This week is set to be a busy one for the US market. On the policy front, there is the Wednesday FOMC meeting which will give insight into the Fed’s latest thinking regarding the timing of rate cuts. On the data front,…

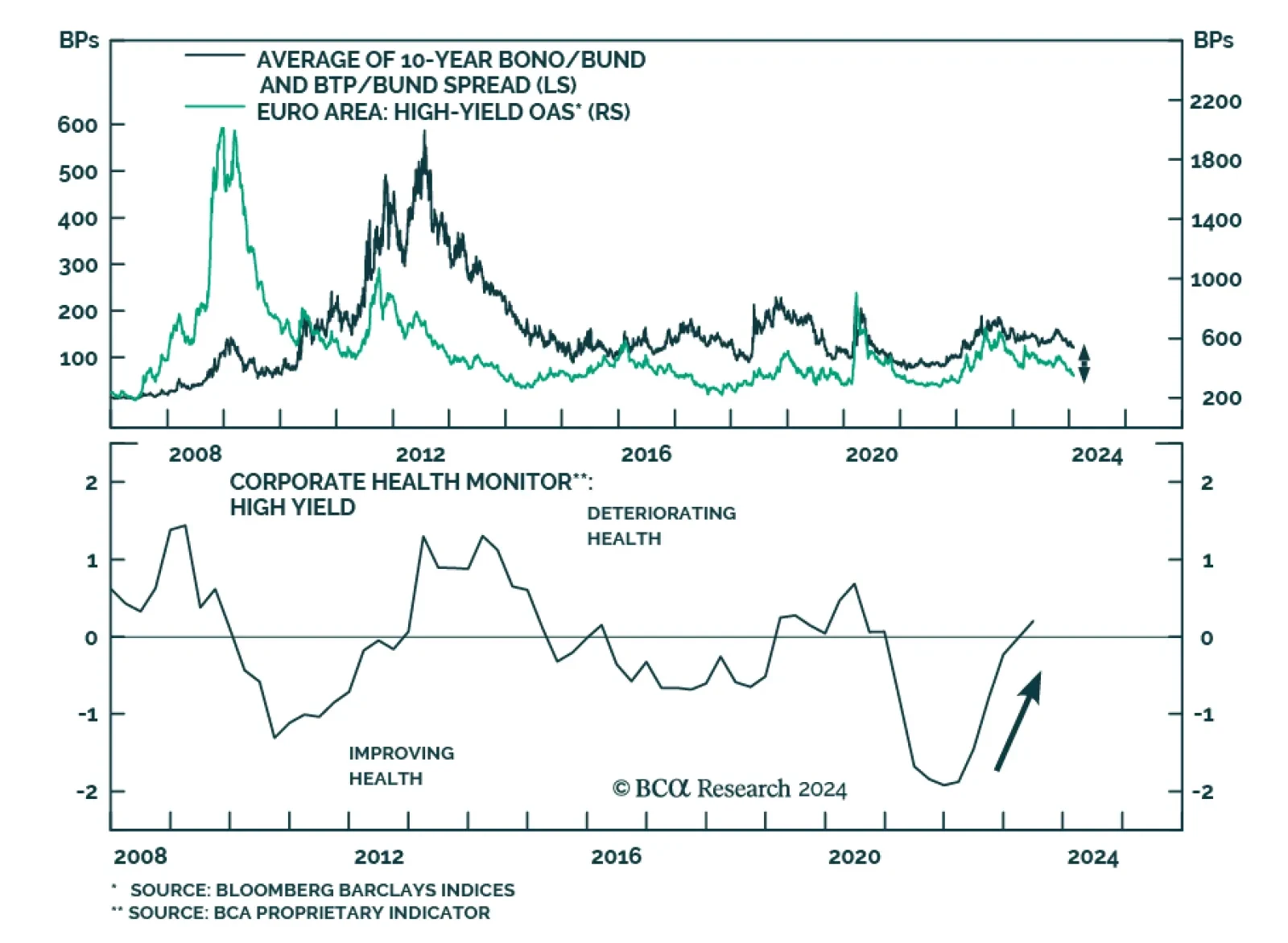

According to BCA Research’s European Investment Strategy service, European sovereign bonds in the periphery offer more upside than high-yield (HY) corporate bonds. Many question the outlook for peripheral bonds in Europe…

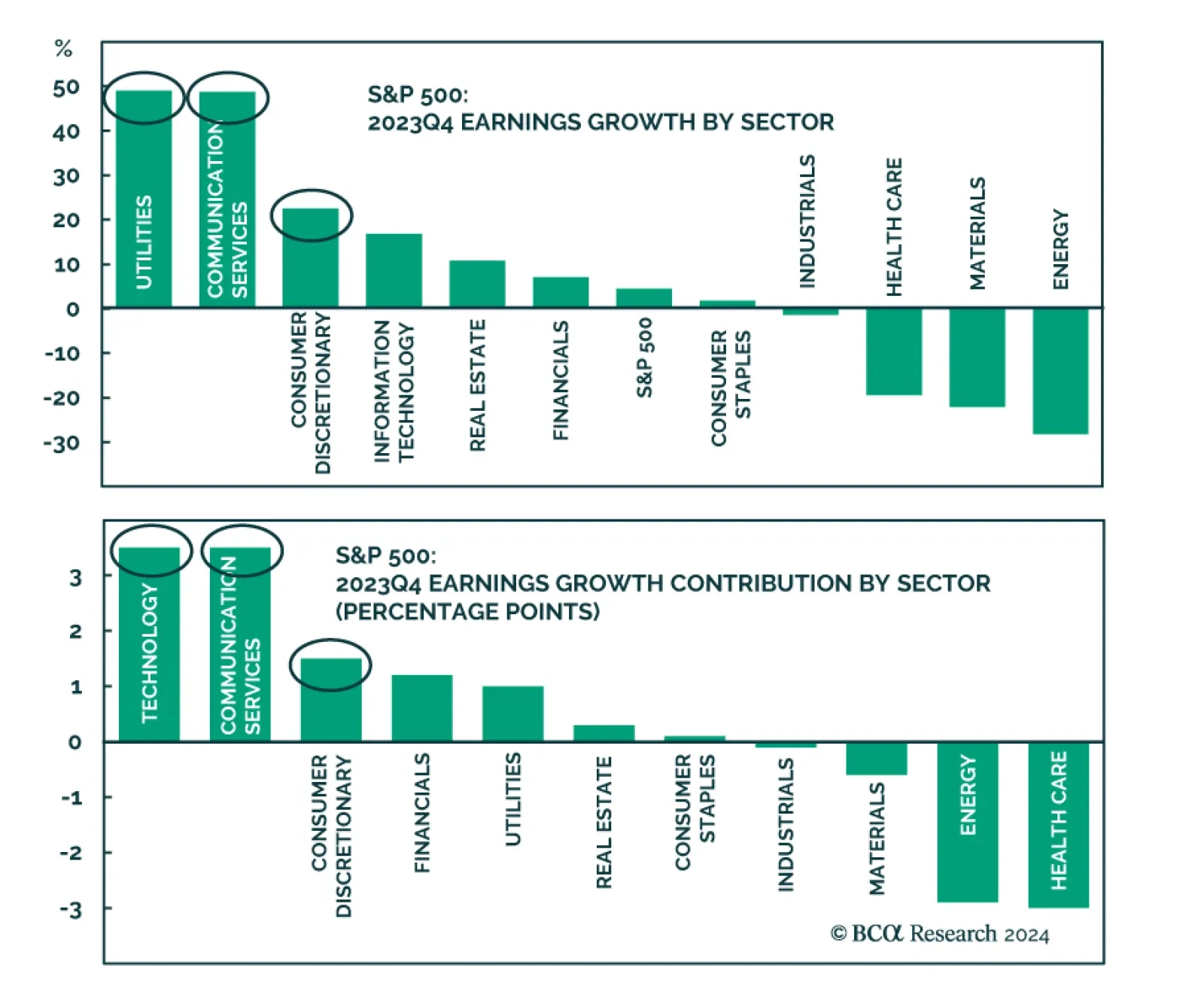

With US equity indices forging new highs, a key dynamic to watch to gauge the sustainability of the rally is earnings releases and forward guidance. With 52 S&P 500 companies having already reported their results, the Q4…

According to BCA Research’s European Investment Strategy service, investors should not chase European equities higher from current levels. The soft-landing narrative has captured the minds of investors. The expectations…

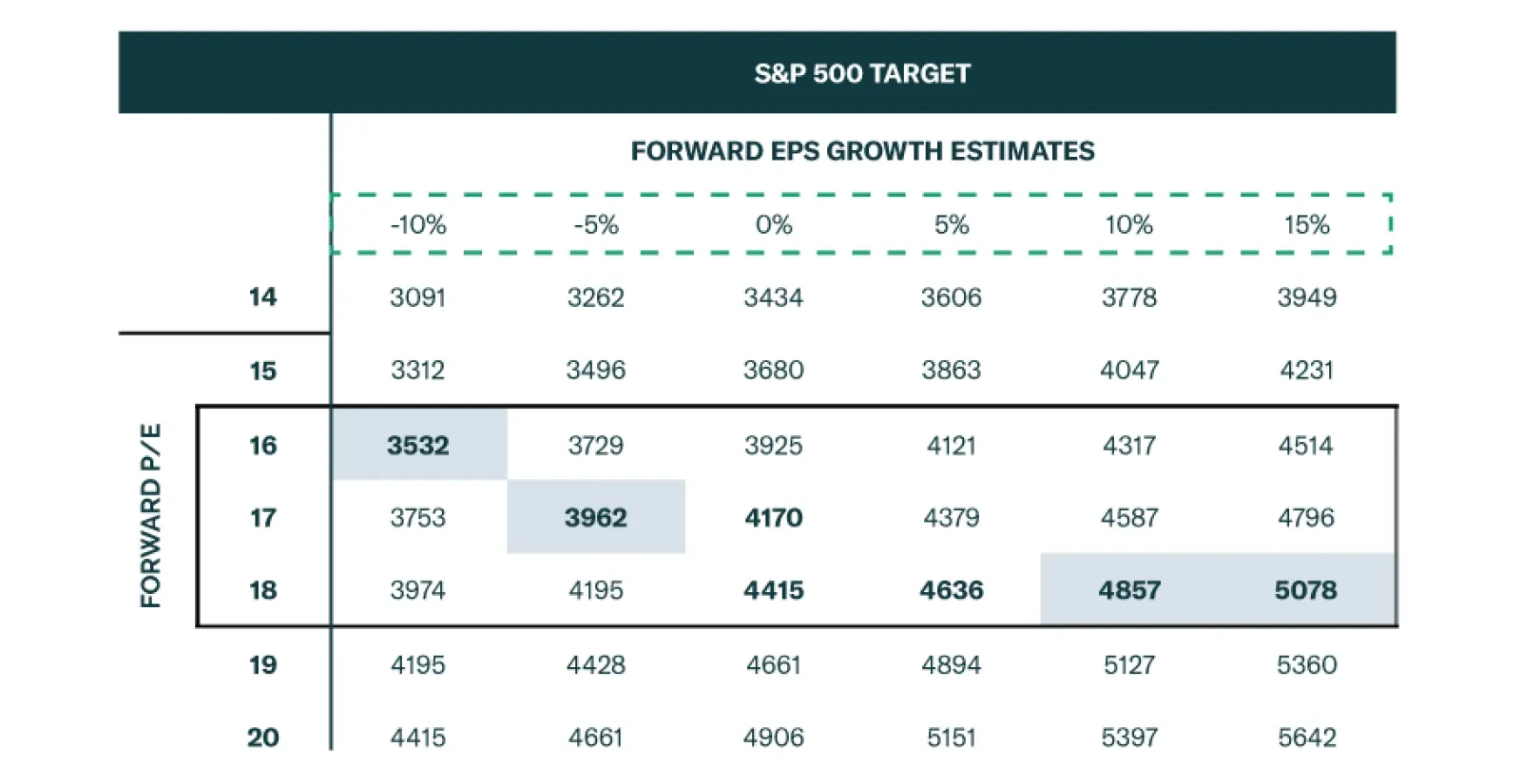

The Santa Claus rally started in late October lifting the S&P 500 by 15.8%. However, there are signs that the rally is getting tired. Consider the following: The S&P 500 has been trading at around 4,750 since the…

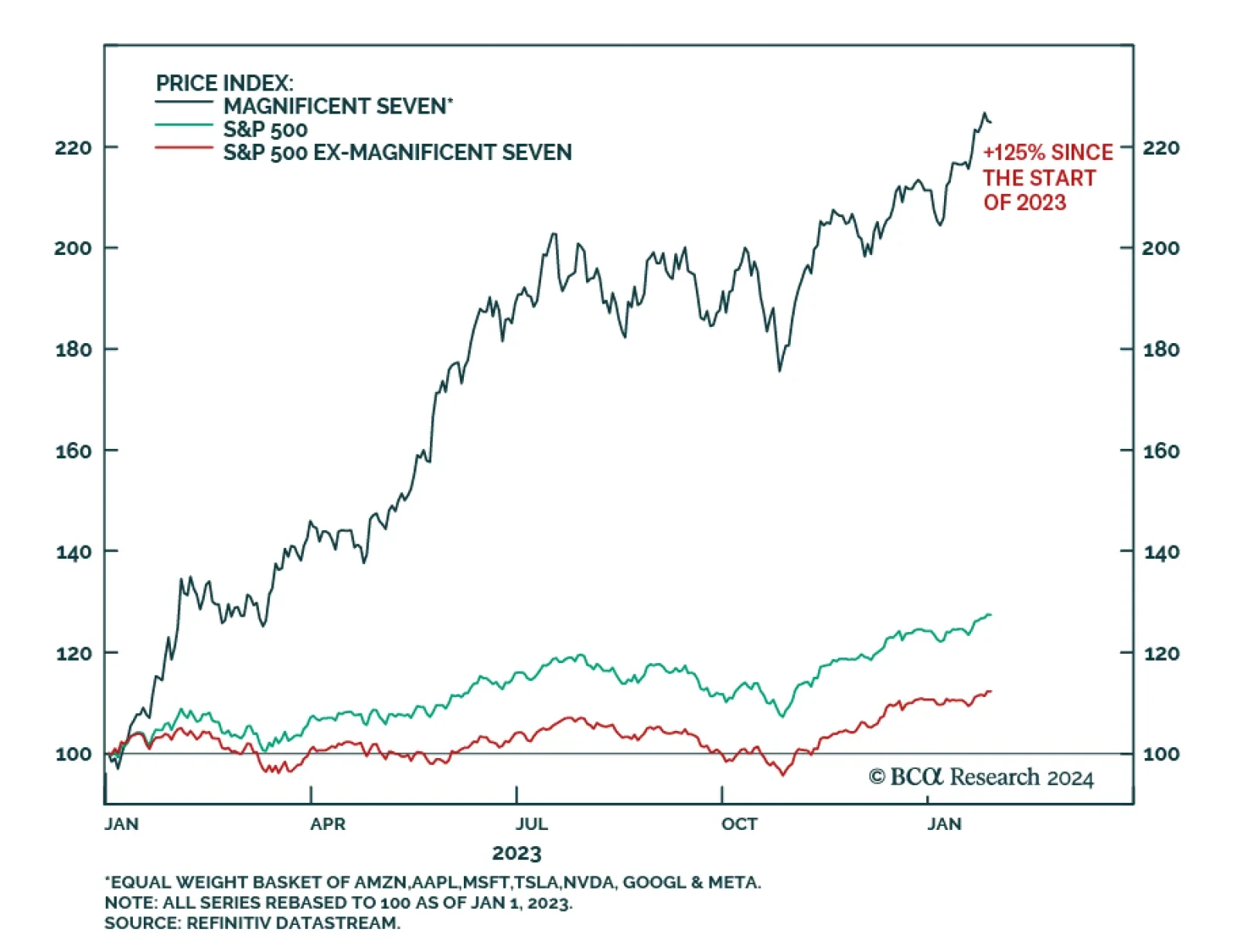

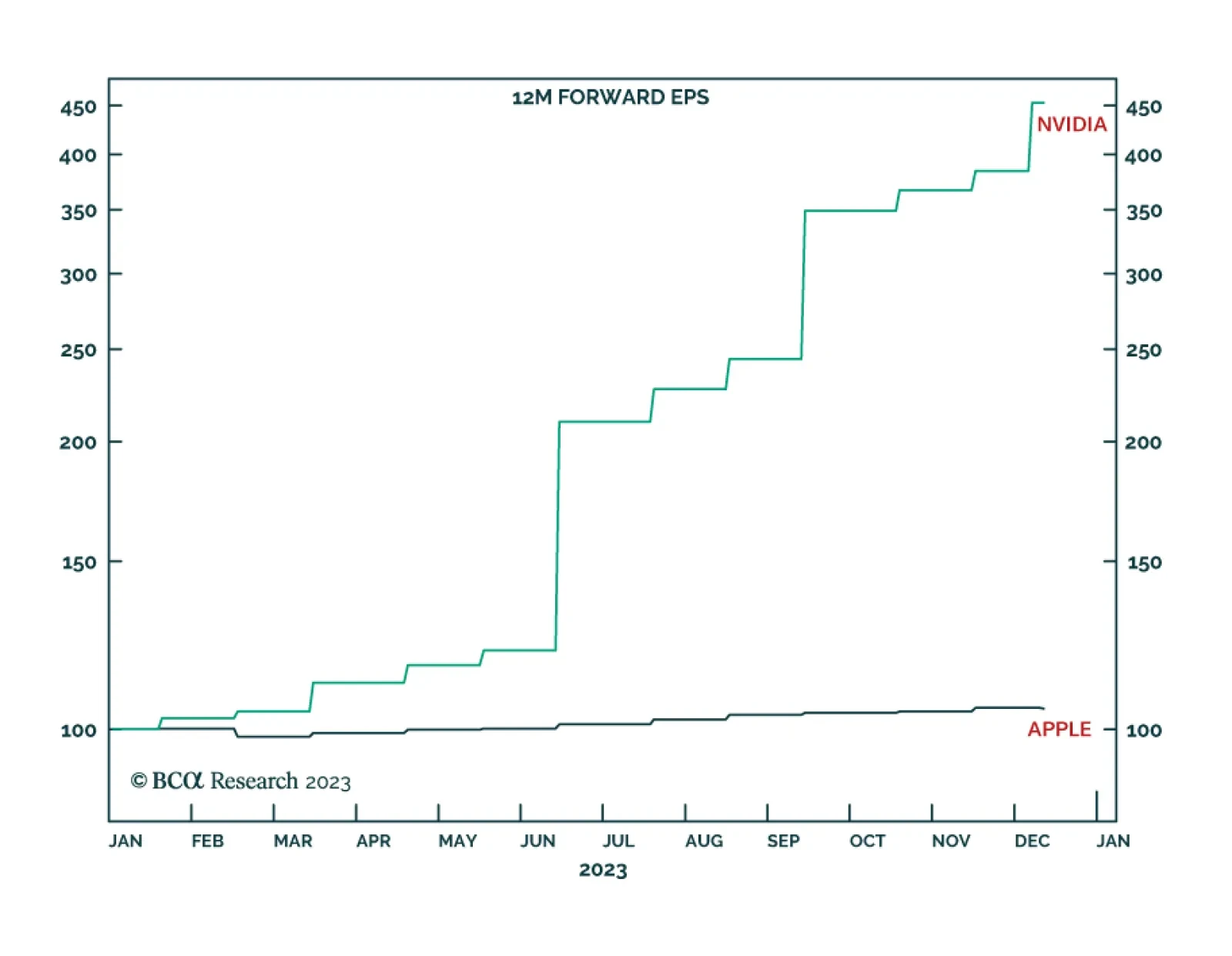

According to BCA Research’s Counterpoint service, the AI gold rush will struggle to find any gold. In a gold rush, very few people get rich finding gold. But the guys selling the picks and shovels make a fortune! In the…

According to BCA Research’s European Investment Strategy service, European equities near cycle highs are vulnerable to weaker earnings. The team’s earnings model for Eurozone equities continues to point to a double…

China’s CPI and PPI releases delivered a negative signal about the domestic economy. The rate of contraction in the CPI index accelerated to -0.5% y/y in November, the sharpest rate of decline in 3 years and disappointing…

The recent decline in yields has powered European equities higher, however, this rally cannot last if earnings decline meaningfully. With this in mind, are our earnings models flagging risks for stocks next year?