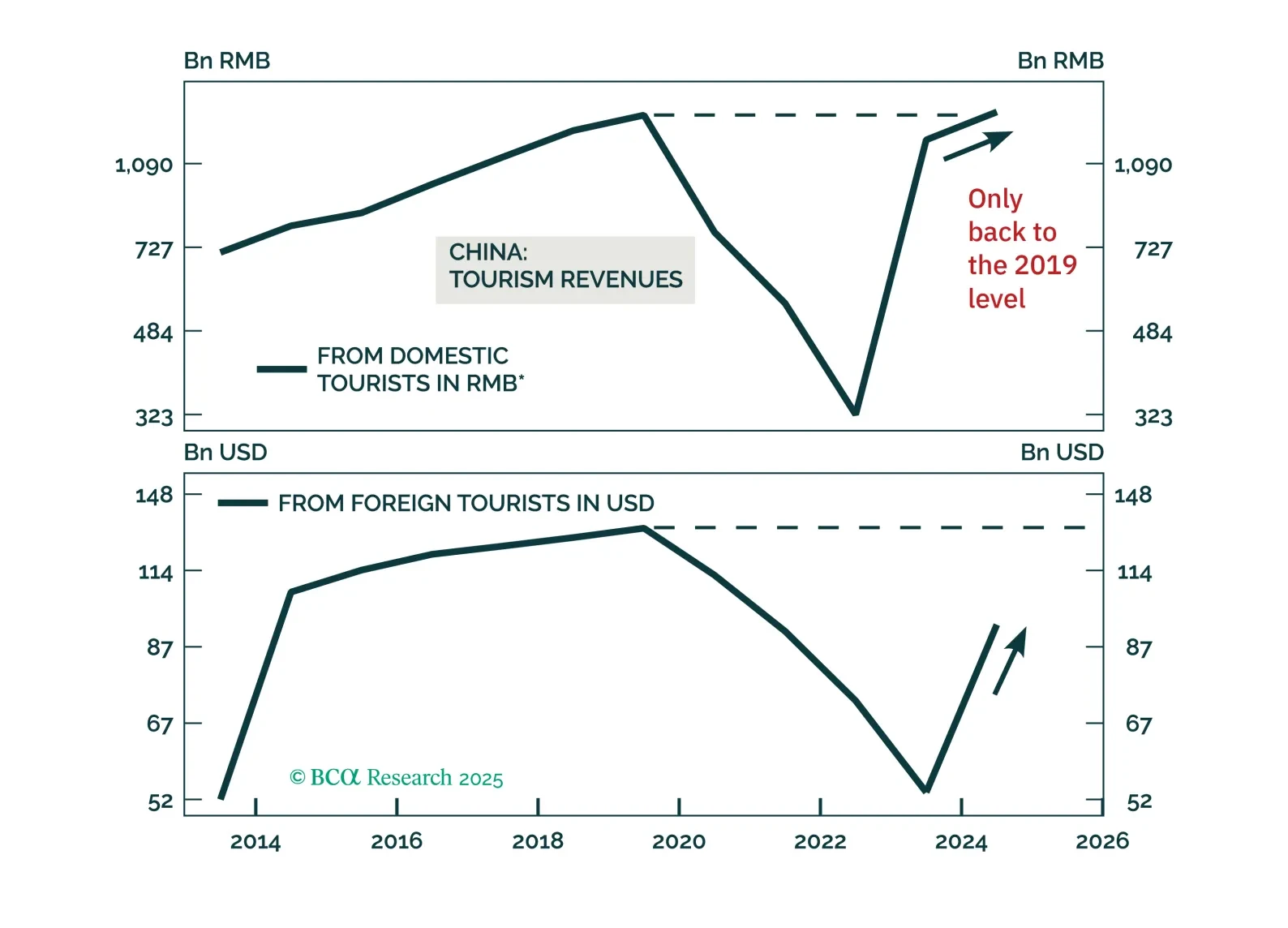

Chinese tourism will continue growing, but investors should be mindful not to overpay for Chinese tourism stocks by extrapolating their past double-digit revenue growth into the future.

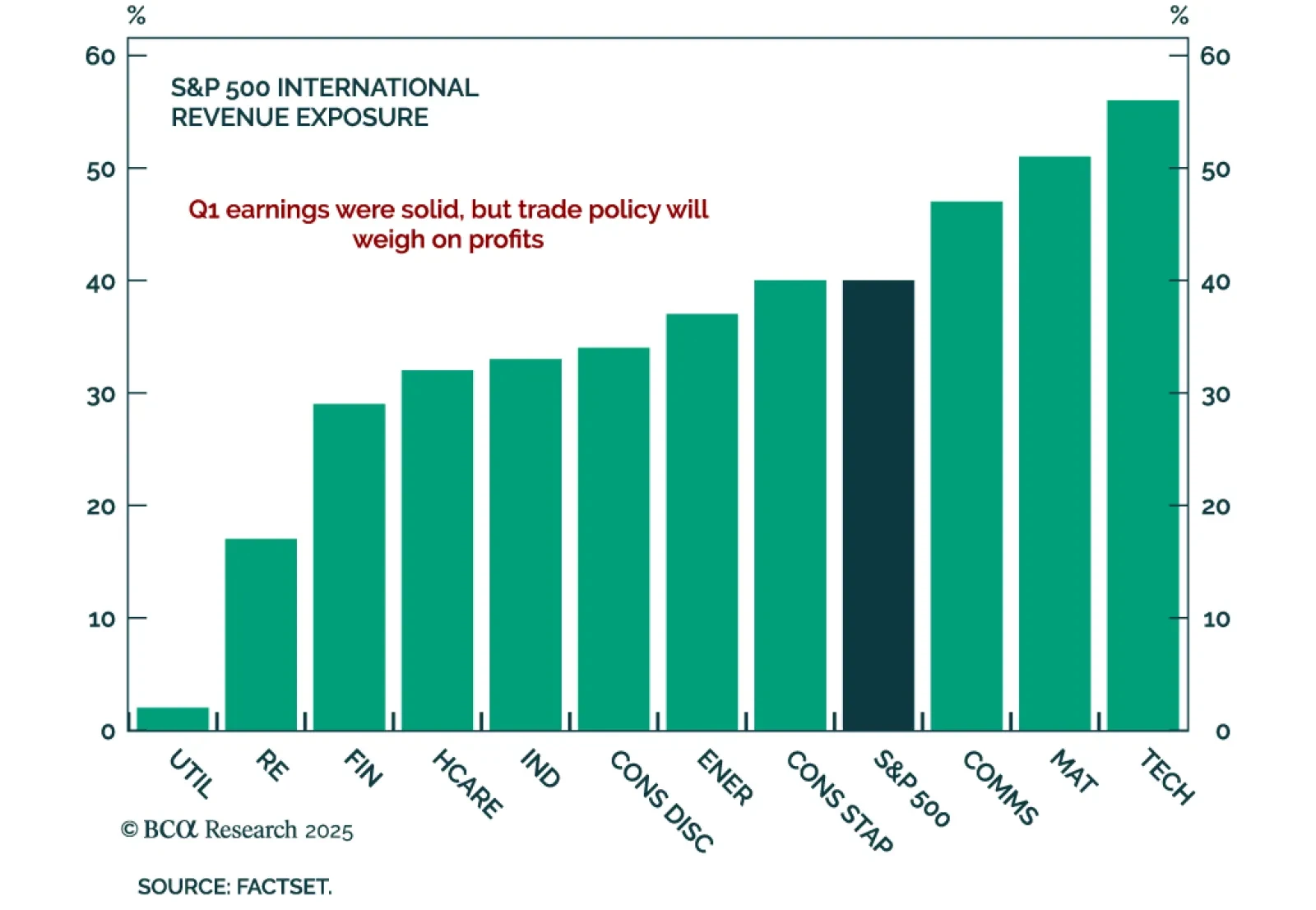

Q1 earnings point to risks for goods-focused sectors, reinforcing our US Equity strategists’ call to overweight services, upstream names, and domestic plays. With most S&P 500 companies having reported Q1 2025 earnings, the…

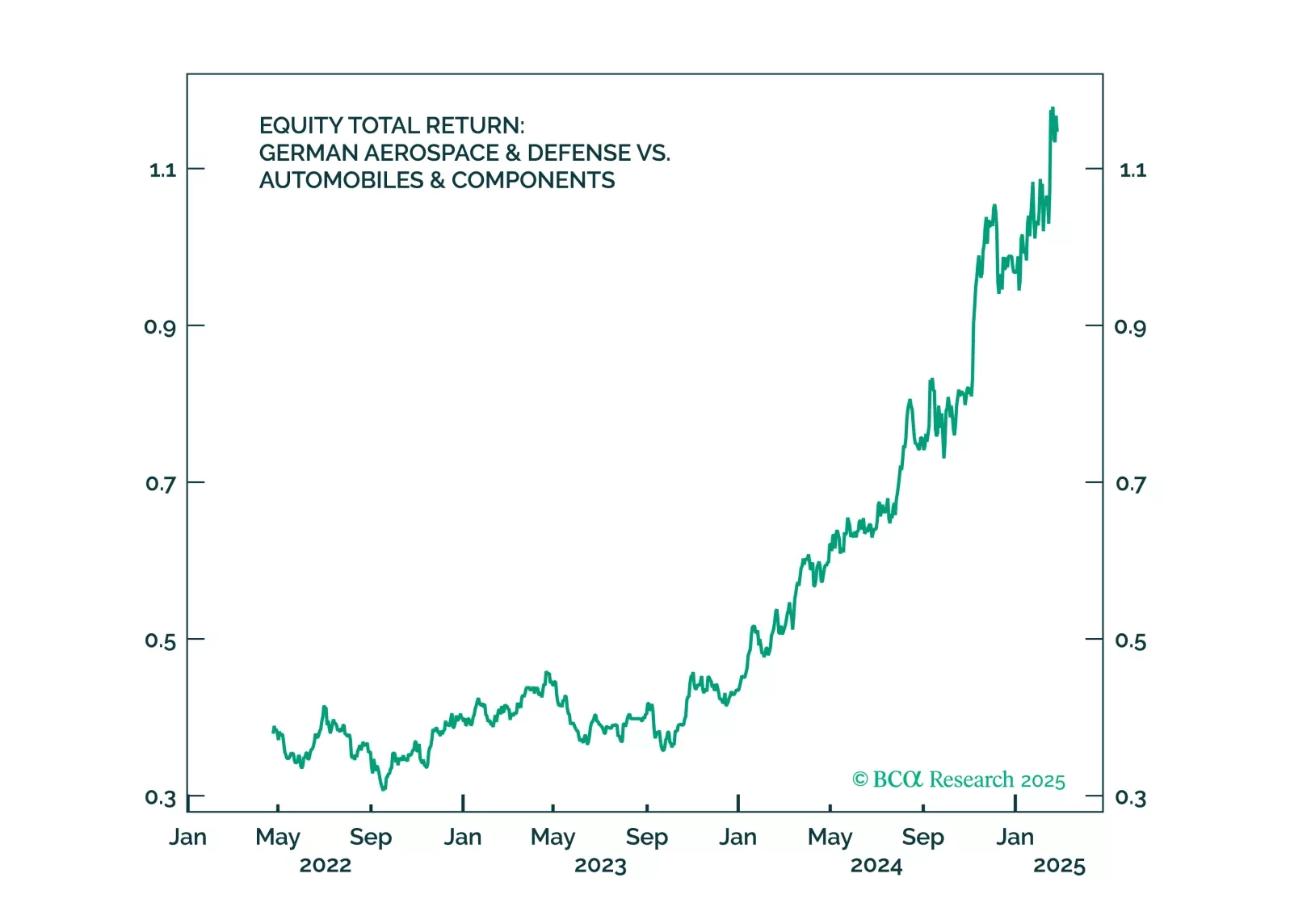

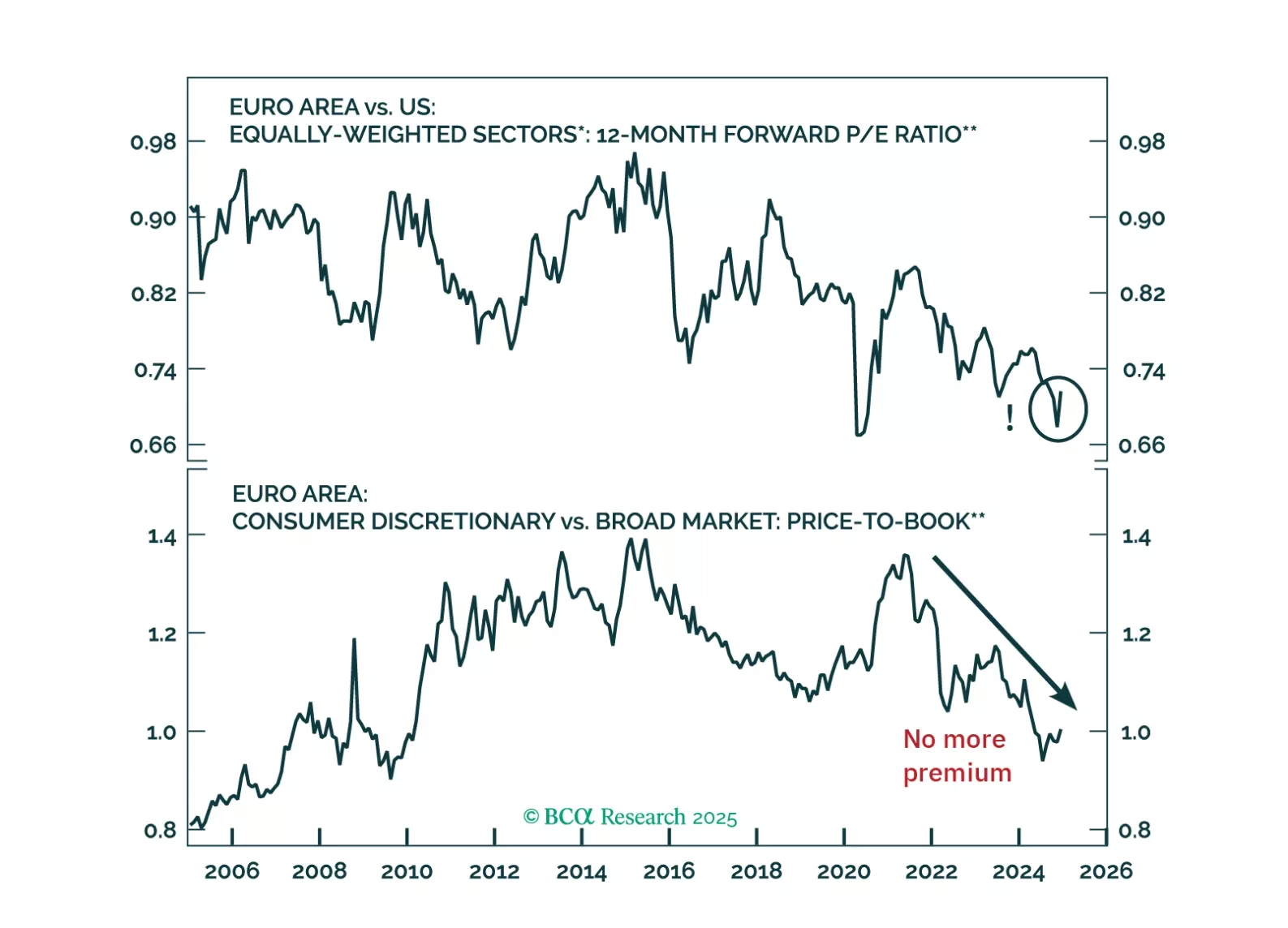

Trump’s ceasefire talks are positive for Germany – and so was the German election result. But Trump’s tariffs will hit Germany soon. Investors should use near-term volatility to increase exposure to Germany.

Global risk assets are engulfed in a wave of euphoria, which is pulling Europe higher along the way. However, risks still abound. How should investors adjust their allocation to Europe under these highly uncertain conditions?

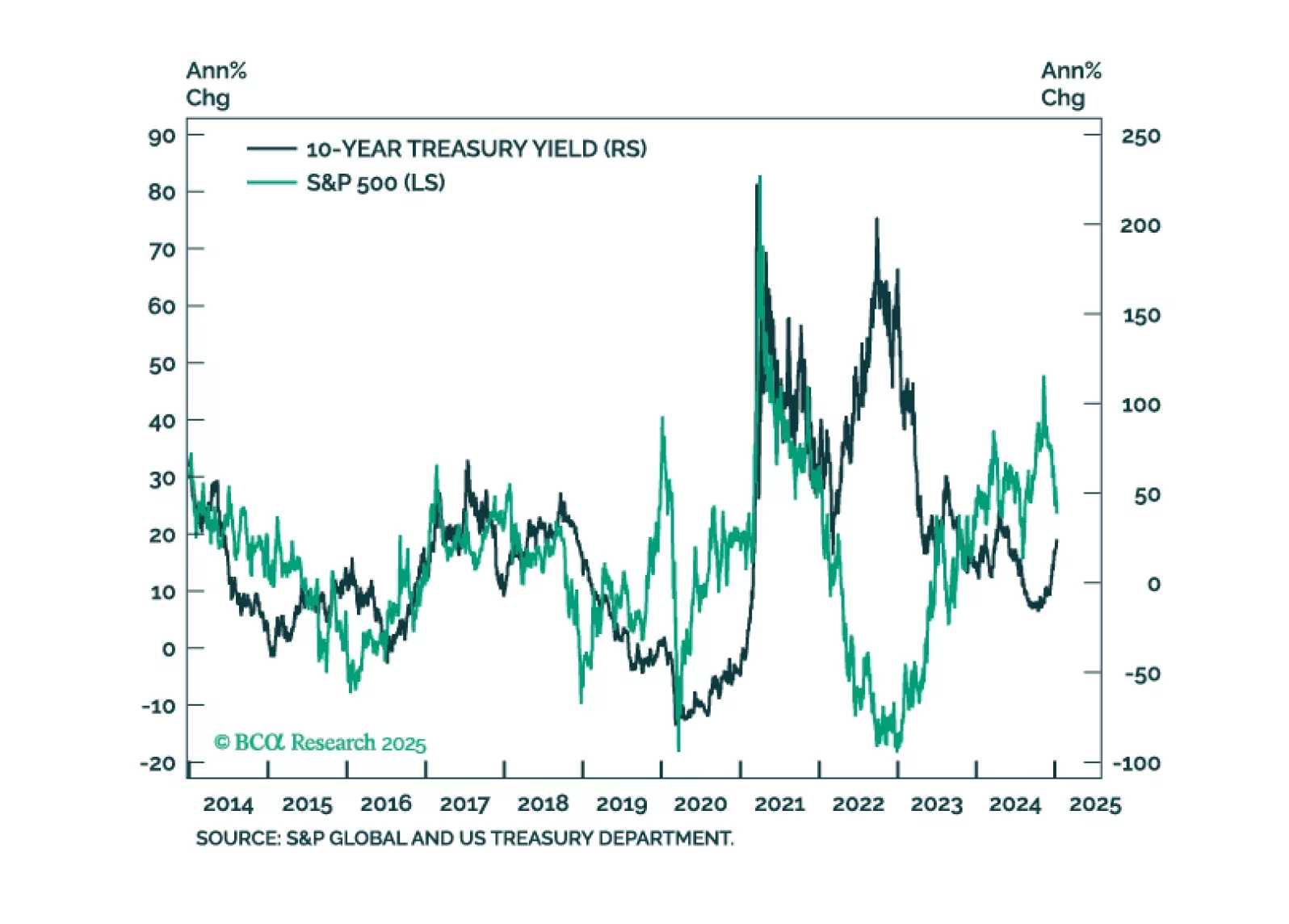

In this first presentation of 2025, we start with an overview of the 2025 outlook webcast polls, and a brief post-mortem of the 2024 market performance. Then, we shift gears and examine what is behind the recent surge in bond yields…

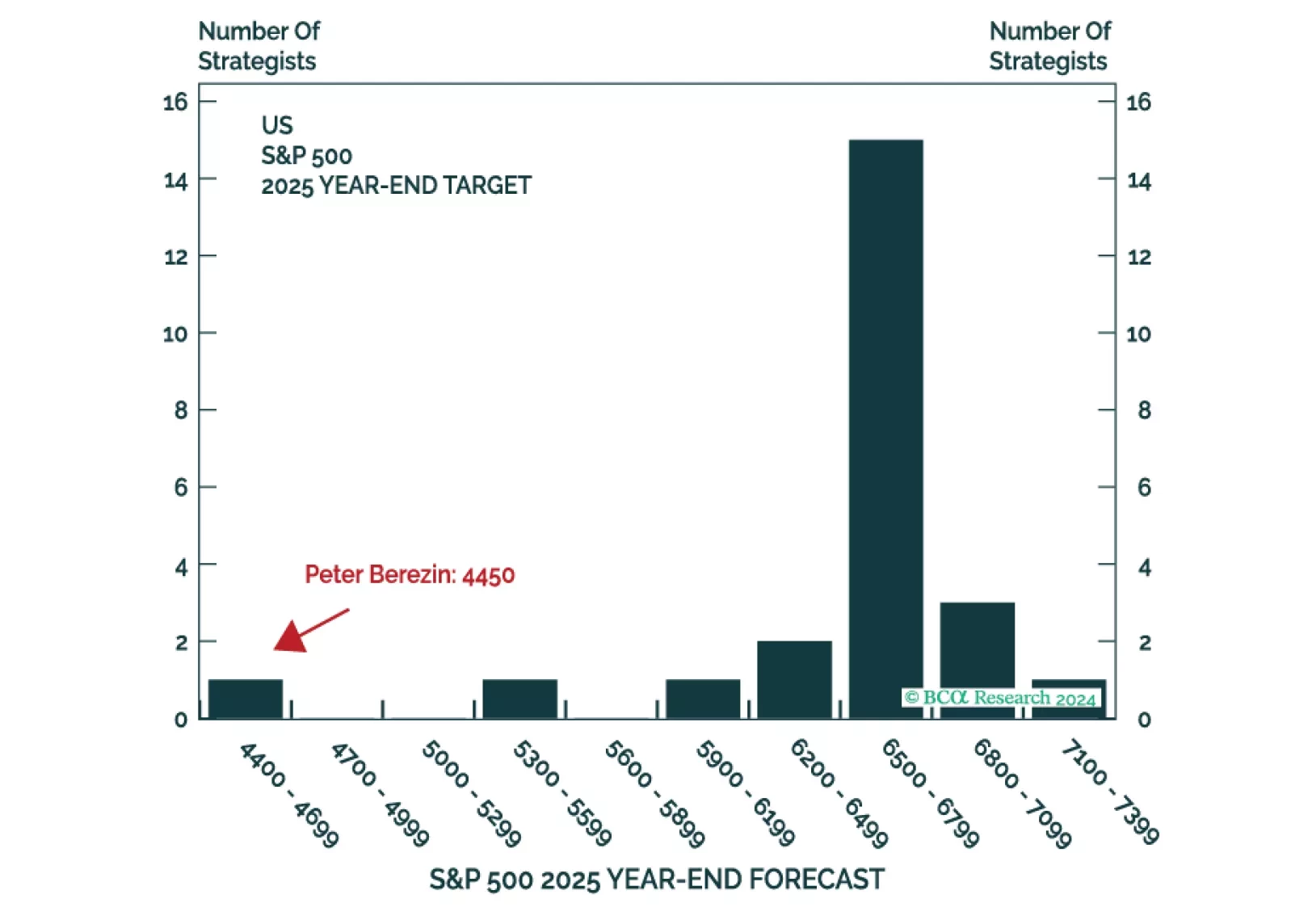

This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

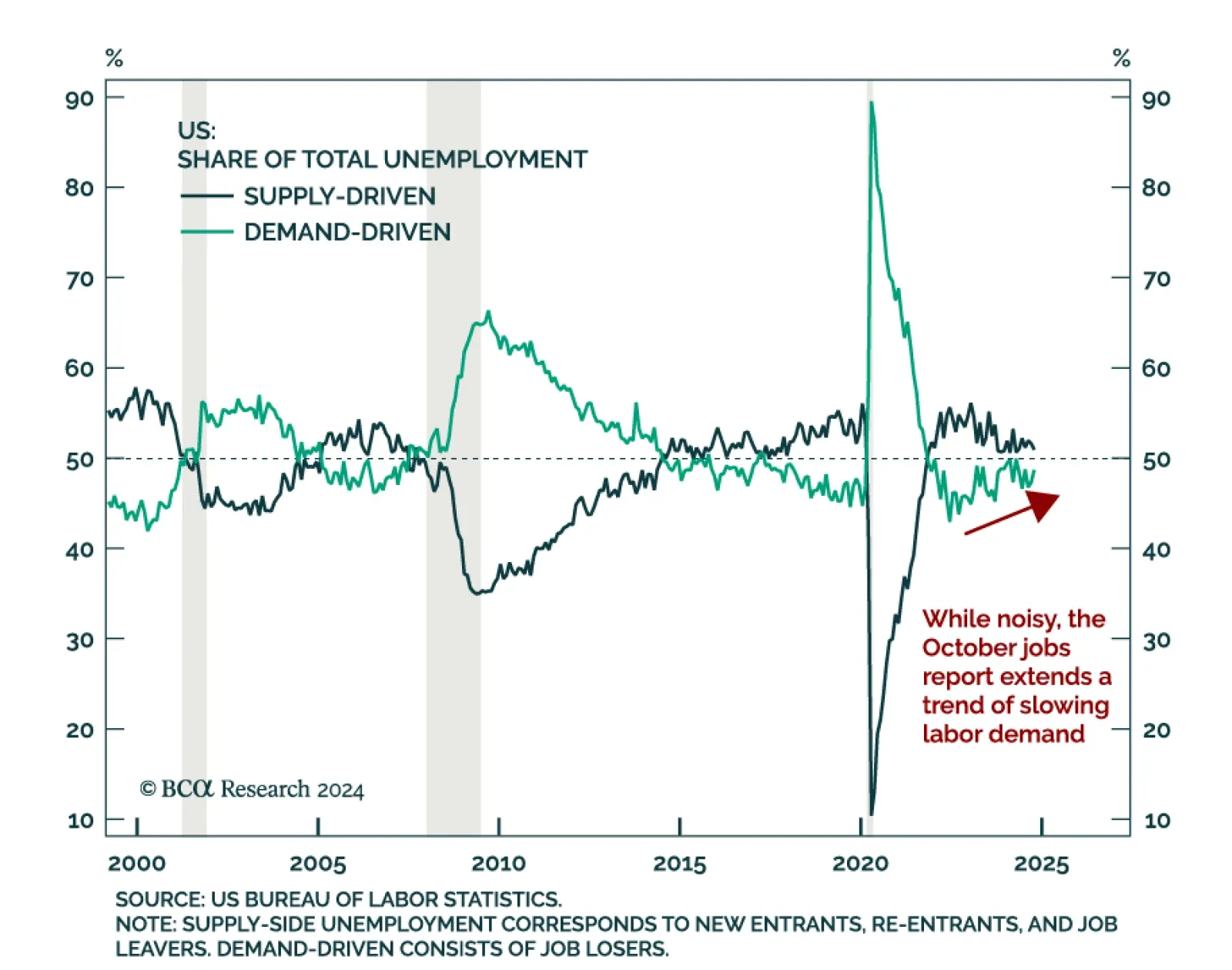

The October US jobs report had mixed signals and was skewed by hurricanes and industrial strikes. Unemployment met expectations by staying unchanged at 4.1%, although it rose nearly 0.1 percentage point on an unrounded basis.…

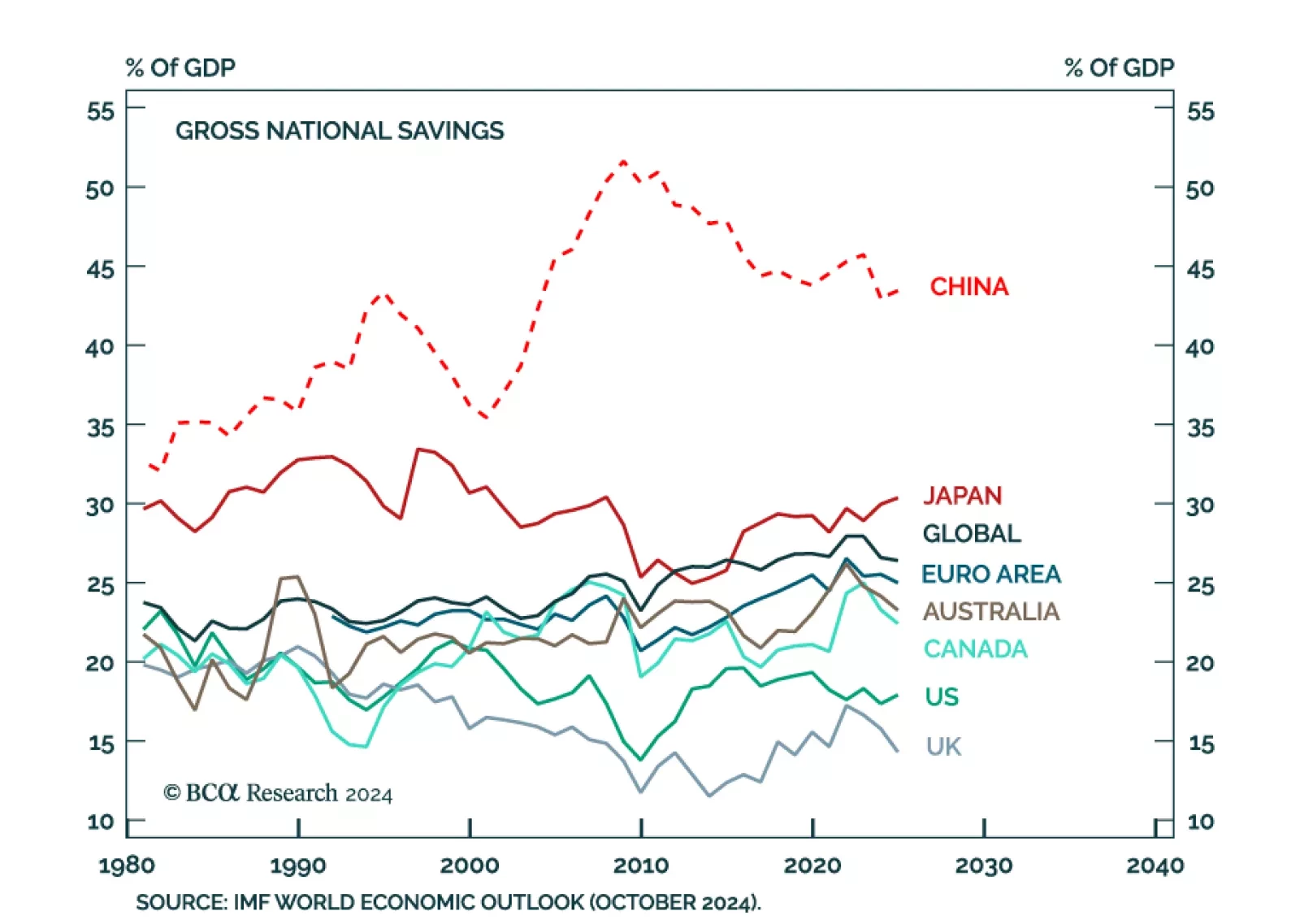

Savings must either flow into domestic investment, or abroad. Saving too much, with nowhere to funnel it, is breaking China’s economic model according to our Global Investment Strategy colleagues. As China's share of…

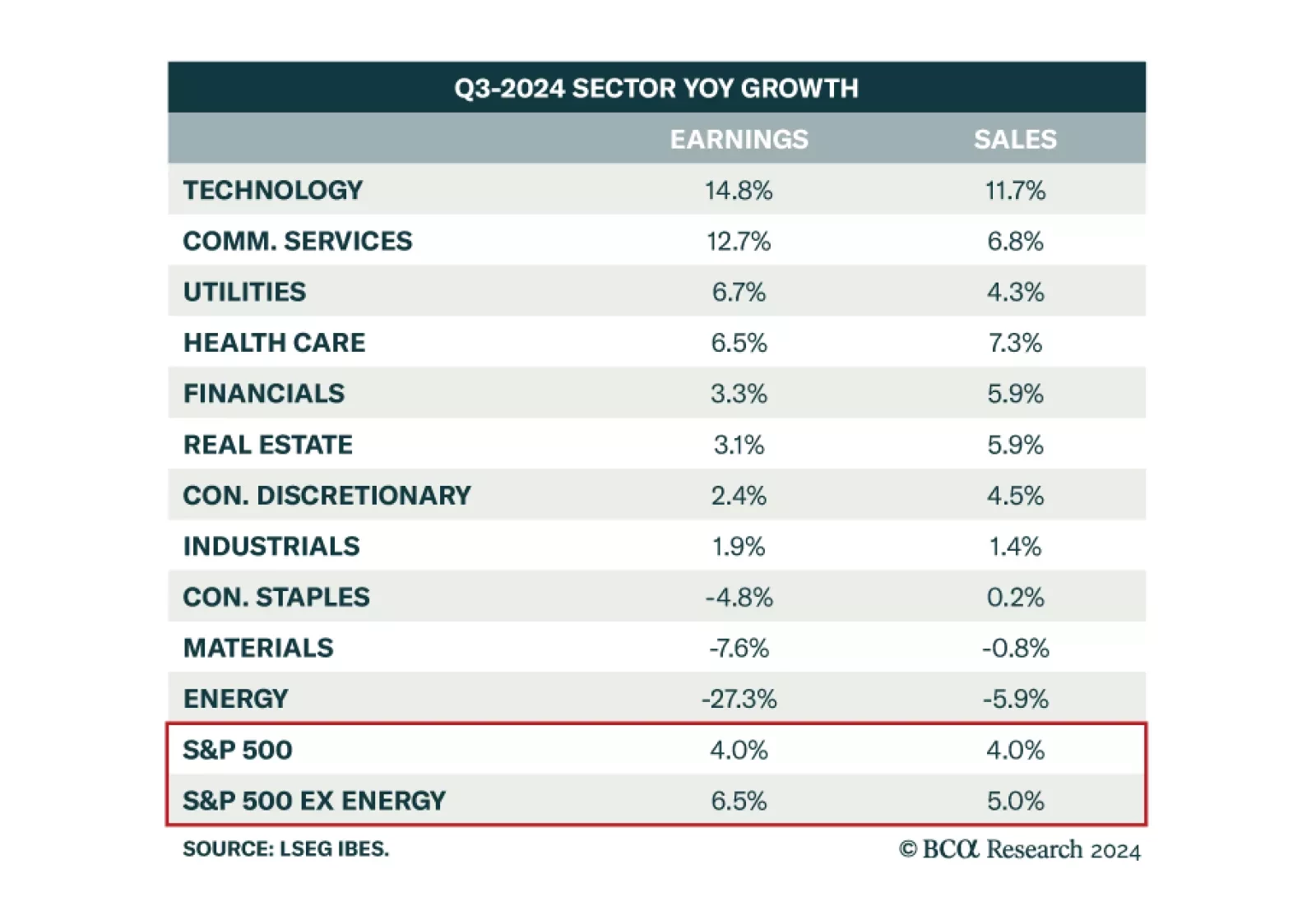

Our US Equity Strategy colleagues expect Q3 earnings to be strong enough to fuel the soft-landing narrative. Analysts expect S&P 500 earnings growth to be 4.0% year-over-year, with sales growth of 4.0% too. Yet, with…