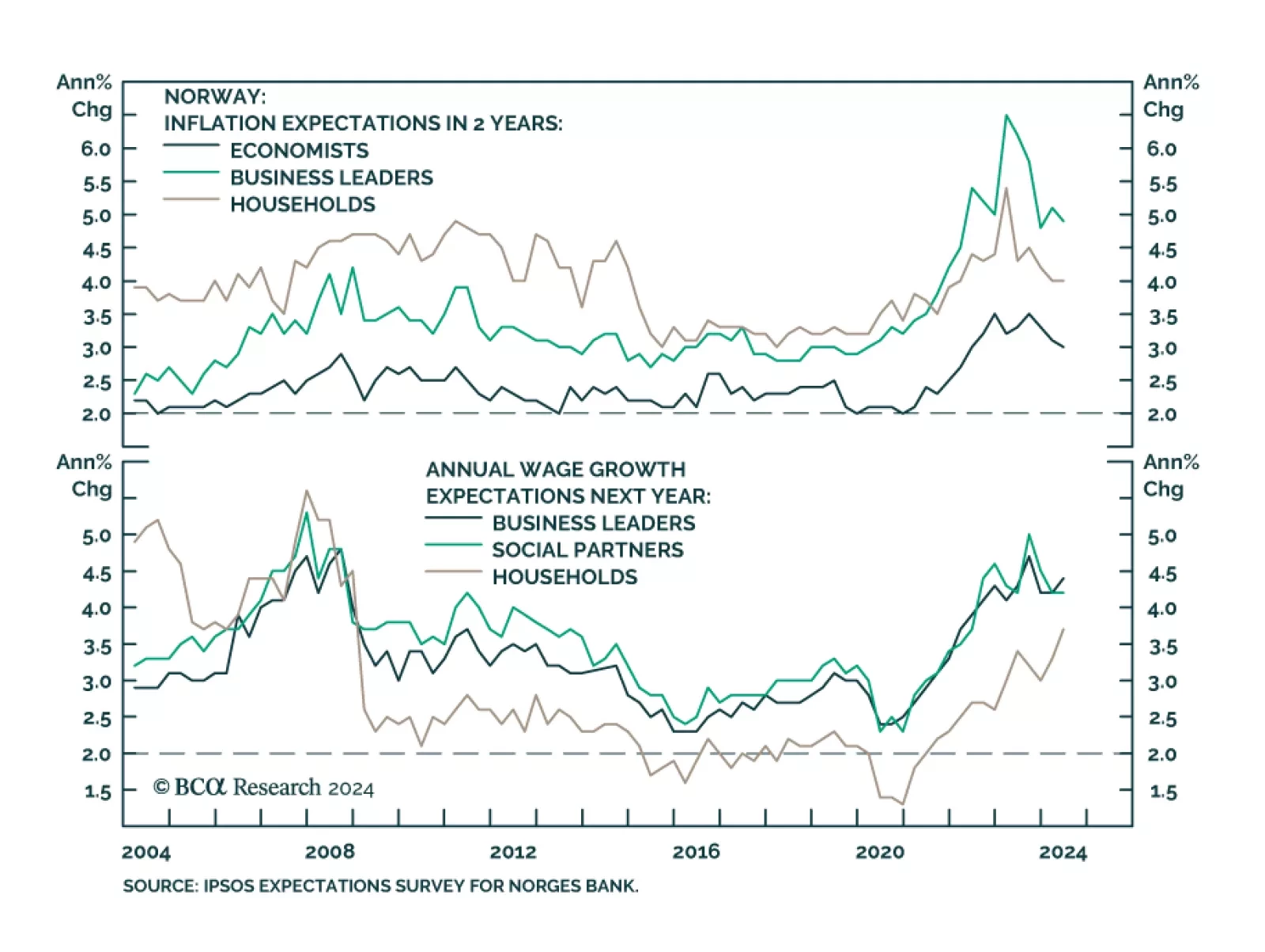

The Norges Bank kept its policy rate unchanged at 4.5% at its September meeting and signaled low odds of policy easing before the first quarter of 2025. The inflation backdrop does not warrant easing policy. Although core CPI…

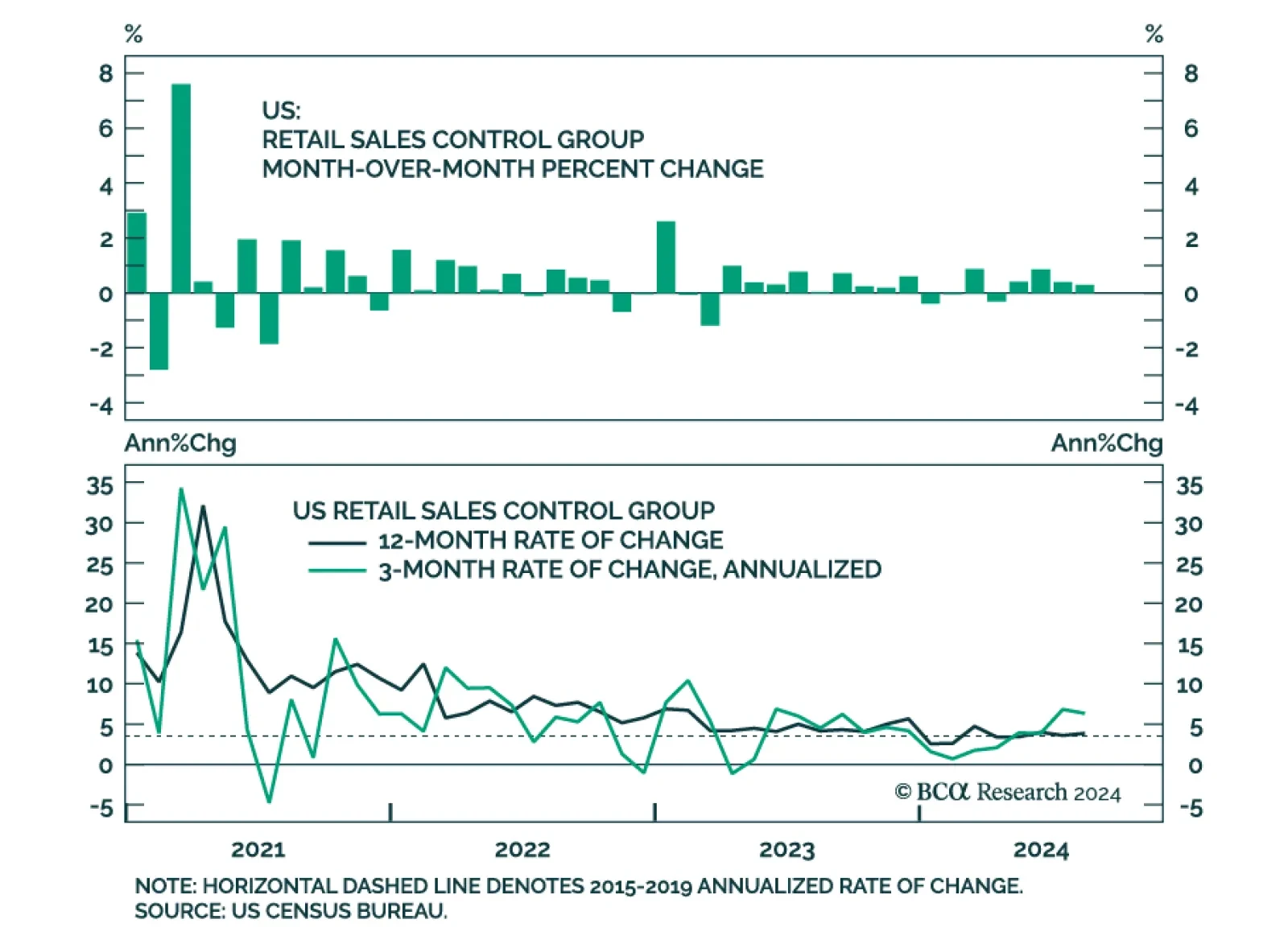

US retail sales grew 0.1% m/m in August and beat expectations of a 0.2% monthly contraction. The positive surprise seemingly spurred equity market gains on Tuesday morning. However, details do not paint as rosy a…

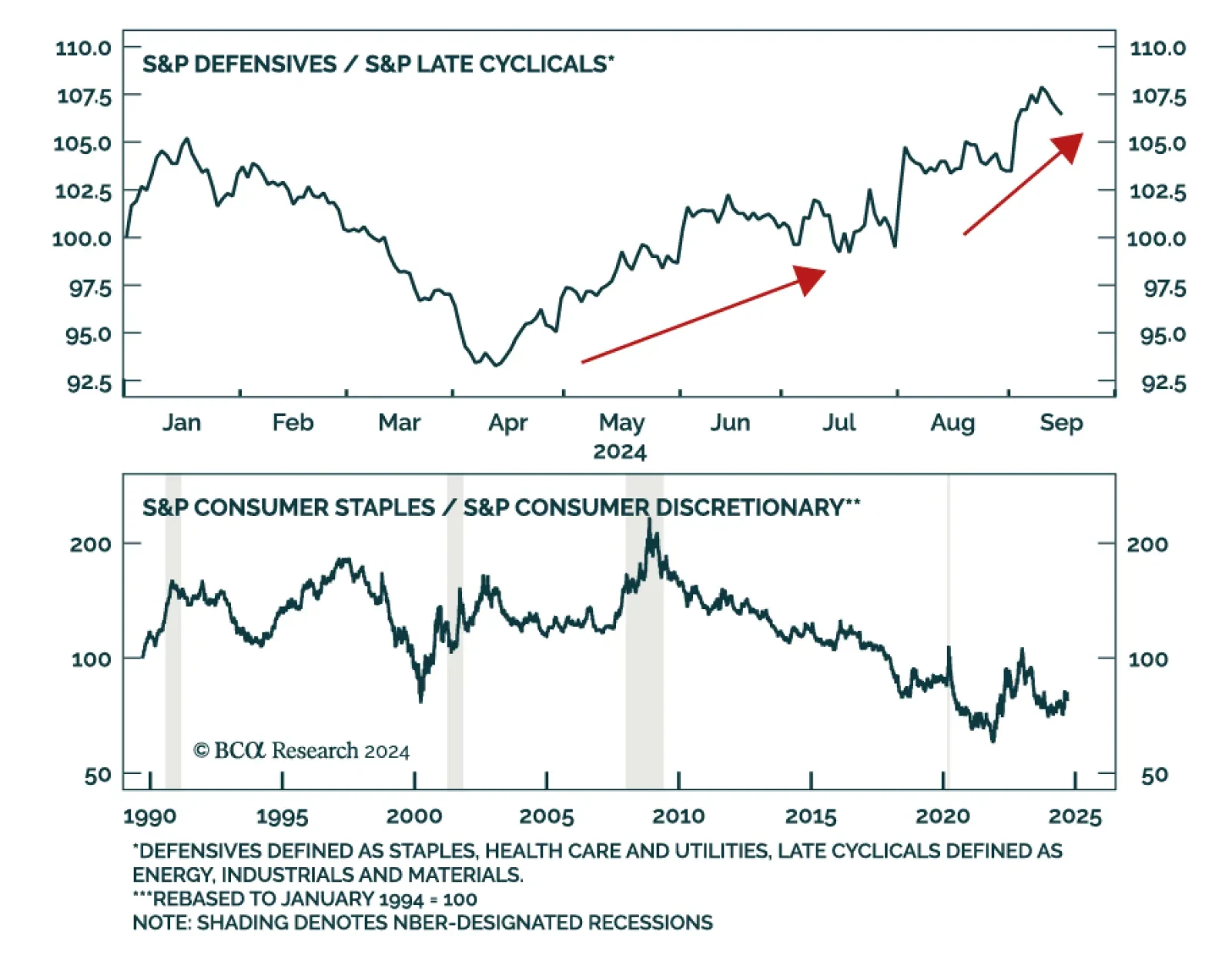

Stocks are a forward discounting mechanism and routinely top before recessions begin, even if they typically do not swoon until the recession has taken hold. According to BCA Research’s US Investment Strategy service, if…

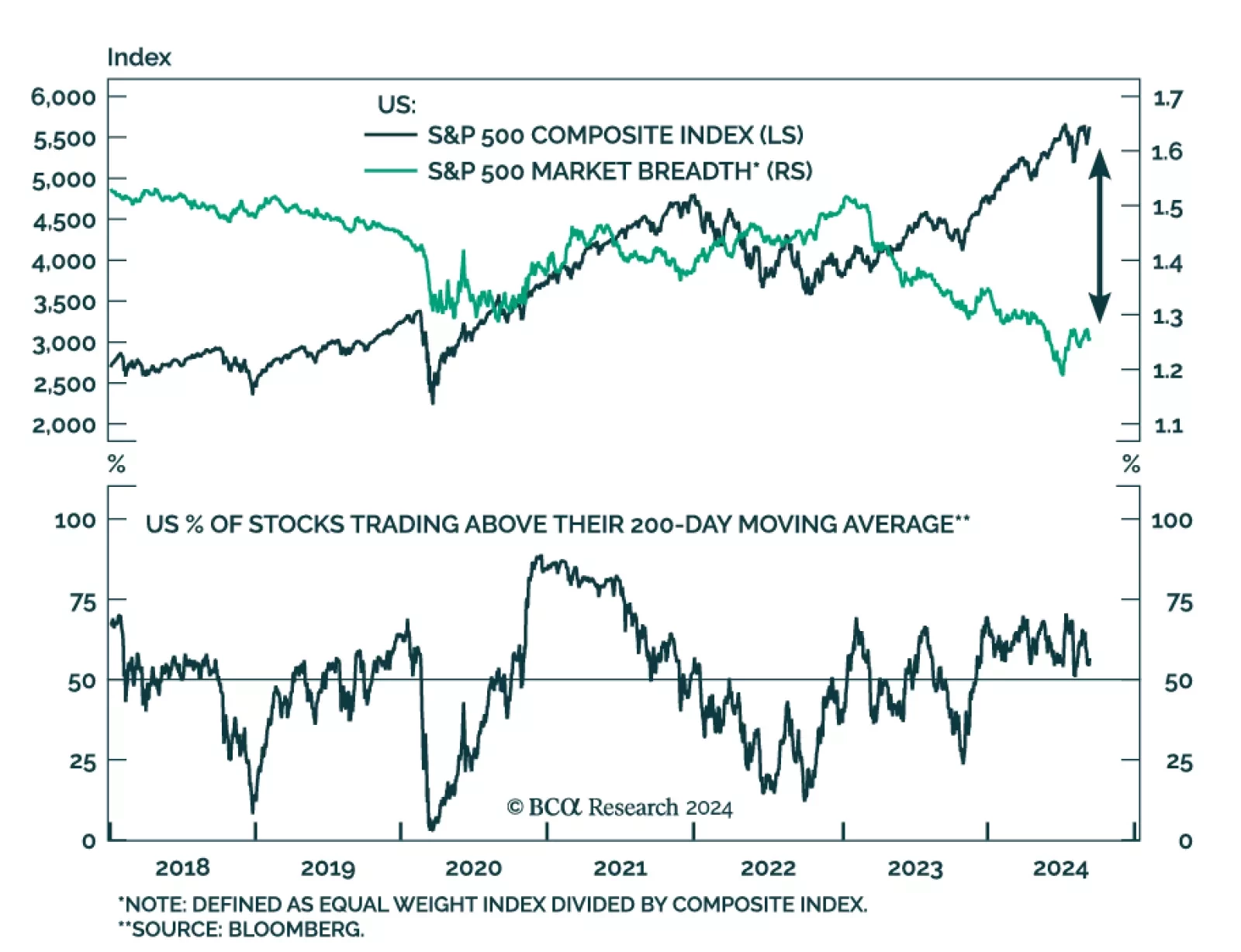

Investors are pricing in a soft landing in the US. Notably, we noted that pro-cyclical assets topped the performance ranking in August. At the same time, the S&P 500 is currently trading only 1% below its all-time highs.…

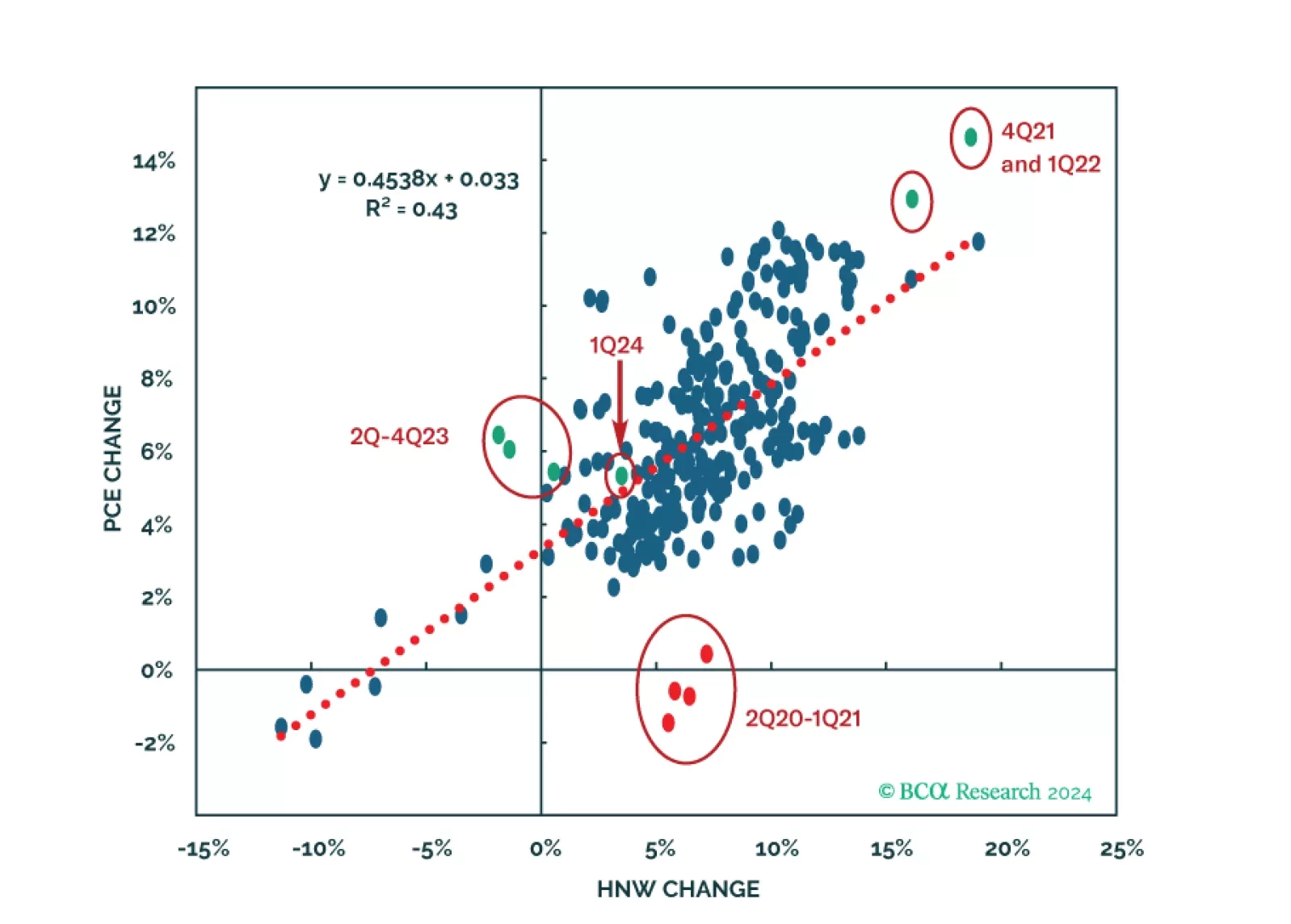

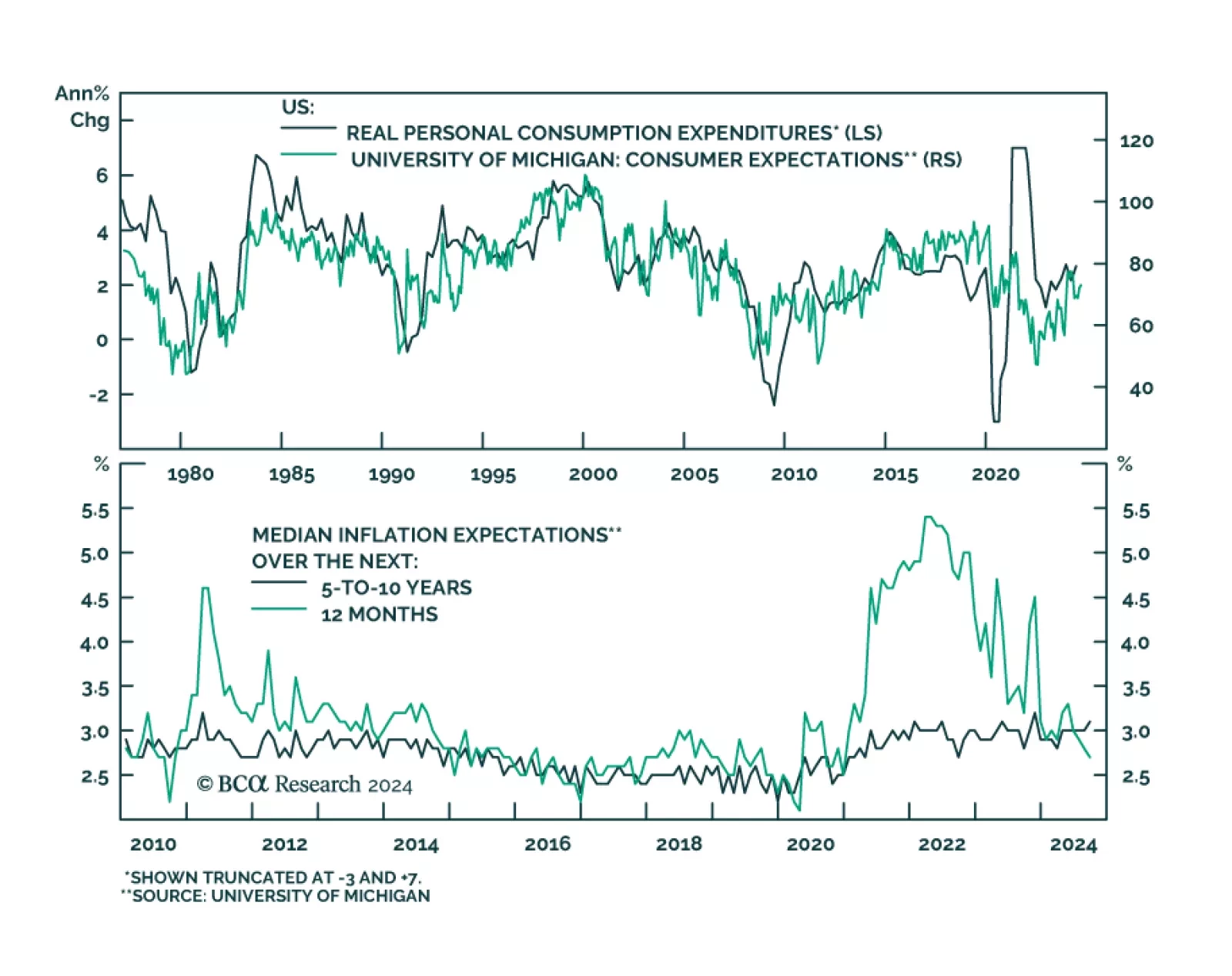

Preliminary estimates suggest that consumer sentiment improved in September. The headline University of Michigan consumer sentiment index increased from 67.9 to a higher-than-projected 68.5. Both the current conditions and…

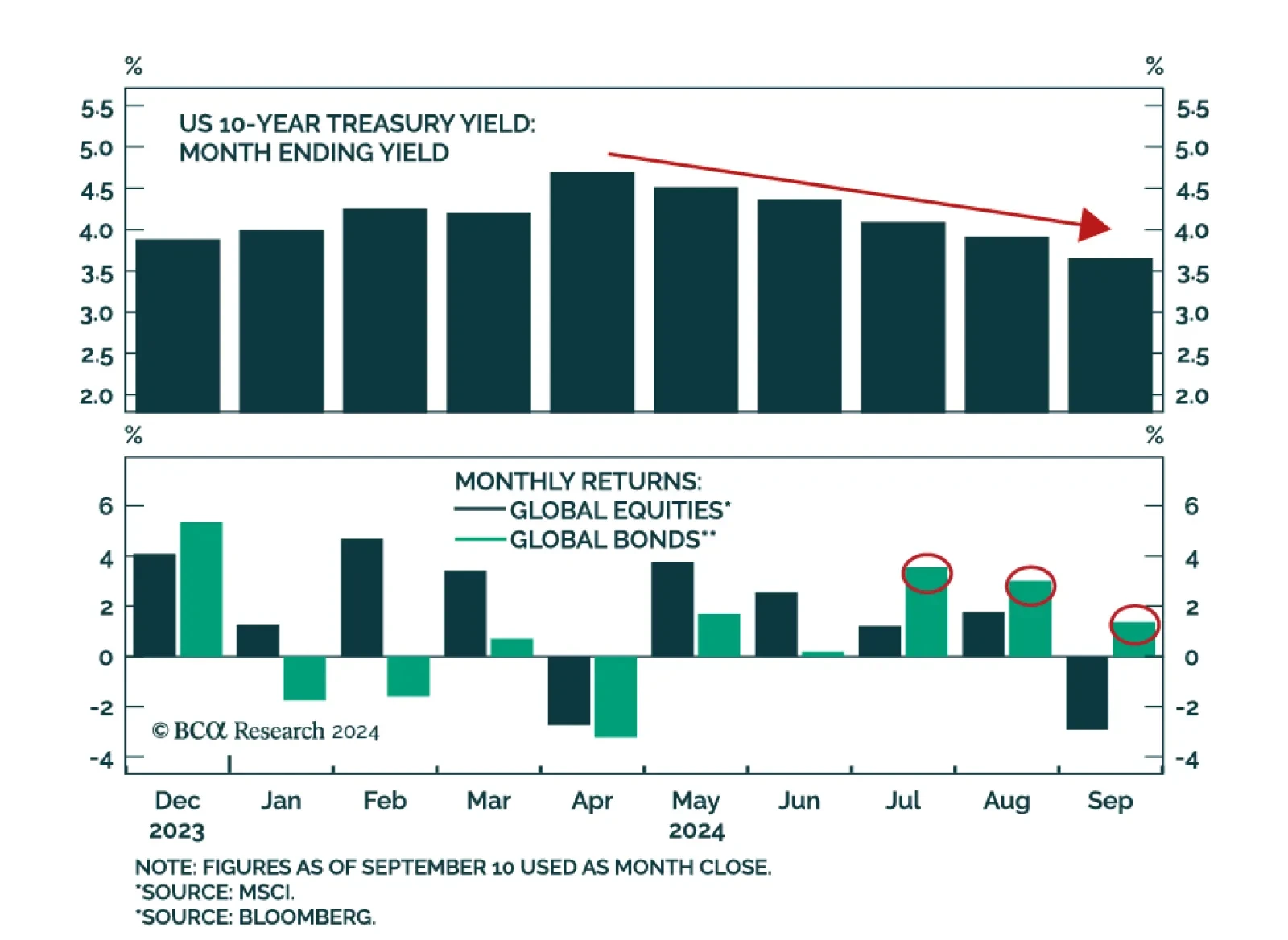

Despite global bond yields having trended lower since April, bonds have only started outperforming equities since July in US dollar terms. We expect this outperformance to persist going forward. Sentiment has largely driven…

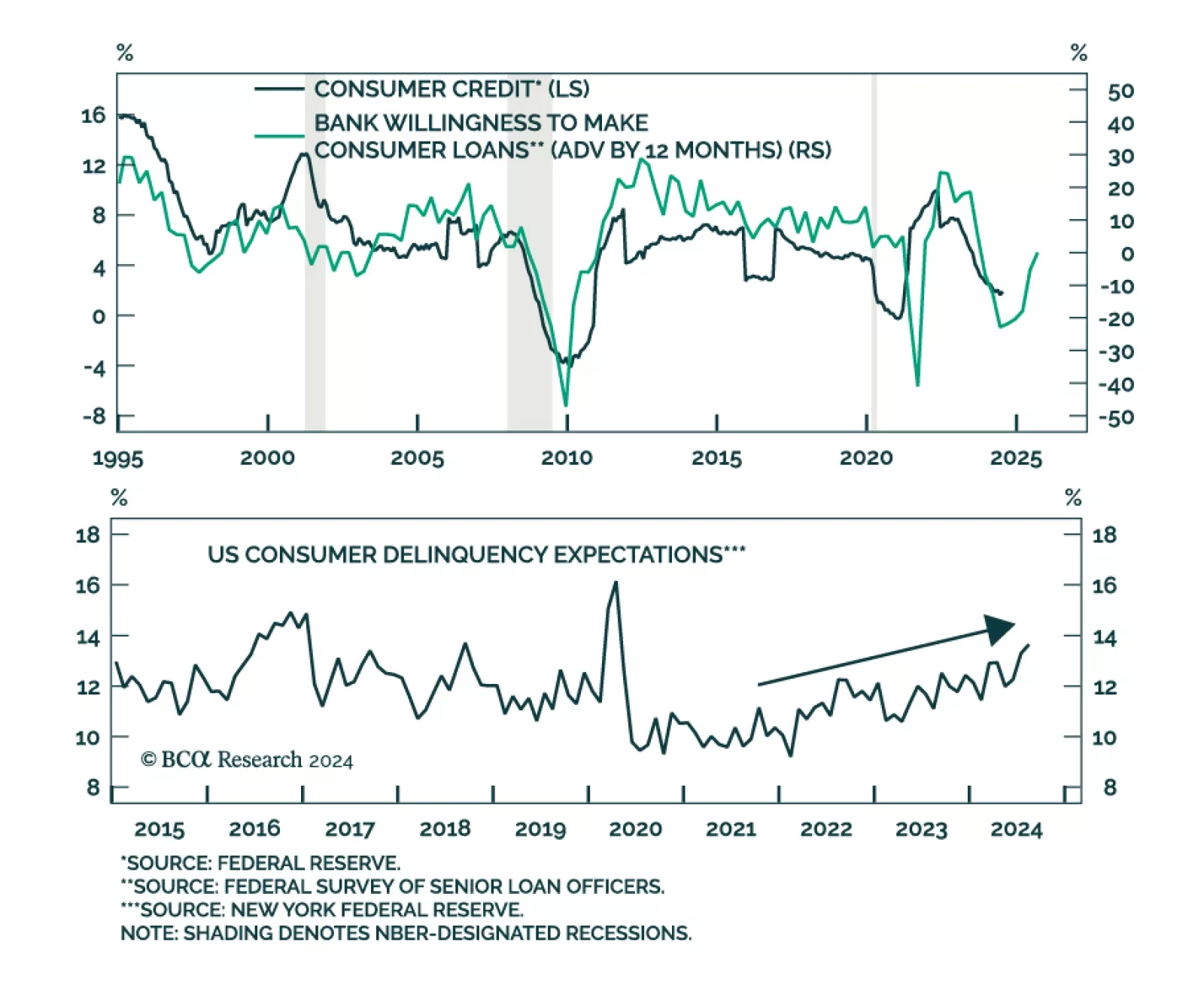

Consumer credit rose by USD 25.5bn in July (to USD 5,093.7 bn outstanding), more than twice the expected growth. However, revisions suggest that June’s consumer credit growth was slower than initially reported (USD 8.9bn to…

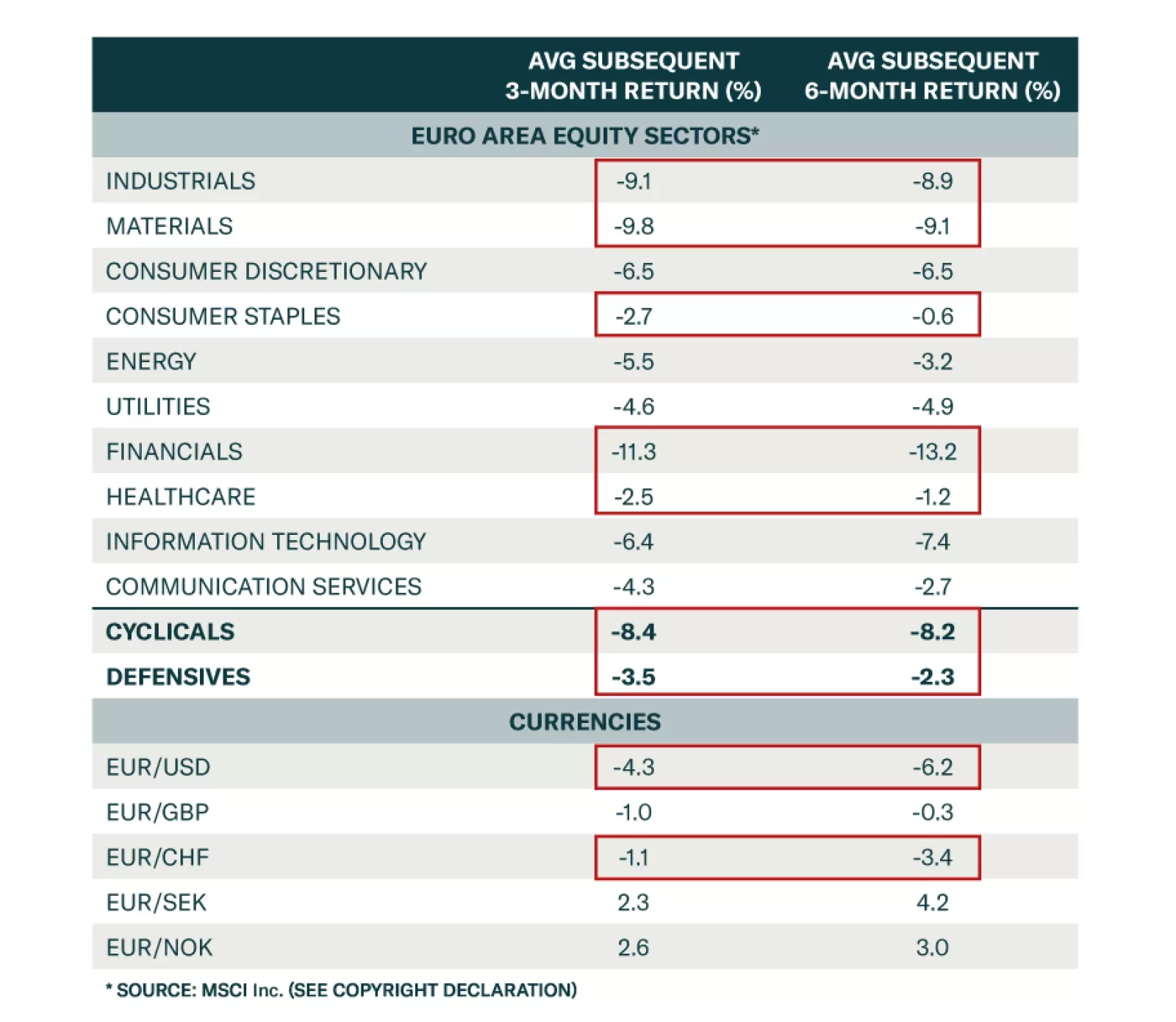

BCA Research’s European Investment strategists looked at previous episodes of carry-trade blowups and assessed the performance of the Eurozone’s key sectors, national markets, and currencies three and six months…

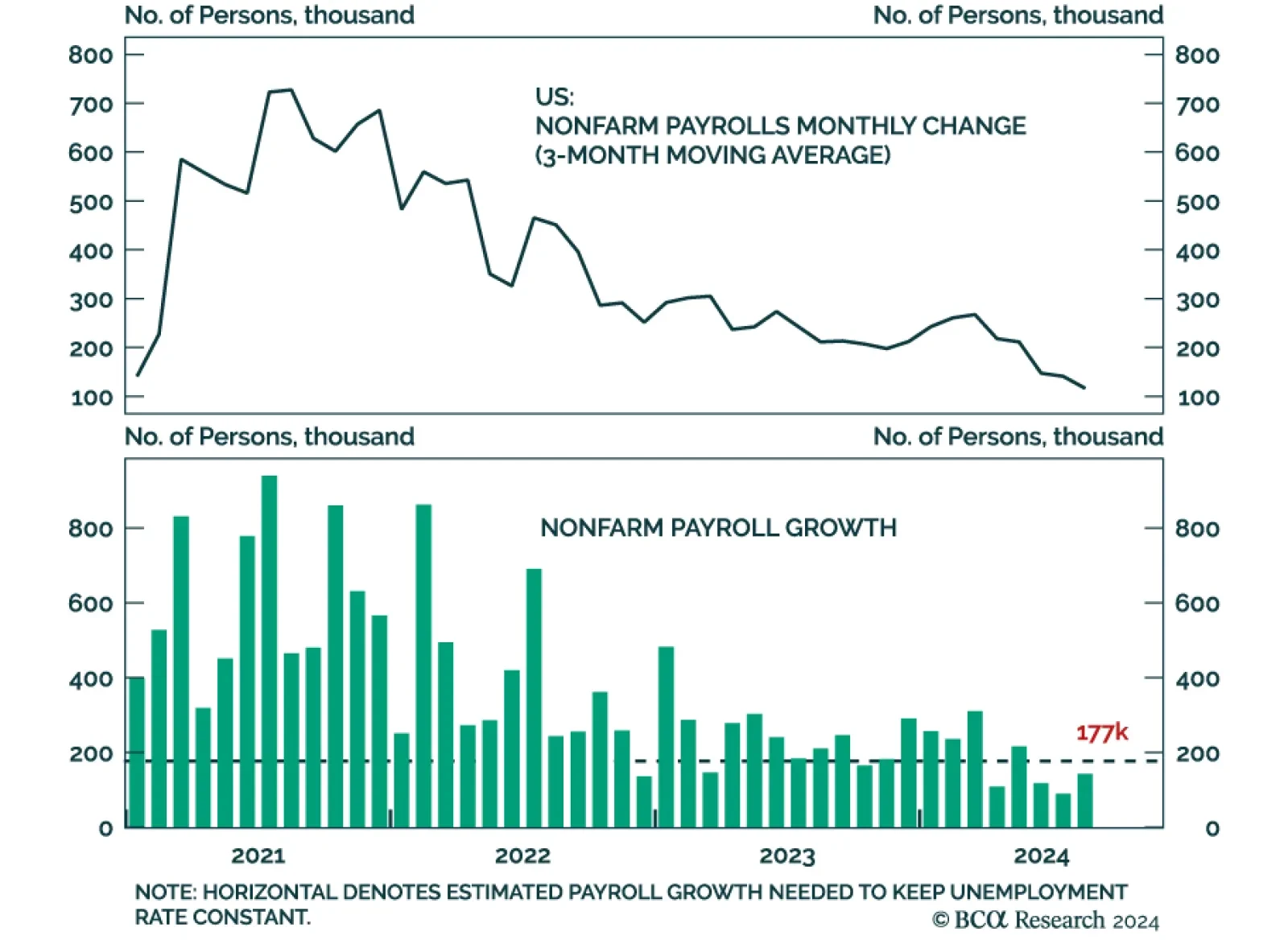

August nonfarm payrolls expanded by 142 thousand workers, from a downwardly revised 89 thousand and below expectations of 165 thousand. Payroll growth fell to a four-year-low of 116 thousand on a 3-month moving average basis.…