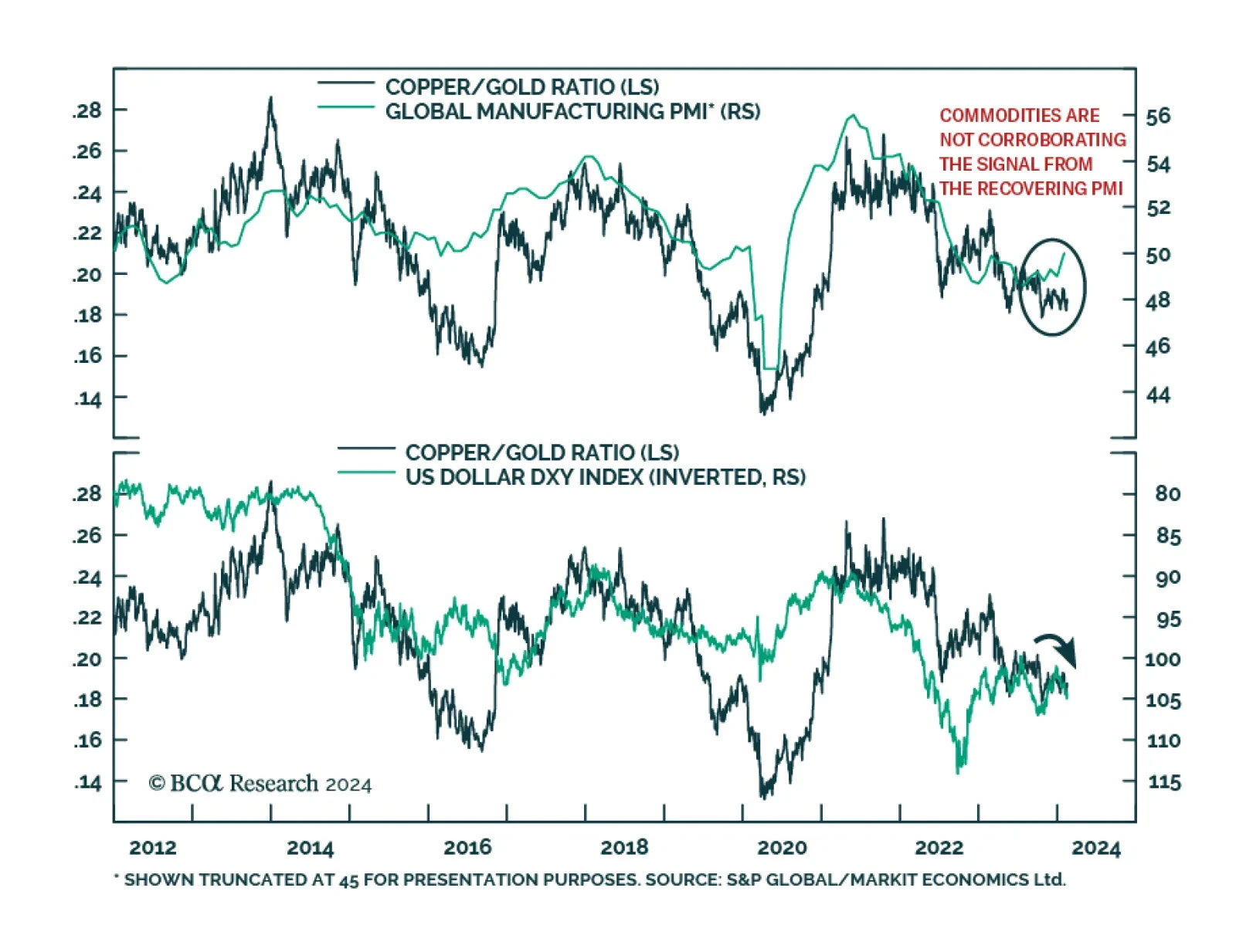

The Global Manufacturing PMI clocked in at 50 in January – exactly on the boom-bust line. The index has been on a general uptrend since mid-2023 with the January figure marking the first non-contractionary reading since…

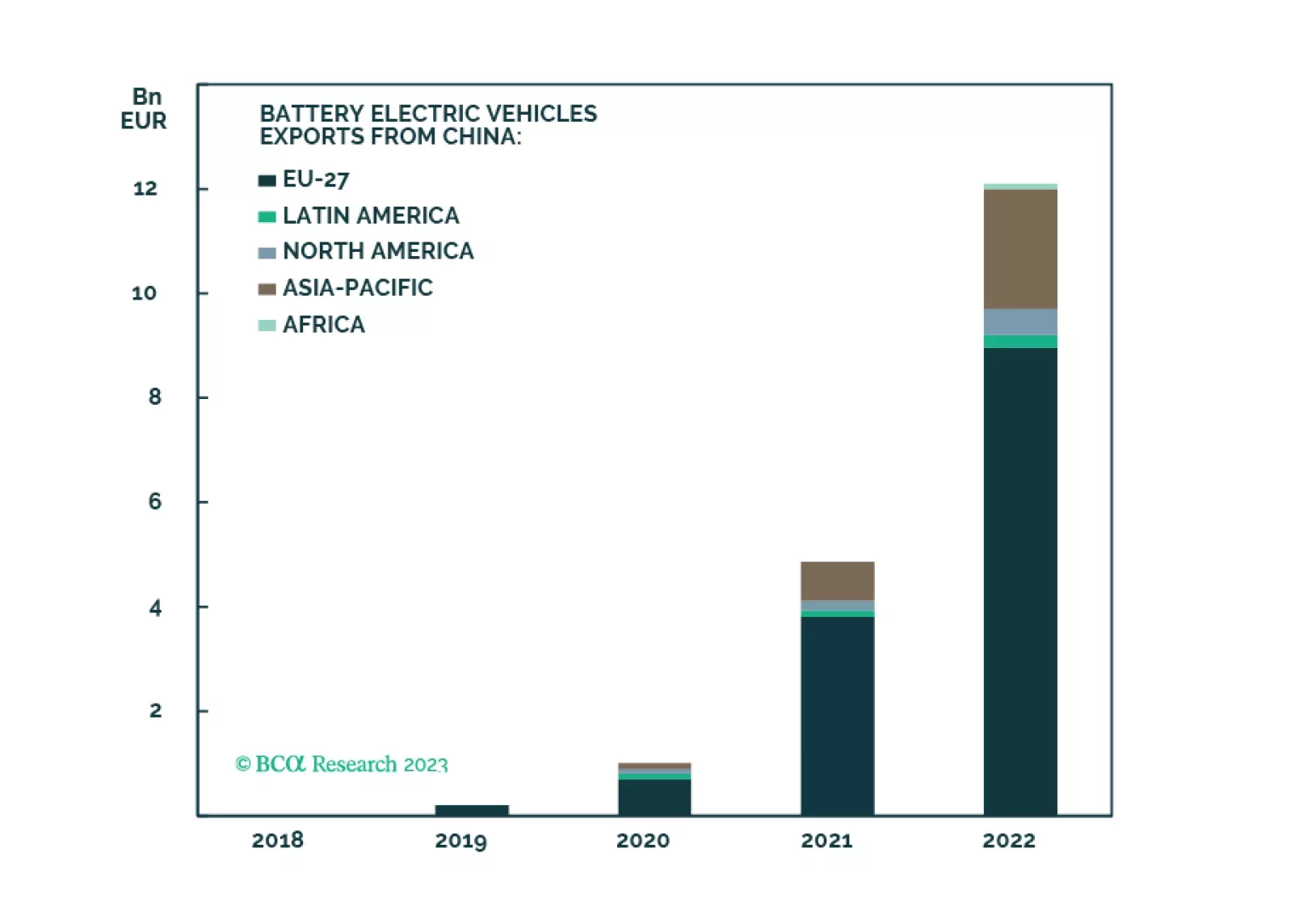

Supply and demand shocks in markets critical to the renewable-energy and defense industries will continue to play havoc with prices, which will negatively impact capex. In the short run, this benefits China given its already-dominant…

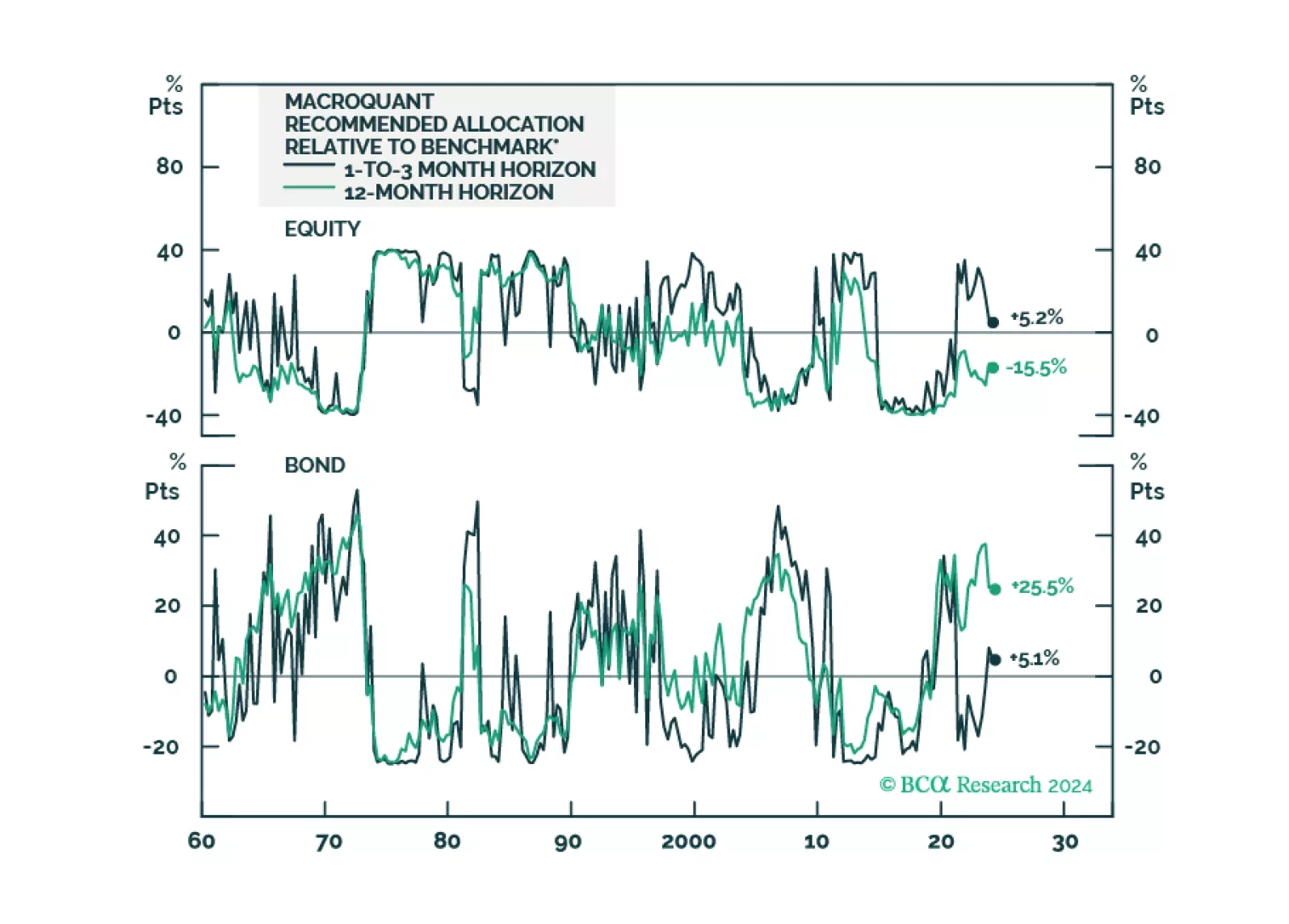

Following the release of the white paper yesterday, today we are sending you the inaugural issue of the MacroQuant Monthly, a report summarizing the output of our next-generation MacroQuant 2.0 model.

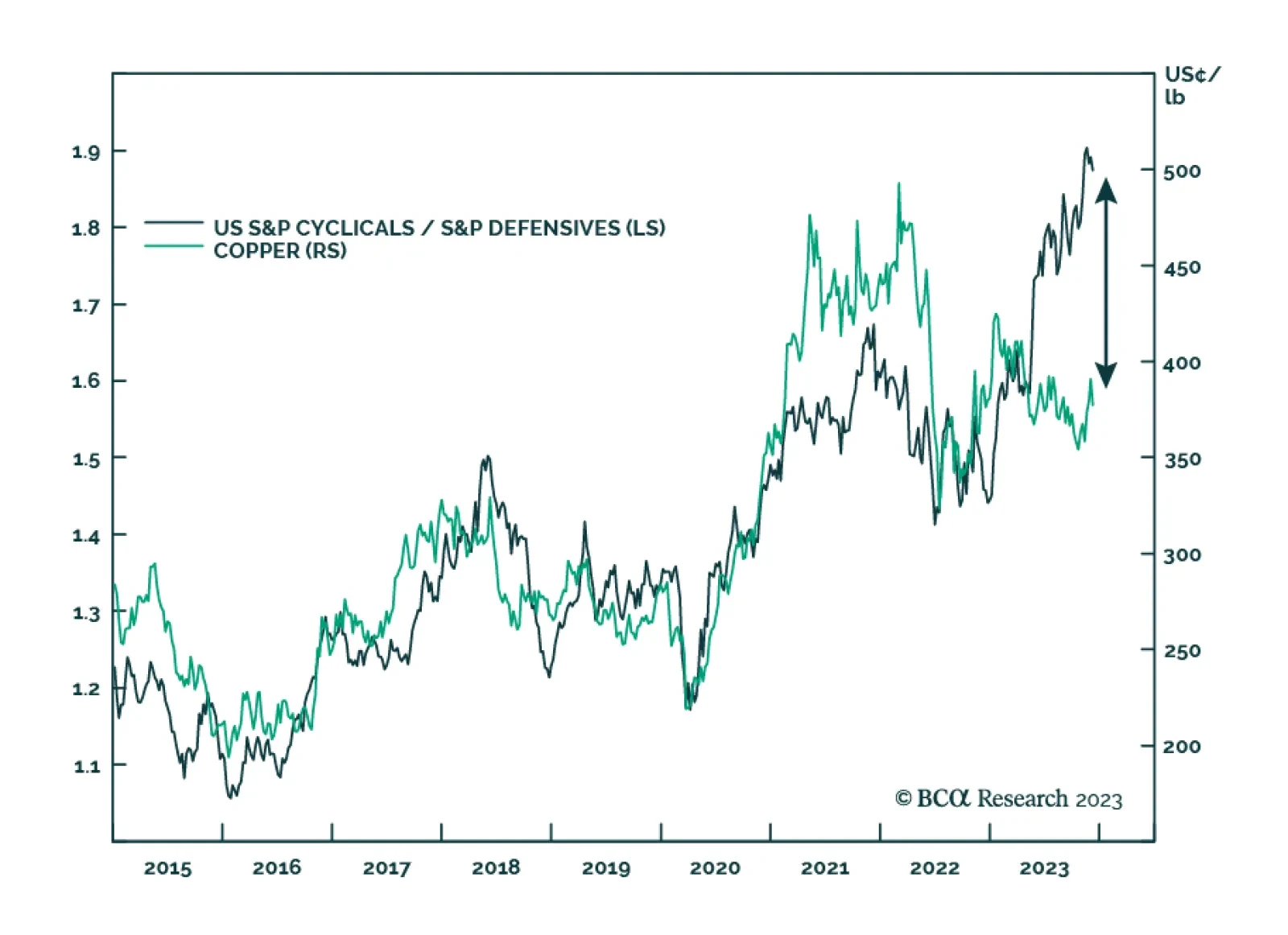

After rallying by 11.2% between October 5 and December 27, the price of copper has since been on a losing streak, falling in each of the subsequent six trading sessions. Notably, this decline has coincided with weakness among…

Copper benefited from the recent improvement in global risk sentiment, participating in the broad-based rally in November. To the extent that the red metal has vast applications across many economic sectors, it is…

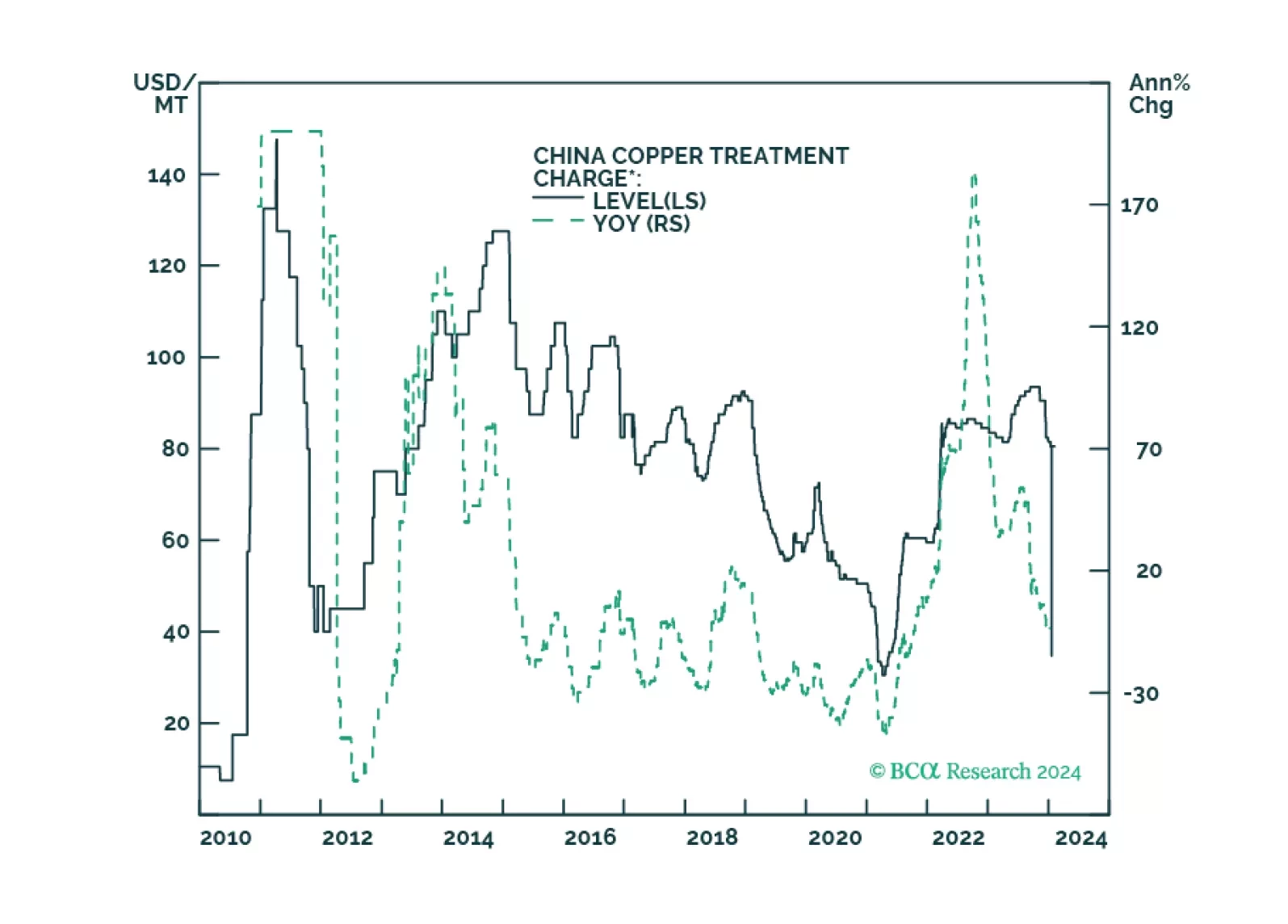

China’s push to dramatically expand its copper-refining capacity will be complemented by further vertical integration of mining assets. However, surplus refining capacity will push treatment and refining charges lower in the short…

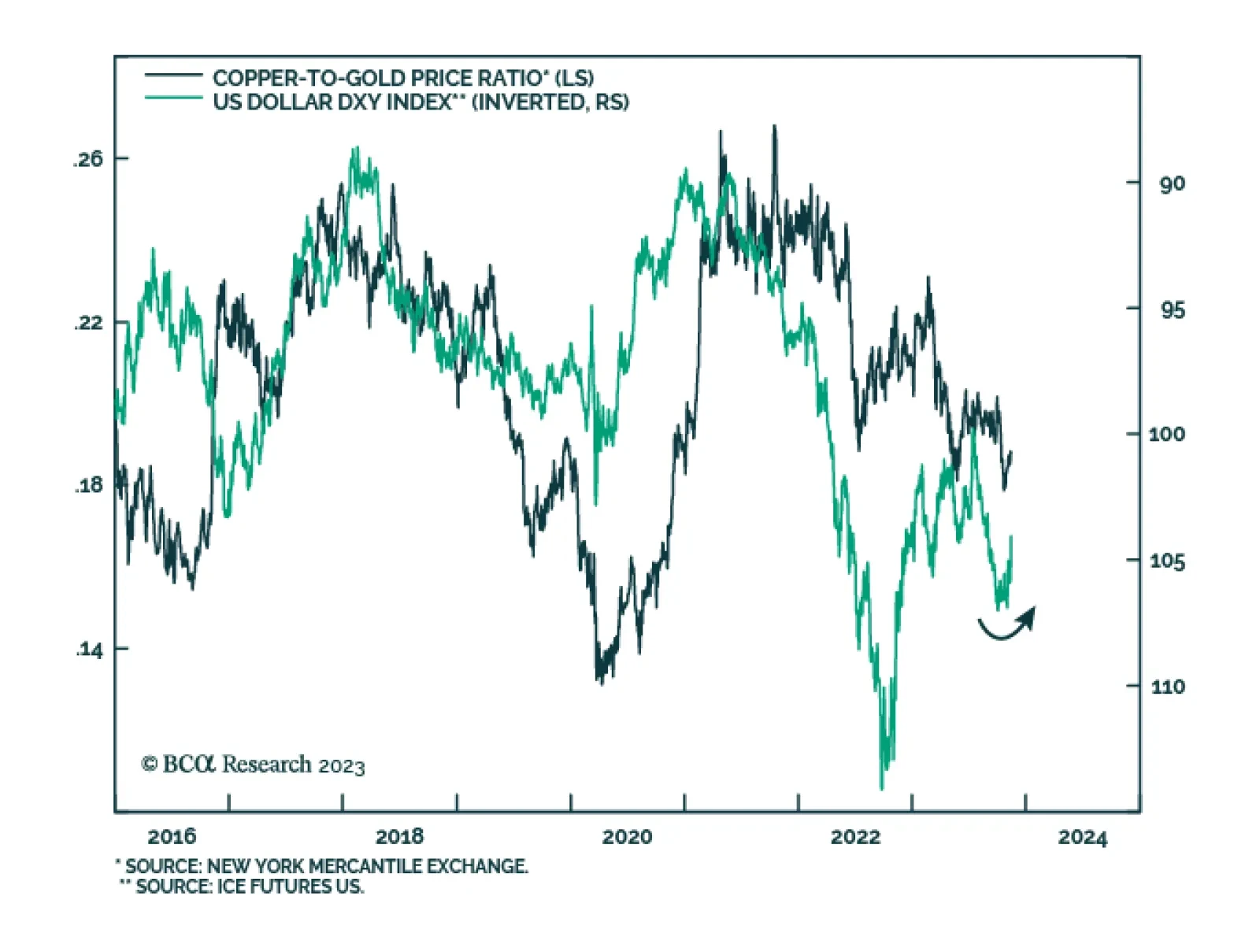

Throughout most of the second half of this year, the copper-to-gold ratio has been relatively stable, gyrating within a tight range. However, it is starting to show some tentative signs of bottoming. After the copper-to-gold…

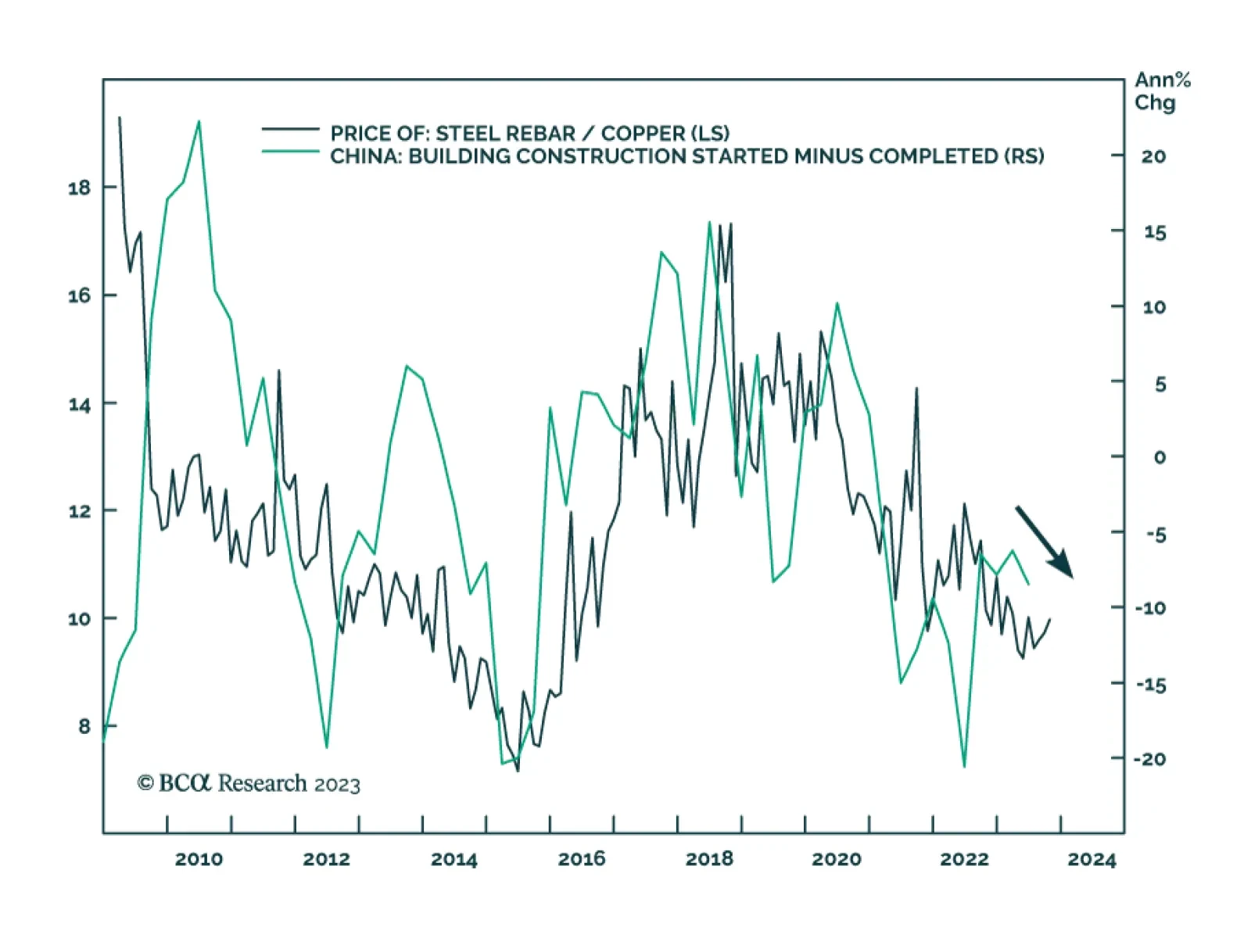

Earlier this year we highlighted that China's property market dynamics pose a greater risk to the price of steel vis-à-vis copper. This view was based on the expectation that Chinese policymakers will direct financing…

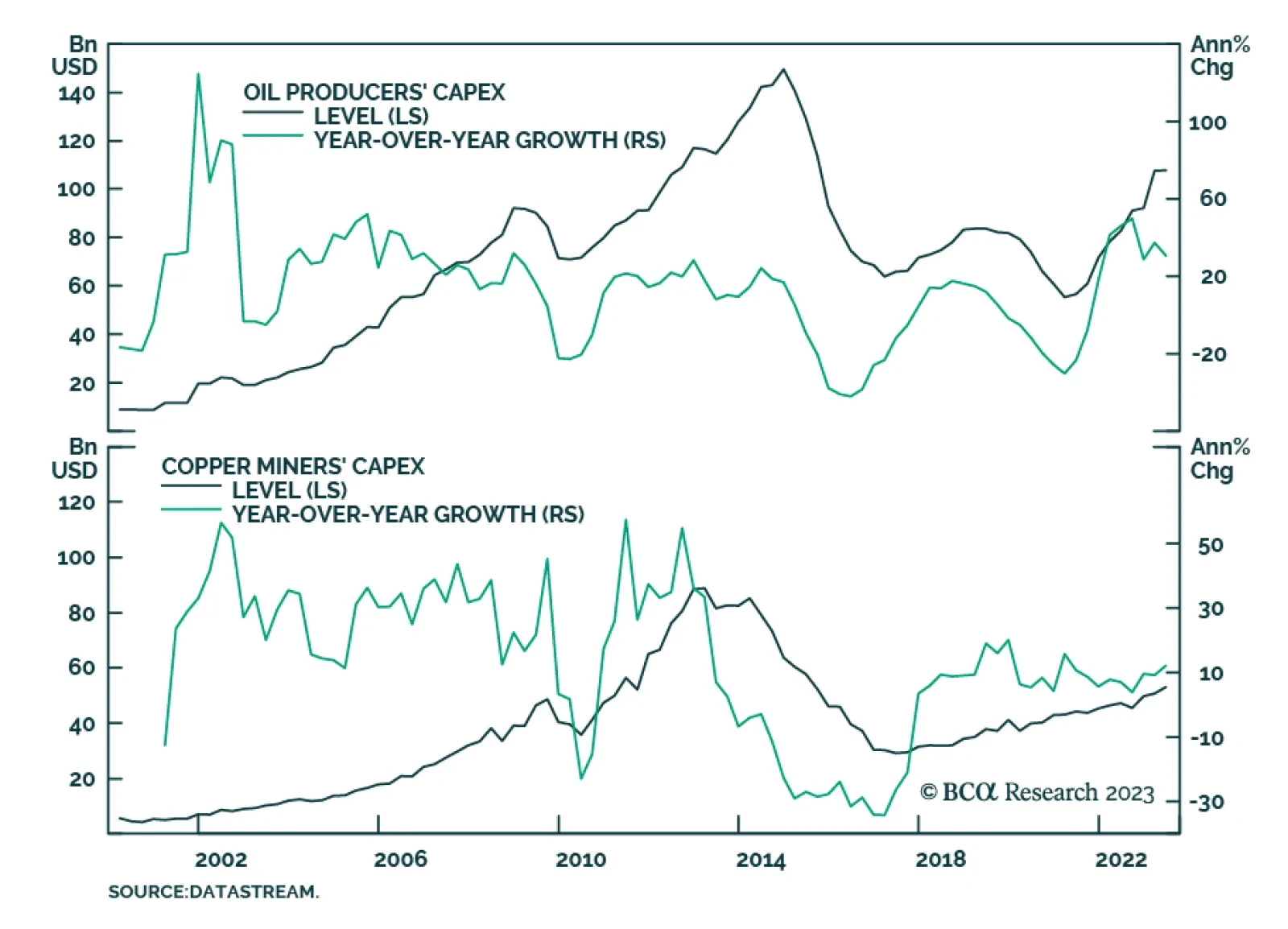

According to BCA Research’s Commodity & Energy Strategy service, the global energy transition will become more disorderly, if oil-and-gas capex growth continues to outpace that of critical minerals. The…