The Fed’s Beige Book compiles qualitative input sourced from business and other organizational contacts in each of its 12 Districts. It precedes FOMC meetings by a couple of weeks and is meant to help participants trace the…

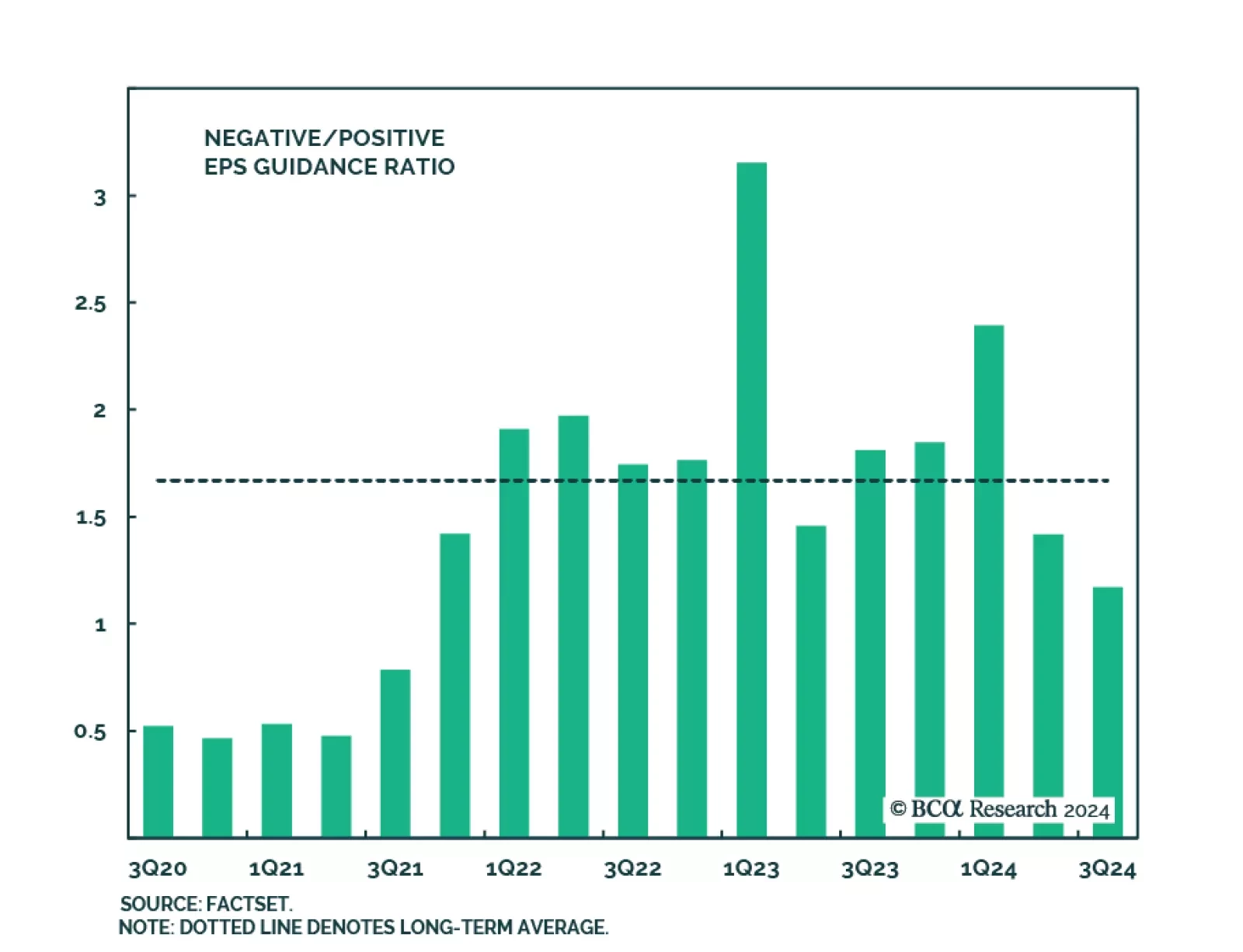

The Q2 2024 earnings season is drawing to a close with 93% of S&P 500 companies having reported results as we go to press. Nearly 80% (60%) of companies have topped earnings (sales) expectations in Q2, according to Factset…

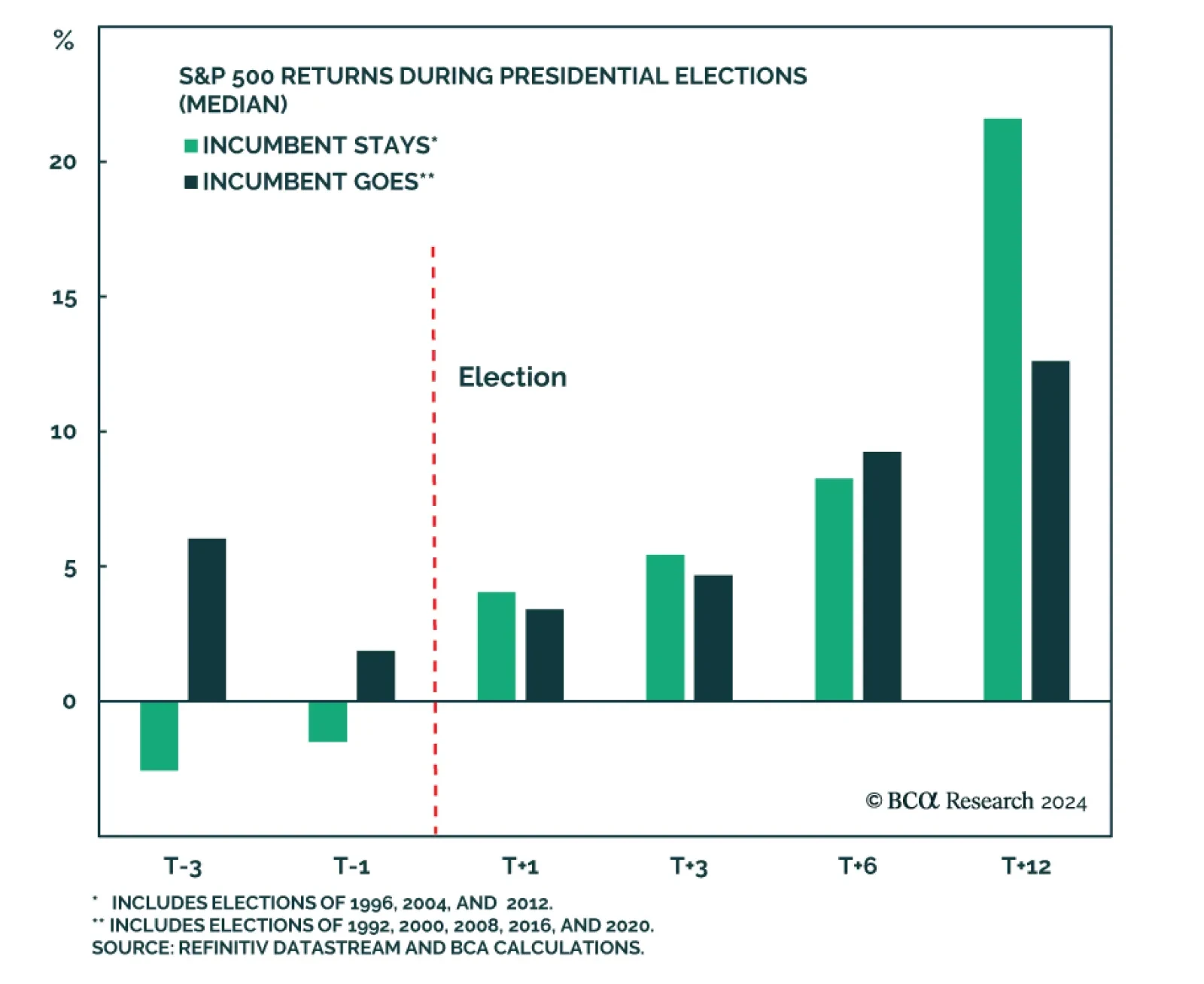

According to BCA Research’s US Political Strategy service, in the final months of an election cycle, equities underperform relative to non-election years. This extends further into Q1 of the following year due to…

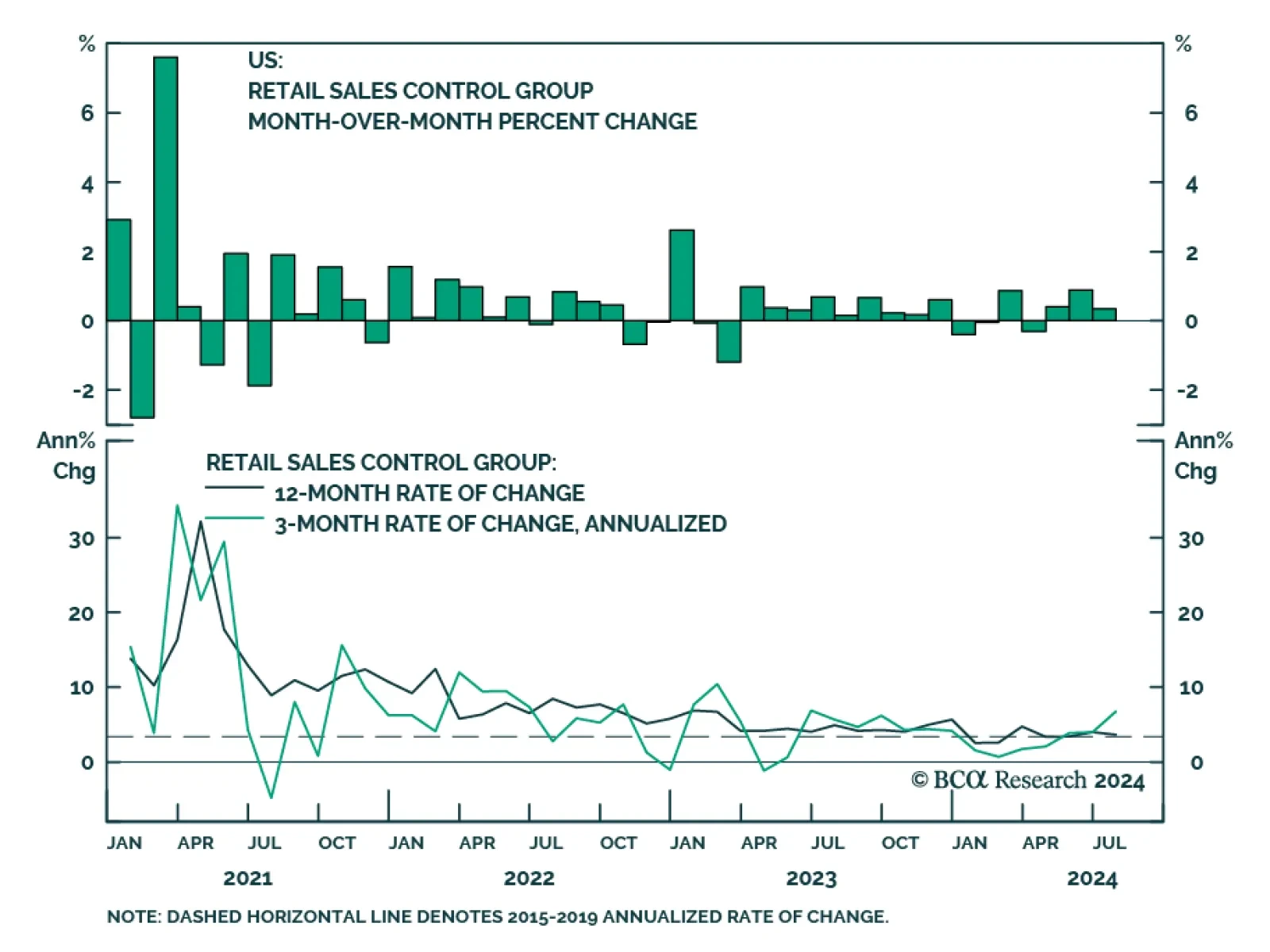

Preliminary estimates suggest that US retail sales surprised to the upside in July. They grew by 1.0% m/m from a 0.2% monthly contraction in June, exceeding expectations of a slower 0.4% pace of growth. Sales of vehicles and…

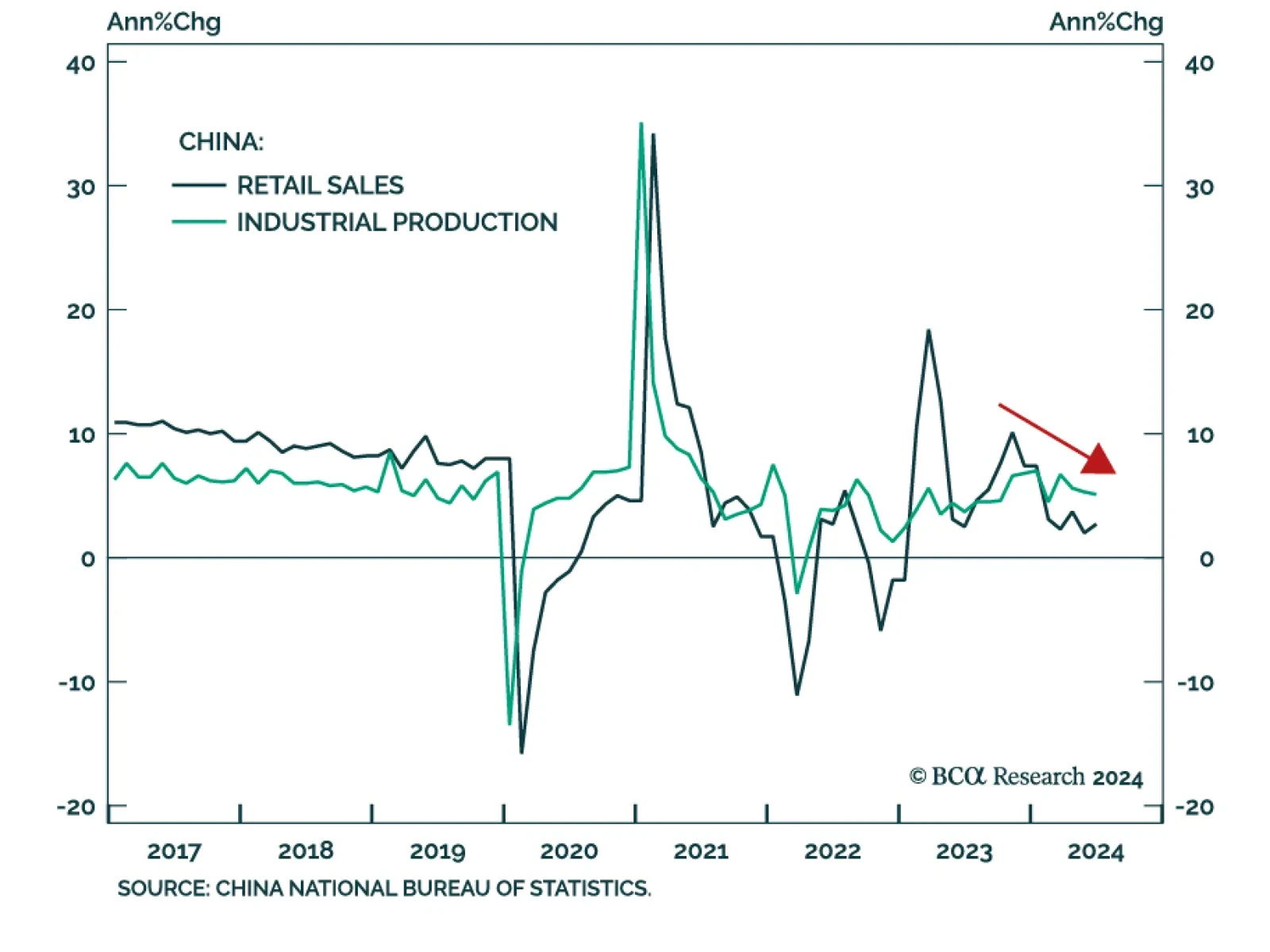

China’s economic malaise extended through the month of July. The contraction in property investment worsened (-10.2% YTD y/y) and disappointed expectations of a slower pace of decline. Residential property sales remained…

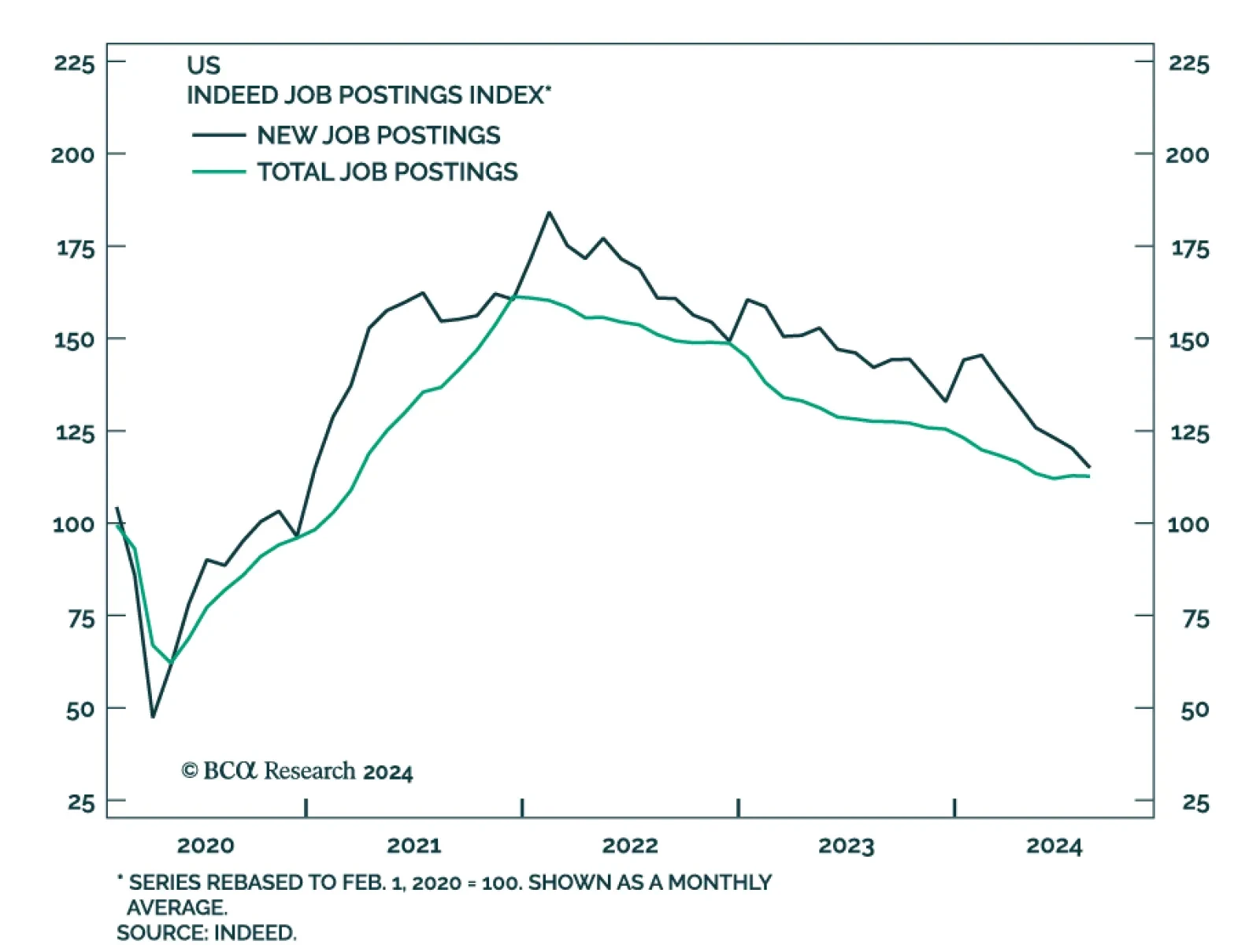

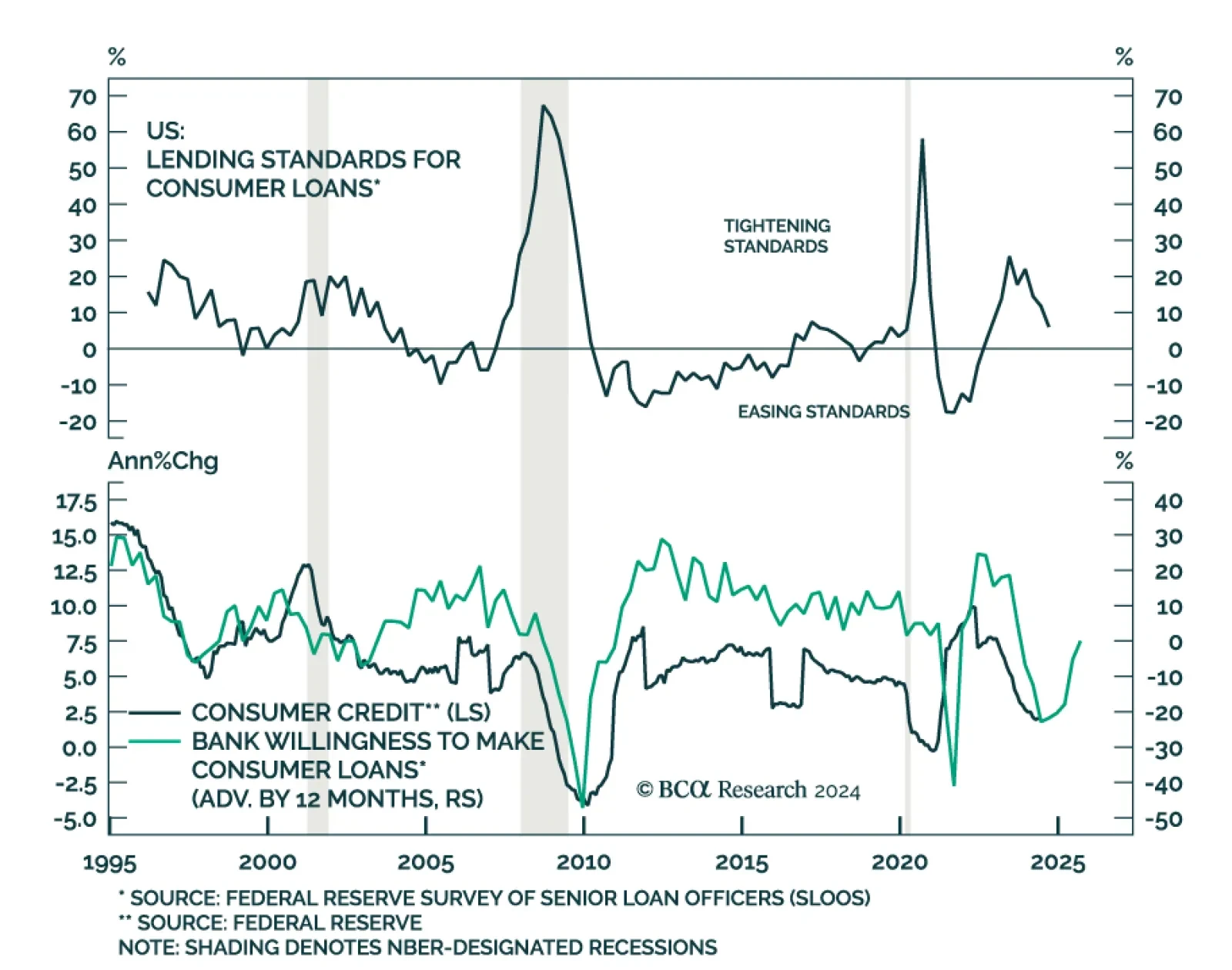

Lending standards continued to tighten for most loan categories in Q2, according to the Senior Loan Officer Survey (SLOOS). US banks reported tightening lending standards to businesses and all CRE categories. They kept…

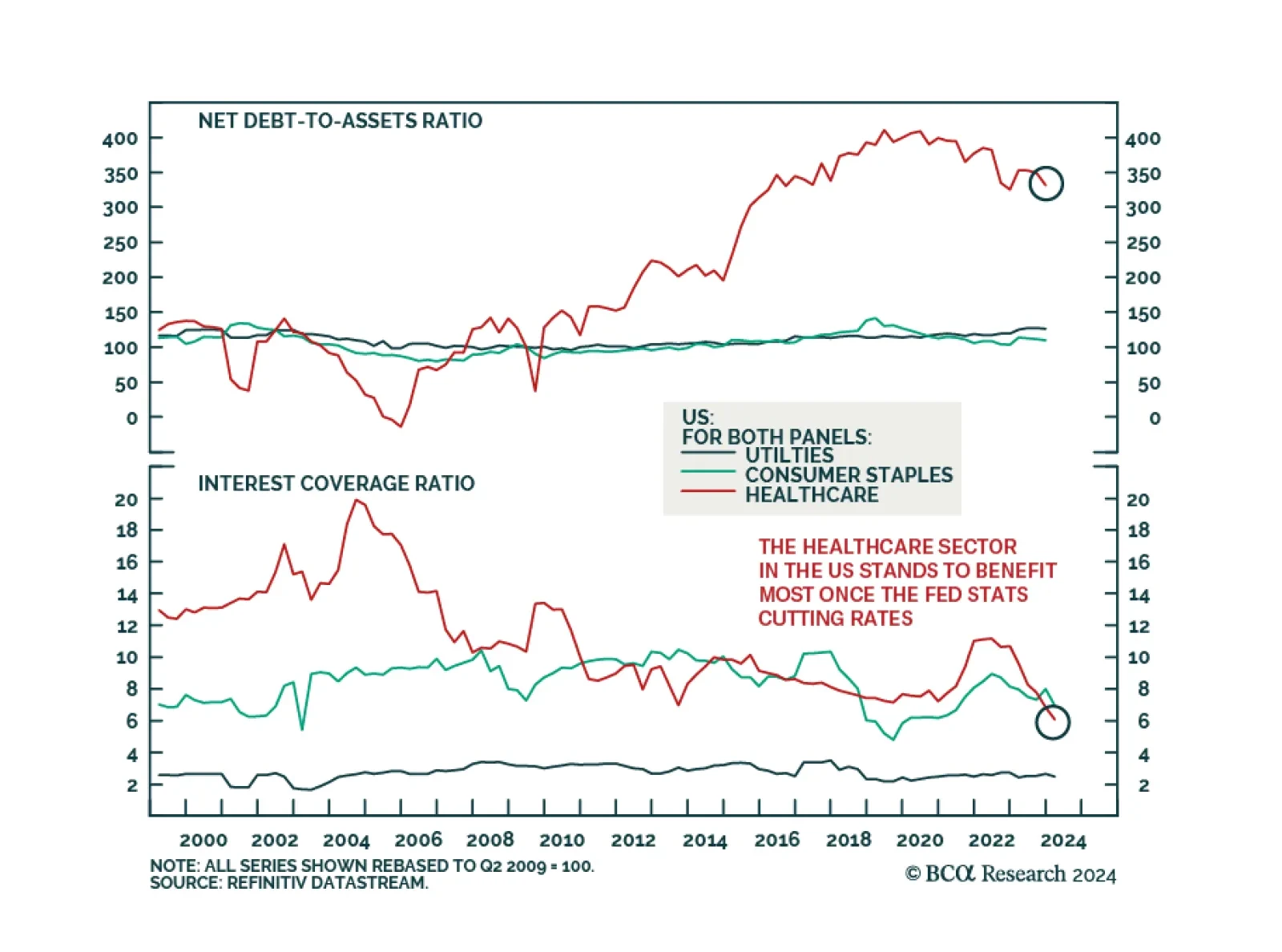

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.

We continue to expect a recession by early 2025 but assign non-trivial odds to growth surprising to the upside until then. Our Global Investment Strategy team thus recommends investors adopt a barbell equity strategy as a…

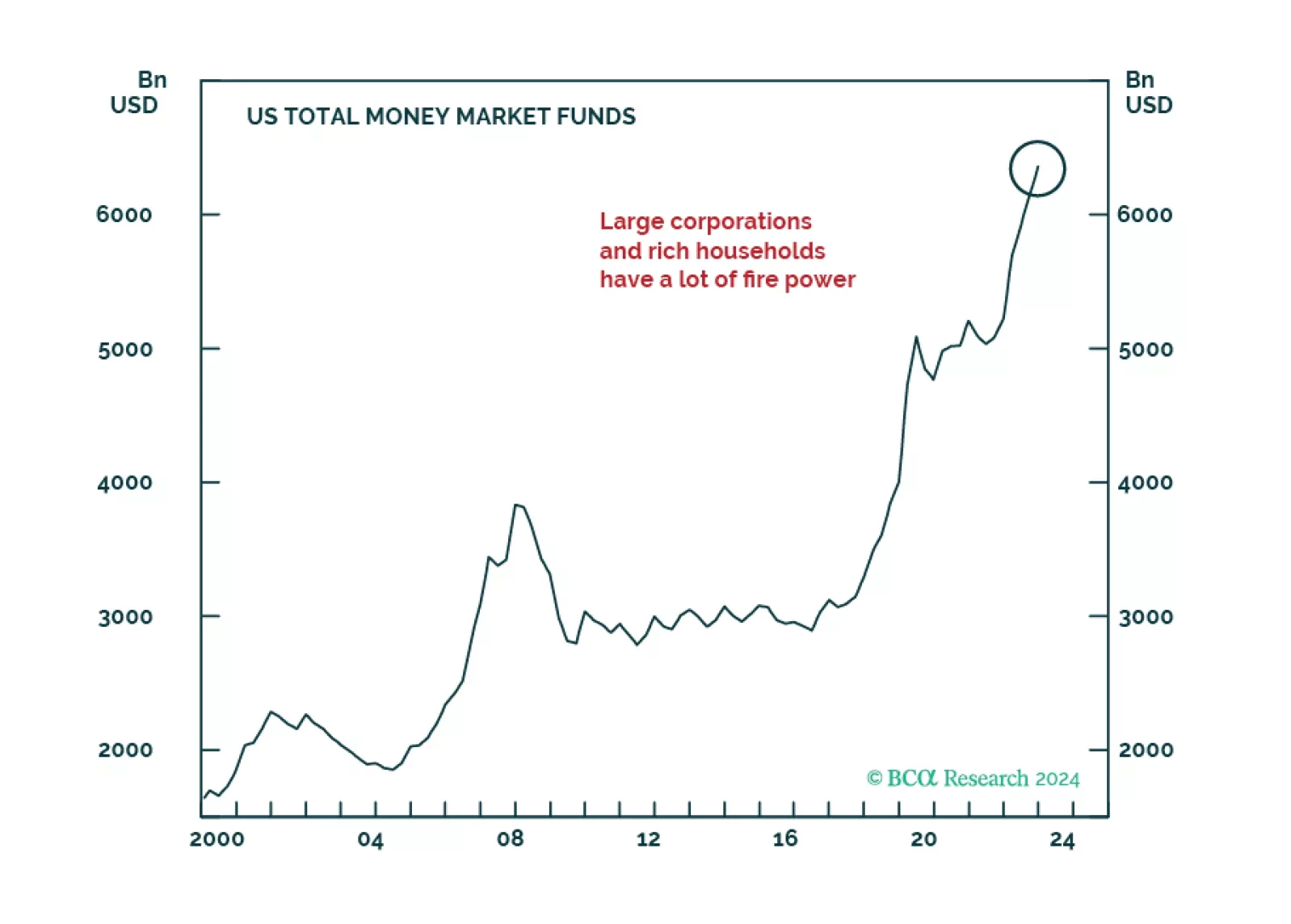

Generative AI-related rally resumed in May. Much of the recent market gains are down to excess liquidity that was begotten by the massive pandemic stimulus, creating a dichotomy between multiple economic challenges and exuberant…