In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

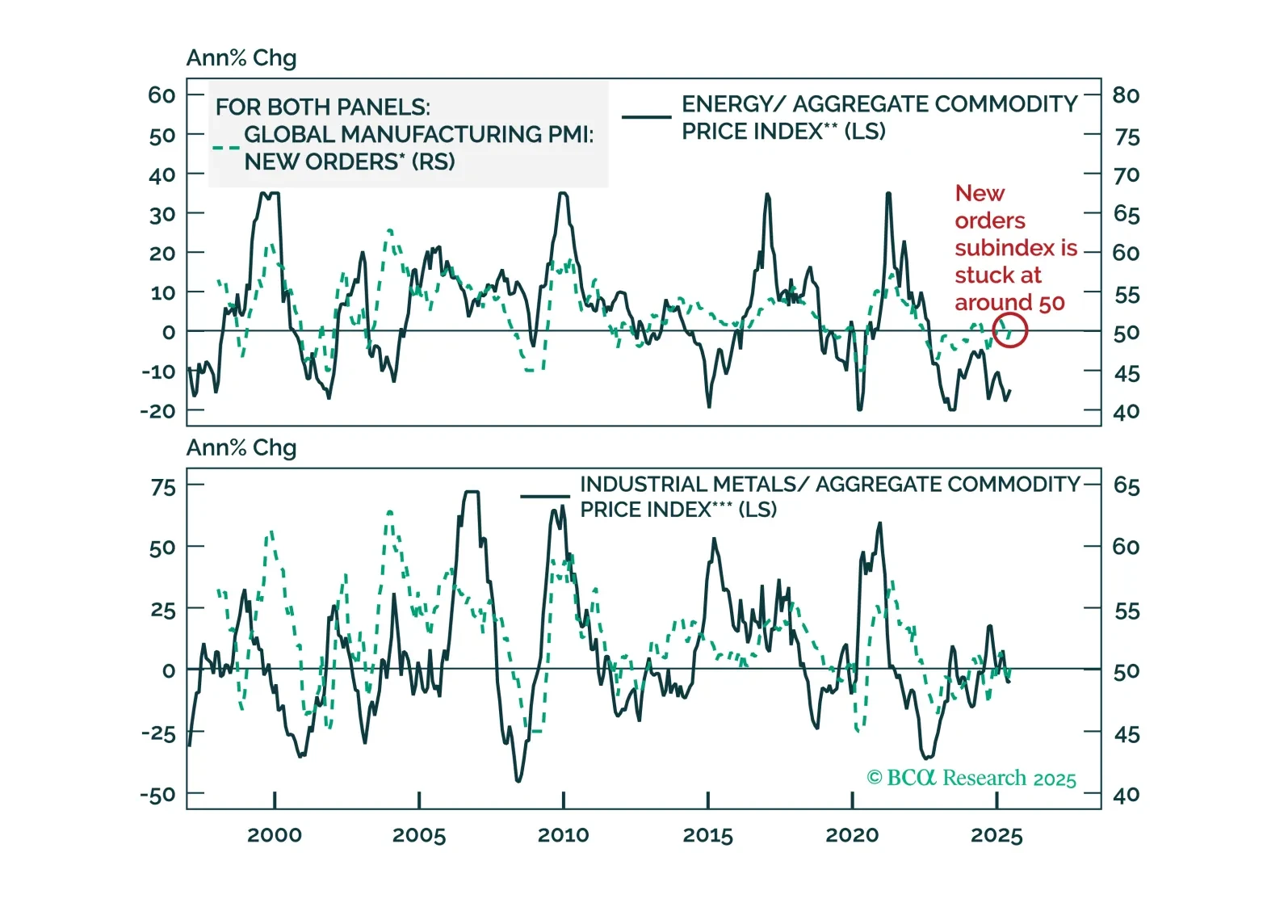

Commodity market breadth would need to improve for it to signal bullish conditions for the aggregate commodity complex. We maintain a defensive tilt within commodities, favoring precious metals over the more cyclically sensitive…

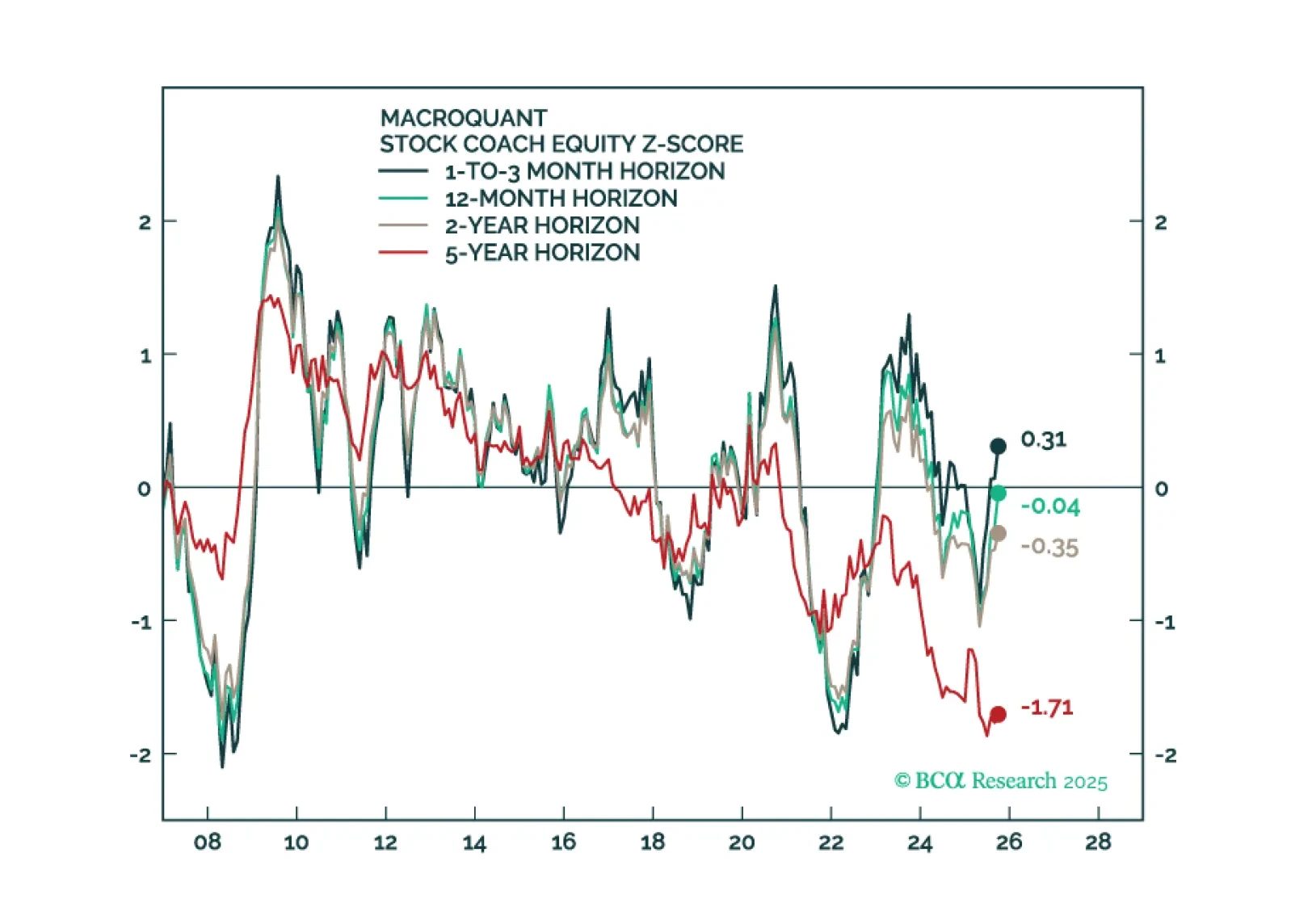

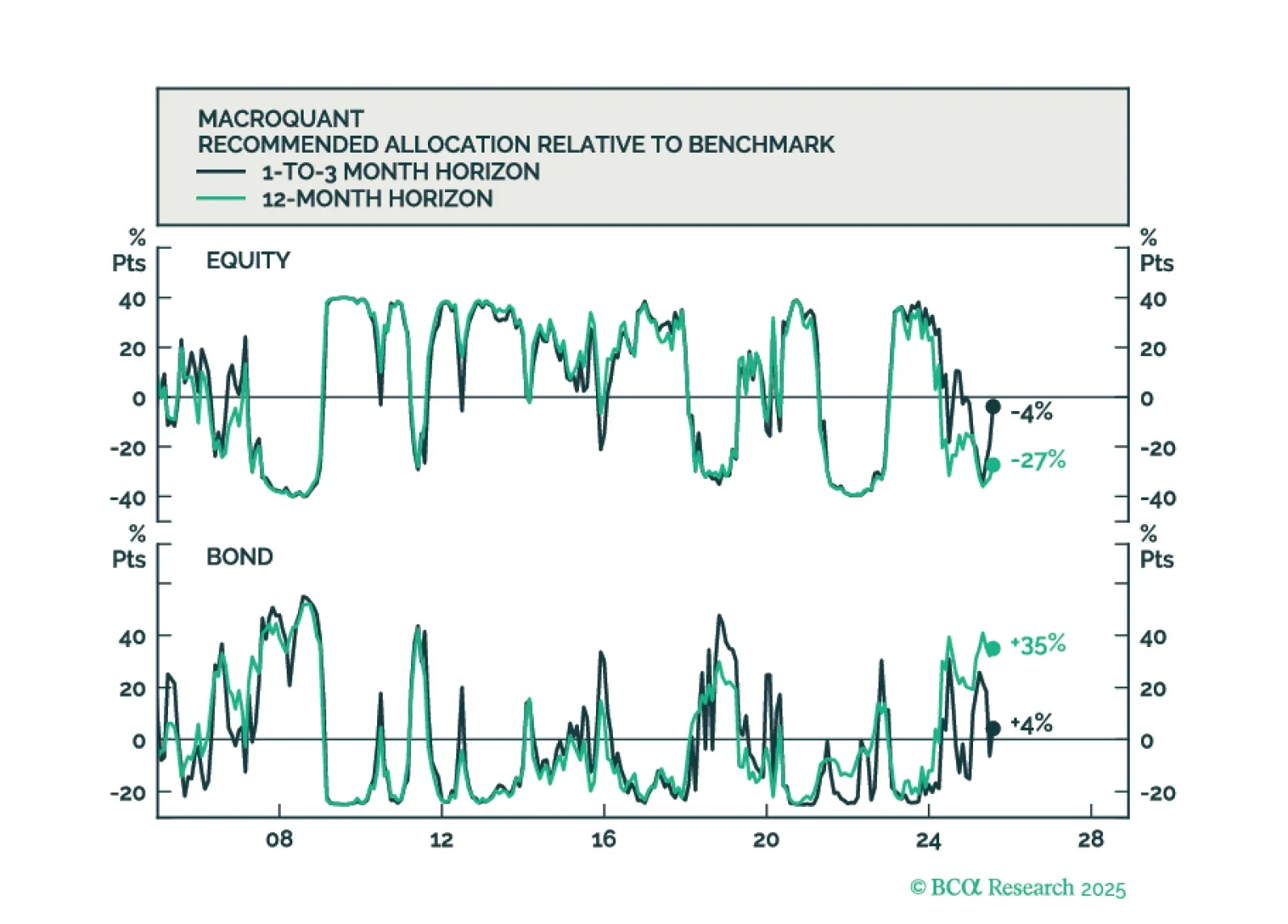

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

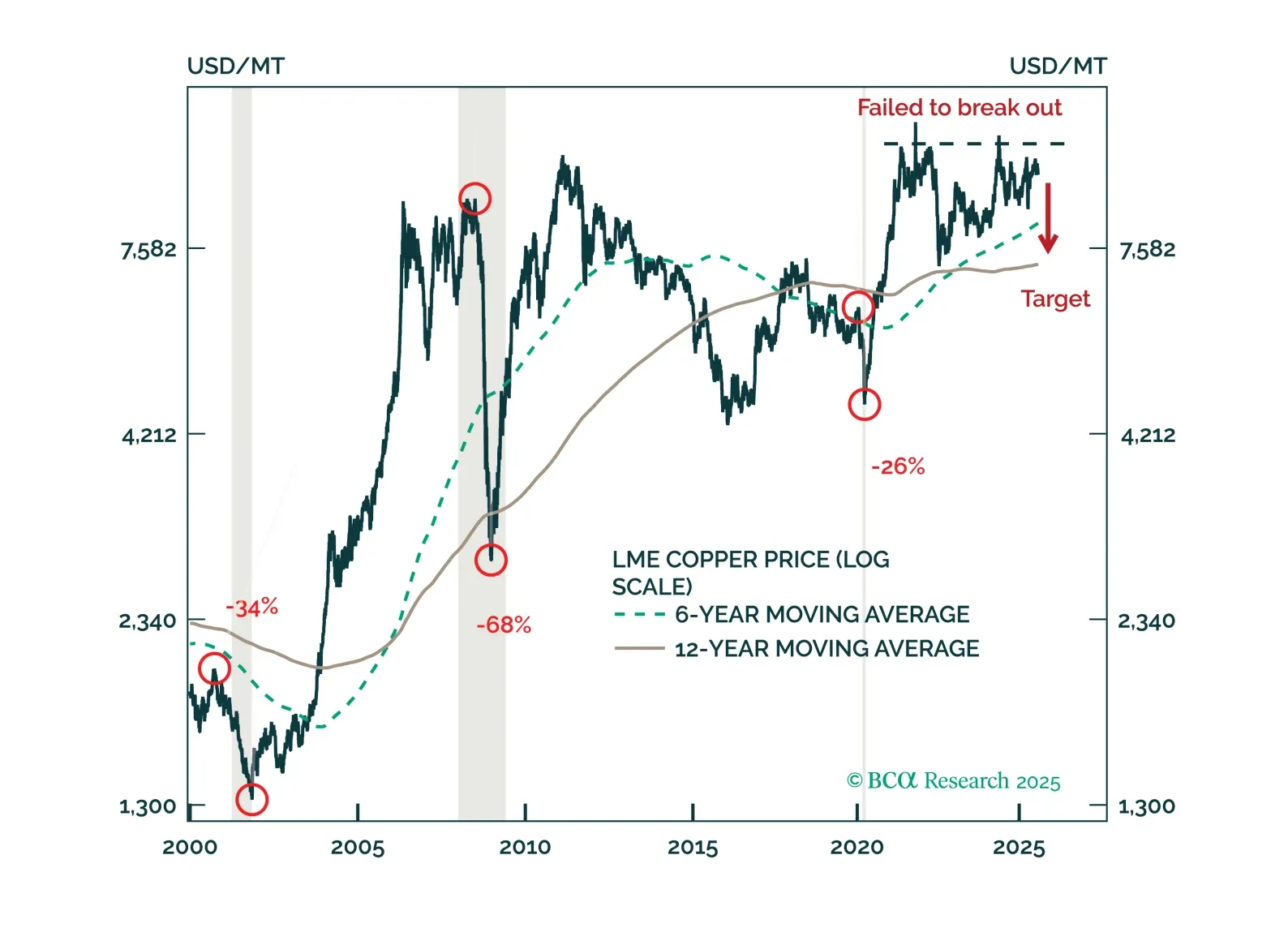

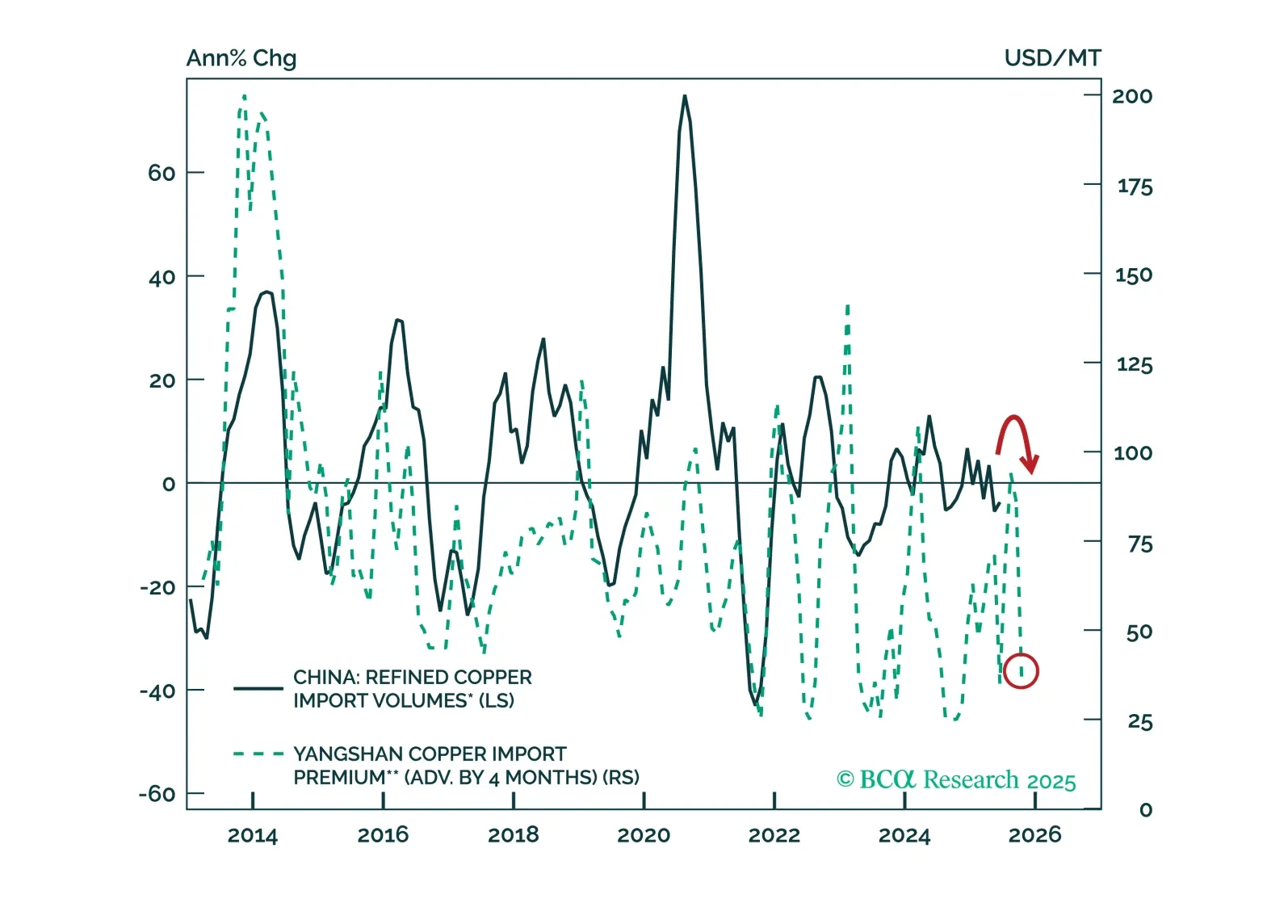

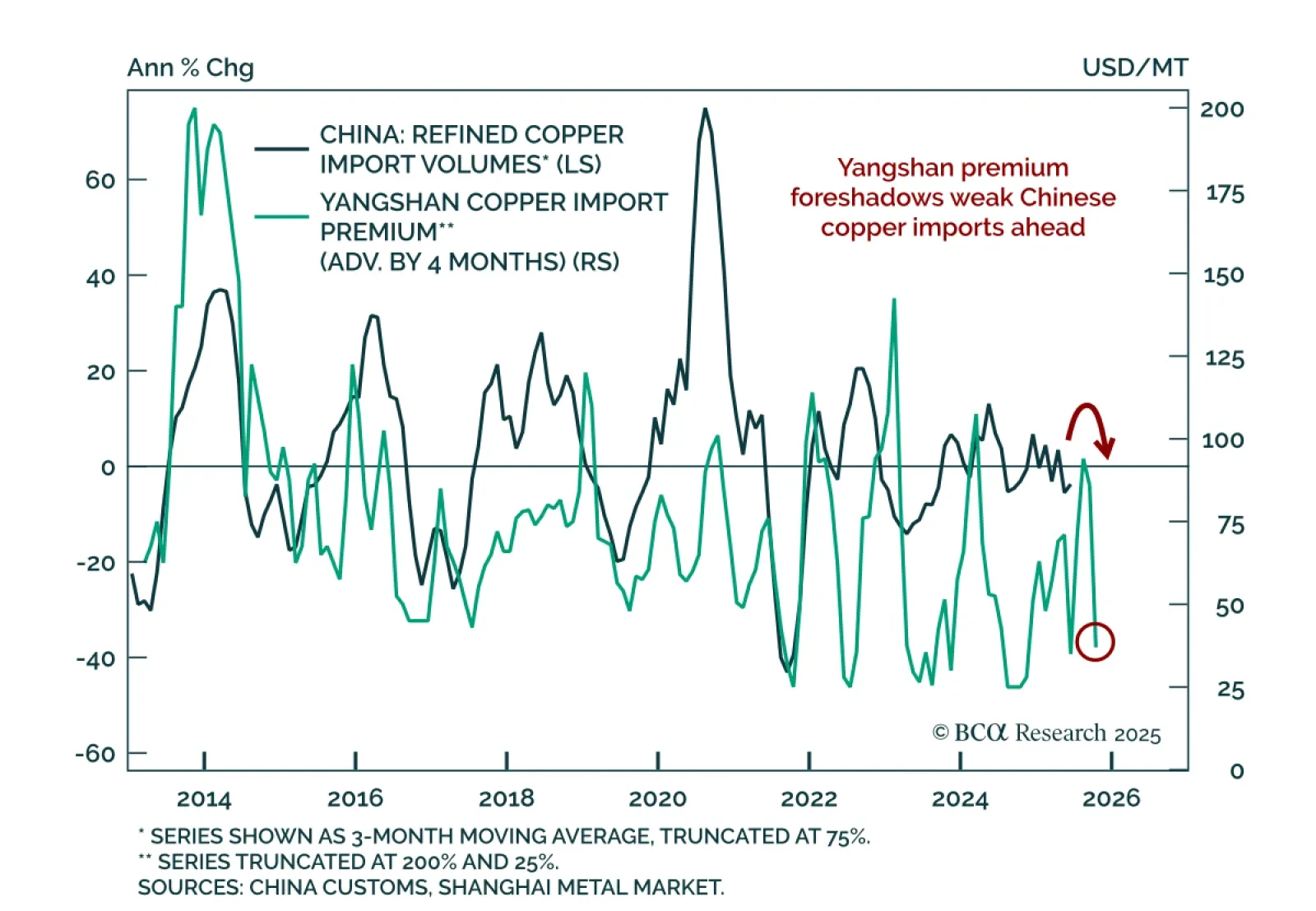

Our Commodity strategists recommend staying short LME copper outright and long gold/short LME copper on a cyclical basis. The unwind in copper, set off by the US tariff exemption on refined metal, is not yet complete. An inventory…

Copper’s unwind – triggered by the refined metal’s US tariff exemption – isn’t over yet. We remain short the red metal on an absolute basis and relative to gold.

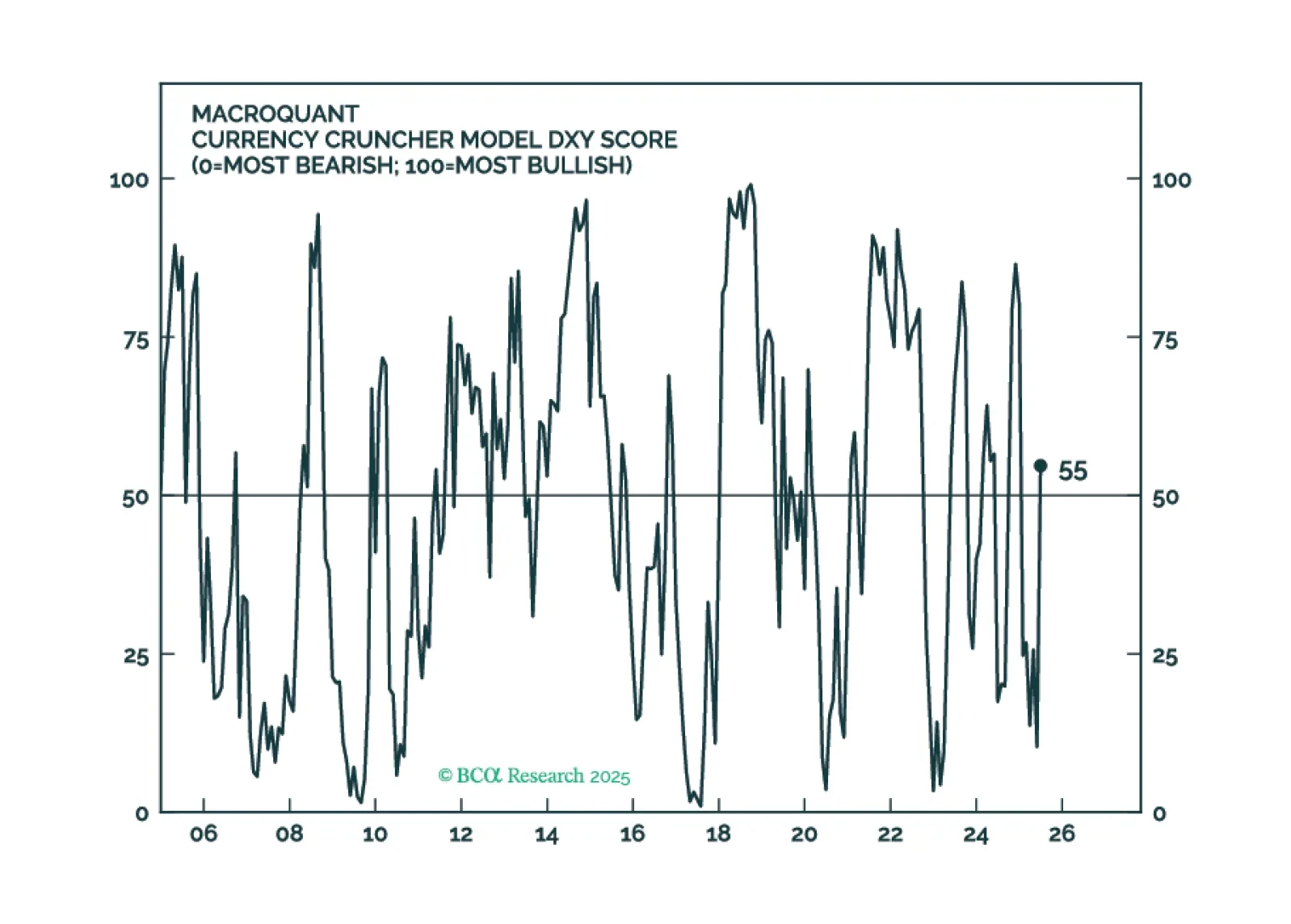

MacroQuant is recommending that equity investors keep their finger near the eject button but avoid pressing it for now. The model is warming up to the dollar again and sees scope for oil prices to rise.

BCA’s Commodity strategists remain long gold/short LME copper and have initiated an outright short in LME copper as a cyclical trade. The US copper tariff will redirect supply away from the US, replenishing depleted inventories…

U.S. copper tariffs will redirect the metal’s trade flows from the US to the rest of the world, replenishing depleted inventories abroad. With global copper demand set to soften in H2, the red metal will likely face downward price…

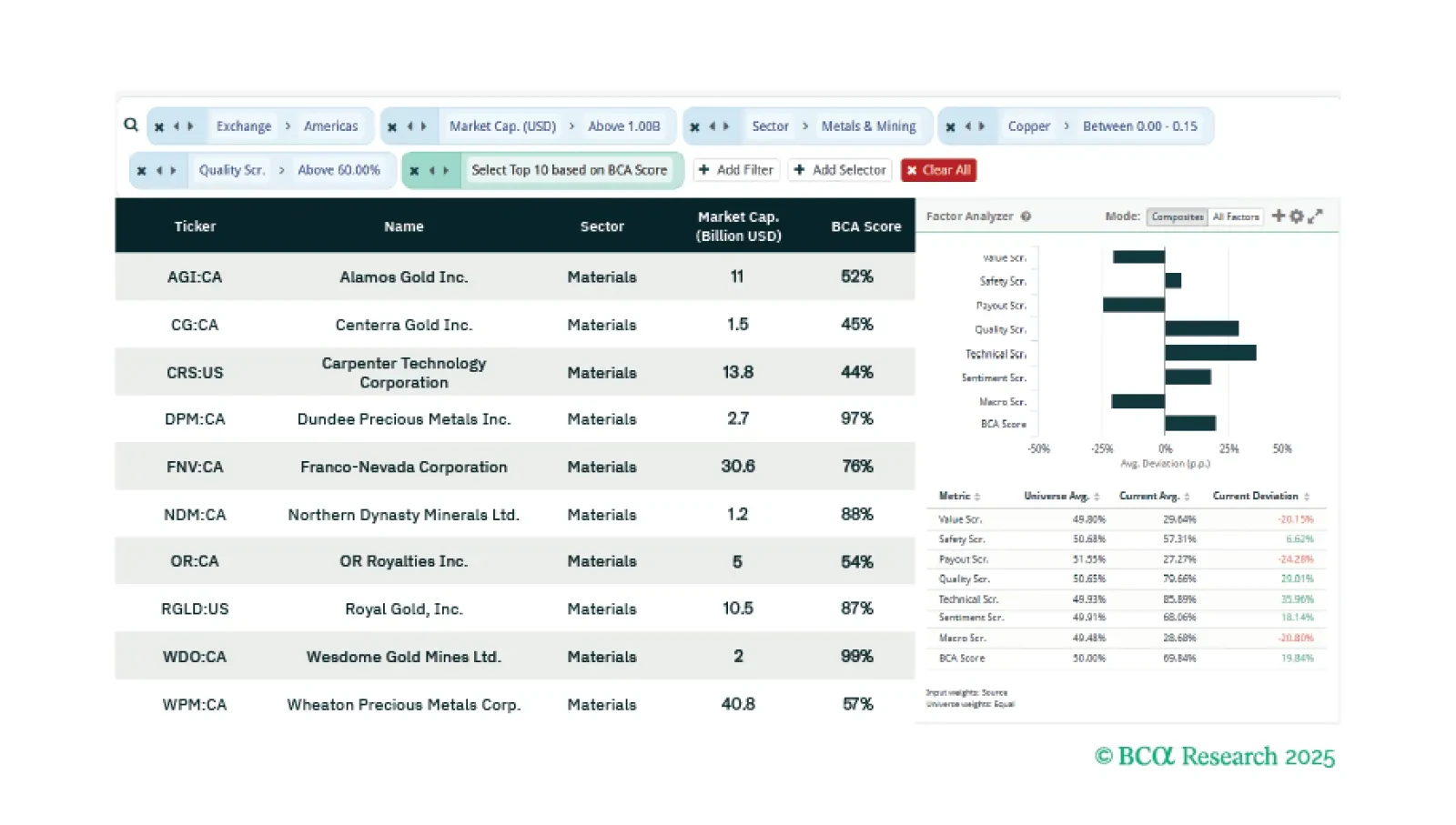

This week our three screeners identify equity plays on copper prices, stocks that are considered “boring” but are solid earners during heightened uncertainty, and stocks which are positively correlated with Bitcoin.

An update on the key themes and views that will shape commodity markets through the remainder of 2025.