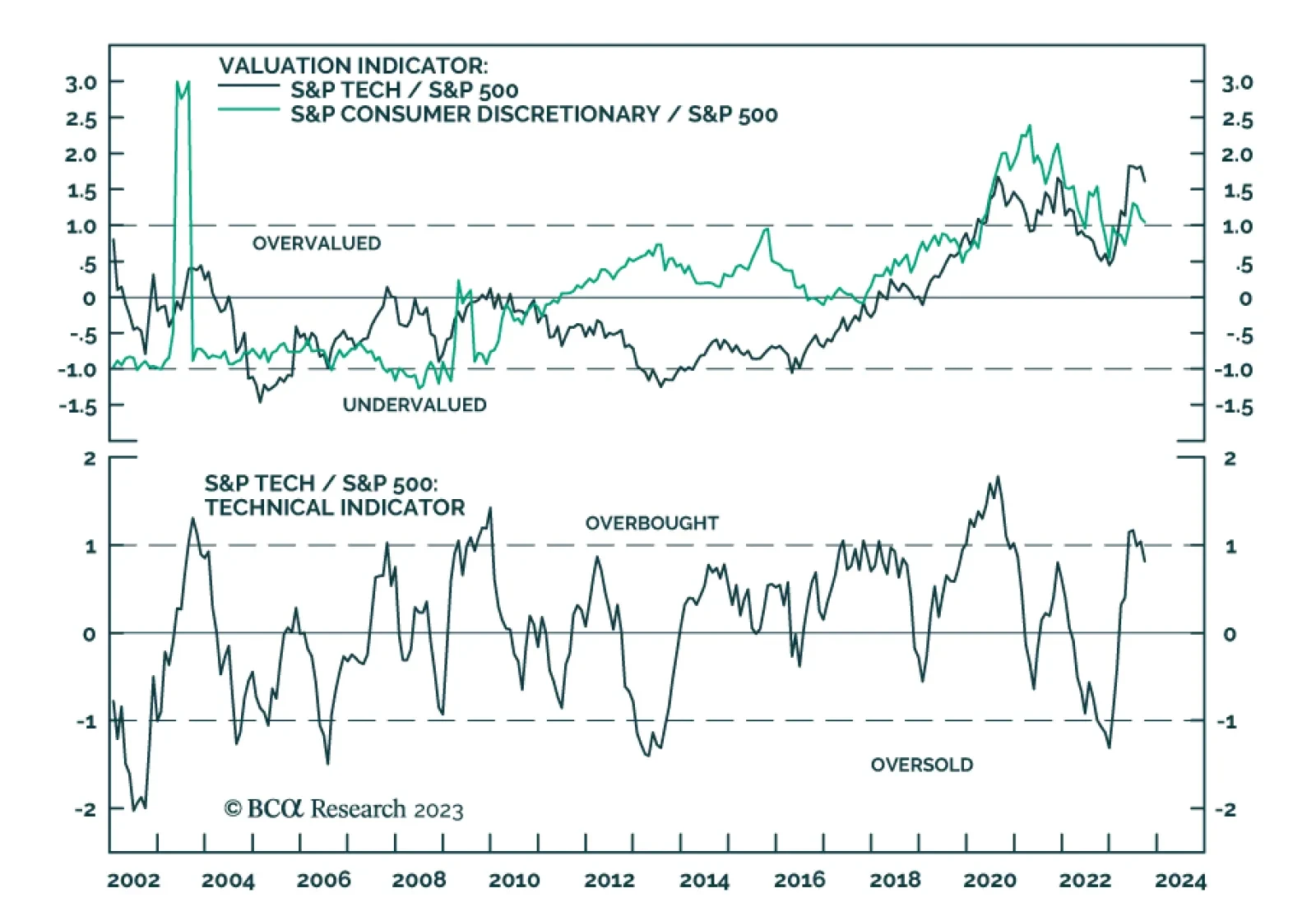

The AI craze was the dominant force driving difference in equity sector returns in 2023. Broadly-defined technology sectors were the top three outperformers last year with IT, Communication Services, and Consumer Discretionary…

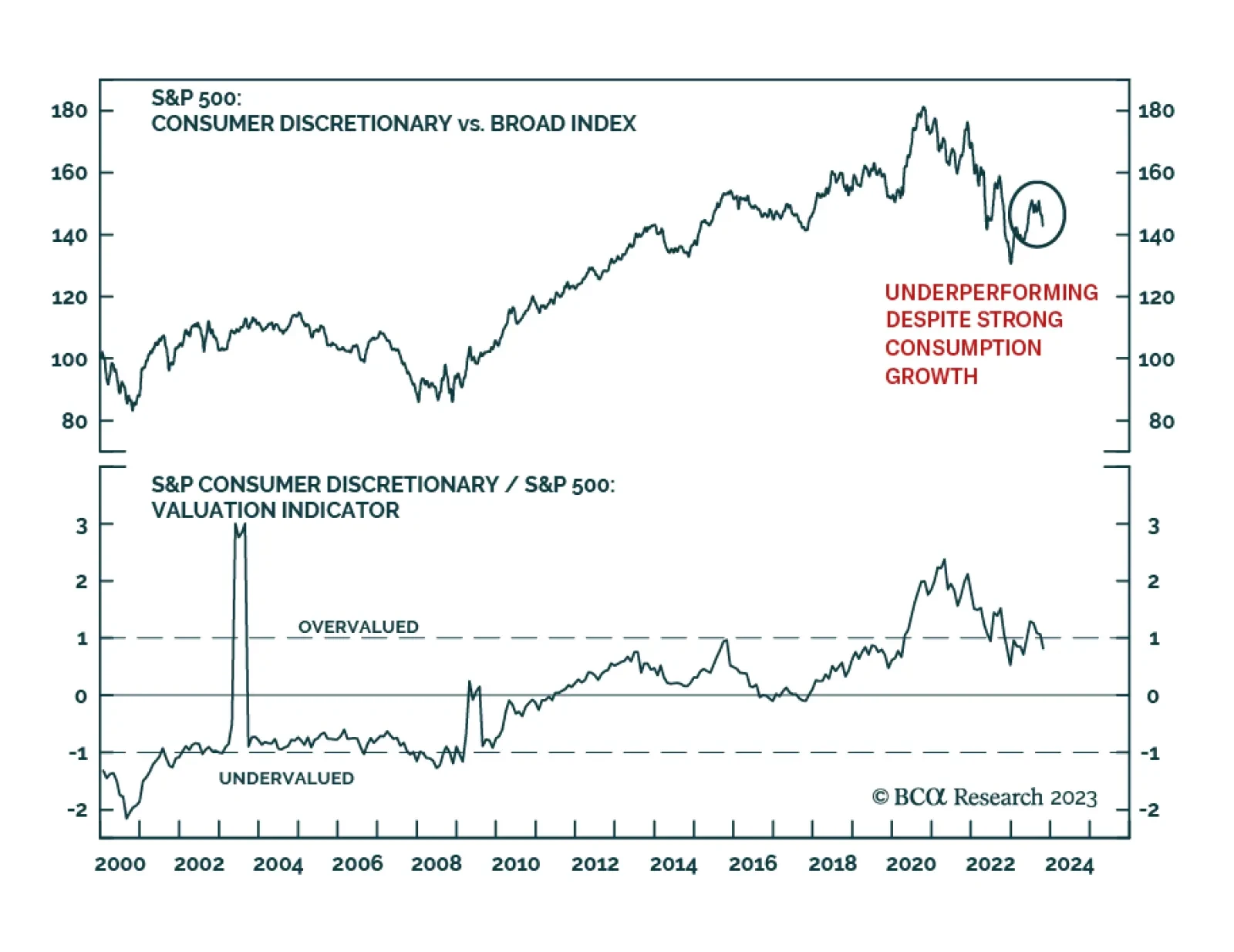

Recent US data reveals that consumer spending has been extremely robust in the US (see The Numbers). Personal consumption expanded by 4.0% q/q annualized in Q3, helping lift aggregate economic growth. Nevertheless, Consumer…

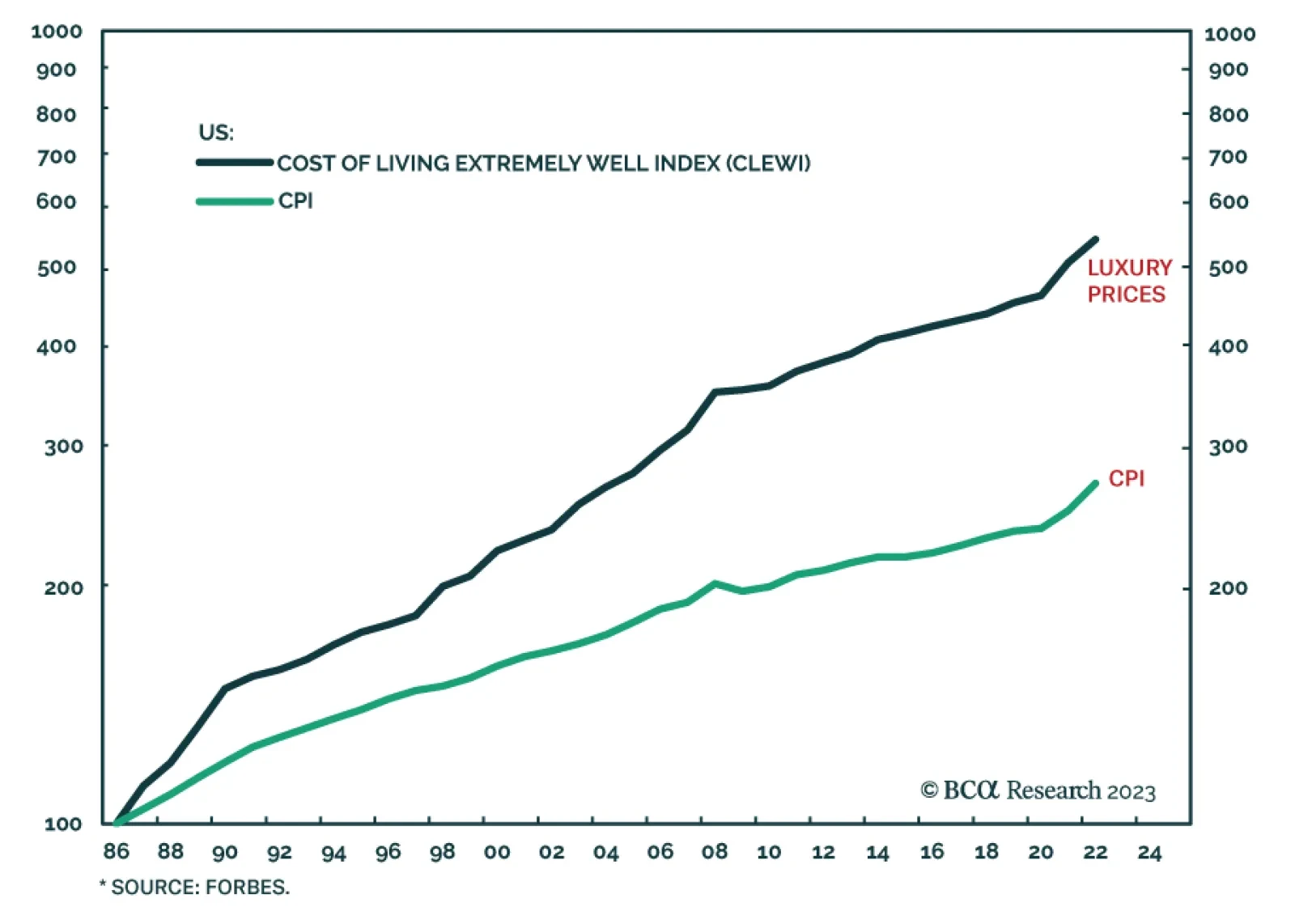

Although luxury goods producers are facing headwinds, the top end is still holding up well. Hermes, which represents the top-end of the luxury sector, reported a 16% increase in sales in the third quarter, of which half came…

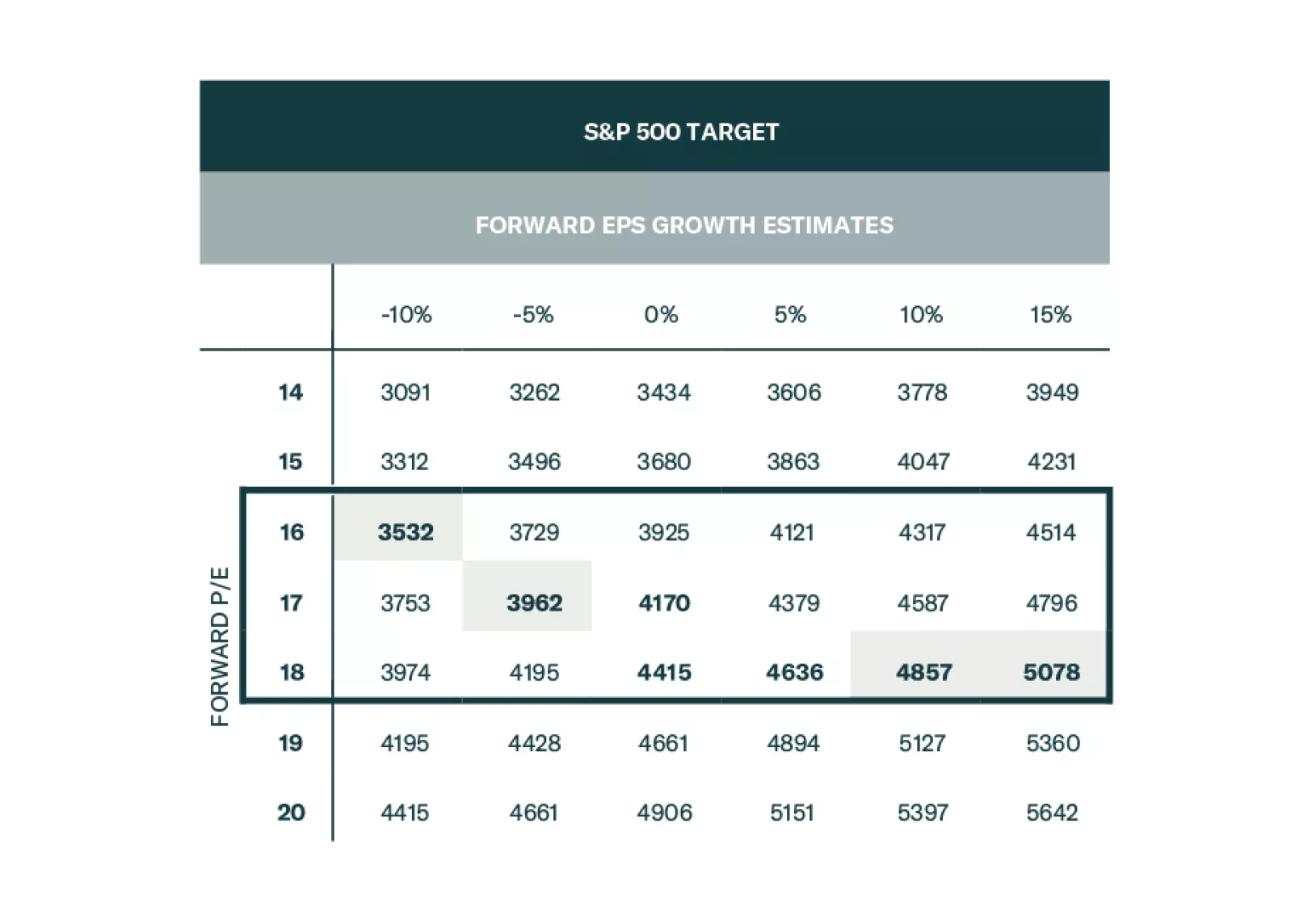

Q3-2023 is expected to mark the end of the earnings recession for the past three quarters, opening the door to positive earnings growth. Whether that would be sustainable or will sputter once the recession settles in as expected in…

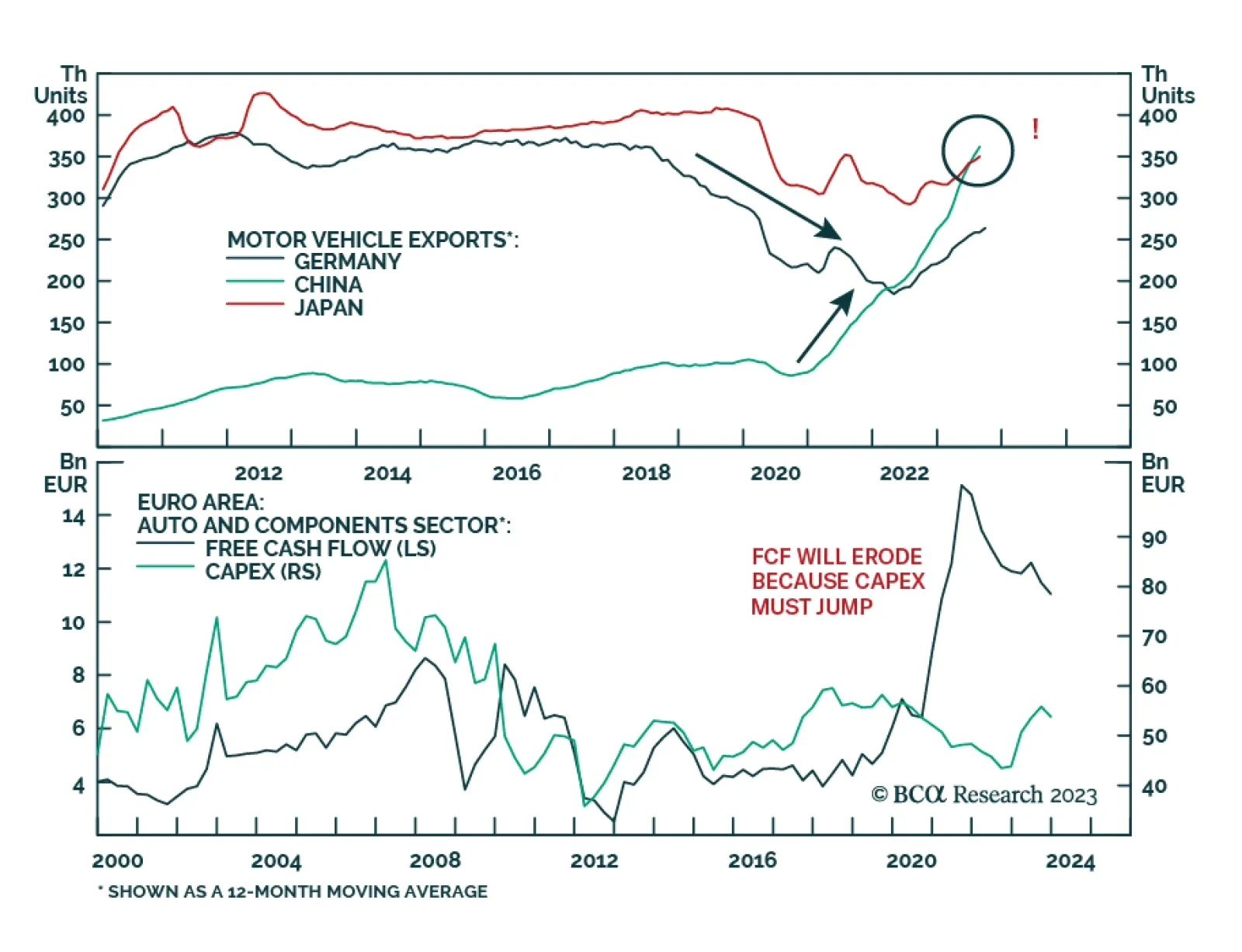

According to BCA Research’s European Investment Strategy service, European automobile and components stocks will suffer over the coming years. The European automobile and components equity sector is cheap, trading at a…

Tech stocks have recently been bearing the brunt of the US equity selloff. The Information Technology and Consumer Discretionary sectors – home to major H1 outperformers including Nvidia, Microsoft, Apple, Amazon, and Tesla…

The German auto and components sector is under stress. Year-to-date, the sector’s equity prices have declined by 3.5% relative to the broader German market, and multiple indicators suggest that further challenges lie ahead…