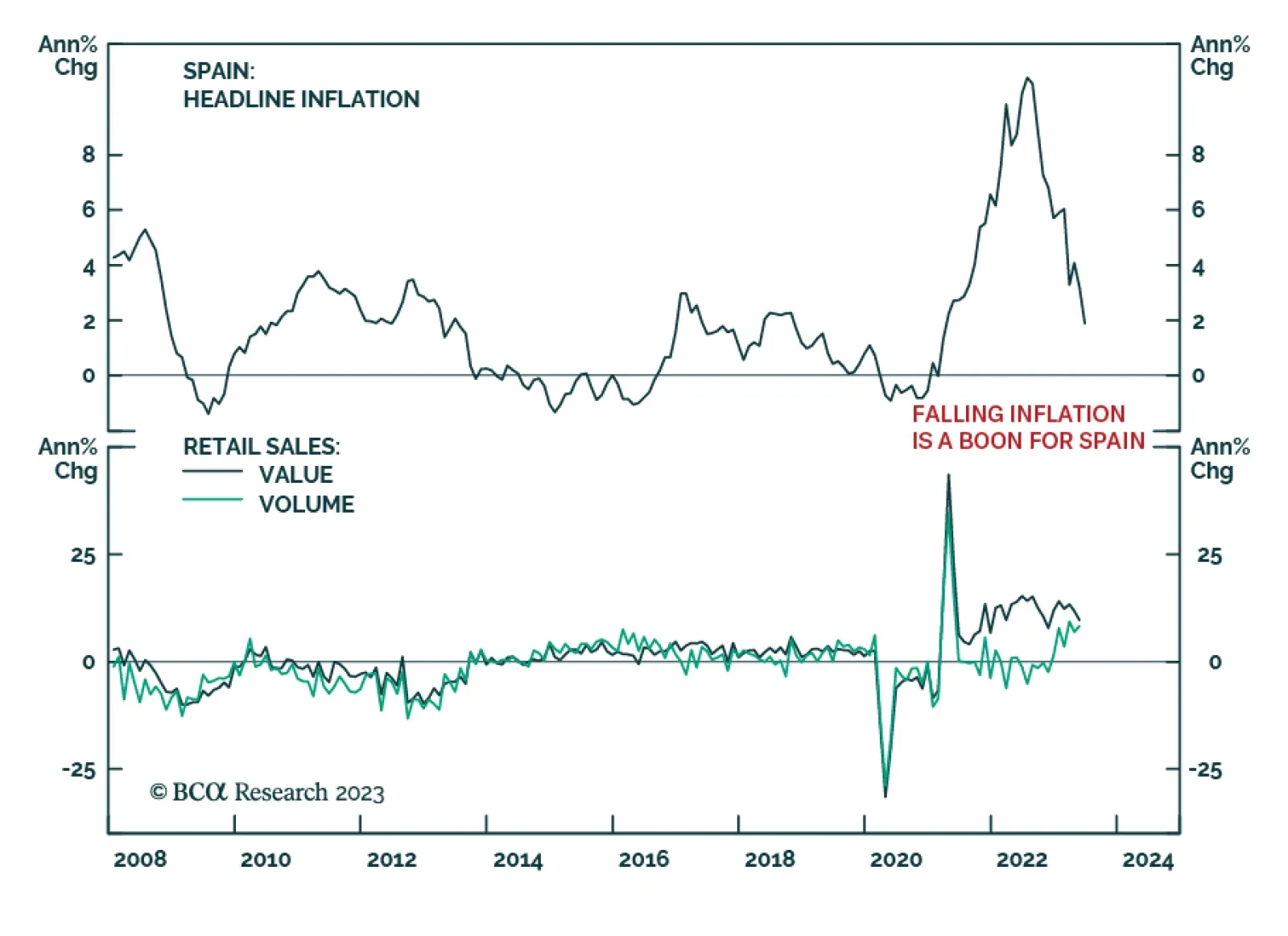

According to BCA Research’s Geopolitical Strategy and European Investment Strategy services, Spain’s economy is outperforming that of the Eurozone thanks to lower inflation and exploding tourism activity. These trends…

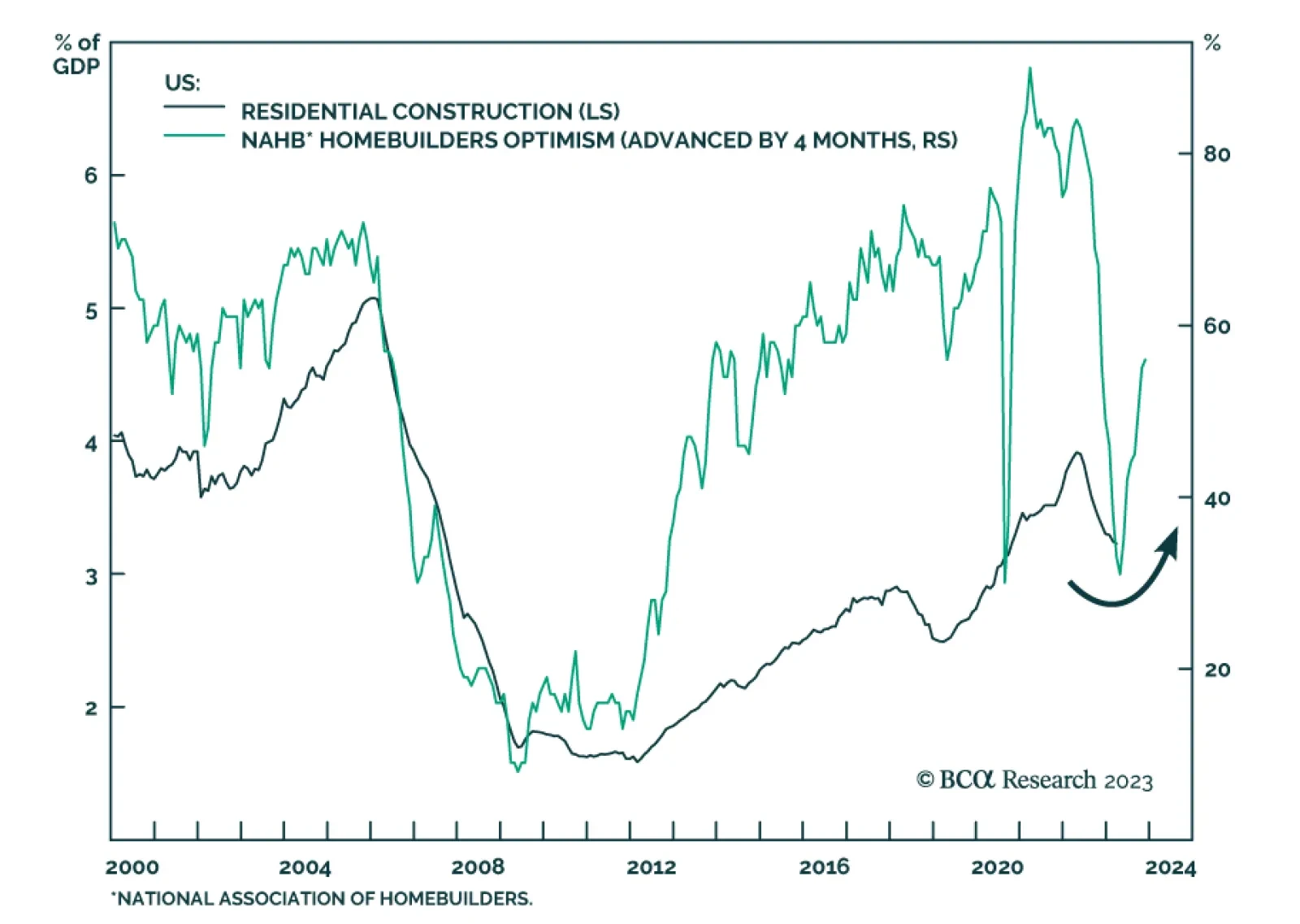

Results of the NAHB survey shows US homebuilder sentiment inched further above 50 to a 13-month high of 56 in July. Its ongoing rise above 50 indicates that net sentiment is becoming increasingly favorable. That said,…

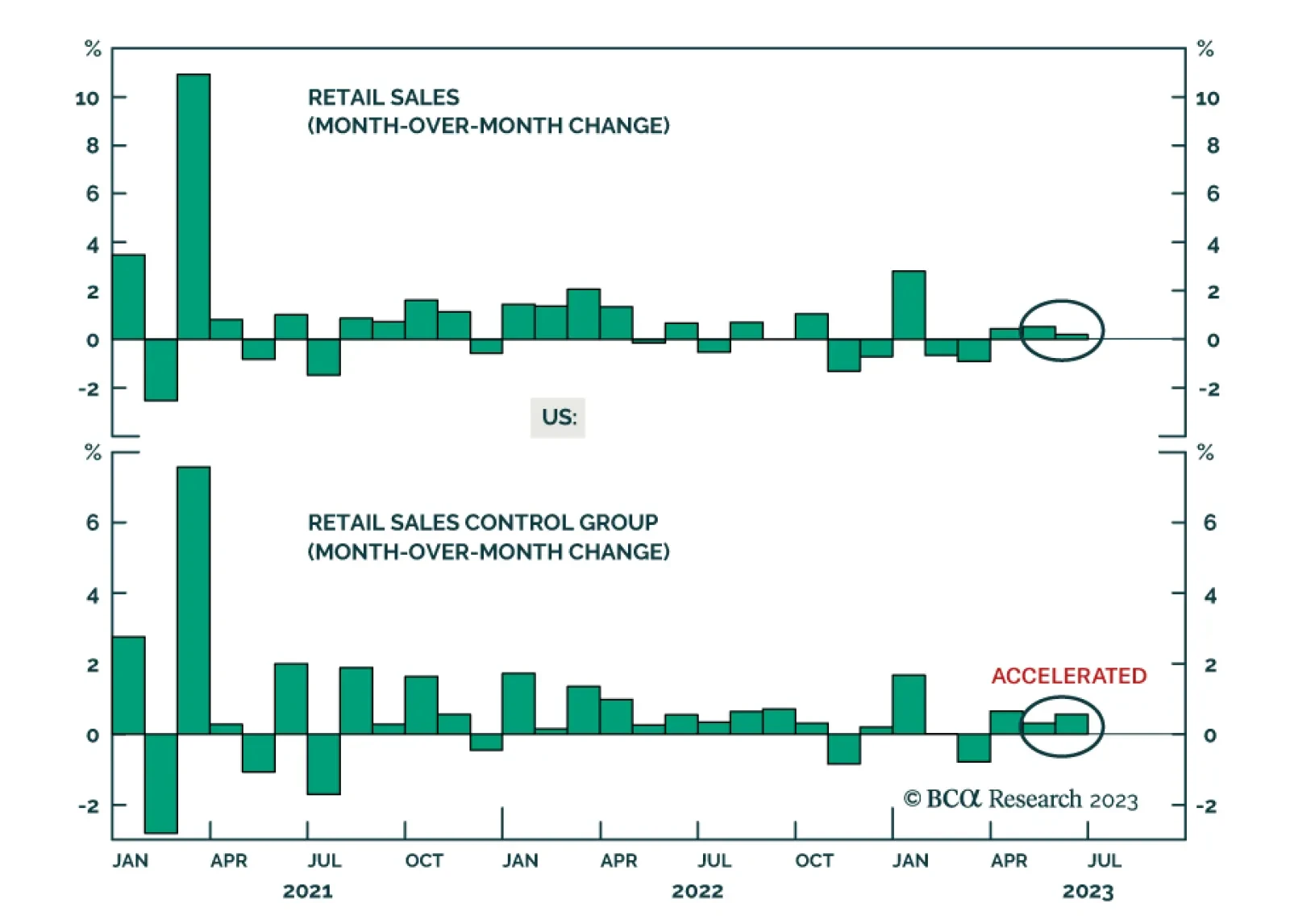

US retail sales delivered a mixed signal on Tuesday. On the one hand, overall retail sales growth decelerated from 0.5% m/m to 0.2% m/m in June– disappointing expectations of 0.5% m/m. Spending on retail sales excluding…

The S&P 500 reached our 4,500 mid-year target last week, but the bears have yet to capitulate and stocks could melt up so we are placing a trailing stop on our tactical overweight instead of downgrading equities outright.

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

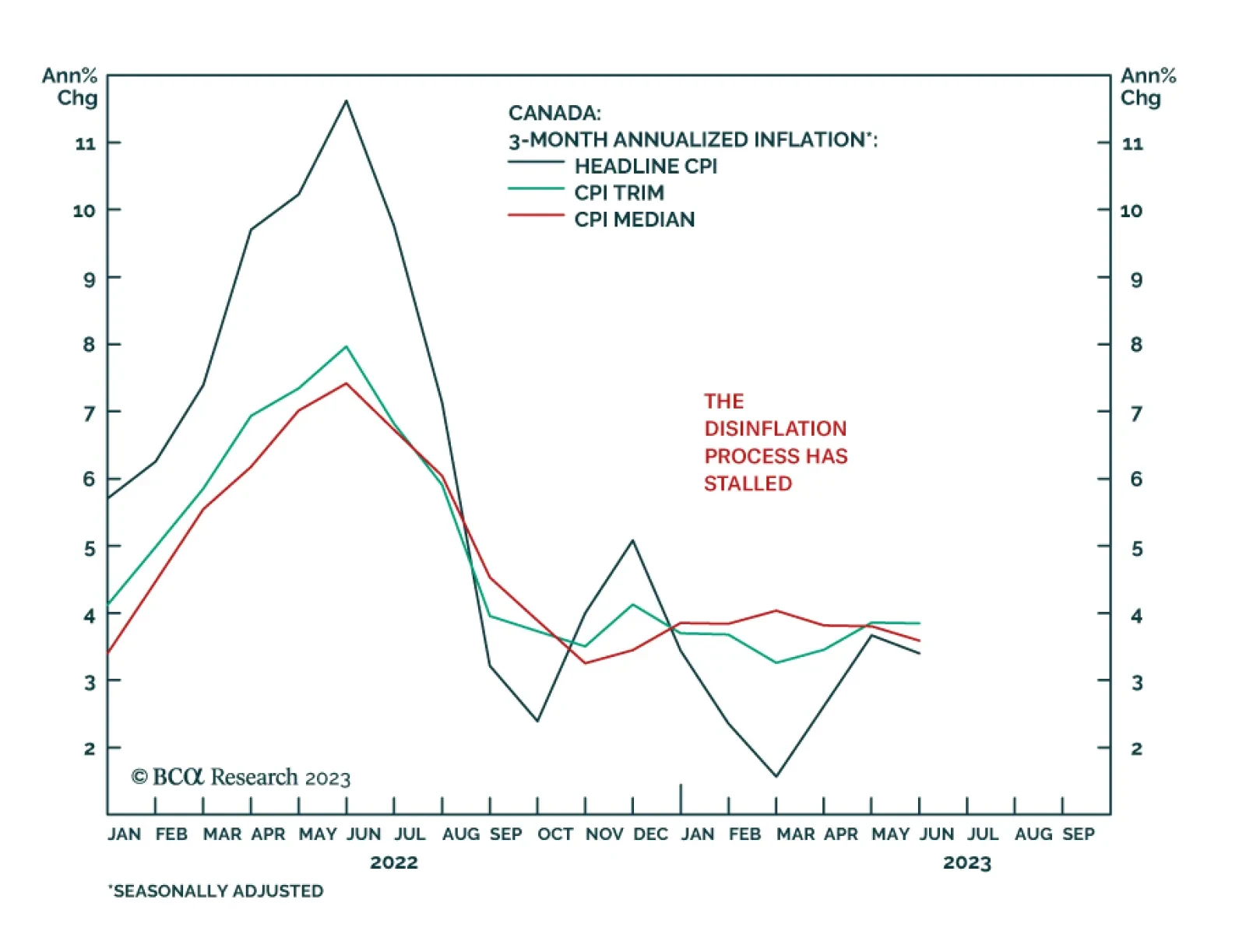

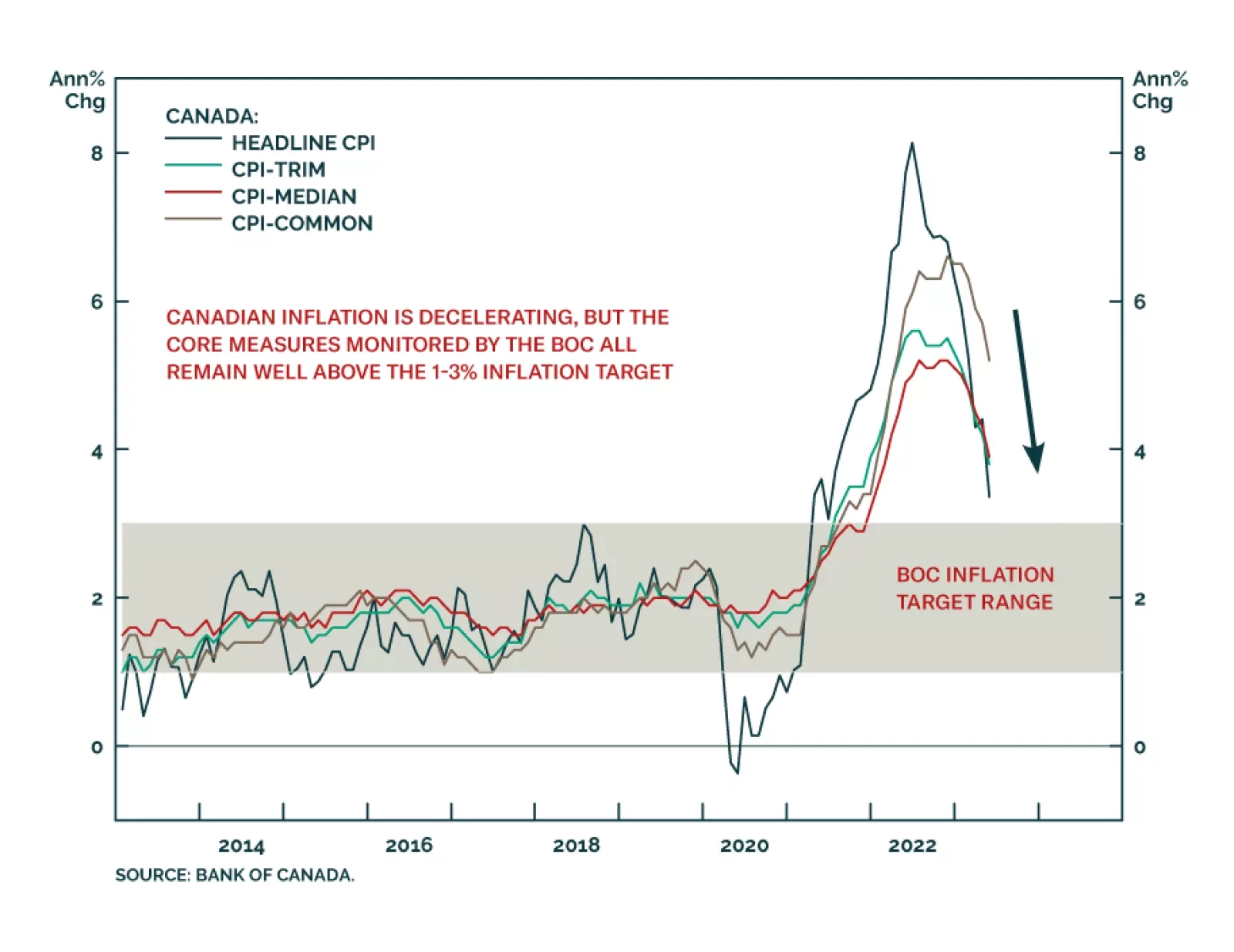

As expected, the Bank of Canada raised interest rates for the second consecutive month after restarting its tightening campaign last month. At 5.0%, the policy rate now stands 4.75 percentage points above where it was at the…

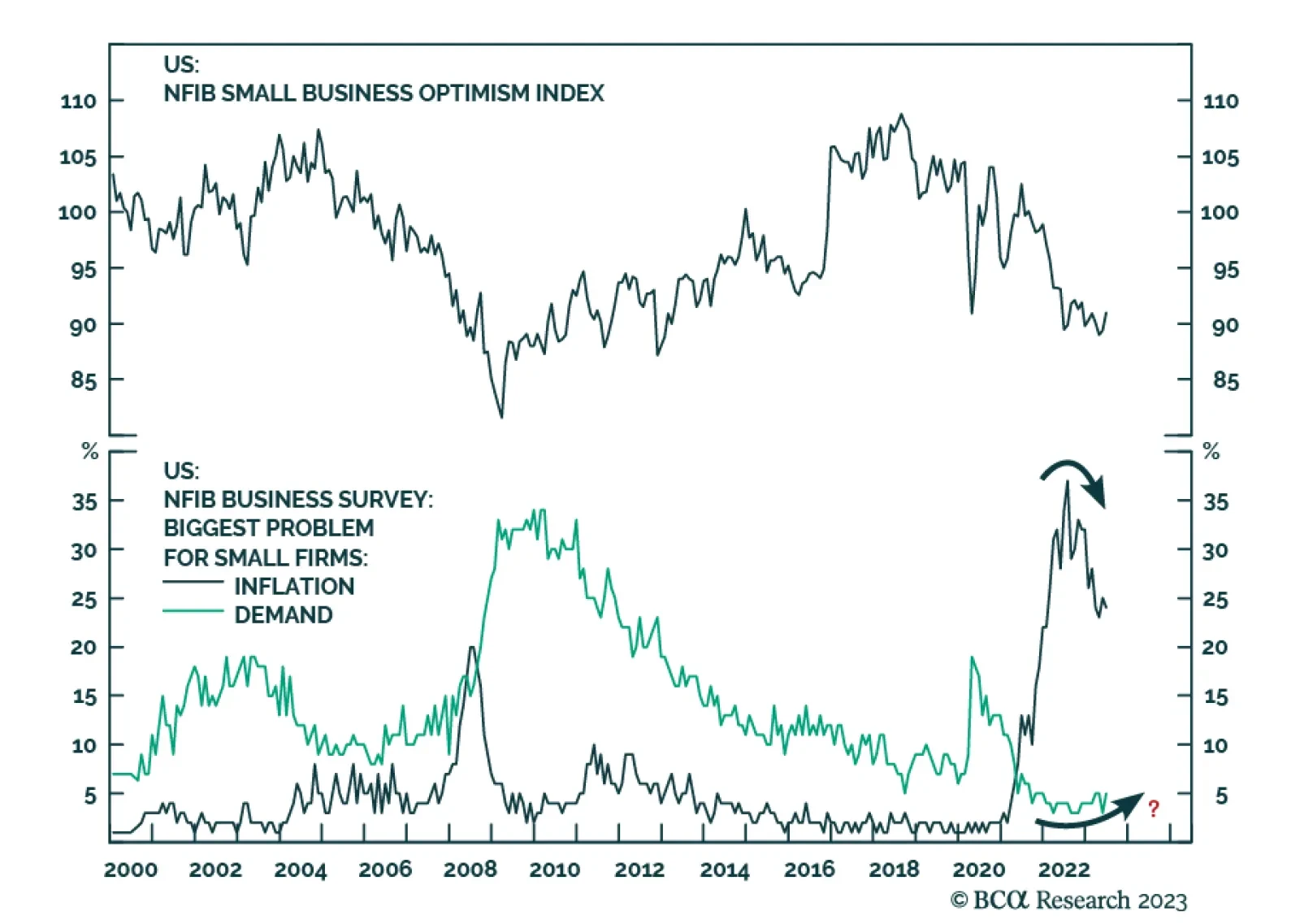

The NFIB survey provided a slightly positive signal about the US economy in June. Small business optimism improved from 89.4 to a 7-month high of 91.0 – beating expectations of a more muted increase to 89.9. Details of…

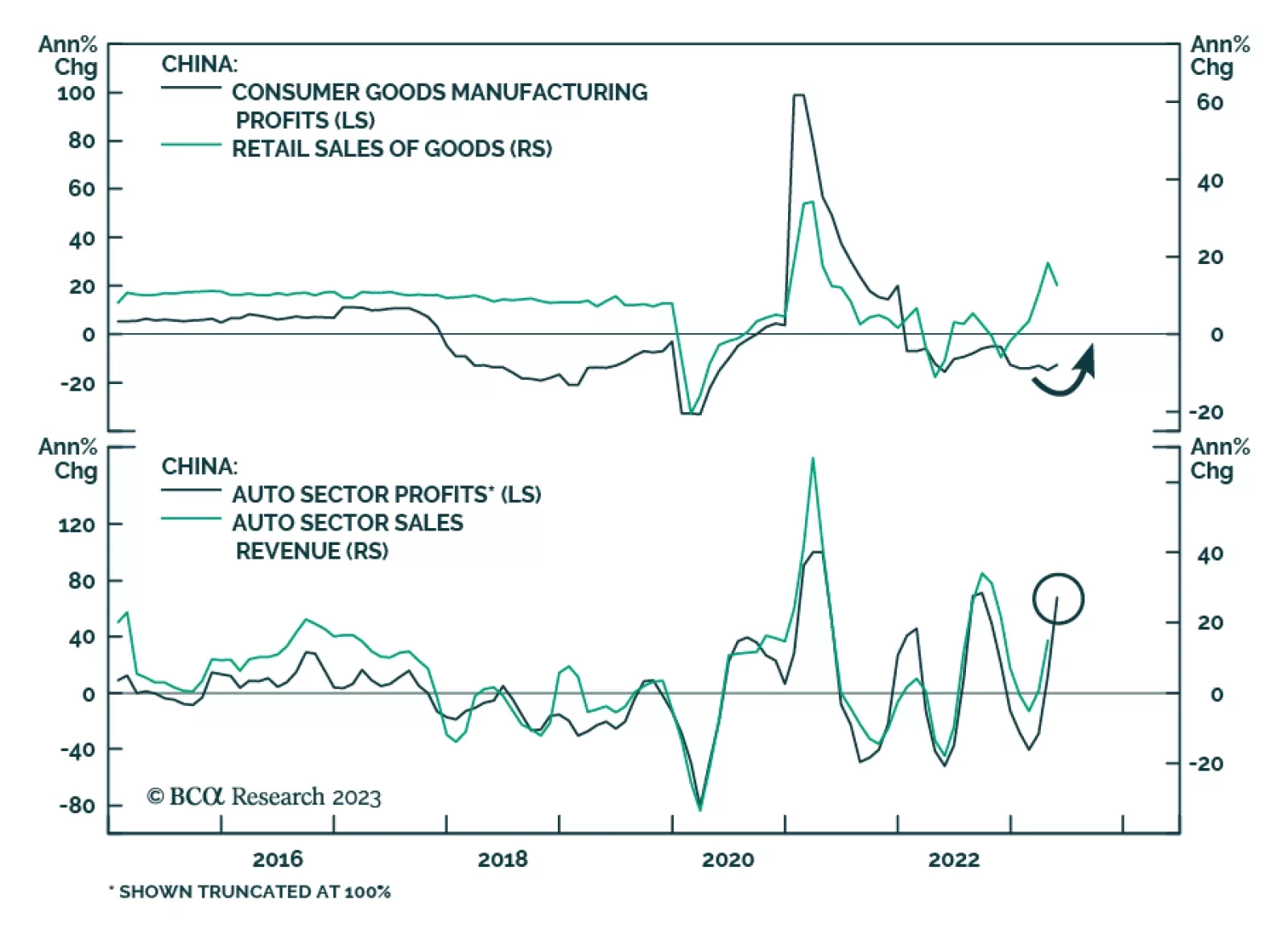

According to BCA Research’s China Investment Strategy service, although the recovery in overall Chinese industrial profits will be subdued, there will be a silver lining among China’s consumer goods producers, autos…

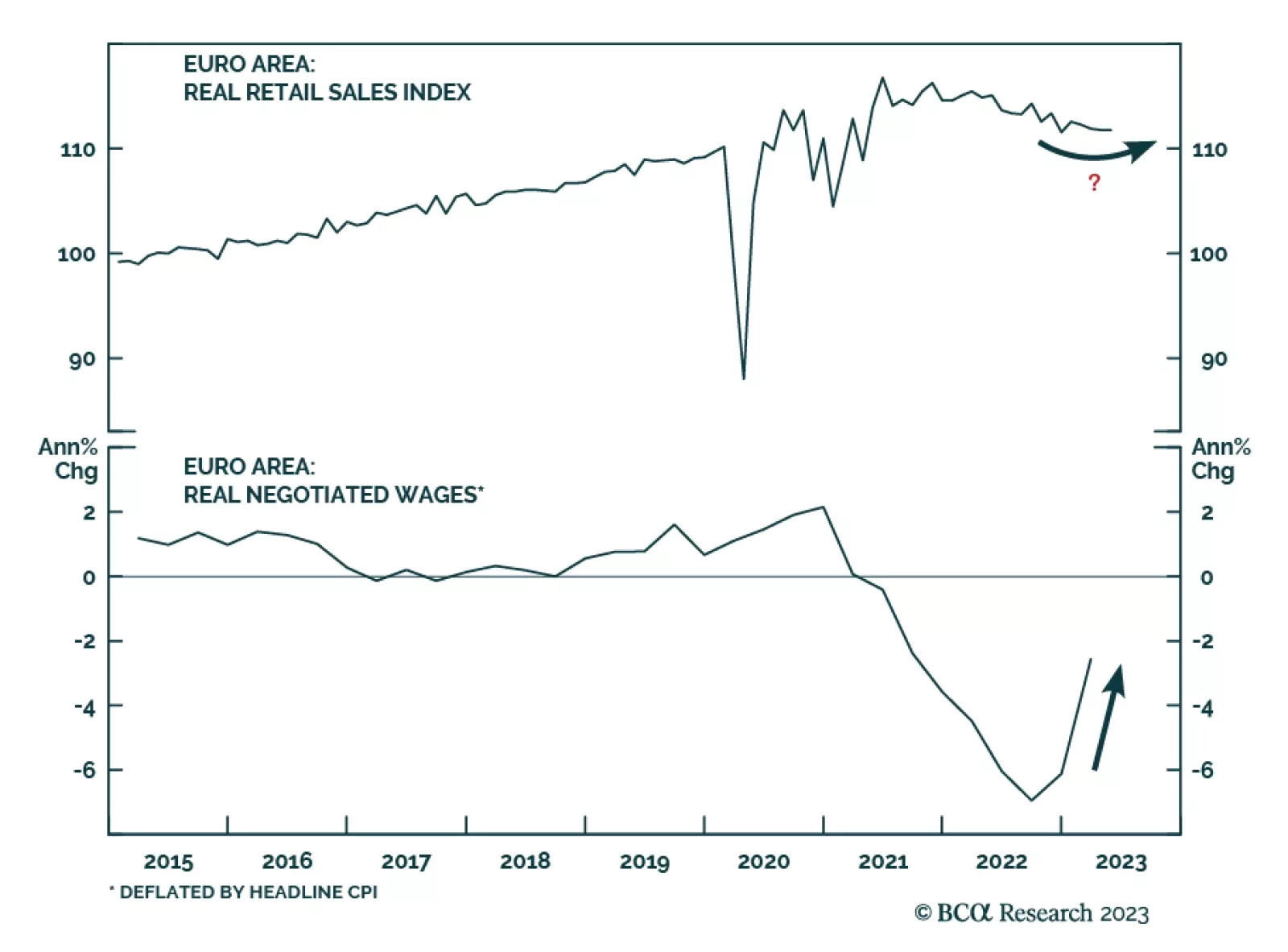

Yesterday we highlighted that falling producer prices foreshadow lower CPI inflation in the Eurozone and argued that this dynamic is positive for the bloc’s consumption outlook. Easing price pressures will ultimately lift…

Canadian inflation slowed in May, slowing to 3.4% on a year-over-year basis from 4.4% in April. This matched market expectations, with the monthly increase of 0.4% (versus 0.7% in April), slightly lower than the 0.5% consensus…