Highlights Portfolio Strategy China’s ongoing reflation trifecta, rising commodity prices, a back-half of the year global growth recovery, favorable balance sheet metrics and neutral valuations and technicals all signal that the…

The relative resilience of consumer discretionary stocks has been puzzling over the past two years. Typically, rising interest rates prelude a period of underperformance in these highly rate sensitive stocks (fed funds rate shown…

Underweight The relative resilience of consumer discretionary stocks has been puzzling over the past two years. Typically, rising interest rates prelude a period of underperformance in these highly rate sensitive…

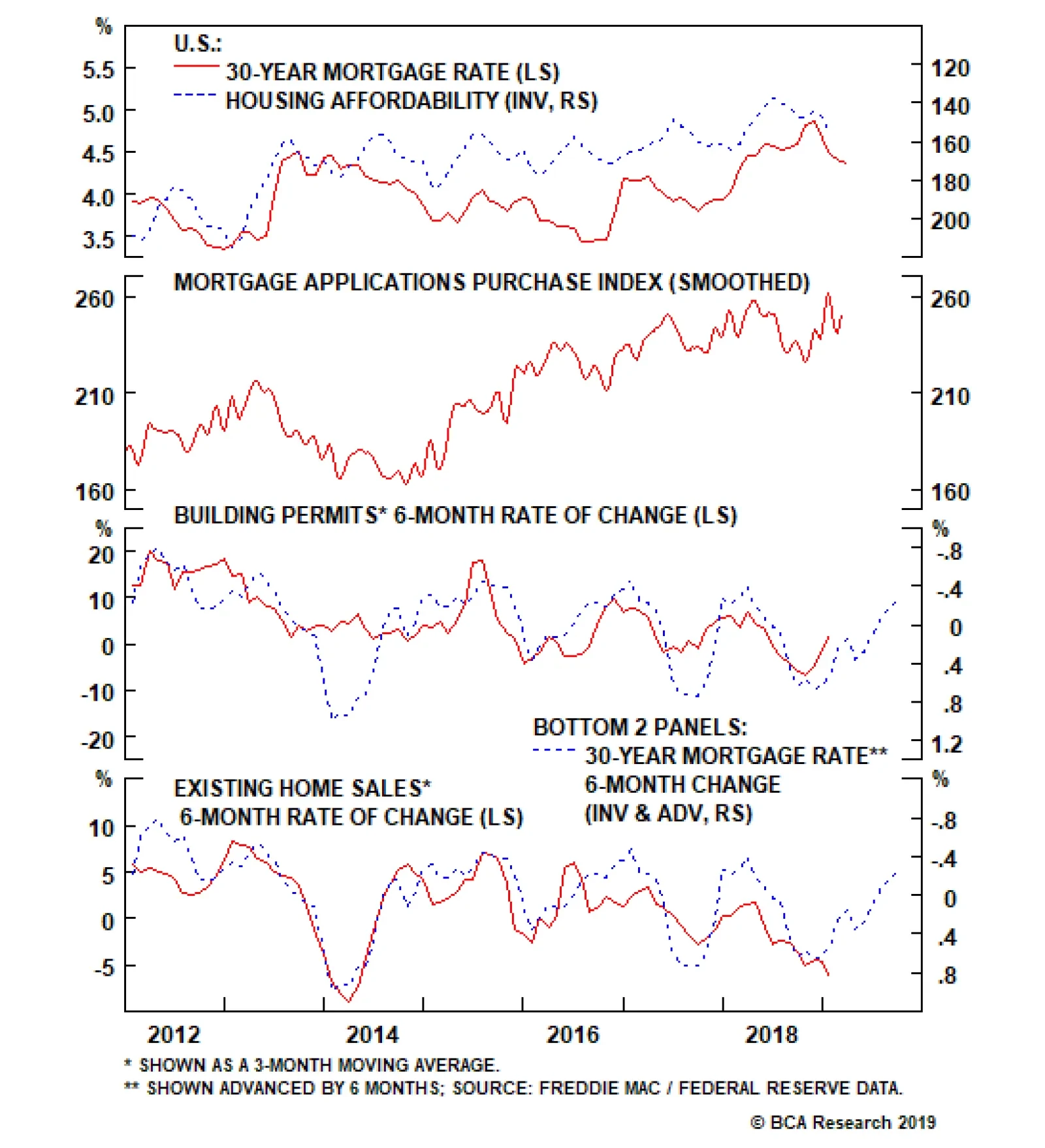

Overweight The S&P homebuilders index has been outperforming nicely so far this year on the back of renewed optimism in the domestic housing market. This is reflected in the V-shaped recovery from the end-…

The share of residential investment as a percentage of GDP has been steadily decreasing over the past 70 years, and is down to just 3% today. Although housing remains an important component of the U.S. economy and large…

Underweight The S&P hotels, resorts and cruise lines index has been trading sideways for the last several months. Weakness in the cruise lines half of the index has been offset by relative outperformance by hotels,…

Dear Client, I am travelling this week so this report is a joint effort juxtaposing two contrasting observations about France. The ‘opulence’ part highlights France as the world’s dominant producer of luxury goods, and…

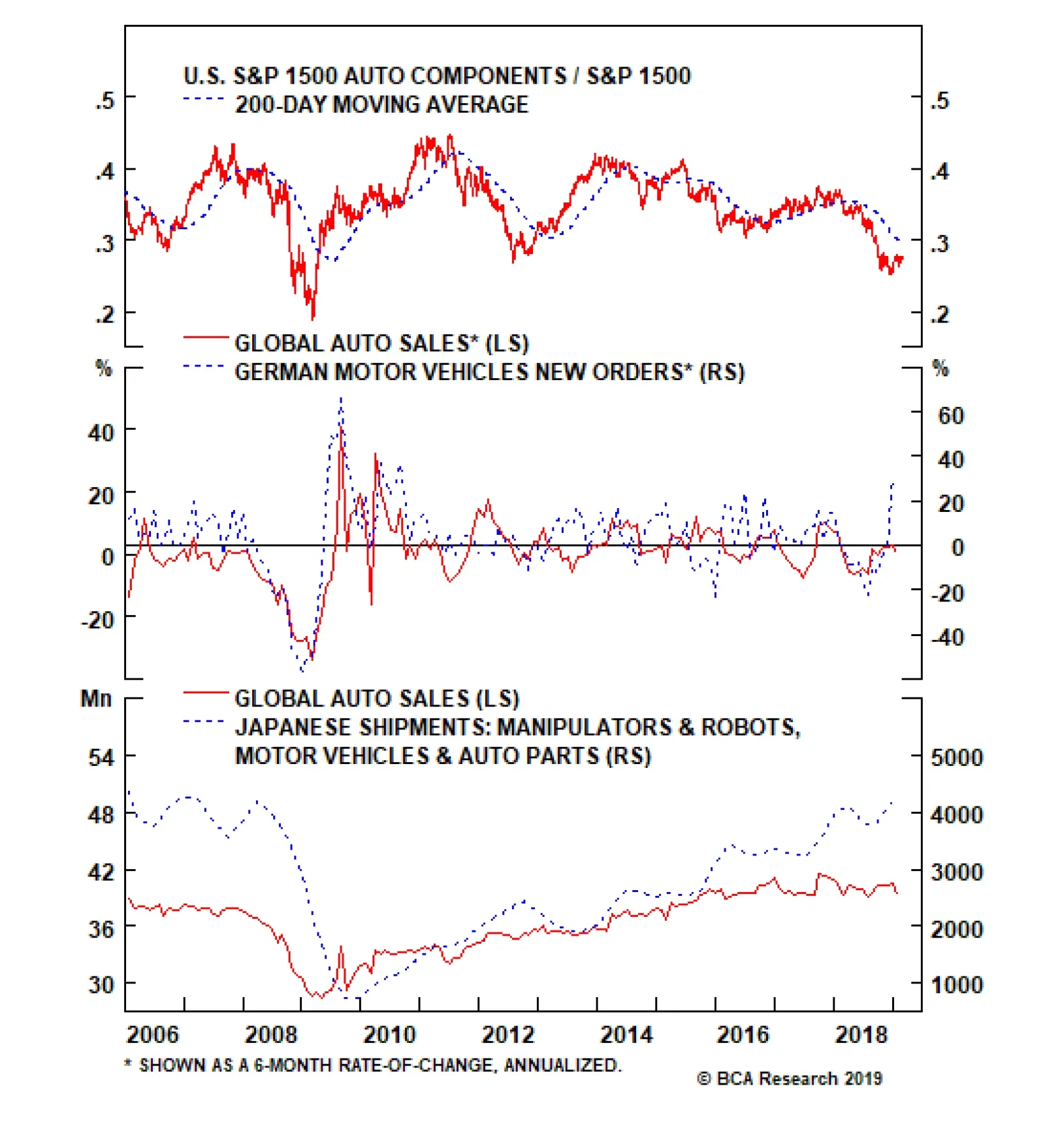

The worst of the drubbing in German automobile production is likely behind us, as new orders have recently gone vertical. Backlogs are also sky-high and suggest that a definitive turn looms in German motor vehicle output. The…

Neutral We have successfully ridden down the S&P 1500 components index on a structural basis over the past four years. But now, factors are falling into place for an end to this multi-year bloodbath. On Monday, we lifted…

Highlights Portfolio Strategy While equities will likely be higher in the coming 9-12 months, we would refrain from committing fresh capital to the market at this juncture. A better entry point lies ahead. Tactically, this market…