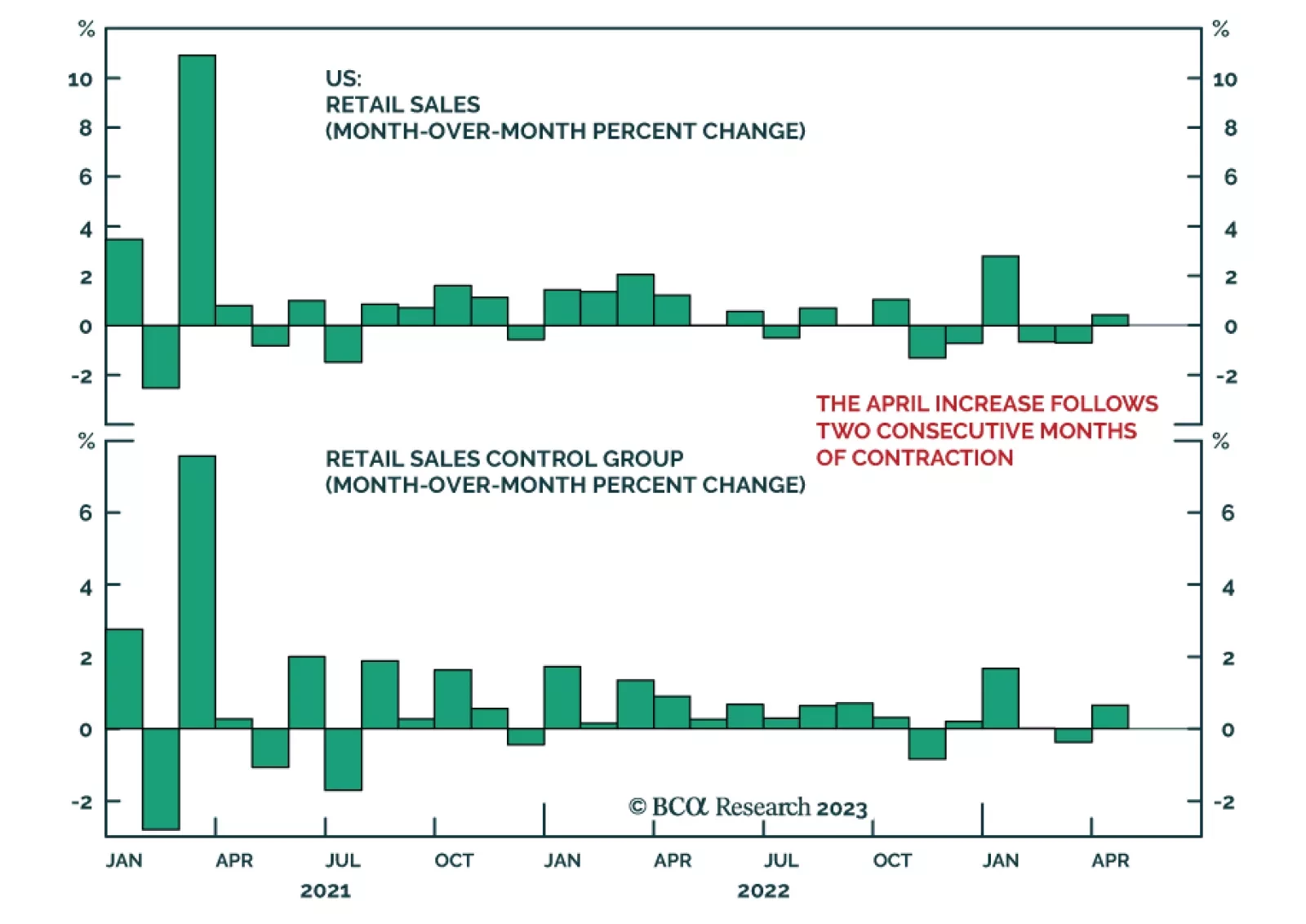

The US Retail Sales report painted a resilient picture of American consumers in April. Although the 0.4% m/m increase in overall retail sales fell below consensus estimates of a 0.8% m/m rise, the details of the report surprised…

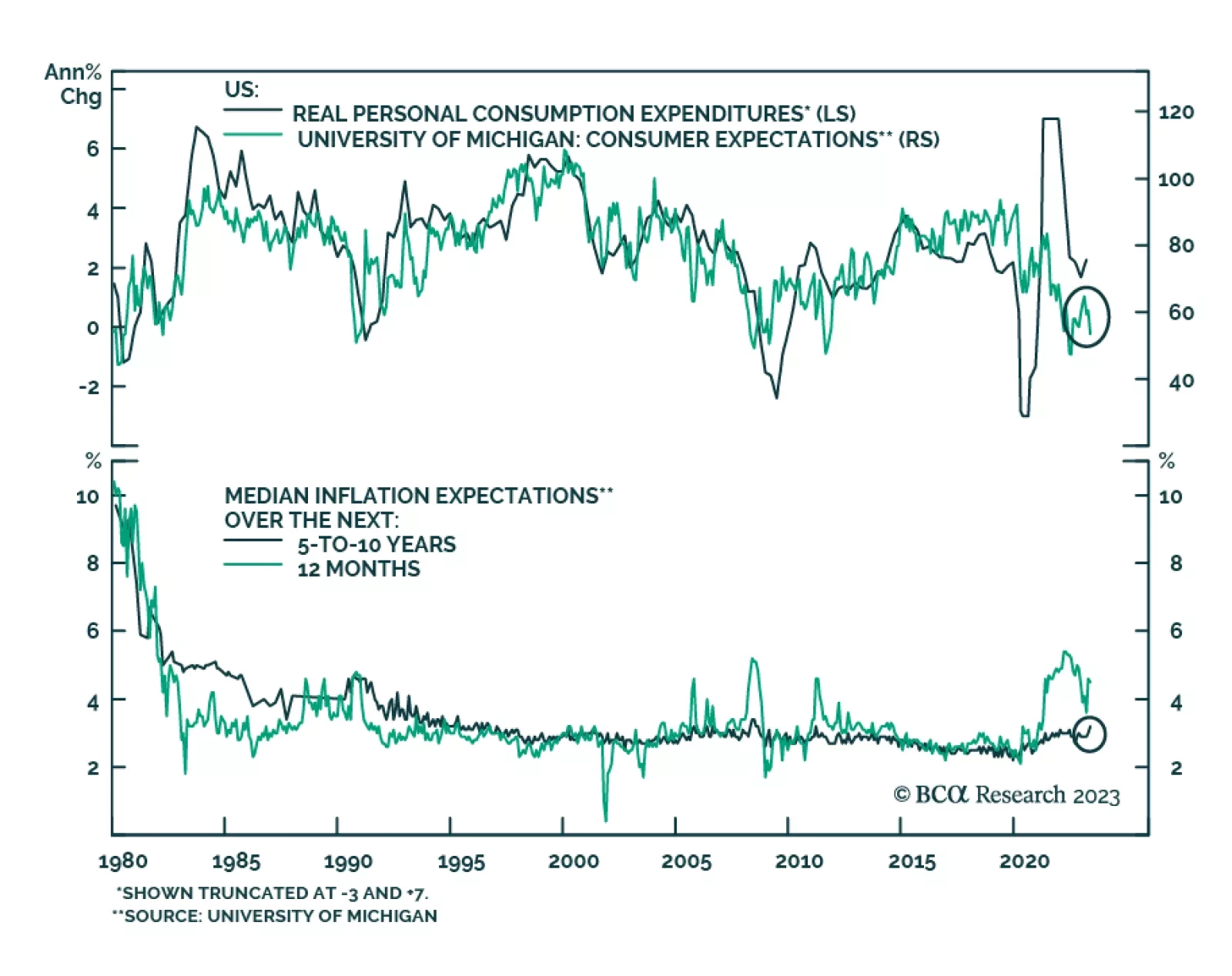

Preliminary results from the University of Michigan survey show consumer sentiment relapsed in May. The headline index plunged from 63.5 to a six-month low of 57.7 – below expectations of a marginal decrease to 63.0.…

China’s reopening, combined with a slew of pro-consumption policy stimuli, will likely boost household consumption by 10% in nominal terms in 2023 from a year ago. Some of the hardest hit service sectors during the pandemic will…

Pent-up demand for services is keeping the global economy going, but we still expect recession over the next 12 months. Investors should keep a cautious portfolio stance.

The latest round of earnings calls from the systemically important banks was encouraging on balance. Households are still flush and still spending and consumer and business delinquencies remain remarkably low. Though a recession is…

China's recovery will be driven by consumer spending in general and on services in particular, while industrial sectors will disappoint.

A benign disinflation is probable during the remainder of 2023. Unfortunately, just when most people become convinced that a recession has been avoided, a recession will begin.

Eventually South Africa will do its macro rebalancing the least painful way: via adjustments in nominal variables such as prices and currency, rather than in real variables such as jobs and incomes. That entails a much weaker rand in…

We think the banking turmoil set off by Silicon Valley Bank’s failure will prove to be less than it’s been cracked up to be and that it will not derail the near-term equity we expect.

Colombian assets are inexpensive, but they are cheap for a reason. The economy is entering a growth recession while inflation will remain sticky and above target. Further, President Gustavo Petro’s policies will lead to lower…