Momentum, high cash balances, FOMO, and expectations of soft landing drive the market higher. This rally may continue for a while, but macroeconomic headwinds are intensifying and will eventually derail the rally. It is too early to…

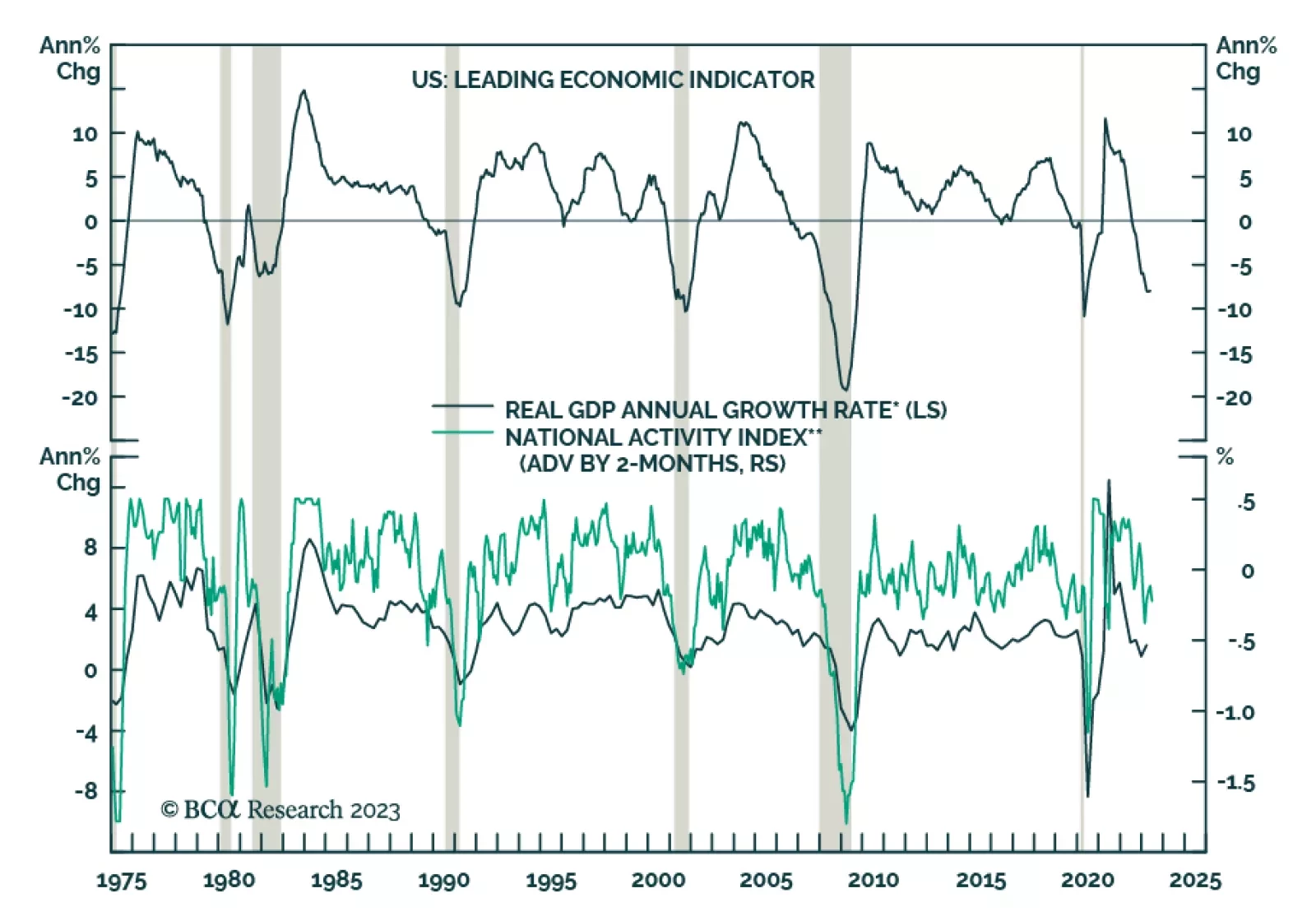

The Conference Board’s US Leading Economic Indicator continues to warn about the economic outlook. The month-on-month rate of change and the six-month rate of change showed the index declining at a faster pace. Weaker…

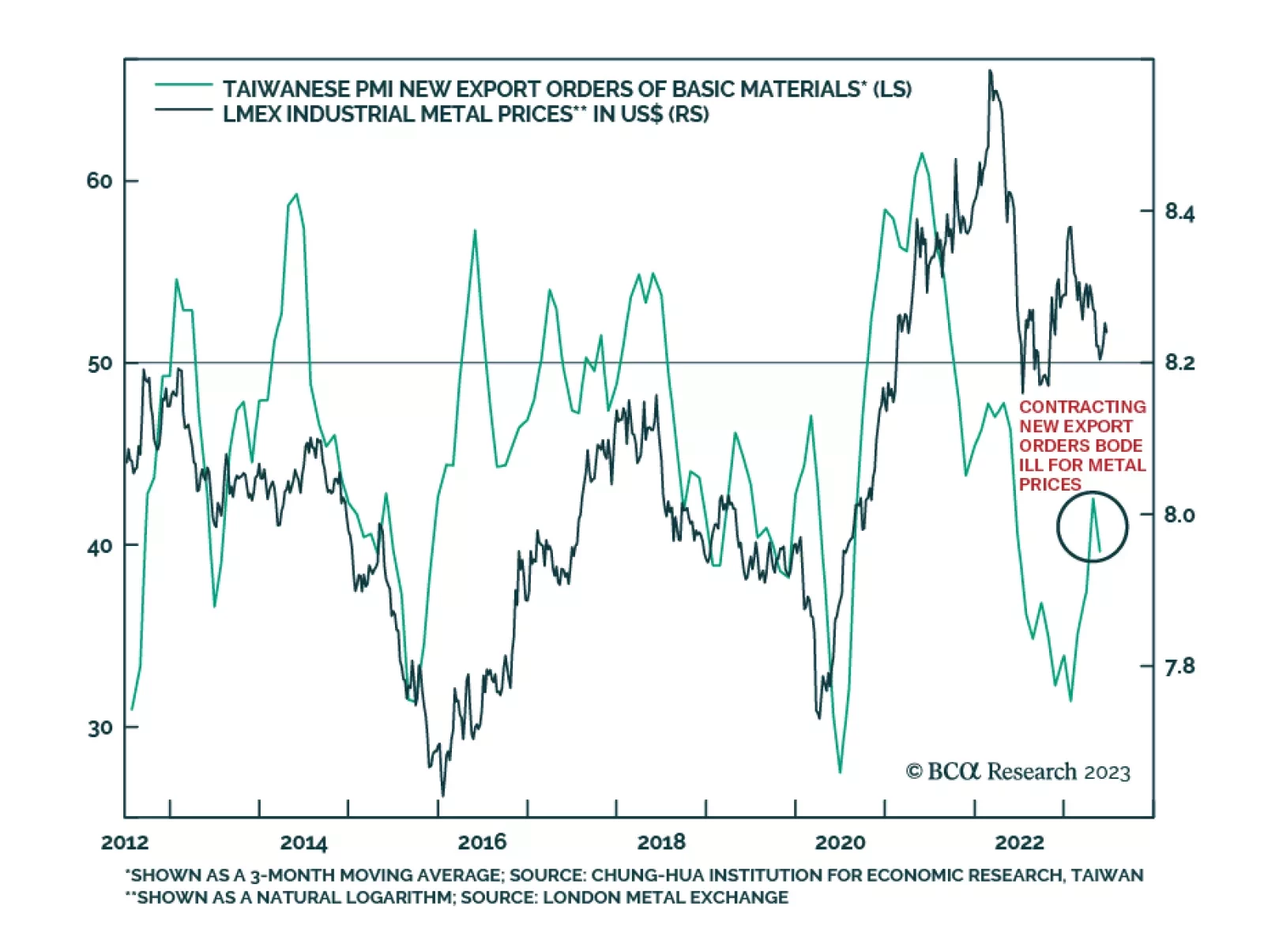

Industrial metals have been rallying in recent weeks. The London Metals Exchange Metals Index (LMEX) – a weighted index that captures the price movement of primary aluminum, zinc, nickel, lead, copper, and tin – has…

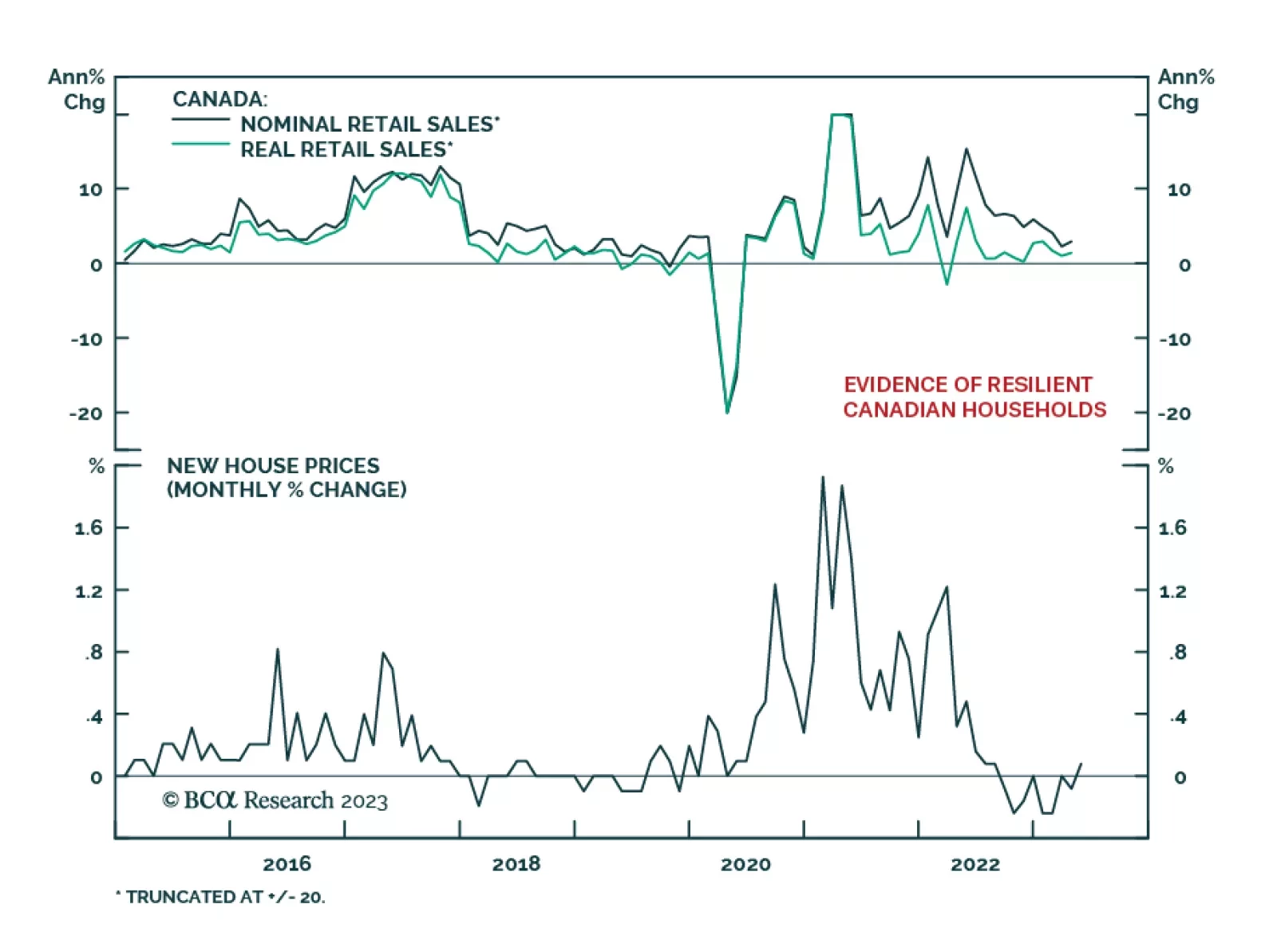

Recent economic data reveal that Canadian household conditions remain resilient. Retail sales surprised to the upside in April. The 1.1% m/m increase follows two consecutive monthly declines and beat expectations of a 0.4% m/m…

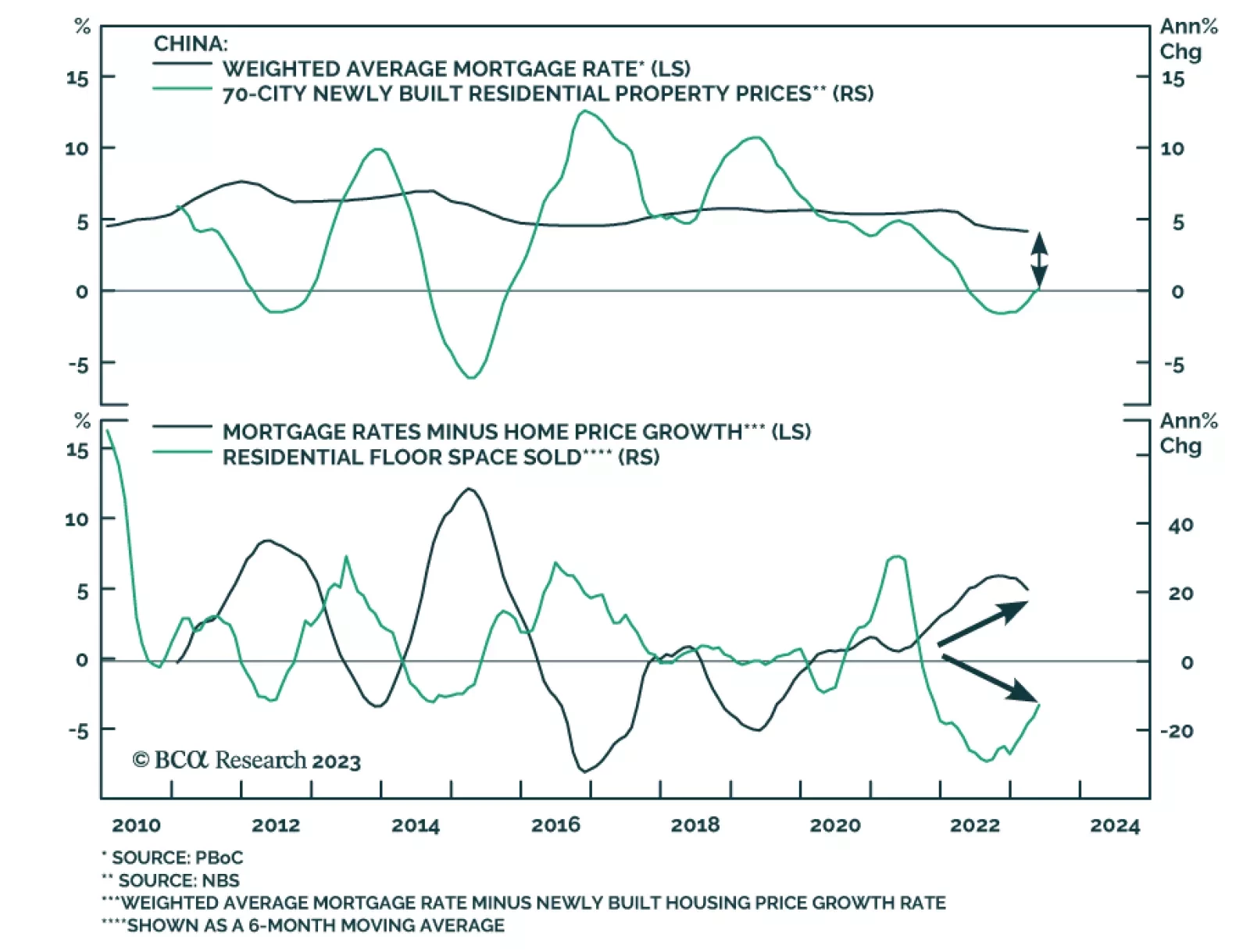

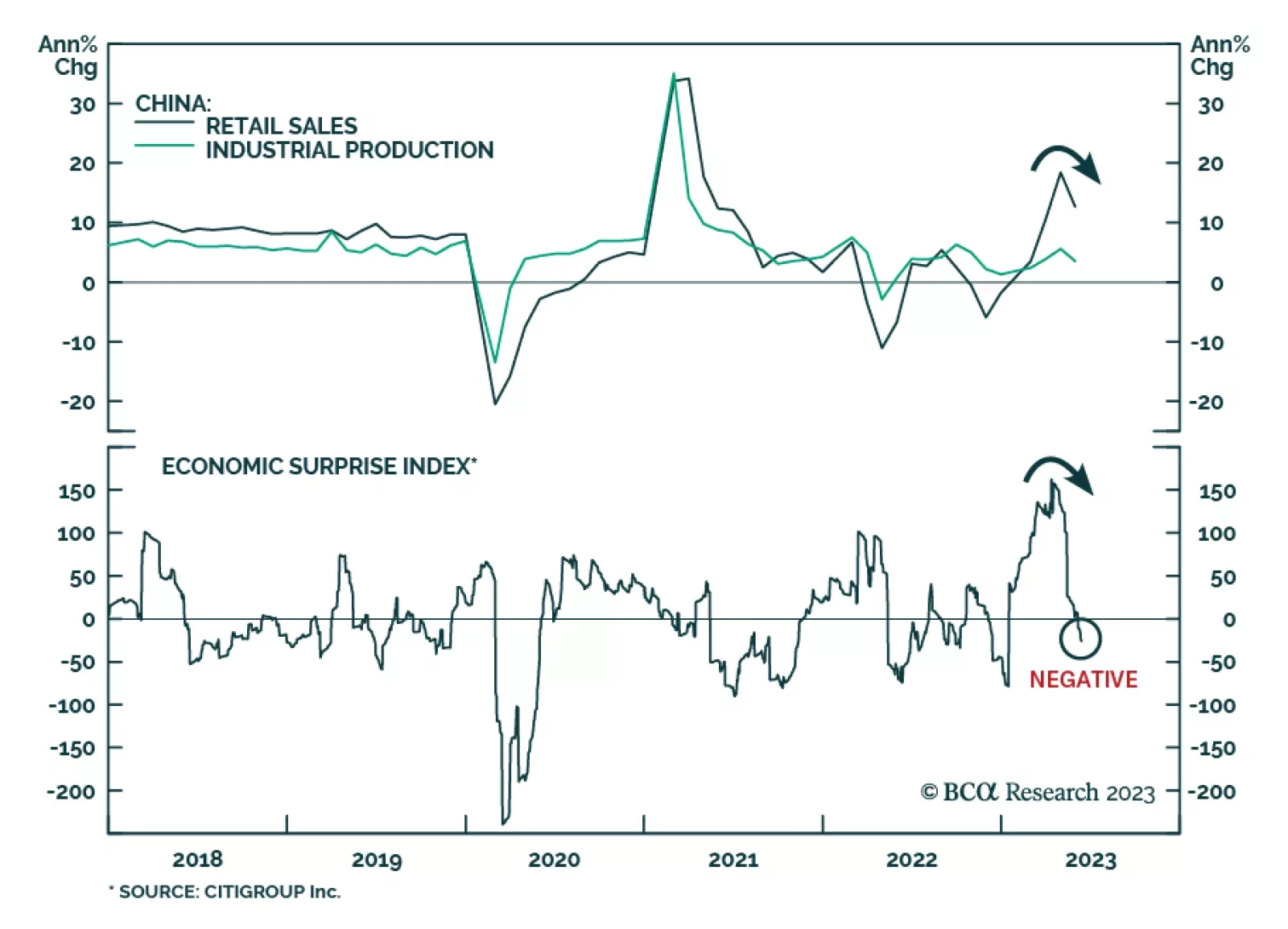

According to BCA Research’s China Investment Strategy service, a sustainable recovery in Chinese property construction is unlikely. The deterioration in China’s property market indicators worsened in May. Home…

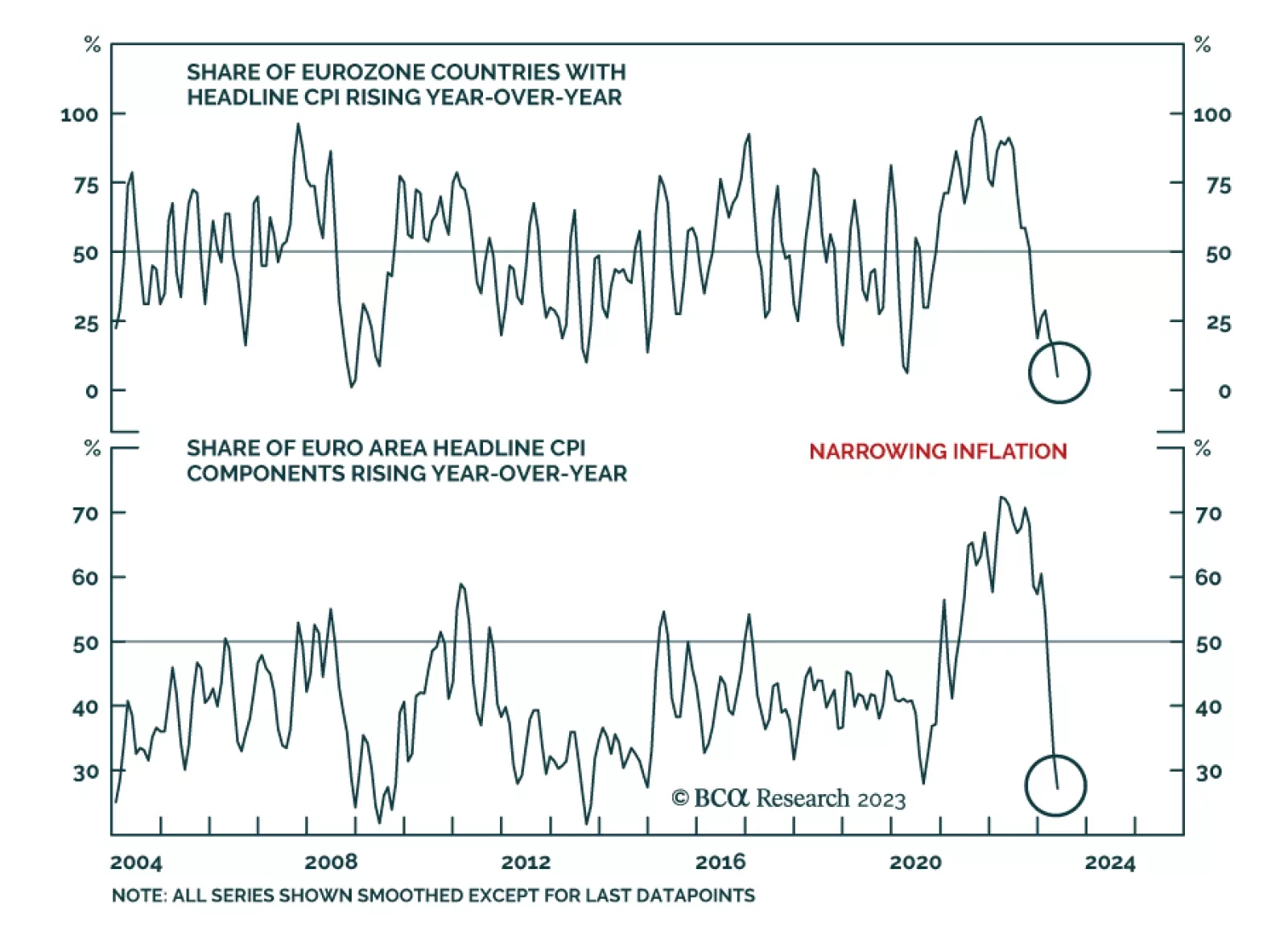

According to BCA Research’s European Investment Strategy service Eurozone inflation likely to diminish further. First, policy is tight. The impact on leading economic variables is already visible, with M1 collapsing,…

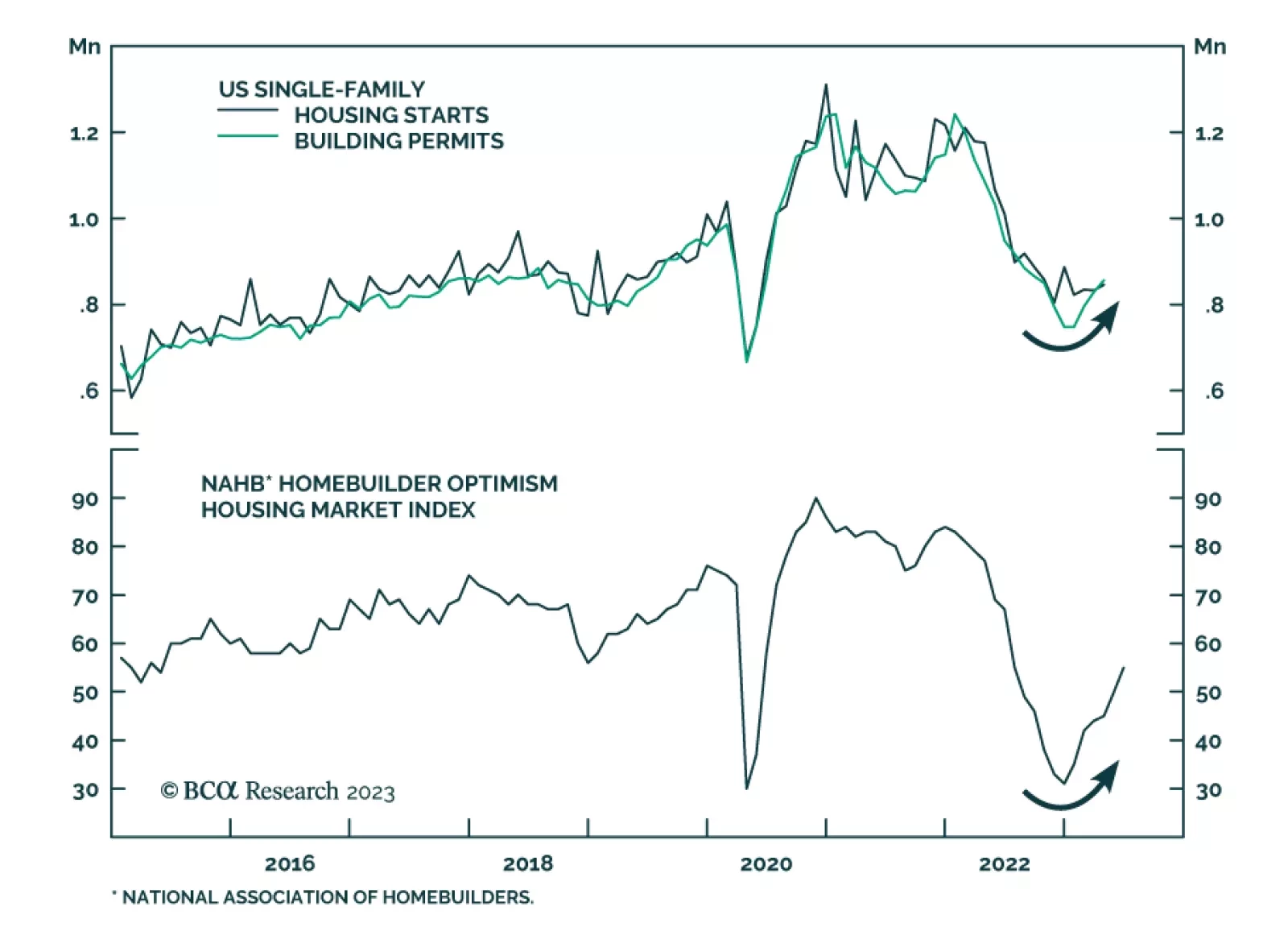

US Homebuilder confidence surprised to the upside on Monday, with the NAHB’s Housing Market Index jumping from 50 to 55 in June – beating expectations of 51. This marks the first time in 11 months that the index rises…

Investors are still cautious and have significant cash that needs to be put to work. Trickle-down of it into the US equity market may extend the rally. Overly bearish futures positioning is also a strong contrarian indicator.…

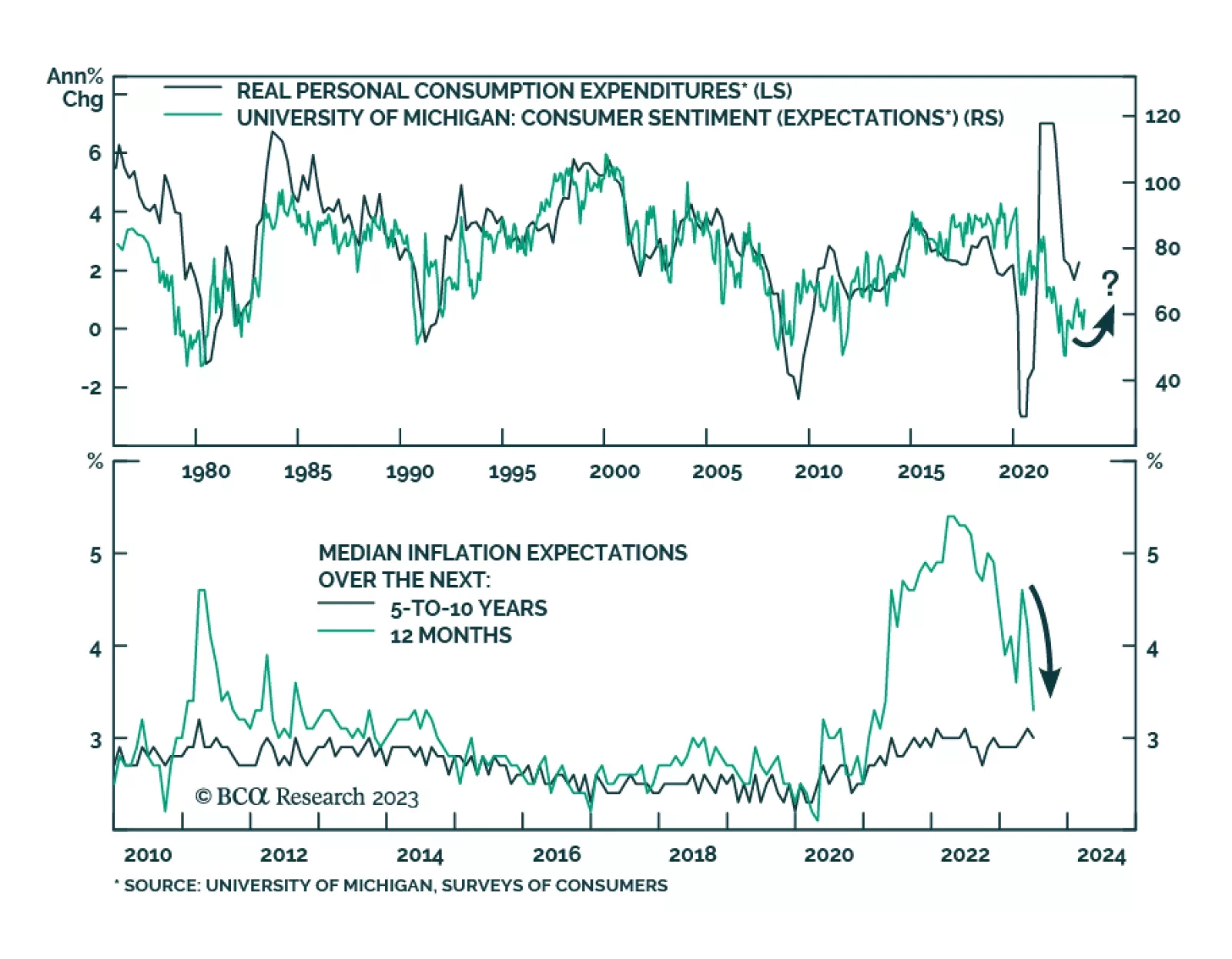

Preliminary results of the University of Michigan Consumer Sentiment survey sent a positive signal about household morale in June. The Sentiment index rose by a greater-than-anticipated 4.7 points to 63.9 on the back of…

China’s economic data releases for May fell below consensus estimates. The 7.2% y/y contraction in property investment in the first five months of the year was worse than the expected 6.7% decline. The deceleration in…