Global Investment Strategy predicted the surge of inflation in 2021/22 and the immaculate disinflation of 2023. Now their unique framework is predicting a recession in the second half of 2024.

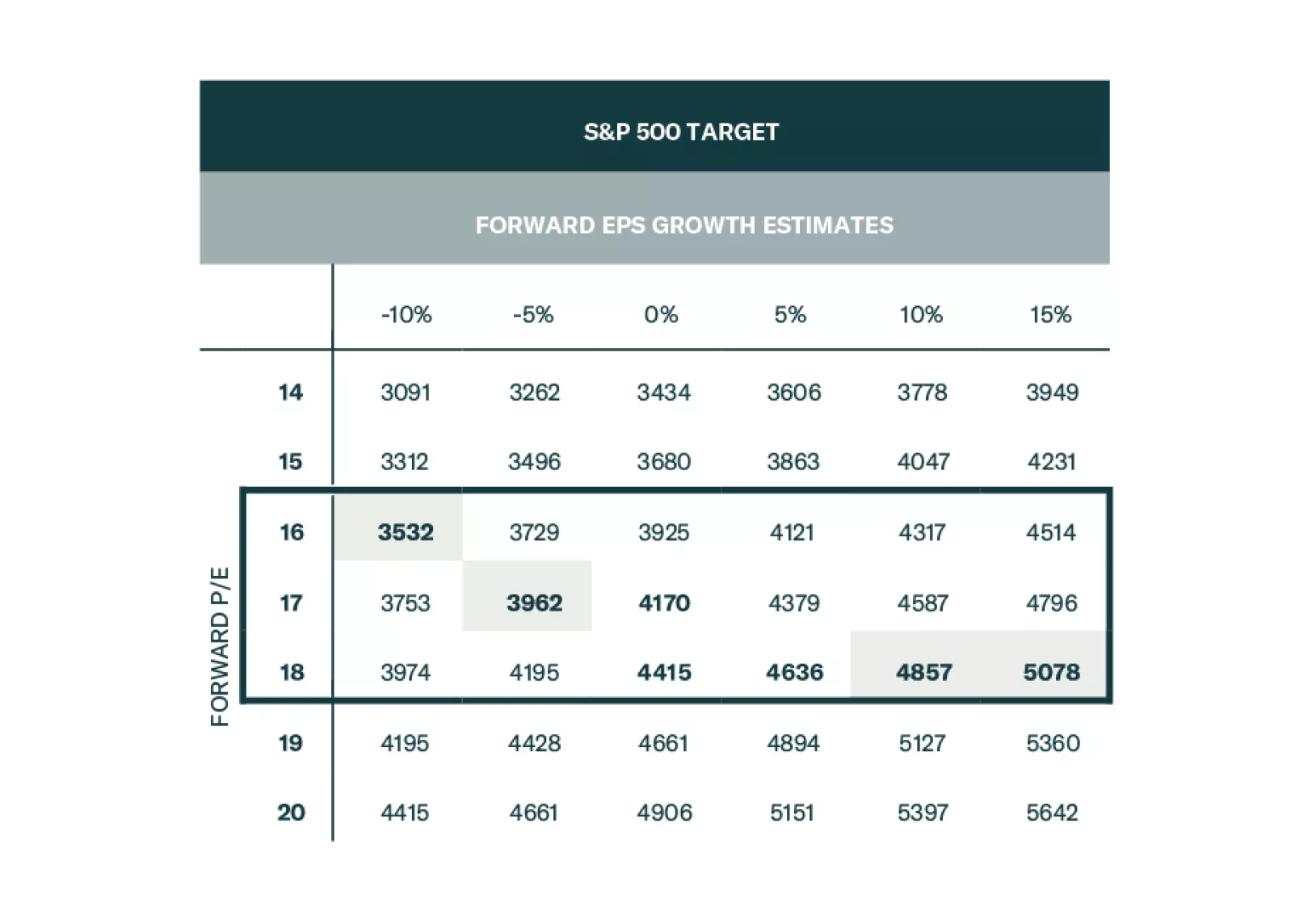

According to BCA Research’s US Equity Strategy service, earnings growth estimates for 2024 appear overly optimistic. Just like economists and strategists, sell-side analysts are optimistic about the US economy. They have…

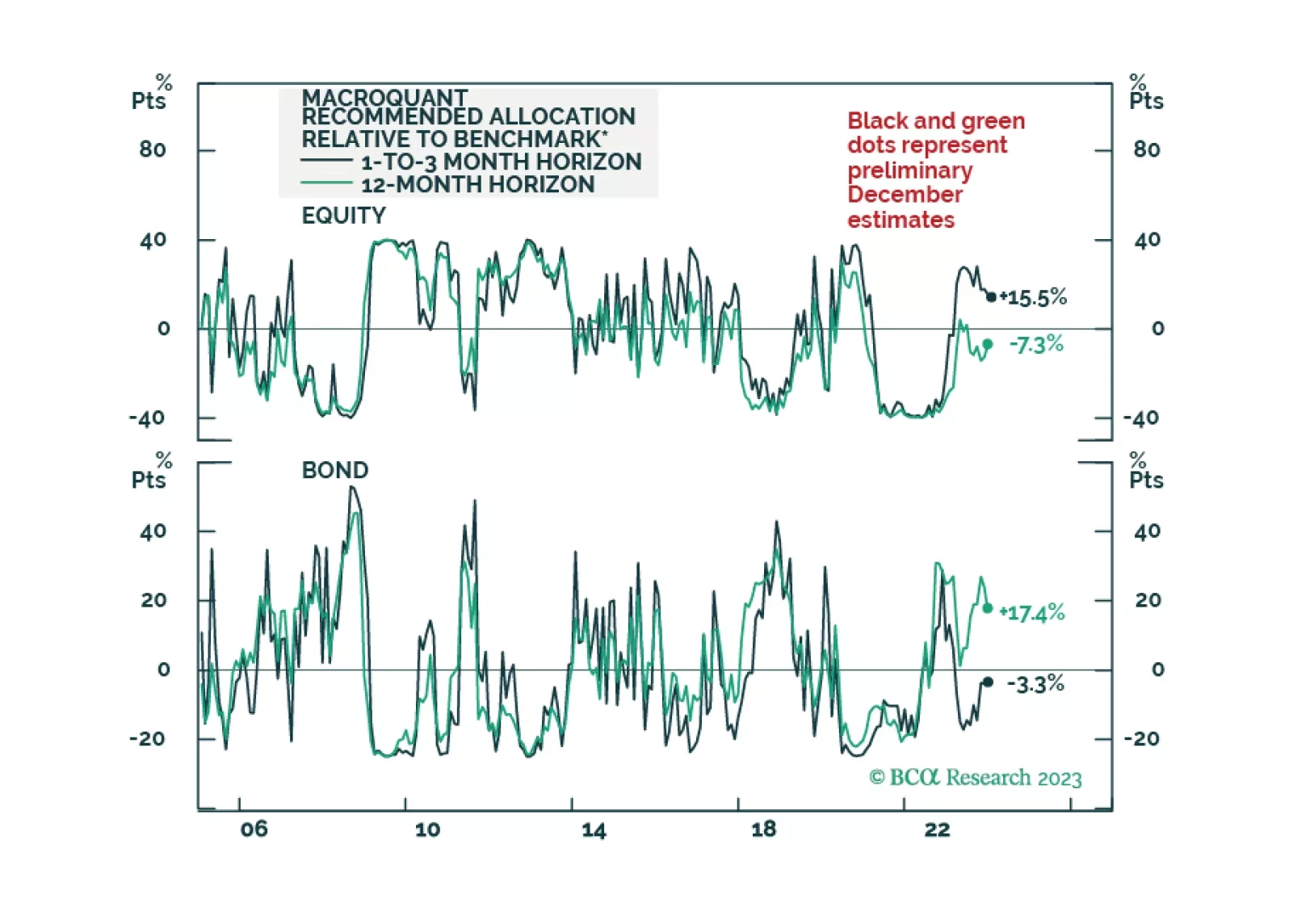

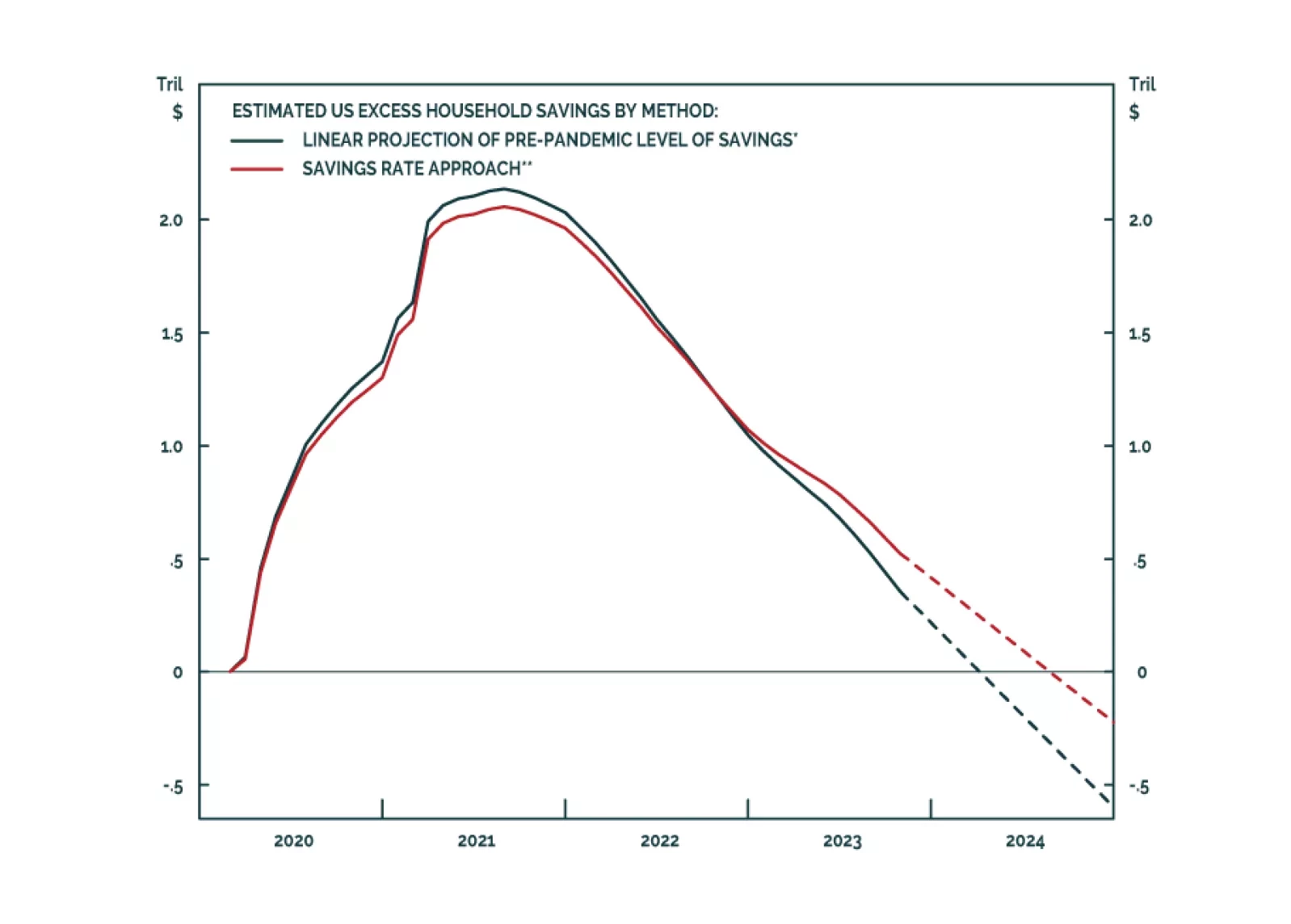

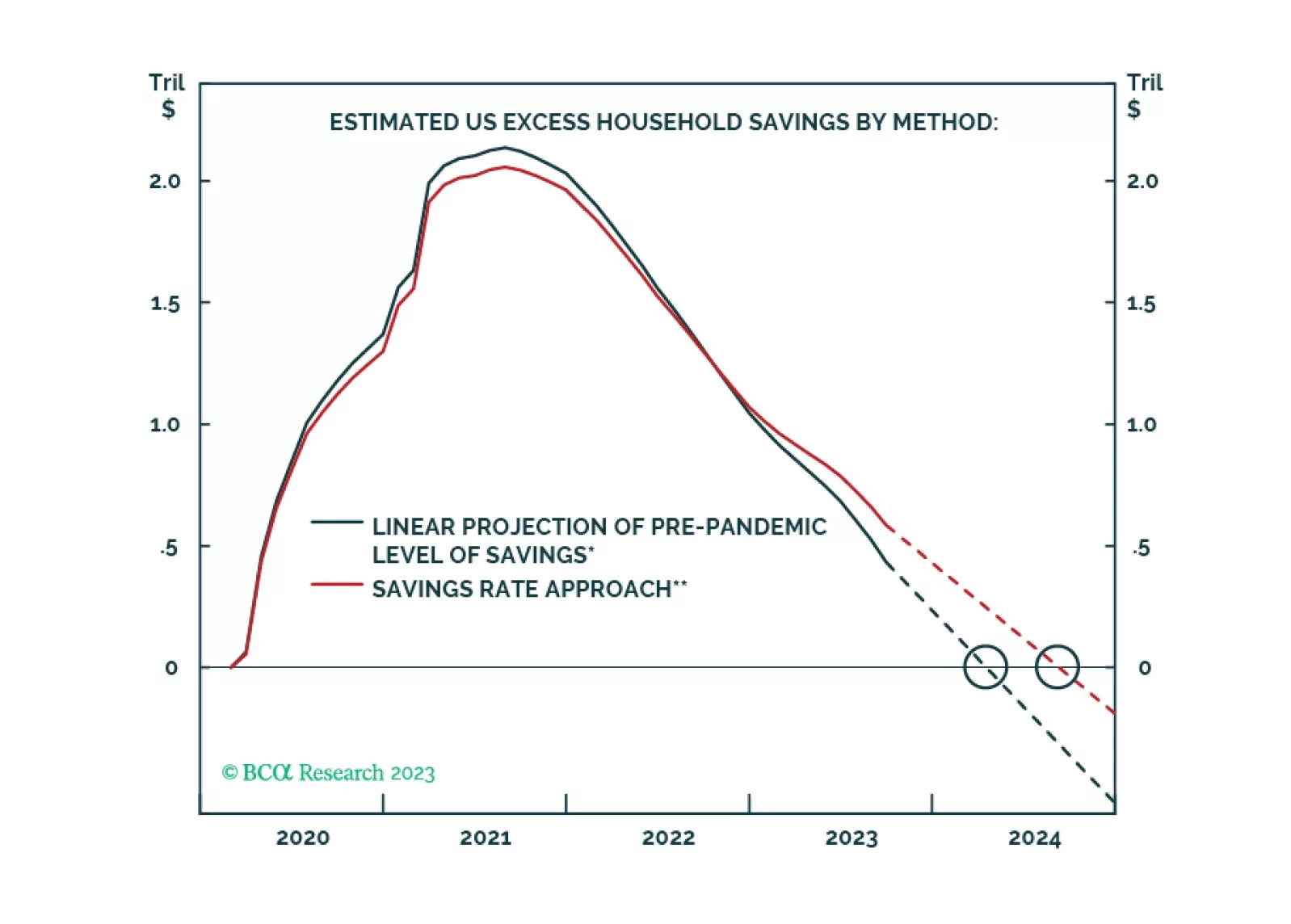

According to BCA Research’s Global Asset Allocation service, recession is still on track to begin in the first half of 2024. Is it the recession that never came? Certainly, the consensus thinks so. Soft landing is now…

Chinese industrial profits for October delivered a pessimistic signal on Monday as the annual growth rate eased to 2.7% y/y. While the latest update marks the third consecutive month of profit growth, it is a sharp slowdown from…

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

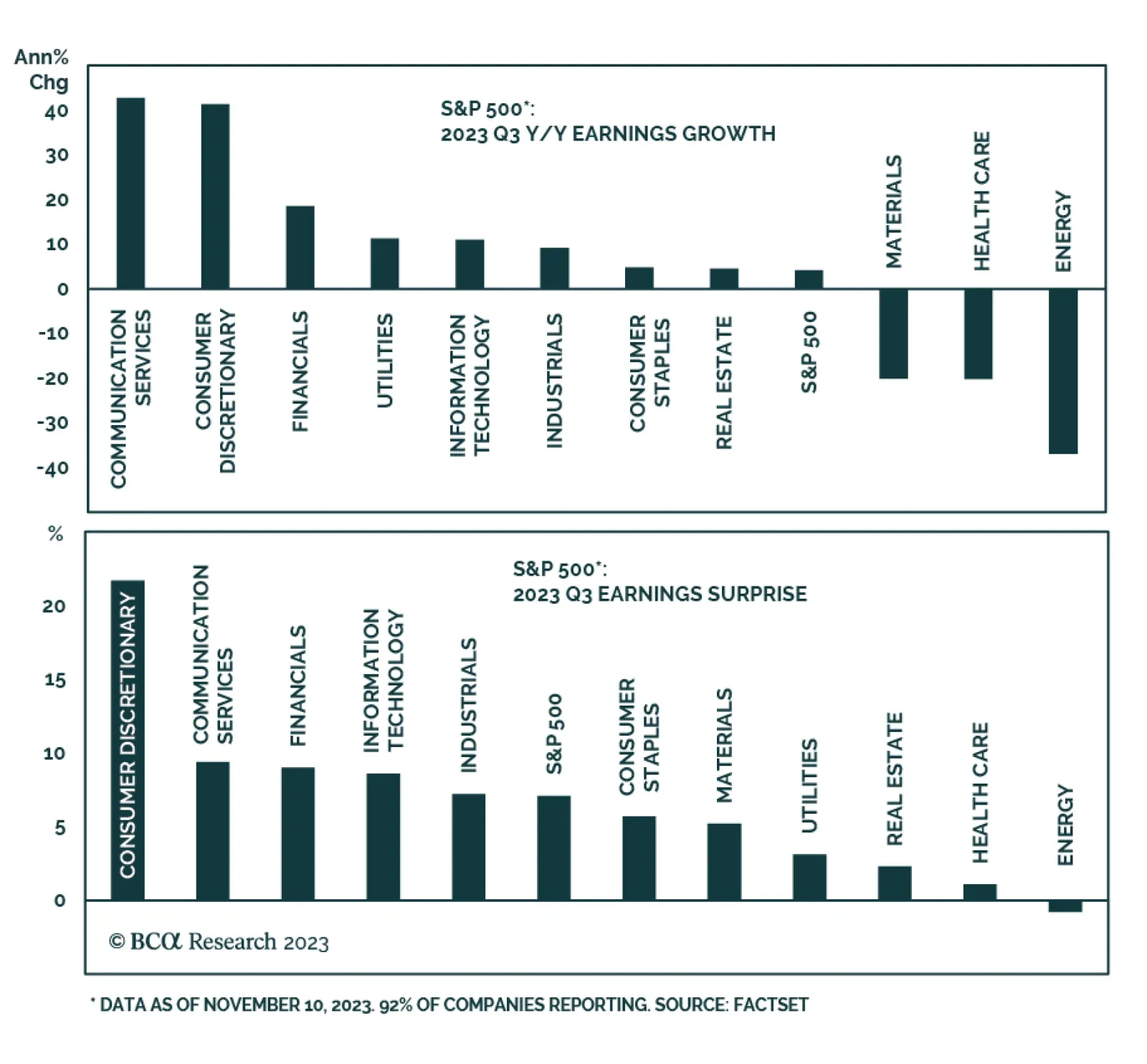

The Q3 earnings season is coming to an end. By Friday, 481 companies in the S&P 500 index had reported earnings. In aggregate, the results are generally favorable. The share of companies whose earnings exceeded analyst…

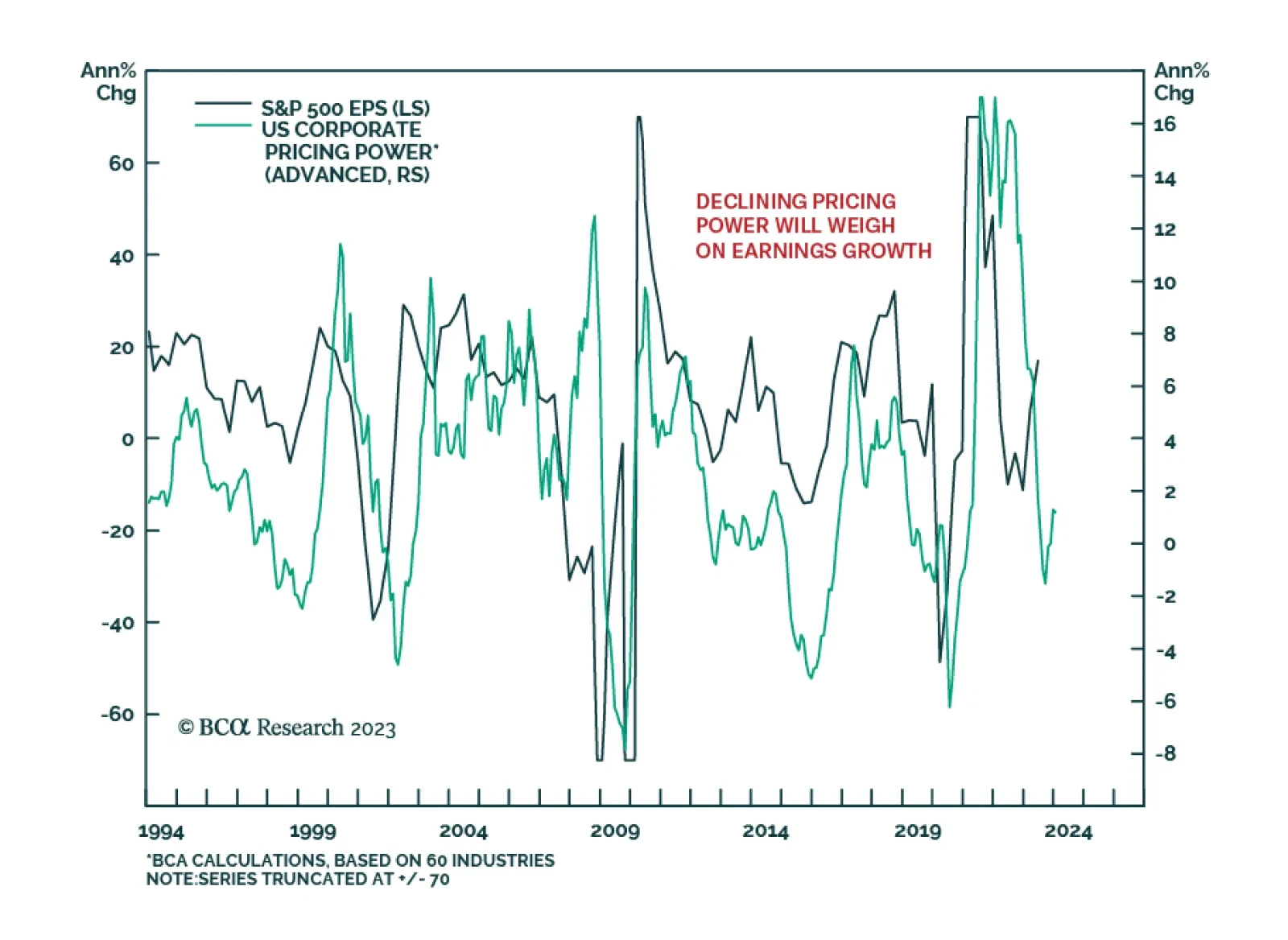

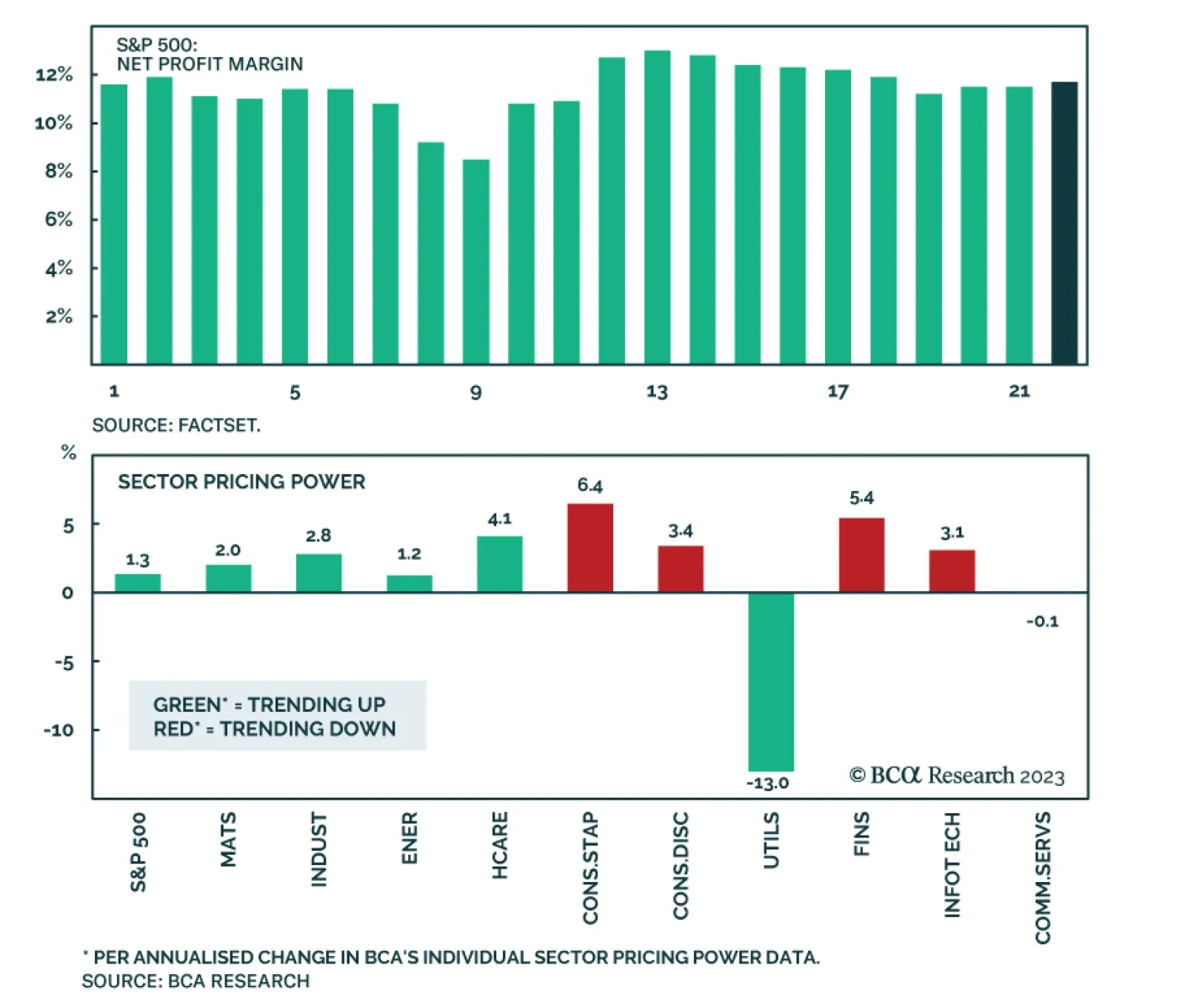

Inflation has been in a downtrend for a few months now, which has translated into fading corporate pricing power. With wage growth still strong, and the cost of energy on the rise, the degree of companies’ pricing power…

The Q3 earnings season is nearing its end. By Friday, 92% of S&P 500 companies had already reported and thus far the results are positive. According to FactSet, the S&P 500's 4.1% y/y blended earnings growth rate is…