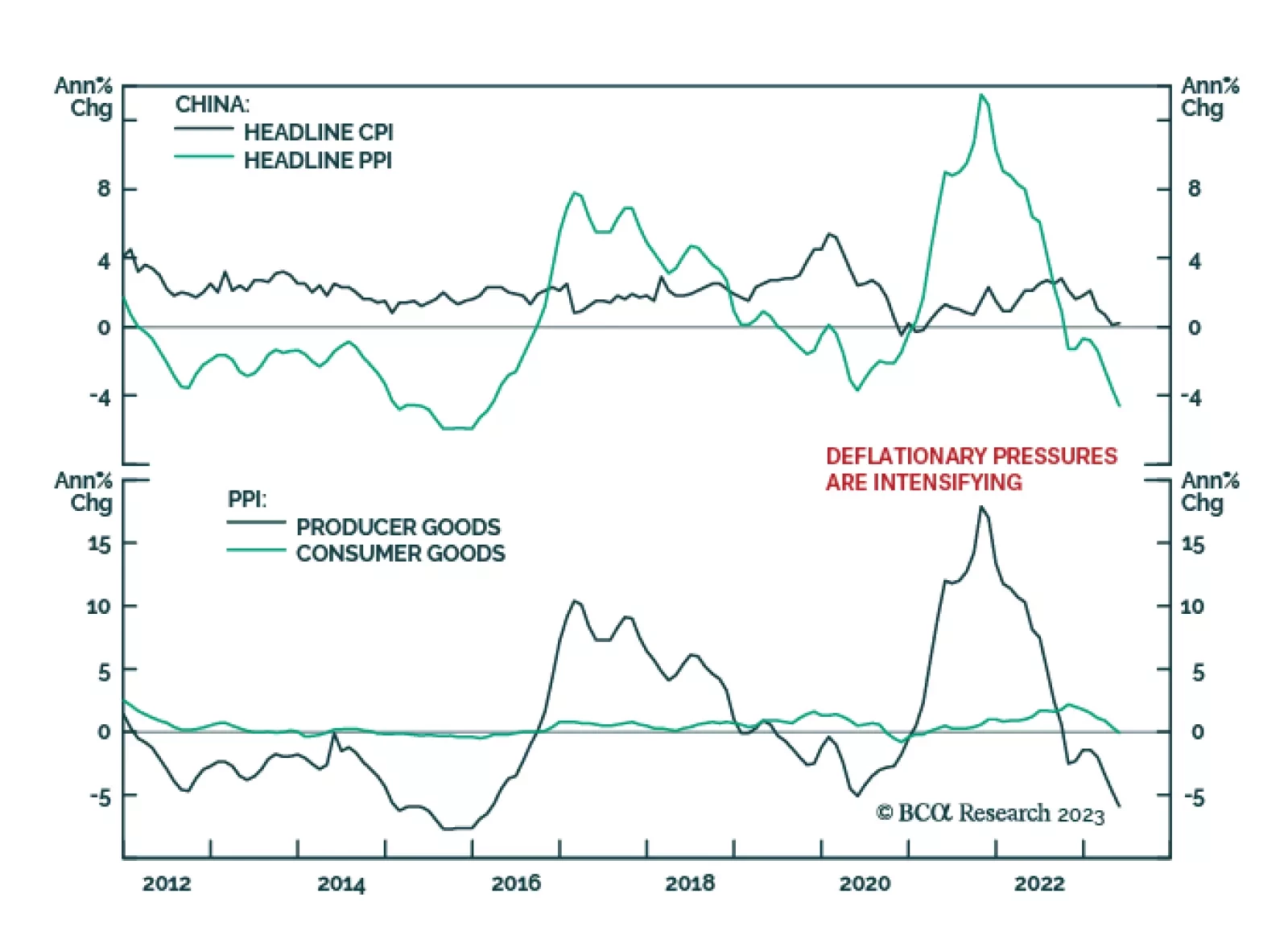

Chinese producer prices sent a disappointing signal about the domestic economy on Friday. The pace of decline in producer prices accelerated from -3.6% in April to -4.6% in May – worse than expectations of a -4.3% drop. The…

A benign disinflation will support equities over the next few quarters. Stocks will fall next year as a recession begins when investors least expect it.

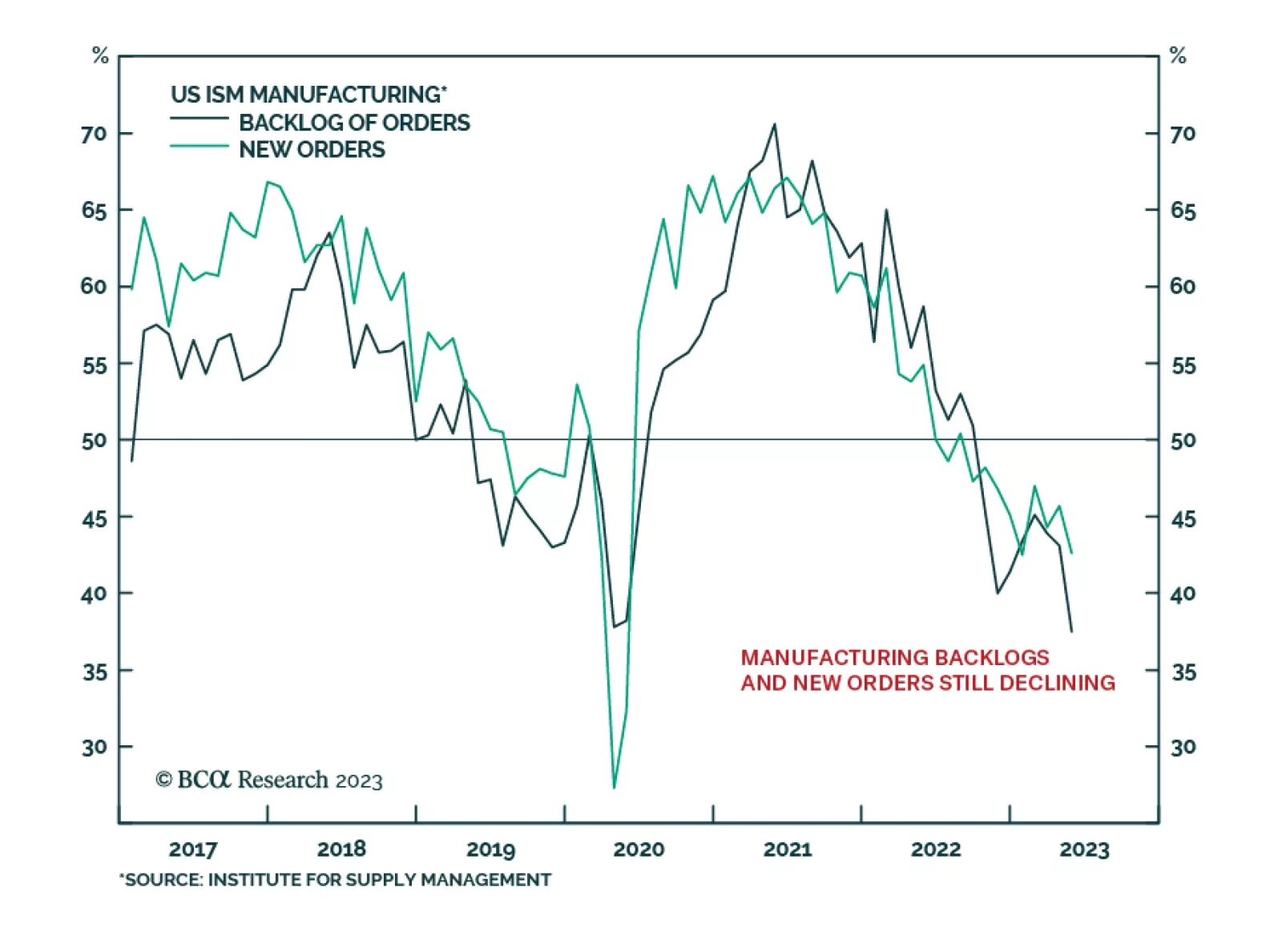

According to BCA Research’s US Equity Strategy service, the earnings contraction is far from over. However, rising productivity, falling costs, or a new restocking cycle could help. Earnings and sales growth beat analyst…

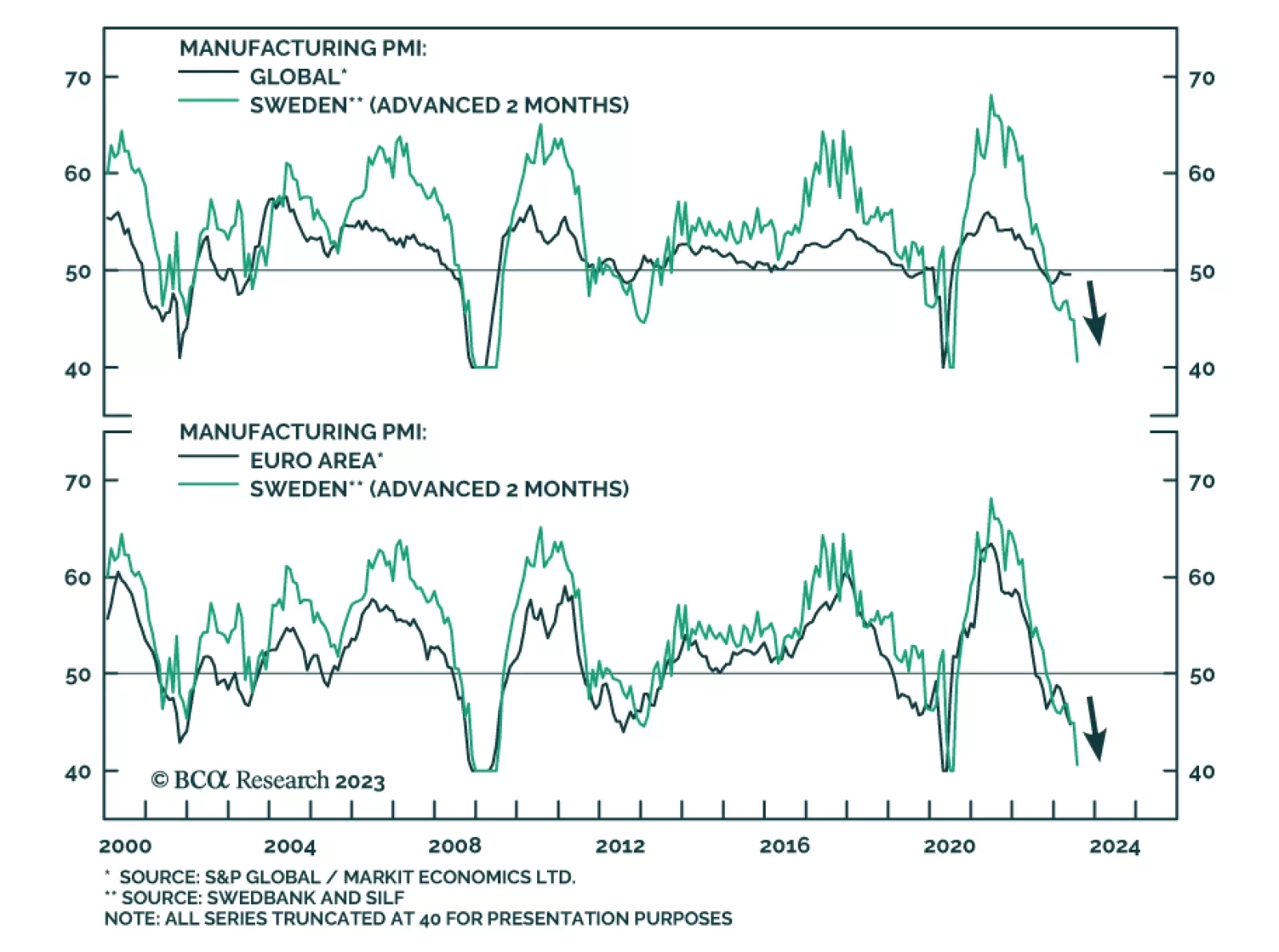

The Swedish manufacturing PMI declined to 40.6 in May, the lowest level since June 2020. This deterioration in Sweden’s manufacturing activity not only reflects the domestic economy, but it also highlights weaknesses in the…

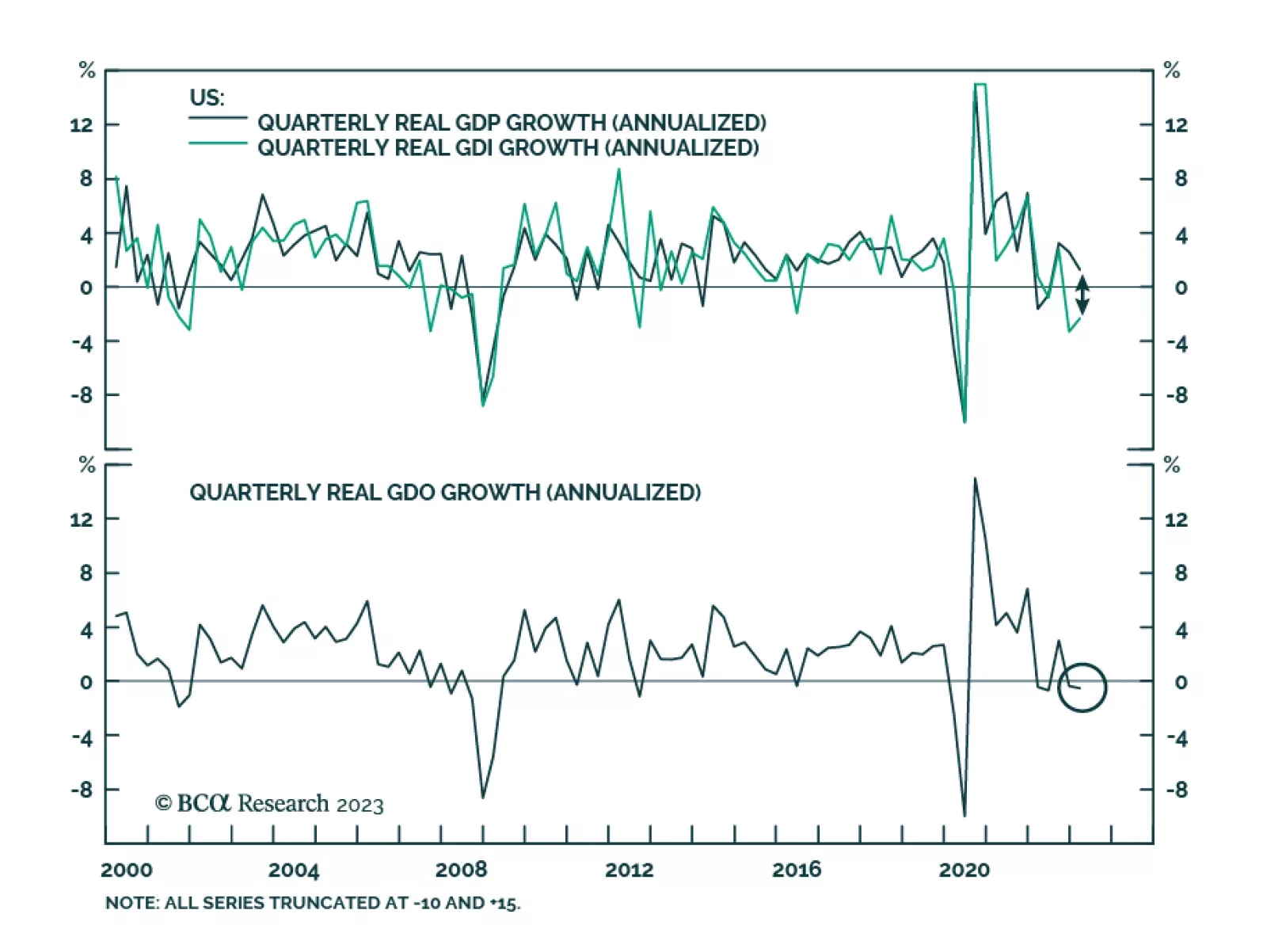

US economic data were mixed on Thursday. On the positive side, Q1 real GDP growth was revised up to 1.3% from the preliminary estimate of 1.1%. In particular, consumption was revised higher by 0.1 percentage points to 3.8%…

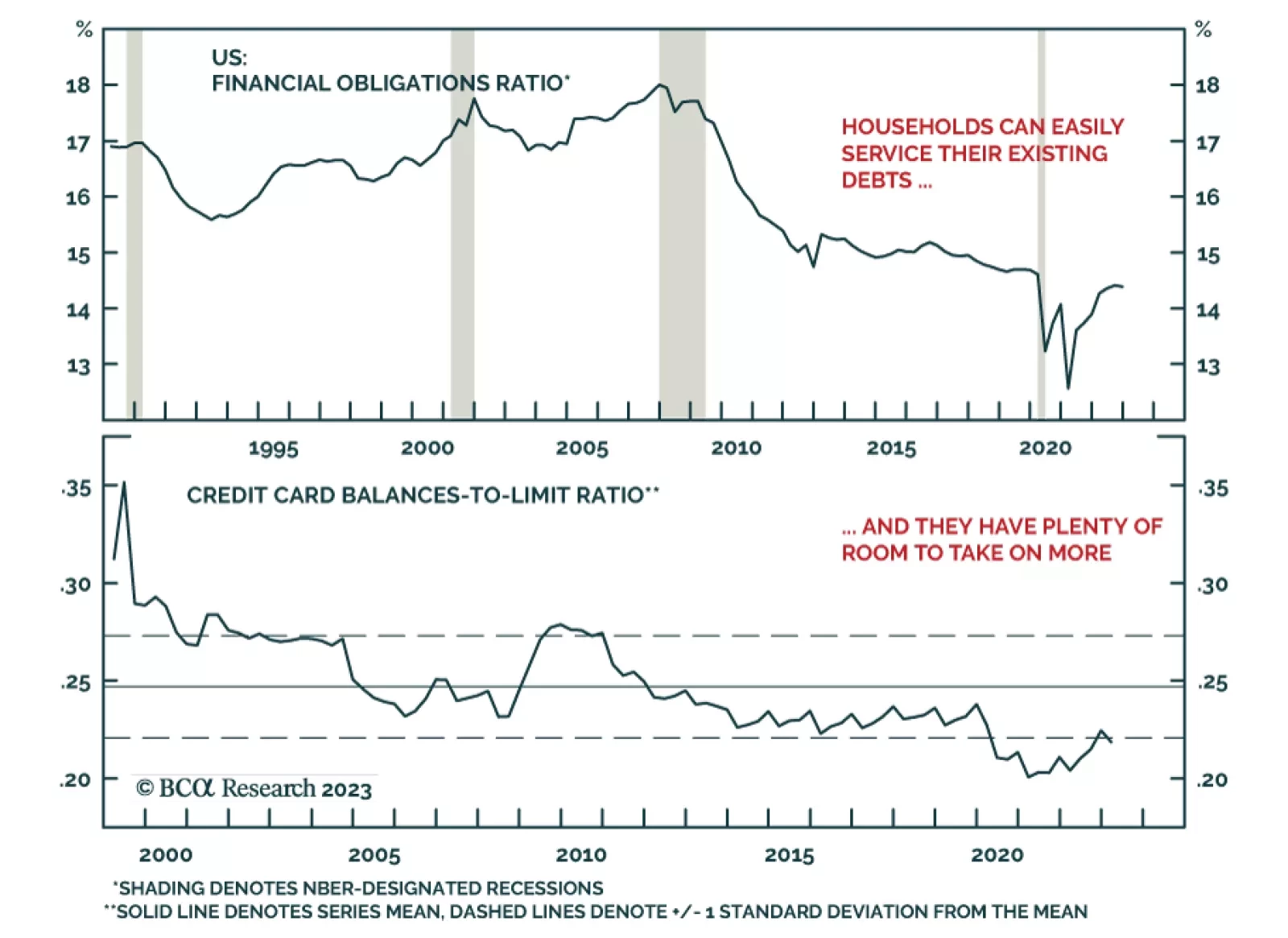

According to BCA Research’s US Investment Strategy service, there are no credit obstacles preventing households from sustaining their consumption growth rate at a level that will keep the recession at bay for the rest of…

The consumption outlook remains solid thanks to households’ sizable excess savings, incomes that will be boosted by a tight labor market and ample capacity to add debt to augment their buying power.

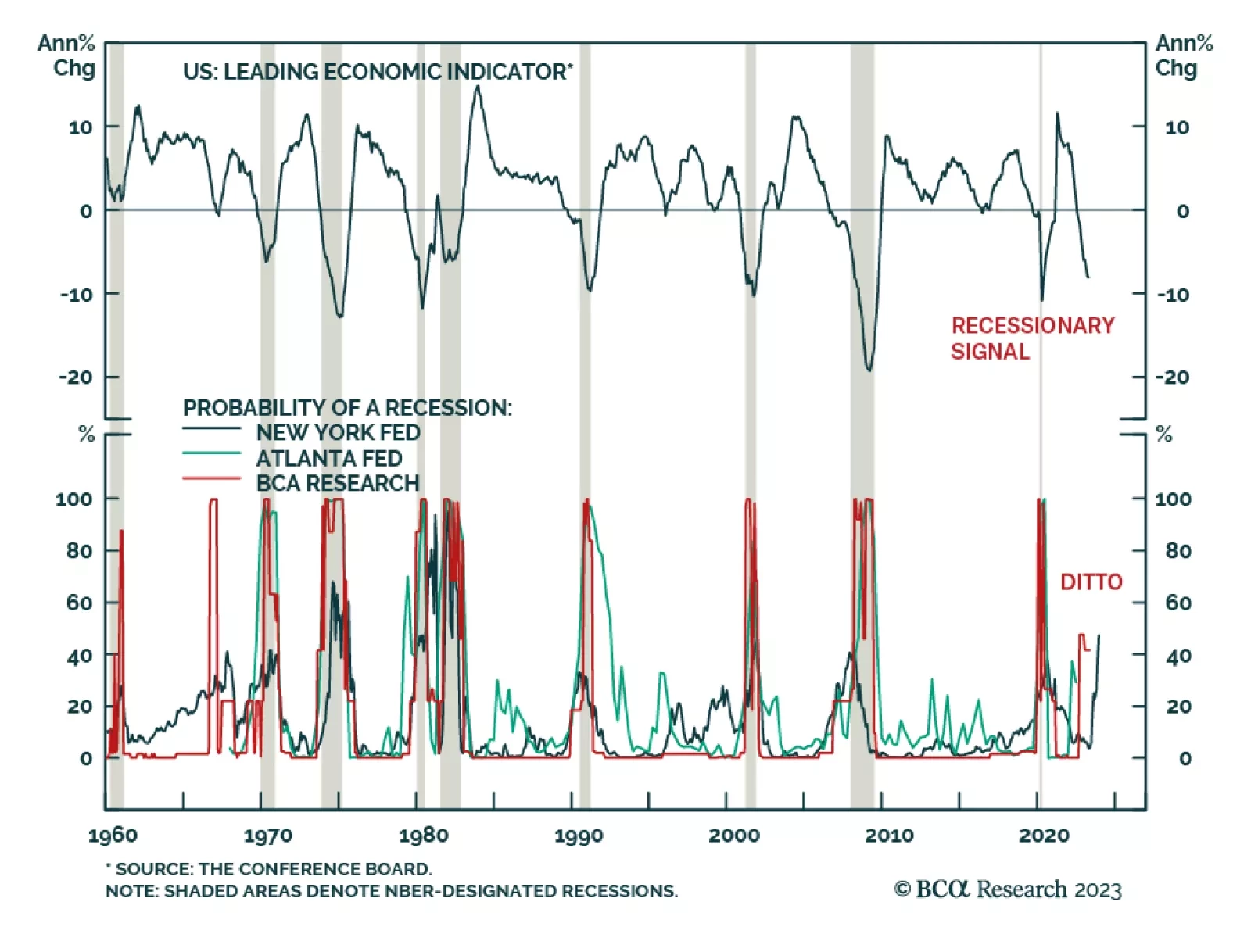

As expected, the Conference Board’s US Leading Economic Indicator (LEI) fell by 0.6% m/m in April, marking the 13th straight monthly decline. Six of the indicator’s 10 components contributed negatively to the April…

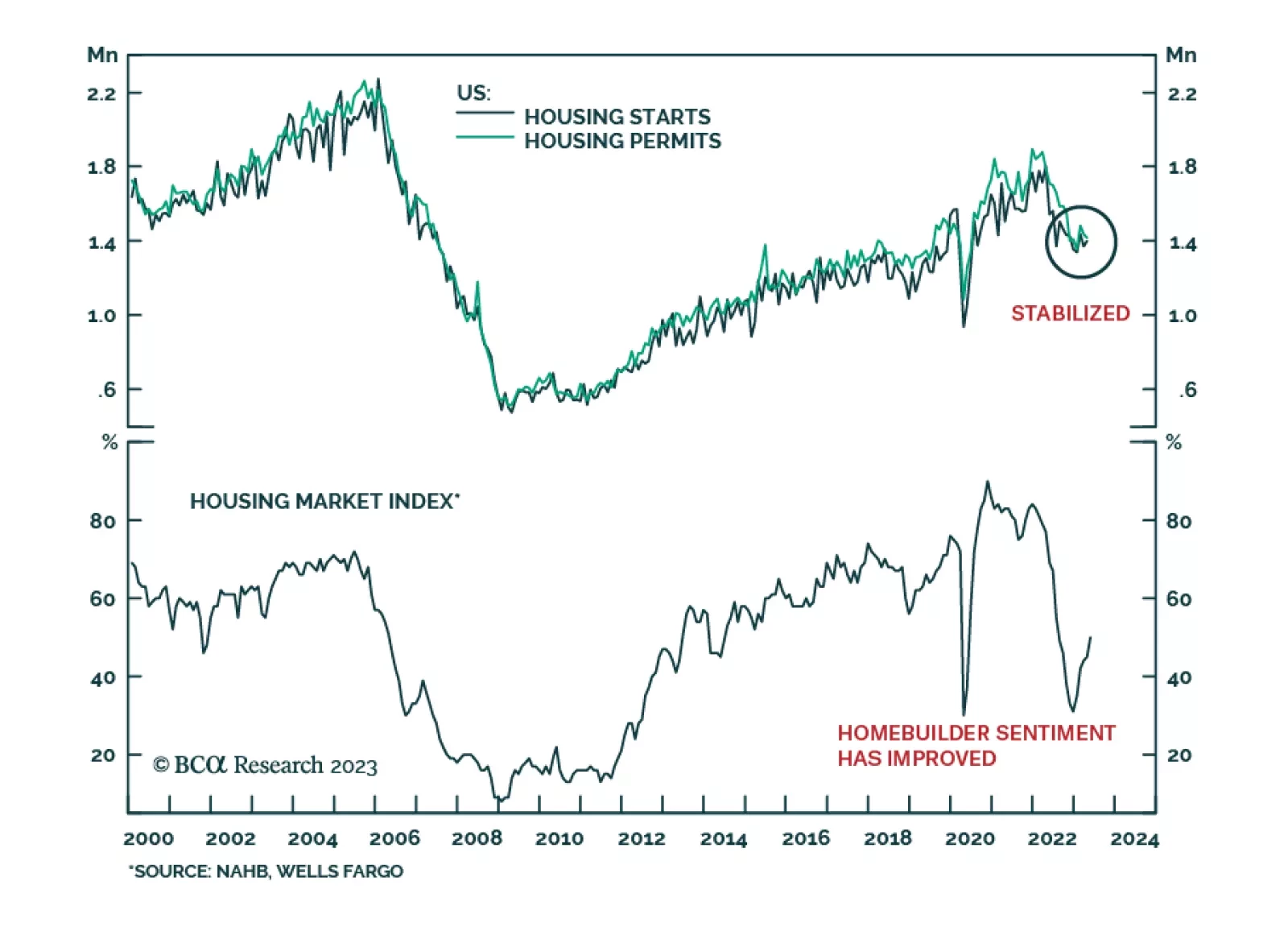

US housing starts unexpectedly increased by 2.2% m/m in April – beating consensus estimates of a 1.4% m/m decline. The upside surprise follows Tuesday’s unanticipated 5-point jump in the NAHB homebuilder sentiment…