Neutral This week we upgraded the S&P home improvement retail (HIR) index to a benchmark allocation and removed it from our high-conviction underweight list for a small relative loss. Similar to the parent Consumer…

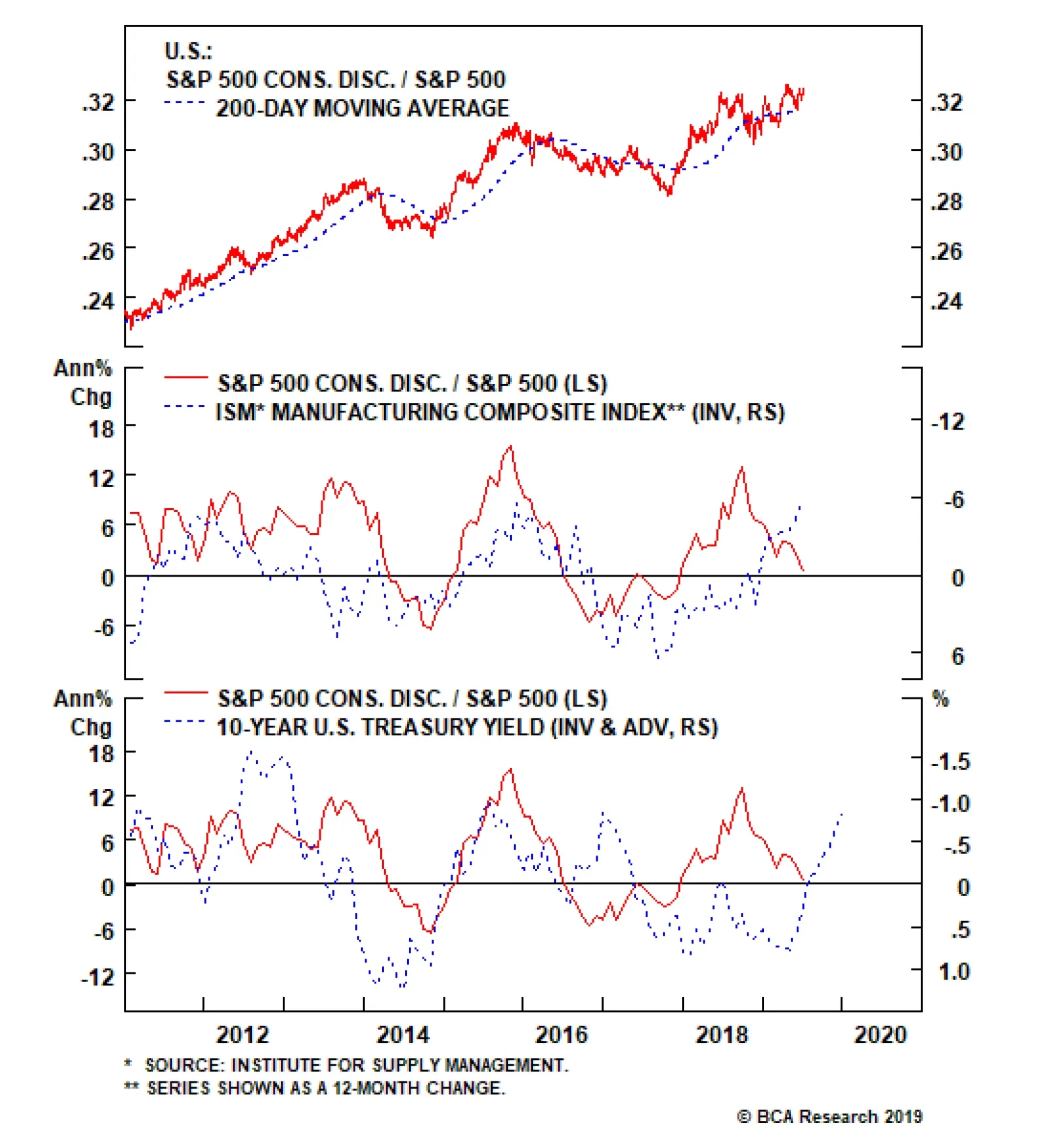

Consumer discretionary stocks have marked time over the past year. But, now that the Fed is ready to ease monetary policy, it will no longer pay to be bearish. This early-cyclical sector is the prime beneficiary from lower…

Highlights Portfolio Strategy Rising lumber prices, melting interest rates and profit-augmenting industry productivity gains all signal that it no longer pays to be bearish the S&P home improvement retail (HIR) index. Poor…

Since early March, when we first turned tactically cautious on the prospects of the broad equity market, we started applying risk metrics to our portfolio in order to protect profits. In recent weeks as our cautiousness morphed from a…

Underweight High-Conviction The latest GDP release as it pertains to housing made for grim reading: residential fixed investment has subtracted from real GDP growth for five consecutive quarters, which is unprecedented outside of a…

Highlights Portfolio Strategy The risk/reward equity market tradeoff is to the downside and we remain tactically cautious. The trade war re-escalation risks pushing out the global growth recovery to early-2020 and has shaken our…

Neutral In a report late last month, we noted that our overweight recommendation on S&P homebuilders had generated alpha in excess of 10% for our portfolio, despite being offside early. However, we further noted a…

In late-January we put on a market, sector and subindustry neutral trade preferring homebuilders to home improvement retailers (HIR) as a way to benefit from the increase in residential construction at the expense of residential…

Highlights Portfolio Strategy Firming relative demand and input cost dynamics, the Medicare For All (MFA)-induced panic selling in HMOs coupled with 5G euphoria buying in semis have set the stage for an exploitable pair trade…