Foreword Today we are publishing a charts-only report focused on the S&P 500, and GICS 1 sectors. Many of the charts are self-explanatory; to some, we have added a short commentary. The charts cover macro, valuations,…

Chart 1Cyclicals Styels and Sectors Outperform In The Rising Rates Environment In a recent daily report, we analyzed performance of the S&P 500 sectors before and after the 2013 tapering announcement. Today we expand our…

August PPI reading came in at 8.3%. Naturally, many investors are wondering whether the companies will be able to pass their soaring input costs to the customers. An in-depth analysis of margins and pricing power requires a significant…

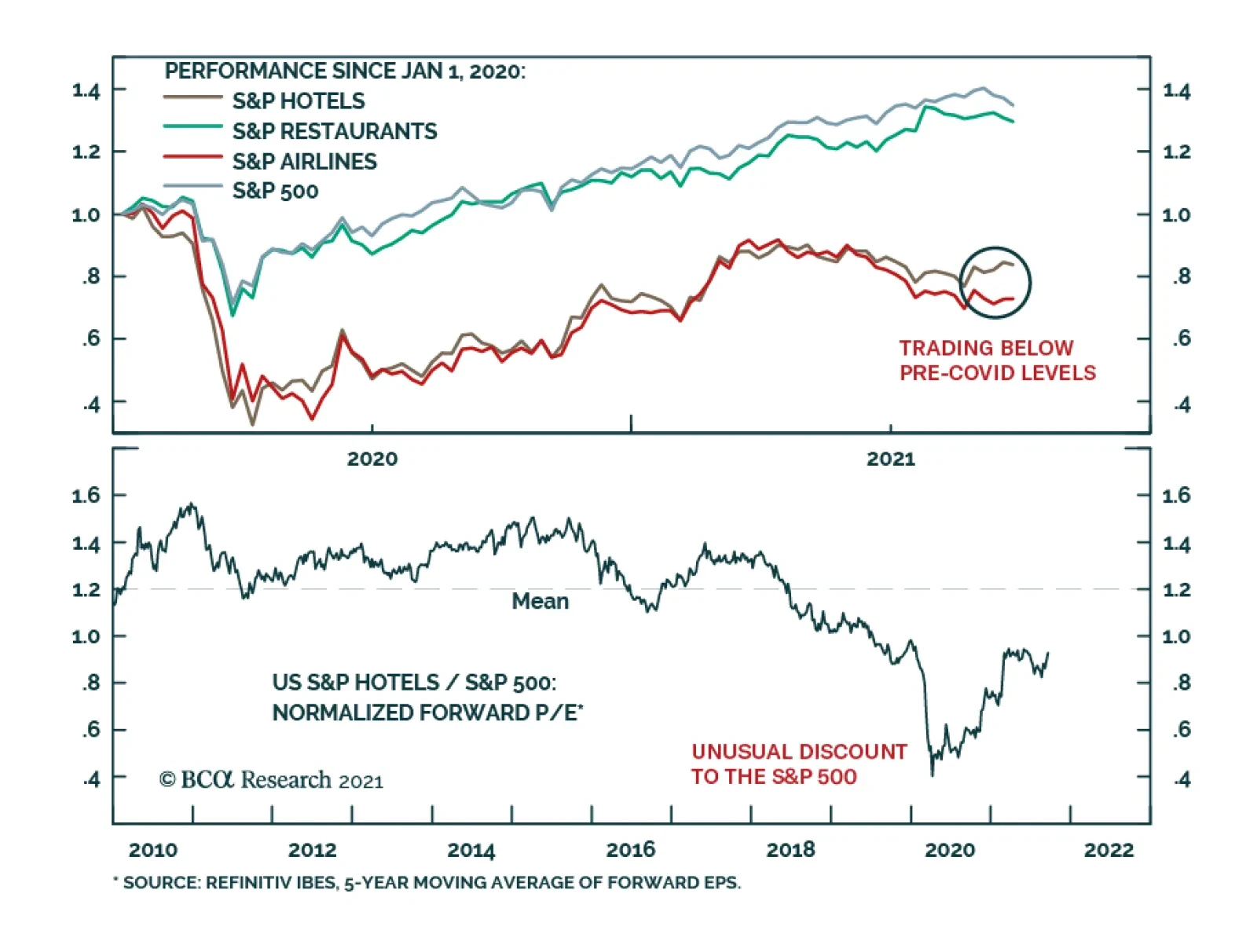

Highlights This is the second part of the publication, in which we provide an in-depth overview of Hotels, Restaurants, and Airlines, or the “travel complex” as we dubbed it. In last week’s report, we provided an…

BCA Research’s US Equity Strategy service recommends overweighting the Hotels, Resorts, and Cruise Lines industry. The team summarizes this view as follows: The Delta variant is cresting. Their base case is that herd…

Today we take a close look at the historical GICS1 level performance following the taper event in 2013. Chart 1 provides an overview of a price action of the 10-year US Treasury yield, the US dollar, and gold to provide context,…

Highlights Covid-19 has wreaked havoc in the markets, but the Hotels, Restaurants & Leisure, and Airline industries have been most affected. These industries constitute what we call the “travel complex” as they share…

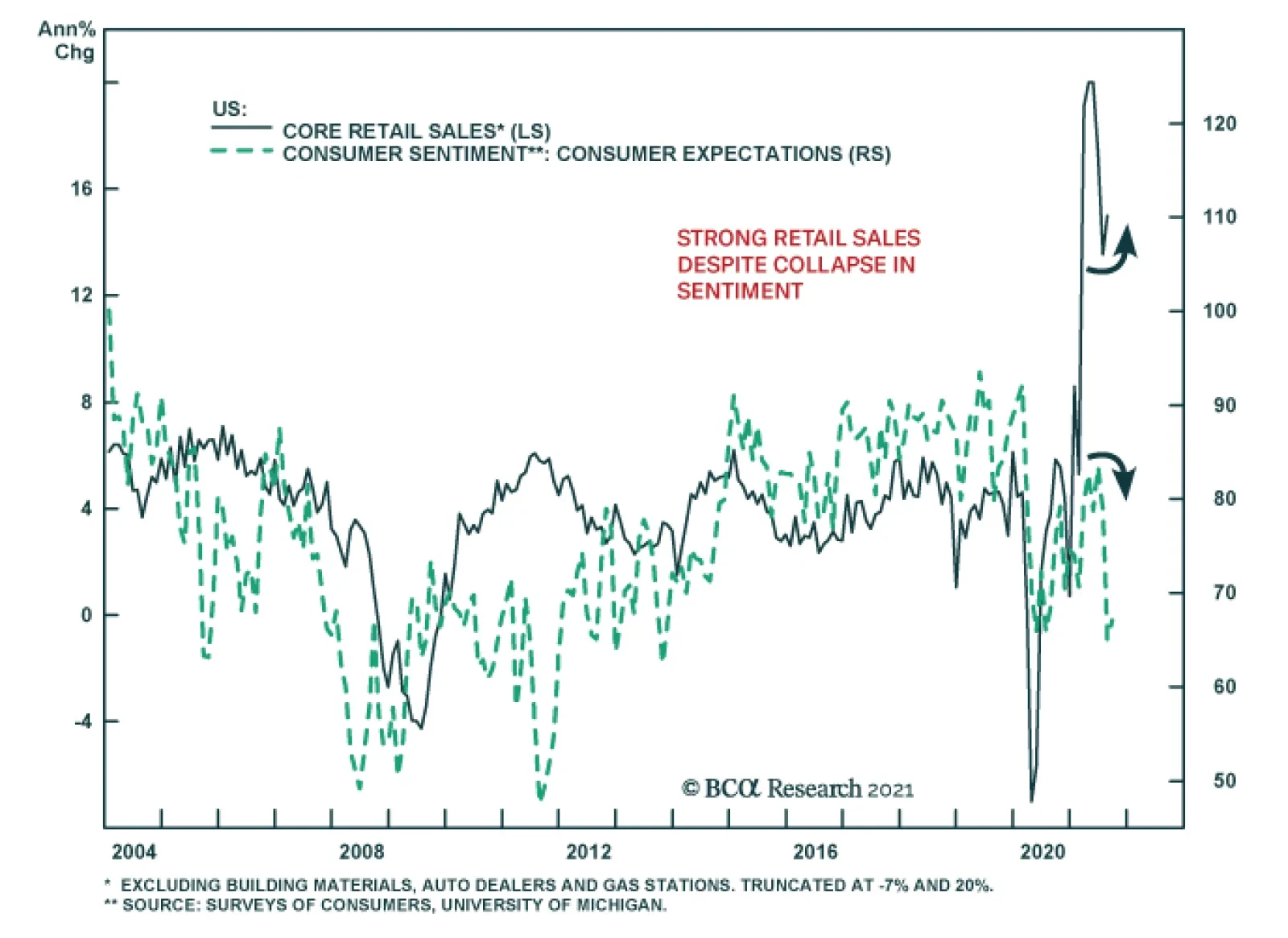

Friday’s preliminary University of Michigan Consumer Sentiment survey revealed that American households experienced a minor improvement in confidence in August. The headline index ticked up 0.7 points to 72. The minor increase…

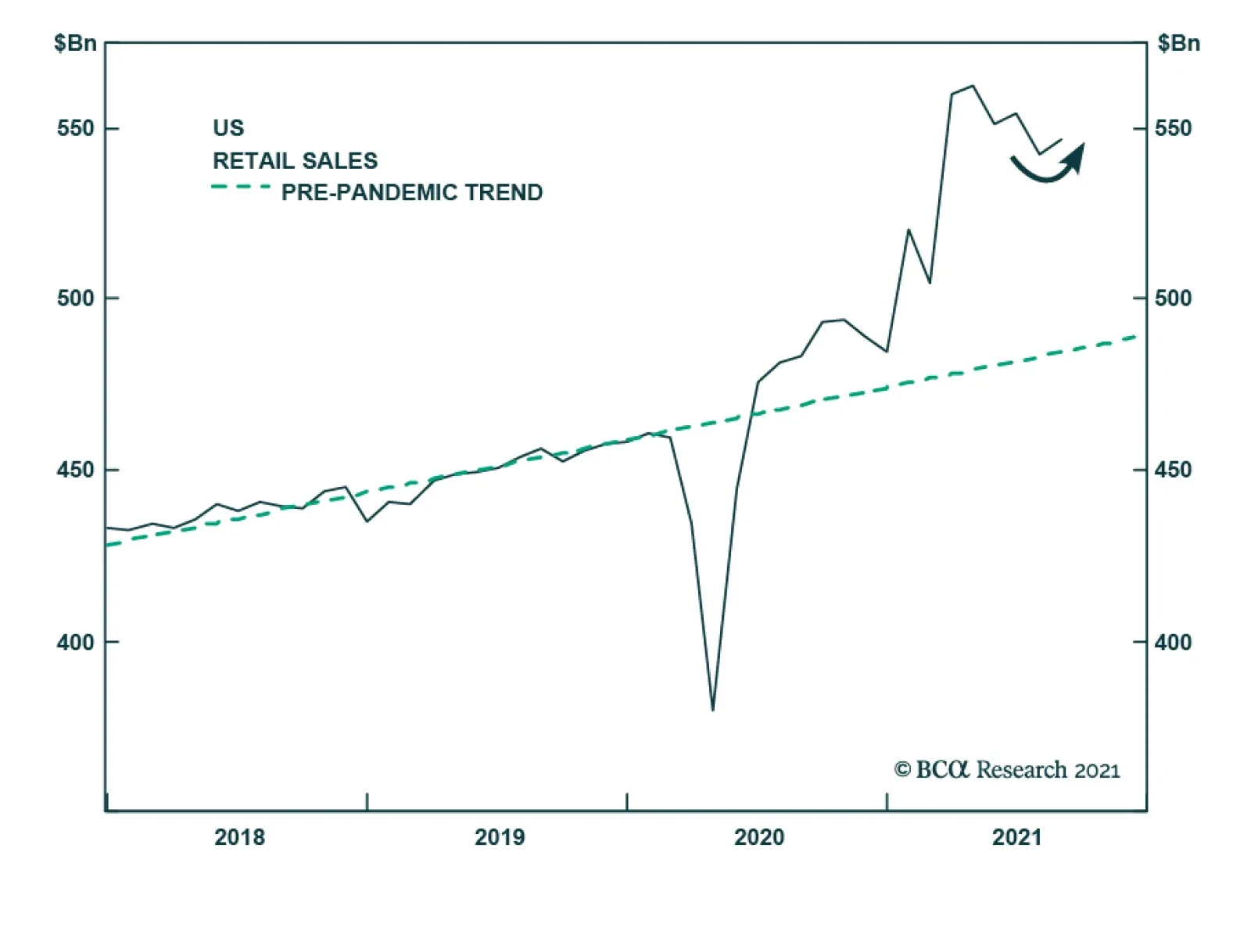

US retail sales for August delivered a positive surprise. The headline number grew 0.7% m/m following the prior month’s downwardly revised decline of 1.8%. Similarly, the retail sales control group expanded 2.5% m/m from a…

Highlights Our willingness to spend money depends on which ‘mental account’ it occupies. Once windfall income enters our ‘savings mental account’, we will not spend it. Hence, the pandemic’s windfall…