This morning’s weak consumer spending and strong inflation data reinforce our sense that the US economy is heading toward recession.

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

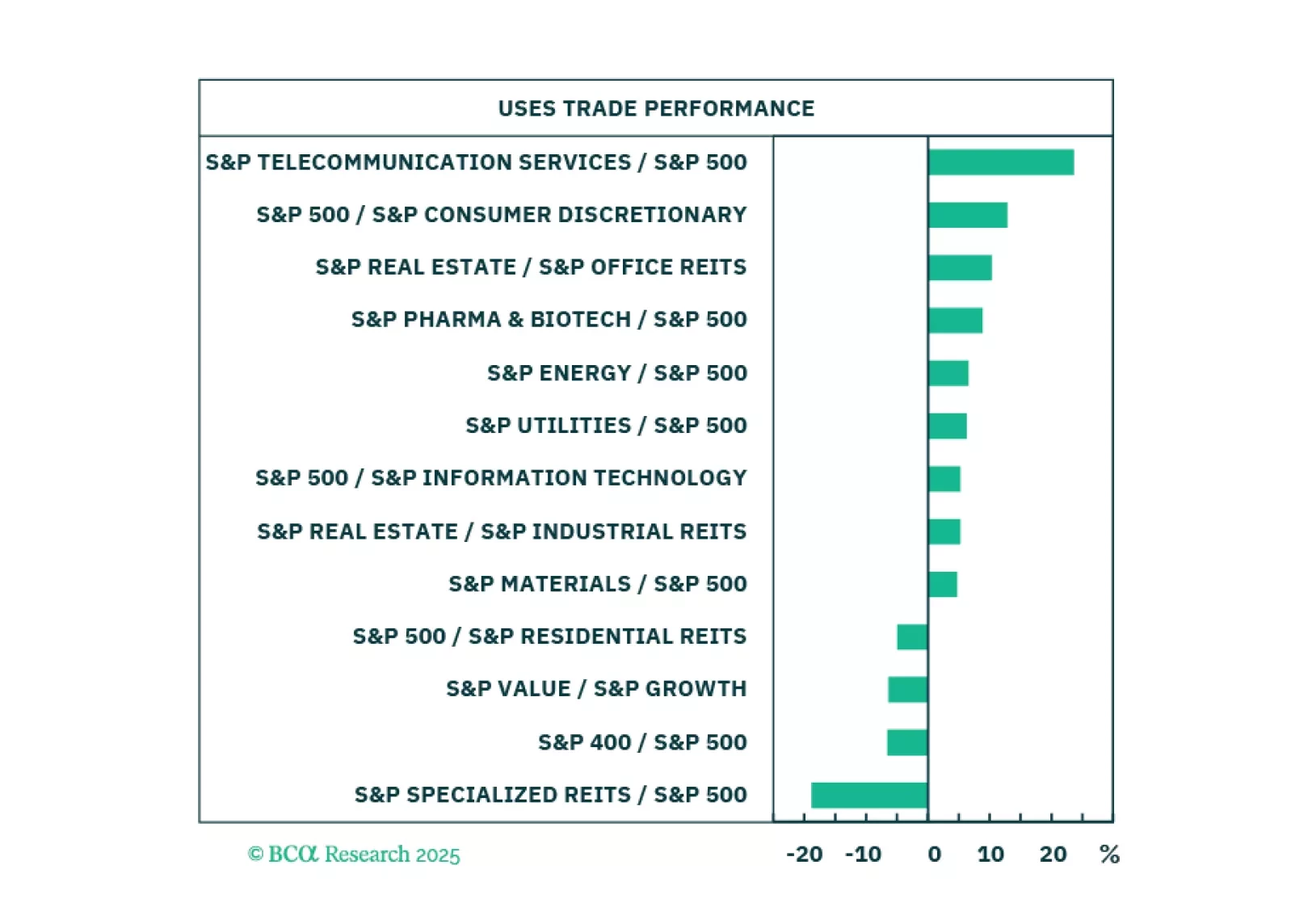

Our US Investment Strategy team recommends investors remain defensively positioned. Stay underweight US equities and overweight Treasuries and cash, on both a tactical and cyclical horizon, as the likelihood of a midyear recession…

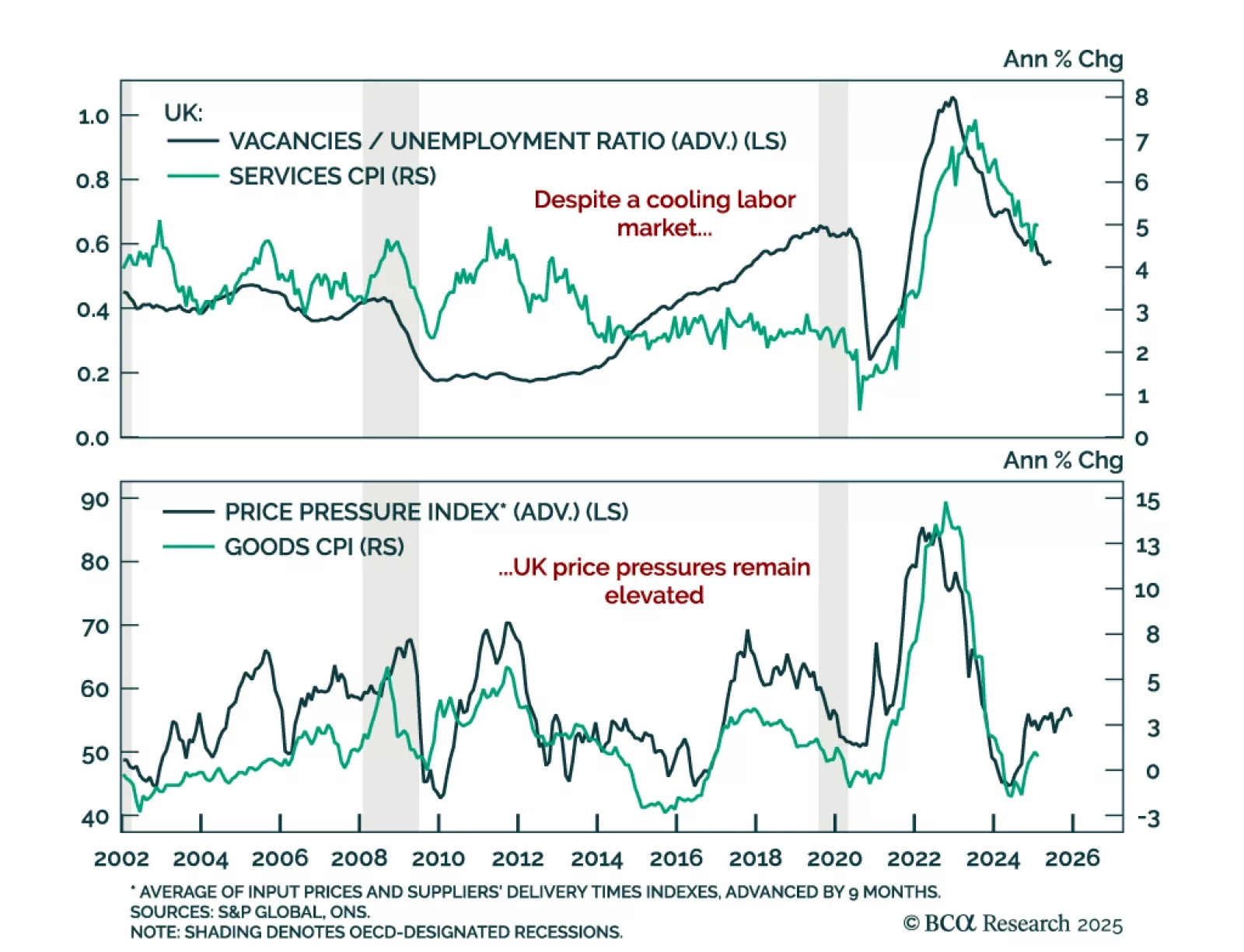

UK inflation came in cooler than expected in February, but lingering price pressures and a still-firm labor market keep the BoE sidelined, for now. Our Global Fixed-Income strategists view the BoE as the most likely DM central bank…

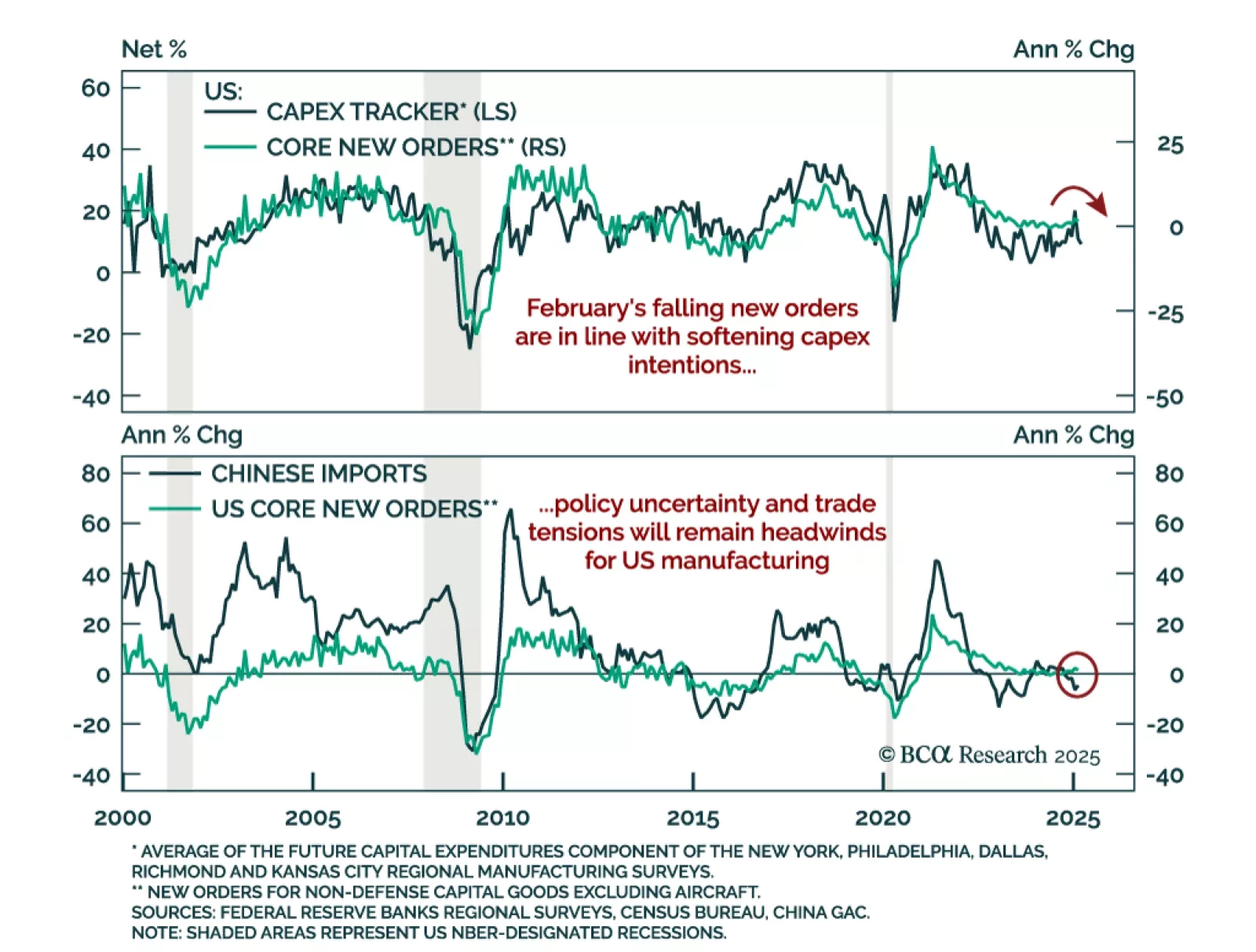

A drop in core capex orders points to slowing business spending and softening global growth. Businesses appear to have front-loaded shipments ahead of potential tariffs while deferring new orders amid policy uncertainty. With hiring…

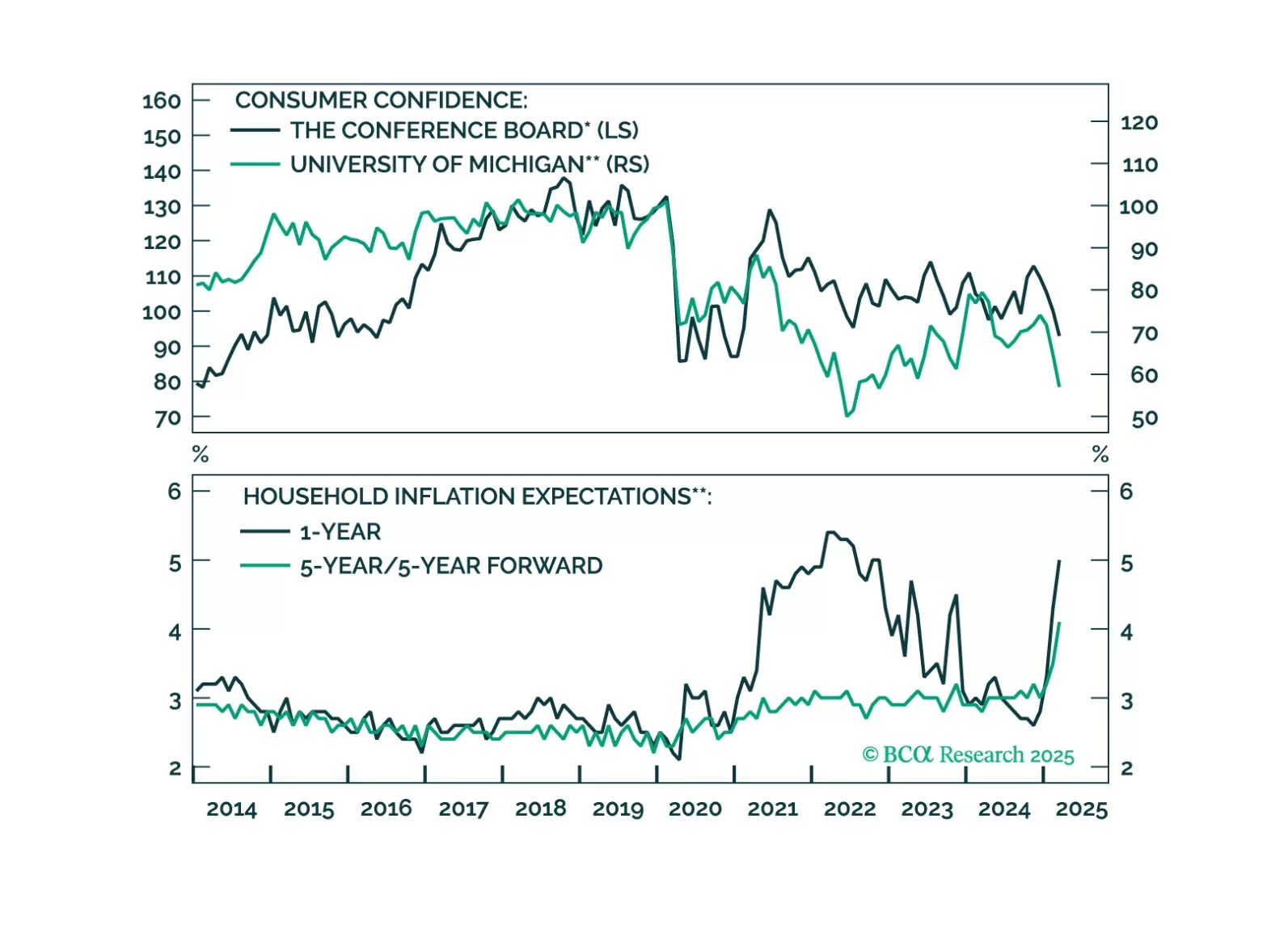

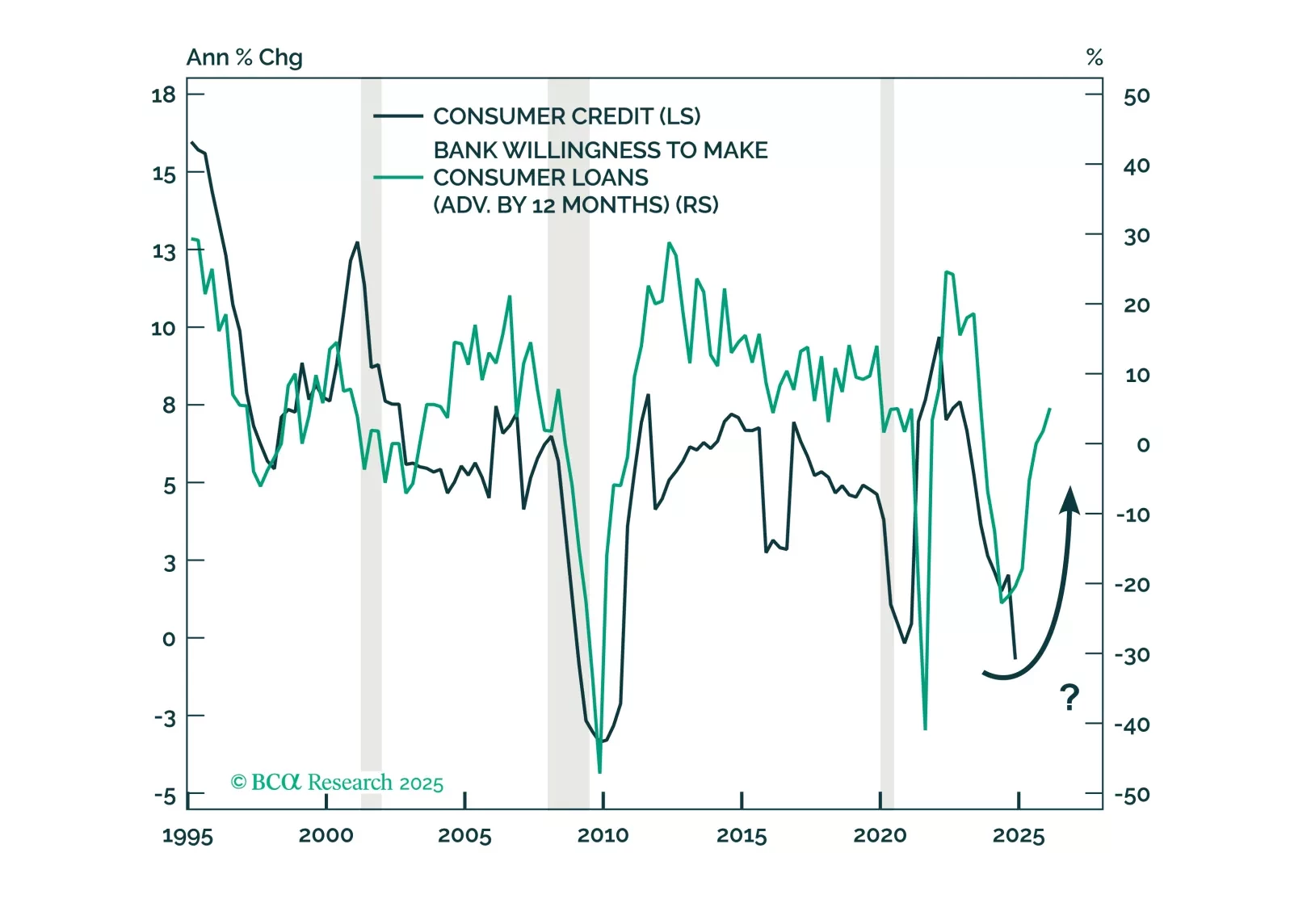

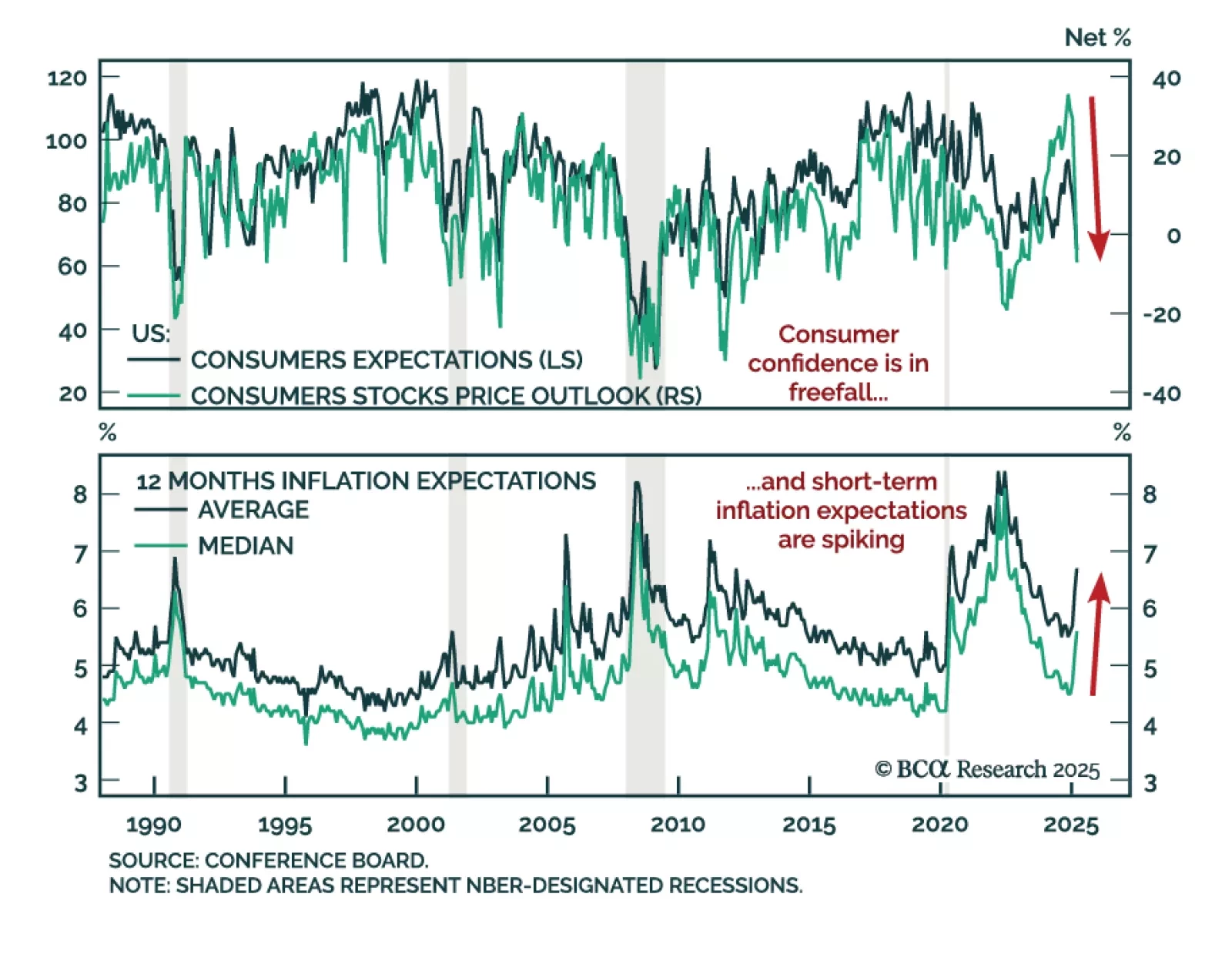

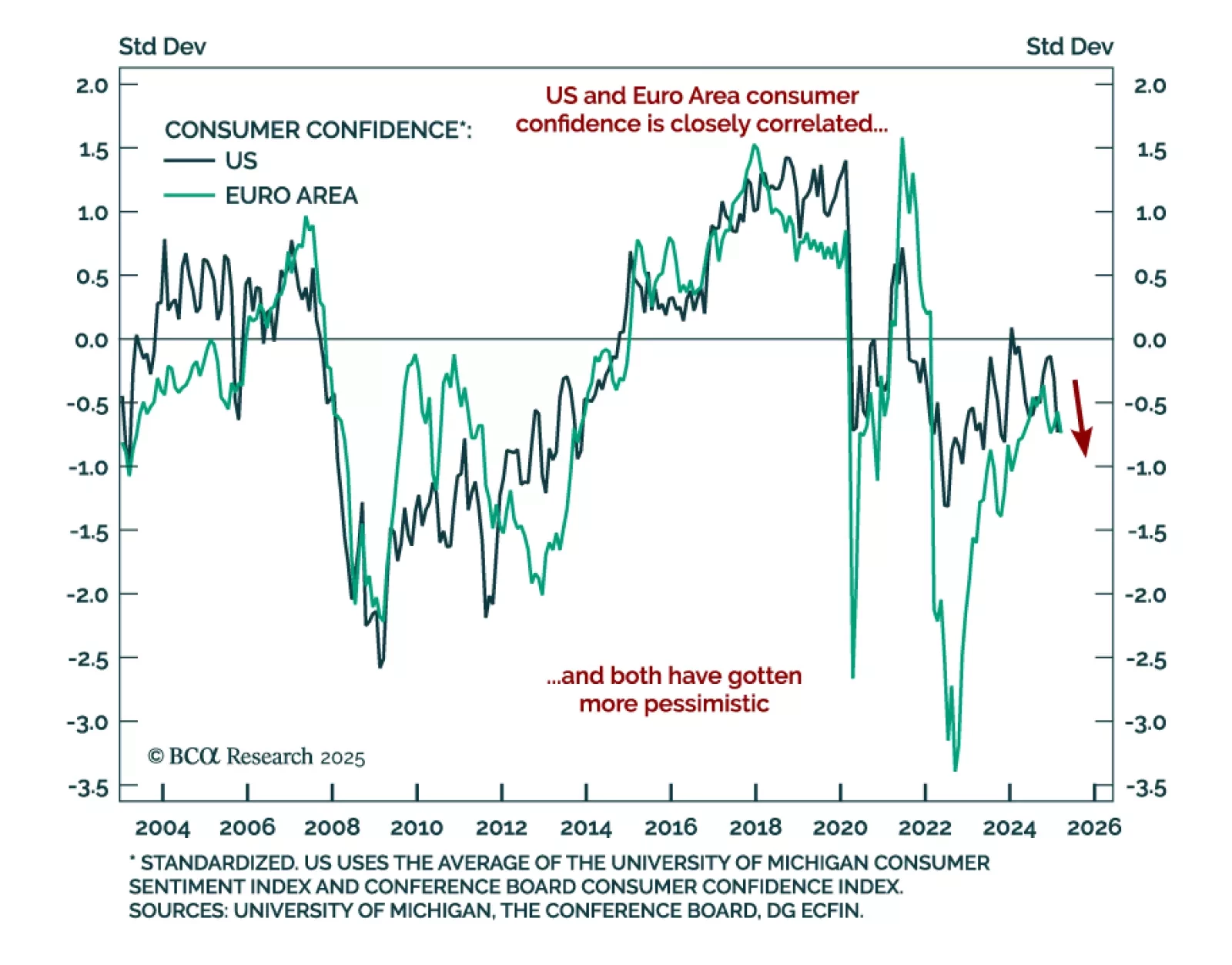

A sharp drop in consumer confidence adds to signs that a consumption slowdown is coming, threatening both US and global growth. Yet rising short-term inflation expectations will keep central banks cautious, weighing on long-term…

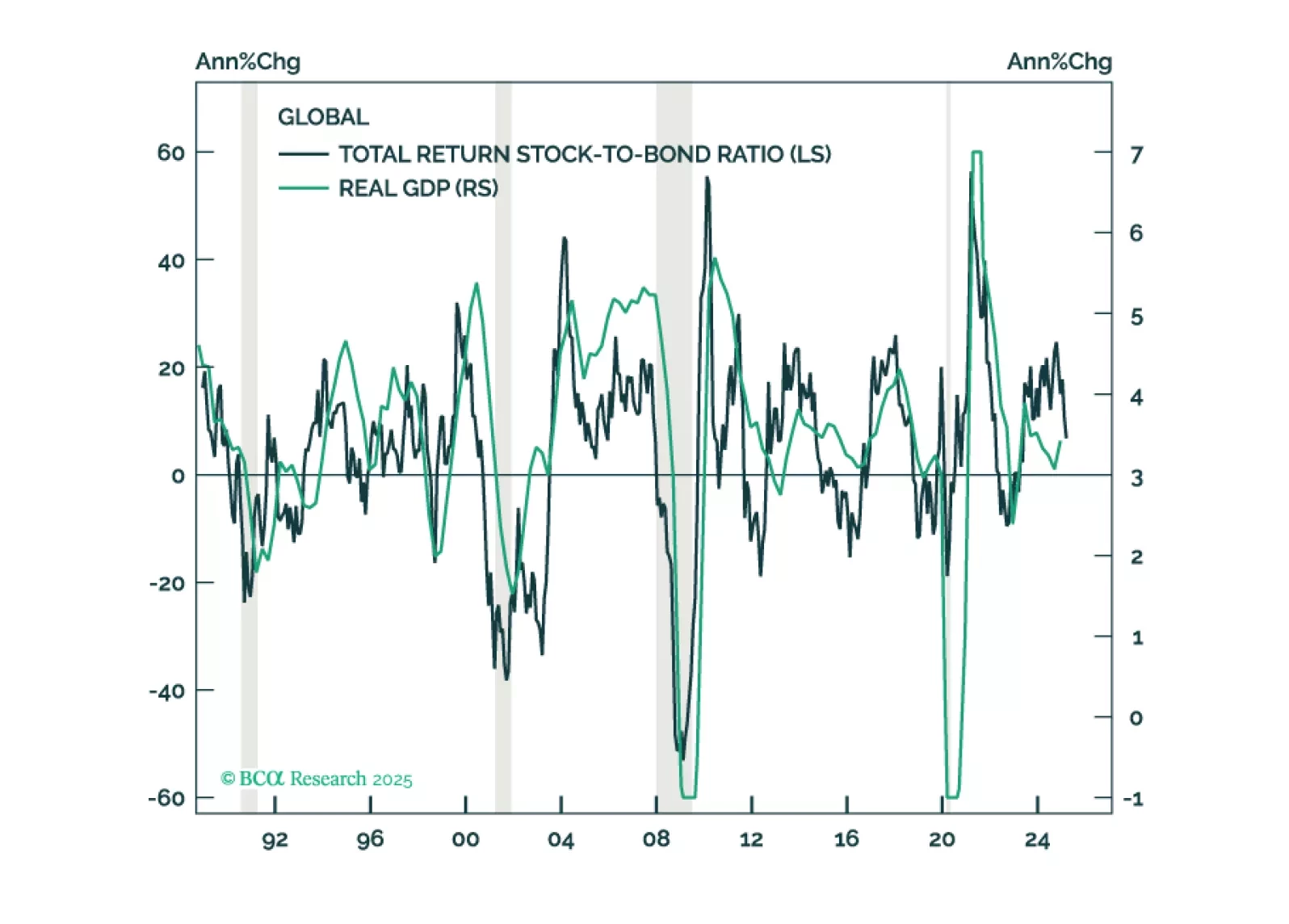

The US economy faces a new investment regime characterized by tighter fiscal and easier monetary policies. The market corrected fast, and a short-lived equity rebound is likely. However, over the long term, US equities face economic…

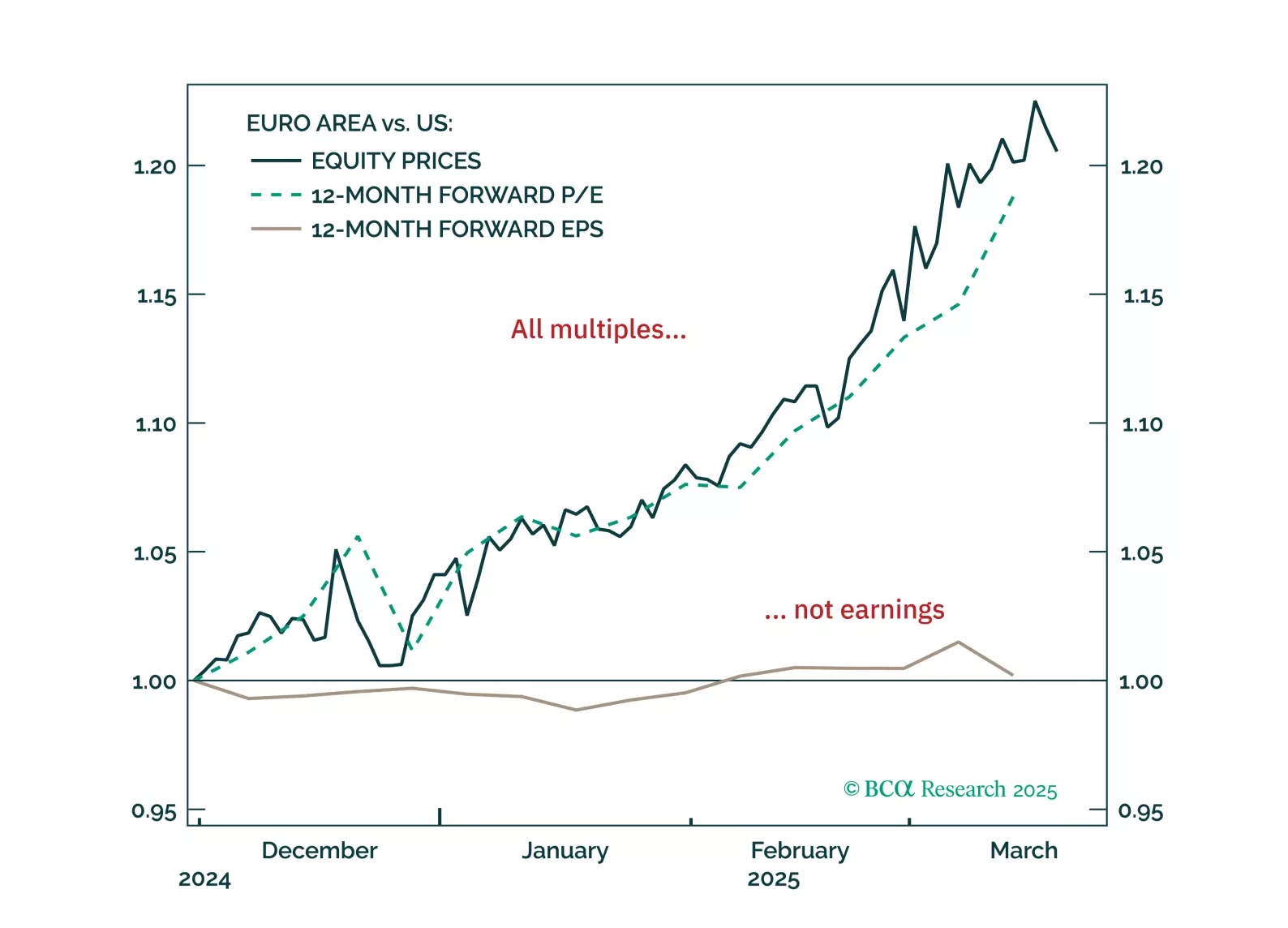

European equities have surged on hopes of a low-inflation boom—but the rally has likely gone too far, too fast. With a pullback now likely, how should investors position themselves over the next 3–6 months?

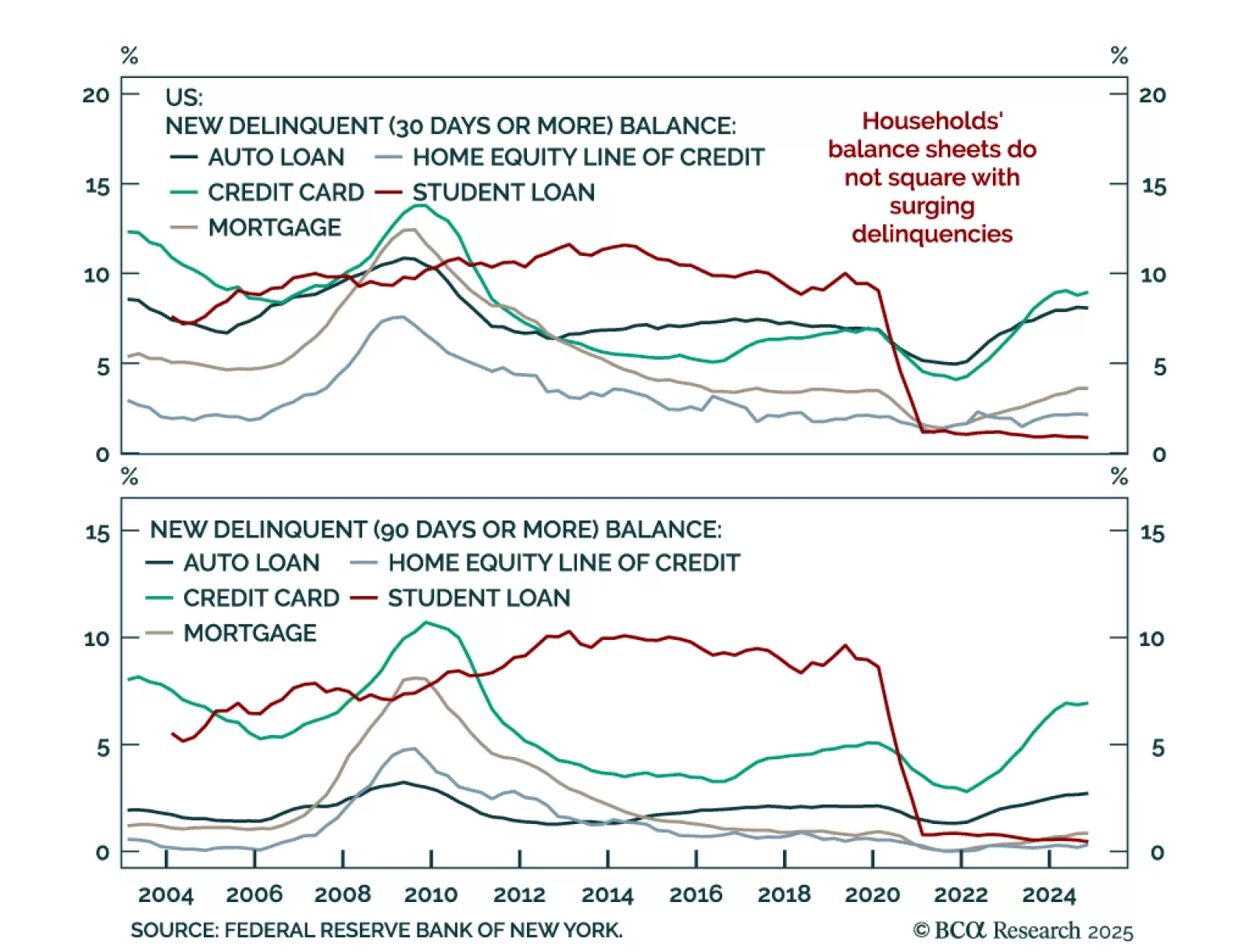

Households’ healthy balance sheets do not square with the rise in credit cards and auto loans delinquencies. The tailwinds that have supported higher-income cohorts’ spending have faded, presaging broad-based deterioration in credit…

The March flash estimate for European Consumer Confidence missed estimates, and fell to -14.5 from -13.6 in February. This negative reading is the first European sentiment number missing expectations since January. The sentiment…