Highlights The use of physical distancing and face masks restricts any activity that requires the use of your mouth and nose in proximity to others. We estimate that this restriction could wipe out 10 percent of jobs. Hence, as…

Last week we put a 5% rolling stop on the long S&P homebuilding/short S&P REITs pair trade in order to protect profits. Yesterday, our stop got triggered and we crystalized 10.3% gains since the May 26 initiation date…

Our intra-real estate pair trade long S&P homebuilders / short S&P REITs vaulted roughly to the 15% return mark intraday yesterday, compelling us to institute a 5% rolling stop in order to protect handsome profits since the late-…

Overweight Consumer discretionary stocks have been on fire of late besting the SPX by 13% since our overweight inception in mid-April. AMZN (44% market cap weight in the sector) is frequently printing two standard deviation…

In mid-April we boosted the S&P internet retail index to overweight as it was poised to benefit from the shifting consumer spending habits due to the COVID-19 outbreak. True, the “amazonification” of the…

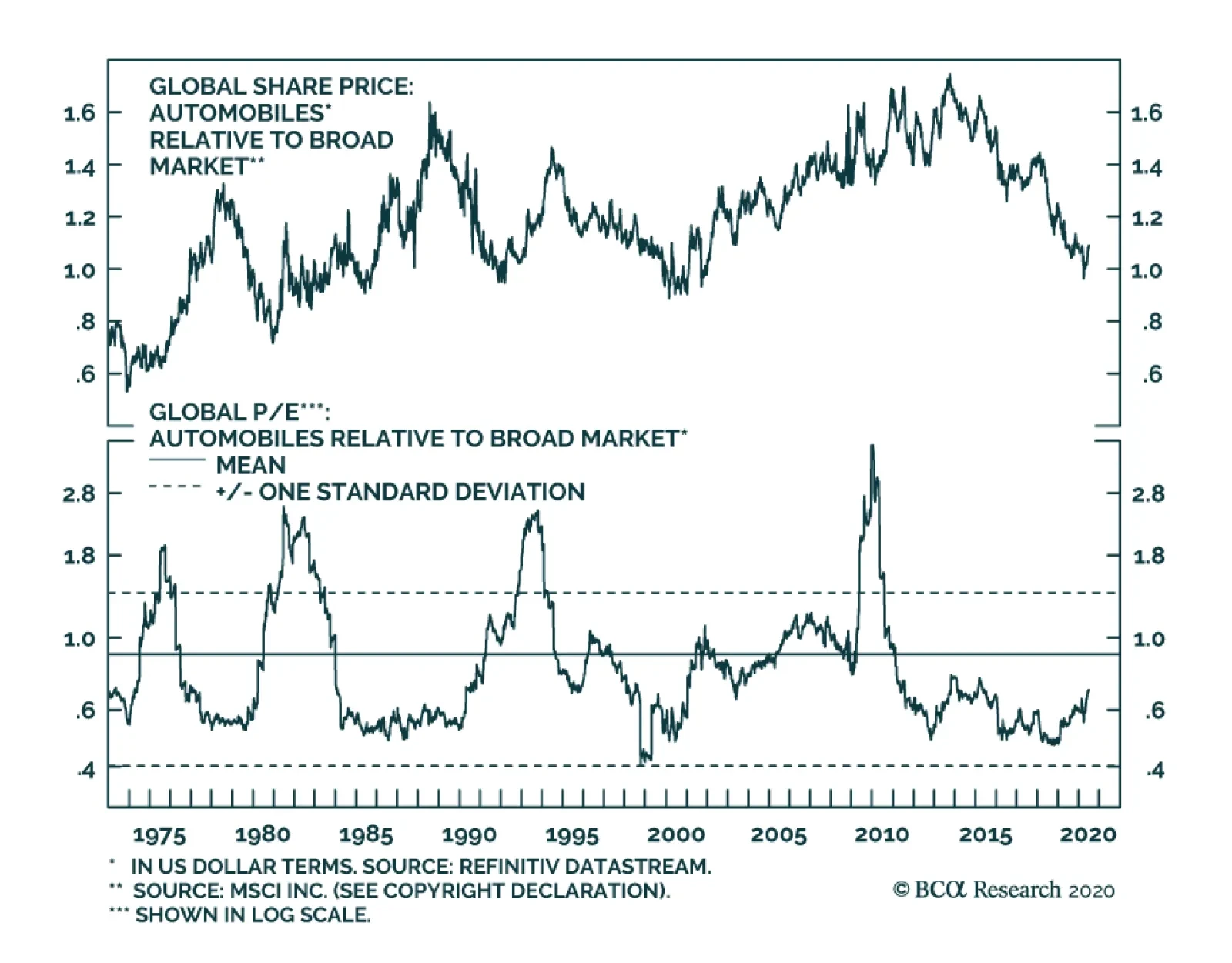

Global automotive stocks are sporting their worst performance in relative terms since March 2000. At the epicenter of the selloff have been two tectonic shifts. First, the COVID-19 crisis has led to widespread shutdowns and…

Overweight (Downgrade Alert) In mid-April we boosted the S&P consumer discretionary index to overweight via assigning an above benchmark allocation to both internet and home improvement retailers (HIR). Our thesis to…

Dear client, It was my pleasure to join Dhaval Joshi, BCA’s Chief European Investment Strategist, this past Friday June 12, 2020 on a webcast he hosted titled: “Sectors To Own, And Sectors To Avoid In The Post-Covid World…