The media went on a hype spree last month forecasting copper prices to the tune of $20,000t ($9.07/lb) on the back of EV-driven demand and supply shortages. While they will likely be right at some point over the next 10 years…

Highlights US labor-market disappointments notwithstanding, the global recovery being propelled by real GDP growth in the world's major economies is on track to be the strongest in 80 years. This growth will fuel commodity demand,…

Highlights Political and corporate climate activism will increase the cost of developing the resources required to produce and deliver energy going forward – e.g., oil and gas wells; pipelines; copper mines, and refineries. Over…

Highlights China's high-profile jawboning draws attention to tightness in metals markets, and raises the odds the State Reserve Board (SRB) will release some of its massive copper and aluminum stockpiles in the near future. Over…

Highlights Global oil markets will remain balanced this year with OPEC 2.0's production-management strategy geared toward maintaining the level of supply just below demand. This will keep inventories on a downward trajectory,…

Highlights Over the 2021-22 period, renewable capacity will account for 90% of global electricity-generation additions, per the IEA's latest forecast. This will follow the 45% surge (y/y) in renewable generation capacity added last…

Highlights Biden’s first 100 days are characterized by a liberal spend-and-tax agenda unseen since the 1960s. It is not a “bait and switch,” however. Voters do not care about deficits and debt. At least not for now.…

Highlights Rising CO2 emissions on the back of stronger global energy growth this year will keep energy markets focused on expanding ESG risks in the buildout of renewable generation via metals mining (Chart of the Week). …

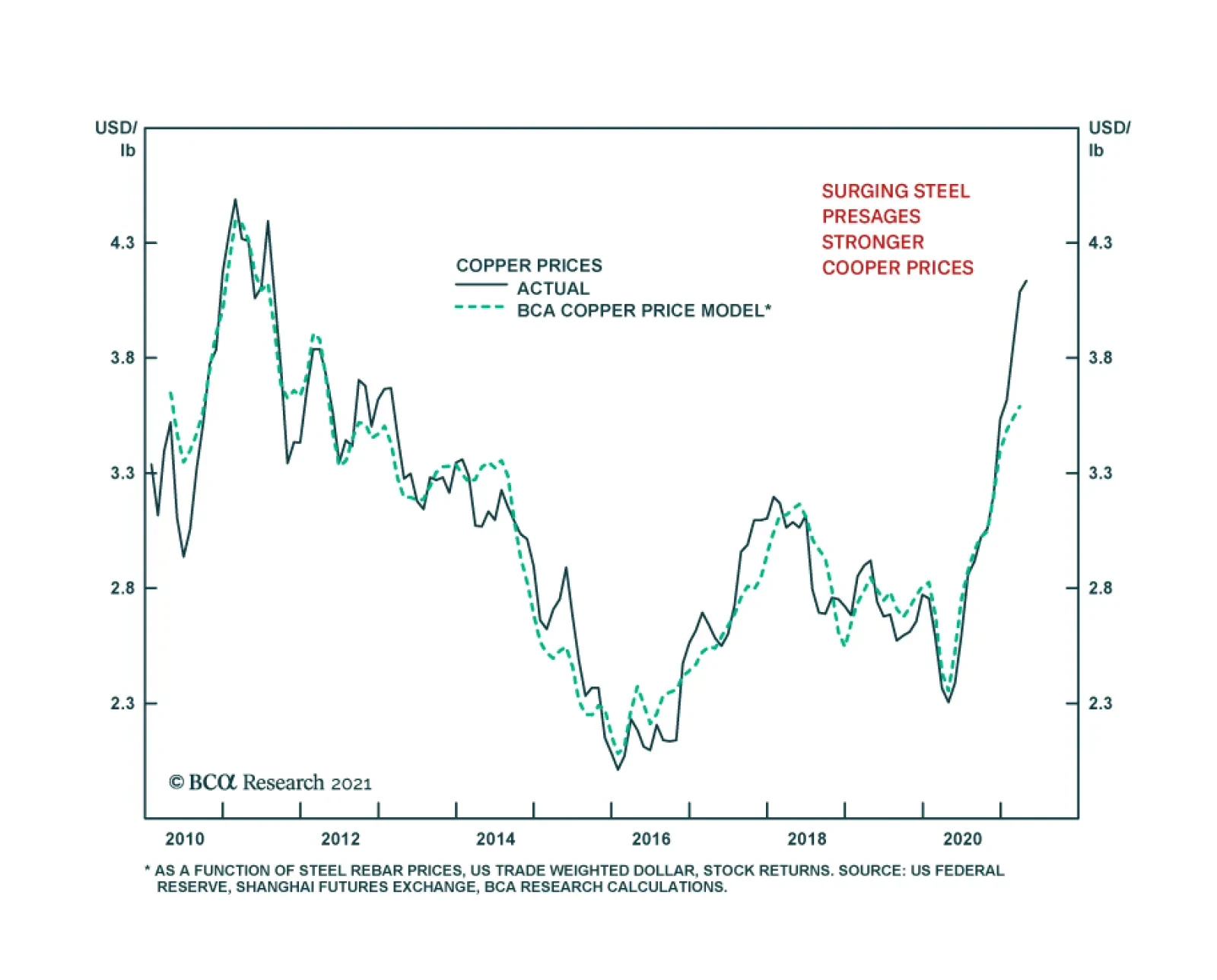

Surging demand on the back of a construction and infrastructure boom has produced record-high steel prices in China, which will set the stage for the next leg of copper's bull run. Government-mandated reductions of up…

Highlights Higher copper prices will follow in the wake of China's surge in steel demand, which lifted Shanghai steel futures to an all-time high just under 5,200 RMB/MT earlier this month, as building and infrastructure projects…