On Monday Chinese A-shares surged by nearly 6%, their best daily performance in three years. In many corners of the investment community, EM assets and China related assets have interpreted these developments as a positive omen.…

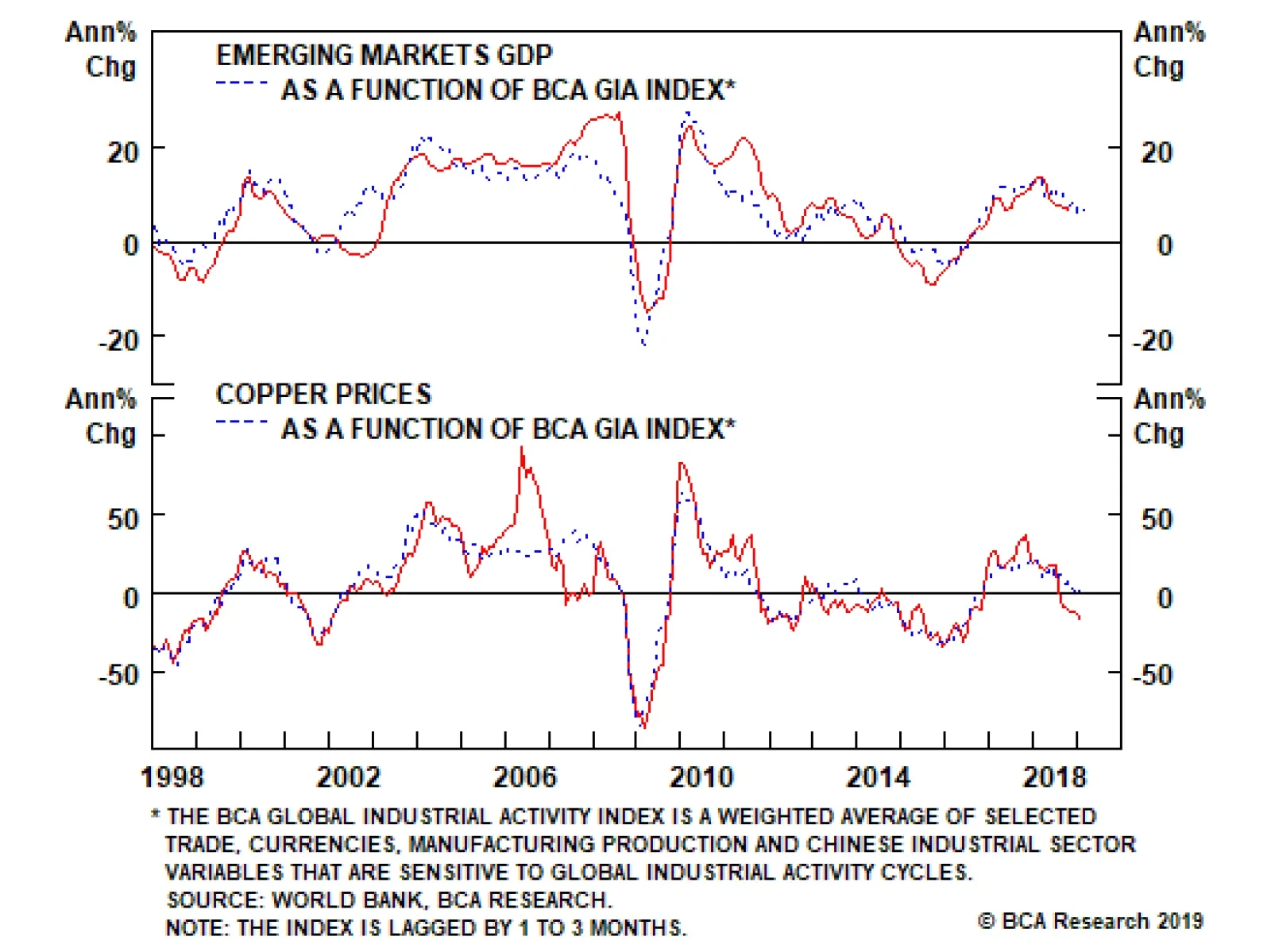

The index is divided into four main components. The GIA index’s Trade Component combines EM import volumes and an estimate of global dry bulk shipping rates to gauge demand. The Currency Component uses a basket of…

Trepidation engulfs commodity markets like a fog weaving through half-deserted streets. Central bankers huddle in muttering retreats, growing more cautious by the day. EM growth concerns – particularly slowing trade volumes, and…

Highlights Gold's performance during the "Red October" equities sell-off, coupled with that of the most widely followed gold ratios (copper- and oil-to-gold), indicates investors and commodity traders are not pricing in a…

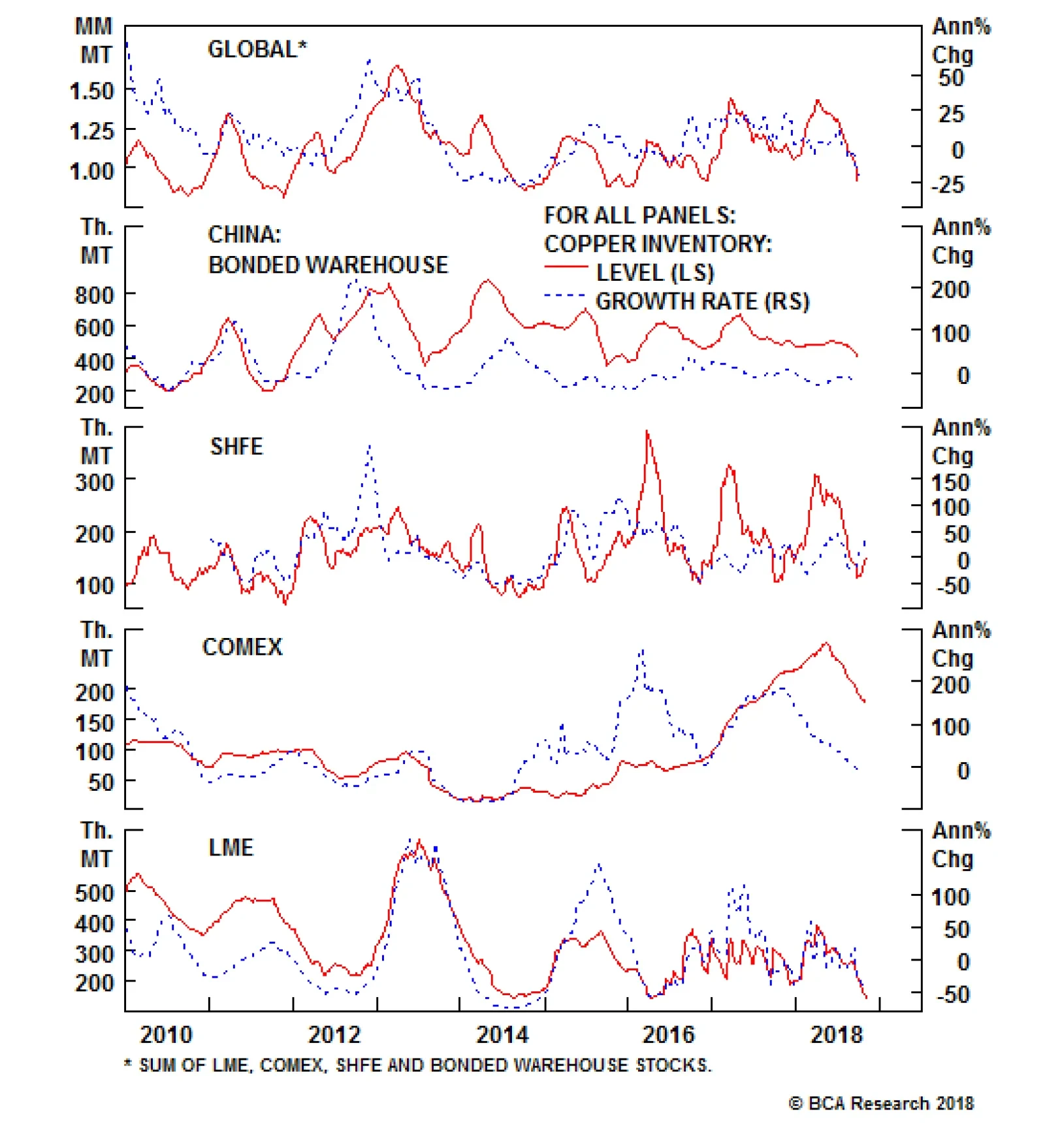

Chinese copper imports came in strong in September. While unwrought copper imports reached a 2.5-year high, ores and concentrates forged new record highs. Copper inventories at the three major global exchange warehouses have…

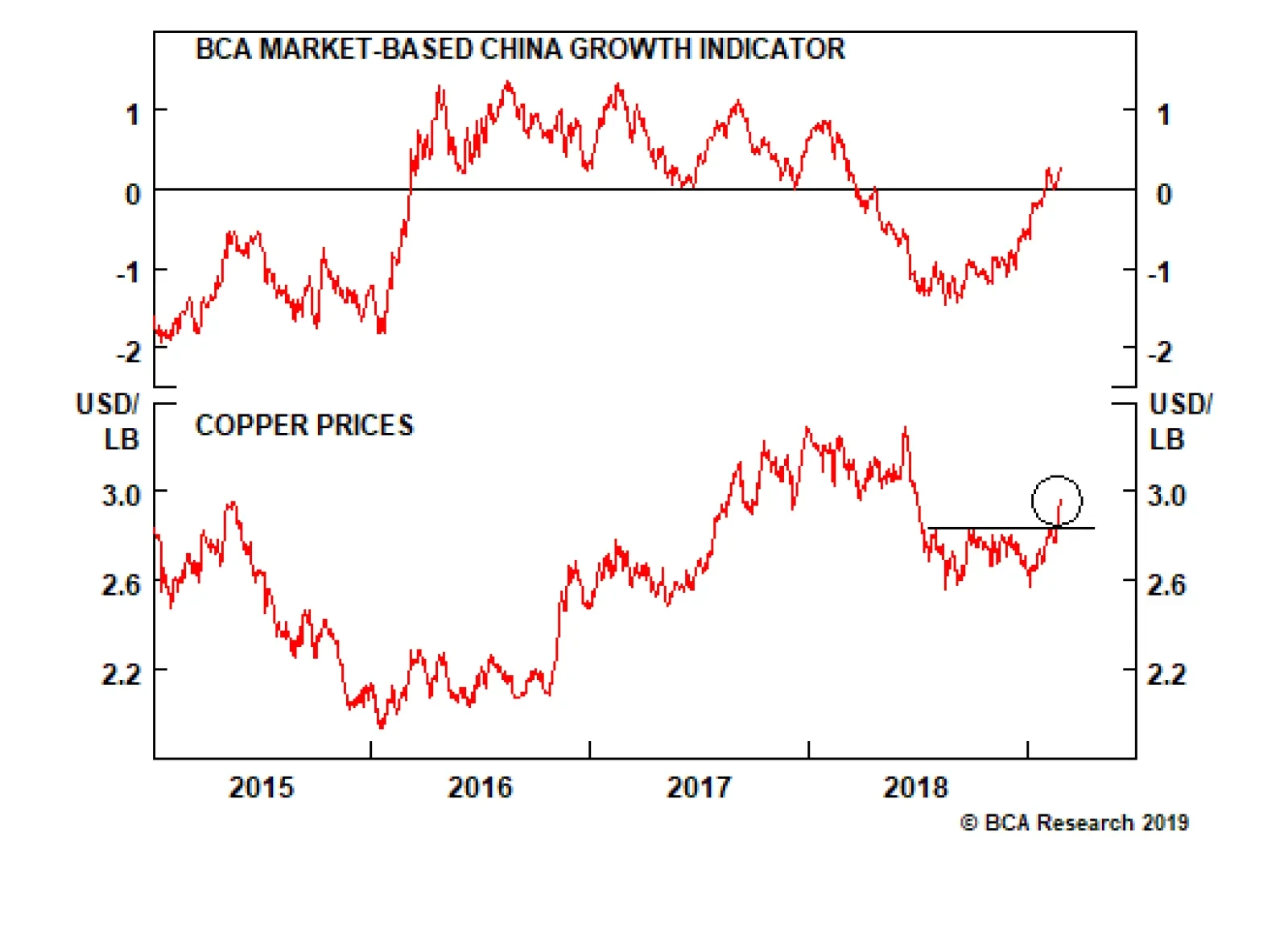

Highlights After tumbling more than 20% between June and August, copper prices have remained largely static. This reflects the tug-of-war between the near-term bullish physical market fundamentals, and the cloudier macro headwinds ahead…

While copper prices remain comfortably within the $2.90 to $3.30/lb range they've occupied this year, the rising threat of a Sino - U.S. trade war spilling into the global trading system, along with slowing credit and monetary…

Highlights Copper has been stuck in the $2.90-$3.30/lb trading range since late August, 2017. Offsetting supply- and demand-side effects are keeping us neutral: Concerns over restrictions on China's scrap imports and possible…

Highlights While bullish sentiment for copper remains high, concerns that policymakers' attempts at a managed slowdown in China this year goes too far will weigh on the market. Fundamentally, support for copper prices from potential…

Highlights The stellar performance in metals over the past year resulted from a combination of favorable demand- and supply-side developments, propelled along, as always, by China's outsized effect on fundamentals. On the demand side…