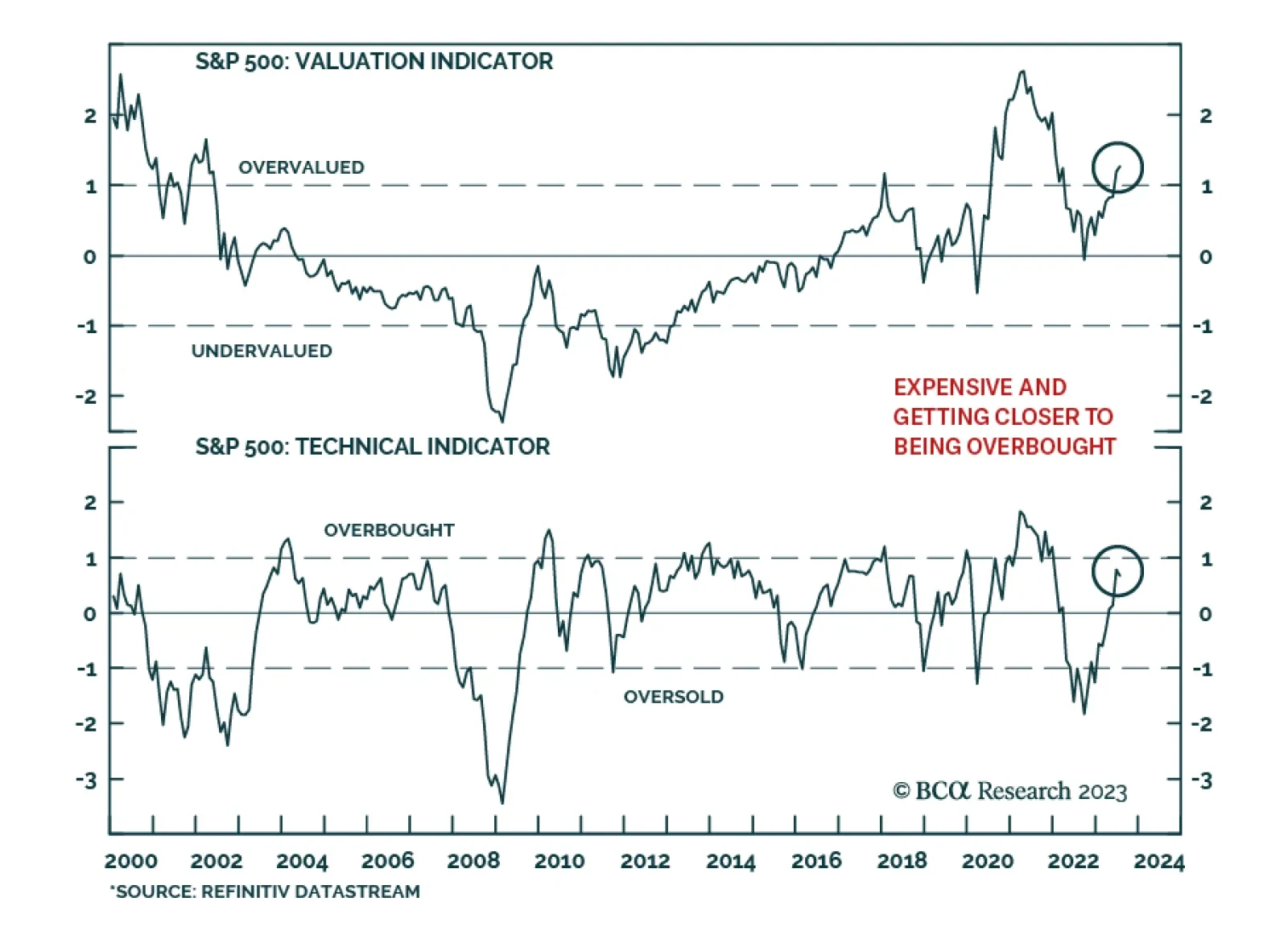

According to BCA Research’s Emerging Markets Strategy service, the gap that has formed between the S&P 500 price and its operating profit margins, as well as the divergence between the S&P 500 Forward P/E ratio and…

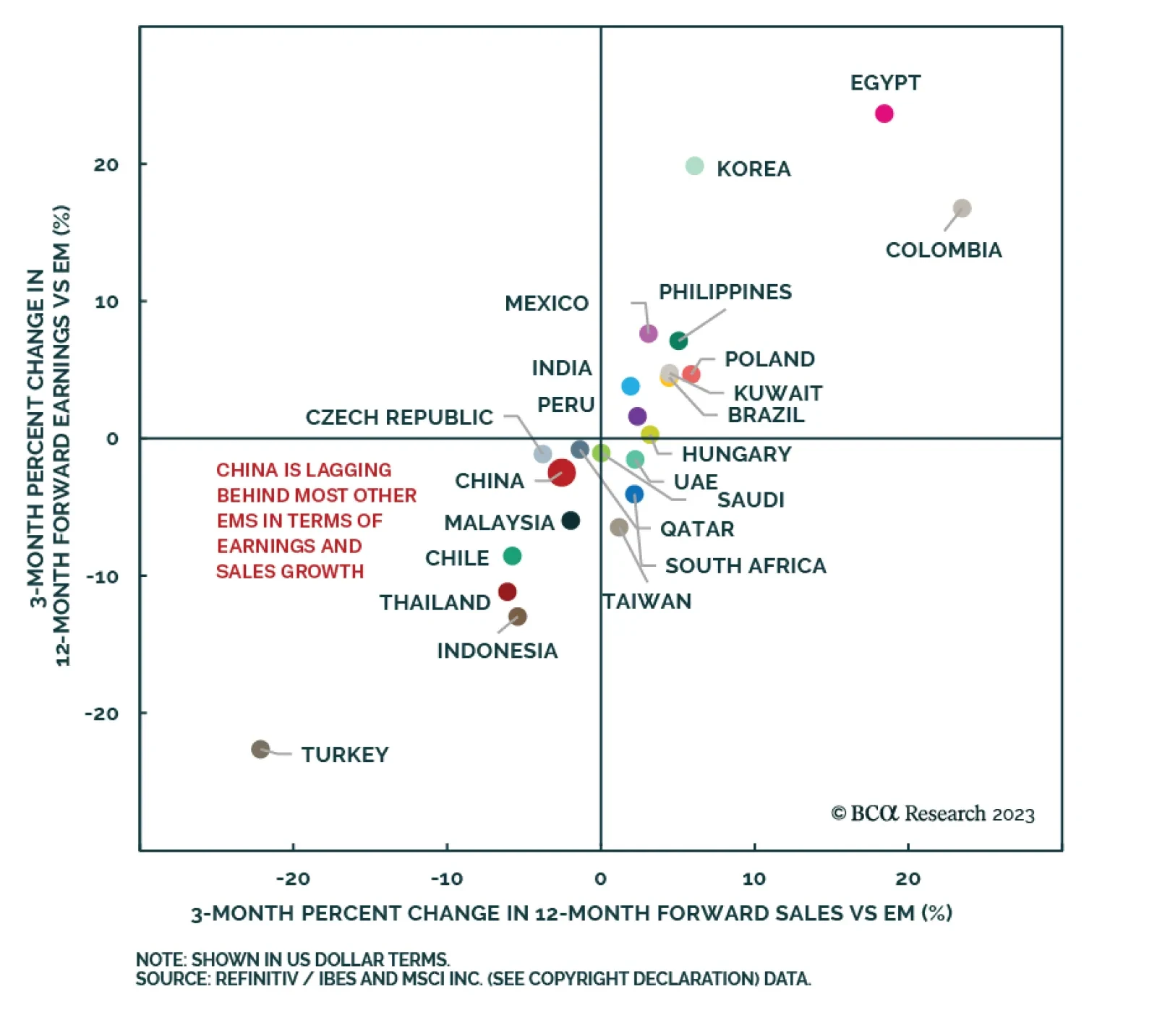

According to BCA Research’s Global Investment Strategy service, EM ex-China equities have potential to outperform China and DM in the remainder of the year. Relative to their own history and compared to other EMs,…

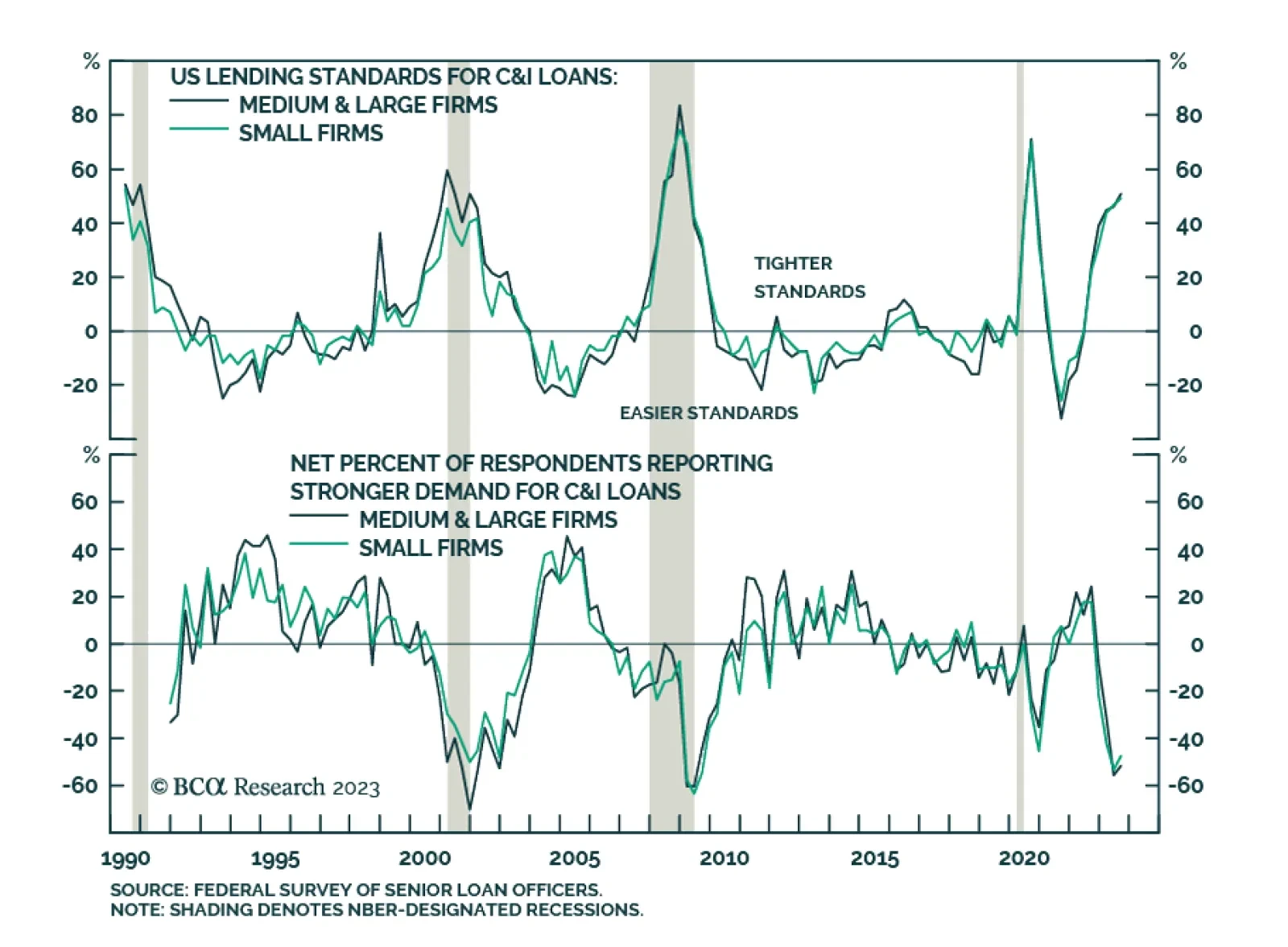

The US Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) reveals that US banks continue to tighten lending standards for commercial and industrial (C&I), commercial real estate (CRE), residential real estate (RRE),…

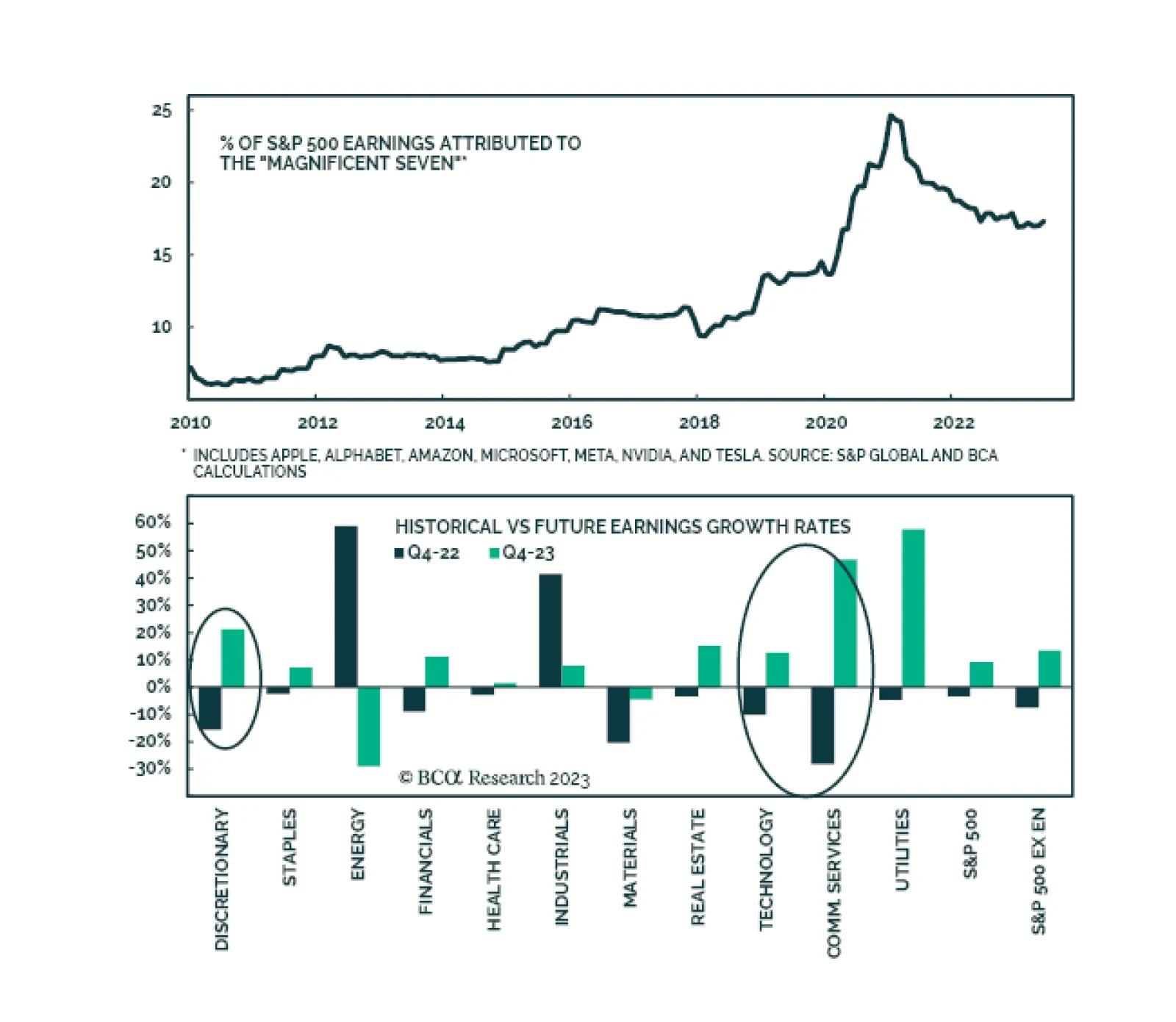

It is widely expected by consensus that earnings growth will rebound into the year-end and into 2024. Multiple factors will drive the reacceleration in earnings growth. Sales growth will pick up: In the remainder of the year,…

We are now midway through the Q2 2023 earnings season: 254 of the companies in the S&P 500 have reported. It’s therefore worthwhile to stand back and observe some of the emerging trends. According to Refinitiv IBES,…

A narrow equity rally was the key characteristic of the US stock market in the first five months of the year. Despite concerns about the domestic economic situation due to ongoing monetary tightening, and poor external dynamics…

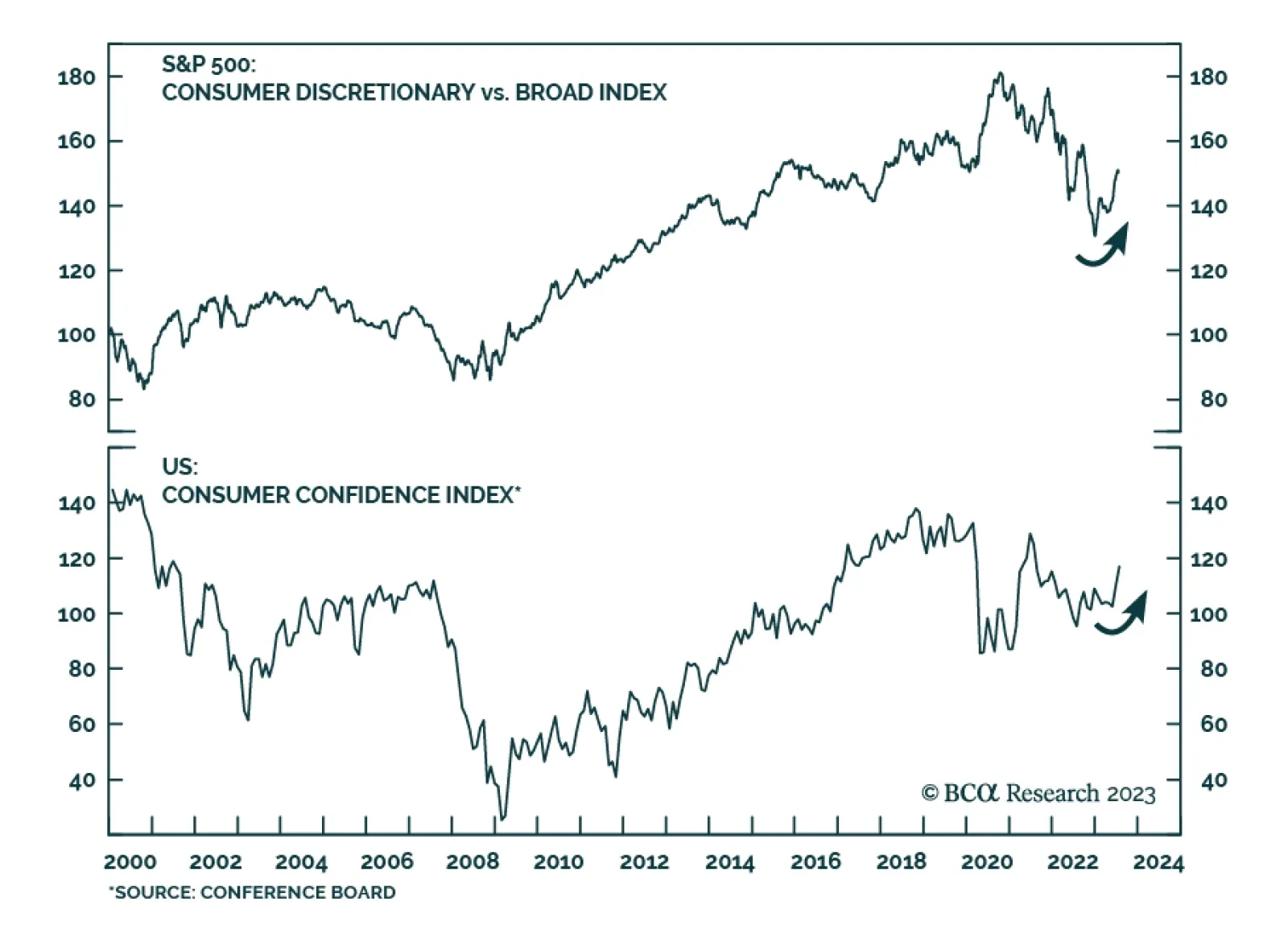

The US Consumer Discretionary sector has been one of the top winners since the equity rally broadened two months ago. Its 13% gain since the end of May outpaces the S&P 500’s rally by 3.8 percentage points This…