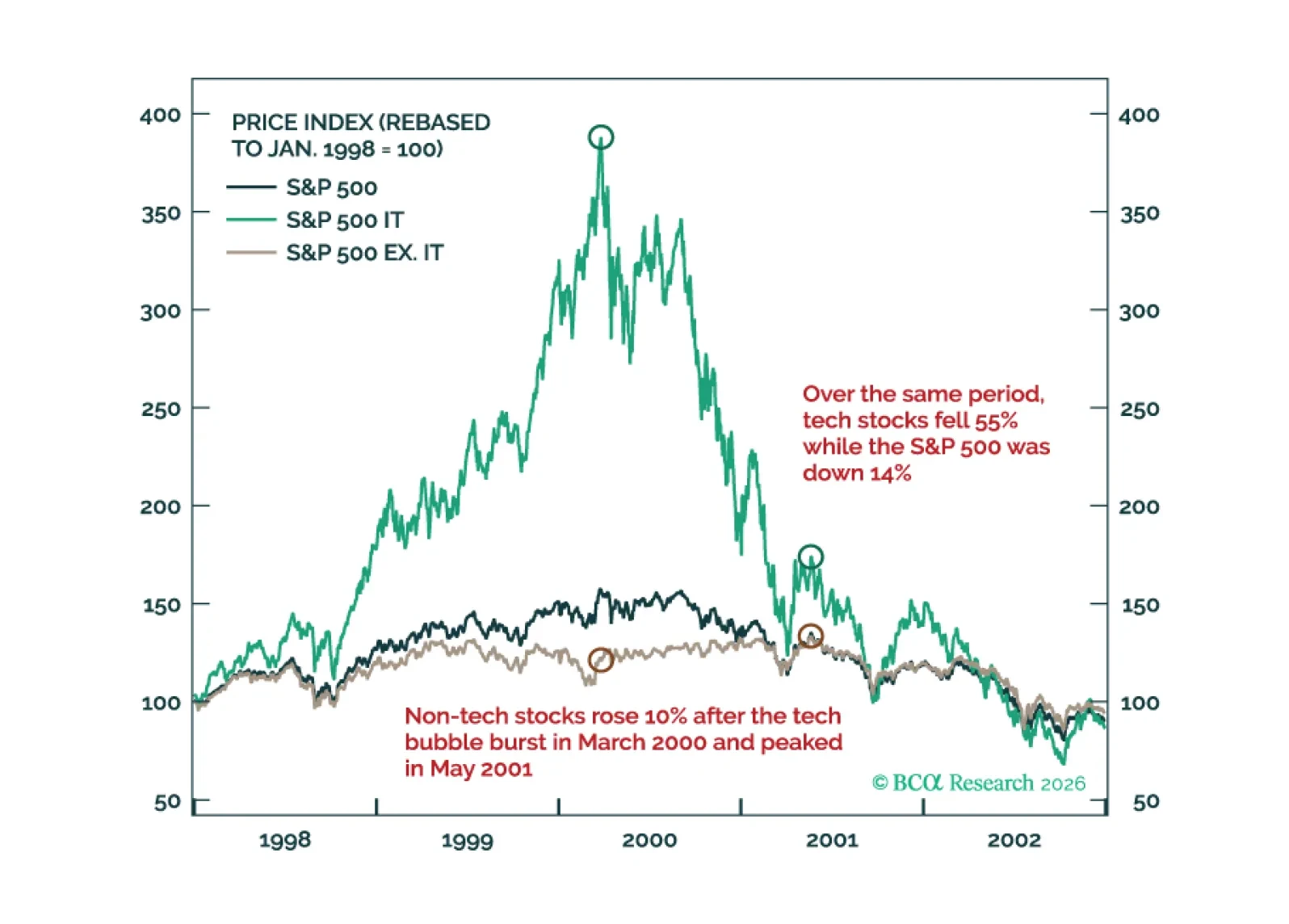

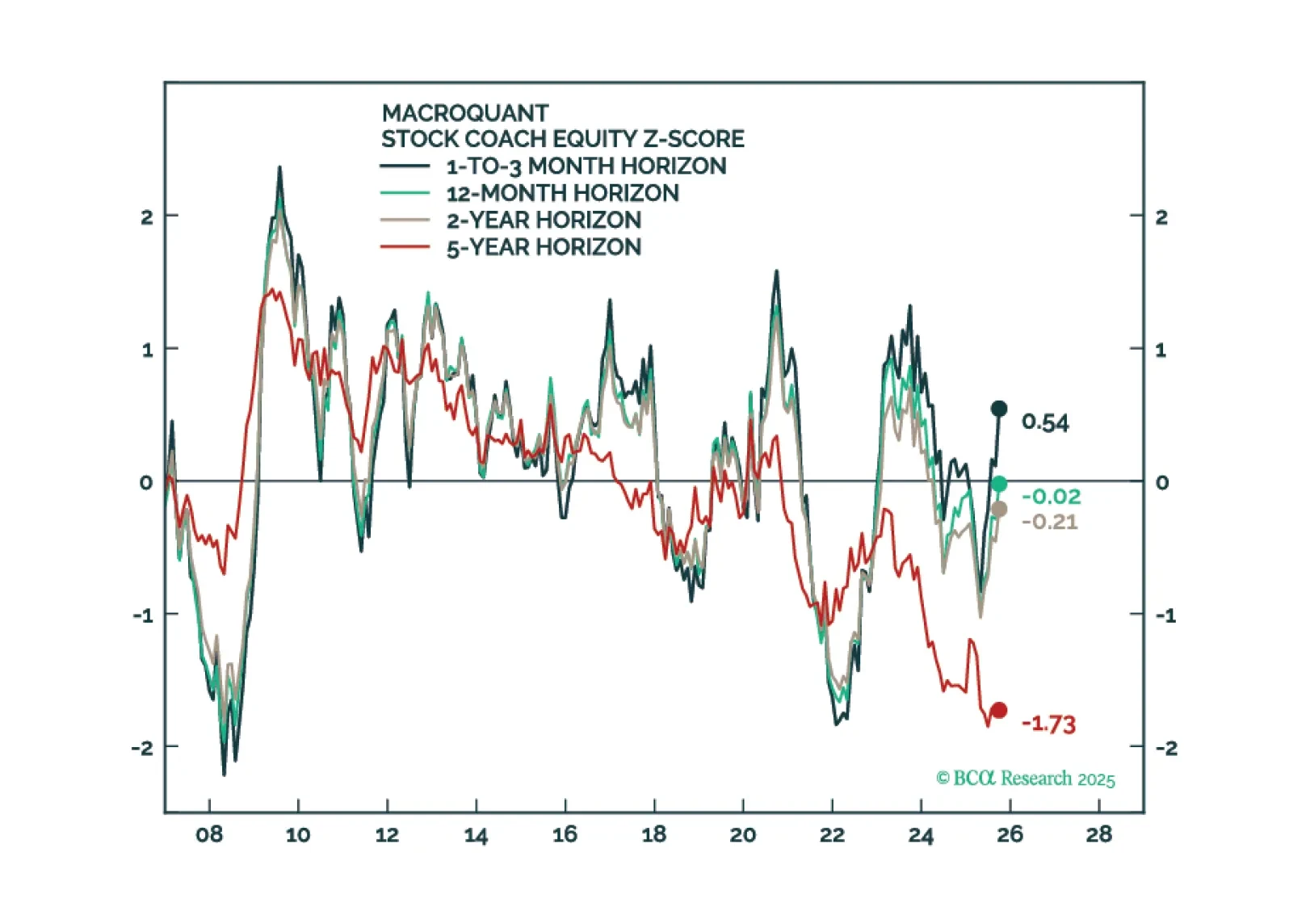

Much like the 2000 episode, we expect this year to unfold in two stages: A “Great Rotation” from tech stocks to non-tech names in the first half of 2026 followed by a broad-based selloff in stocks in the second half on the back of a…

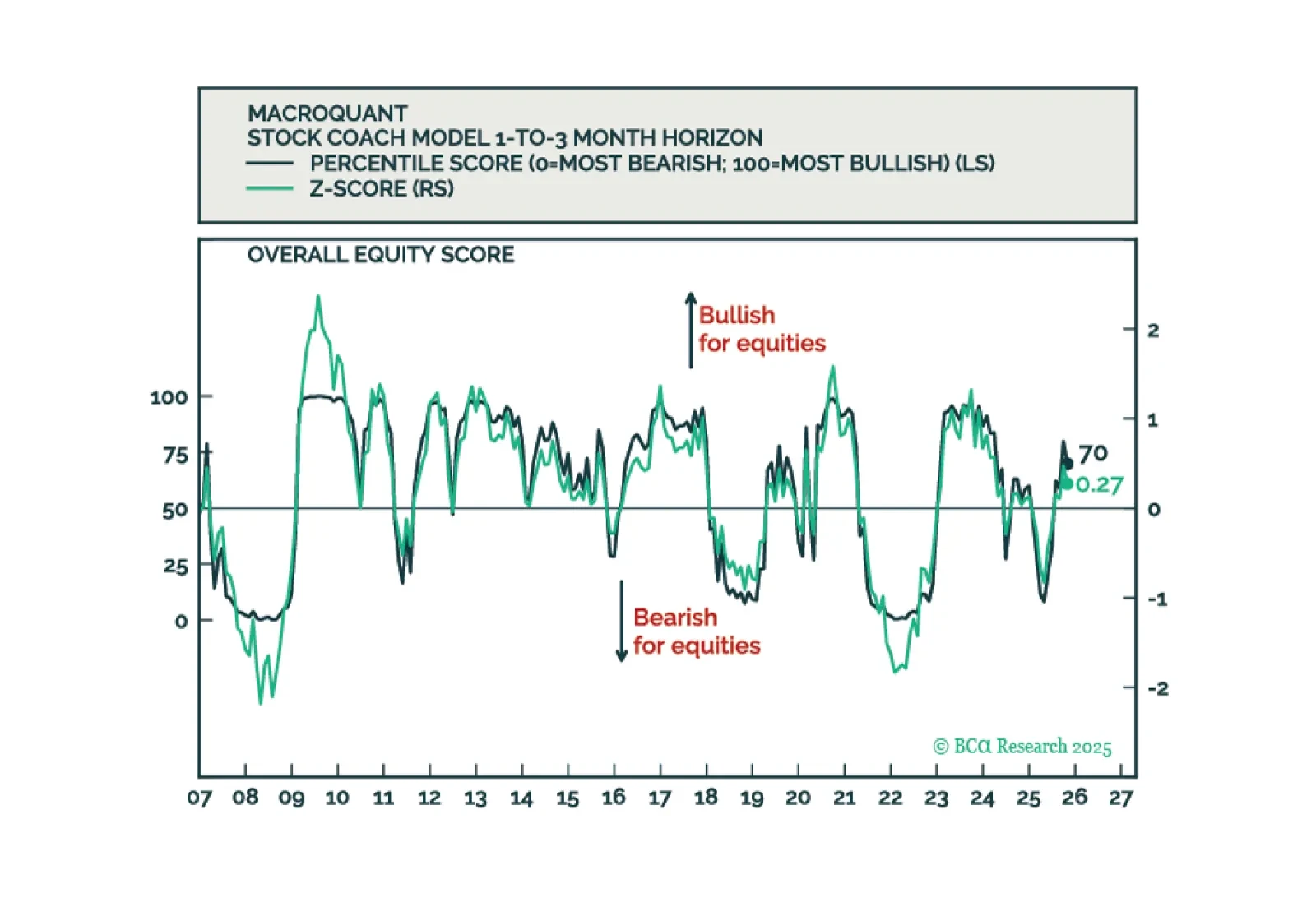

MacroQuant has downgraded equities to underweight, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is still bullish on gold.

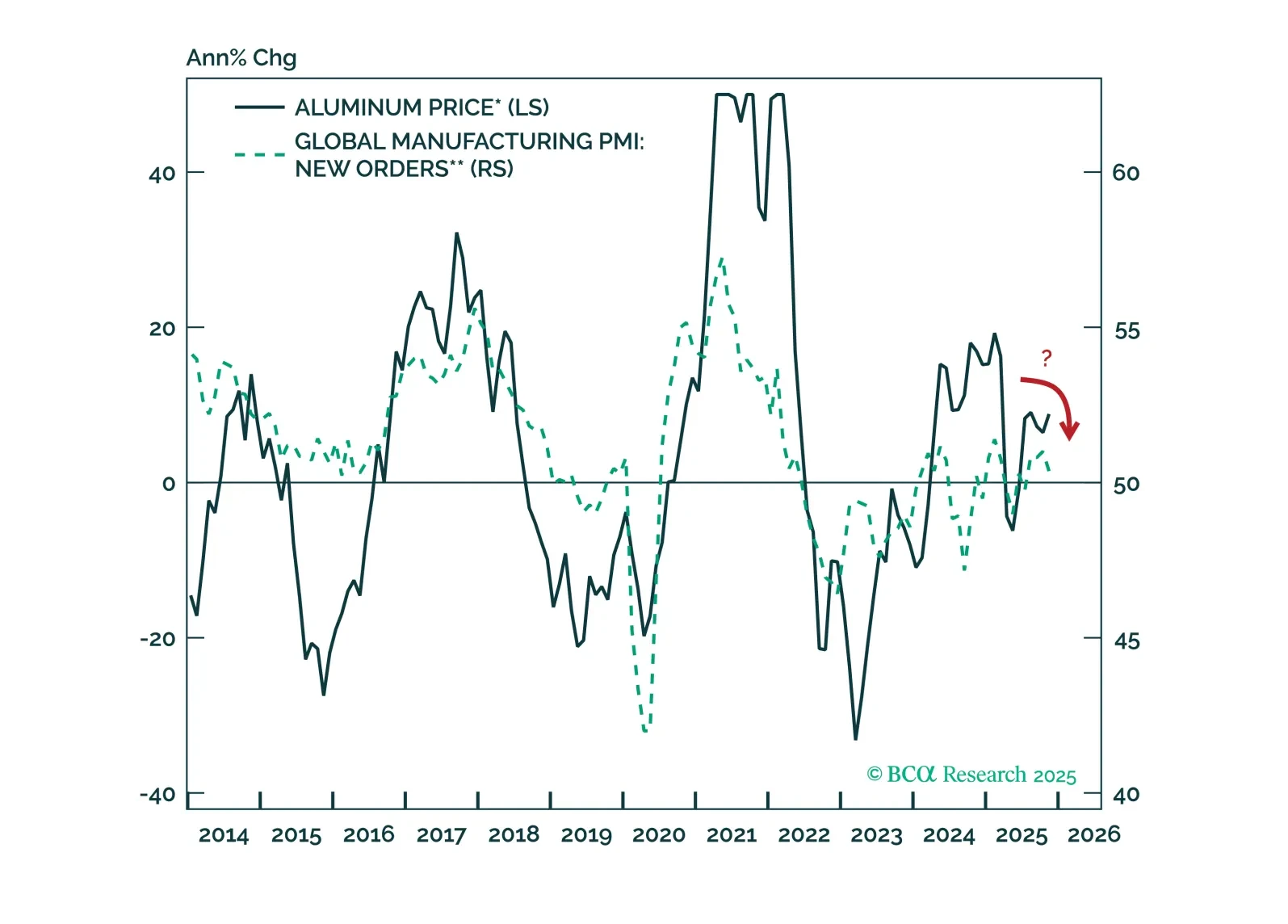

The forces that have recently propelled aluminum prices will remain supportive over the near term. However, beyond the coming months, aluminum prices will retreat as bearish cyclical pressures overwhelm over the course of 2026.

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

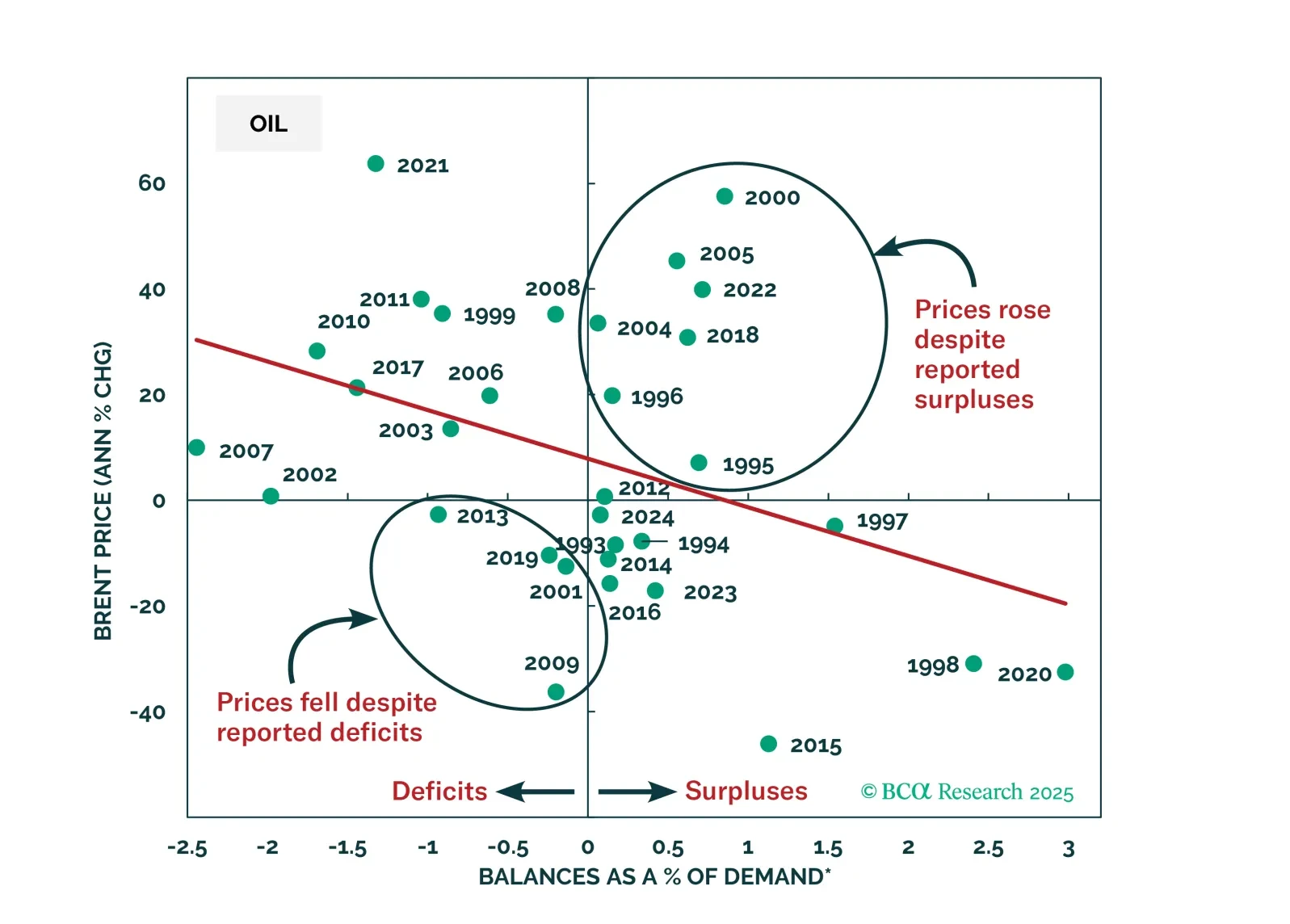

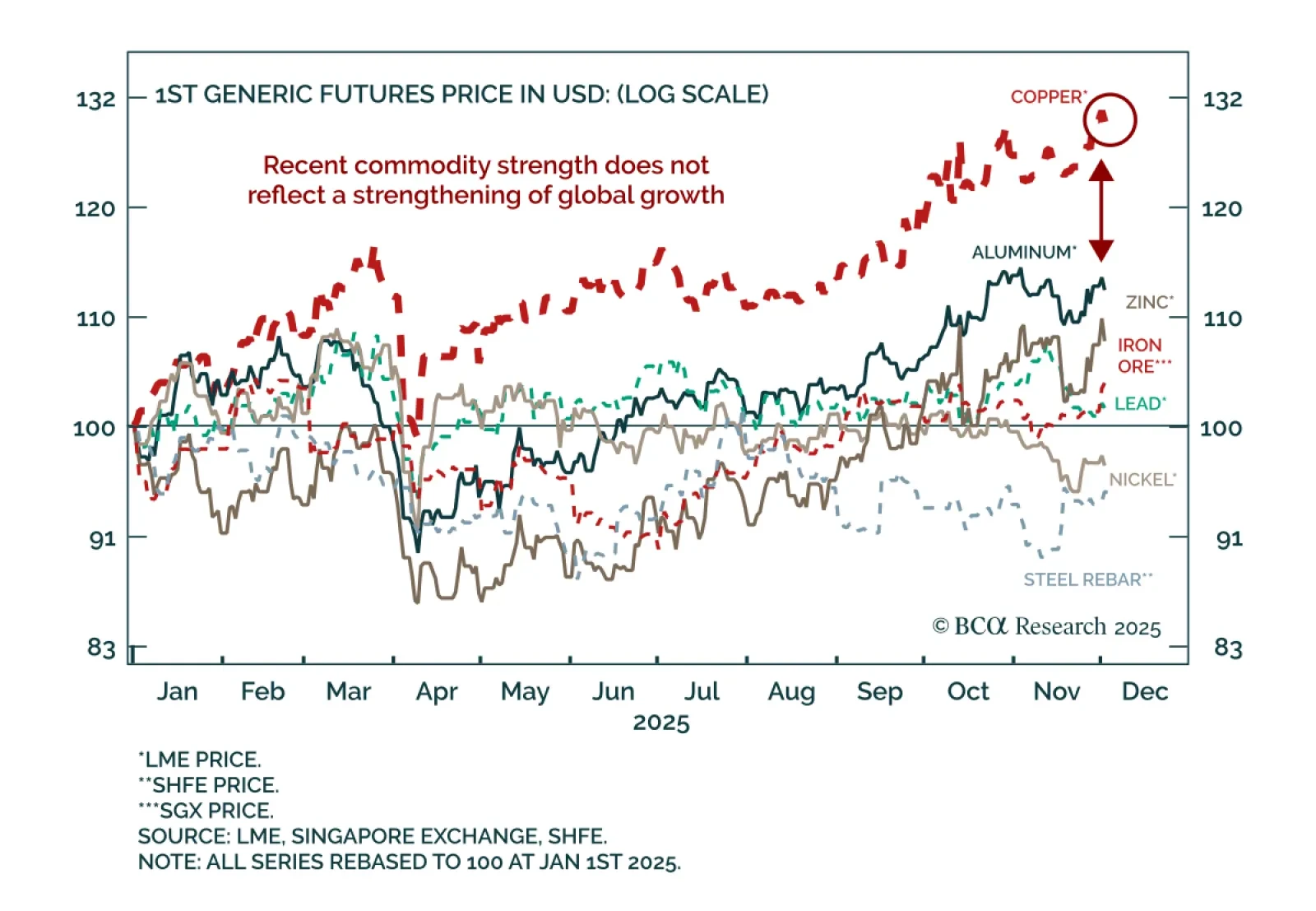

Maintain defensive commodity positioning as recent rallies reflect tariff distortions, not a turn in global growth. Despite soft global growth, copper, silver, gold, and shipping rates have rallied. Our Commodity strategists do not…

MacroQuant remains tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold.

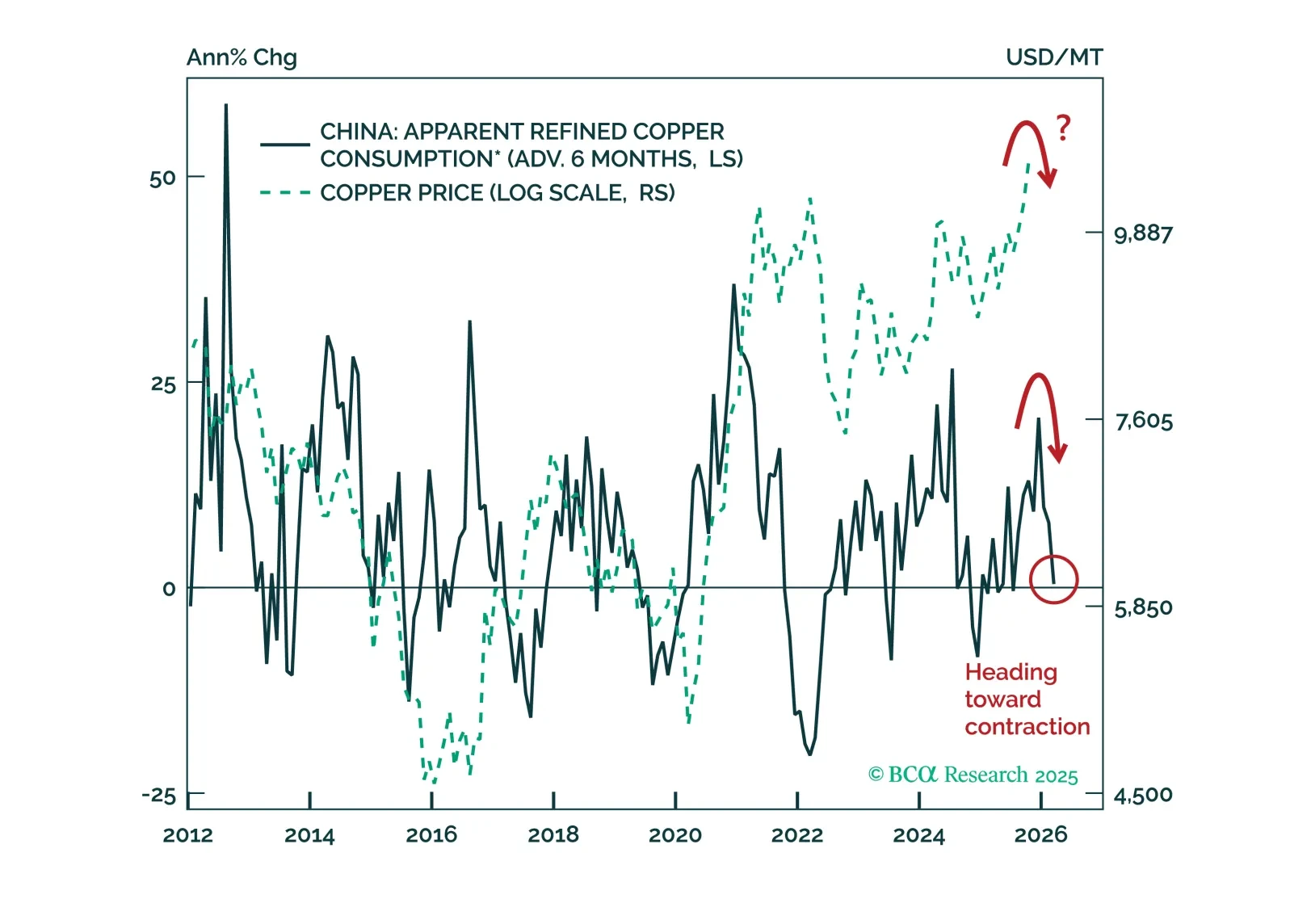

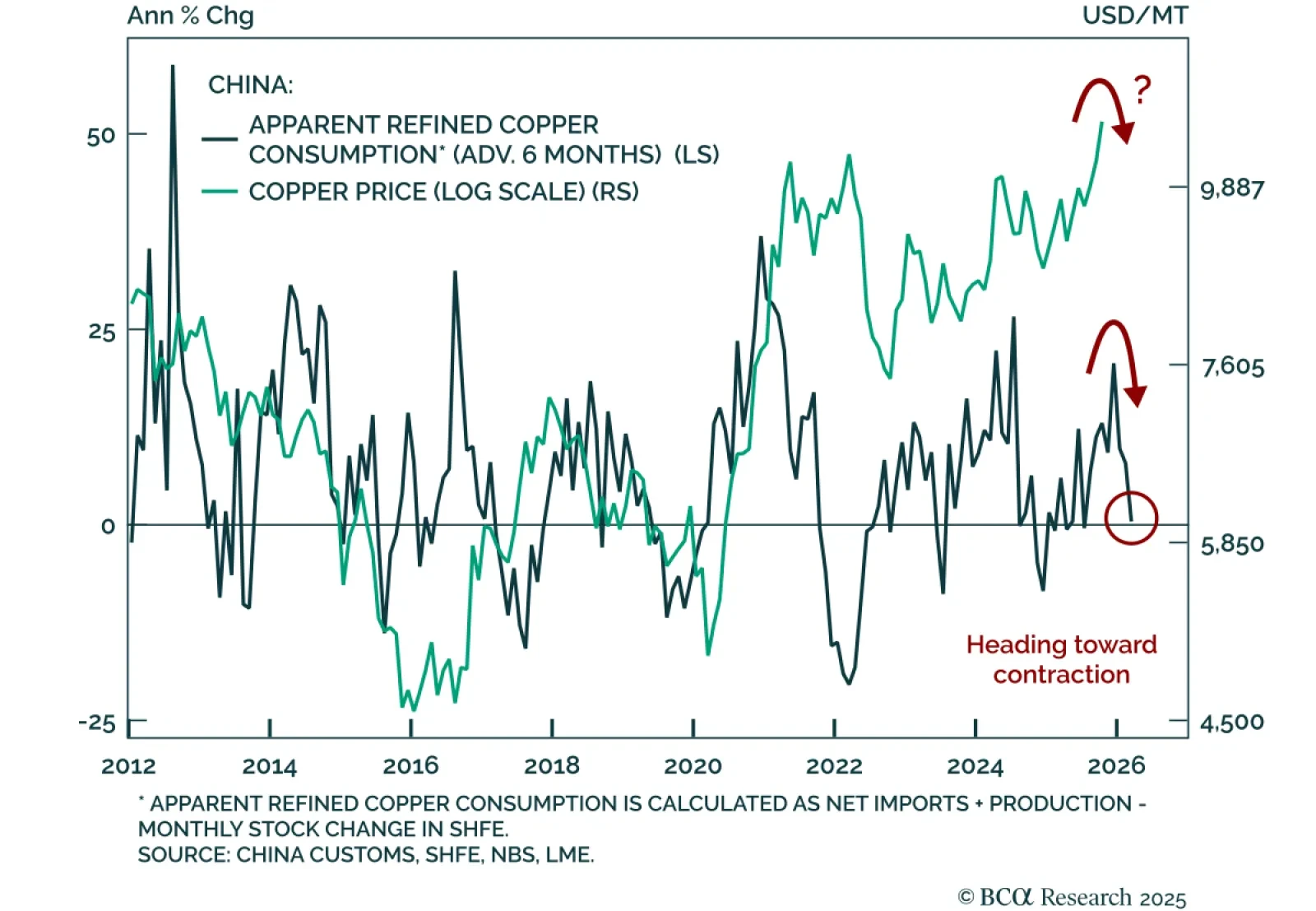

Our Commodity strategists remain cyclically short LME copper and introduce a stop-loss at $11,500, as supply-driven strength faces growing demand headwinds. While recent price gains have been fueled by production disruptions and…

Should investors chase the copper rally or use the latest bout of strength as an opportunity to sell?We warn that weakening Chinese demand and shrinking global manufacturing will weigh on the metal’s price over a cyclical timeframe…

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.