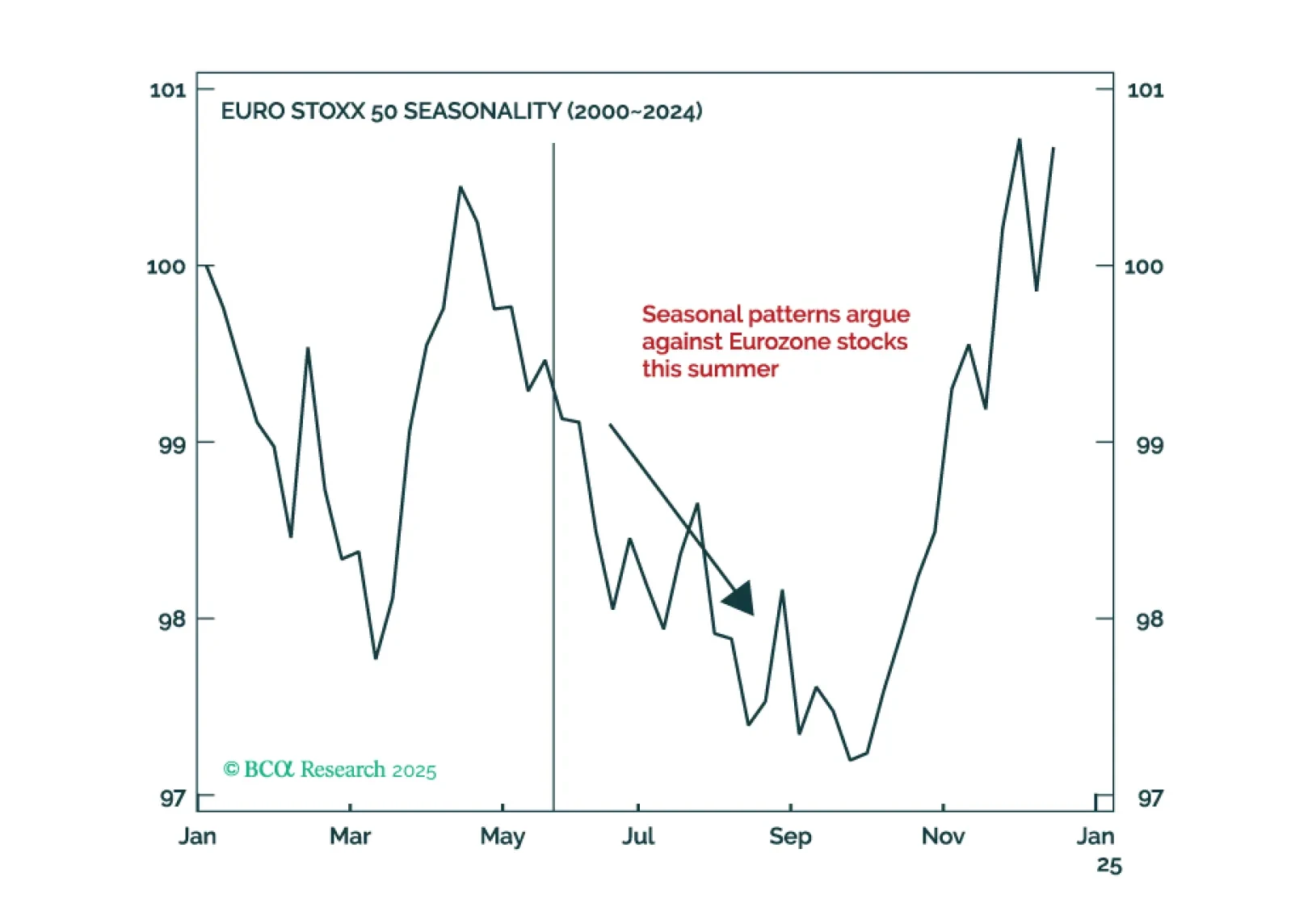

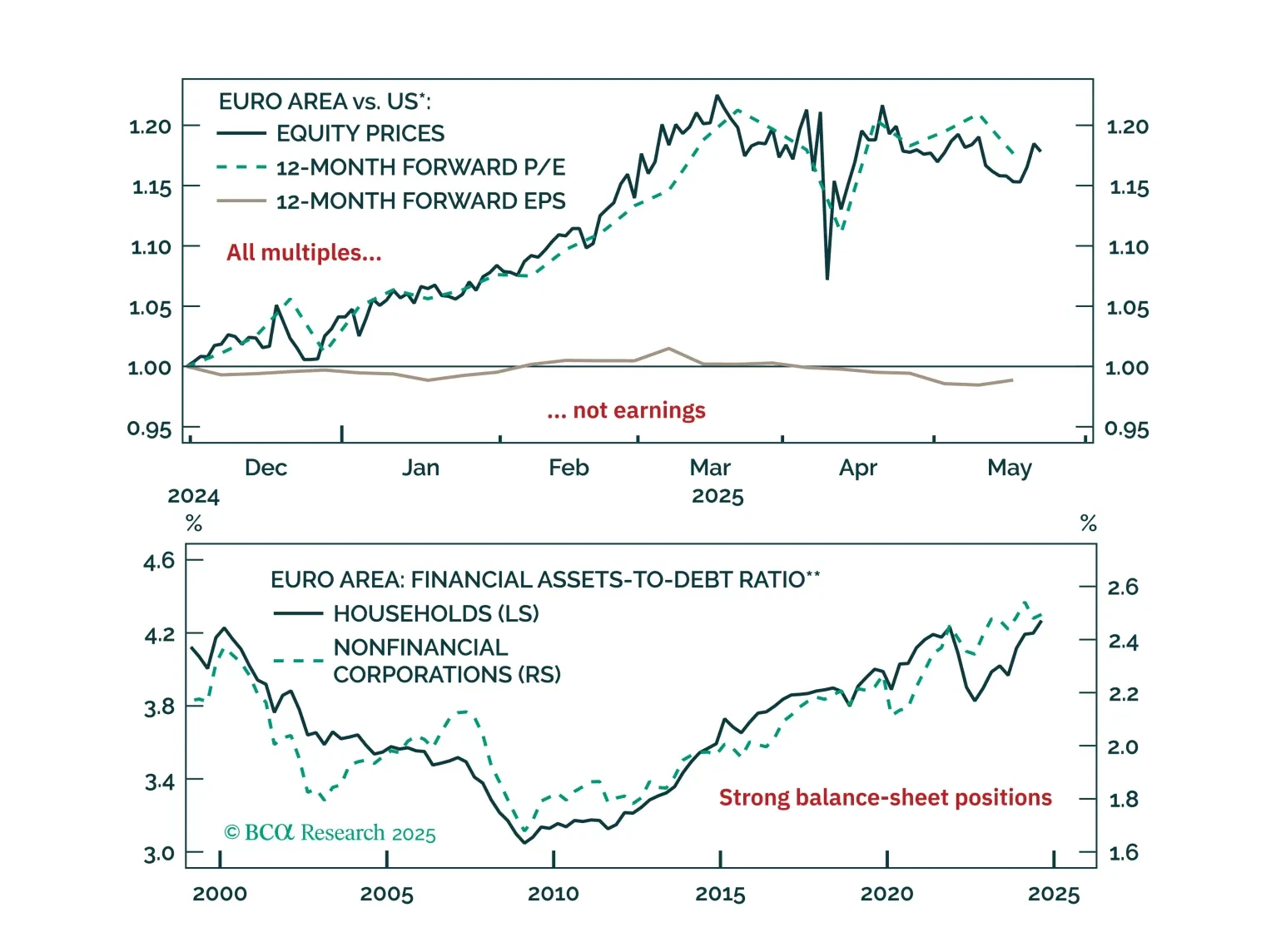

European equities will face a clash of powerful forces this summer. Expect sharp swings and false breaks, creating an ideal terrain for nimble traders but a minefield for buy-and-hold investors seeking steady gains.Within this backdrop,…

Bursting Japanese inflation warrants a cautious stance on the country’s bonds relative to other DM markets. Tokyo's annual core CPI reached 3.6% in May, the highest print in 44 years (excluding the post-pandemic inflation flare…

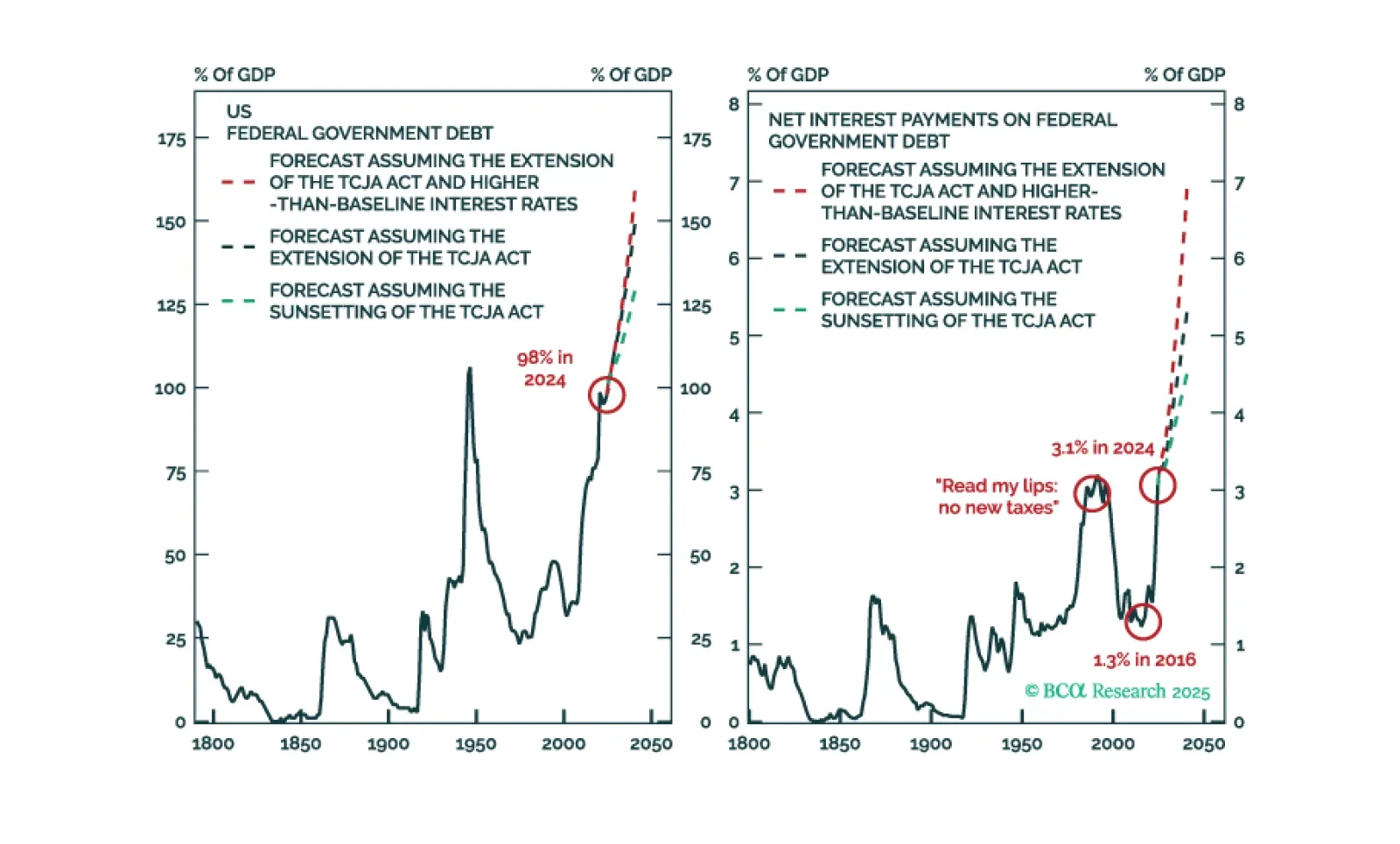

Rising bond yields may present an even greater danger to the global economy than the trade war. With equity valuations no longer discounting much economic risk, investors should position themselves defensively.

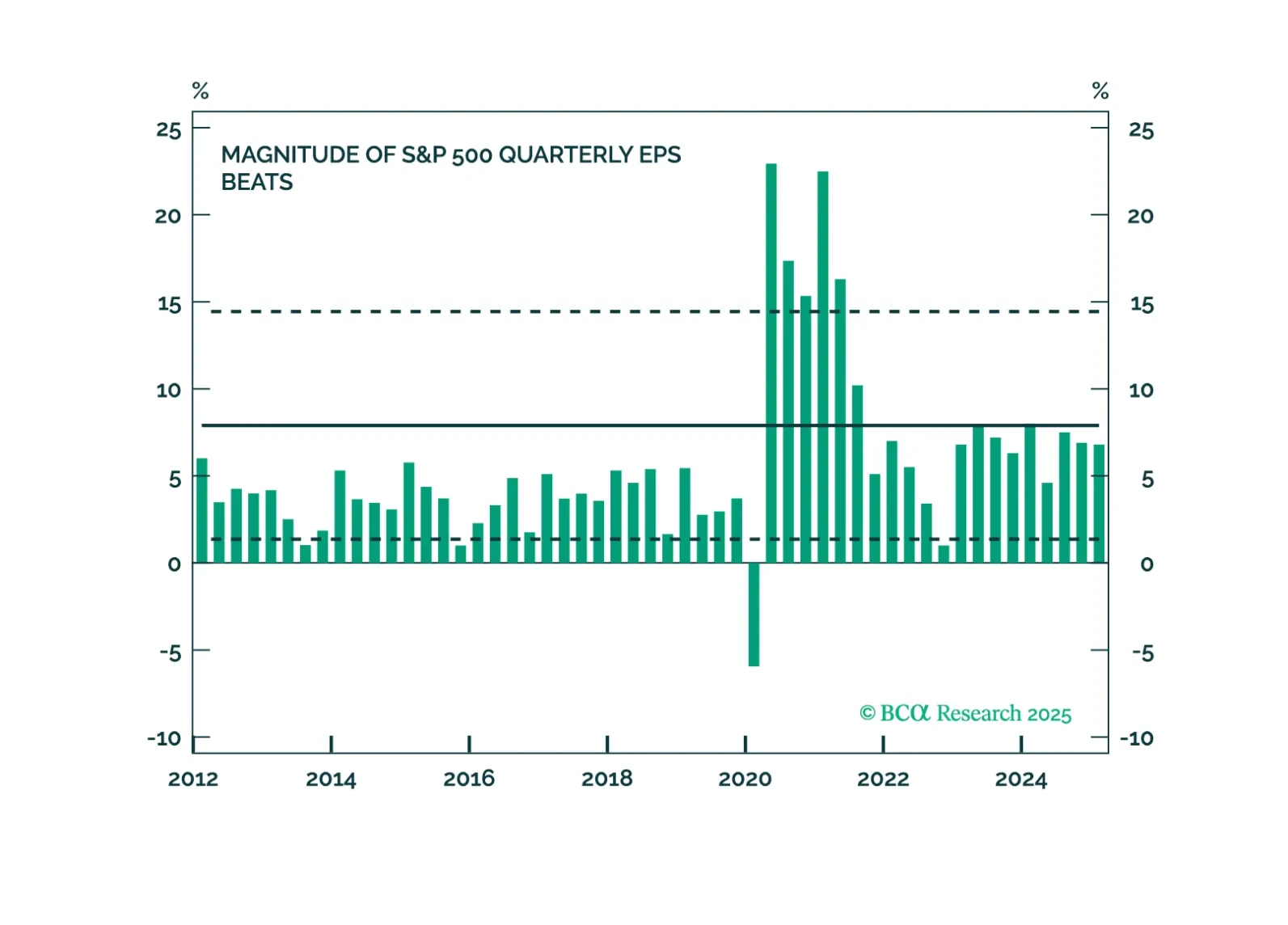

In this report, we take stock of the Q1 2025 earnings season. Corporate commentary and forward guidance provide valuable insights into the state of the economy, tariff mitigation strategies, and consumer spending.

Five questions, five answers from the road. We unpack what Europe’s biggest investors are worried about right now, from trade‑war whiplash to bund‑versus‑Treasury positioning; and where the real opportunities still lie.

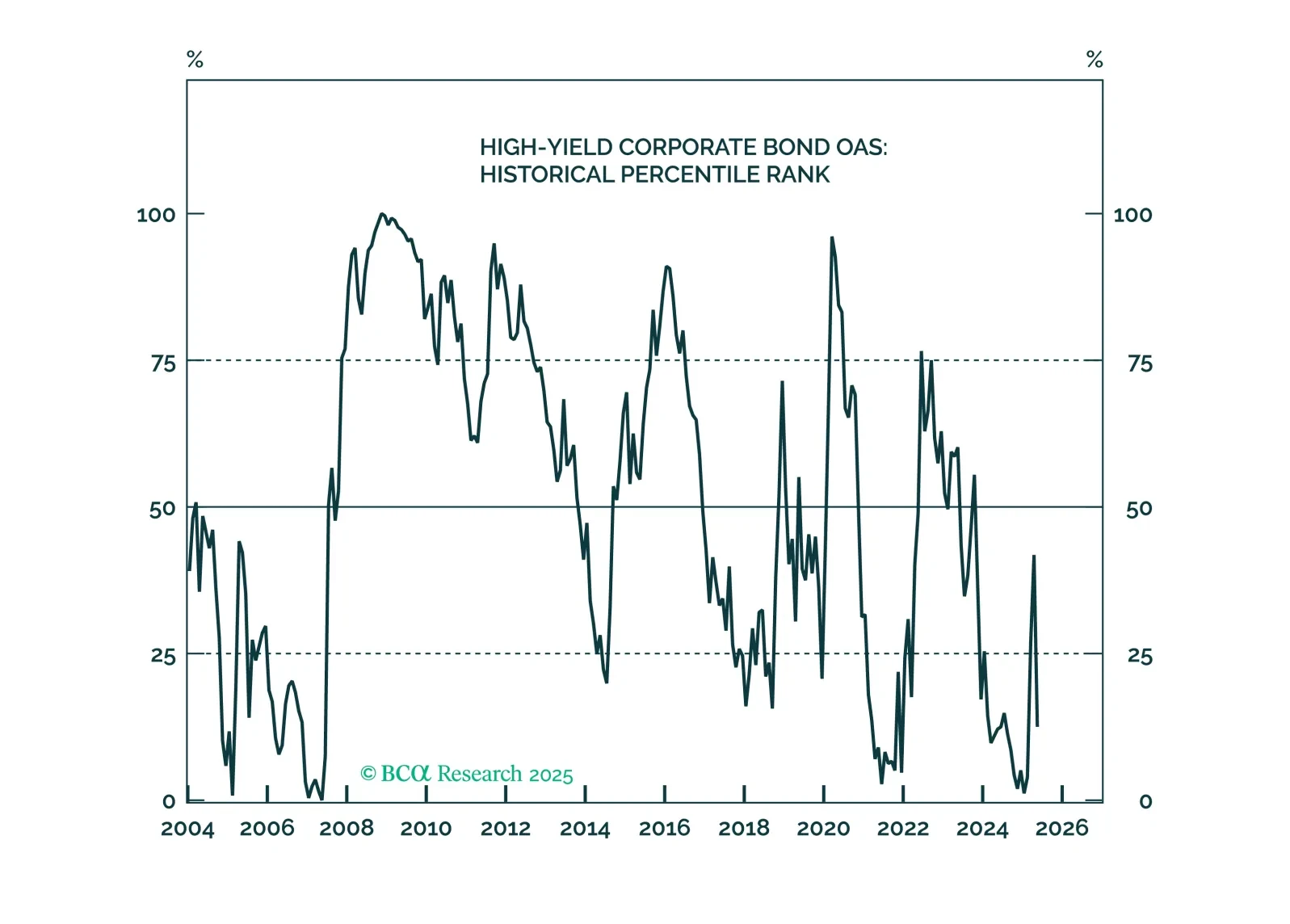

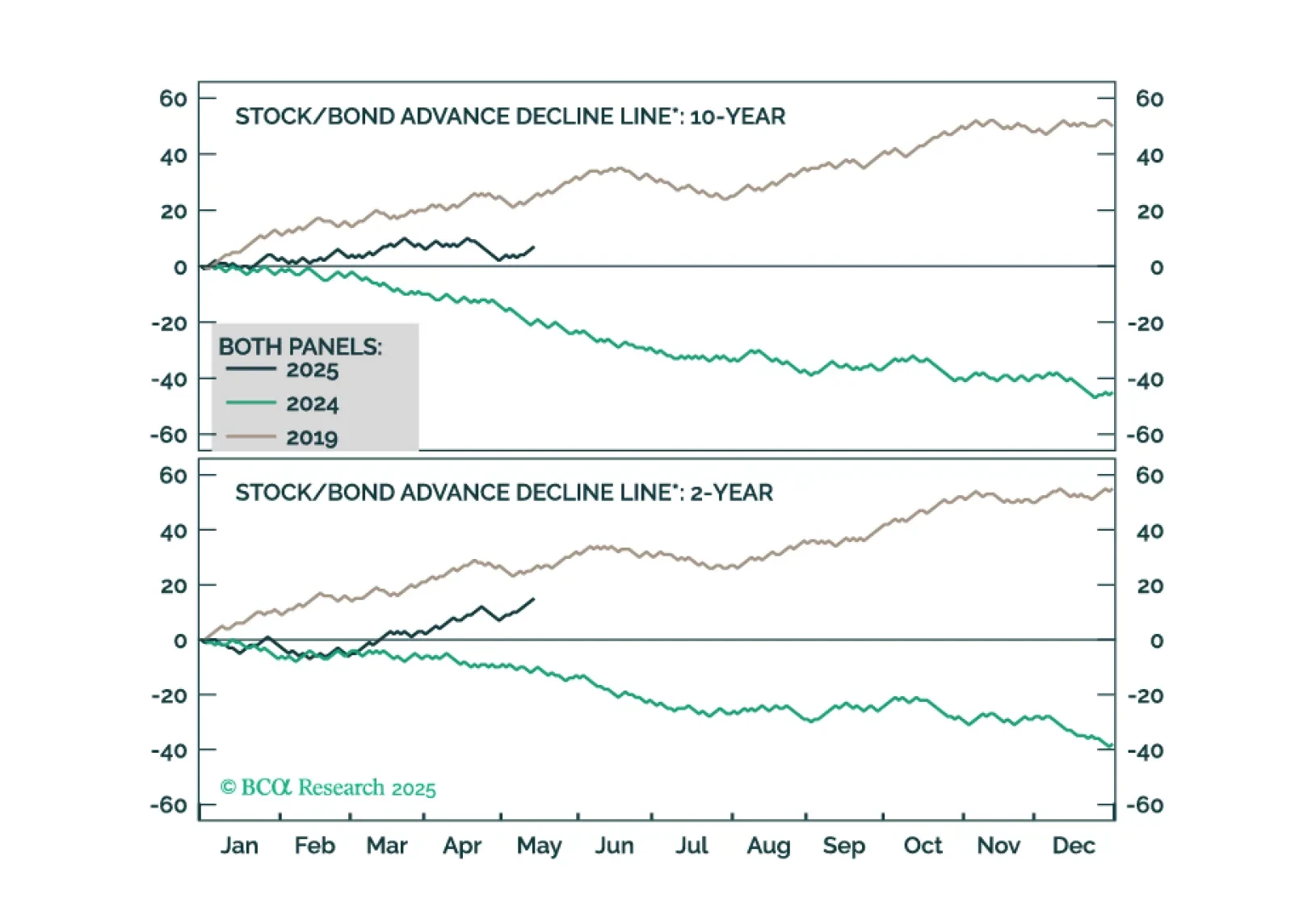

Risk assets rallied hard following the Great Geneva De-escalation, but we are not enamored of risk assets’ risk-reward profile. Forward-looking survey data remain awful on balance and we continue to recommend a defensive asset…

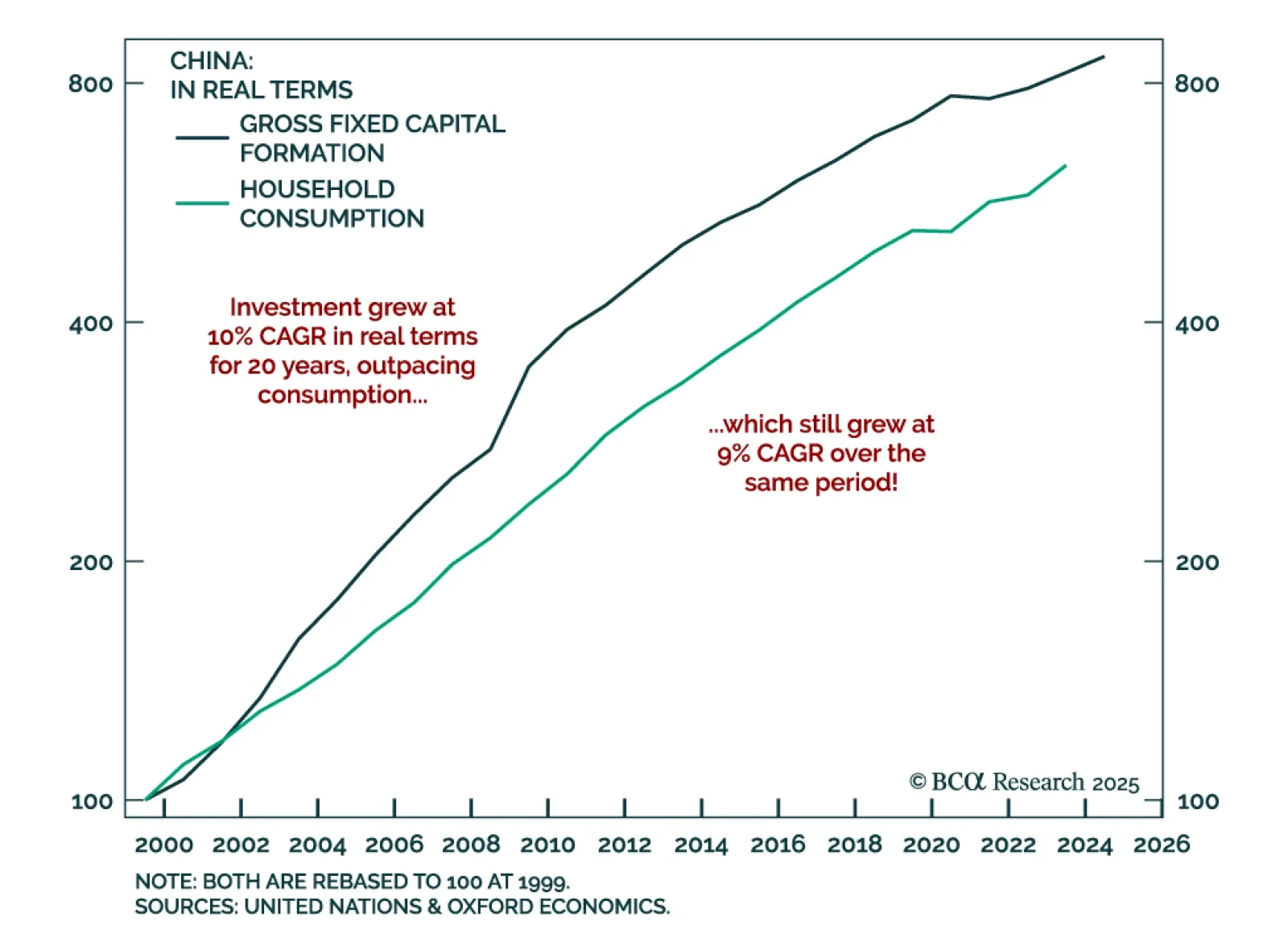

Our EM strategists warn that China’s overinvestment problem has no quick fix, keeping deflationary pressures in place and limiting upside for Chinese equities. Excessive domestic investment, driven by aggressive credit creation, is…

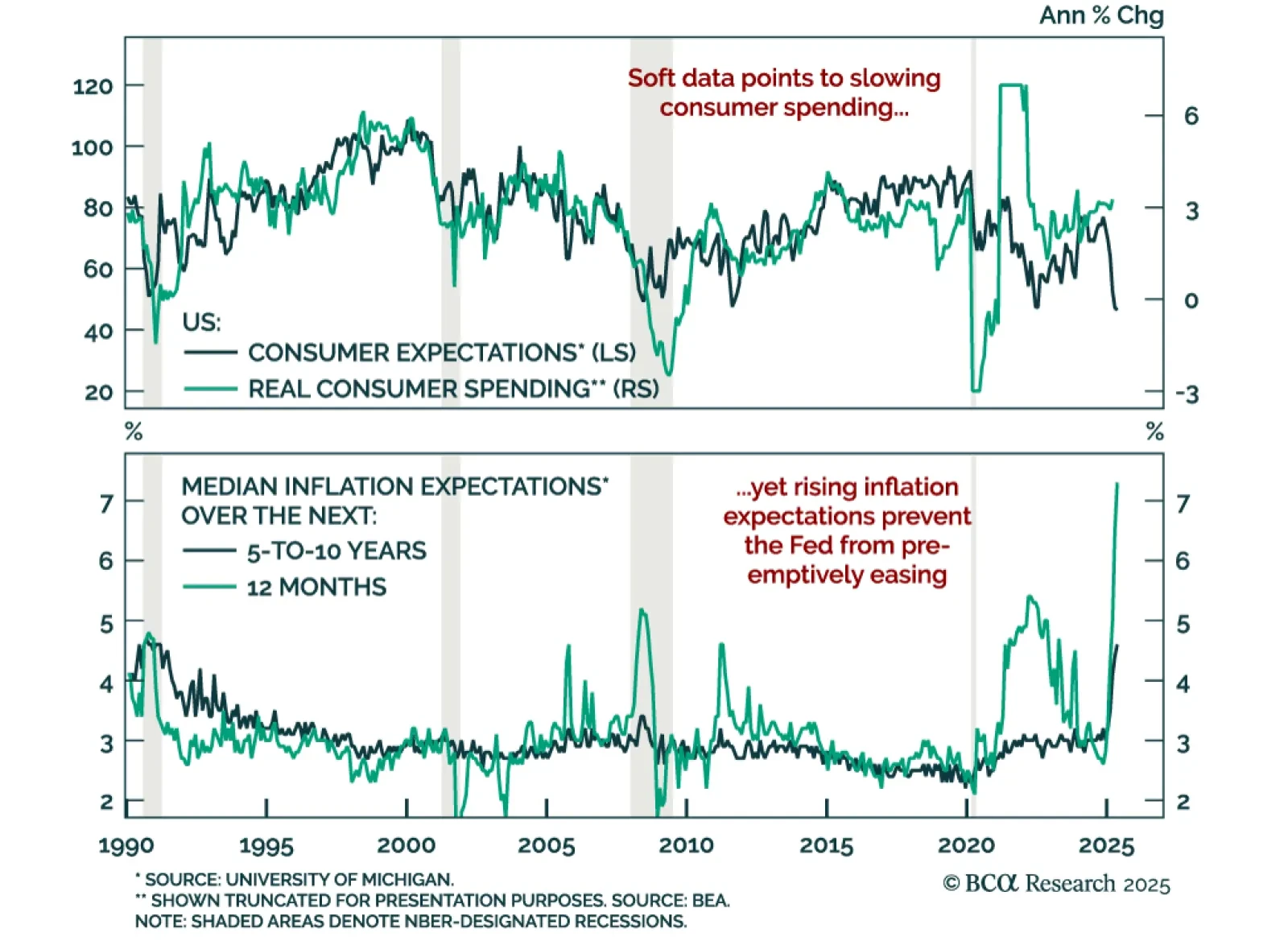

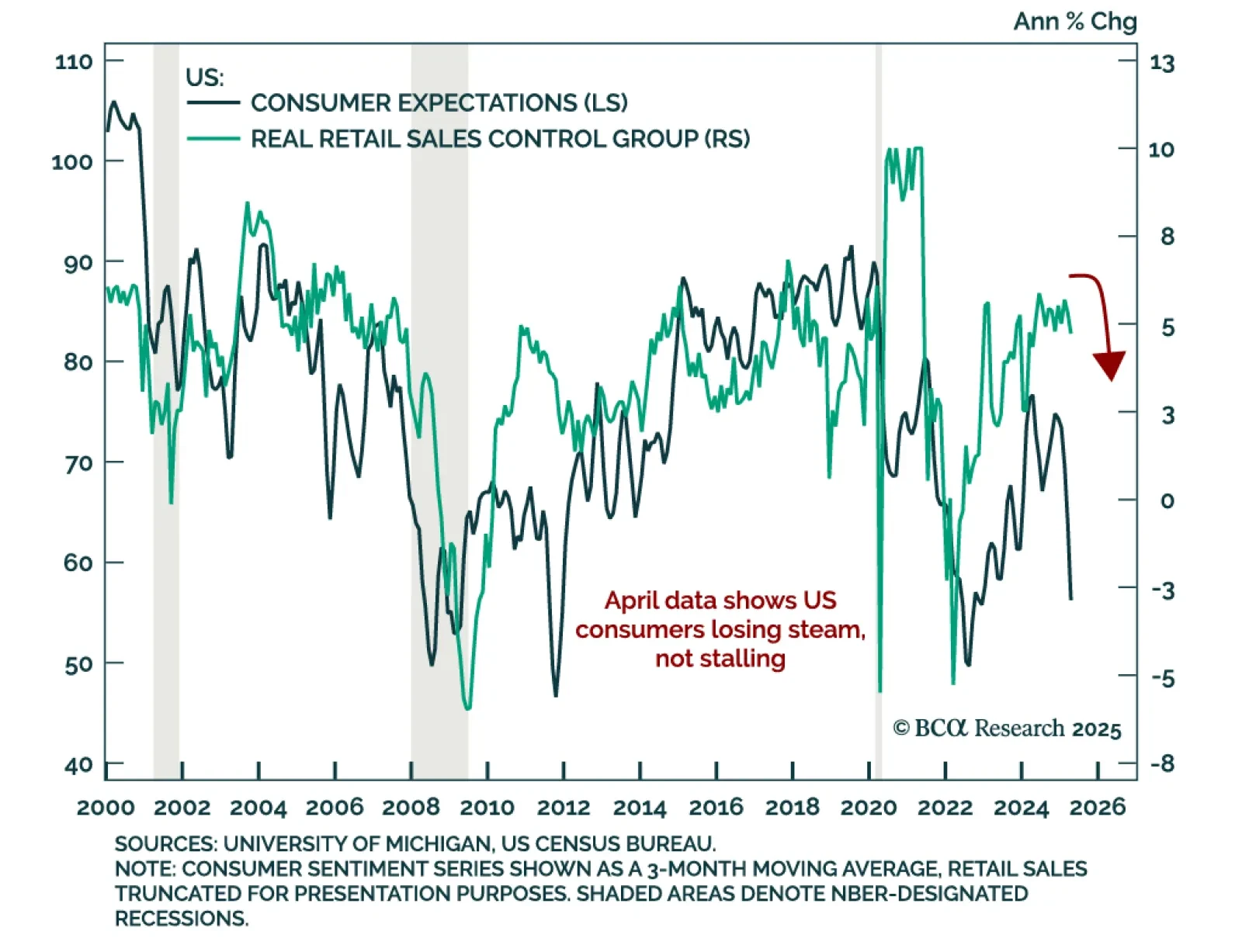

Deteriorating US consumer sentiment and surging inflation expectations add to growth concerns and reinforce our long-duration bond stance. The preliminary May University of Michigan Consumer Sentiment Index missed expectations,…

April retail sales slowed, but signs of resilience in discretionary spending and labor data suggest US consumers are holding up. Headline retail sales rose 0.1% m/m, above expectations but decelerating from the upwardly revised 1.7%…

Tariff front-running behavior makes the April hard economic data difficult to interpret, but we take the strong reading from Food Services spending as a signal that the US consumer has not yet buckled.