S&P Hypermarkets (Overweight) Upgraded from Neutral S&P Soft Drinks (Neutral) Upgraded from Underweight As a follow up to our yesterday’s Insight where we outlined some of our reasons to go underweight the S…

Highlights Portfolio Strategy Despite the Fed’s supra natural powers, the deep rooted global growth slowdown will likely win the tug of war versus flush liquidity, especially if the trade war spat stays unresolved and the U.S.…

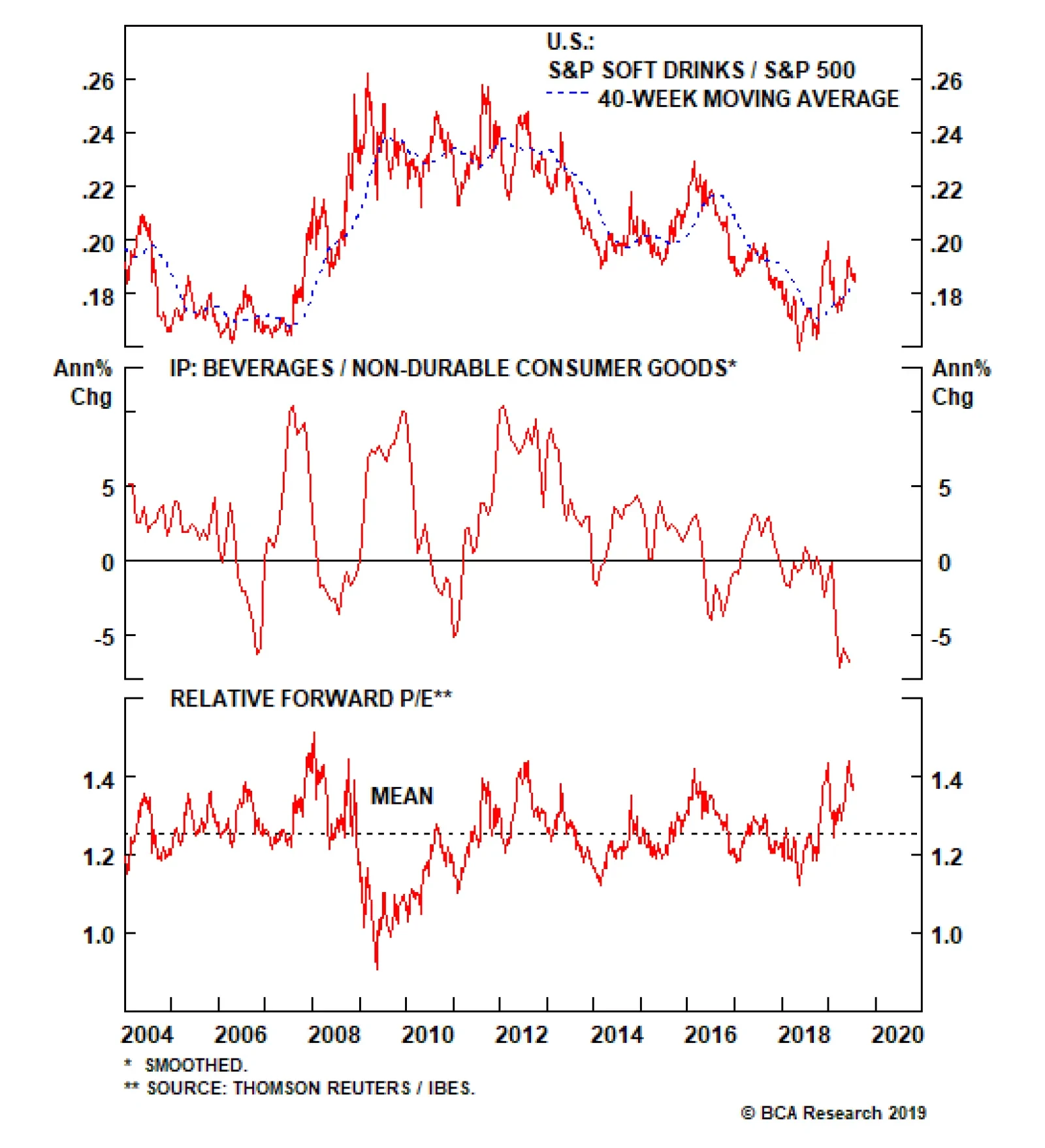

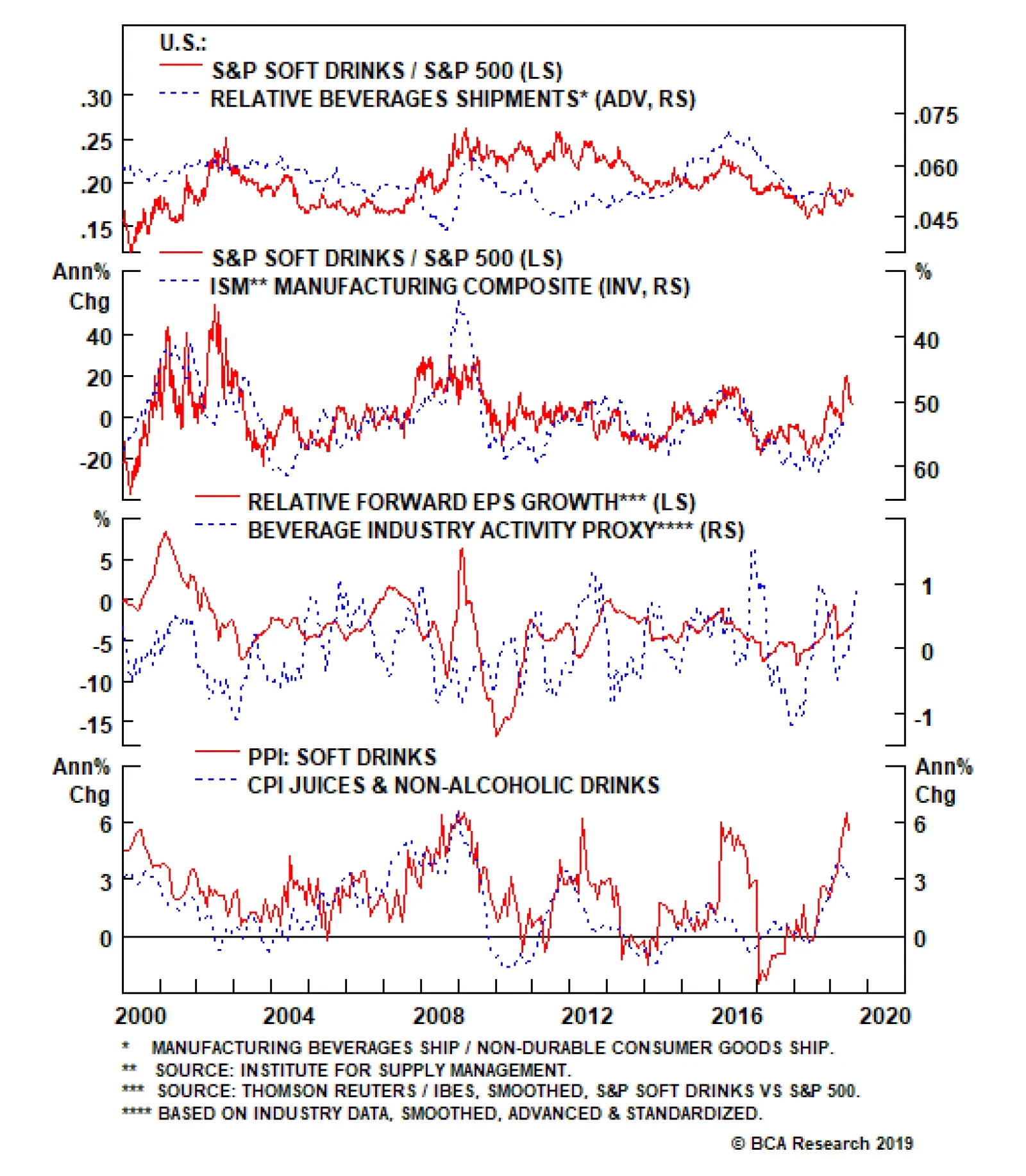

In the previous Insight we highlighted a number of firming beverage industry operating metrics, however, soft drinks industrial production itself is still waving a yellow flag. In fact, relative output is contracting at the…

As our U.S. Equity Strategy team continues to shift its portfolio away from cyclical and toward defensive exposure, it is upgrading the S&P soft drinks index from underweight to neutral. This defensive pure-play consumer…

Neutral While in the previous Insight we highlighted a number of firming beverage industry operating metrics, soft drinks industrial production is still waving a yellow flag. In fact, relative output is contracting at the…

Neutral As we continue shifting our portfolio away from cyclical and toward defensive exposure, we are upgrading the S&P soft drinks index from underweight to neutral, locking in a relative gain of 5.5% since inception…

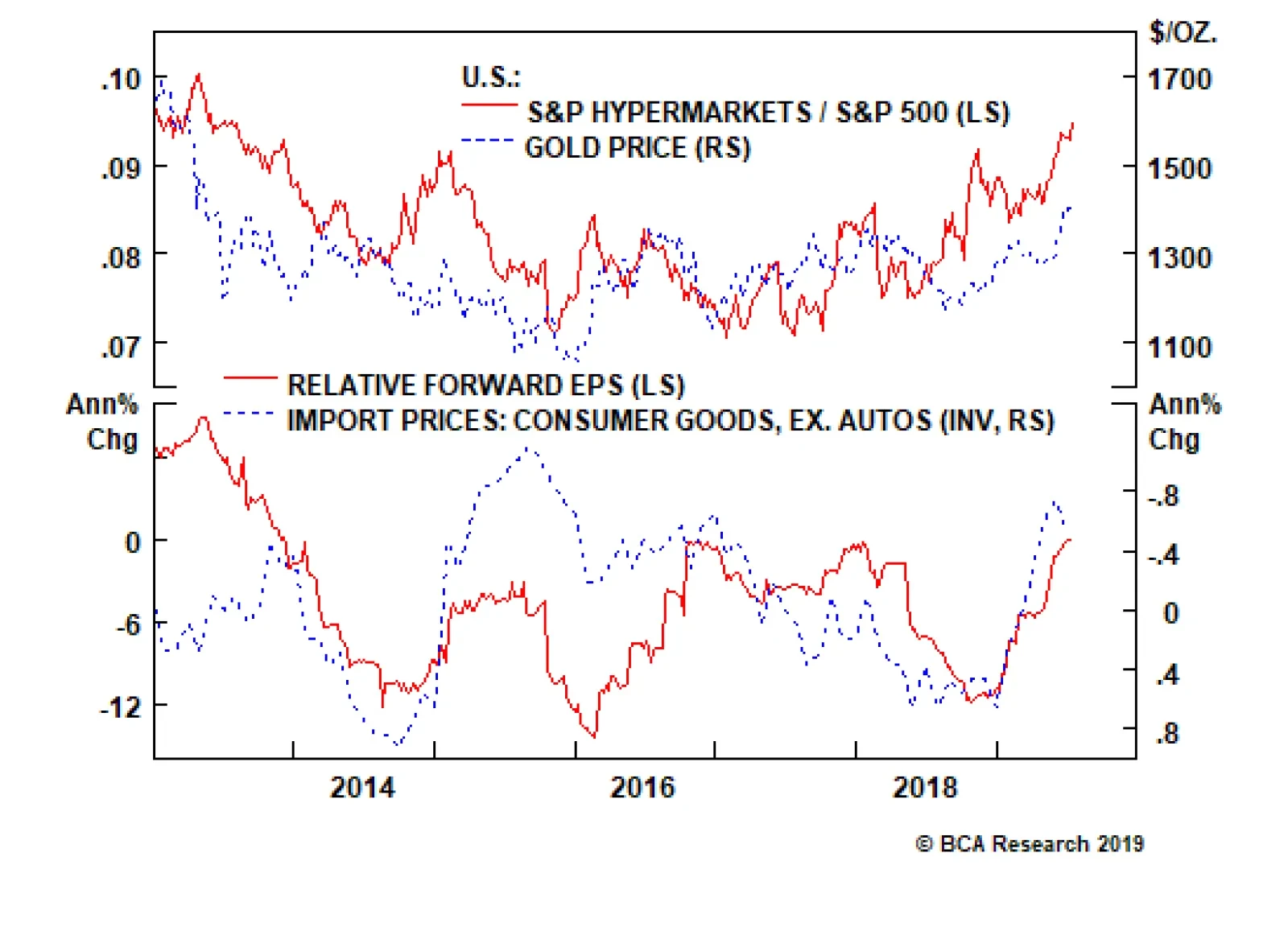

This disinflationary backdrop along with the Fed’s looming easing interest rate cycle have put a solid bid under gold prices. Hypermarket equities and bullion traditionally move in lockstep, and the current message is to…

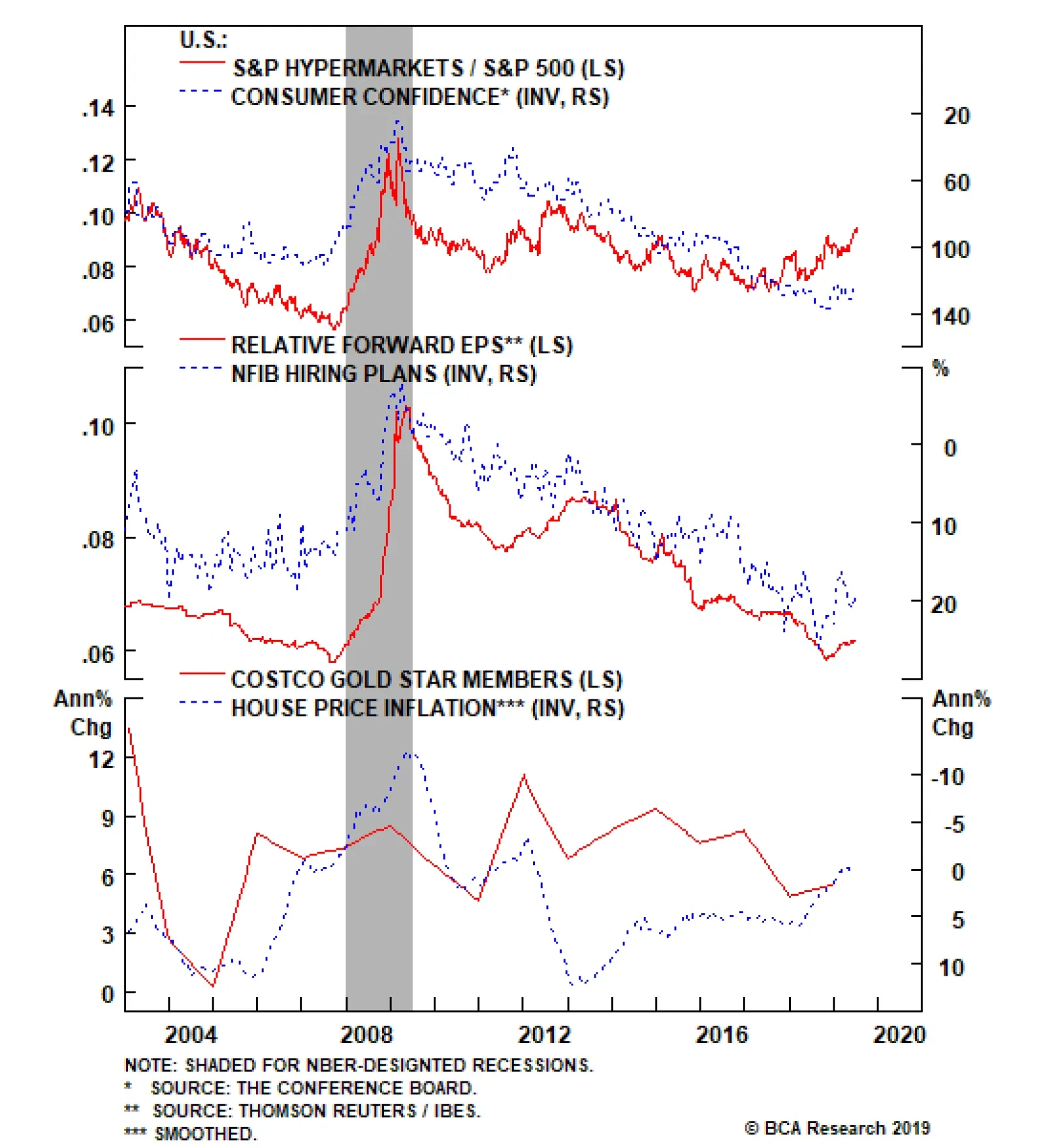

The tide is shifting and we are upgrading the S&P hypermarkets index to an above benchmark allocation. While valuations are stretched, trading at a 50% premium to the overall market on a 12-month forward P/E basis, our thesis…

Overweight The tide has shifted and on Monday we upgraded the S&P hypermarkets index to an above benchmark allocation. While valuations are stretched, trading at a 50% premium to the overall market on a 12-month forward P…

Highlights Portfolio Strategy Recession odds continue to tick higher, according to the NY Fed’s probability of recession model, at a time when global growth is waning, U.S. profit growth is contracting and the non-financial ex-…