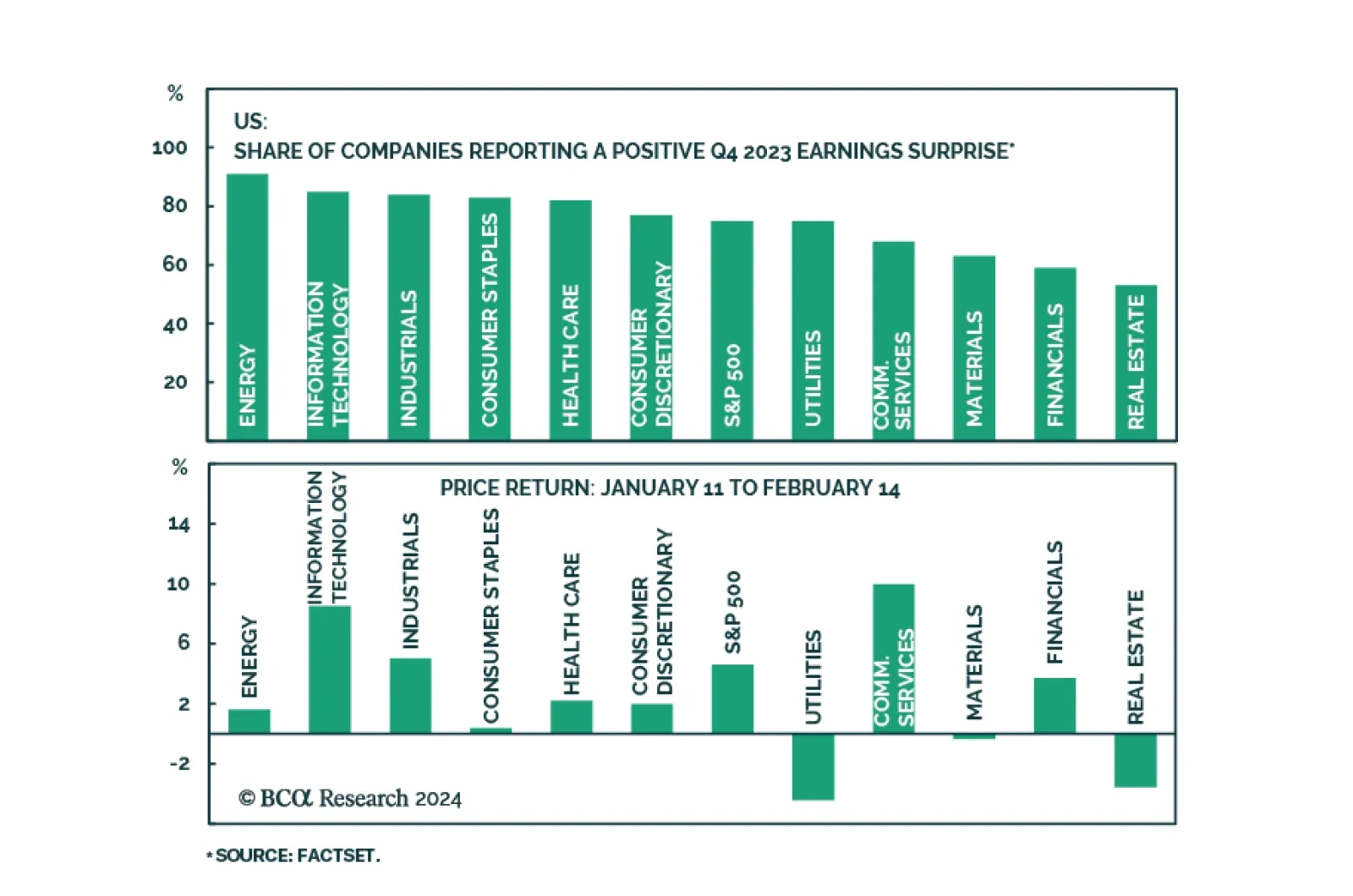

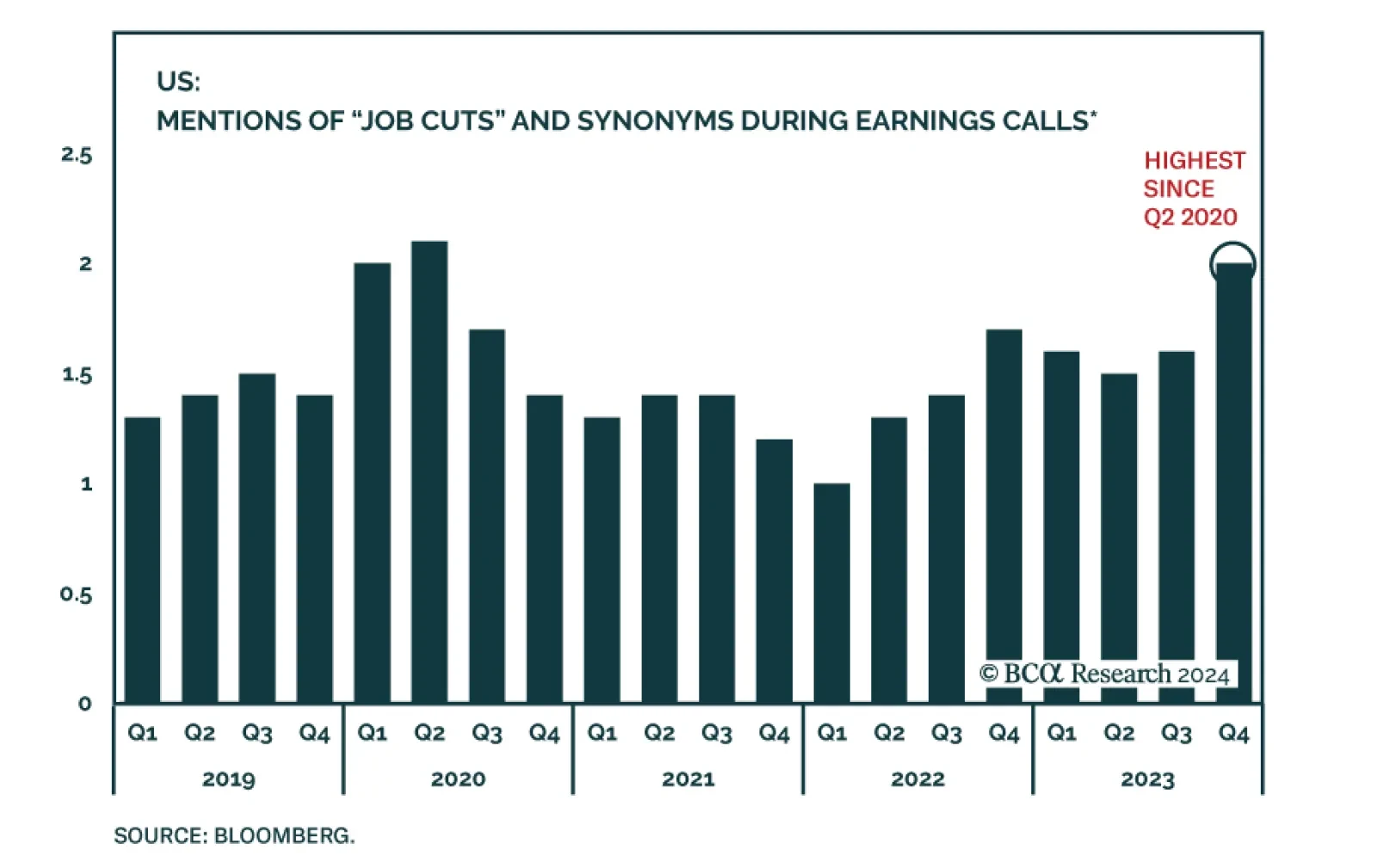

Reported earnings for Q4-2023 were rather underwhelming and prone to issues that we have identified over the past few months: Growth is concentrated in just a few sectors and companies, while the profitability of a broad swath of the…

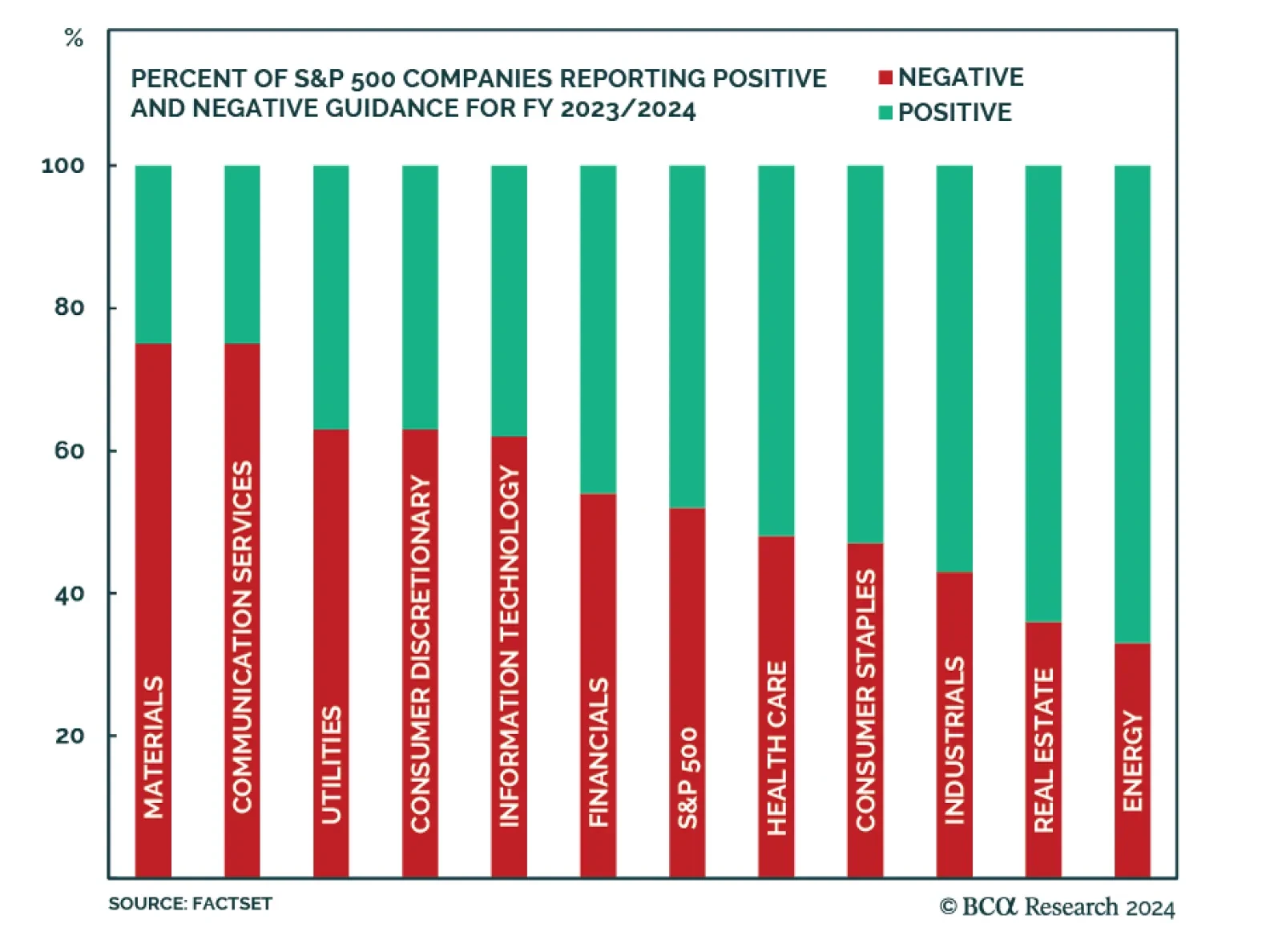

According to the latest figures from FactSet, 59 of the 85 S&P 500 companies that have issued EPS guidance for Q1 2024 have guided lower. At 69%, the share of companies issuing negative EPS guidance is above both the 5-year…

According to BCA Research’s Emerging Markets Strategy service, the diminishing pace of disinflation in the US could pose a threat to US share prices in the near term. In the medium term, the key risk to US share prices is…

We are now more than midway through the Q4 2023 earnings season. Roughly two-thirds of the companies in the S&P 500 have released their earnings reports. It’s therefore worthwhile to stand back and observe some of the…

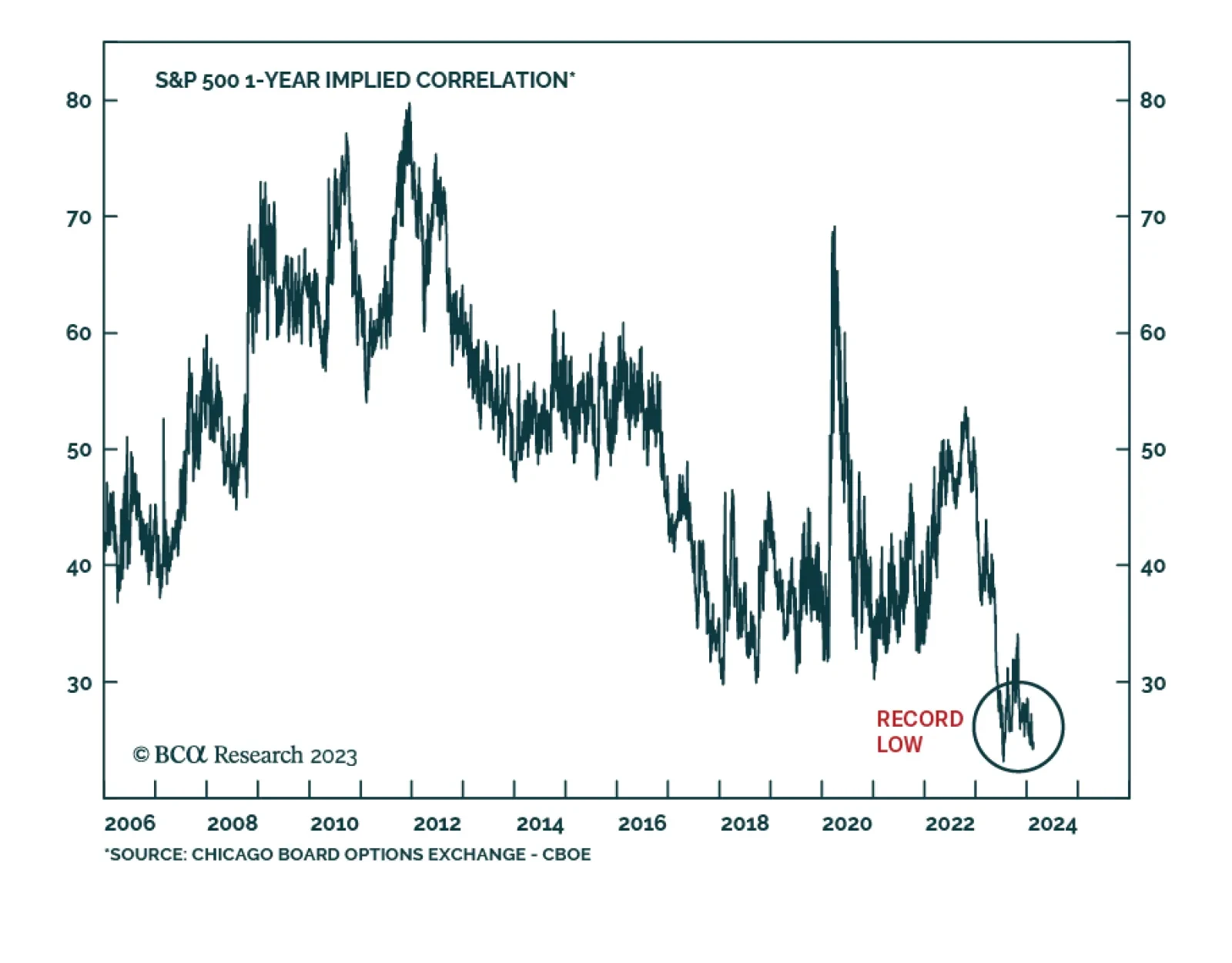

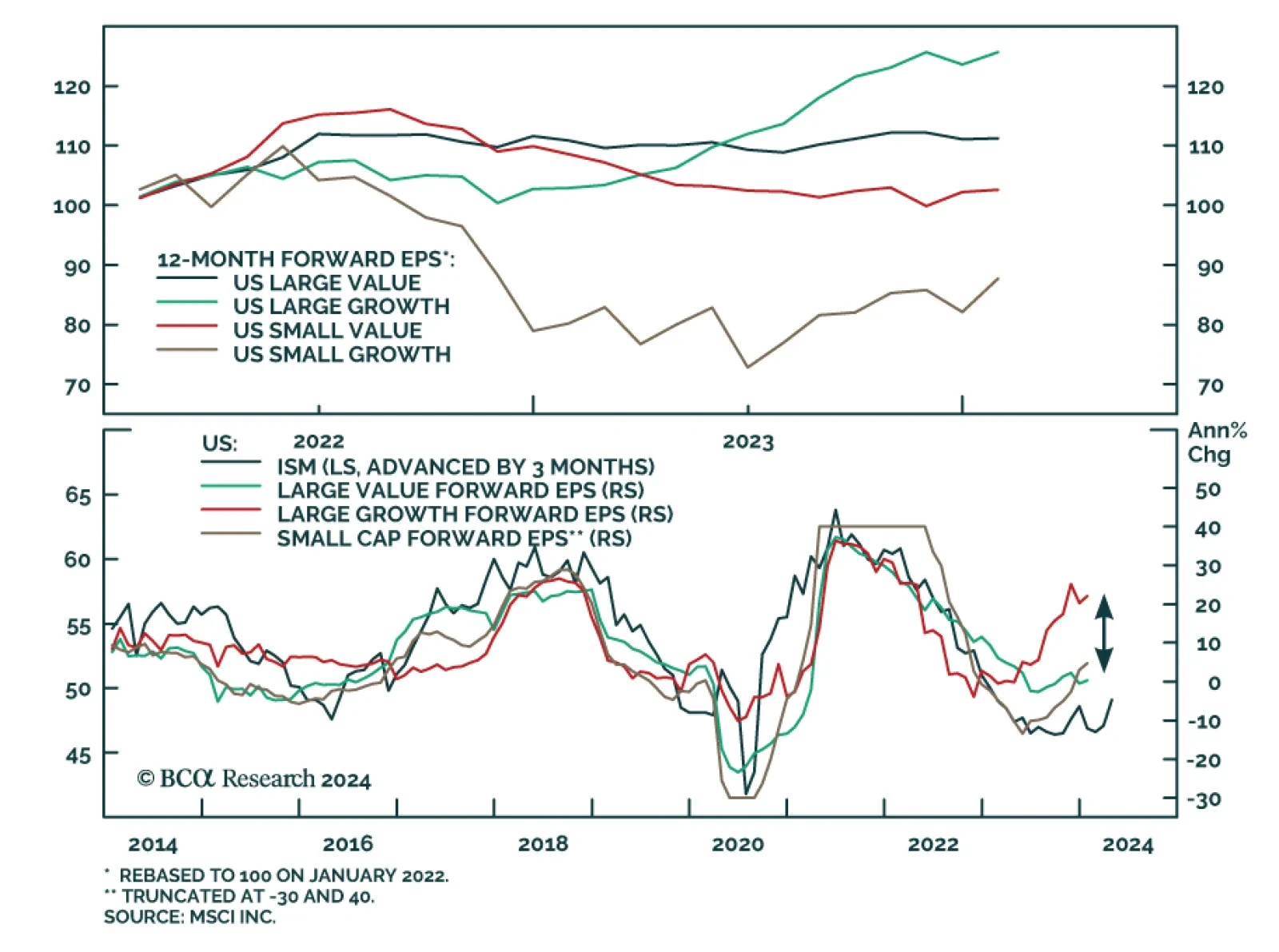

The dominance of large tech companies in the S&P 500 has caused concern amongst investors. The Magnificent Seven now represent 30% of the index. These companies have more than doubled in value over the past year, in contrast…

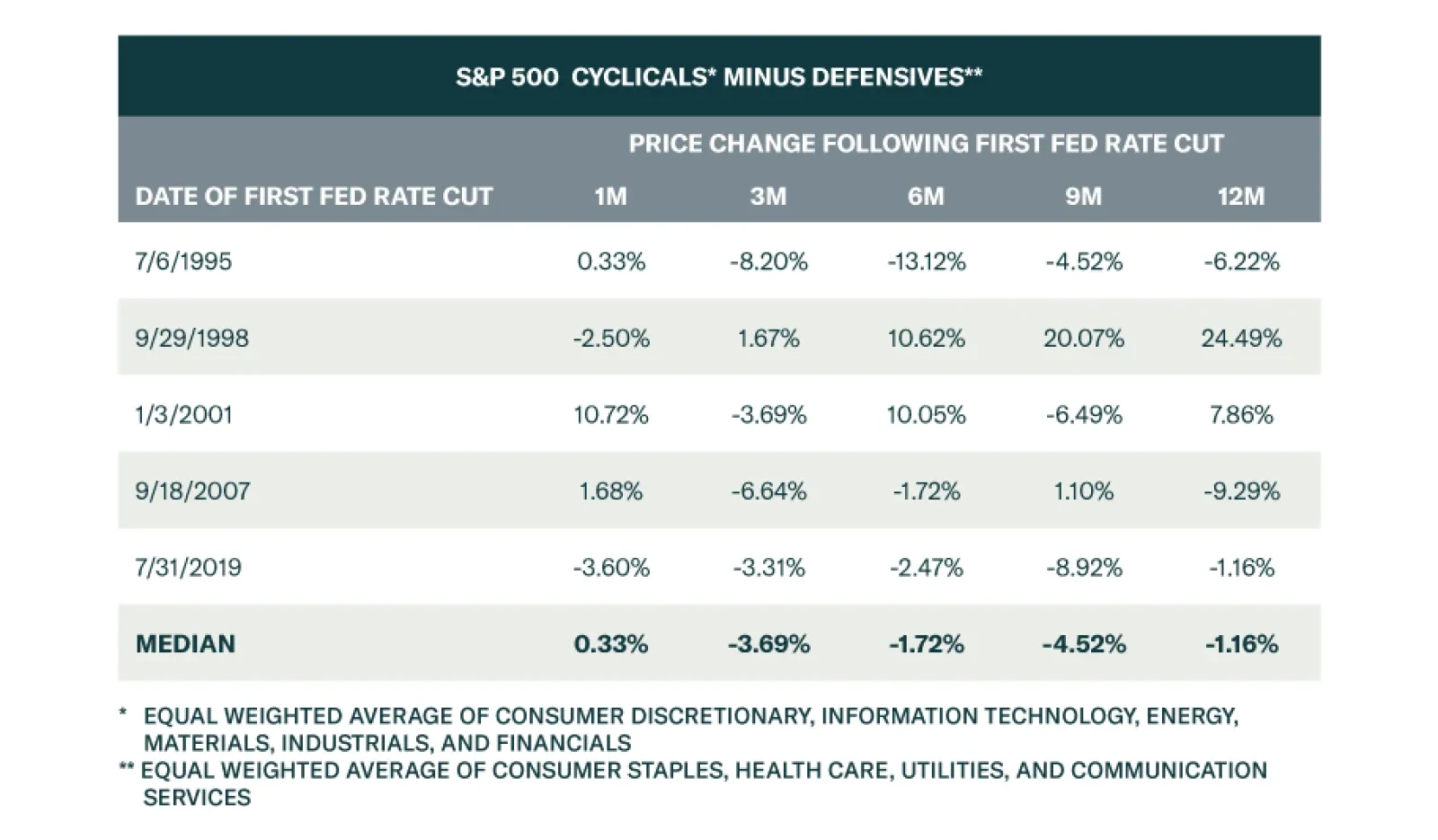

Last Friday’s blockbuster US employment report is among the recent data releases that have focused investors’ attention on the possibility that resilient economic conditions will reduce the magnitude of Fed easing…

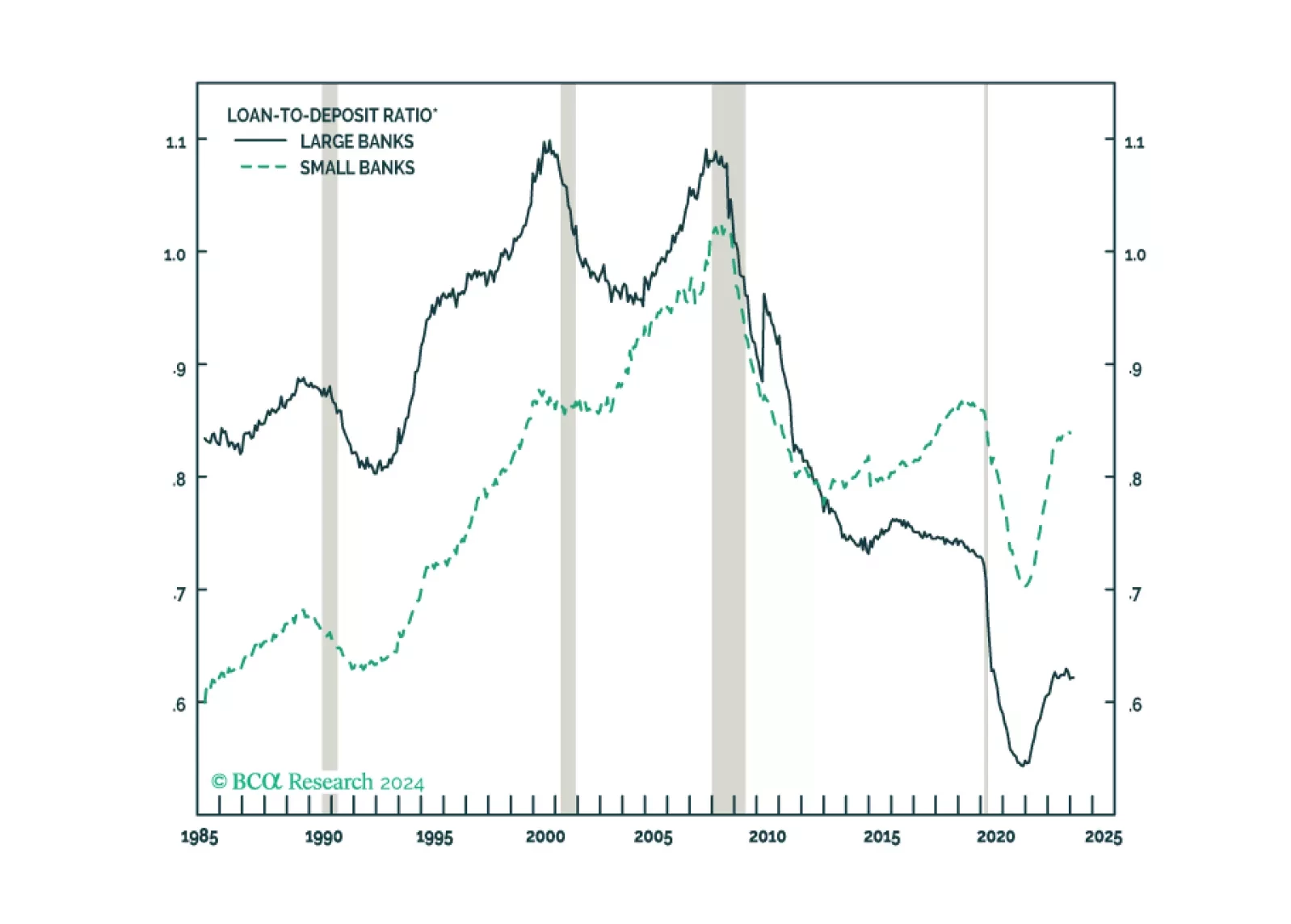

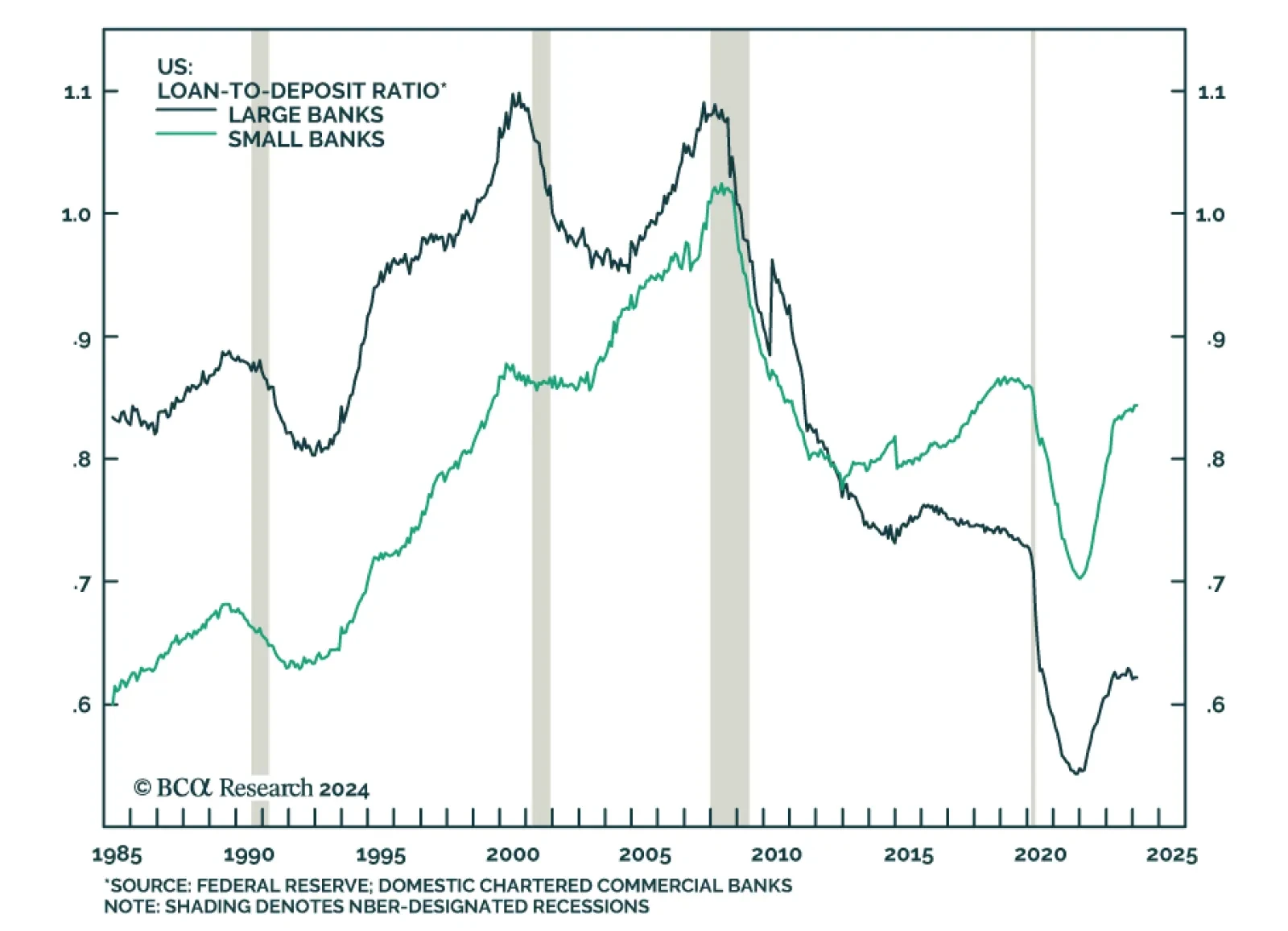

Banks were thrust back in the spotlight’s unflattering glare last week when mid-cap regional New York Community Bank shocked analysts and shareholders with an enormous credit loss. According to BCA Research’s US…

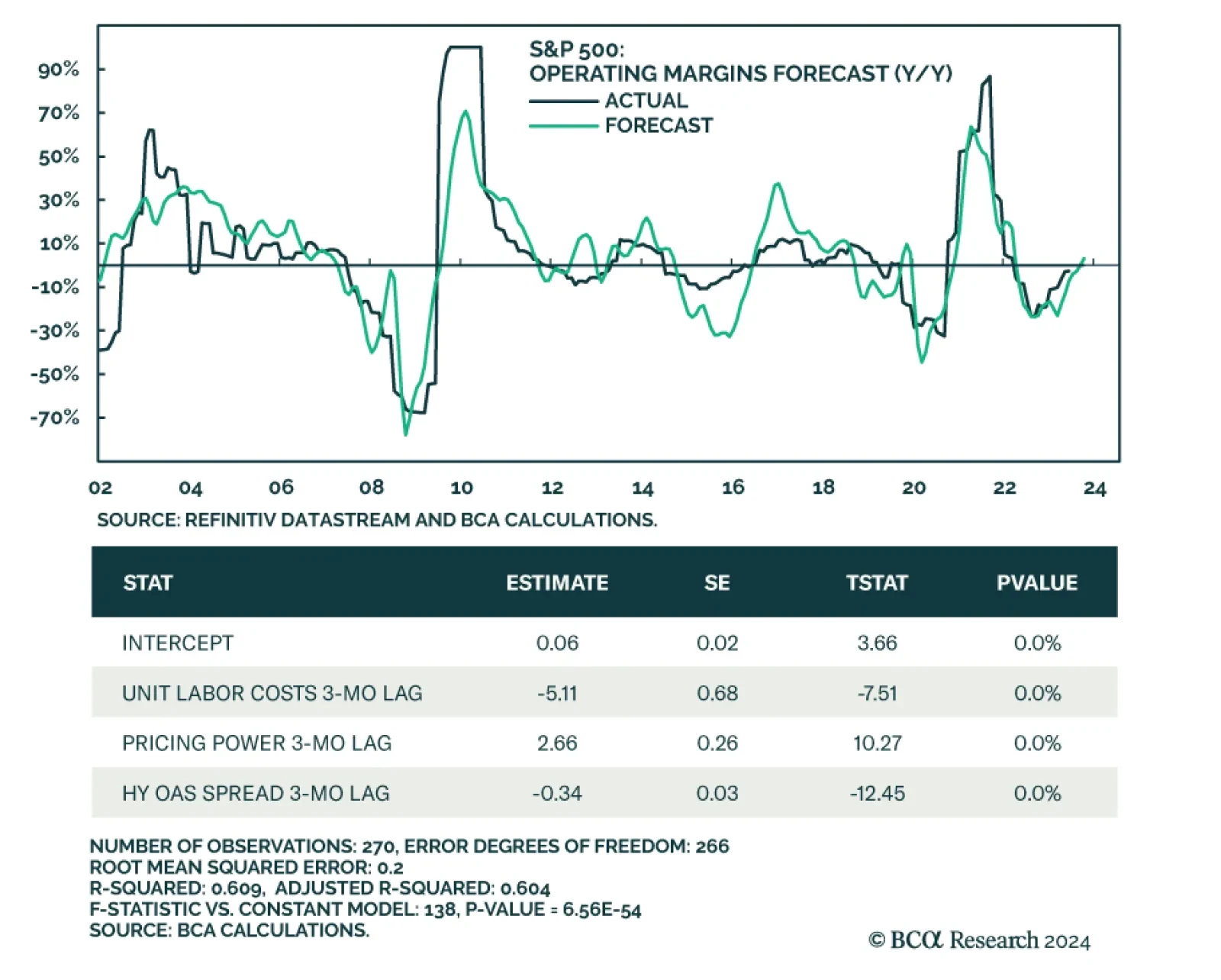

S&P 500 operating margins have been in a downdraft for nearly two years – but the consensus is still penciling in expansion for 2024. How likely is that? Our US Equity Strategy colleagues have addressed this question…

Investors are likely to pay close attention to the Fed’s communication on Wednesday for clues about the likely timing of the first rate cut. For now, markets are assigning slightly higher odds to the central bank standing…