The sharp selloff in Treasurys over the past week has ignited a debate among BCA Research strategists about whether it is attributed to rising fears about inflation (see Country Focus) or is part of the reopening trade. The…

August PPI reading came in at 8.3%. Naturally, many investors are wondering whether the companies will be able to pass their soaring input costs to the customers. An in-depth analysis of margins and pricing power requires a significant…

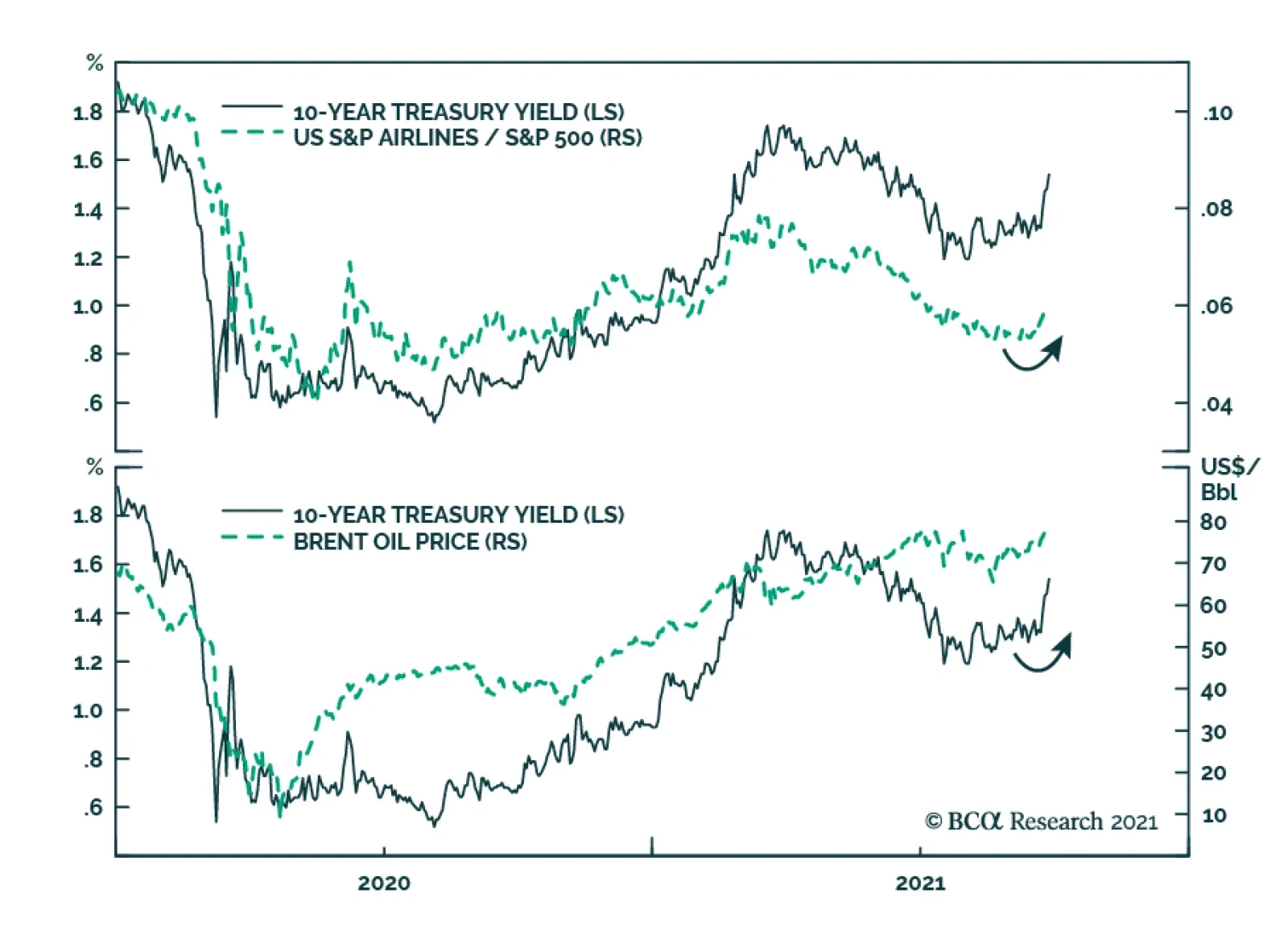

Today we take a close look at the historical GICS1 level performance following the taper event in 2013. Chart 1 provides an overview of a price action of the 10-year US Treasury yield, the US dollar, and gold to provide context,…

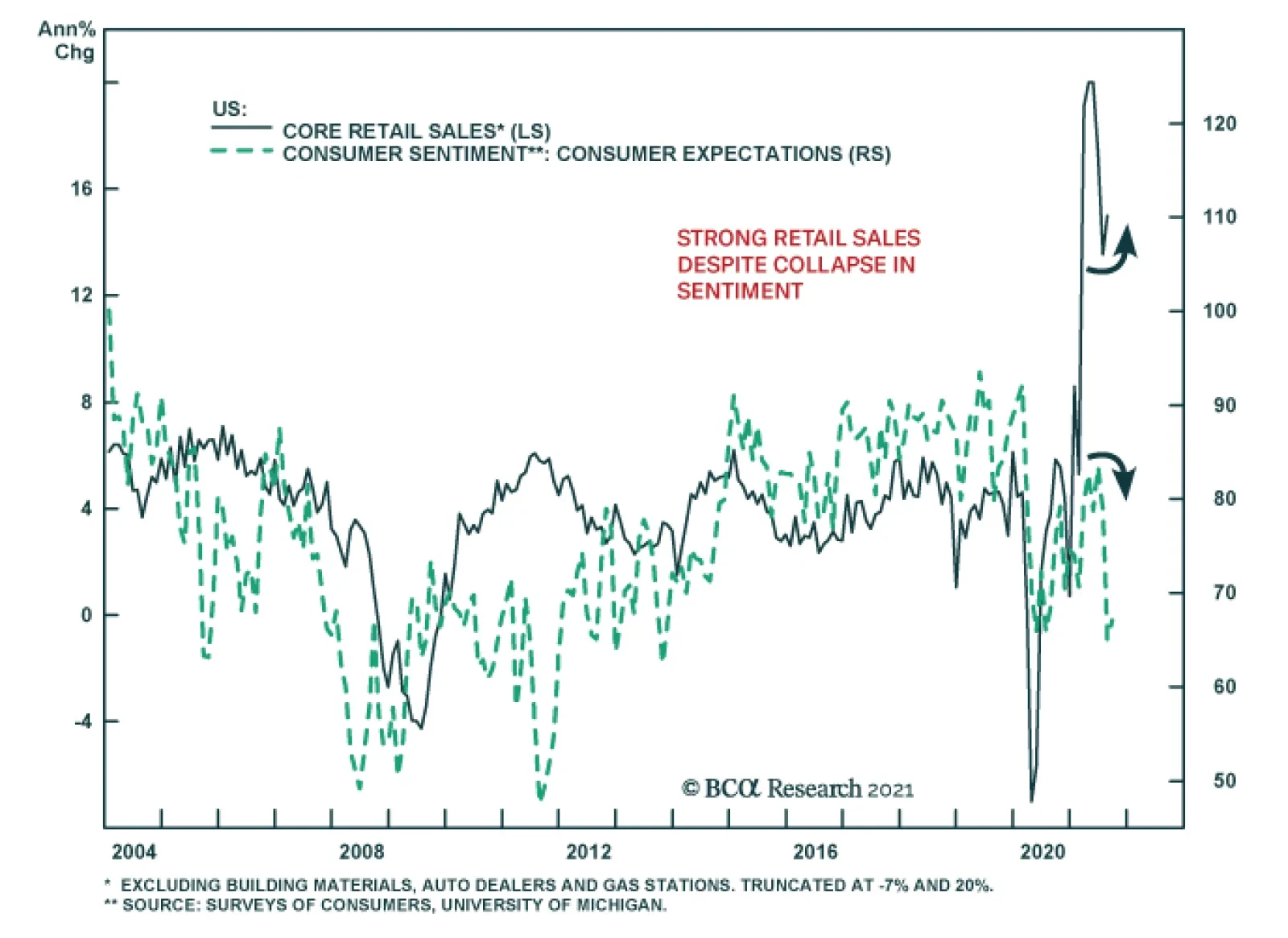

Friday’s preliminary University of Michigan Consumer Sentiment survey revealed that American households experienced a minor improvement in confidence in August. The headline index ticked up 0.7 points to 72. The minor increase…

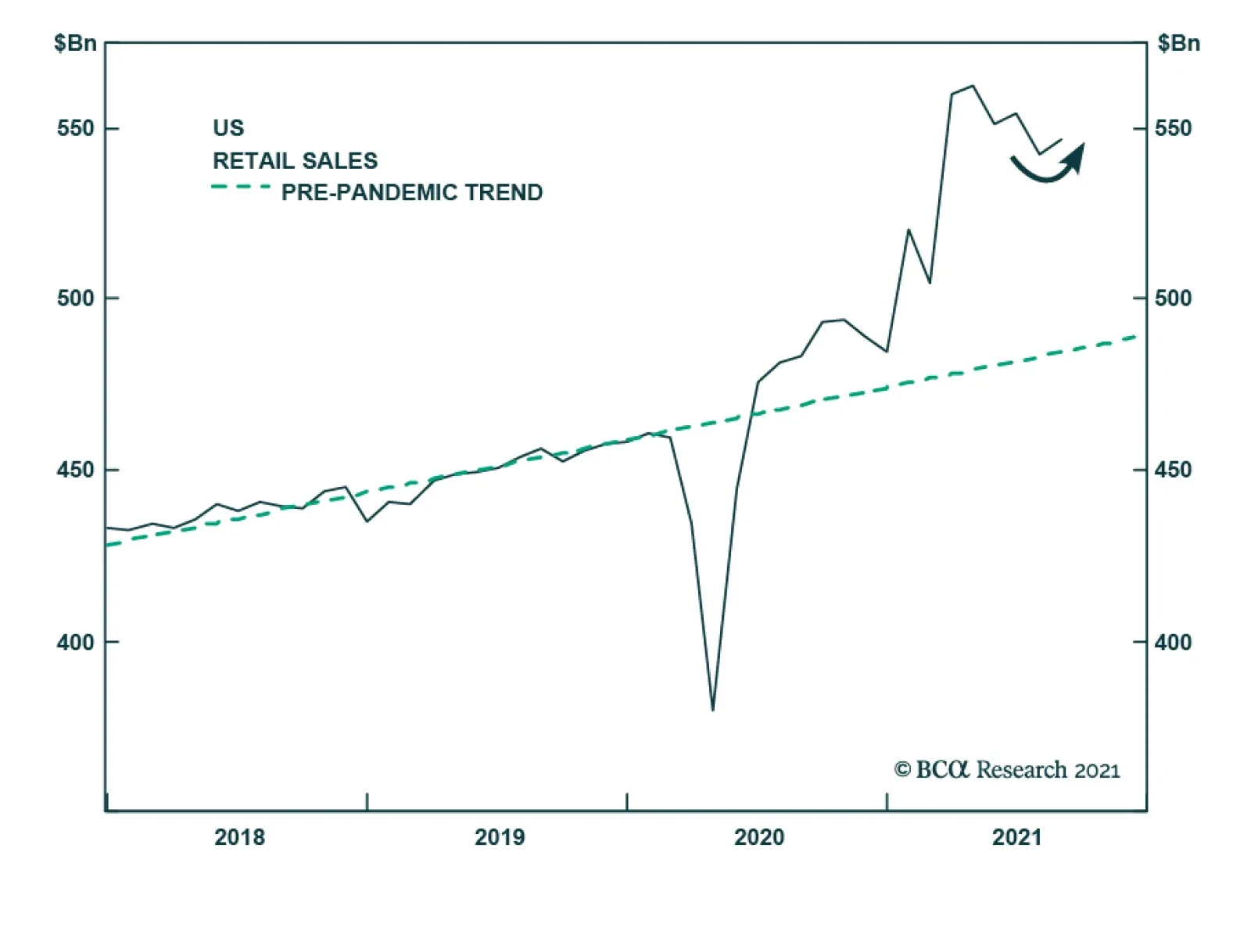

US retail sales for August delivered a positive surprise. The headline number grew 0.7% m/m following the prior month’s downwardly revised decline of 1.8%. Similarly, the retail sales control group expanded 2.5% m/m from a…

Highlights Our willingness to spend money depends on which ‘mental account’ it occupies. Once windfall income enters our ‘savings mental account’, we will not spend it. Hence, the pandemic’s windfall…

Highlights Earnings season was impressive, with 87% of companies beating analyst earnings expectations. Analysts’ targets were too low because a whopping 38% of companies provided negative forward guidance for the Q2-2021 results…

Highlights Going into the new crop year, we expect the course of the broad trade-weighted USD to dictate the path taken by grain and bean prices (Chart of the Week). Higher corn stocks in the coming crop year, flat wheat stocks and…

Foreword Today we are publishing a charts-only report focused on the S&P 500 and its sectors. Many of the charts are self-explanatory; to some we have added a short commentary. As with the styles Chart Pack, published a month…

Neutral (Downgrade Alert) Soft drinks have taken a beating recently and we are on the lookout for an oversold bounce before we go underweight this consumer goods sub-group, especially given our short-term cautious outlook.…