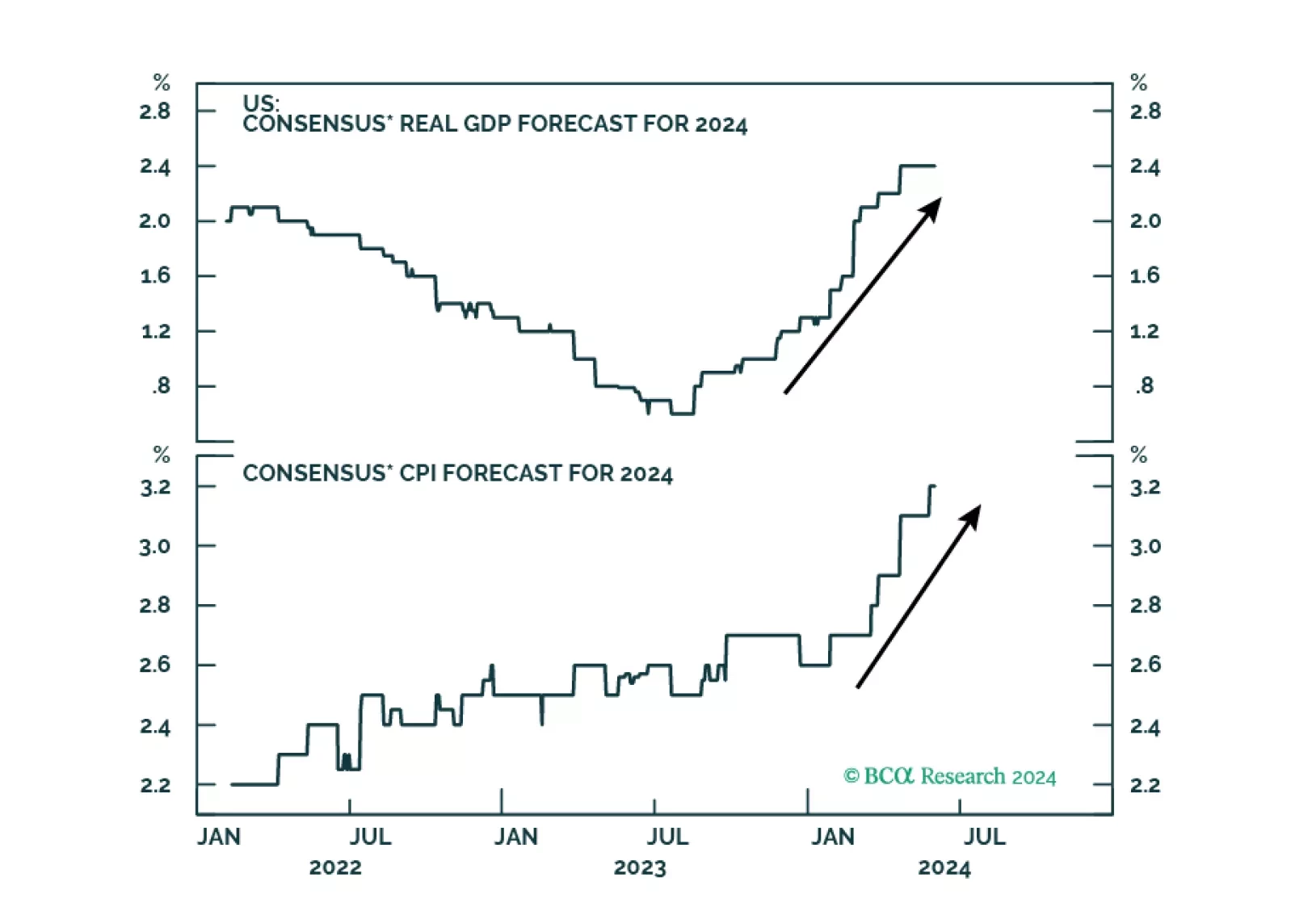

The US economy is in the “Overheating” phase, so stronger growth brings higher inflation. Tight monetary policy means recession is still likely over the next 12 months. Stay defensive.

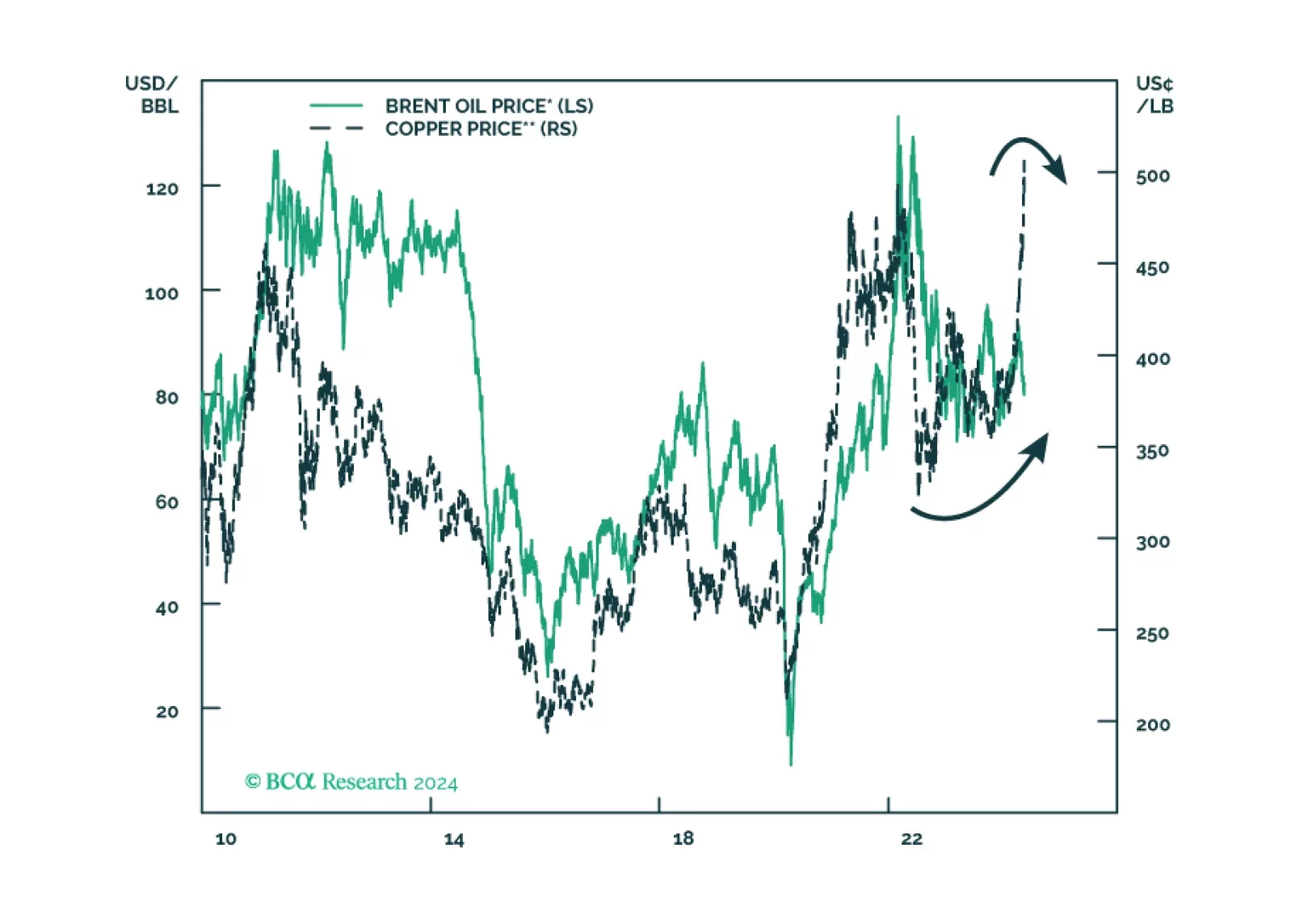

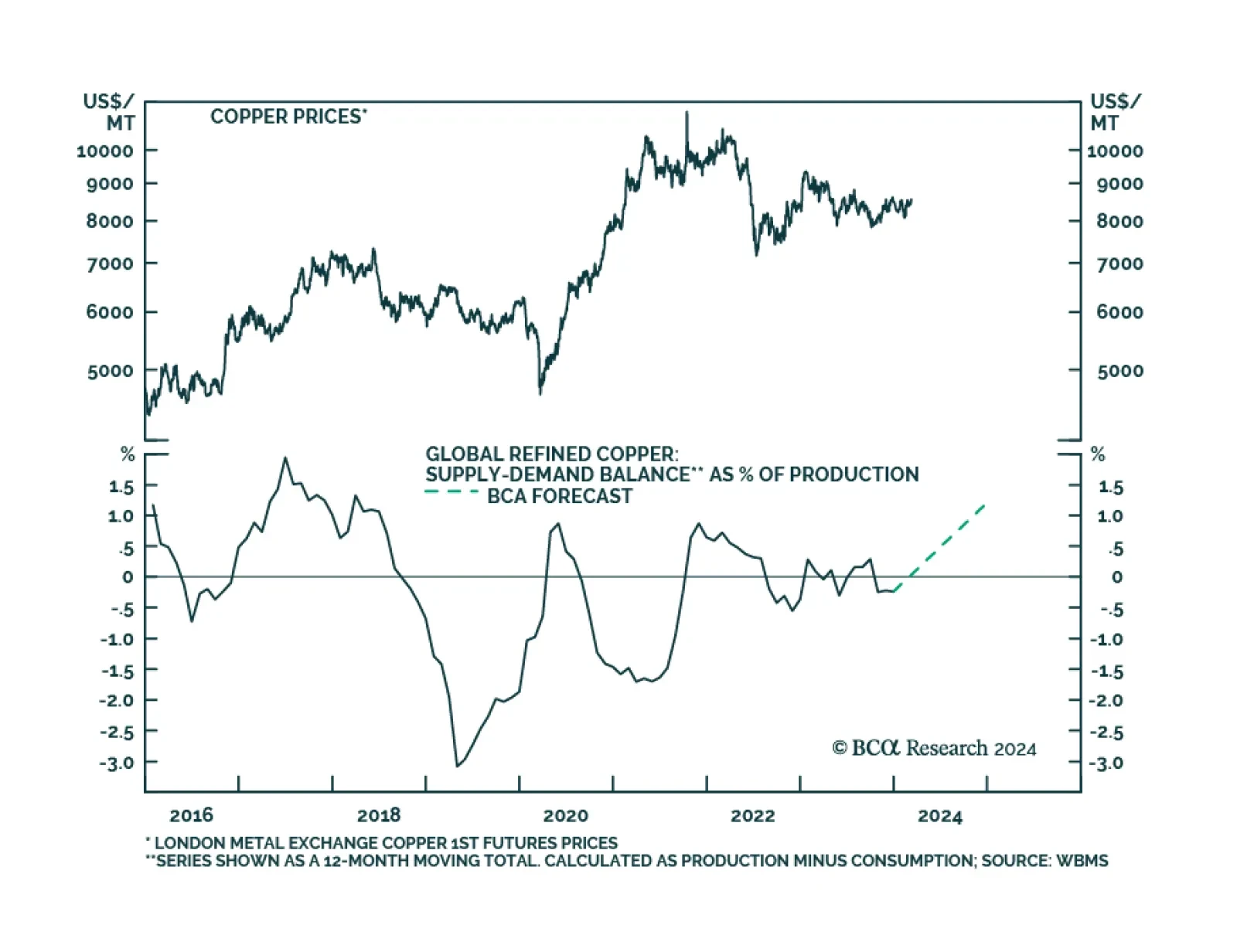

Copper prices have returned a whopping 25.6% YTD, briefly breaking above USD 5 earlier this month. The red metal accounts for a large share of industrial metals indices and it is being buoyed by the same late-cycle dynamics as…

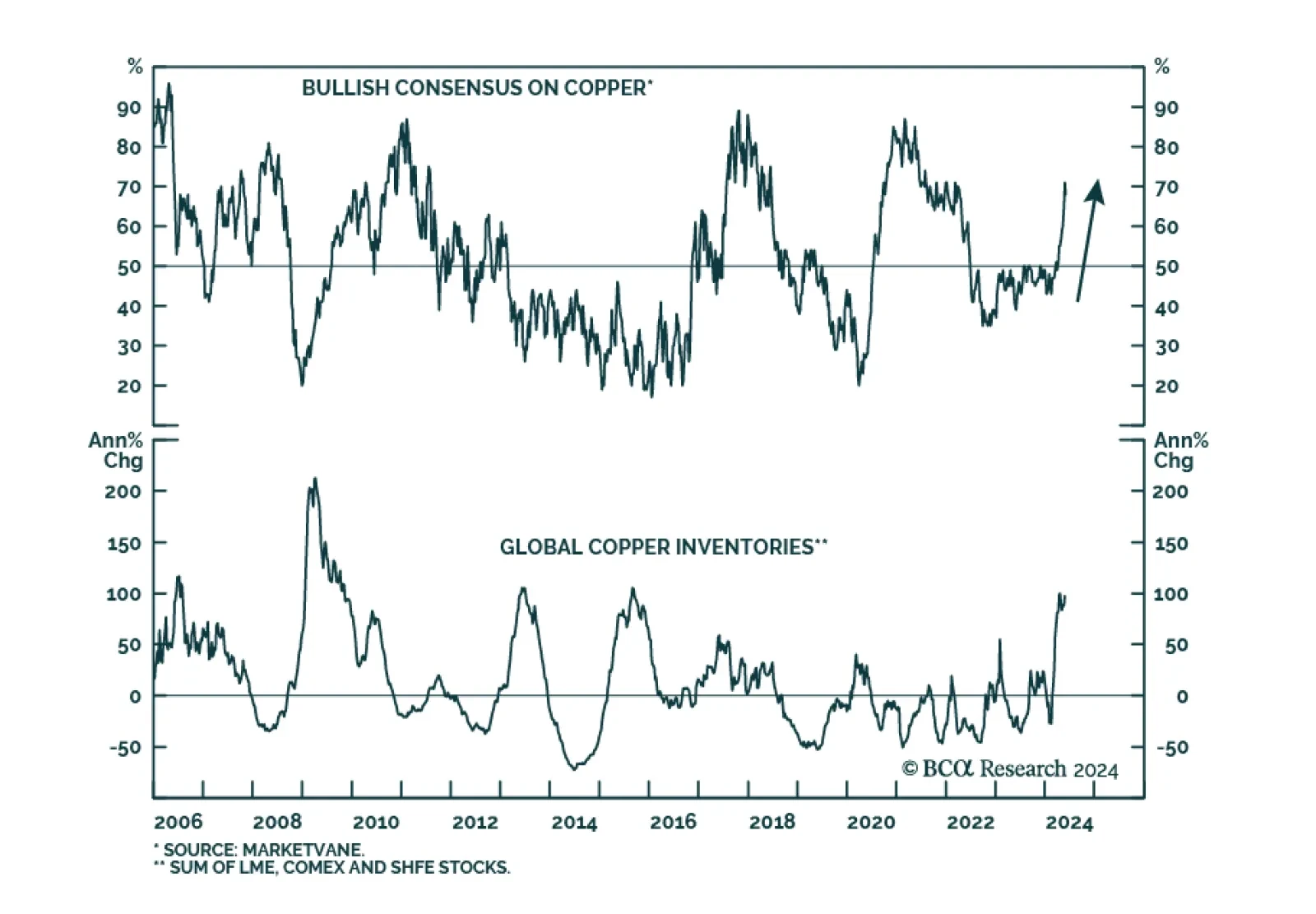

According to BCA Research’s Commodity & Energy Strategy service, the sudden increase in investor optimism about copper and lopsided long positioning has led to a short squeeze. Short squeezes are typically short-lived…

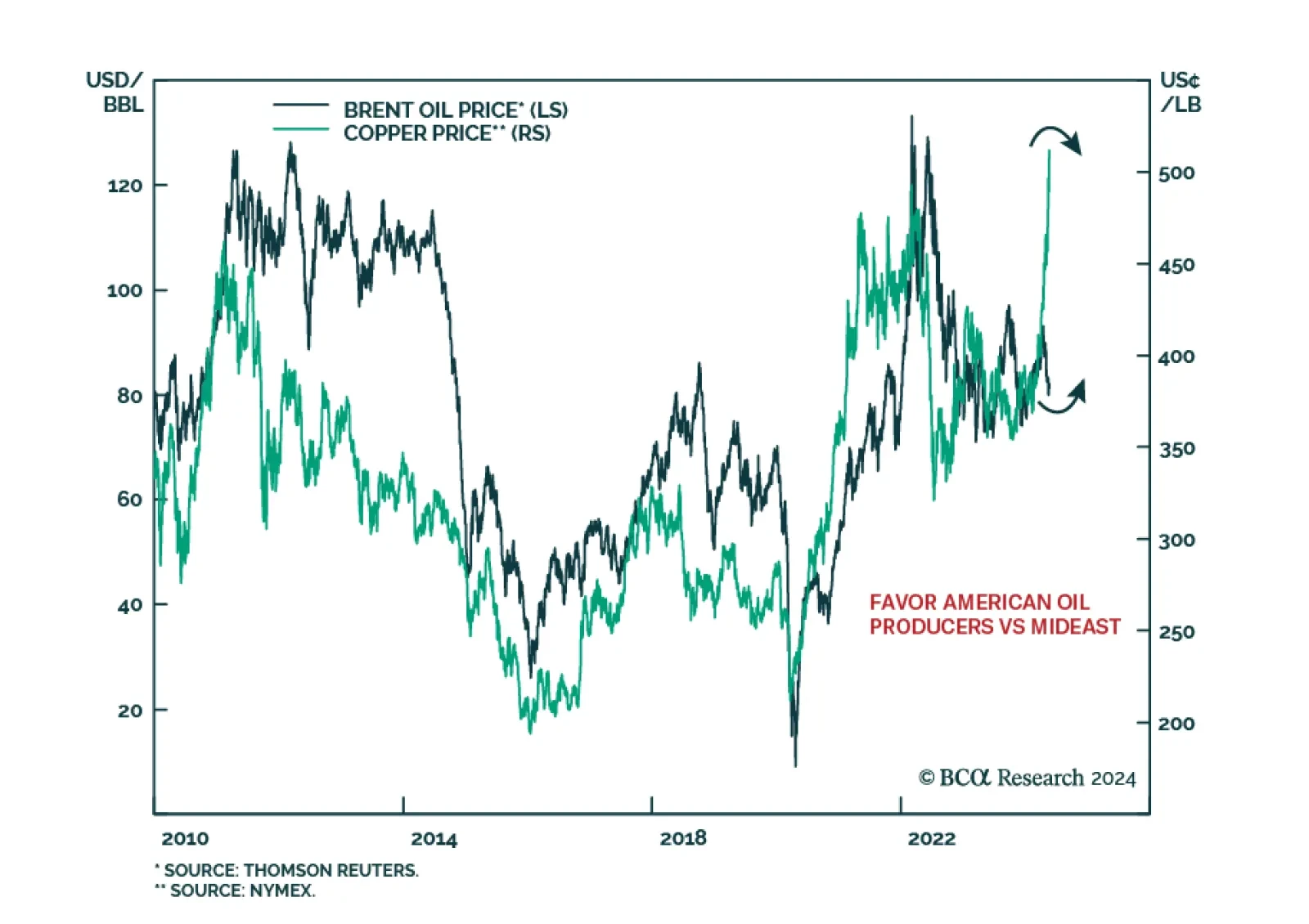

According to BCA Research’s Geopolitical Strategy service, the death of Iran’s President Ebrahim Raisi in a helicopter crash underscores the instability of Iran and the Middle East, which is getting worse, not better…

The death of the Iranian president reinforces our base case view of Middle Eastern instability and at least minor oil supply shocks. Rapid geopolitical developments in recent weeks are pointing to a new bout of global instability.…

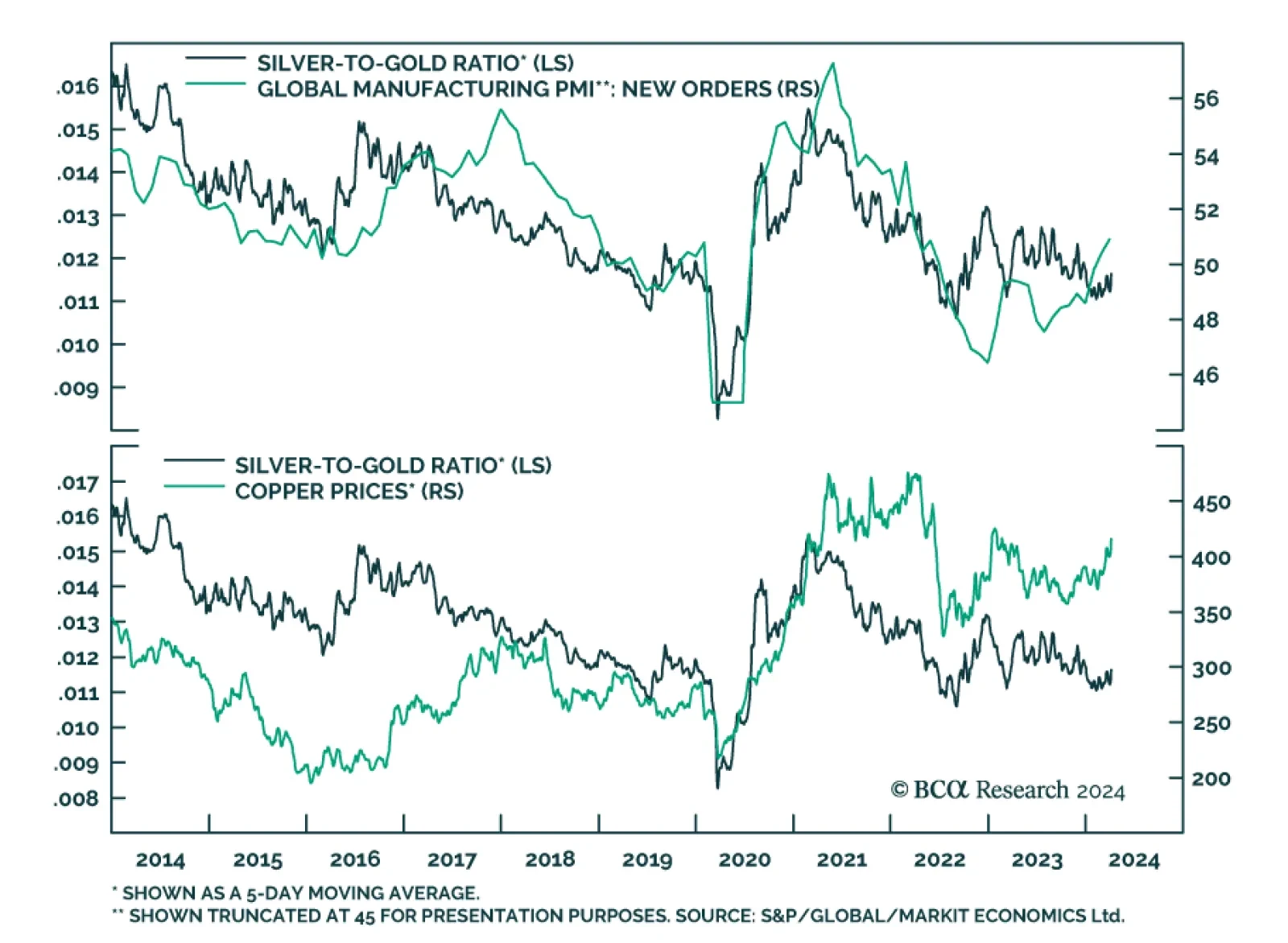

Commodities are making headlines with the prices of crude oil, copper, and gold all making sizeable gains since mid-February. Multiple forces have been cited as drivers of the rally across these commodities. Increased…

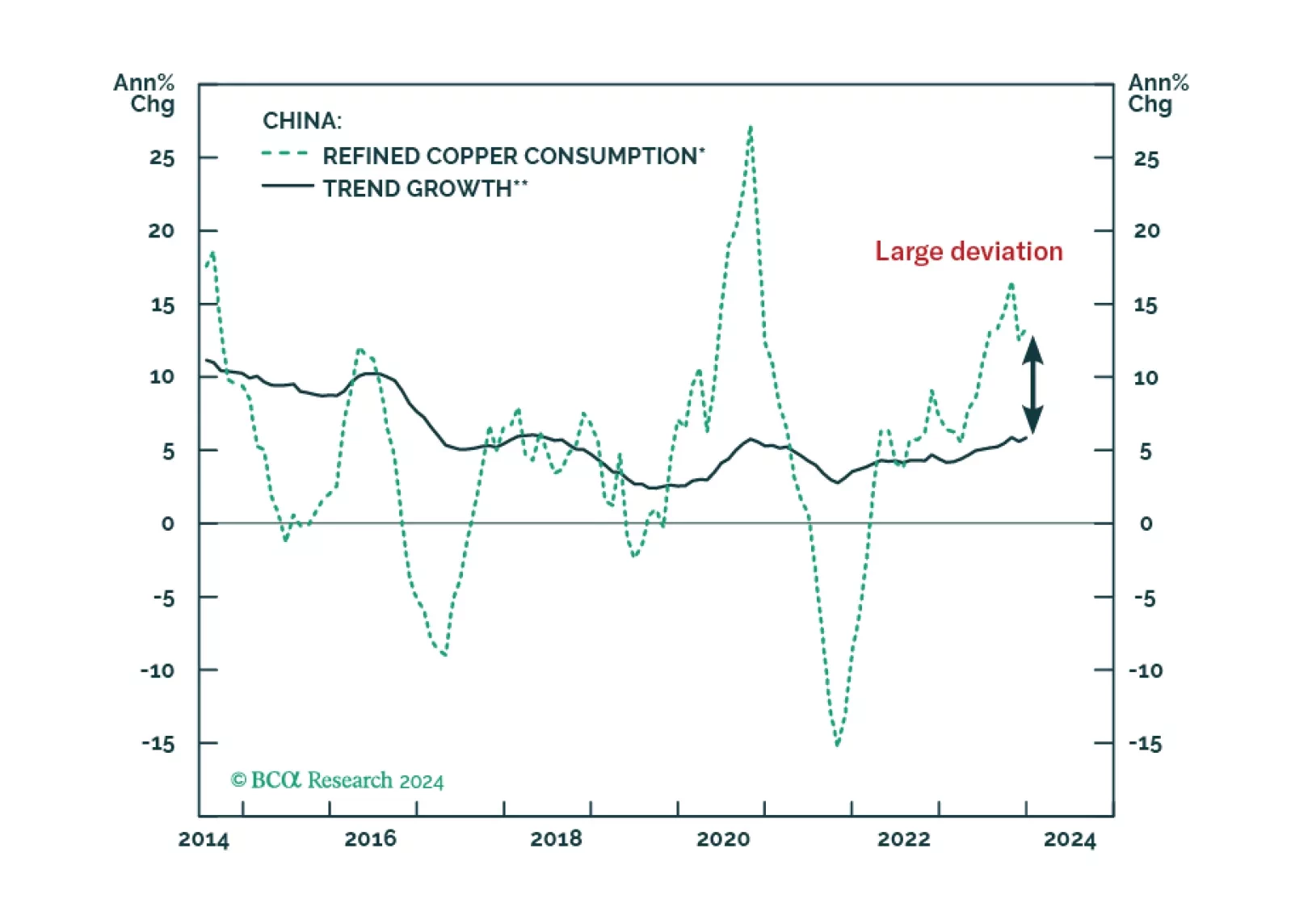

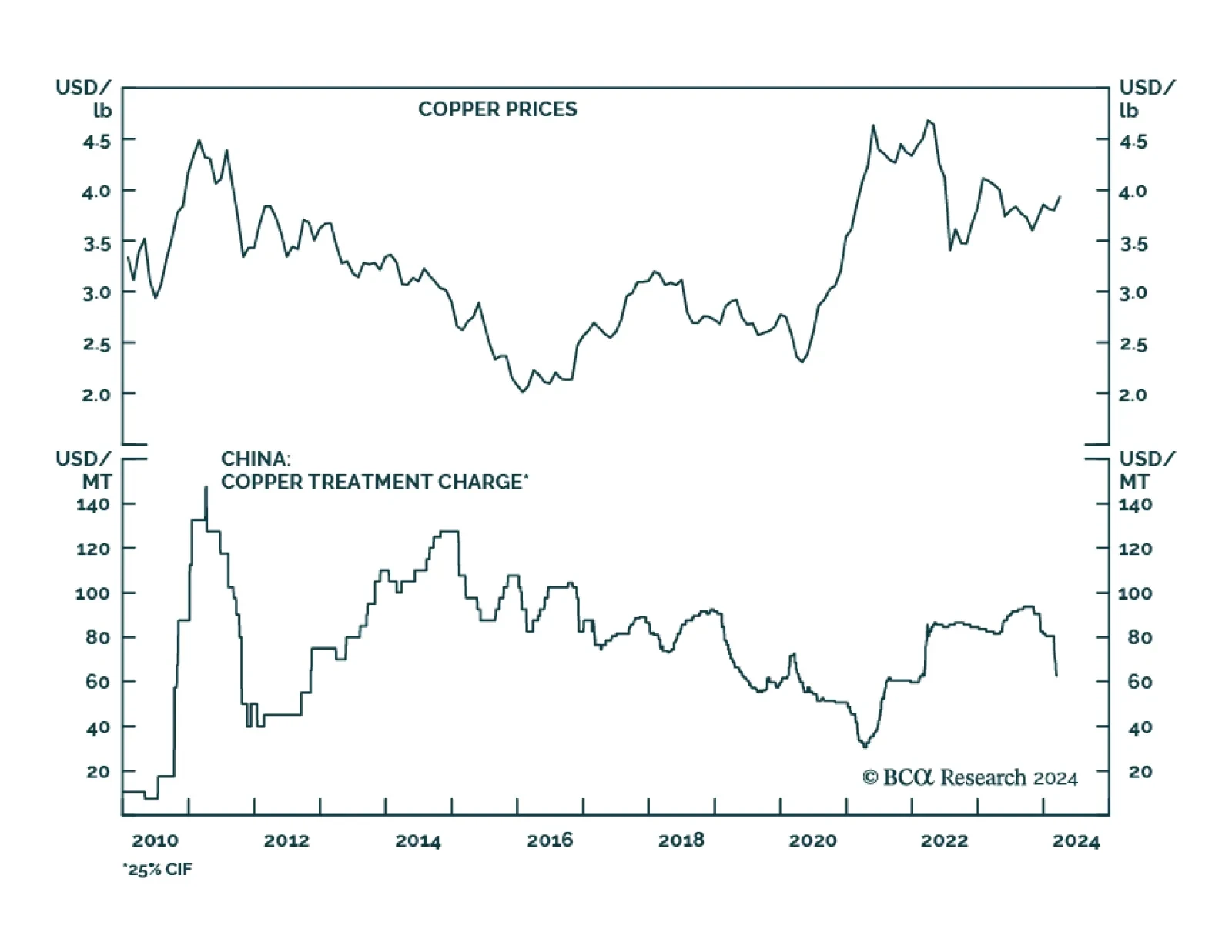

Copper markets are fast approaching a price breakout, as Chinese smelters scramble to find ore to meet increasing refined-copper demand in the wake of a global manufacturing rebound. We are holding fast to our expectation of $4.50/lb…

In a recent Insight we highlighted that the selloff in the price of iron ore – which is down 25.4% year-to-date – is sending a pessimistic signal on China’s economy, suggesting that the current rally in Chinese…

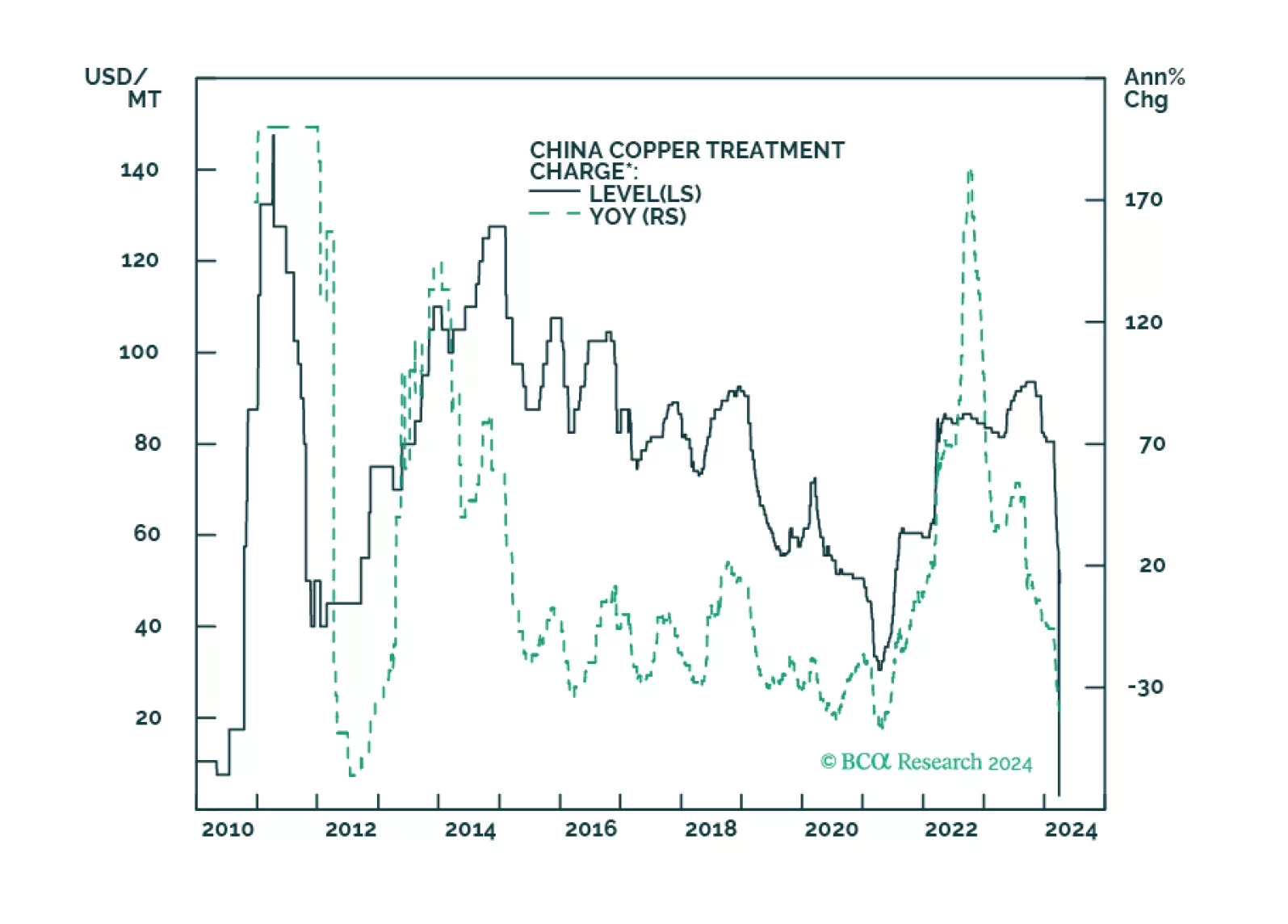

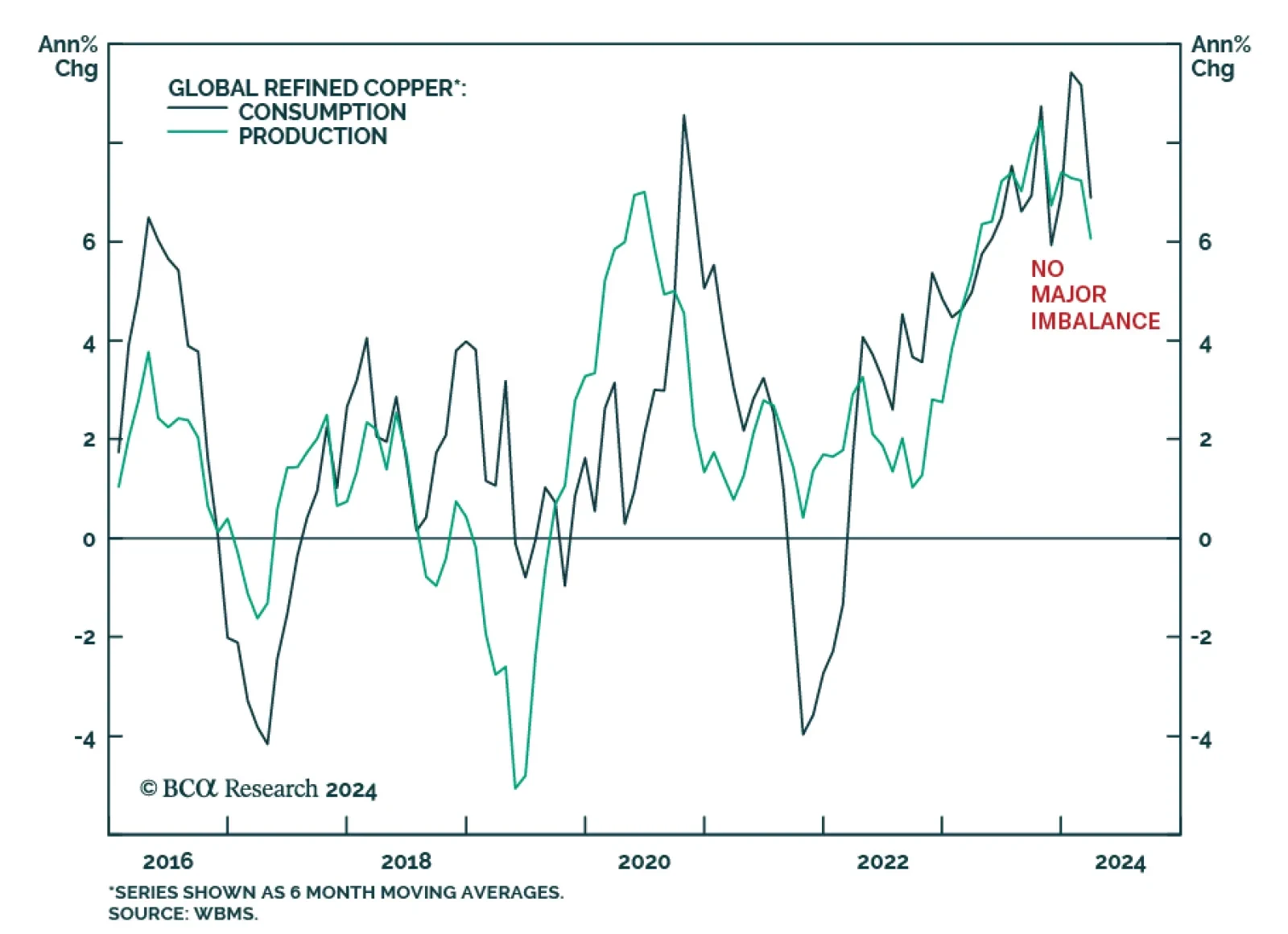

2023 was a year of mystery for the copper market. On the one hand, China’s copper intake boomed last year despite the travails of the mainland economy and shrinking property construction. On the other hand, global copper…