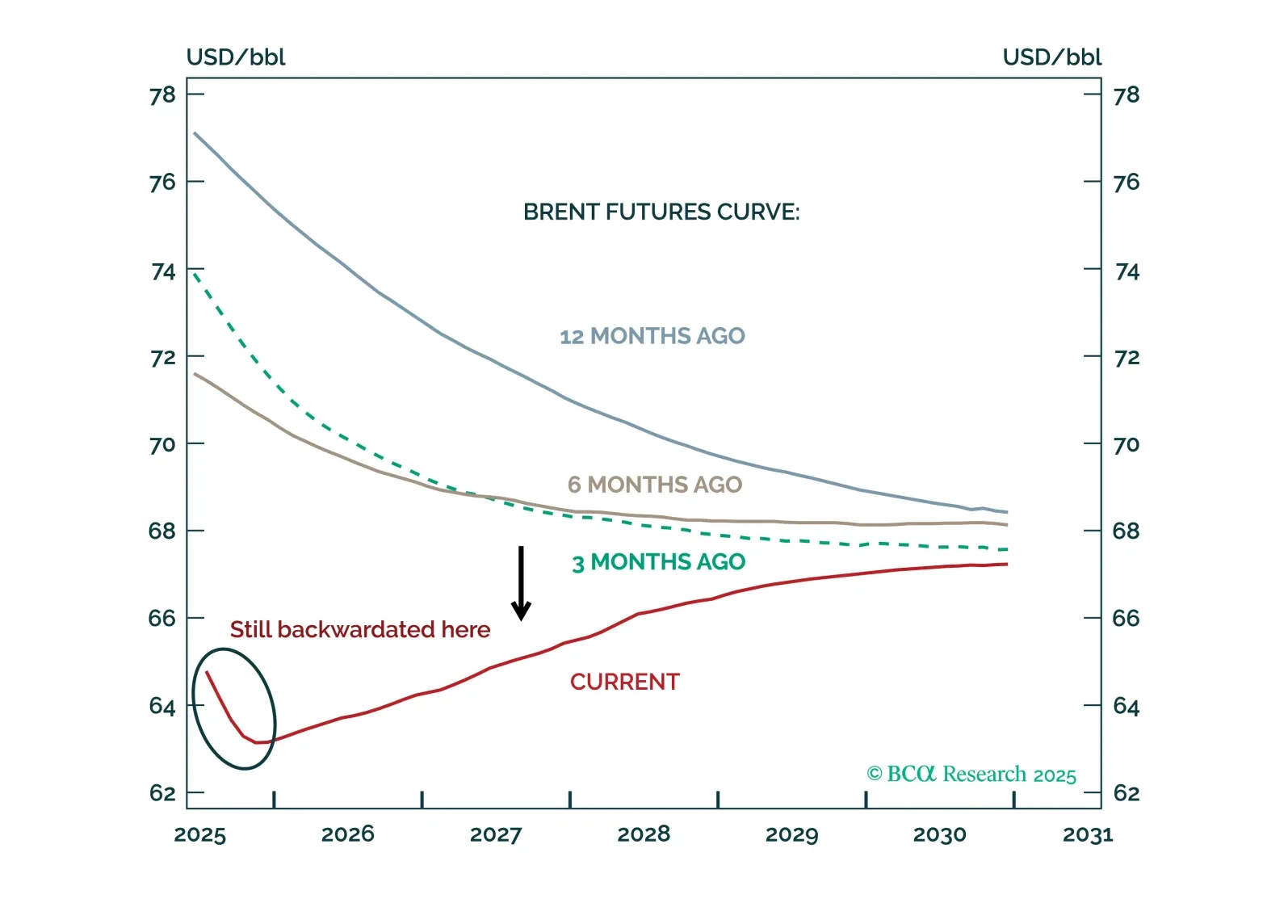

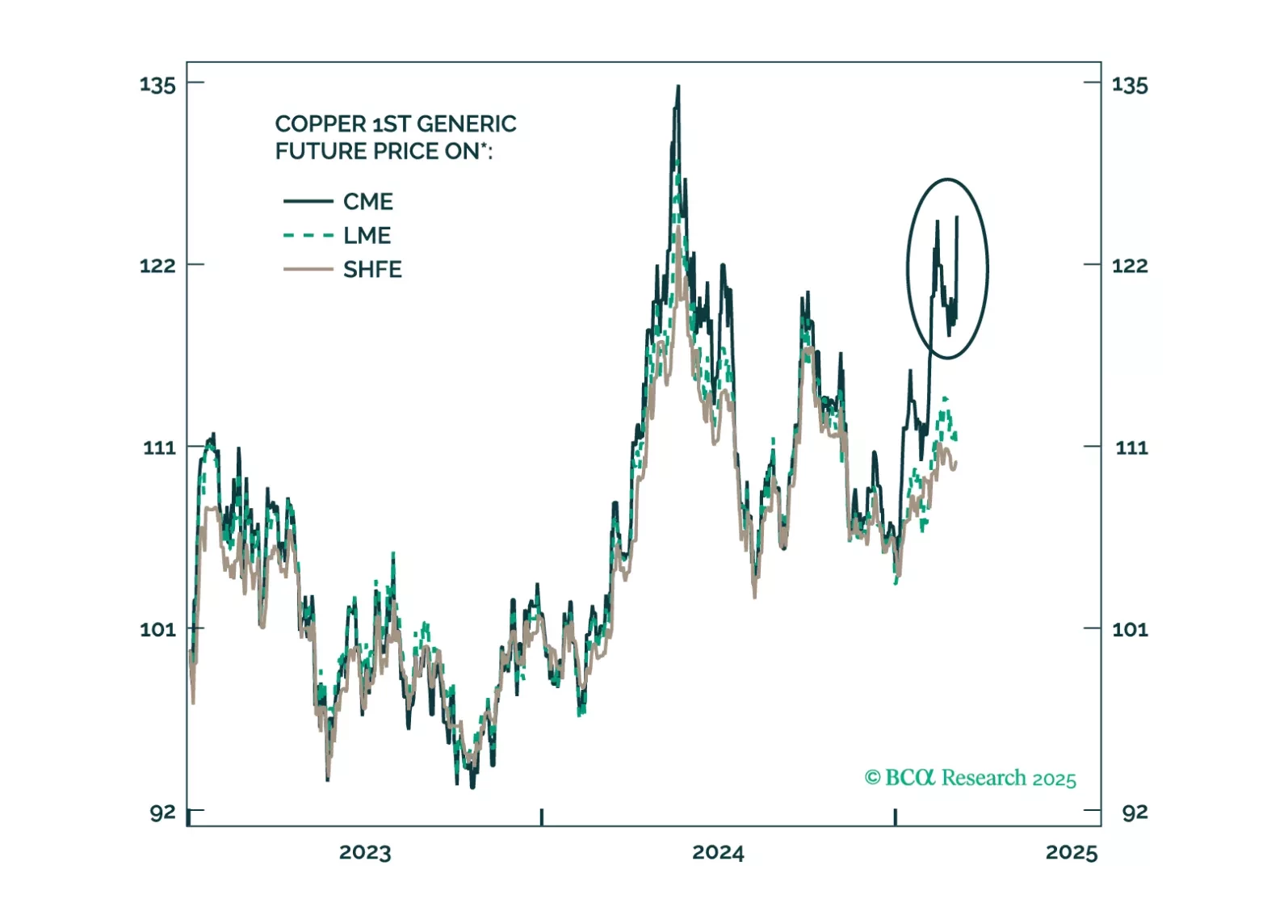

Oil, copper, and gold futures curves have recently experienced abnormal shifts and twists. Brent is no longer fully backwardated, copper curves on the LME and CME have diverged, and gold is in a steep contango. We examine the…

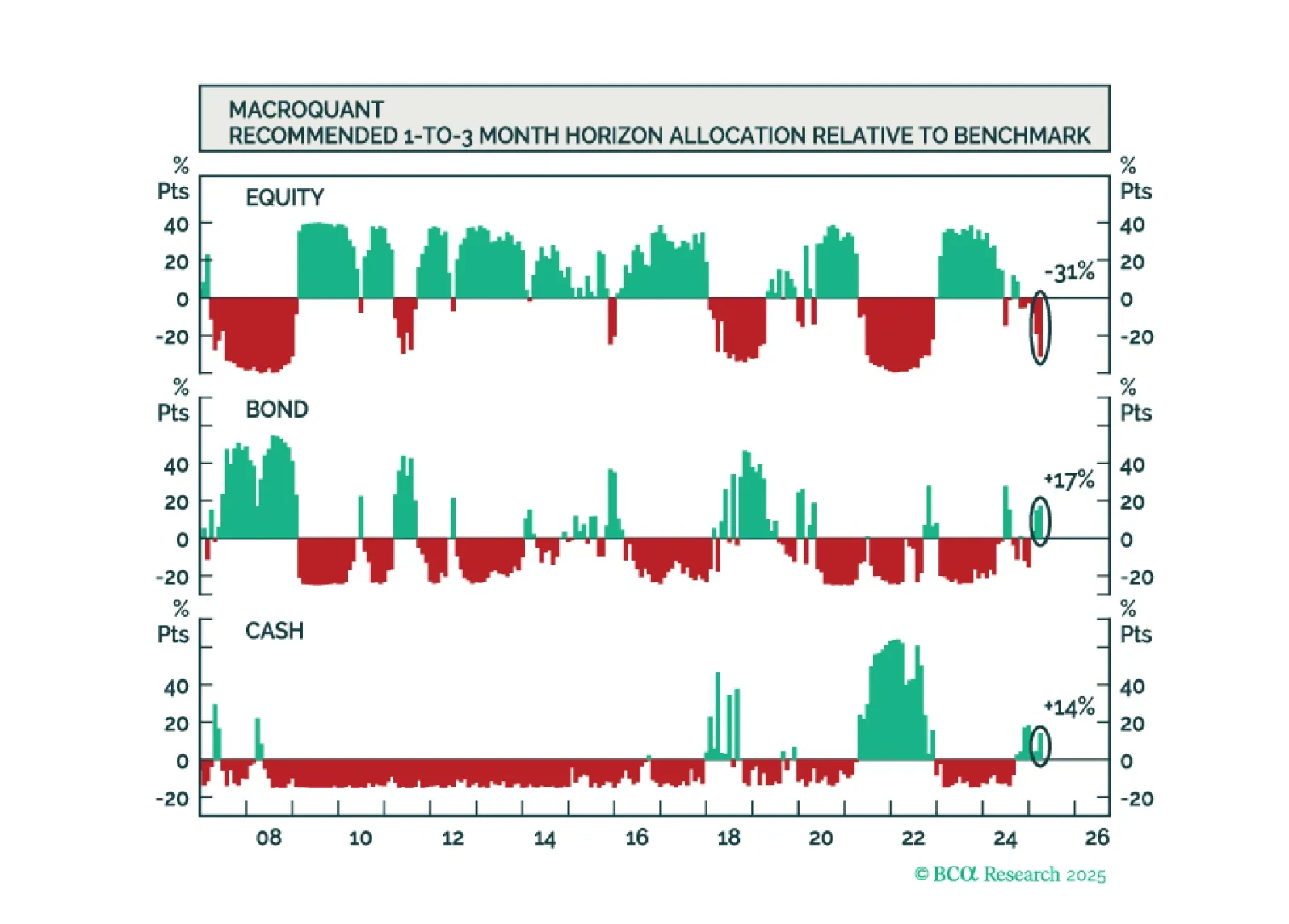

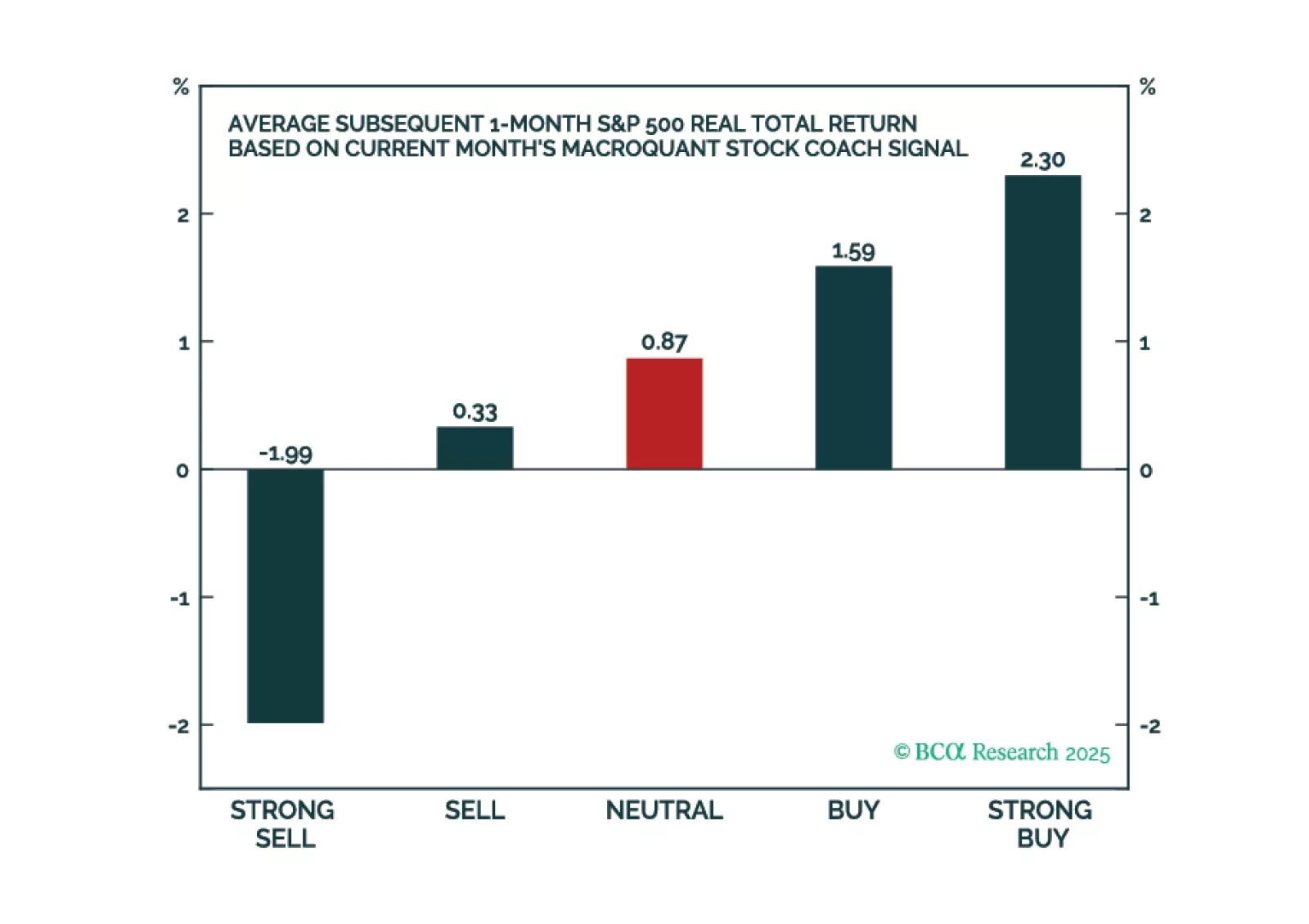

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

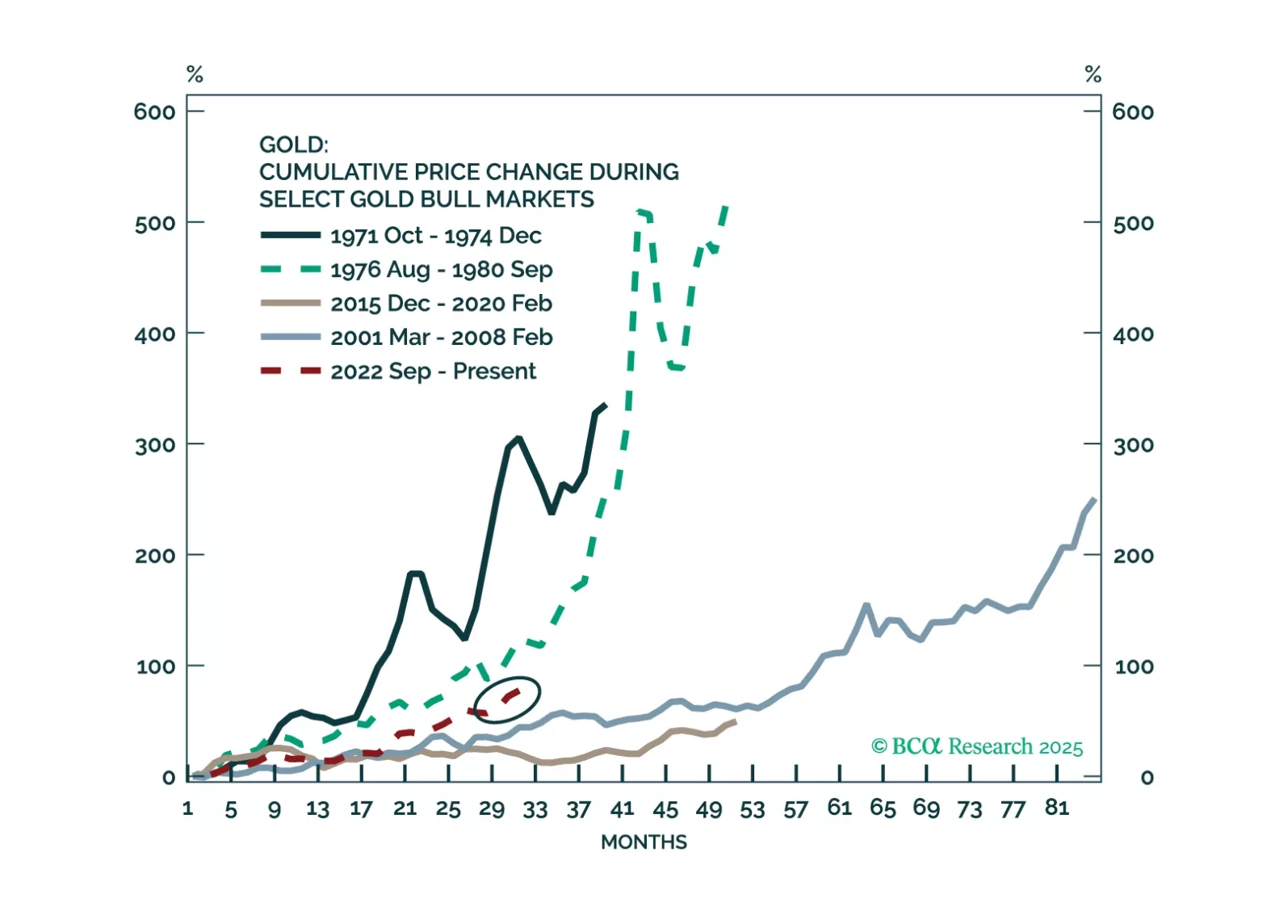

Commodities have not been spared the wrath of the post-"Liberation Day" selloff. However, in the sea of red, gold continues to shine bright, climbing to a fresh record high. How much further does the recent price action have left to…

Copper prices in New York shot higher on Wednesday amid concerns that US imports of the red metal will face a 25% tariff. The catalyst for the renewed concern is President Trump’s comments during his Tuesday night speech: “And I have…

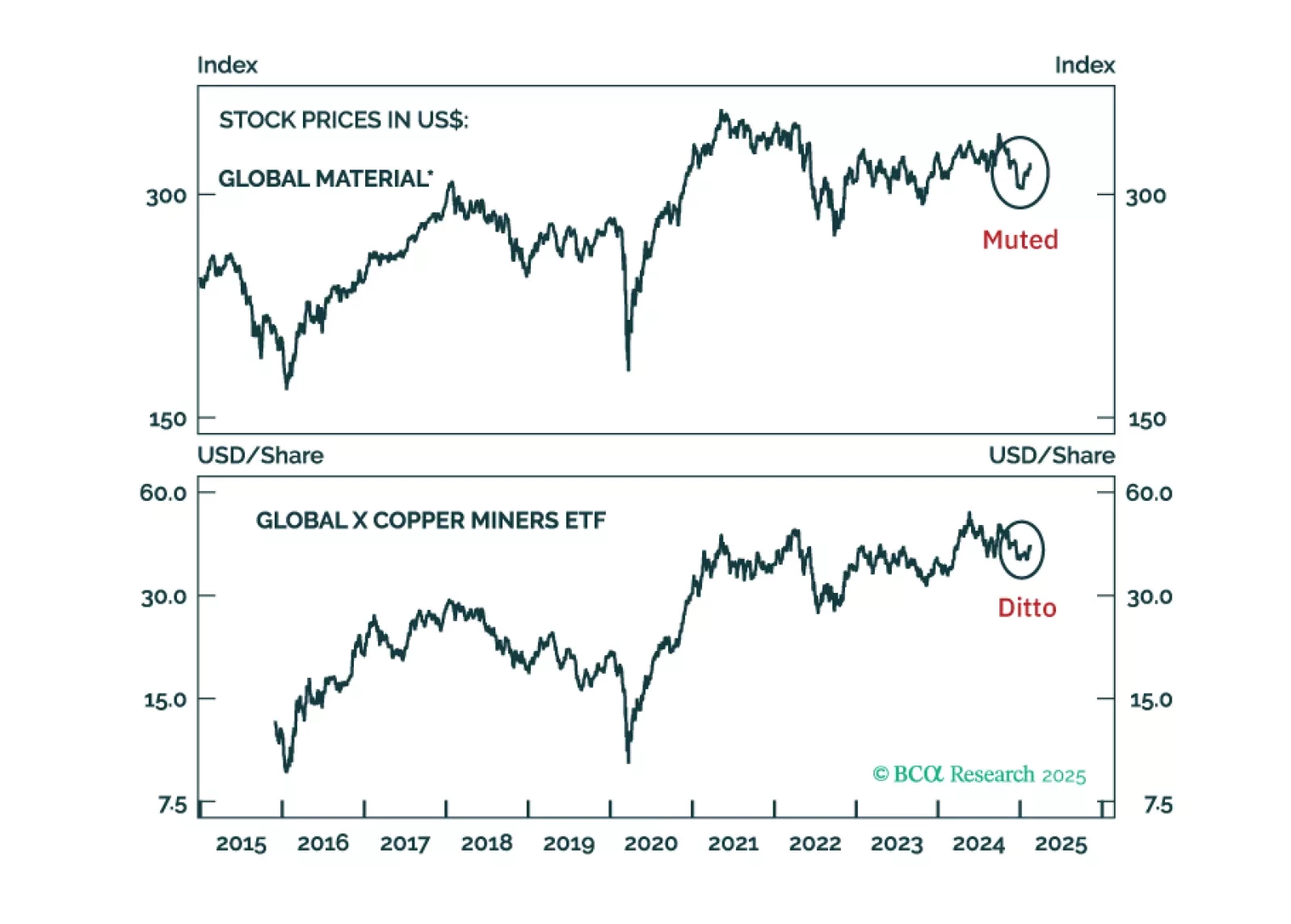

Expectations of US import tariffs drove the latest upleg in the prices of precious and industrial metals. However, there are no significant economic or political incentives for the US to impose import tariffs on these metals.…

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.

The latest version of the MacroQuant model suggests that the bull market in US stocks is winding down. The model expects Treasury yields to fall later this year but is not ready to go long duration just yet.

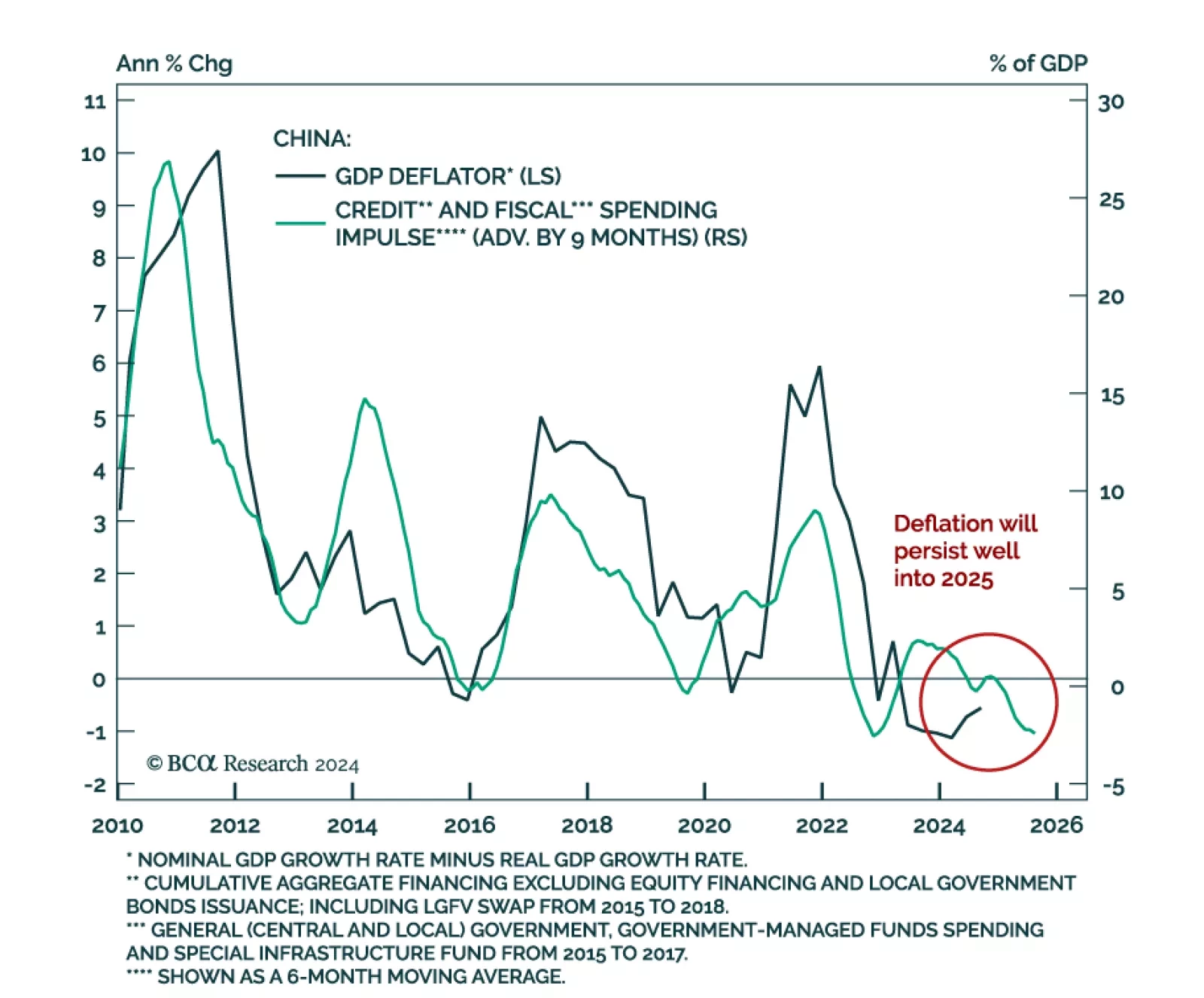

Our Emerging Markets, China, and Commodities strategy teams published their 2025 joint outlook. Our colleagues remain bullish on the US dollar for now but see rising odds of the Trump administration actively pursuing greenback…

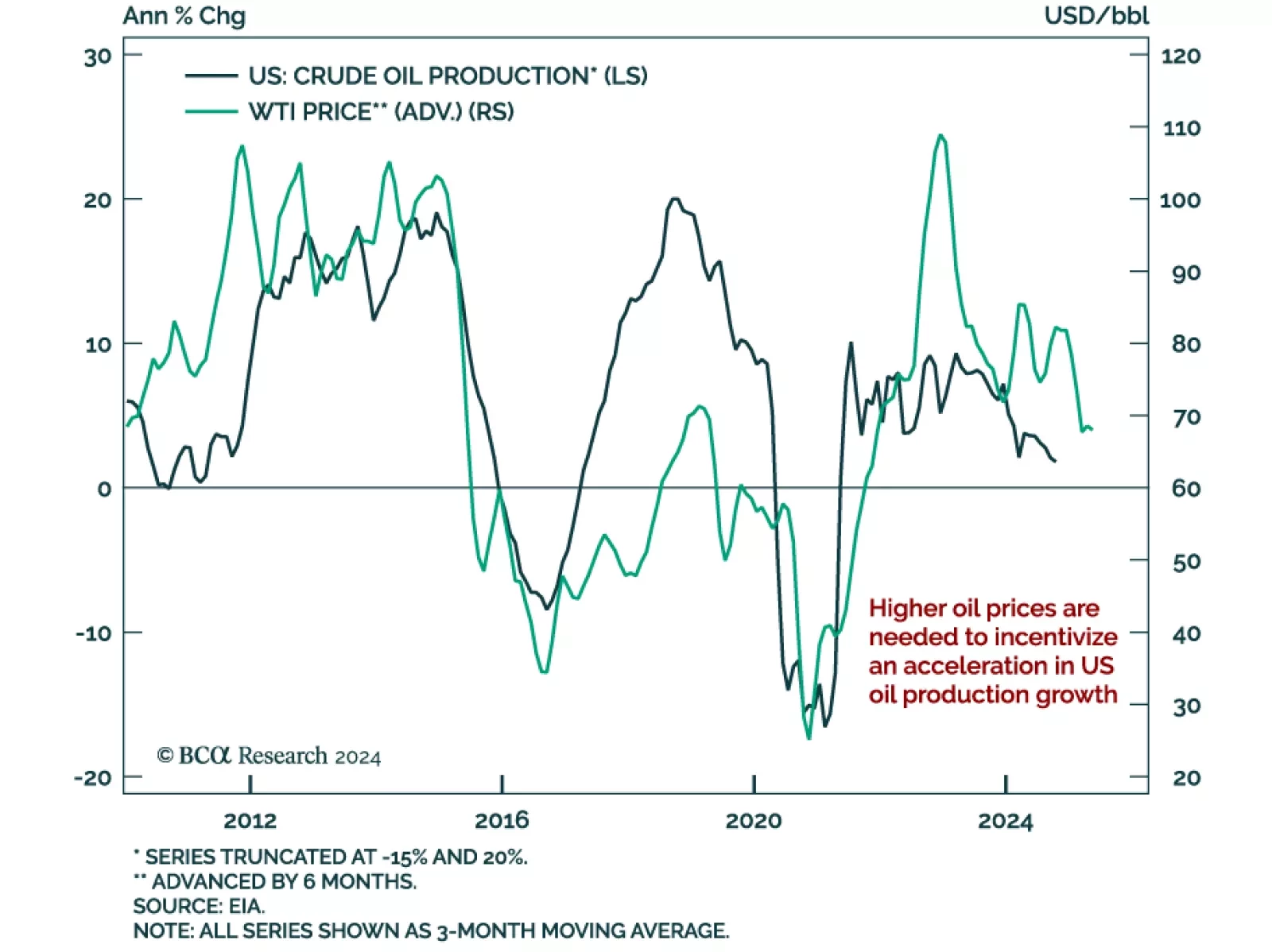

Our Commodity & Energy Strategy team evaluated the impact of president-elect Trump’s policies on commodity markets. Trump’s energy policies, while promoting increased domestic oil production, are unlikely to…