COMEX copper peaked at $4.30/lb on February 24, up a remarkable 103% since its late-March 2020 lows. Since then it has traded mostly sideways, but recently perked up and is nearing its February top. Our Commodity &…

Highlights Continued upgrades to global economic growth – most recently by the IMF this week –will support higher natgas prices. In our estimation, gas for delivery at Henry Hub, LA, in the coming withdrawal season (…

Highlights The Biden Administration's $2.25 trillion infrastructure plan rolled out yesterday will, at the margin, boost global demand for energy and base metals more than expected later this year and next. Global GDP growth…

Highlights Copper prices will continue to rally, following a surge this week to highs not seen since early 2013 on the back of falling inventories, particularly in China, where physical demand has taken stocks to their lowest levels in…

Highlights Pandemic uncertainty is keeping the USD well bid by raising global economic policy uncertainty. When this breaks – i.e., as higher vaccination rates push contagion rates down – the USD will resume its bear market…

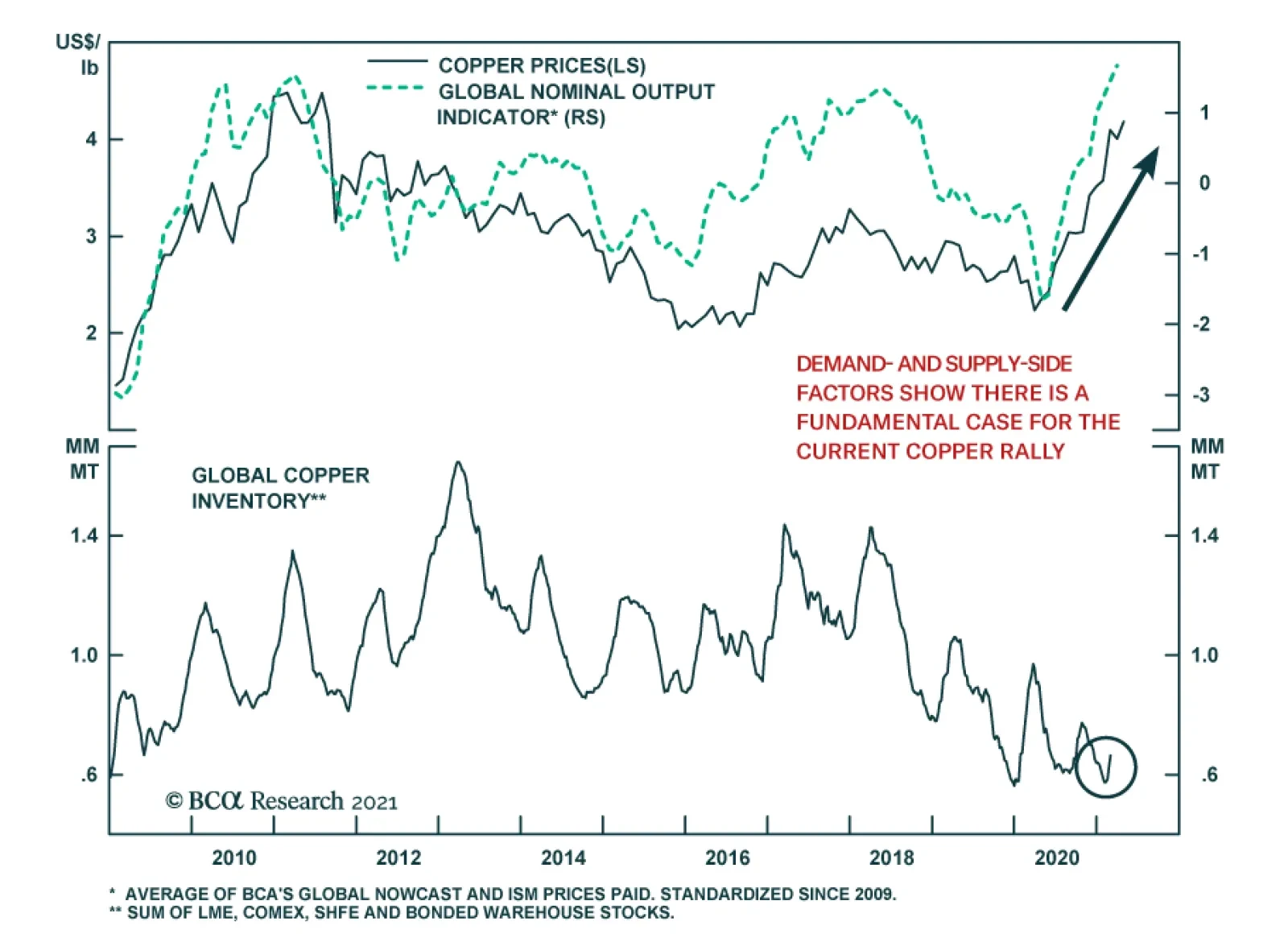

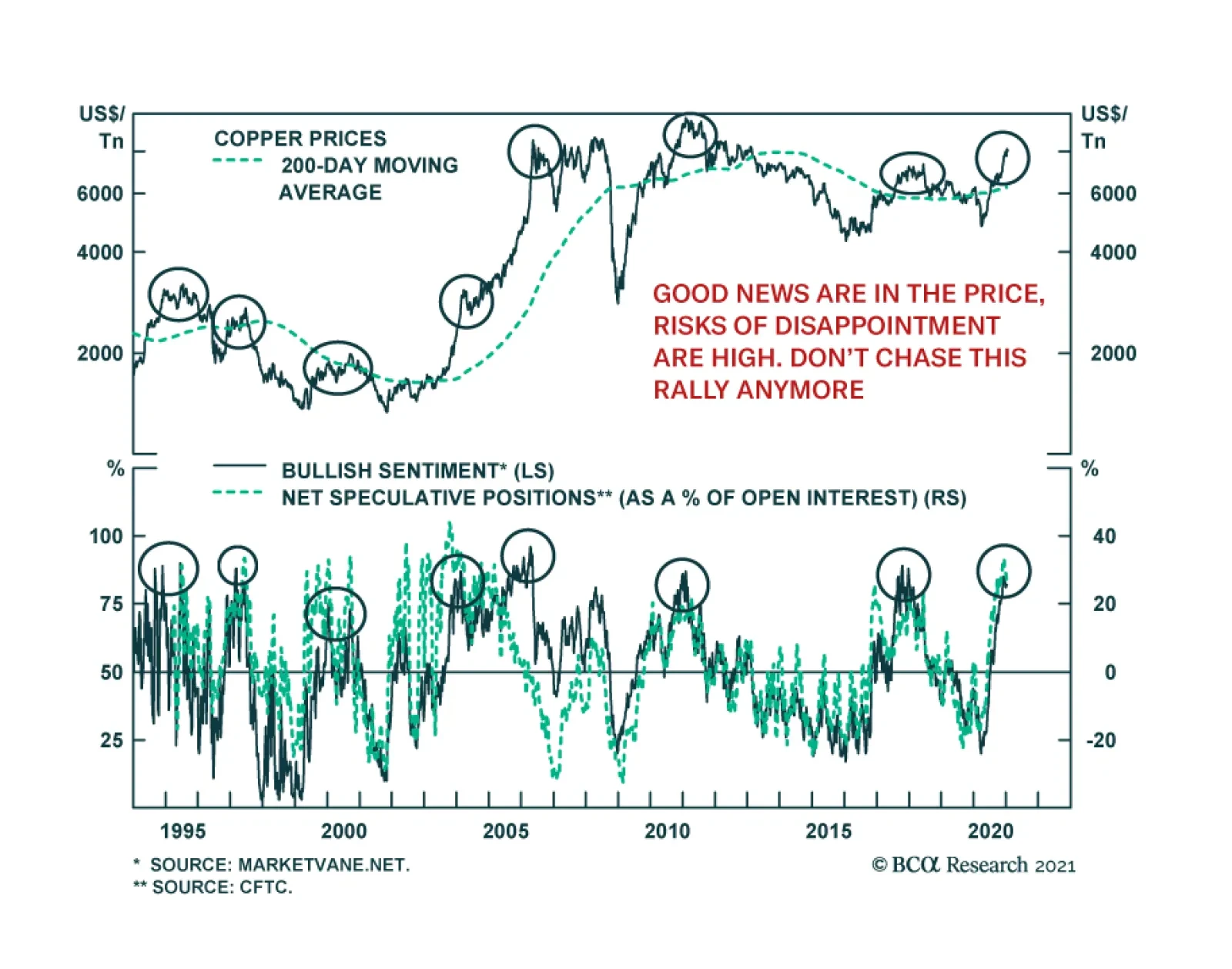

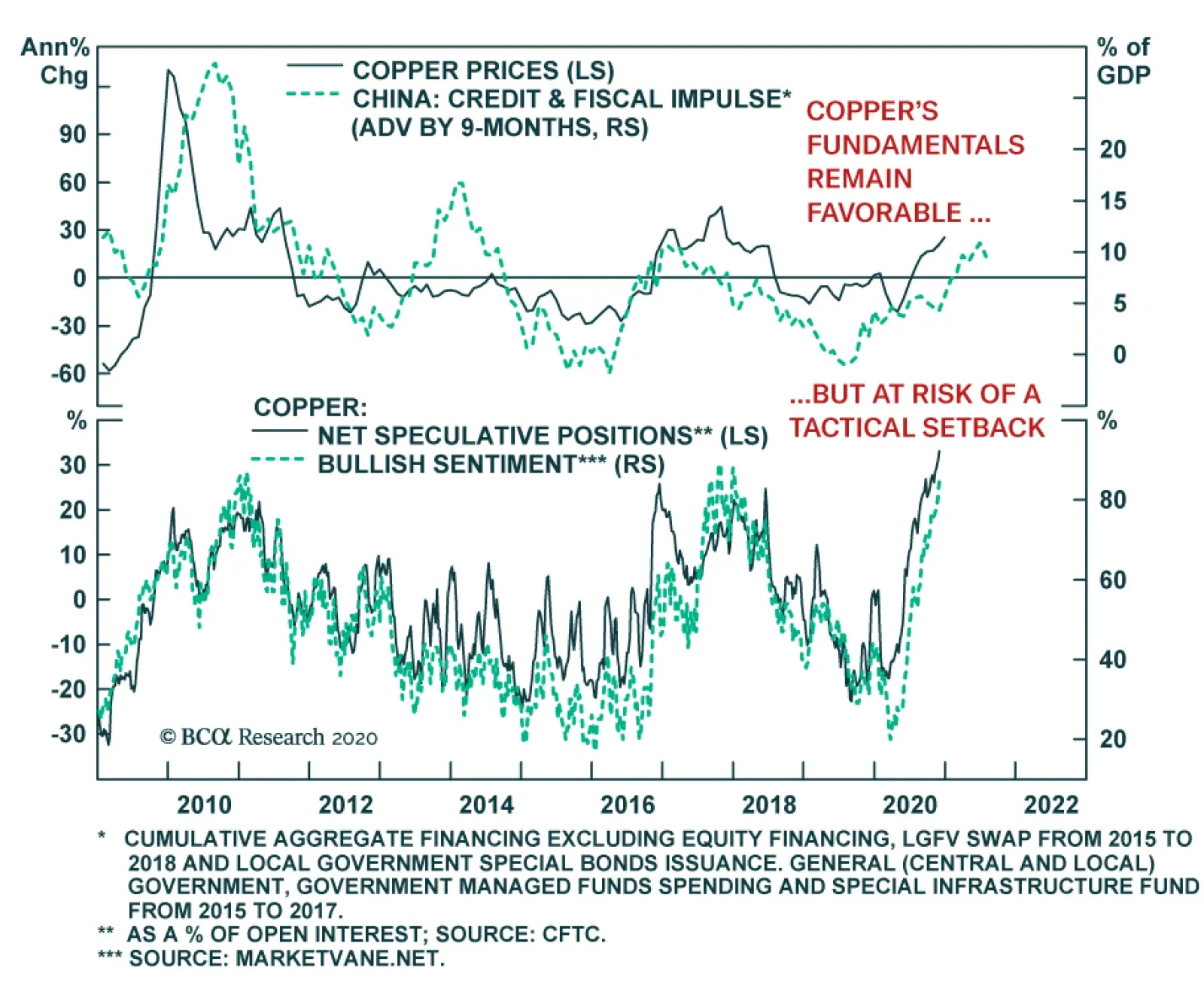

Copper prices have rallied roughly 70% since late March, fueled by a weak dollar, generous global liquidity conditions, expectations of a robust economic recovery, and supply constraints. Most of these fundamental…

Highlights Rising commodity prices and a weaker dollar will lead to higher inflation at the consumer level beginning this year. In the real economy, tighter commodity fundamentals – restrained supply growth, increasing demand,…

Copper has had an impressive run this year, rallying 60% since the beginning of April to its highest level since March 2013. However, long copper is among the most crowded macro trades amid rebounding economic activity and hope…

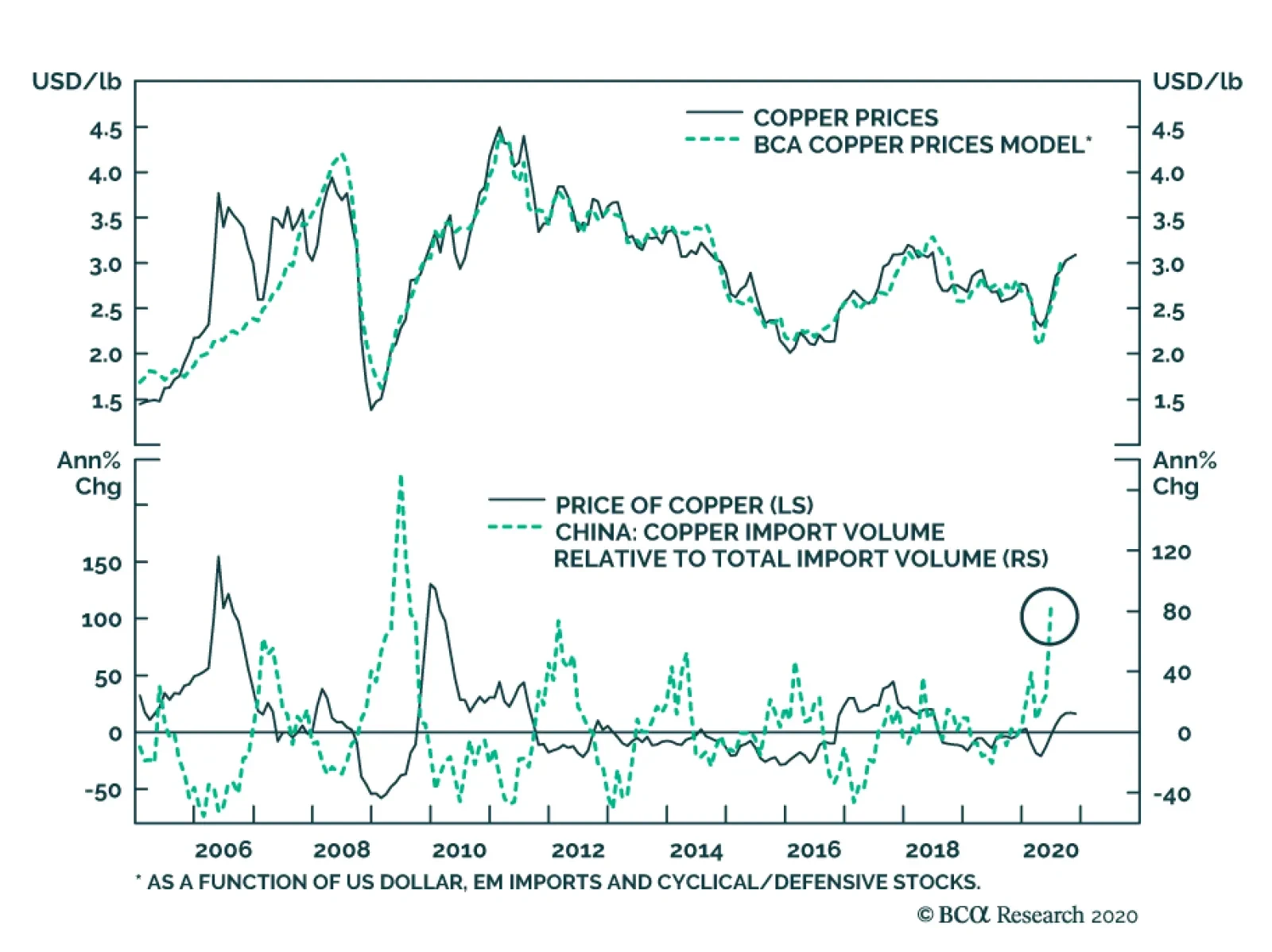

BCA Research's Commodity & Energy Strategy service's Copper Prices model indicates that the rebound in copper prices this year has been justified. Copper has rebounded particularly strongly from the recession, and…